Ann Hollingshead

January 12, 2026

The 2026‑27 Budget

Overview of the Governor’s Budget

- Introduction

- Governor’s Budget Roughly Balanced on Higher Revenues

- Discretionary Choices in Governor’s Budget

- Budget Condition

- Comments

- Conclusion

- Appendix

Executive Summary

Governor’s Budget Roughly Balanced on Higher Revenues. The administration projects the budget faces a roughly $3 billion deficit. This is lower than our November Fiscal Outlook estimate of an $18 billion deficit, for two offsetting reasons. First, and most importantly, the administration’s revenue estimate is considerably higher than ours because it does not incorporate the strong risk of a stock market downturn. Second, however, these higher revenues are offset by higher spending under the administration’s assumptions and estimates.

Stock Market Poses Serious Risk to Revenues. Several historically reliable signs suggest the stock market is overheated and at high risk of reversing course into a downturn in the next year or so. Should a stock market downturn occur, income tax revenues would fall considerably. These risks are severe enough that not incorporating them into this year’s budget, as the Governor proposes, would put the state on precarious footing. Further amplifying this precariousness, even under the administration’s more optimistic revenues, the budget is only roughly balanced in the near term.

Multiyear Budget Deficits Alarming. Both our office and the administration expect the state to face multiyear deficits, with estimates ranging from $20 billion to $35 billion annually. These deficits are concerning for three reasons. First, after four years of projected deficits and a cumulative total of $125 billion in budget problems solved so far, the state’s negative fiscal situation is now chronic. Second, structural deficits have grown—our November outlook is the most negative forecast of the budget’s position since the pandemic. Finally, deficits have persisted even as the state’s economy and revenues have grown, underscoring that the problem is structural rather than cyclical. Taken together, these trends raise serious concerns about the state’s fiscal sustainability.

Administration Acknowledges These Challenges, but Governor’s Budget Does Not Materially Address Them. In the budget summary and presentation, the Governor and administration officials have acknowledged the downside risk to the state’s revenue picture and the multiyear challenges facing the budget. However, the Governor’s budget does not include material actions to address either challenge. In this report, we offer an alternative approach for the Legislature to take that would put the state on better fiscal footing. Ultimately, this approach includes: adopting LAO revenue estimates, tackling the resulting budget problem, and shrinking multiyear deficits.

Introduction

On January 9, 2026, Governor Newsom’s administration presented its proposed state budget to the California Legislature. In this report, we provide a high‑level summary and our initial analysis of the Governor’s budget based on our preliminary review (as of January 10). In the coming weeks, we will analyze the plan in more detail and release many additional issue‑specific budget analyses.

Governor’s Budget Roughly Balanced on Higher Revenues

In November, We Anticipated the State Faced an $18 Billion Deficit. In our November Fiscal Outlook report, we estimated that the state faced an $18 billion budget problem. This budget problem was larger than the one anticipated by the administration in June, despite strong trends in income tax collections in the intervening months. There were two main reasons we anticipated the deficit to grow. First, while our revenue forecast represented an upgrade to budget act assumptions, it also incorporated the strong risk of a stock market downturn, which tempered the estimates. Second, we found that spending was much higher than had been anticipated in June, in large part due to the state’s constitutional requirements eroding revenue gains.

Administration’s Higher Revenue Estimate Significantly Improves Budget Condition. The administration’s revenue estimate represents a $42 billion upgrade from the budget act. This upgrade reflects strong income tax collections in recent months and an assumption that this strength will continue through 2026‑27. The administration’s assessment that recent gains will continue differs from our Fiscal Outlook, which, in contrast, reflects an assessment that recent gains are unlikely to be sustainable as they are tied to an overheated stock market. As such, the administration’s revenue estimate exceeds ours by almost $30 billion across the budget window (2024‑25 through 2026‑27). This higher revenue assumption substantially improves the budget condition relative to our forecast and is the main driving difference between our estimates of the deficit.

Higher Spending Estimates Erode Some of the Budget Improvement. There are several other differences between our November estimates of the deficit and the administration’s current forecast. Together, these differences offset some of the budget improvement generated by a higher revenue estimate. Specifically:

- Higher Constitutional Spending. Under two voter initiatives, the State Constitution requires the state to set aside a share of revenues for schools and community colleges (Proposition 98, 1988) and debt payments and reserve deposits (Proposition 2, 2014). Constitutionally required spending is higher under the administration’s estimates by about $13 billion across the budget window. This increases the administration’s estimate of the deficit relative to our forecast, partially offsetting some of the revenue improvement.

