Rowan Isaaks

February 28, 2025

The 2025-26 Budget

California’s Film Tax Credit

- California’s Motion Picture Industry

- Film and Television Tax Credit Program

- Allocation and Use of Tax Credits

- Tax Incentives in Other Jurisdictions

- Economic Analysis of Film Tax Credits

- Governor’s Proposal

- Assessment

- Final Considerations

Summary

California’s Film Industry Impacted by Increased Competition, Recent Disruptions. Over the last two decades, California has faced increasing competition in the motion picture industry from other states and countries offering production companies financial incentives and lower labor costs. This has led to a gradual decline in the state’s dominance in the industry. Recent disruptions, including COVID‑19, the 2023 Screen Actors Guild‑American Federation of Television and Radio Artists (SAG‑AFTRA) and Writer’s Guild of America strikes, and the 2025 Los Angeles Wildfires, have further depressed production activity.

Governor Proposes to Increase the Annual Cap on Credit Awards. The Governor’s budget proposes to increase the annual cap on tax credits available under the program from $330 million to $750 million. This would apply to version 4.0 of the credit for fiscal years 2025‑26 through 2029‑30.

Expanding the Credit Is a Valid Approach to Increase Production Activity in California. Our assessment of the available evidence suggests that increasing the size of the credit will increase the number of productions that choose to locate in California. Although some credit recipients would have located in the state regardless, a sizable number would choose to film in other jurisdictions absent the credit. Since the credit is consistently oversubscribed, increasing the annual cap would likely result in a corresponding increase in credits awarded.

Legislature’s Response to Proposal Should Depend on the Importance of Protecting Hollywood Relative to Other Goals. Although the film tax credit likely increases the size of California’s film industry, there is weak evidence that expanding the tax credit would benefit California’s economy as a whole. Therefore, we recommend the Legislature consider adopting the Governor’s proposal only if the Legislature views maintaining California’s market share of the film industry as a high priority and an end in itself.

If Protecting Market Share a Priority, Use of Benchmarks Would Help Improve Fiscal Oversight of Credit. If the Legislature elects to expand the credit, utilizing explicit benchmarks that compare the desired market share to the state’s current position would help improve fiscal oversight of the credit.

California’s Motion Picture Industry

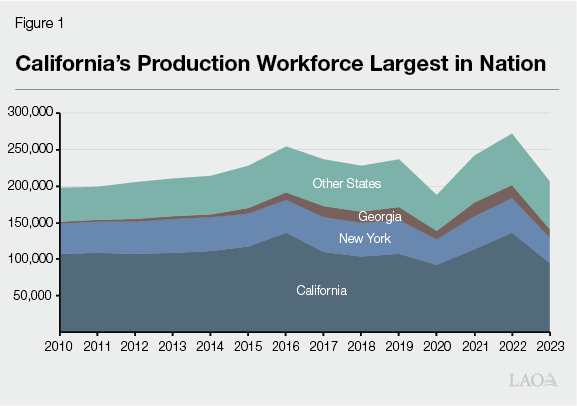

California Remains the Largest Player in the U.S. Motion Picture Industry. Despite making up only 1.4 percent of California’s total economic output, the state’s motion picture industry is one of its most iconic, particularly given its heavy concentration in Hollywood and Los Angeles County. As shown in Figure 1, California’s motion picture production workforce is by far the largest in the United States, over 2.5 times the size of its largest competitor (New York), and has held fairly steady in size over the last two decades.

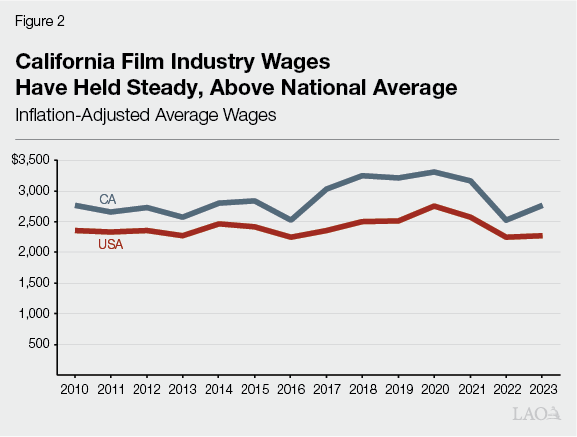

Motion Picture Industry Workers Earn Above Average Wages. In 2023, workers in California’s motion picture industry earned a weekly wage of over $2,700 on average, 60 percent higher than the average weekly wage in California across all industries ($1,730). As seen in Figure 2, inflation‑adjusted wages in the industry have not changed much in recent years, nor has California’s wage premium relative to the rest of the country (around 20 percent).

