Mark Newton

October 16, 2025

The 2025-26 California Spending Plan

Health

Overview

General Fund Spending on Health Programs Increases Due to Medi-Cal Expenditure Growth. As Figure 1 shows, the spending plan provides almost $50 billion General Fund for health departments in 2025-26, an increase of $6.7 billion (16 percent) over the revised 2024-25 level. As is the case in most years, most of the spending, as well as the growth in spending, is for Medi-Cal, California’s Medicaid program administered by the Department of Health Care Services (DHCS). Outside of Medi-Cal, health program spending declines. While the health spending plan includes a handful of augmentations, the bulk of the major actions consist of reductions and other savings that help to address the significant General Fund budget program.

Figure 1

Health Departments—Spending Trends

General Fund (Dollars in Millions)

|

2023‑24 |

2024‑25 |

2025‑26 |

Change From 2024‑25 |

||

|

Amount |

Percent |

||||

|

Health Care Services |

|||||

|

Medi‑Cal |

$37,249 |

$37,436 |

$44,943 |

$7,507 |

20% |

|

State operations |

356 |

359 |

286 |

‑73 |

‑20 |

|

Other |

427 |

472 |

374 |

‑98 |

‑21 |

|

Totals |

$38,033 |

$38,267 |

$45,604 |

$7,337 |

19% |

|

Other Departments |

|||||

|

State Hospitals |

$2,960 |

$3,098 |

$2,932 |

‑$166 |

‑5% |

|

Public Health |

1,207 |

942 |

799 |

‑143 |

‑15 |

|

Health Care Access and Information |

366 |

470 |

164 |

‑305 |

‑65 |

|

Health and Human Services Agency |

65 |

292 |

262 |

‑30 |

‑10 |

|

Emergency Medical Services Authority |

32 |

40 |

36 |

‑4 |

‑10 |

|

California Health Benefit Exchange |

10 |

21 |

20 |

‑1 |

‑3 |

|

Totals |

$4,641 |

$4,863 |

$4,214 |

‑$649 |

‑13% |

|

Grand Totals |

$42,674 |

$43,130 |

$49,818 |

$6,688 |

16% |

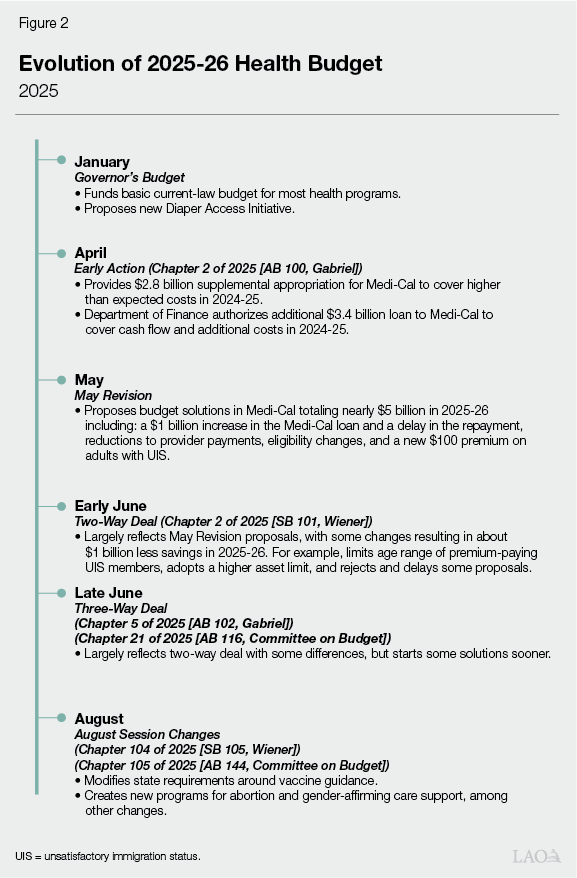

Health Budget Evolved Over Time. As Figure 2 shows, the health budget changed several times during the budget process. This reflects higher-than-anticipated costs in the Medi-Cal program and a worsening state fiscal condition. The Governor’s proposed budget in January estimated Medi-Cal General Fund expenditures to be $2.6 billion higher in 2024-25 than the 2024-25 Budget Act. The administration also estimated that Medi-Cal expenditures in 2025-26 would increase by $4.5 billion General Fund absent any changes to the program. Following early action by the Legislature in April to provide cash flow support and supplemental appropriations, the proposed May Revision included nearly $5 billion of General Fund budget solutions in Medi-Cal to address the state’s projected ongoing deficit. Following negotiations in June, the final budget included around $4.7 billion General Fund budget solutions for Medi-Cal, with many of the solutions focused on coverage for individuals with unsatisfactory immigration status (UIS).