- Other Costs Also Higher. Across the rest of the budget, the administration’s estimates of baseline costs—that is, the cost of the state’s services under current law and policy—are also higher than our November estimates by a couple billion of dollars. Among these, some of the largest drivers of increased costs include Medi‑Cal, debt service on general obligation bonds, and employee compensation. This increases the administration’s estimate of the deficit relative to our forecast, partially offsetting some of the revenue improvement.

Even With $42 Billion Revenue Improvement, Budget Only Roughly Balanced. Taken together, the administration projects the budget faces a roughly $3 billion deficit. We view this as roughly balanced—that is, neither a clear surplus nor a clear deficit. That said, it is notable that the budget is in a neutral position even though the administration’s revenue estimate reflects growth and is up significantly relative to the budget act.

Discretionary Choices in Governor’s Budget

The Governor’s budget includes three categories of discretionary proposals, which are those that are not already committed to under current law or policy. First, the budget includes about ten budget solutions—proposals that create budget capacity, improving the budget’s bottom line—and they total around $9 billion. Second, the Governor’s budget includes about 60 discretionary spending proposals—proposals that use budget capacity, eroding the budget’s bottom line—and these total about $600 million. (These proposals are numerically fewer than in some previous years, although roughly equivalent to the amount of discretionary spending proposed in last year’s Governor’s budget.) Finally, the Governor sets the balance of the state’s discretionary reserve to $4.5 billion. We describe the major items in each of these categories below.

Budget Solutions

Budget solutions are proposals that create more budget capacity. Taken together, the budget solutions in the Governor’s budget result in an improvement in the budget’s bottom line by $9 billion. Ongoing, the Governor’s spending‑related solutions provide $5 billion in savings within a few years. Appendix 1 provides a list of the Governor’s budget solutions.

Generates $5.6 Billion School and Community College Settle‑Up Obligation in 2025‑26. The State Constitution sets a minimum spending requirement for schools and community colleges. For 2025‑26, this requirement is up $6.9 billion under the administration’s estimates, but the Governor’s budget provides $5.6 billion less than this revised estimate. This difference provides one‑time savings, giving the state more budget capacity, but if revenues meet expectations for 2025‑26 would eventually require the state to “settle up.” Because the administration does not account for this payment, it would add to a future deficit. If revenues fall short of their projections, the state’s settle‑up obligation would decline. We understand this proposal is intended, in part, to acknowledge revenue risks and avoid unintentionally spending more than the minimum requirement if revenues decline and the requirement drops. Although the settle‑up proposal responds to revenue risk in the current year, downside risk to revenues is likely greater in 2026‑27 than it is in 2025‑26.

Suspends BSA True‑Up Deposit for 2025‑26. Proposition 2 requires the state to make annual deposits into the Budget Stabilization Account (BSA), with amounts generally increasing when revenues—particularly those from capital gains—are higher. Deposits may be suspended if the Governor declares a budget emergency. However, deposits are later revised or “trued up” to reflect updated revenue estimates in the subsequent two fiscal years. This occurs even if the initial deposit was suspended. In last year’s budget, the state suspended the initial BSA deposit for 2025‑26. Under the administration’s higher revenue estimates, a $2.8 billion true‑up deposit would be required for the current year. The Governor proposes suspending this true‑up deposit as well.

Implementing Immigrant Population‑Related H.R. 1 Policies in Medi‑Cal. As part of the state’s required implementation of H.R. 1, the Governor proposes taking two discretionary actions related to immigrants that reduce state costs. The first would end comprehensive coverage for certain immigrant groups that will lose most federal cost sharing under H.R. 1. The second would extend new eligibility rules (such as work requirements) for certain federally funded populations to additional immigrant groups with state‑only‑funded comprehensive coverage. The proposals reduce costs by around $900 million in 2026‑27, with savings in future years ramping up to a few billion dollars annually.