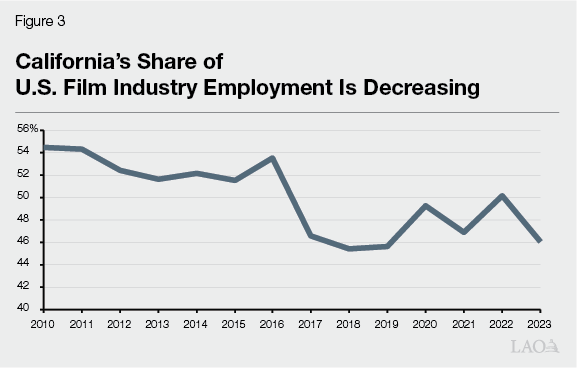

State’s National Market Share Has Declined. Figure 3 shows the evolution of motion picture production employment in California relative to the U.S. Since 2010, California’s share of employment has decreased from over 54 percent to 46 percent as of 2023, becoming particularly volatile over the last few years.

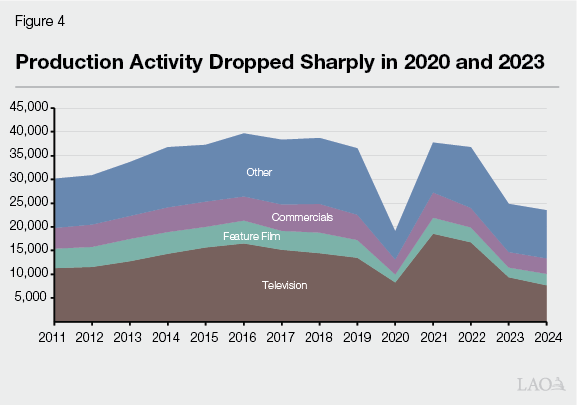

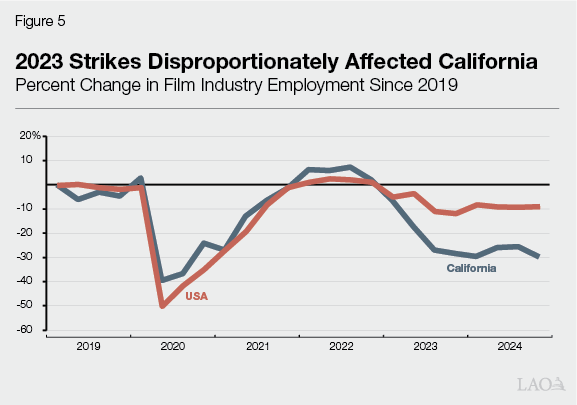

Recent Disruptions Have Negatively Affected Filming Activity in California. Two notable events account for the volatility seen in Figure 3, namely COVID‑19 and the 2023 SAG‑AFTRA and Writer’s Guild of America strikes, which coincide with the sharp decreases observed in 2020 and 2023 respectively. The drop in California’s production activity is displayed in Figure 4, which shows the number of shoot days in the Los Angeles area by year and type of production. The COVID‑19 effect was short‑lived and shoot days returned to pre‑pandemic levels in 2021. In contrast, filming activity following the strikes has shown no signs of recovering so far, with shoot days slightly declining further in 2024. Figure 5 shows the differing effects of these two events by comparing the total percent change in employment levels for California and the U.S. since 2019. The impact of COVID‑19 was similar in California and the U.S. overall, and employment bounced back in both cases by the end of 2021. However, while the U.S. as a whole saw a more modest decline in employment in 2023, California experienced a much larger decrease and has not yet seen any signs of recovery.

Effects of Los Angeles Wildfires on Industry Are Unknown, but Likely Small. The recent Los Angeles wildfires caused significant property damage, primarily in the Pacific Palisades and Altadena neighborhoods. Although it appears that most productions that halted filming in the wake of the fires have resumed production, some industry workers will have been severely affected by the fires and may decide to relocate. However, based on estimates from entertainment industry unions, this number is likely in the hundreds and thus probably not a significant shock to the broader workforce.