Final Budget Includes Package of Budget Solutions, Mostly in Medi-Cal. To limit health program spending, the spending plan includes budget solutions. Most of these solutions are in Medi-Cal, reflecting the program’s overall budget impact and its higher-than-expected spending growth. (Appendix Figure 1 summarizes all of the budget solutions.) This reflects the third consecutive budget where the state has adopted health budget solutions. In contrast to previous years, however, the largest budget solutions are ongoing, rather than limited term, to help address projected state budget deficits in the future. In fact, as Figure 3 shows, many Medi-Cal solutions will not begin until at least July 2026, the start of the 2026-27 fiscal year. As a result, the Medi-Cal budget solutions total $4.7 billion in 2025-26 but nearly double to $8.6 billion by 2028-29.

Figure 3

Time Line for Major Medi‑Cal Budget Solutions

|

January 2026 |

|

Undocumented adult enrollment freeze |

|

Various pharmacy‑related solutions |

|

Asset limit reinstatement |

|

Long‑term care directed payment elimination |

|

Skilled nursing facility rule suspension |

|

July 2026 |

|

Payment reduction for clinic services to adults with UIS |

|

Eliminate dental coverage for adults with UIS |

|

Eliminate dental supplemental payments |

|

Prior authorization for hospice services |

|

January 2027 |

|

PACE capitation rate limit |

|

July 2027 |

|

Monthly premium for adults with UIS (19‑59 years old) |

|

Operational efficiencies |

|

UIS = unsatisfactory immigration status and PACE = Program of All‑Inclusive Care for the Elderly. |

Medi-Cal

This section describes the major actions and adjustments in Medi-Cal in the budget package. It first provides an overview of Medi-Cal’s budget. It then discusses various actions to help address the state General Fund budget shortfall. The discussion on budget solutions includes a summary of the Proposition 35/Managed Care Organization (MCO) Tax spending plan.

Overview

Total Medi-Cal Spending Grows Significantly in 2025-26. As Figure 4 shows, total Medi-Cal spending across all fund sources is $197 billion in 2025-26, up $17.7 billion (almost 10 percent) from the revised 2024-25 level. This overall increase is the net result of an $11.1 billion (10.2 percent) increase in federal spending and a $7.5 billion (20.1 percent) increase in General Fund spending, slightly offset by a roughly $800 million (2.5 percent) decline in spending from other funds.

Figure 4

Medi‑Cal Budget

(Dollars in Billions)

|

2024‑25 |

2025‑26 |

Change From Revised 2024‑25 |

|||||

|

Adopted |

Revised |

Amount |

Percent |

||||

|

Total Spendinga |

$161.0 |

$179.0 |

$196.7 |

$17.7 |

9.9% |

||

|

By Fund Source |

|||||||

|

Federal funds |

$98.5 |

$108.6 |

$119.7 |

$11.1 |

10.2% |

||

|

General Fund |

35.0 |

37.4 |

44.9 |

7.5 |

20.1 |

||

|

Other funds |

27.4 |

32.9 |

32.1 |

‑0.8 |

‑2.5 |

||

|

By Program |

|||||||

|

Managed care |

$82.7 |

$89.4 |

$100.4 |

$11.0 |

12.3% |

||

|

Fee‑for‑service |

38.1 |

42.2 |

45.6 |

3.4 |

8.2 |

||

|

Other programs |

33.0 |

39.8 |

43.3 |

3.5 |

8.8 |

||

|

Local administration |

7.3 |

7.6 |

7.5 |

‑0.2 |

‑2.4 |

||

|

aConsists of Department of Health Care Services local assistance expenditures only. Excludes billions of dollars in state and local expenditures that are used to draw down federal Medicaid funds but are not directly tracked in Medi‑Cal budget estimates. |

|||||||

Budget Solutions Increase in Out-Years. The year-over-year increase in total expenditures is driven by higher spending on base program costs in the managed care and fee-for-service delivery systems. These increases are partially offset by the substantial Medi-Cal budget solutions. Without these budget solutions in place, General Fund spending on Medi-Cal would otherwise grow by billions of dollars more in the out-years. The largest of the out-year solutions are related to individuals with UIS, a new Medi-Cal loan, Proposition 35, and prescription drugs. We describe these and other actions below.

