Helen Kerstein

December 9, 2025

Cap-and-Invest: November 2025 Auction Update and 2026-27 Budget Context

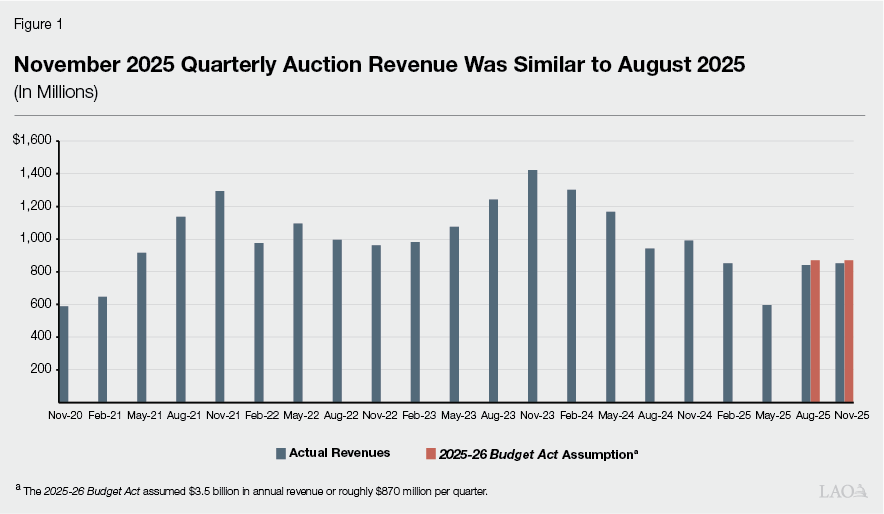

November 2025 Auction Generated $844 Million in State Revenue. The California Air Resources Board (CARB) released a summary of the results from the most recent quarterly cap-and-invest auction held on November 19, 2025. This was the first auction since the passage of Chapter 117 of 2025 (AB 1207, Irwin) and Chapter 121 of 2025 (SB 840, Limón), which extended and made various changes to the program. According to the information provided by CARB, the state expects to receive $844 million in revenue from the auction, which will be deposited into the Greenhouse Gas Reduction Fund (GGRF).

November Revenues Were Similar to the Prior Quarter… As shown in Figure 1, the projected amount of revenue from the November auction is roughly equivalent to the amount the state received from the August 2025 auction ($841 million). Both the allowance prices and number of allowances sold were similar across the two auctions. (In both auctions, all the state-owned allowances offered for sale were purchased.)

…Continuing to Come in Slightly Below 2025-26 Budget Act Assumptions. At the time the Legislature enacted the 2025-26 Budget Act, the Department of Finance (DOF) projected annual GGRF revenues of $3.5 billion for 2025-26, or roughly $870 million per quarter. The preliminary auction results for the November auction of $844 million are lower than this quarterly amount by roughly $26 million (3 percent). As shown in the figure, this was also the case for the August auction. Future quarterly revenues are subject to substantial uncertainty. However, should the recent trends continue, total 2025-26 revenues would come in slightly below—potentially by around $100 million—the 2025-26 Budget Act assumptions. This could result in the need to make some minor midyear adjustments—potentially totaling in the low tens of millions of dollars—to programs receiving discretionary allocations in 2025-26. (Under this revenue scenario, the statutory allocations that receive funding on a percentage basis also would be reduced somewhat compared to budget act assumptions.) Budget Control Section 15.14 authorizes DOF to address such a circumstance by making midyear reductions if auction revenues are insufficient to support discretionary GGRF spending at the budgeted levels.

Starting in 2026-27, Allocation of Revenues Will Be Guided by New Legislation. Senate Bill 840 made various modifications to the allocation of GGRF revenues starting in 2026-27, such as (1) changing some allocations from being set percentages of GGRF revenues to fixed dollar amounts and (2) changing the order in which certain allocations are made. (We discuss SB 840’s changes to the statutory allocations of GGRF in greater detail in our recent report, Overview of New Updates to the Cap-and-Invest Program.) In Figure 2, we summarize the GGRF allocations under SB 840. Notably, roughly $4.3 billion in annual GGRF revenues are necessary to fully fund the allocations made under the new legislation. This amount includes a total of $3.2 billion for various identified programs and purposes, $1 billion set aside for unspecified programs subject to appropriation, and roughly $100 million for state administrative costs.