Film and Television Tax Credit Program

California Film Tax Credit Created in 2009. In response to the proliferation of state‑level tax credits and other incentives for film and TV production in the early 2000s, the Legislature approved the creation of its own credit in 2009. Applications for the credit are evaluated by the California Film Commission (CFC), who then allocate and issue credits to successful applicants based on the amount of qualified expenditures the proposed production would make in California. The amount of credits available annually under the program has grown from $100 million in 2009 to $330 million as of 2015. The credit can be used to defray corporation, personal income, or sales tax liabilities.

Recent Changes to Program Take Effect in 2025. The 2023‑24 budget package included changes to the film tax credit that will take effect starting with tax credits awarded in 2025‑26. There are two notable changes:

- Refundable Credits. Production companies allocated a tax credit may make a one‑time election to make the credit refundable. This option allows taxpayers who do not have a significant California tax liability to more effectively utilize the credit. Taxpayers must apply as much of their credit to their current tax liability as possible before the excess is refundable for that year. Taxpayers may only elect to make 90 percent of their total credit allocation refundable, and the use of such credits must be spread across the five taxable years beginning with the year of election.

- Diversity Plans. Currently, credit recipients must submit a work plan that includes explicit diversity goals and is approved by the CFC. Starting with awards made in 2025‑26, a production can receive an additional 4 percent credit if they submit a work plan to CFC and CFC determines that the recipient has made a “good‑faith effort” to achieve the goals in the work plan.

Allocation and Use of Tax Credits

$3.4 Billion in Credits Allocated Since Program’s Inception. The CFC has issued over $3 billion in credits to around 700 projects since its inception in 2009. In recent years, the commission has averaged approximately $272 million of credits awarded to 38 separate projects per year. Not all credits made available by the Legislature for the CFC to award are distributed each year. Some credits initially made available to production companies are never issued, usually due to cancellations/delays in production or lower expenditures during production than anticipated at the time of application.

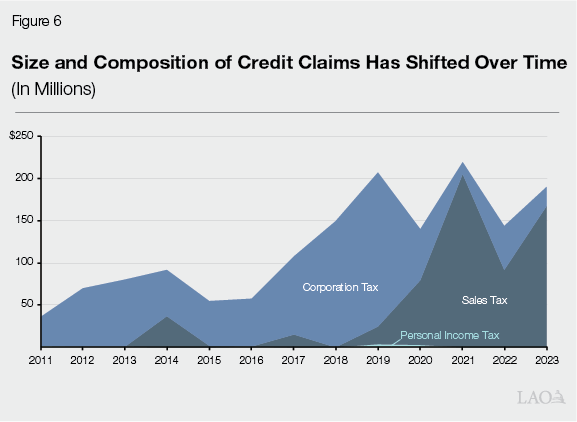

Credit Claims Have Increased in Size and Changed in Composition Over Time. Figure 6 shows the amount of credits claimed by recipients over time. The annual amount of credit claims per year has settled in the range of $150 million to $200 million for the last several years. Claims were lower in the first several years of the program because (1) the amount of credits available was lower and (2) credit claims often lag behind the initial award as taxpayers can carry forward credits if they do not have sufficient tax liability in that year. A recent shift away from claims against the corporate income tax and towards sales and use taxes is at least partially due to temporary restrictions placed on the use of tax credits as part of the 2020‑21 budget package. Since the 2024‑25 budget package implemented similar restrictions, this trend will likely continue for the next few years.

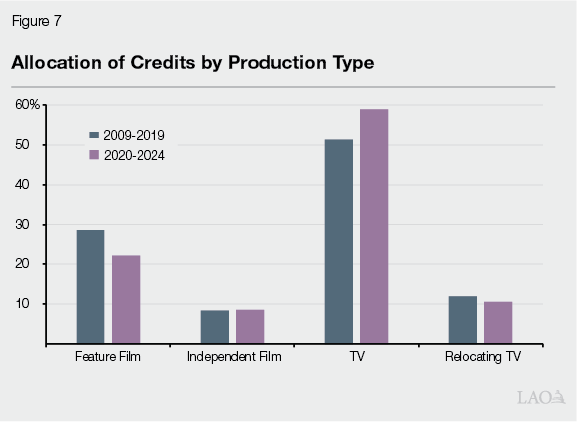

Mix of Productions Shifts Towards Television. Figure 7 shows the types of productions that were awarded tax credits. The most notable change is an increase in the share of credits awarded to non‑relocating TV shows from 51 percent in the first decade of the program to 59 percent in the credits most recent iteration starting in 2020, with a corresponding decrease in credit allocations for feature films.