Budget Solutions

Individuals With UIS

Several of the largest budget solutions in the spending plan focus on the UIS population. This population primarily consists of undocumented individuals, but also includes certain immigrant individuals who are lawful residents without citizenship (such as green card holders who have not satisfied a five-year waiting period). One solution is tailored to undocumented individuals only, while others impact the broader UIS population. Appendix Figure 1 provides a footnote regarding the UIS-related solution that applies to undocumented adults only.

Freezes Comprehensive Coverage Eligibility for Undocumented Adults. Over the past several years, the state has expanded access to comprehensive Medi-Cal coverage to all individuals regardless of immigration status. However, Medi-Cal program costs for this undocumented population expansion significantly exceeded original estimates. The spending plan includes freezing enrollment for the adult undocumented population beginning in January 2026, prohibiting new applicants from enrolling in comprehensive coverage while maintaining eligibility for existing enrollees. (New enrollees would still be eligible for certain limited services, such as emergency and pregnancy-related care, that are partially funded by the federal government.) This budget solution is estimated to result in savings of $78 million General Fund in 2025-26, growing to $3.3 billion General Fund in 2028-29.

Charges Monthly Premium on UIS Adults. The spending plan includes a $30 monthly premium for UIS adults (aged 19 to 59) who remain enrolled in comprehensive Medi-Cal beginning in July 2027. This budget solution is estimated to save approximately $700 million General Fund annually beginning in 2027-28. While there is some additional revenue anticipated as a result of the premium, the majority of the savings in the budget solution are estimated to be due to disenrollments from Medi-Cal by individuals who do not pay the monthly premium.

Reduces Payments to Safety Net Clinics for Services to UIS Population. The spending plan changes how Medi-Cal pays safety net clinics (Federally Qualified Health Centers and Rural Health Clinics) for state-only-funded services to individuals with UIS. Generally, Medi-Cal pays safety net clinics for services to all patients using a prospective payment system. Beginning in July 2026, the budget eliminates use of the prospective payment system for the UIS population only. Instead, clinics will be paid using the regular state fee-for-service rate or the rates they negotiate with managed care plans. Because these new rates are expected to be lower than what clinics currently receive, this action is scored as a budget solution, with estimated ongoing General Fund savings of about $1 billion beginning in 2026-27.

Ends Dental Coverage for UIS Adults. The spending plan eliminates dental coverage for all UIS adults enrolled in Medi-Cal beginning in July 2026. Individuals would still be covered for certain emergency dental procedures. This budget solution is estimated to result in General Fund savings of about $300 million in 2026-27 and ongoing.

Medi-Cal Loan

Loans Billions of Dollars to Medi-Cal. The budget borrows $4.4 billion General Fund over two years (2024-25 and 2025-26) and deposits the funds to the Medi-Cal Provider Interim Payment Fund. This fund, created in 1998, provides loans (from the General Fund and/or Federal Trust Fund) to Medi-Cal to temporarily help cover higher-than-expected program costs. While these loans are not themselves unusual, the amount in this year’s spending plan is notably higher than in past years. Of the total amount of the loan, the Department of Finance (DOF) executed $3.4 billion in March 2025, with the remainder to be executed following enactment of the budget.

Delays Timing of Repayment Into Future. Other than its large size, another unusual feature of the loan in this year’s spending plan is that it is a budget solution. Typically, these loans are for short-term, midyear cash needs in the Medi-Cal program and are repaid from budget act appropriations later in the year. This year’s budget, however, delays the repayment of the loan into the future. In effect, this maneuver creates a loan from the state’s cash resources and a future obligation that is repaid over time. Fiscal scoring assumes an annual repayment amount of $325 million beginning in 2027-28—effectively stretching out repayment over more than a decade. As a result, the state is able to score the loan as General Fund savings in 2024-25 and 2025-26.

Proposition 35/MCO Tax Spending Plan

Includes Updated Spending Plan. The MCO tax is a tax on health plans that supports the Medi-Cal program. The tax specifically helps cover the cost of existing service levels—thereby offsetting General Fund spending on the program—and supports augmentations (such as provider rate increases). In November 2024, California voters approved Proposition 35, which made the tax permanent and created new rules on how to spend the funds. Following this development, this year’s spending plan begins implementing Proposition 35’s rules. As Figure 5 shows, relative to last year’s spending plan (before Proposition 35 was enacted), this year’s plan allocates more funding for augmentations. This effect is from implementing Proposition 35’s rules.