Other Budget Solutions. The budget also includes a few other, smaller budget solutions. In the budget window, for example, the administration proposes: (1) reverting $71 million in unused EDDNext project funding early, and (2) modifying In‑Home Supportive Services (IHSS) eligibility to align with Medi‑Cal, which provides $86 million in savings). The Governor’s budget also includes some proposals that provide savings in future years (that is, in 2027‑28 and after). This includes proposals to: (1) remove the state’s share of costs associated with growth in IHSS hours per case, which we estimate could save $650 million by 2029‑30 (if hours continue to grow at their current rates); (2) make an ongoing reduction to the Middle Class Scholarship program, which generates $541 million in savings beginning in 2027‑28; and (3) make $12 million in previously provided ongoing federal‑related litigation funding limited term.

Discretionary Spending Proposals

New Spending Proposals of About $600 Million. The Governor’s budget includes around $600 million in new discretionary General Fund spending across the budget window. (We consider a proposal to be “discretionary” if it provides more funding for a program or a service above what is already committed under current law or policy.) After 2026‑27, these proposals would add about $200 million in ongoing spending. Some of the largest spending augmentations proposed for the budget window include: (1) $76 million for utility replacement and site improvements at Exposition Park, (2) $67 million to the California Department of Forestry and Fire Protection for fixed‑wing aircraft pilot and mechanics contract increases, (3) $60 million to the Department of Health Care Access and Information for a reproductive health care grant program, and (4) a $50 million General Fund loan to the Department of Toxic Substances Control for residential cleanup around the former Exide facility. We provide a full list of the Governor’s discretionary proposals in Appendix 2.

Discretionary Reserves

Sets Discretionary Reserve Balance to $4.5 Billion. The Special Fund for Economic Uncertainties (SFEU) is a general‑purpose reserve commonly used to provide capacity for unanticipated expenditures, including state costs associated with disasters and other emergencies. On a technical basis, it can be thought of as the end balance of the state’s General Fund—the money that remains after accounting for all of the state’s expected revenues and spending. The State Constitution has a balanced budget requirement, which means the balance of the SFEU must be set above zero for the upcoming fiscal year. Any level above that is up to the discretion of the Legislature. As a result, we consider the entire balance of the SFEU to be a discretionary choice. That said, recent budgets have set the SFEU between $3.5 billion and $4.5 billion, so the Governor’s budget proposal to set the balance to $4.5 billion is generally in line with recent policy.

Budget Condition

General Fund Condition

Figure 1 shows the General Fund condition based on the Governor’s proposals and using the administration’s estimates and assumptions.

Figure 1

General Fund Condition Summary

(In Millions)

|

2024‑25 |

2025‑26 |

2026‑27 |

|

|

Prior‑year fund balance |

$52,872 |

$55,951 |

$53,451 |

|

Revenues and transfers |

232,309 |

235,162 |

227,385 |

|

Expenditures |

229,231 |

237,662 |

248,330 |

|

Ending Fund Balance |

$55,951 |

$53,451 |

$32,506 |

|

Encumbrances |

$27,998 |

$27,998 |

$27,998 |

|

SFEU balance |

$27,953 |

$25,453 |

$4,508 |

|

Reserves |

|||

|

BSA |

$18,427 |

$11,327 |

$14,350 |

|

SFEU |

27,953 |

25,453 |

4,508 |

|

Safety net |

— |

— |

— |

|

Total Reserves |

$46,380 |

$36,780 |

$18,858 |

|

SFEU = Special Fund for Economic Uncertainties and BSA = Budget Stabilization Account. |

|||

Under Governor’s Budget, Reserves Would Total $19 Billion at End of 2026‑27. Under the Governor’s budget proposals and assumptions, general‑purpose reserves would total $19 billion by the end of 2026‑27. This includes an SFEU balance of $4.5 billion and $14.4 billion in the state’s main constitutional reserve, the BSA. These balances would be available to mitigate a future budget problem. (In addition, the state would have $4.1 billion in the Proposition 98 Reserve, available only for school and community college programs.)

