Helen Kerstein

May 7, 2025

Assessing California’s Climate Policies—

Cap‑and‑Trade Reauthorization

- Introduction

- Background

- Legislature’s Reauthorization Choices Have Significant Implications

- Addressing Potential Legislative Priorities

- Legislature Plays Important Role in Reauthorization of Program

Summary

Legislature Faces Important Decisions Related to Reauthorization of Cap‑and‑Trade Program. As the 2030 statutory sunset date approaches, the Legislature faces choices about whether and how to extend the cap‑and‑trade program. These decisions are particularly important given that reauthorization could shape the program for many years to come. Also, in light of the dollar amounts at stake, these choices could have significant implications for various legislative priorities, such as greenhouse gas (GHG) reductions and affordability.

Cap‑and‑Trade Plays Important Role in Helping State Reduce GHGs Cost‑Effectively. Since its creation, the cap‑and‑trade program has served an important role in helping the state ensure that it meets its GHG reduction goals in a relatively cost‑effective manner. Fundamentally, the cap‑and‑trade program works by making polluters pay a price for each unit of GHGs they emit. This price provides a financial incentive for households and businesses to undertake low‑cost emission reductions (similar in many ways to a carbon tax). Should the program expire in 2030, the state would need to identify other—likely less cost‑effective—activities and policies to attain additional emissions reductions in order to meet its GHG‑reduction goals.

Reauthorization Decisions Will Have Significant Financial Implications for Households, Businesses, and the State. If the program were to be extended for 15 years (until 2045), we estimate that emitters could potentially pay a couple of hundred billion dollars for allowances during this period. Many of these charges likely would be passed on to California households and businesses in the form of higher prices, such as for gasoline and diesel fuel. Notably, however, the revenue from these charges also can be directed to meet legislative priorities, such as offsetting the costs of the program to consumers, further reducing GHG emissions, or supporting other policy priorities. As a result, decisions about both the design of the program and how the revenue is used will have important implications for households and businesses, as well as on funding levels for various state programs.

Legislature Faces Various Options, Each With Key Trade‑Offs. To help inform the Legislature’s decisions, in this report we summarize some options available to the Legislature to help achieve its policy priorities through reauthorization. For example, the Legislature may want to focus on improving affordability, particularly given that the extension of the program could put upward pressure on allowance prices and result in higher associated costs to emitters and consumers. If affordability were the Legislature’s focus, some options for addressing it include: (1) lowering the price ceiling to prevent the potential for high allowance prices; (2) using cap‑and‑trade revenues to offset consumer costs, such as by providing rebates to households; and/or (3) increasing the number of free allowances dedicated to offsetting consumer costs. These options would all come with notable trade‑offs.

Important for Reauthorization to Reflect Legislative Priorities. Whichever approaches the Legislature chooses to adopt, we encourage it to ensure that its key policy priorities are reflected in the design and operation of the program going forward, including providing clear statutory direction when applicable.

Introduction

Legislature Faces Decisions Related to Reauthorization of Cap‑and‑Trade Program. Since the cap‑and‑trade program was created through the passage of Chapter 488 of 2006 (AB 32, Núñez), it has served as one of the state’s primary policies intended to help it achieve its ambitious GHG reduction goals. Chapter 135 of 2017 (AB 398, Garcia) extended the statutory authorization for the program from 2020 through 2030. As the 2030 statutory sunset date approaches, the Legislature faces important choices about whether and how to extend the program.

Report Is Intended to Help Inform Decisions on Reauthorization. This report is intended to help inform legislative decision‑making around reauthorization of the cap‑and‑trade program. The report has four main sections. First, we begin by providing background on various aspects of the cap‑and‑trade program. Second, we discuss some reasons why decisions about reauthorization of the program are important. Third, we summarize some options for addressing key potential legislative priorities for the program—GHG reductions, affordability, and various other policy goals—as part of reauthorization. Finally, we discuss the importance of the Legislature providing clear statutory authorization and direction for the program in priority areas.

Report Meets Statutory Requirement. This report is submitted pursuant to AB 398, which requires our office to report annually on the economic impacts and benefits of the state’s GHG emissions reduction targets. Consistent with the statutory direction, this report discusses the potential economic impacts and benefits of the state’s GHG targets, focusing on the cap‑and‑trade program.

Background

In this section, we provide background on California’s existing cap‑and‑trade program.