Tax Incentives in Other Jurisdictions

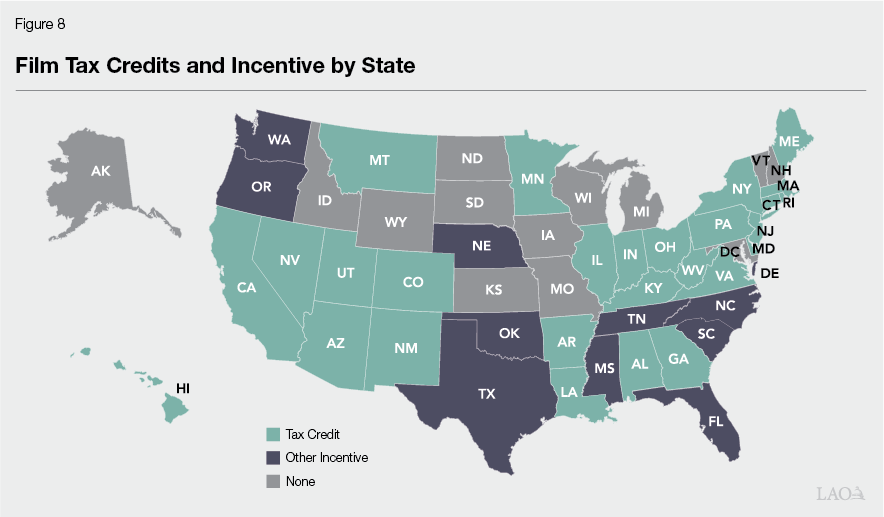

Majority of U.S. States have a Tax Incentive for Film and TV Production. Policymakers in many states have put in place a variety of incentives to lure film and TV production away from Hollywood and other production hubs. Figure 8 shows the distribution of such incentives across the U.S. Tax credits based on a percentage of expenditures made in‑state are the most common type of incentive, but several states provide rebates or partial exemptions from taxation. Over the years, some states have expanded their existing programs to make them stand out relative to other states, while others have scaled back or eliminated them completely.

Incentives Outside the U.S. Are Becoming Common, More Generous. California’s competition for motion picture production is increasingly coming from outside the United States. In particular Australia, Canada, and the United Kingdom have tax credits and incentives that are more generous than most similar incentives in the United States. As a result of these incentives and generally lower baseline costs (such as wages), these countries have gained some market share at the expense of the U.S. in recent years.

Structure of California’s Incentive Differs From Main Competitors. There are a few notable elements of California’s tax credit that differ from some of its main competitors in the industry (New York, Georgia, New Mexico, Canada, and the United Kingdom). California is the only state that has an explicit competitive element to its tax credit, as it ranks projects using a formula that weighs the wages that will be generated by a production versus the value of credits that will be allocated to that project. In contrast, competitors allocate credits on a first‑come, first‑served system or simply as an uncapped entitlement. Additionally, California tends to have more requirements and restrictions on the use of tax credits than other competitors. Although elective refundability is available from 2025, California’s version does come with more restrictions, as discussed above. California is also the only program in our comparison that does not allow any so called “above‑the‑line spending,” such as wages for directors, writers, and actors, to count toward expenditures for credit purposes. Finally, California and New York’s programs tend to stand out as having the most additional requirements such as diversity and workforce development plans, although the tax credit programs outside the U.S. that we analyzed do have cultural tests relating primarily to hiring a certain number of local crewmembers and/or executives.

Economic Analysis of Film Tax Credits

Good Evidence That Tax Credits Increase Production Activity. A key fact about the modern film and TV industry is that production is relatively mobile. Although California has an agglomeration of infrastructure and skilled workers, production facilities are present in most states that offer a production incentive, and talent/equipment can be easily transported. When not bound by physical constraints, financial incentives are more likely to be salient for location decisions. Existing empirical evidence on the effect that tax credits have on production location is not watertight but does suggest that there is a meaningful relationship. A previous LAO analysis of the early years of California’s tax credit estimated that two‑thirds of the projects that were allocated a tax credit would have filmed in another location had they not been awarded a credit. Academic research has found (1) a positive relationship between states that have film tax credits and production activity, and (2) offering a tax credit does increase the likelihood of a production choosing to locate in that state.

