Rowan Isaaks

May 1, 2025

Overview of Diversity Efforts in the Film Tax Credit Program

- Introduction

- Film Tax Credit Diversity Requirements

- Workforce Diversity in California’s Film Industry

- Evaluating Changes Made in Program 4.0

- Other Considerations

Introduction

In recent years, the Legislature has modified the state’s film tax credit in an effort to increase the diversity of the motion picture workforce. Chapter 114 of 2021 (SB 144, Portantino) required our office to issue a report summarizing the workforce diversity information collected by the California Film Commission (CFC) and evaluate the effectiveness of the tax credit for increasing diversity. In this report, we describe the existing requirements and upcoming changes to diversity efforts in the program, compare and contrast the workforce diversity of productions receiving credits with the broader California workforce and population, and provide some broader considerations for evaluating the expanded requirements taking effect in version 4.0 of the credit.

Film Tax Credit Diversity Requirements

Film Tax Credit Created to Counteract Motion Picture Incentives in Other States. In 2009, the Legislature created a film tax credit to encourage motion picture and television productions to locate in California. The 1990s and 2000s had seen a proliferation of similar credits in other states and countries, which led to policymakers voicing concerns about projects choosing to film in jurisdictions with generous incentives instead of in Hollywood, often referred to as “runaway productions.” The tax credit has been extended and expanded three times since its inception, currently allowing $330 million in tax credits to be allocated per year. Version 4.0 of the credit will begin in July 2025, is scheduled to sunset in 2030, and notably introduces the ability for the credit to be refundable.

Diversity Provisions Introduced in 2020. Version 3.0 of the credit, which began in 2020 and runs through June 2025, requires applicants to provide (1) statistics on the gender, ethnic, and racial makeup of their workforce, and (2) a written policy outlining the applicant’s procedures for dealing with unlawful harassment in the workplace. Additionally, applicants can voluntarily submit a list of programs and initiatives they have in place to increase representation of minorities and women. Finally, while not explicitly mentioning diversity, the Pilot Career Pathways Training Program, which provides training and pathways into relevant employment, is stated to target individuals from underserved communities. Tax credit recipients are required to contribute 0.25 percent of their estimated credit allocation to the program.

Expansion of Diversity Requirements Take Effect in 2025. Version 4.0 creates new diversity, equity, inclusion, and accessibility (DEIA) requirements. Most notably, 4 percent of an applicant’s awarded credit will be contingent on the submission and approval of several documents related to the applicant’s efforts to set and achieve DEIA goals. If these requirements are not met, the CFC may only certify a credit equal to 96 percent of the original award. The broad structure of the new requirement is as follows:

- Within 30 days of receiving a credit allocation letter, applicants must submit a DEIA Workplan that reflects California’s population in terms of race, ethnicity, gender, and disability status and includes specific DEIA goals and how the applicant intends to fulfill them. Workplans may not include quotas or other numerical goals regarding any protected class.

- Prior to the start of principal photography, applicants must submit an Interim Assessment that summarizes current progress made towards goals set out in the workplan.

- Within 60 days of concluding production activity, the applicant must submit a Final Assessment summarizing how the applicant has met or made a “good‑faith attempt” to meet the goals detailed in the workplan.

- If the applicant fulfills these requirements and the CFC agrees that a good‑faith effort has been made, then the additional 4 percent of the award can be certified. There are limited exemptions to this requirement, including independent productions with a total expenditure of less than $10 million. Version 4.0 also increases the required contribution to the Career Pathways Program from 0.25 percent to 0.5 percent for non‑independent productions only.

Workforce Diversity in California’s Film Industry

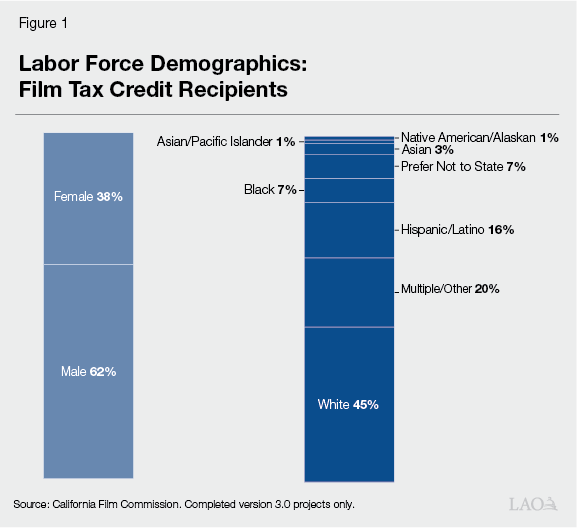

Completed Version 3.0 Productions Hire Men, White Workers at Higher Rates Than Other Groups. Figure 1 summarizes data collected and published by CFC on the gender and ethnicity of labor hired for projects that have received tax credits under version 3.0 of the program (2020‑2025) and have been completed. There are three broad takeaways from this data: (1) men represent over 60 percent of individuals who worked on completed projects, (2) individuals identifying as white are the most represented group by a large margin, and (3) a significant minority of respondents (27 percent) either declined to respond or identified as Multiple/Other.