Cap‑and‑Trade Program Overview

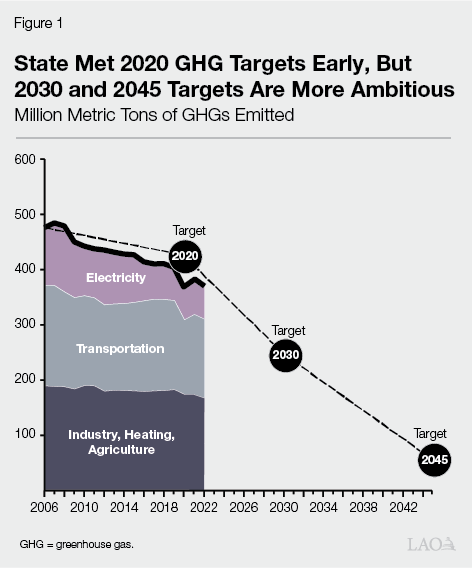

California Has Adopted Ambitious GHG Reduction Goals. GHG emissions are the main drivers of global climate change. To try to reduce California’s contributions to climate change and encourage innovations that influence actions in other states and countries, the Legislature has adopted three successive statewide GHG emission reduction goals (also known as targets) for 2020, 2030, and 2045. As shown in Figure 1, the state met its 2020 goal several years ahead of schedule. However, emissions will need to decline at a much faster rate in order to meet the 2030 and 2045 targets, which are significantly more ambitious.

State Is Implementing Various Programs to Reduce GHGs. In order to meet its GHG‑reduction goals, the state has implemented various programs and policies. For example, in 2006, the Legislature adopted AB 32, which authorized the California Air Resources Board (CARB) to create a market‑based mechanism to reduce GHG emissions from large emitters through 2020. Under this authority, CARB adopted the cap‑and‑trade program as the state’s market‑based mechanism. (In the nearby box, we discuss how cap‑and‑trade compares to another main market‑based approach: carbon taxes.) The program first took effect in 2012. Subsequently, in 2017, the Legislature enacted AB 398 to extend the explicit statutory authorization for the program through 2030 and modify certain aspects of the program design. The state also has developed various other programs to reduce GHGs. Some of these programs were established by the Legislature in statute, such as the Renewable Portfolio Standard, which requires a growing share of electricity generation to come from renewable sources. In other cases, CARB has developed programs under the broad authority it received through AB 32. For example, CARB created the Low‑Carbon Fuel Standard (LCFS) program—which requires transportation fuel suppliers to reduce the amount of GHGs per unit of fuel sold in the state—through regulation.

Cap‑and‑Trade Program Aims to Limit the Overall Level of Emissions From Large Emitters. Under the cap‑and‑trade program, CARB issues a limited number of allowances each year—sometimes known as the “cap” on emissions. Entities covered under the program represent roughly three‑quarters of the state’s GHG emissions and include oil refineries, electricity generators and importers, and manufacturing facilities. These “covered entities” can meet compliance obligations under the program through a combination of the following actions:

- Reducing their GHG emissions.

- Obtaining allowances (essentially a permit to emit one ton of carbon dioxide equivalent) to cover their emissions.

- Purchasing “offsets” (paying to support a GHG reduction project outside of the capped sectors) to cover their emissions.

Cap‑and‑Trade and Carbon Taxes Are Both Market‑Based Policies

Both Policies Rely on Financial Incentives to Reduce Emissions. The two main market‑based policies for reducing emissions are cap‑and‑trade and carbon taxes. Market‑based approaches differ in a few key ways from other potential regulatory approaches such as traditional command‑and‑control regulations. Under traditional regulations for reducing emissions, the government requires every affected business to install a certain type of emission reduction technology or meet a certain minimum emissions standard. In contrast, a market‑based approach adds a financial cost to producing greenhouse gases (GHGs), which provides a financial incentive for private businesses and consumers to reduce emissions.

Policies Differ in Some Key Ways. A carbon tax sets a price on GHG emissions and allows the market to determine the quantity of those emissions. In contrast, a cap‑and‑trade program sets the quantity of GHG emissions allowed and lets the market determine the price. Thus, in concept, cap‑and‑trade generally provides more certainty regarding emissions while carbon taxes generally provide more certainty regarding the price of emissions (and thereby on the price effects on consumers and businesses). Notably, California’s cap‑and‑trade program has some design features that make it more similar to a carbon tax than the most basic stylized version of a cap‑and‑trade program would suggest. For example, California’s cap‑and‑trade program has a price floor and price ceiling, which limit the ability of carbon prices to fluctuate outside of a defined range. Also, notably, in California’s program, if allowance prices were to reach the price ceiling, the California Air Resources Board would sell an unlimited number of permits to emit at that price level. (Under current regulations, the proceeds from the sale of those permits must be used to pay for mitigation activities outside of the capped sectors, such as those funded by offsets.) In effect, this would allow additional emissions beyond the program’s cap, but it also would help ensure that the effects on prices did not exceed a certain threshold.

By limiting the number of allowances and offsets that can be used, the program requires that, in aggregate, these major sources of emissions do not exceed a certain level. Covered entities—as well as certain other qualifying entities—can buy and sell (“trade”) allowances, thereby creating a market price for the allowances. As discussed in more detail below, this market price for allowances provides a financial incentive for emitters to identify low‑cost opportunities to reduce emissions.