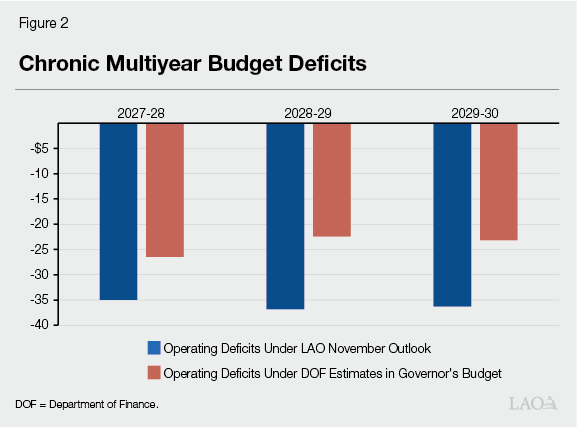

Chronic Multiyear Budget Deficits Remain. For the fourth year in a row, our office and the administration are forecasting multiyear budget shortfalls. Under the administration’s proposed budget and revenue assumptions, the state faces operating deficits of $27 billion in 2027‑28, $22 billion in 2028‑29, and $23 billion in 2029‑30, as seen in Figure 2. In November, our office projected the state faced deficits around $35 billion per year, with much of the difference attributable to our lower revenue estimates.

Schools and Community Colleges Budget

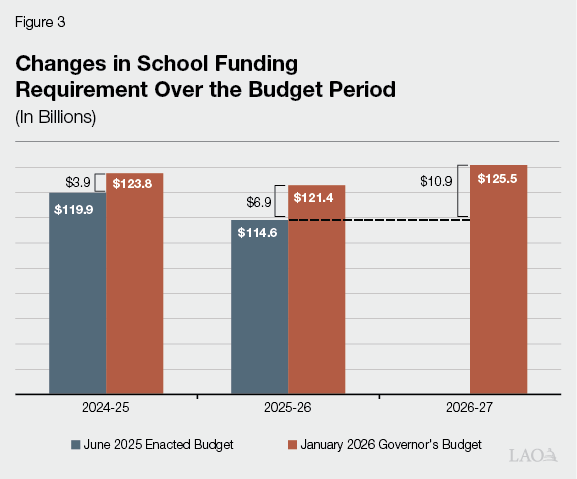

School Funding Requirement Revised Up $21.7 Billion Across the Budget Period. Compared with the June 2025 budget level, the administration estimates that the Proposition 98 funding requirement for schools and community colleges has increased by nearly $21.7 billion. About half of this increase is attributable to 2026‑27, with smaller portions attributable to 2024‑25 and 2025‑26 (Figure 3). The main reason for the increase is the administration’s higher General Fund revenue estimates. Over the three‑year period, the state General Fund is required to cover more than $19.4 billion of the increase, whereas growth in local property tax revenue covers $2.2 billion.

Makes Required and Discretionary Deposits Into the Proposition 98 Reserve. The Proposition 98 Reserve is a statewide reserve account for school and community college funding. The June 2025 budget withdrew the entire balance from this reserve. Under the Governor’s budget, the state would make mandatory deposits totaling $4.3 billion across 2024‑25 and 2025‑26. These deposits reflect significantly higher estimates of capital gains revenue. The budget also includes a discretionary deposit of $240 million in 2025‑26 and a mandatory withdrawal of $407 million in 2026‑27. After all these actions, the reserve would have a balance of $4.1 billion. The deposits also trigger a statutory cap on the local reserves held by medium and large school districts. This cap nominally limits a district’s discretionary reserves to 10 percent of its budgeted expenditures, though various exemptions and exclusions typically allow higher reserve levels.

Funds Three Notable Ongoing Increases. The Governor’s budget provides approximately $2.4 billion for a 2.41 percent statutory cost‑of‑living adjustment for existing school and community college programs. It also provides $1 billion ongoing to support the implementation of community schools. Additionally, it provides $509 million to increase per‑student funding rates for special education. Separate from these larger proposals, the budget funds several smaller initiatives, including (1) $62 million to increase and stabilize funding rates for certain districts participating in the Expanded Learning Opportunities Program, (2) $38 million for Calbright College to cover higher operational costs, and (3) $32 million to fund 0.5 percent systemwide enrollment growth for the community colleges.

Allocates One‑Time Funds for Discretionary Grant, Eliminating Deferrals, and Various Other Initiatives. The largest one‑time proposal is a $2.8 billion discretionary block grant for schools. Another significant one‑time proposal allocates $2.3 billion to eliminate the school and community college payment deferrals the state implemented in the June 2025 budget. The budget also funds several other activities. For schools, the most notable proposals include $757 million to restore the Learning Recovery Emergency Block Grant to its original level and $250 million to support teacher residency programs. For community colleges, the budget includes $121 million for deferred maintenance and $100 million for a student support block grant. Nearly all of the spending proposals build on activities the state has funded in previous budgets.