Figure 5

MCO Tax Multiyear Spending Plan

(In Billions)

|

2023‑24 |

2024‑25 |

2025‑26 |

2026‑27 |

Totals |

|

|

2025‑26 Budget Act |

|||||

|

Net revenue |

$5.1 |

$9.2 |

$7.0 |

$6.3 |

$27.5 |

|

General Fund offset |

5.1 |

8.5 |

4.2 |

2.8 |

20.6 |

|

Augmentations used as budget solution |

— |

— |

1.3 |

0.3 |

1.6 |

|

Other augmentations |

— |

0.7 |

1.5 |

3.2 |

5.4 |

|

2024‑25 Budget Act |

|||||

|

Net revenue |

$4.8 |

$7.5 |

$7.6 |

$6.6 |

$26.5 |

|

General Fund offset |

4.5 |

7.1 |

6.6 |

5.0 |

23.2 |

|

Augmentations |

0.3 |

0.4 |

1.0 |

1.6 |

3.3 |

|

Difference |

|||||

|

Net revenue |

$0.2 |

$1.7 |

‑$0.7 |

‑$0.3 |

$1.0 |

|

General Fund offset |

0.6 |

1.5 |

‑2.4 |

‑2.2 |

‑2.6 |

|

Augmentations |

‑0.3 |

0.2 |

1.8 |

1.9 |

3.6 |

|

Notes: Reflects spending on a fiscal‑year and cash‑budgeting basis. “General Fund offset” includes $145 million in 2024‑25 used to help cover Proposition 56 costs. |

|||||

|

MCO = managed care organization. |

|||||

Includes Plan for Augmentations… The spending plan also reflects a two-year plan for augmentations supported pursuant to Proposition 35. In 2025 and 2026, Proposition 35 sets aside $2.7 billion in augmentations each year for specified services (such as primary care and specialty care). The measure tasks DHCS with developing the plan, in consultation with stakeholders. Accordingly, the department released its two-year plan in May 2025. As Figure 6 shows, the plan allocates funding for the required services, as well as different kinds of activities.

Figure 6

Proposition 35 Spending Plan

Planned Augmentations (In Millions)

|

2025 |

2026 |

|

|

Totals |

$2,568 |

$2,656 |

|

By Service |

||

|

Primary care |

$691 |

$691 |

|

Specialty care |

487a |

575 |

|

Emergency care |

355 |

355 |

|

Outpatient services |

245 |

245 |

|

Behavioral health |

300 |

300 |

|

Designated public hospital services |

150 |

150 |

|

Reproductive health care |

90 |

90 |

|

Graduate medical education |

75 |

75 |

|

Medi‑Cal workforce |

75 |

75 |

|

Primary care services and supports |

50 |

50 |

|

Ground emergency medical transport |

50 |

50 |

|

By Activity |

||

|

Underlying base managed care rate growth |

$1,101 |

$452 |

|

Hospital and clinic directed payments |

455 |

455 |

|

Base physician rate increases (to 87.5 percent of Medicare) |

356 |

374 |

|

Supplemental rates (physicians and ground emergency transport) |

116 |

835 |

|

Workforce initiatives |

240 |

240 |

|

Behavioral health coordination |

200 |

200 |

|

Housing subsidies |

100 |

100 |

|

aThe spending plan assumes a portion of funds designated for this service ($88 million) cannot be allocated due to implementation issues and instead will be spent in 2027. |

||

…Including One Budget Solution. As Figure 6 shows, the largest activity supported by the Proposition 35 spending plan is underlying growth in managed care costs. According to DHCS, managed care plans have increased rates for certain services (such as primary care) in the last few years. These rate increases reflect higher costs in the Medi-Cal program. Accordingly, the administration’s Proposition 35 spending plan treats this cost growth as an augmentation in 2025 and 2026. Because the General Fund would have otherwise covered these costs, the spending plan also scores these amounts as budget solutions.

Prescription Drugs

Eliminates Coverage of Certain Drugs. The spending plan ends coverage of certain optional pharmacy benefits in Medi-Cal, beginning January 2026. Most notably, the administration plans to end coverage of Glucagon-Like Peptide-1 (GLP-1) agonists used to treat obesity (such as Wegovy). (Medi-Cal will still cover GLP-1s that treat diabetes, such as Ozempic, as required under federal law.) This action is estimated to save $85 million General Fund in 2025-26, with savings rising to $790 million General Fund by 2028-29. In addition, the spending plan assumes Medi-Cal ends coverage of certain kinds of over-the-counter drugs, such as COVID-19 tests, vitamins, and antihistamines. The associated savings with this action are much smaller, at $3 million General Fund in 2025-26, rising to $6 million General Fund in subsequent years.