Allocation and Sale of Allowances

State Gives Away Roughly Half of the Allowances. As shown in Figure 2, currently the state gives away about half of the program’s allowances for free to industrial facilities, electric utilities, and natural gas suppliers. The free allowances to industry are intended to keep companies from moving their operations outside of California to avoid the need to comply with the program (known as emissions “leakage”). The free allowances for electric utilities and natural gas suppliers are intended to protect consumers from significant cost increases. To that end, many of these free allowances are used to provide regular—annual or twice annual—rebates to customers, known as the “California Climate Credit.” The remaining free allowances provided to electric and natural gas utilities are used to support other purposes that are generally intended to benefit ratepayers, such as activities that reduce the utilities’ emissions and thereby reduce their compliance costs. For example, some of these allowances support energy efficiency programs and solar energy programs.

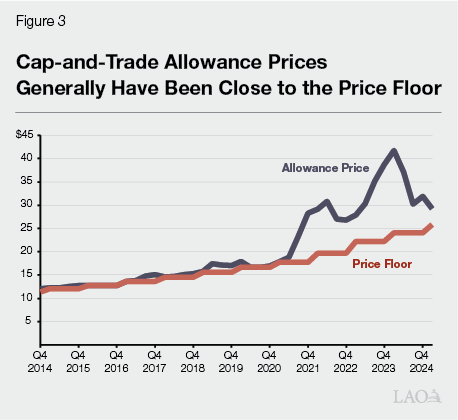

CARB Sells the Remaining Allowances at Quarterly Auctions. CARB sells the remaining half of allowances at quarterly auctions and the revenues are deposited into the state’s Greenhouse Gas Reduction Fund (GGRF). CARB sets a minimum and maximum price at which allowances can be sold (known as a “price floor” and “price ceiling”) at its auctions. Multiple factors affect the relative supply and demand for allowances and thus allowance prices. For example, some dynamics that can affect prices include the program’s specific design features (such as the number of allowances issued), confidence in the longevity of the program, and the level of GHG reductions achieved by other state policies. (The greater the level of reductions achieved by other programs and policies, the less “work” the cap‑and‑trade program must do to ensure emissions stay within the cap, which can lower allowance demand.) As shown in Figure 3, for most of the program’s history, allowance prices have been at or near the price floor. While allowance prices generally have increased since 2020, they have been somewhat lower in the last few auctions compared to late 2023 and early 2024. Thus far, however, allowance prices have never gotten close to the price ceiling (roughly $95 per allowance in 2025).

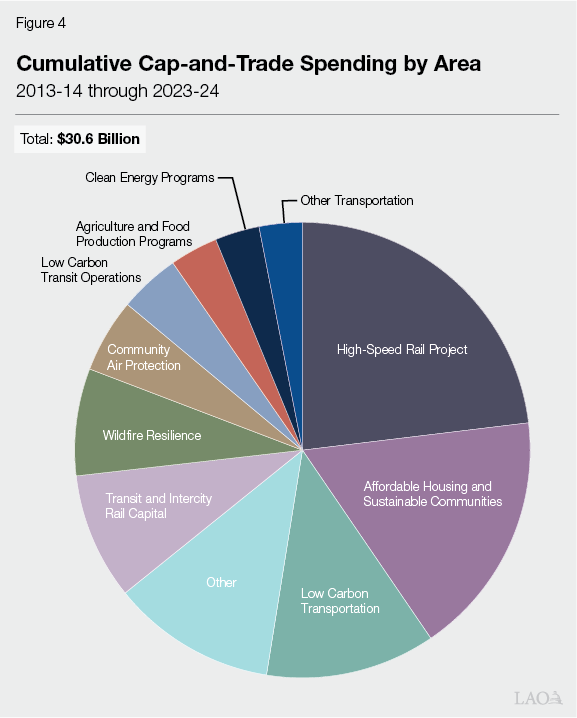

Auctions Generate Billions of Dollars, Which State Has Mostly Used to Further Climate Goals. From its inception through 2023‑24, cap‑and‑trade auctions have provided roughly $31 billion for GGRF. As shown in Figure 4, these revenues have been used to support a wide range of programs, many of which are aimed at reducing GHG emissions. Initially, the program’s emphasis on supporting GHG reductions with GGRF was due in part to legal uncertainty regarding the allowable use of the funds. However, from a legal perspective, since the passage of AB 398, which was adopted with a two‑thirds vote of both houses of the Legislature, GGRF funds have been considered akin to tax revenues, so they can be used for any purpose.

Most GGRF Spending Directed by Statute. As shown in Figure 5, by statute, roughly two‑thirds of auction revenues are dedicated for certain purposes. Most of these statutory GGRF spending commitments are continuously appropriated, meaning they are not subject to appropriation by the Legislature through the annual budget act. The remaining revenues that are not statutorily directed are available for appropriation by the Legislature for other discretionary spending programs. Some of the existing statutory allocations do have sunset dates. For example, under current law, the continuous appropriations for forest health and safe and affordable drinking water are scheduled to expire at the end of the 2028‑29 and 2029‑30 fiscal years, respectively. (Should the cap‑and‑trade program fail to be extended, revenues would cease, thereby effectively sunsetting all the statutory allocations.)