Delays $5.6 Billion in Payments Related to 2025‑26. When the Proposition 98 requirement increases after the budget is adopted, the state makes one‑time settle‑up payments to cover the difference. Whereas the state usually provides these payments as part of the subsequent budget, the Governor proposes delaying $5.6 billion associated with higher estimates of the 2025‑26 requirement. The administration indicates that the state will make these payments after finalizing its Proposition 98 calculations for the year (no earlier than June 2027). For schools and community colleges, this delay reduces the amount of one‑time funding available in this year’s budget. (The state took a similar action in June 2025 to delay a $1.9 billion payment related to 2024‑25. The Governor’s budget proposes to make that payment in full.)

Comments

Stock Market Poses Serious Risk to Revenues. As we discussed in our Fiscal Outlook, several historically reliable signs suggest the stock market is overheated and at high risk of reversing course into a downturn in the next year or so. Should a stock market downturn occur, income tax revenues would fall considerably. These risks are severe enough that not incorporating them into this year’s budget, as the Governor proposes, would put the state on precarious footing. Further amplifying this precariousness, even under the administration’s more optimistic revenues, the budget is only roughly balanced in the near term.

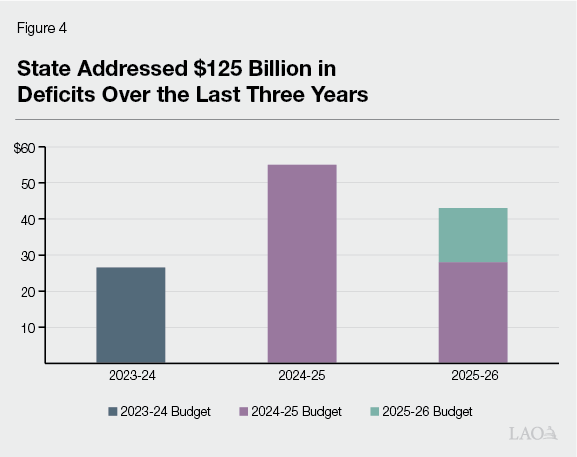

Multiyear Budget Deficits Alarming. Both our office and the administration expect the state to face multiyear deficits, with estimates ranging from $20 billion to $35 billion annually. These deficits are concerning for three reasons. First, after four years of projected deficits and a cumulative total of $125 billion in budget problems solved so far (see Figure 4), the state’s negative fiscal situation is now chronic. Second, as we pointed out in our Fiscal Outlook, structural deficits have grown—our November outlook is the most negative forecast of the budget’s position since the pandemic. Finally, deficits have persisted even as the state’s economy and revenues have grown, underscoring that the problem is structural rather than cyclical. Taken together, these trends raise serious concerns about the state’s fiscal sustainability.

Governor Acknowledges These Challenges… In the budget summary and presentation, the Governor and administration officials have acknowledged the downside risk to the state’s revenue picture. For example, in the budget summary, the administration points out that: (1) much of the revenue surge is attributable to investor enthusiasm around artificial intelligence, (2) history suggests these gains are not sustainable, and (3) the dominant risk to the budget is the stock market and asset price declines. Further, the administration notes that downside risk to revenues is a key motivator for its Proposition 98 settle‑up proposal, which would allow the state to avoid overcommitting funding to schools and community colleges in the event revenues decline in 2025‑26. (However, this proposal would not provide protection against downside risk in 2026‑27.)

…But Governor Proposes No Material Actions to Address Downside Risk. The Governor has two proposals to address downside revenue risk: (1) its settle‑up proposal, which provides a limited hedge against downside revenue risk, but only in 2025‑26, and (2) a commitment to revisit the state’s budget condition and multiyear situation in May. Otherwise, the Governor’s budget takes no material actions to address this challenge. In fact, the Governor’s two major budget solutions—that is, the settle‑up proposal and suspending a BSA true up—mostly reduce budget resilience rather than increasing it. On an ongoing basis, the Governor’s budget proposes about $5 billion in spending solutions. However, these fall well short of the amount needed to substantially address future deficits.

