Ryan Woolsey

February 18, 2026

The 2026‑27 Budget

CalWORKs

This post provides some basic background on the California Work Opportunity and Responsibility to Kids (CalWORKs) program, followed by an overview and assessment of the Governor’s CalWORKs budget proposal. The Governor’s budget proposes about $7.1 billion in CalWORKs funding in 2025-26 and $7.2 billion in 2026-27. Under the Governor’s budget, there are no newly proposed augmentations or budget solutions.

Background

CalWORKs was created in 1997 in response to 1996 welfare reform legislation that created the federal Temporary Assistance for Needy Families (TANF) program. CalWORKs is administered by counties and overseen by the California Department of Social Services.

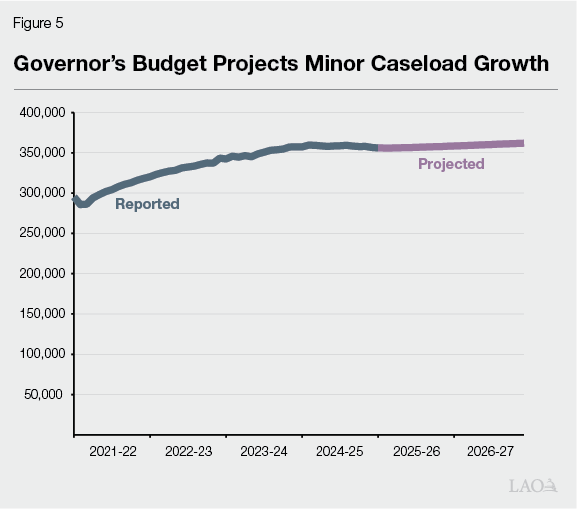

CalWORKs Provides Cash Assistance and Other Supportive Services to Low-Income Families. CalWORKs cash grants vary based on region, number of eligible family members, and income. Families in high-cost coastal counties such as Los Angeles and San Francisco receive grants that are about 5 percent higher than similar families living in inland counties such as Fresno and Shasta. In general, grant amounts increase as family size increases and decrease as family income is higher. In 2025-26, the administration estimates that the average CalWORKs grant will be $999 per month across all family sizes and income levels. CalWORKs recipients are often also eligible to receive supportive services and resources including subsidized child care, employment training, mental health counseling, and housing assistance.

Most Services and Administration Funding Provided to Counties Through the Single Allocation. The state provides counties with a “single allocation” to cover most costs associated with CalWORKs other than cash assistance. The single allocation consists of three main components—eligibility determination and administration, employment services, and Cal-Learn case management. (Cal-Learn provides additional services to pregnant and parenting teens participating in CalWORKs.) Counties may shift funds between the multiple single allocation components depending on local needs.

Federal, State, and County Governments Share Program Costs. California receives $3.7 billion annually from the federal TANF block grant, the majority of which supports CalWORKs costs. In order to receive TANF block grant funding, the state is required to expend a minimum of $2.8 billion on CalWORKs and other allowable activities from state and local funding sources to meet a maintenance of effort (MOE) requirement. The General Fund supports some CalWORKs costs. Counties are also responsible to support a share of CalWORKs costs.

Realignment Revenues Support County Share of CalWORKs Costs. Following major realignments of state and local responsibilities in 1991 and again in 2011, some state sales tax and vehicle license fee revenue are deposited into a special fund with a series of subaccounts that support local fiscal responsibilities for various health and human services programs. Some of these subaccounts were established to support an increased county share of cost in CalWORKs, offsetting what otherwise would be General Fund costs.

Under State Law, Realignment Revenue Growth Automatically Triggers Grant Increases. One realignment subaccount—the Child Poverty and Family Supplemental Support Subaccount—is used to increase the level of cash grants CalWORKs families receive. Each year, the administration determines whether subaccount revenues are sufficient to cover the cost of previous grant increases provided from subaccount funds. If they are, the administration then calculates the level of additional grant increase, if any, projected subaccount revenues could support. If subaccount funds are insufficient in any given year to fund the cost of previously provided grant increases provided from the subaccount, the remaining cost for that year is covered by the General Fund.