Figure 5

Continuous Appropriations and Other Statutorily Required GGRF Appropriations

|

Program |

Department |

Appropriation Amount |

|

High‑speed rail project |

HSRA |

25 percent of annual revenues |

|

Affordable Housing and Sustainable Communities Program |

SGC |

20 percent of annual revenues |

|

TIRCP |

CalSTA |

10 percent of annual revenues |

|

Low Carbon Transit Operations Program |

Caltrans |

5 percent of annual revenues |

|

Healthy and resilient forest activities |

CalFire |

$200 million |

|

Safe and Affordable Drinking Water Program |

SWRCB |

5 percent of annual revenues (up to $130 million) |

|

Manufacturing tax credit |

N/A |

Roughly $100‑$140 million |

|

State Responsibility Area fee backfill |

CalFire |

Roughly $70‑$90 million |

|

GGRF = Greenhouse Gas Reduction Fund; HSRA = High‑Speed Rail Authority; SGC = Strategic Growth Council; TIRCP = Transit and Intercity Rail Capital Program; CalSTA = California State Transportation Agency; Caltrans = California Department of Transportation; CalFire = California Department of Forestry and Fire Prevention; SWRCB = State Water Resources and Control Board; and N/A = not applicable. |

||

Legislature’s Reauthorization Choices Have Significant Implications

Whether the Legislature decides to extend the cap‑and‑trade program and—if it does proceed with reauthorization—its decisions regarding how to do so could have significant implications for the state’s climate policies, affordability, and other policy priorities for many years to come. In this section, we discuss some of the main impacts of these decisions. Specifically, reauthorization decisions will have important implications for: (1) the costs of reducing GHG emissions; (2) the financial costs paid by households and businesses that continue to produce and use GHG‑intensive products; and (3) revenue generated from the program, which can be used to offset costs to households and businesses or achieve other policy priorities.

Program Can Help State Meet GHG Goals Cost‑Effectively

Cap‑and‑Trade Can Provide Greater Certainty for State to Meet Its GHG Reduction Goals. By limiting emissions to a designated level, the cap‑and‑trade program has sometimes been considered a “backstop” to help make sure the state meets its targets. That is, to the degree other policies collectively fall short of meeting the state’s GHG reduction goals, the cap‑and‑trade program can ensure that covered entities reduce emissions further to make up the difference. As a result, were the program not to operate beyond 2030, the state would have less certainty that it will be able to meet its 2045 GHG‑reduction goals.

Cap‑and‑Trade Reduces GHGs Relatively Cost‑Effectively… Another important attribute of the cap‑and‑trade program is that it provides the private sector with the flexibility to determine which emission reduction activities are least costly and provides a monetary incentive for undertaking those relatively low‑cost activities. By adding a cost to activities that produce emissions, the program provides businesses with a financial incentive to emit fewer GHGs when producing their goods and services. Also, in many cases, the additional costs of GHG‑intensive products are passed on to consumers in the form of higher retail prices for those products. For example, transportation fuel suppliers must purchase allowances associated with the emissions from gasoline consumption and the costs generally are passed on to consumers in the form of higher gasoline prices. As these prices increase, households and businesses have an incentive to reduce their gasoline consumption. By sending these price signals to emitters and consumers, cap‑and‑trade likely is among the most cost‑effective approaches to reducing GHG emissions the state can consider; it generally is more cost‑effective than direct industry regulations, other narrower market‑based mechanisms (like LCFS), or expenditures on programs aimed at reducing GHGs.

…Allowing the State to Meet Its Goals at Lower Cost Than Many Other Options. To the extent that the state relies more heavily on other climate programs—which generally are less cost‑effective than cap‑and‑trade—emitters likely would face higher overall costs to reduce emissions and meet the state’s climate goals as compared to depending more on cap‑and‑trade. Moreover, if the program were to cease operating after 2030, the state would need to identify other—likely more costly—activities and policies to attain additional emissions reductions in order to meet its 2045 GHG‑reduction goals. We note that cost‑effectiveness considerations could become increasingly important as the state’s GHG‑reduction goals become more ambitious and the costs of achieving them grow.

Program Imposes Costs on Households and Businesses That Continue to Emit

Cap‑and‑Trade Program Imposes Costs on Emitters and, Ultimately, Consumers. While the cap‑and‑trade program is a relatively cost‑effective approach to reducing GHG‑emissions, it still imposes notable costs on entities that continue to emit and must pay to purchase allowances. Many of these costs are in turn passed along to consumers in the form of higher prices for the associated products. These financial costs for businesses and consumers are largely a byproduct of the way the program is designed to incentivize the emission reductions—not the primary goal of the program. However, many households and businesses still pay higher costs under the program. For example, based on current allowance prices (which are near the price floor), we estimate that the cap‑and‑trade program adds about 23 cents to each gallon of retail gasoline sold in California. Consumers that continue to use gasoline—for example, because they may not have the resources to purchase an electric vehicle—have to pay these costs.