Administration’s Delay Magnifies Challenges. The state’s deficits will require legislative action. It is essential that the Legislature begin that work now, rather than waiting until the administration puts forward a revised budget in May. Beginning deliberation now would provide time for public scrutiny and legislative vetting of possible solutions. By contrast, delaying until May forces the Legislature to either accept solutions that have not received sufficient public discussion or defer action even more. Given that a new administration will take office next year, further delays would mean making difficult decisions during a period of transition to new leadership across the executive branch. This could further complicate efforts to take timely and deliberative action.

Steps for Recognizing Revenue Risk and Addressing Structural Deficits. The budget faces two key and sizeable challenges: downside risk to the Governor’s revenue estimates in the budget window and significant structural deficits in the out‑years. To address these challenges, we recommend the Legislature:

- Acknowledge Downside Risk by Adopting LAO Revenue Outlook. Both our office and the administration agree the budget faces downside risk, particularly from the stock market. However, only our revenue forecast explicitly incorporates the possibility of a market downturn, hedging against this risk. Using our revenue forecast as the budget’s starting place would make difficult choices unavoidable, providing a practical baseline for action.

- Tackle the Budget Problem. If the Legislature adopts our revenue outlook, the primary task will be to identify solutions that bring the budget into balance. If the Legislature uses the administration’s revenue estimates, however, we recommend two steps. First, maintain—rather than suspend—all required BSA deposits across the budget window, including the $2.8 billion true‑up deposit in 2025‑26. Second, increase budget resilience by setting aside $5.6 billion associated with the settle‑up proposal into a reserve, rather than using these funds for other budget commitments (as done by the administration). This could be achieved by depositing these funds into the Proposition 98 reserve or another general‑purpose reserve. Both of these actions would also require commensurate budget solutions.

- Shrink Multiyear Deficits. Finally, we recommend the Legislature adopt a plan to address at least half of the identified multiyear deficits. Based on the administration’s estimates, this would require additional ongoing solutions totaling at least $10 billion. These solutions could include spending reductions, revenue increases, or a combination of both. Some of these solutions—in combination with those made in the budget year—could be phased in starting in 2027‑28 to allow programs time to implement the changes thoughtfully.

Identifying budget solutions—spending reductions and revenue increases—while revenues continue to beat expectations is challenging. Moreover, there is the possibility that revenues ultimately will beat our forecast in the near term, resulting in the seeming possibility of deferring action. But we still urge the Legislature to start addressing the budget’s structural imbalance now. Starting now, before a crisis is at the state’s doorstep, enables the Legislature to take a more thoughtful approach to rebalancing the state’s commitments. Moreover, approaching the structural deficit in increments allows the Legislature to ensure those solutions ultimately improve the state’s fiscal position as intended and take subsequent action as needed.

Conclusion

Nearly four years ago—on the heels of the pandemic and two years of extraordinary revenue growth and historic surpluses—revenues fell sharply, posting double‑digit declines. Since then, revenues resumed growing, even above historic averages, but not fast enough to catch up with the state’s spending level. As a result, recent budgets have proven difficult for policymakers as deficits have transitioned from cyclical to structural.

In two other cases in recent history, the state encountered similar conditions: deficits lingering in the wake of a sharp revenue decline, despite subsequent revenue growth. Specifically, this occurred after the dot‑com bust and after the Great Recession. The state responded to the dot‑com bust with mostly short‑term solutions rather than realigning its structural shortfalls. As a result, when California entered another recession only a few years later—the most severe since the Great Depression—the budget rapidly deteriorated into crisis. Similar conditions also existed in the wake of the Great Recession. By contrast, in those years, the state made significant ongoing reductions to programs and later enacted Proposition 30 (2012), raising personal income taxes. Coupled with the longest economic expansion on record, these factors eventually stabilized the budget. Today, without action to realign ongoing expenditures with ongoing revenues, the risk of repeating history looms large.