Spending Associated With Projects Allocated Tax Credits Slightly Increases Size of Film Industry. California’s film tax credit likely increases the size of the state’s motion picture and sound recording industry by a few percent. CFC reporting shows total expenditures associated with projects receiving a tax credit have averaged about $2.5 billion per year over the three most recent fiscal years. Relative to the gross domestic product of California’s motion picture industry in 2023 of $54.4 billion, this represents a little under 5 percent of the sector. This, however, overstates the effect of the credit on the size of California’s industry, as some productions receiving credits would have been made in California anyway. Further adjusting for this, the increase in the output of California’s film industry associated with the tax credit decreases to around $1.5 billion, or just under 3 percent. As discussed next, this should not necessarily be interpreted as increasing the total size of the state’s economy.

Weak Evidence That California’s Tax Credit Benefits the State’s Economy Overall. While the film tax credit likely increases the size of California’s film industry, a much more difficult question to answer is whether it grows the state’s economy as a whole. There is currently no compelling evidence to suggest that film tax credits have a positive effect on the size of the state’s economy overall, after considering two important offsetting factors. First, since the credit results in reduced state revenues, in the absence of the credit, additional revenue could have been used for another purpose, which may have an equal or even larger effect on the state’s economy. For example, estimates of local employment multipliers, which attempt to measure the total increase in local jobs due to investment in specific industries, find that motion picture, video, and sound recording have roughly average multipliers compared to other sectors. Second, increases in motion picture production activity due to incentives may partially replace other economic activity. Labor and resources used on tax credit productions may have been used on other productions or in other industries and, therefore, do not necessarily represent new economic activity.

State Incentives Typically Do Not Pay for Themselves. Film tax credits generally have a negative overall effect on state revenues. Evidence from academic research and state evaluations in places such as Georgia and New York find that every $1 of credit allocated returns significantly less than $1 in state revenue. One notable outlier to this pattern is a report from the Los Angeles County Economic Development Corporation, who claim to find a small fiscal benefit associated with the film tax credit. The Los Angeles County Economic Development Corporation estimates, however, very likely are overstated. These estimates ignore some of the important offsetting factors discussed above, specifically that some productions receiving the credit would have filmed here anyway and revenues lost to the film tax credit could have been used to fund other economically beneficial programs.

Governor’s Proposal

Increase the Credit’s Annual Cap From $330 Million to $750 Million. The Governor’s Budget proposes to raise the amount of tax credits available for the CFC to allocate to $750 million starting in 2025‑26.

Assessment

Proposal Would Position California’s Incentive Among Most Generous. Among states with caps on credit allocations, California would pass New York ($700 million) for the largest program under the Governor’s proposal. Although several states and countries have uncapped programs, California would still be among the largest in terms of credits allocated due to its size relative to other markets.

Program Expansion Is Not Justified on Economic Development Grounds. As discussed above, there is little justification for the claim that film tax credits increase the size of the economy overall. More broadly, research suggests that industry subsidies, such as the film tax credit, rarely are effective at achieving broader economic development. Therefore, without rigorous evidence to the contrary, we are skeptical that further expanding California’s credit will buck this trend.

Revenue Losses Coincide With State’s Expected Operating Deficit. The administration estimates the total revenue losses from the Governor’s proposal to be $438 million over the next four years, reaching $209 million in 2028‑29. As discussed in our Fiscal Outlook, beginning in 2026‑27, the state faces future operating deficits of $20 to $30 billion per year due to state expenditures growing faster than revenues. Given these projected deficits, the Legislature should be cautious about making new commitments which would widen the gap between revenues and expenditures.

Recent Trends Raise Concerns About Long‑Term Position of Hollywood. California’s motion picture industry is facing headwinds. Increased competition from places with lower labor costs and generous incentives, particularly outside the United States, combined with technological progress that has further decreased the need to be located in a specific location has led to a noticeable decrease in market share over the last decade. While not there yet, at some point, further deterioration of the state’s market share could pose a risk to California’s place as a center of the film industry, potentially eroding the state’s competitive advantage in this area.