Amount Consumers Would Pay in the Future Depends on Allowance Prices. Future allowance prices are highly uncertain. For illustrative purposes, Figure 6 highlights three example scenarios for potential impacts of various allowance prices, including if (1) allowance prices were to fall to the current price floor of about $26, (2) allowance prices were to stay at the level of the February 2025 auction, and (3) allowance prices were to reach the current price ceiling of roughly $95.

Figure 6

Illustrative Example of Relationship Between Cap‑and‑Trade Allowance

Prices, Gasoline Cost Increases, and Allowance Values

Floor and Ceiling Prices and Allowance Allocations Reflect 2025 Levels

|

Hypothetical Price Scenario |

Price Per |

Per Gallon Retail |

GGRF Revenues |

Total Value of All |

|

Price Floor |

$25.87 |

$0.20 |

$3.2 billion |

$6.9 billion |

|

February 2025 Actual Price |

29.27 |

0.23 |

3.6 billion |

7.8 billion |

|

Price Ceiling |

94.92 |

0.74 |

11.6 billion |

25.4 billion |

|

aIncludes combined value of both free and auctioned allowances. |

||||

|

GGRF = Greenhouse Gas Reduction Fund. |

||||

If Allowance Prices Were to Reach the Price Ceiling, Consumer Impacts Would Be Much Larger. Some recent modeling suggests that reauthorization likely will put upward pressure on prices and potentially lead to them reaching the price ceiling over the next several years. As highlighted in the figure, in the hypothetical scenario of allowance prices reaching the price ceiling, we estimate that cap‑and‑trade would contribute roughly 74 cents per gallon to gasoline prices, compared to the current level of roughly 23 cents per gallon based on February 2025 allowance prices. (We estimate that the average household would pay about $700 per year as a result of the program if the program were to contribute 74 cents per gallon to gasoline prices and gasoline use remained stable.) Such higher costs would be particularly burdensome for lower‑income households, as they tend to spend a relatively high share of their incomes on transportation fuels compared to wealthier households. These potential increases come at a time when the state is implementing changes to other programs and policies—such as updates to LCFS—that also are expected to raise consumer costs, including for transportation fuels.

Program Generates Revenue That Can Be Used to Offset Costs and/or Achieve Legislative Priorities

Allocating Allowances Is Similar to Allocating Tax Revenues. CARB issues a set number of allowances each year equal to the annual cap. Emitters pay for allowances, similar to the way they would pay a tax on their GHG emissions. A key difference between allowances and taxes is how the revenues are allocated. In the case of taxes, all of the revenues come directly to the state. In contrast, in the case of allowances, the revenues go to whichever entity is provided the allowances. As a result, in concept, the decision about who gets the allowances essentially determines where the revenue from the charges paid by emitters will go, including which entities will receive these revenues and for what purposes. For example, under the current program structure established through CARB regulations, the value of allowances goes to the entities that receive free allocations (such as utilities and some industries) and to the state (in the case of allowance revenues sold for deposit into GGRF).

Allowance Value Could Be Used to Reduce Consumer Costs or Address Other Priorities. Another important aspect of the cap‑and‑trade program is that the significant value of these allowances can be directed by the Legislature to reduce the financial costs to households and/or meet its other policy priorities, such as those discussed further below. For example, currently, some of the allowances are allocated to utilities for free. These utilities are required to consign most of these free allowances to auction and use the resulting revenues to provide customer rebates. Specifically, the California Climate Credit that is provided to electricity customers generally offsets the costs that are passed along to them as a result of the cap‑and‑trade program. California natural gas customers also receive similar credits aimed at mitigating much of their costs. Also, roughly half of the allowances are sold by the state, deposited in the GGRF, and used to fund a variety of state environmental programs. This aspect of the program is a key distinction of cap‑and trade as compared to alternative approaches for reducing GHG emissions—such as direct industry regulations or the LCFS program—which do not generate discretionary revenues that the state can direct to offset costs or meet its policy goals.

Allowances Could Be Worth a Couple Hundred Billion Dollars Under Reauthorization. The decisions around the allocation of cap‑and‑trade allowances are akin those around the use of tax revenues. These decisions are particularly important given the dollar amounts involved, both in terms of the potential price impacts to consumers discussed above as well as the potential value of future allowances. Specifically, if the Legislature were to extend the program from 2030 through 2045, we estimate that the total value of allowances issued over that 15‑year period could be in the range of roughly $70 billion to $260 billion (in 2025 dollars). (This estimate is based on allowance scenarios CARB has identified as part of its forthcoming rulemaking and assumes that allowance prices remain between the current price floor and ceiling, adjusted by 5 percent annually, consistent with current CARB regulations.)