Promotes Higher Drug Rebates. This year’s spending plan also aims to increase drug rebates (which serve to create General Fund savings) in a number of ways. Most notably, the administration plans to contract with a pharmacy rebate aggregator to negotiate rebates with manufacturers on drugs provided to UIS members. This is a population for which the state currently does not receive drug rebates. The spending plan estimates this action saves $370 million General Fund in 2025-26, rising to $600 million General Fund in subsequent years. In addition, this year’s health trailer bill adjusts the statutory formula for state rebates on HIV and cancer drugs, estimated to save $75 million General Fund in 2025-26 and $150 million General Fund ongoing in subsequent years.

Adopts New Drug Utilization Management Practices. The spending plan includes new utilization management practices to control Medi-Cal pharmacy spending, beginning in January 2026. For example, DHCS plans to end an existing policy providing automatic coverage of drugs for existing users when the drugs are removed from Medi-Cal’s contract drug list. Moving forward, users will need to receive prior authorization to continue using the drugs. The administration also plans to implement step therapy, in which Medi-Cal members are first directed to start using lower-cost alternatives before turning to more expensive prescriptions. The administration also indicates it plans to explore various other utilization management methods. These combined efforts are estimated to generate $175 million General Fund savings in 2025-26, rising to $350 million General Fund savings in subsequent years.

Other Budget Solutions

Medi-Cal-related budget solutions also include, but are not limited to, the following solutions. (For a complete list of Medi-Cal and other health-related budget solutions, please see Appendix Figure 1.)

Reinstates an Asset Test. The spending plan reinstates the verification of assets, commonly referred to as an asset test, to determine Medi-Cal eligibility for seniors and persons with disabilities. Under the spending plan, seniors and persons with disabilities will need to verify that their countable assets do not exceed $130,000 per individual and $195,000 per couple. (These asset limits reflect the higher limits that temporarily applied before the asset test was fully phased out in January 2024. Prior to 2021-22, the asset limits were $2,000 per individual and $3,000 per couple.) This change will take effect beginning January 1, 2026. With regard to income, seniors and persons with disabilities still must have countable income below 138 percent of the federal poverty level. This budget solution provides General Fund savings of $45 million in 2025-26, $ 343 million in 2026-27, and $ 510 million in 2027-28 and ongoing.

Includes Savings From Operational Efficiencies. The spending plan includes General Fund savings of $737 million in 2027-28 and $ 503 million in 2028-29 from operational improvements at DHCS. The administration has stated that it intends to hire one or multiple contractors to identify areas where operations could be improved to achieve savings, as well as to identify new ways to improve processes. (These savings are distinct from state operations budget solutions enacted as part of the 2024-25 Budget Act, which directed DOF to identify efficiencies to reduce state costs without diminishing service levels.)

Eliminates Supplemental Dental Payment. The spending plan eliminates supplemental payments for specific dental services, which were originally established in the 2017-18 Budget Act as part of the Proposition 56 (2016) spending plan. Since 2017, the Legislature has continued funding these supplemental payments in subsequent budget acts. The spending plan will end the supplemental payments as of July 1, 2026, which will provide $362 million in General Fund savings in 2026-27 and ongoing.

Eliminates Long-Term Care Directed Payment. The spending plan eliminates the Skilled Nursing Facility Workforce and Quality Incentive Program (SNF WQIP) as of December 31, 2025. The SNF WQIP provides performance-based directed payments to facilities that satisfied metrics in quality of care, equity in healthcare outcomes, and workforce investments. This budget solution provides General Fund savings of $70 million in 2025-26 and $140 million in 2026-27 and ongoing.

Requires Prior Authorization for Hospice Services. The spending plan implements prior authorization requirements for hospice services starting July 1, 2026, providing $50 million in General Fund savings in 2026-27 and ongoing.

State Hospitals

Reduces General Fund Spending. Under the spending plan, General Fund spending for the Department of State Hospitals (DSH) is $2.9 billion in 2025-26, a decrease of $166 million (about 6 percent) from the revised 2024-25 expenditure estimate. This decrease reflects reductions to the state’s efforts to address the Incompetent-to-Stand-Trial (IST) waitlist.