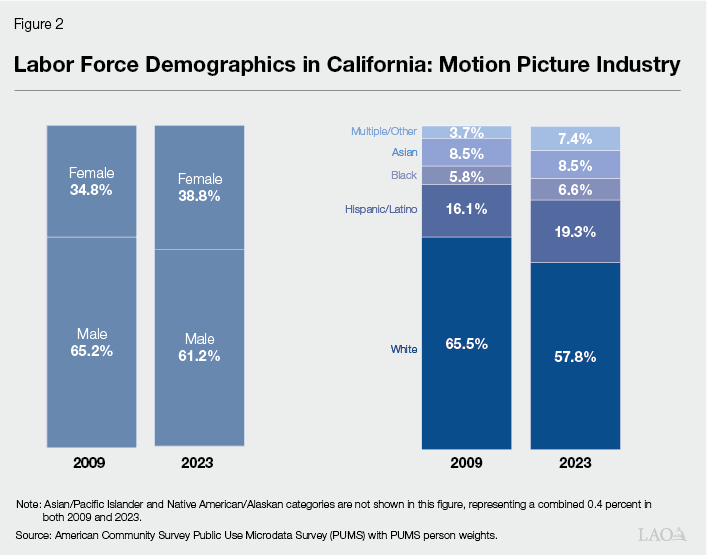

Motion Picture Workforce Differs in Ethnic Makeup, but Not Gender Diversity. The percentages presented in Figure 1 alone do not give a sense of how diverse the labor forces of version 3.0 productions are relative to both (1) the overall motion picture workforce in California and (2) California’s population as a whole. Figure 2 shows the composition of the broader motion picture workforce in California by gender and ethnicity for both 2009 and 2023. First, the overall motion picture workforce shows a similar pattern to the CFC statistics in Figure 1: men and white individuals represent the largest shares of the workforce. Second, since the creation of the film tax credit in 2009, there has been a moderate decrease in the share of the industry workforce that is male or white, with corresponding increases for the female, Hispanic/Latino, Black, and Multiple/Other categories. Third, comparing the 2023 numbers in Figure 2 with the CFC data in Figure 1, white and Asian individuals are less represented in the workforces of completed version 3.0 projects compared to the overall workforce, and other racial/ethnic groups including Black and Hispanic/Latino are more represented. There is no significant difference in gender diversity between version 3.0 productions and the overall motion picture industry.

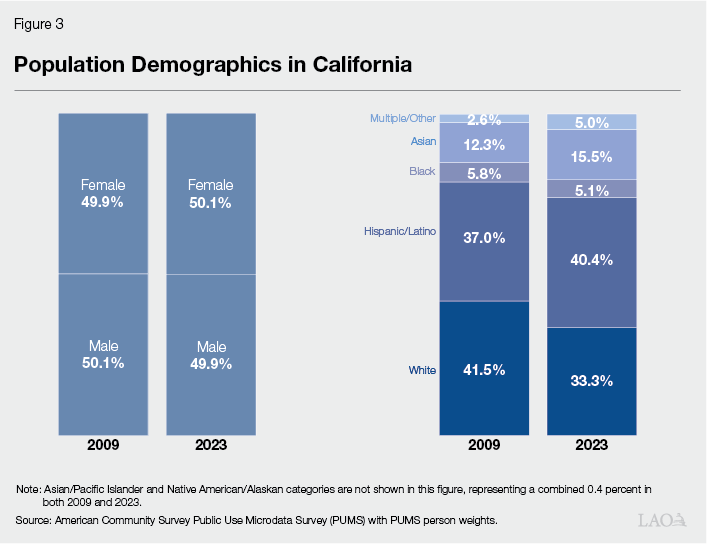

Mix of Over and Underrepresented Ethnic Groups Relative to California Population. The statute outlining DEIA provisions for the film tax credit states that the goals of diversity workplans and initiatives should be “broadly reflective of California’s population, in terms of race, ethnicity, gender, and disability status.” To get a sense of how proportional the current labor force of tax credit recipients is relative to the population, Figure 3 shows gender and ethnicity composition in California for 2009 and 2023, which serve as the baseline for thinking about whether certain groups are under or over‑represented in productions receiving credits. One trend of note is that since the inception of the film tax credit, the share of Californians who identify as white only has decreased from 41.5 to 33.3 percent, making white no longer the largest ethnic group in the state. Comparing Figure 1 with the 2023 data in Figure 3, white, Black, and Multiple/Other individuals are overrepresented among credit recipients relative to their California population share, while Hispanic/Latino and Asian individuals are underrepresented.