Addressing Potential Legislative Priorities

In this section, we highlight three potential legislative priority areas for the future of cap‑and‑trade: GHG emission reductions, affordability, and other various goals. We also highlight some key decision points—and policy options—that the Legislature might want to consider, depending on how it weighs its different policy priorities. Figure 7 provides a summary of these policy options.

Figure 7

Summary of Some Options for Addressing Potential

Legislative Priorities in Cap‑and‑Trade

|

Category |

Options |

|

Policy Priority: Greenhouse Gas Reductions |

|

|

Program Design |

|

|

|

|

Use of Allowance Value |

|

|

Policy Priority: Affordability |

|

|

Program Design |

|

|

Use of Allowance Value |

|

|

|

|

Other Policy Priorities |

|

|

Use of Allowance Value |

|

|

|

|

GGRF = Greenhouse Gas Reduction Fund. |

|

GHG Emission Reductions

One of the Clear Goals for Reauthorization Is Promoting GHG Reductions. One obvious legislative priority is pursuing GHG reductions, which traditionally has been the main purpose of the cap‑and‑trade program. The Legislature faces important decisions about (1) the level of GHG reductions it wants to achieve through the program, recognizing that more significant reductions will be necessary to meet legislatively established GHG reduction targets, and (2) how to achieve its preferred level of GHG reductions. We discuss some potential approaches for achieving greater GHG reductions through the program below. In the box below, we discuss an approach that—while it may not reduce overall GHG emissions—could also play a role in supporting the state’s climate goals.

Changes to Utility Allowances Could Also Support Climate Goals

As we discuss in our January 2025 report, Assessing California’s Climate Policies—Residential Electricity Rates in California, a barrier to achieving the state’s goals for electrification—which is an important step in meeting the state’s greenhouse gas (GHG)‑reduction goals—is the high volumetric cost of electricity in the state. This is because high volumetric rates reduce the financial incentives for consumers to pursue electrification through switching out their fossil fuel‑powered cars and appliances. Currently, a significant share of the free cap‑and‑trade allowances provided to electric and natural gas utilities are used to provide rebates of fixed dollar amounts to ratepayers. The Legislature could consider various modifications to this approach with the goal of reducing volumetric electricity rates and thereby increasing incentives for electrification. For example, the Legislature could require that utilities structure electricity rebates to offset volumetric rates rather than providing them as fixed amounts. Additionally, shifting some allowances from other existing purposes—such as natural gas utility rebates and programs—to electric utilities could result in a greater number available for lowering electricity rates. We note that such changes would have associated trade‑offs. For instance, these changes would have distributional impacts, with some customers receiving bigger or smaller rebates than under current practices. If the Legislature were concerned about such distributional impacts, it could consider focusing volumetric rebates for certain vulnerable groups of customers, such as households in hotter areas (which tend to have higher electricity usage) and/or those with lower incomes.

Main Way to Drive GHG Reductions Is Through Design of Cap‑and‑Trade Program. Generally, the best way to reduce GHGs using a cap‑and‑trade program is through the program design. (This is largely more impactful than directing spending from the revenues it generates because the cap already ensures GHG reductions take place in covered sectors regardless of how GGRF spending is directed, as discussed in the box below.) Some examples of program design modifications that could strengthen the program’s ability to reduce GHGs include:

- Lower Cap on Emissions. CARB’s existing regulations include planned annual reductions in the program’s cap (and associated number of allowances). The board has indicated that it plans to propose new regulations that will further tighten the emissions cap by removing a greater number of allowances from the program in 2026 through 2030 than would currently be the case. The most straightforward way to modify the program’s design to further reduce GHG emissions would be to drop the cap on emissions even lower, which could be done through regulations or by statute. Taking such a step would result in allowing fewer GHGs to be emitted in the capped sectors. A key trade‑off of a lower cap is that allowances would become more scarce, thus driving up allowance prices. This, in turn, would result in higher costs to emitters, and ultimately to households and businesses, as discussed previously.

- Modify Treatment of Offsets. Changing how offsets are handled under the program could affect GHG emissions in various ways, depending upon what modifications are made. For example, one potential change could be to remove an allowance from the program for each offset that is used to meet a compliance obligation. (This approach often is referred to colloquially as placing offsets “under the cap.”) In practice, this would lower the effective cap relative to what it would otherwise be, which would reduce the amount of allowable emissions and thereby likely increase the scarcity and costs of remaining allowances. Accordingly, the key trade‑off would be lower emissions but higher consumer cost impacts. Another potential change would be to enhance requirements for offset projects, such as by adopting stronger standards to ensure that offsets result in permanent emissions reductions that would not otherwise have occurred. A trade‑off of this option is that it likely would increase the price of offsets and decrease their use, which would increase overall compliance costs for emitters (and associated costs to consumers).