Budget Solutions Include Reductions to IST Waitlist Solutions Funding. The spending plan includes General Fund reductions of $4 million in 2024-25, $161 million in 2025-25, $329 million in 2026-27, and $157 million in 2027-28 and ongoing to various programs meant to address the IST waitlist. The department also reverts $233 million General Fund from 2022-23 that was available until 2026-27 (the department is reappropriating $3.4 million for the Judicial Council to carry out training related to IST evaluations). In accordance with a court ruling in 2021, DSH was required to provide substantive treatment services to restore competency to an IST individual within 28 days from the transfer of responsibility to DSH by March 2025. In 2022-23, the Legislature appropriated multiyear funding to DSH to implement solutions to meet the court-issued deadline. As of March 2025, the department submitted evidence that 100 percent of IST individuals referred to DSH received substantive treatment services within the 28-day deadline. As of the Governor’s May Revision, the IST waitlist was 278 individuals, which is less than the average monthly referrals (469 individuals) in 2024-25. The reductions to ongoing IST waitlist solutions funding include savings in early access and stabilization services, community-based restoration and diversion, and the county collaborative workgroup grant. The department does not anticipate these reductions will impact the progress made on the IST waitlist to date.

Other Updates to IST Waitlist Solutions Funding. Aside from the ongoing reductions to the IST waitlist solutions funding, the spending plan also reduces funding for other IST-related programs by $119 million in 2025-26, $118 million in 2026-27, and $51 million in 2027-28 and ongoing due to updated time lines, primarily for new community-based treatment infrastructure.

Other Budget Solutions. The spending plan includes reductions to staffing for isolation units to align with utilization, resulting in General Fund savings of $22 million in 2025-26 and ongoing. The spending plan also reduces General Fund support for the Los Angeles County community-based restoration and diversion contract by $12 million in 2025-26 and ongoing to reflect current enrollment rates. Moreover, the spending plan includes General Fund reductions for operational efficiencies of $5 million in 2025-26, $6 million in 2026-27, and $2 million in 2027-28 and ongoing and for modified reporting requirements of $1.5 million in 2025-26 and ongoing.

Public Health

Maintains Overall Spending, but Ratchets Down One-Time General Fund Spending. Under the spending plan, total funding for the California Department of Public Health (CDPH) is $5.2 billion ($942 million General Fund) in 2025-26. Total funding in 2025-26 is about the same as the revised 2024-25 expenditure estimate, but General Fund spending is$143 million (about 15 percent) lower. This net reduction in General Fund is primarily due to the end of temporary funding, partially offset by one-time supplemental funding for a number of state public health information technology (IT) systems.

Support for Public Health IT Systems. The spending plan includes one-time General Fund support for a number of public health IT systems in 2025-26, including the state’s vaccine management system ($31.4 million), public health laboratory reporting system ($27 million), disease investigation and contact tracing system ($18 million), and immunization registry ($5 million). The spending plan also supports the development of an online accreditation and application for lead remediation ($2 million General Fund) and reappropriates funds for California’s Parkinson’s and Neurodegenerative Disease Registries ($3 million General Fund). The 2022-23 budget act included funding position authority to maintain and implement a dozen IT systems involved in—or developed specifically for—the state’s COVID-19 response. CDPH has worked to adapt a number of these systems for other public health purposes, such as laboratory reporting of other infectious diseases or vaccine management for non-COVID-19 vaccines. As the state works to develop an overarching public health IT strategy, the department is renewing short-term maintenance and operations contracts to maintain current system capabilities.

Support for Public Health Equity Programs. The spending plan includes General Fund reappropriations for public health equity initiatives, including Lesbian, Bisexual, Transgender, Queer (LGBTQ+) Women’s Health Equity ($15.5 million); reproductive health ($13.3 million); and support for LGBTQ+ foster youth ($4 million). The spending plan also includes $15 million one-time General Fund support for the Transgender, Gender Nonconforming, and Intersex Wellness and Equity Fund, which will be used to support grants and contracts for community-based organizations.

Budget Solutions and Other Adjustments. The spending plan reduces about $3 million General Fund for the public health workforce upskilling program in 2025-26, though it maintains $370,000 for the current training cohort. While the spending plan includes funding for the public health laboratory system in 2025-26, it eliminates out-year General Fund support ($20.4 million in 2026-27 and $16.3 million in 2027-28 and ongoing). The spending plan includes additional, one-time General Fund support in 2025-26 for wraparound services for individuals with Amyotrophic Lateral Sclerosis (ALS) ($3.5 million) and increased wastewater surveillance to monitor disease outbreaks ($3.2 million). The spending plan also includes a $2.5 million reappropriation for the Governor’s Advisory Council on Physical Fitness and Mental Well-Being.