Appendix

Appendix 1, Figure 1

General Fund Spending Solutions Proposed in the 2026‑27 Governor’s Budget

(In Millions)

|

Department or Program |

Description |

2025‑26 |

2026‑27 |

|

CSAC |

Middle Class Scholarship |

— |

—a |

|

DOJ |

Ongoing federal‑related litigation funds made limited term |

— |

—b |

|

EDD |

Unused EDDNext project funding |

$71 |

— |

|

IHSS |

Align IHSS eligibility with Medi‑Cal |

— |

$86 |

|

IHSS |

Eliminate permanent back‑up provider system |

— |

4 |

|

IHSS |

Eliminate states’ share of cost for growth in hours per case |

— |

—c |

|

Medi‑Cal |

End comprehensive coverage for certain groups |

— |

786 |

|

Medi‑Cal |

Work requirements and 6‑month renewals for adults with UIS |

— |

125 |

|

Totals |

$71 |

$1,001 |

|

|

aOngoing reduction of $541 million beginning in 2027‑28. bProvides $12 million in savings beginning in 2029‑30. cOngoing reduction of $234 million beginning in 2027‑28, which we estimate could grow to $664 million by 2029‑30. |

|||

|

CSAC = California Student Aid Commission; DOJ = Department of Justice; EDD = Employment Development Department; IHSS = In‑Home Supportive Services; and UIS = unsatisfactory immigration status. |

|||

Appendix 1, Figure 2

Other General Fund Solutions Proposed in the 2026‑27 Governor’s Budget

(In Millions)

|

Solution Type |

Description |

2025‑26 |

2026‑27 |

|

Borrowing |

Proposition 98 settle up |

$5,560 |

— |

|

Reserves |

Suspend true up for BSA deposit |

2,819 |

— |

|

Revenue Related |

Require delivery network companies to register as marketplace facilitators |

— |

$10 |

|

Totals |

$8,379 |

$10 |

|

|

BSA = Budget Stabilization Account. |

|||

Appendix 2, Figure 1

General Fund Discretionary Spending Proposals in the 2026‑27 Governor’s Budget:

Criminal Justice

(In Millions)

|

Department or Program |

Description |

2026‑27 |

|

CDCR |

Statewide correctional video surveillance |

$10.0 |

|

CDCR |

Telemental health staffing |

8.9 |

|

CDCR |

Tattoo removal program |

1.2 |

|

CMD |

Drug Interdiction program continuance |

15.0 |

|

DOJ |

Firearms IT Systems Modernization Project |

11.2 |

|

DOJ |

Shift support for some firearm workload to General Fund for three years |

8.0 |

|

DOJ |

Firearm barrels workload that can be supported by fees |

1.2 |

|

JB |

Fresno County—New Fresno Courthouse (reappropriation) |

18.1 |

|

JB |

Supreme Court and Courts of Appeal Court‑Appointed Counsel programs |

11.0 |

|

JB |

Kings County—New shelled courtroom for new judgeship |

7.6 |

|

JB |

Sutter County—New shelled courtroom for new judgeship |

6.5 |

|

JB |

San Joaquin County—New shelled courtroom for new judgeship |

6.4 |

|

JB |

Solano County—New Hall of Justice (reappropriation) |

5.2 |

|

JB |

Plumas County—New Quincy Courthouse |

2.3 |

|

JB |

Nevada County—New Nevada City Courthouse |

1.5 |

|

Total |

$114.1 |

|

|

CDCR = California Department of Corrections and Rehabilitation; CMD = California Military Department; IT = information technology; DOJ = Department of Justice; and JB = Judicial Branch. |

||

Appendix 2, Figure 2

General Fund Discretionary Spending Proposals in the 2026‑27 Governor’s Budget:

All Other

(In Millions)