Spending Revenues in Capped Sectors Generally Does Not Reduce GHGs

In a well‑functioning cap‑and‑trade program, the cap will ensure that greenhouse gases (GHGs) are reduced, regardless of how revenues generated from allowance sales are spent. At first glance, using cap‑and‑trade revenues to subsidize GHG reductions from capped sources might appear to encourage additional emission reductions. However, as long as the cap is already limiting emissions from these emitters, spending on activities to reduce emissions from these same entities likely will have no net effect on overall emissions. This is because subsidizing an emission reduction from one capped source will simply free‑up allowances for other covered emitters to use. The end result is a change in the sources of emissions under the cap, but no change in the overall level of emissions. In contrast, spending on reductions from uncapped sources—that is, entities that are not subject to the cap‑and‑trade program, such as agriculture, landfill methane emissions, and emissions from refrigerants—is likely to reduce overall emissions. Net reductions would occur in the non‑covered sectors because it would not result in a trading of allowances that simply change the source of emissions, as such entities are not required to purchase allowances or comply with the cap. For more detail, please see our 2016 report, Cap‑and‑Trade Revenues: Strategies to Promote Legislative Priorities.

In Some Limited Cases, GGRF Revenues Can Also Be Used to Reduce GHG Emissions. While adjusting the program design generally is the most impactful and cost‑effective approach to reducing GHGs, the state could achieve some additional GHG reductions with the use of GGRF revenues. In general, the best way to do so would be to fund GHG‑reduction activities that are outside of the capped sectors, such as related to natural and working lands and landfills. This is because the cap does not otherwise limit emissions from these sources.

We note that to the extent the Legislature would like to direct additional spending toward reducing GHGs, such as by funding GHG reductions outside of the capped sectors, it would be important to consider factors such as (1) the cost‑effectiveness of this spending; (2) how this spending interacts with other programs besides cap‑and‑trade; (3) any co‑benefits beyond GHG reductions that might be achieved through the proposed spending; and (4) whether the timing of the funding needs align with the availability of GGRF funding, as the volatility of auction revenues mean that GGRF is not well‑suited to securitization.

Affordability

A Potential Legislative Goal for Reauthorization Is Mitigating Impacts on Affordability. Affordability is an important policy priority, particularly in the context of cap‑and‑trade reauthorization. This is because a lower cap on GHG emissions likely will increase consumer costs notably, particularly for gasoline and diesel fuel, as discussed previously.

Revenues From Allowances Can Play Key Role in Helping Preserve Affordability. The value of allowances—both those that are given away for free and those that are sold to generate GGRF revenue—can play an important role in mitigating the program’s impacts on affordability. Some options for using the value of allowances to mitigate costs to consumers include:

- Increase Number of Free Allowances Dedicated to Offsetting Costs. The state could consider altering how it currently allocates allowances to certain covered entities. For example, it could increase the number of free allowances it provides to electric utilities to sell on the market, enabling them to generate more revenue for customer bill credits such as the California Climate Credit. Additionally, the Legislature could modify how these credits are provided to help achieve other goals—such as reducing volumetric electricity rates to help encourage electrification or providing targeted assistance to those who are most vulnerable. A key trade‑off of this option is that such an approach would reduce the number of allowances available for other purposes, such as for leakage protection or generating revenue for GGRF.

- Use GGRF Revenues to Offset or Reduce Costs. The state also could consider dedicating GGRF revenues to support rebates—potentially focused on low‑ and middle‑income consumers—for energy cost growth that might result from program changes. Alternatively, it could consider using GGRF revenues to reduce other existing costs for consumers, such as by paying for activities that otherwise would be funded by electricity ratepayers, including for wildfire mitigation activities or energy efficiency programs.

Cap‑and‑Trade Design Features—Like a Lower Price Ceiling—Can Also Promote Affordability. The design of the cap‑and‑trade program also can be modified to mitigate potential impacts on affordability. A straightforward example of this would be to set a lower price ceiling for the program. This is because the effect of the cap‑and‑trade program on consumer costs largely is driven by allowance prices. Accordingly, setting a lower upper bound for allowance prices can thereby constrain potential associated costs for consumers. The Legislature could set a price ceiling at whatever level it deems appropriate given its policy priorities. A key trade‑off of this option is that a relatively low price ceiling would limit the program’s ability to reduce GHGs because once the price ceiling is reached, CARB issues an unlimited amount of permits to emit at the level of the price ceiling. This, in turn, means that the cap would no longer be binding and emissions beyond the capped levels would be allowed. It would therefore require the state to rely more on other programs—which likely are less cost effective—to meet its climate goals.