Modifies State Vaccine Guidance. The August session trailer bill (Chapter 105 of 2025 [AB 144, Committee on Budget]) modifies state law’s requirements around federal vaccine guidance. Whereas previous law generally required providers, schools, and other groups to follow current federal recommendations, the legislation creates a new baseline. Specifically, the legislation establishes the federal recommendations in place in January 1, 2025 as the starting point. Moving forward, CDPH can modify these recommendations, in consultation with certain medical organizations. CDPH’s modifications can include changes to federal recommendations since January 2025, but only if the department determines them to be consistent with promoting public health.

Health Care Access and Information

Continues Ratcheting Down Spending. In 2025-26, the state is spending $164 million General Fund ($510 million total funds) on the Department of Health Care Access and Information (HCAI). Overall General Fund spending on HCAI is down in 2025-26 compared to the 2024-25 level. The decline primarily is driven by a continued, multiyear ramp down of one-time and carryover spending. Below, we summarize the major actions.

Supports New Behavioral Health Workforce Initiative. The spending plan funds the first year of a new five-year behavioral health workforce initiative. The initiative is a component of a recently federally approved Medi-Cal waiver called Behavioral Health Community-Based Organized Networks of Equitable Care and Treatment (BH-CONNECT). The workforce initiative, administered by HCAI, includes a variety of activities, such as scholarships, loan repayments, and grants for residency programs. The initiative is expected to cost $1.9 billion over the five-year period, with nearly all of the funds coming from federal Medicaid funds. Certain other sources, such as the Behavioral Health Services Fund and additional federal funds generated through the Medi-Cal Designated State Health Programs authority, also will help cover costs. (In 2025-26, the budget also provides $67 million General Fund to HCAI for this initiative. According to DOF, this placeholder amount does not reflect a net cost to the General Fund. Instead, it will be offset by funds in Medi-Cal’s budget in future years.)

Reduces Funding for CalRx Insulin Initiative. The 2022-23 budget provided $100 million one-time General Fund to manufacture a biosimilar insulin product. Half of the funds supported a contract with a private partner, and the other half was to help construct a new manufacturing facility in California. Since this time, the private partner has started initial manufacturing in a facility in Virginia. Accordingly, as a budget solution, the spending plan eliminates $45 million unspent carryover construction funds in 2024-25.

Supports New Diaper Access Initiative. The spending plan includes General Fund spending of $7.4 million in 2025-26 and $12.5 million in 2026-27 for a new two-year diaper access initiative. Under the initiative, the state will provide households with newborn babies a three-month supply of free diapers. The initiative also includes funds to explore other market interventions to reduce the cost of diapers. When the Governor first announced this proposal, HCAI estimated the funds would cover around 25 percent of newborn babies in 2025-26 and around 50 percent of newborn babies in 2026-27. The initiative is expected to end at the end of 2026-27, absent delays in implementation or future augmentations to make the initiative ongoing.

Provides One Additional Year of Funding for Health Care Payments Database. The spending plan provides $6 million General Fund ($18 million total funds) for the Health Care Payments Database. The database, created as part of the 2018-19 budget, includes data from most health care payors in California (including private insurance, Medi-Cal, and Medicare) around health care utilization and costs. The program’s initial operations had been supported by $60 million one-time General Fund, provided in 2018-19 and spent down over time. To cover costs in 2025-26, the spending plan reappropriates the remaining unspent General Fund amount ($6 million) and provides additional support from a few special funds. The administration states that it is still assessing a long-term funding plan for the database.

Funds Three Other External Entities. The spending plan includes $5.5 million one-time General Fund for three external entities: (1) the Northeast Valley Health Corporation ($3 million), (2) the Youth Mental Health Academy ($2 million), and (3) the American Reproductive Centers fertility clinic ($500,000). Funds for two of these entities (Northeast Valley Health Corporation and American Reproductive Centers) will support infrastructure repairs and improvements. Funds for the third entity (Youth Mental Health Academy) will support mental health profession-related training, summer internships, and other outreach activities for a cohort of high school students in Los Angeles.

Increases Regulation of Pharmacy Benefit Managers. This year’s health trailer bill creates a new regulatory system over pharmacy benefit managers, third-party entities that health care payors (such as health plans) contract with to oversee pharmacy benefits and billing. Previously, state law only required these entities to register with the state. Under the health trailer bill, pharmacy benefit managers must now receive licenses from the Department of Managed Health Care (DMHC) to operate in California. To maintain licensure, these entities must (1) act in a payor’s best interests; (2) submit financial statements to DMHC; and (3) submit drug pricing data to HCAI, among other requirements. Pharmacy benefit managers are to pay annual fees to support DMHC’s and HCAI’s ongoing regulatory costs.