|

Department or Program |

Description |

2025‑26 |

2026‑27 |

|

BOE |

Information Technology Modernization Project |

— |

$3.2 |

|

BPPE |

Costs shifted to General Fund |

$10.0 |

— |

|

CCC |

Four new positions at Chancellor’s Office |

— |

0.6 |

|

CDE |

State Preschool direct deposit |

— |

2.1 |

|

CDE |

Server room air conditioning and power supply replacement |

— |

1.3 |

|

CDE |

Staff for transitional kindergarten multilingual learner screening instrument |

— |

0.3 |

|

CDE |

Staff to support Proposition 28 arts and music funding |

— |

0.1 |

|

CDFA |

Farm to school efforts |

— |

24.6 |

|

Child Care |

Prospective payments for child care providers |

— |

43.8 |

|

CHP |

Sawtooth Ridge Enhanced Radio system project |

— |

1.3 |

|

CHP |

Capital outlay planning and site identification |

— |

1.0 |

|

CSAC |

Golden State Teacher Grants (reappropriation) |

— |

14.4 |

|

CSL |

Higher rental costs (Library and Courts I and II Buildings) |

— |

1.1 |

|

CSU |

Payment deferral (retire) |

— |

—a |

|

CTC |

Various Commission on Teacher Credentialing staff increases |

— |

3.0 |

|

DDS |

Life Outcomes Improvement System IT project planning |

— |

5.7 |

|

DOJ |

Additional funding for federal‑related litigation |

— |

10.0 |

|

EMSA |

Administrative resources |

— |

1.4 |

|

FTB |

Replacement of disaster recovery mainframe servers |

— |

13.1 |

|

GO‑Biz |

Ongoing funding for California Export Promotion Program |

— |

1.4 |

|

GovOps |

California Education Learning Lab (reinstatement) |

— |

4.0 |

|

HCAI |

Reproductive Health Care Grant Program |

60.0 |

— |

|

HHS |

Menopause public awareness campaign |

— |

3.0 |

|

UC |

Payment deferral (retire) |

— |

—a |

|

WDB |

Additional Operational Resources |

— |

5.6 |

|

Totals |

$70.0 |

$140.9 |

|

|

aThe Governor’s budget proposes retiring the UC and CSU payment deferrals in 2027‑28. |

|||

|

BOE = State Board of Equalization; BPPE = Bureau for Private Postsecondary Education; CDE = California Department of Education; CDFA = California Department of Food and Agriculture; CHP = California Highway Patrol; CSAC = California Student Aid Commission; CSL = California State Library; CTC = Commission on Teacher Credentialing; DDS = Department of Developmental Services; DOJ = Department of Justice; EMSA = Emergency Medical Services Authority; FTB = Franchise Tax Board; GO‑Biz = Governor’s Office of Business and Economic Development; GovOps = Government Operations Agency; HCAI = Department of Health Care Access and Information; HHS = Health and Human Services Agency, Secretary; and WDB = Workforce Development Board. |

|||

Appendix 2, Figure 3

General Fund Discretionary Spending Proposals in the 2026‑27 Governor’s Budget:

Resources and Environment

(In Millions)

|

Department or Program |

Description |

2026‑27 |

|

CalFire |

Fixed‑wing aircraft pilot and mechanics contract increases |

$66.5 |

|

CalFire |

Riverside Unit headquarters property acquisition |

10.0 |

|

CalFire |

Permanent resources for enhanced defensible space inspections |

6.2 |

|

CalFire |

Happy Valley Fire Center property acquisition |

6.0 |

|

CalFire |

Hollister Air Attack Base/Bear Valley Helitack Base facility relocation |

5.5 |

|

CalFire |

Boggs Mountain Helitack Base facility relocation |

4.8 |

|

CalFire |

Tehama Glenn Unit Headquarters facility relocation |

4.5 |

|

CalFire |

Parlin Fork Conversation Camp kitchen repairs |

4.1 |

|

CalFire |

Humboldt‑Del Norte Unit headquarters |

4.0 |

|

CalFire |

Witch Creek Fire Station facility relocation |

3.3 |

|

CalFire |

Howard Forest Helitack Base facility replacement |

1.9 |

|

CalFire |

Hemet‑Ryan Air Attack Base facility replacement |

1.8 |

|

CalFire |

Los Angeles Moran Reforestation Center improvements |

1.2 |

|

CCC |

Hand crew daily wildfire readiness schedule |

11.7 |

|

DFW |

Nutria eradication program |

8.2 |

|

DFW |

San Joaquin River basin chinook salmon restoration |

5.0 |

|

DSC |

Independent peer review for science and monitoring |

0.7 |

|

DSC |

Information security officer |

0.2 |

|

DTSC |

Exide residential cleanup (loan) |

50.0 |

|

DWR |

Delta levees program mitigation |

14.0 |

|

DWR |

River forecast and snow survey resources |

9.5 |

|

Expo Park |

Utility replacement and site improvements |

76.0 |

|

Parks |

California State Parks Library Pass Program |

6.8 |

|

Parks |

California Indian Heritage Center initial operations |

0.8 |

|

Total |

$302.6 |

|

|

CalFire = California Department of Forestry and Fire Protection; CCC = California Conservation Corps; DFW = Department of Fish and Wildlife; DSC = Delta Stewardship Council; DTSC = Department of Toxic Substances Control; DWR = Department of Water Resources; Expo Park = Exposition Park; and Parks = Department of Parks and Recreation. |

||