Other Legislative Goals

Various Other Legislative Goals for Reauthorization. The Legislature may have various other goals for the program besides GHG emission reductions and affordability. For example, in the past, the Legislature has prioritized GGRF funding for various programs—such as high‑speed rail, safe drinking water, and community air protection—because they met other policy goals, such as improving transportation mobility and supporting access to clean water and air, particularly in disadvantaged communities.

Revenues From Allowances Can Support Other Priorities. The Legislature could assess whether the current allocations of allowances and GGRF revenues still are consistent with its most pressing policy goals. To the extent the Legislature identifies other policy goals beyond GHG emission reductions and affordability—such as related to environmental quality, transportation mobility, or climate change adaptation—it could structure the program to support those goals. Some examples of ways to use the value of allowances to support other policy goals include:

- Change Allowance Allocation. The state could consider altering its current allowance allocation to reduce the number of free allowances (such as those provided to certain industrial emitters that may be at lower risk for leakage), thereby making more available to be sold at auction and generating additional GGRF revenues for spending on legislative policy priorities. A key trade‑off of this option would be that fewer free allowances would mean less support for the purposes for which they are currently being used, potentially including mitigating affordability impacts through the California Climate Credits or for protection against leakage.

- Modify Activities Funded by GGRF. The Legislature also could consider various options for modifying the activities that are funded by GGRF to ensure that they most closely align with current legislative goals. For example, the Legislature could:

- Eliminate Some Continuous Appropriations. The Legislature could eliminate existing continuous appropriations for certain programs if they no longer reflect its highest priorities for multiyear funding. This would free up additional funding for discretionary purposes, better allowing the Legislature to respond to its evolving policy priorities. Eliminating continuous appropriations also could enhance legislative oversight by creating a natural opportunity to more regularly review and revisit the allocations of cap‑and‑trade revenues through the annual budget process. However, a key trade‑off to consider is that taking this step would provide less funding certainty to the affected programs, as they would then be subject to annual funding decisions alongside other priority programs through the budget process.

- Reduce Some Statutory Funding Levels. Even if some or all of the existing statutory appropriations remain among its highest priorities for continued funding from GGRF, the Legislature could consider adjusting their current funding levels. For example, the Legislature could establish fixed annual GGRF appropriation amounts for certain programs rather than providing them with percentages of auction revenues. In years where auction revenues are comparatively high, this would free up additional GGRF for spending on other legislative priorities while still providing certain and consistent funding streams to the existing programs.

Legislature Plays Important Role in Reauthorization of Program

In this final section, we discuss the importance of the Legislature weighing in on the cap‑and‑trade program through (1) reauthorizing the program to provide more certainty and flexibility and (2) providing additional statutory direction on the program design, where appropriate, to help ensure legislative policy priorities are achieved.

Explicit Statutory Authority Provides Greater Program Certainty and Flexibility. As mentioned previously, the explicit statutory authority for the cap‑and‑trade program sunsets at the end of 2030. Whether the Legislature must explicitly authorize a further extension or CARB already could continue the program beyond 2030 under its existing broad statutory authority is an area of some legal uncertainty. To the extent CARB were able to continue a cap‑and‑trade program absent explicit additional statutory authority, it could face limitations around how it structures the program and how GGRF revenues could be used, particularly in light of the requirements of Proposition 26 of 2010. (Proposition 26 expanded the definition of a tax under the State Constitution.) Accordingly, to the extent the Legislature would like the program to continue, providing explicit statutory authority passed with a two‑thirds vote of both legislative houses would be important to increasing program certainty and flexibility. Such certainty would help businesses make long‑term investment decisions and facilitate the state’s plans for how it can pursue its GHG goals and support high‑priority programs.

Historically, Legislature Has Delegated Many Decisions on Cap‑and‑Trade to CARB. Assembly Bill 32 gave CARB almost complete discretion over how to design the cap‑and‑trade program. Since the program’s establishment, much of the Legislature’s role has revolved around how to spend GGRF revenues, including establishing ongoing statutory allocations and selecting discretionary allocations on an annual basis. Through AB 398, the Legislature opted to provide more specific direction about certain program design features—such as specifying the share of compliance obligations that can be met with offsets. However, AB 398 still granted CARB broad authority to make decisions about many aspects of the program, such as related to setting the number of allowances, the price floor and ceiling, and the share of allowances directed for different purposes (such as for GGRF and the various allocations of free allowances).

If It Reauthorizes Program, Providing Greater Direction in Key Areas Would Ensure Legislative Priorities Are Reflected. As part of reauthorization, the Legislature faces important decisions about which choices to defer to CARB—allowing the agency the discretion to weigh the trade‑offs associated with various policy options and make program design choices consistent with its statutory mandates—and which to direct through statute. In general, particularly in light of the high stakes involved, we advise the Legislature to weigh in—through providing additional statutory direction to CARB—on any areas it deems to be of particular importance and for which it has specific preferences. Providing such additional direction in key areas would ensure that the decisions on those components reflect legislative policy priorities.