Tax Credit a Valid Tool for Preserving Hollywood’s Market Share. Despite sizeable windfall effects, we view the film tax credit as being reasonably effective at increasing production activity in California. Since the credit is consistently oversubscribed, adopting the Governor’s proposal would result in the state’s market share being higher than if no action is taken.

Final Considerations

Response to Proposal Should Depend on What Goal Legislature Intends to Achieve. Based on our assessment above, increasing the annual cap on the film tax credit to $750 million would somewhat increase the size of the motion picture industry in California and help maintain its share of worldwide production, but likely would not result in economic benefits to the state as a whole. If the Legislature views maintaining California’s market share of the film industry as a high priority and an end in itself, then the Governor’s proposal would help achieve that goal.

If Acting to Protect Hollywood’s Market Share, Explicit Targets Could Help Inform Future Expansions and Improve Fiscal Oversight. If the Legislature wants to use tax credit expansions to protect the film industry, establishing more explicit benchmarks about what constitutes protecting the industry could help improve fiscal oversight of the credit. Going forward, the effectiveness of the film credit, and the need for future changes, could be informed by comparing the state’s actual market share to the desired market share.

References

Bivens, Josh. Updated Employment Multipliers for the U.S. Economy. Washington, DC: Economic Policy Institute Report. (2019)

Bradbury, John Charles. “Can movie production incentives grow the economy? Evidence from Georgia and North Carolina.” Evidence from Georgia and North Carolina (August 4, 2019) (2019).

Bradbury, John Charles. “Do movie production incentives generate economic development?” Contemporary Economic Policy 38.2 (2020): 327‑342.

Button, Patrick. “Do tax incentives affect business location and economic development? Evidence from state film incentives.” Regional Science and Urban Economics 77 (2019): 315‑339.

Button, Patrick. “Can tax incentives create a local film industry? Evidence from Louisiana and New Mexico.” Journal of Urban Affairs 43.5 (2021): 658‑684.

Kline, Patrick, and Enrico Moretti. “People, Places, and Public Policy: Some Simple Welfare Economics of Local Economic Development Programs.” Annual Review of Economics 6:629‑662 (2014)

Moretti, Enrico. “Local Multipliers.” American Economic Review 100 (2): 373‑77. (2010)

Owens, Mark F., and Adam D. Rennhoff. “Motion picture production incentives and filming location decisions: a discrete choice approach.” Journal of Economic Geography 20.3 (2020): 679‑709

Patrick, Carlianne, Peter Bluestone, Federico Carvajal, Nadia Farooq, and Kshitiz Shrestha. “Tax Incentive Evaluation: Georgia’s Film Tax Credit Tax Incentive Evaluation.” Georgia’s Film Tax Credit Georgia Department of Audits and Accounts. (2023)

PFM Group Consulting LLC. “Economic Impact of Tax Incentive Programs.” New York State Department of Taxation and Finance. December 30, 2023.

ProdPro. “2025 TV & Film Outlook Report.” January 30, 2025

Rickman, Dan, and Hongbo Wang. “Lights, Camera, What Action? The Nascent Literature on the Economics of US State Film Incentives.” (2020).

Slattery, Cailin, and Owen Zidar. “Evaluating State and Local Business Incentives.” Journal of Economic Perspectives 34 (2): 90‑118. (2020)

Swenson, Charles W. “Preliminary evidence on film production and state incentives.” Economic Development Quarterly 31.1 (2017): 65‑80.

Thom, Michael. “Lights, camera, but no action? Tax and economic development lessons from state motion picture incentive programs.” The American Review of Public Administration 48.1 (2018): 33‑51.

Thom, Michael. “Time to yell “cut?” An evaluation of the California Film and Production Tax Credit for the motion picture industry.” California Journal of Politics and Policy 10.1 (2018).

Thom, Michael. “Do state corporate tax incentives create jobs? Quasi‑experimental evidence from the entertainment industry.” State and Local Government Review 51.2 (2019): 92‑103.

Workman, Alec. “Ready for a close‑up: The effect of tax incentives on film production in California.” Economic Development Quarterly 35.2 (2021): 125‑140.