Other Actions

Creates New Abortion Fund Program. The August session health trailer bill (Chapter 105) creates the Abortion Access Fund. Administered by HCAI, the fund is to support abortion services through grants and contracts. To support the fund, the legislation allocates a portion of money from excess balances in health plans’ special abortion accounts. Health plans that participate in Covered California must use these accounts so that federal subsidies do not pay for abortion services. The fund is continuously appropriated through the 2028-29 fiscal year.

Allocates Funds for Gender-Affirming Care. The August session health trailer bill (Chapter 105) directs Covered California to provide payments to plans to help them with the cost of covering gender-affirming care. The payments are to begin January 2026 and are subject to legislative appropriation. Accordingly, the August session budget bill provides $15 million Health Care Affordability Reserve Fund in 2025-26 for the first year of payments.

Appendix

Appendix Figure 1

Health Budget Solutions

General Fund (In Millions)

|

Solution |

2024‑25 |

2025‑26 |

2026‑27 |

2027‑28 |

2028‑29 |

|

Health Care Access and Information |

|||||

|

CalRx reduction |

— |

$45 |

— |

— |

— |

|

Health Care Services (Medi‑Cal) |

|||||

|

Medi‑Cal Financing |

|||||

|

Medi‑Cal loan repayment delay |

$2,150 |

$1,291 |

— |

‑$250 |

‑$250 |

|

Proposition 35 support of program growth |

— |

1,289 |

$264 |

— |

— |

|

Additional Medi‑Cal loan |

— |

1,000 |

— |

‑75 |

‑75 |

|

BHSF offset |

40 |

100 |

— |

— |

— |

|

Adults With Unsatisfactory Immigration Status |

|||||

|

Enrollment freezea |

— |

$78 |

$743 |

$1,759 |

$3,295 |

|

Clinic finance change |

— |

— |

1,037 |

1,131 |

1,131 |

|

New premiums ($30 per month) |

— |

— |

‑30 |

696 |

675 |

|

End of dental coverage |

— |

— |

308 |

336 |

336 |

|

Prescription Drugs |

|||||

|

New aggregator to increase rebates |

— |

$370 |

$600 |

$600 |

$600 |

|

End of anti‑obesity coverage |

— |

85 |

215 |

520 |

790 |

|

Prescription Drug Utilization Management |

— |

25 |

50 |

50 |

50 |

|

Pharmacy step therapy protocols |

— |

88 |

175 |

175 |

175 |

|

HIV/Cancer drug rebates |

— |

75 |

150 |

150 |

150 |

|

Prior authorization for continuation of drug therapy |

— |

63 |

125 |

125 |

125 |

|

End of over‑the‑counter drug coverage |

— |

3 |

6 |

6 |

6 |

|

Other |

|||||

|

Asset limit reinstatement |

— |

$45 |

$343 |

$510 |

$510 |

|

Operational efficiencies |

— |

— |

— |

737 |

503 |

|

PACE capitation rate limit |

— |

— |

13 |

30 |

30 |

|

Long‑term care directed payment elimination |

— |

70 |

140 |

140 |

140 |

|

Skilled nursing facility back‑up power requirement suspension |

— |

98 |

140 |

— |

— |

|

End of dental supplemental payments |

— |

— |

362 |

362 |

362 |

|

Prior authorization for hospice services |

— |

— |

50 |

50 |

50 |

|

Reduction to Proposition 56 Loan Repayment Program |

— |

26 |

— |

— |

— |

|

Public Health |

|||||

|

SaPHIRE System reduction |

— |

— |

$20 |

$16 |

$16 |

|

Workforce Development and Engagement Program reduction |

— |

$3 |

— |

— |

— |

|

State Hospitals |

|||||

|

IST Waitlist Solutions reduction |

— |

$161 |

$239 |

$157 |

$157 |

|

Isolation unit staffing |

— |

22 |

22 |

22 |

22 |

|

Other solutions |

$5 |

23 |

20 |

16 |

16 |

|

aApplies to undocumented beneficiaries only. |

|||||

|

BHSF = Behavioral Health Services Fund; PACE = Program of All‑Inclusive Care for the Elderly; SaPHIRE = Surveillance and Public Health Information Reporting and Exchange; and IST = Incompetent to Stand Trial. |

|||||