Figure 2

Statutorily Required GGRF Appropriations Pursuant to SB 840a

|

Program |

Department |

Annual Amount Starting in 2026‑27b |

|

Starting in 2026‑27, funding will be allocated first to the following programs: |

||

|

Manufacturing tax exemption |

— |

Roughly $100‑$140 million |

|

State Responsibility Area fee backfill |

CalFire |

Roughly $70‑$90 million |

|

Legislative Counsel Climate Bureau |

Legislative Counsel |

$3 million |

|

Then second, to the following programs: |

||

|

High‑speed rail project |

HSRA |

$1 billion |

|

Unspecified programs subject to appropriation |

Various |

$1 billion |

|

Then third, if funding is available, to the following programs:b |

||

|

Affordable Housing and Sustainable Communities Program |

SGC |

$800 million |

|

TIRCP |

CalSTA |

$400 million |

|

Community Air Protection Program—AB 617c |

CARB |

$250 million |

|

Low Carbon Transit Operations Program |

Caltrans |

$200 million |

|

Wildfire and forest resilience—SB 901d |

CalFire |

$200 million |

|

Safe and Affordable Drinking Water Program |

SWRCB |

$130 million |

|

Then fourth, remaining funding is subject to legislative appropriation for discretionary purposes. |

||

|

aChapter 121 of 2025 (SB 840, Limón). bSenate Bill 840 requires the Department of Finance to proportionately reduce the amounts for these programs if there is insufficient funding to fully support them and pay for state administrative costs. cChapter 136 of 2017 (AB 617, C. Garcia). dChapter 626 of 2018 (SB 901, Dodd). |

||

|

GGRF = Greenhouse Gas Reduction Fund; CalFire = California Department of Forestry and Fire Prevention; HSRA = High Speed Rail Authority; SGC = Strategic Growth Council; TIRCP = Transit and Intercity Rail Capital Program; CalSTA = California State Transportation Agency; Caltrans = California Department of Transportation; and SWRCB = State Water Resources and Control Board. |

||

Recent Legislation Also Expressed Legislative Intent for Use of Funds in 2026-27. In addition to the statutory allocations shown in the figure, the Legislature also enacted statutory language expressing its intent to use discretionary GGRF monies to support certain other activities in 2026-27 and future years. For example, for 2026-27, SB 840 and Chapter 5 of 2025 (AB 102, Gabriel) expressed legislative intent to use a combined total of up to $1.5 billion of GGRF to support the following activities:

$1.25 billion of California Department of Forestry and Fire Protection (CalFire) costs if there is a General Fund deficit (with additional allocations in future years). If there is no deficit, $500 million in CalFire costs.

$125 million for transit passes.

$85 million for climate-focused technological innovation.

$25 million for seed funding for a University of California Climate Research Center.

$15 million to rebuild Topanga Park (which sustained damage in the Palisades fire).

Revenues May Not Be Sufficient to Fully Support Statutory Allocations and Legislative Intent for 2026-27… As illustrated in Figure 1, cap-and-invest auction revenues have varied across months and years, and multiple influencing factors make them difficult to predict. However, recent trends raise some concerns regarding whether the Legislature will be able to fund all of its stated priorities in the coming year. Specifically, if the level of cap-and-invest revenues generated in the past two auctions was to continue through 2026-27, we estimate the program would generate roughly $3.4 billion for GGRF in the coming fiscal year. In recent years, GGRF has also received about $600 million annually in interest income, which would bring the GGRF balance to a total of about $4 billion under this scenario. This revenue level would be insufficient to fully fund the $4.3 billion in statutory allocations under SB 840, let alone the additional $1.5 billion for activities specified in legislative intent discussed above.

…Which Could Lead to Difficult Budget Decisions in the Coming Year. Under the revenue scenario outlined above, the Legislature would have to make some difficult choices, as previous commitments would exceed the available GGRF by over $1.8 billion. Even if the Legislature decided to use the full $1 billion set aside for programs subject to appropriation (that has not yet been allocated) to support some of the programs identified in the legislative intent language, we estimate a remaining funding gap of more than $800 million. Notably, this scenario could have implications for the state’s General Fund. Even if the Legislature were to dedicate all of the unallocated $1 billion to support CalFire costs and achieve General Fund savings, sufficient funding would not be available to fully support the $1.25 billion assumed as part of the 2025-26 budget agreement. (In our November 2025 publication, The 2026-27 Budget: California’s Fiscal Outlook, we estimate that the Legislature faces an almost $18 billion budget problem in 2026-27—and that estimate already assumes that GGRF and not the General Fund covers $1.25 billion of CalFire costs.)

Continued Monitoring of Auctions Will Be Important Going Forward. We note, however, that future GGRF revenues are subject to substantial uncertainty. If allowance prices were to jump notably, the state could receive a substantial increase in revenues. Under such a scenario, the state might be able to fully support all the statutory allocations along with other activities such as the programs and projects identified in recent legislative intent language. In contrast, if allowance prices were to dip or substantially fewer allowances were to be sold than was the case in the November 2025 auction, an even greater funding gap could emerge. Considering this uncertainty, it will be important for the Legislature to closely monitor upcoming cap-and-invest auction results before finalizing its GGRF expenditure decisions for 2026-27.