Available Data Provides Limited Ability to Assess Workforce Diversity. Although an interesting exposition, the above comparisons do not provide a perfect estimate of the relative gender and ethnic diversity within the film tax credit and its contribution to overall representation in the motion picture industry. One reason for this is that the CFC data has a 7 percent nonresponse rate and the propensity for nonresponse is not random across projects, which suggests that the true gender and ethnicity representation is different than what is reported by those who do respond. Additionally, only version 3.0 projects that have been completed are included in the data, and may not represent the set of all projects that will be completed under version 3.0 of the credit.

Evaluating Changes Made in Program 4.0

New Diversity Rules Provide a More Credible Incentive for Applicants. Compared to the version 3.0 diversity requirements, the upcoming changes in version 4.0 represent a more significant incentive for production companies to engage in DEIA activities, since 4 percent of the total credit is contingent on enacting and documenting specific initiatives. Whether this additional incentive will be enough to improve diversity remains to be seen and necessitates ongoing evaluation by the Legislature. We offer some considerations for these future evaluations below.

New Checklist Includes Holistic Set of Requirements. The effectiveness of the version 4.0 diversity requirements hinge on the veracity of CFC’s determination of a good‑faith effort. As such, the Legislature will want to be sure it is confident in CFC’s processes to make this determination. The CFC’s new DEIA checklist provides a rubric for the types of DEIA activities that should be enacted and subsequently documented in the DEIA Workplan, Interim Assessment, and Final Assessment. Four separate categories must be addressed and are evaluated by CFC as part of their determination as to whether an applicant has made a good‑faith attempt to meet the requirements:

- Inclusive Hiring: minimizing bias during the hiring process, valuing diverse perspectives, and implementing an equitable recruiting process.

- Equity Education: learning about the historical and contemporary experiences of underrepresented communities and people, existing civil rights and discrimination laws, and setting goals for ensuring DEIA for everyone on the production.

- Industry Building Capacity: helping to increase an inclusive and qualified workforce and qualified vendor and supplier base in all areas that contribute to motion picture production in California.

- Supplier Diversity: contracting with qualified vendors, including but not limited to catering companies, accounting firms, equipment rentals, and postproduction houses, owned and operated by individuals from socially and economically underrepresented groups to support production.

Varying Components in Workplans Will Limit Evaluation Potential. A holistic set of criteria as described above allows for a breadth of interventions/initiatives. However, the array of interventions and the range of acceptable goals and methods, including the use of external partners to administer programs makes it difficult to provide a detailed evaluation of individual initiatives outside of broad comparisons of film tax credit recipients to the workforce more generally. Conversely, the Career Pathways Program will be easier to evaluate directly as a single cohesive program.

Demographic Data Varies in Availability. The definition of DEIA adopted by the CFC and in the California Code of Regulations includes a commitment to provide equitable access to opportunities on the basis of a wide range of protected classes. However, current data collection on tax credit recipients is limited to gender and race/ethnicity. As such, it will be difficult to assess the degree of representation that exists in the workforce of tax credit recipients in dimensions such as disability and veteran status, class, and sexual orientation.

Other Considerations

Scope of Underrepresented Group Is Variable. For the purposes of the film tax credit, representation is typically defined as the share of the recipient’s workforce from a specific group relative to their share of the overall California population, with progress toward proportional representation being seen as desirable. However, there are some cases where metrics may want to be viewed more broadly. A good example of this is the Black population in California. Based on the figures presented above, the Black population is somewhat overrepresented in California’s motion picture industry (6.6 percent) compared to their share of the total population (5.5 percent). Conversely, Black Americans have historically been underrepresented in both Hollywood, and many higher‑paying fields more generally, relative to their share of the national population. Therefore, representation proportionate to California’s population is simply one of many statistics that can be considered as part of the state’s equity objectives.

Increases in Diversity May Partially Come From Selection Effects. An observed increase in labor force diversity among productions receiving tax credits could come from two different channels. It could be that DEIA requirements are having an actual effect on representation. Conversely, there is also the potential for a selection effect, whereby the version 4.0 requirements cause productions that are more diverse to select into California or productions that are less diverse to select out of California. This channel would still result in Hollywood becoming more diverse and representative but would do so by concentrating more diverse productions in California rather than increasing diversity in the industry as a whole.

Evidence Suggests Crew Diversity Is Downstream of Executive Diversity. Although below‑the‑line positions make up the large majority of workers in the motion picture industry, some studies have documented a relationship between the gender/race/ethnicity of executive positions (such as director/producer) and the downstream diversity of cast and crew for that production. Given this, additional effort or focus on diversity among these career trajectories may have an outsized effect on overall crew diversity.

- Note: This report was prepared in fulfillment of the reporting requirements of Chapter 114 of 2021 (SB 144, Portantino).