Federal Government Briefly Froze TANF Funding Earlier This Year. On January 6, 2025, the federal government notified California and four other states that it was freezing allocations from the TANF block grant, as well as two other significant federal grants: the Child Care and Development Block Grant and the Social Services Block grant (SSBG). The federal government indicated that the freeze was related to concerns about improper use of the federal funds. On January 8, 2025, California and the other states sued to prevent the freeze. A federal court initially granted a temporary restraining order that was followed by a preliminary injunction, ordering that funds continue to be available pending resolution of the case.

Budget Overview

Overall CalWORKs Funding Increases Slightly Year Over Year. As shown in Figure 1, the Governor’s budget estimates $7.1 billion in total spending in CalWORKs in the current fiscal year. This is essentially unchanged from amounts approved in the 2025-26 Budget Act. The budget proposes $7.2 billion in total funding for CalWORKs in 2026-27, a net increase of $104 million (1 percent) over the revised 2025-26 estimate.

Figure 1

CalWORKs Budget Summary

All Funds (Dollars in Millions)

|

2025‑26 |

2026‑27 |

Change From 2025‑26 to 2026‑27 Proposed |

||

|

Amount |

Percent |

|||

|

Number of CalWORKs Cases |

356,744 |

360,137 |

3,393 |

1% |

|

Cash Grants |

$4,270 |

$4,310 |

$40 |

1% |

|

Single Allocation |

||||

|

Employment services |

$1,193 |

$1,220 |

$26 |

2% |

|

Cal‑Learn case management |

11 |

11 |

— |

1 |

|

Eligibility determination and administration |

453 |

453 |

— |

— |

|

Subtotals |

($1,657) |

($1,683) |

($26) |

(2%) |

|

Stage 1 Child Care |

$615 |

$630 |

$15 |

2% |

|

Other Allocations |

||||

|

Home Visiting Program |

$94 |

$120 |

$26 |

28% |

|

Housing Support Program |

95 |

95 |

— |

— |

|

Expanded Subsidized Employment |

134 |

134 |

— |

— |

|

Family Stabilization |

66 |

67 |

1 |

1 |

|

Mental Health and Substance Abuse Services |

104 |

130 |

26 |

25 |

|

Subtotals |

($493) |

($546) |

($53) |

(11%) |

|

Othera |

$52 |

$23 |

‑$30 |

‑57% |

|

Totals |

$7,087 |

$7,192 |

$104 |

1% |

|

aPrimarily includes various state‑level contracts. |

||||

Governor’s Budget Projects Minor Growth in Caseload and Services Costs. Costs for cash assistance are projected to increase by $40 million (1 percent) in 2026-27. This reflects a very slight projected caseload increase. Similarly, costs for employment services and Stage 1 child care are projected to increase by $26 million (2 percent) and $15 million (2 percent), respectively. These factors explain the majority of the modest increase in total projected CalWORKs spending in 2026-27.

Funding Restored Consistent With Prior Budget Agreements. The Governor’s budget increases funding for the CalWORKs Home Visiting Program, which provides in-home support for CalWORKs families with young children, by $26 million. Funding for mental health and substance abuse services for CalWORKs families is also increased by $26 million. This restores funding that was temporarily reduced as a budget solution in the 2024-25 Budget Act, consistent with the budget agreement. These restorations also contribute to the year-over-year growth in projected CalWORKs costs.

General Fund Spending Down in Current Year Largely Due to Unspent TANF Funds… Within the total funding amount, the Governor’s budget estimates $1.1 billion from the General Fund will be spent in CalWORKs in the current fiscal year, as shown in Figure 2. This is a decrease of $194 million (15 percent) compared to the 2025-26 Budget Act. This decrease is primarily because the Governor’s budget uses unspent prior-year TANF funds that were not accounted for at budget enactment to replace General Fund spending.

Figure 2

CalWORKs Funding Sources

(Dollars in Millions)

|

2025‑26 |

2026‑27 |

Change From 2025‑26 to 2026‑27 Proposed |

||

|

Amount |

Percent |

|||

|

Federal TANF block grant funds |

$2,877 |

$2,616 |

‑$261 |

‑9% |

|

270 |

— |

‑270 |

‑100 |

|

General Fund |

1,121 |

1,489 |

368 |

33 |

|

Realignment funds from local indigent health savings |

768 |

694 |

‑75 |

‑10 |

|

Realignment funds dedicated to grant increases |

1,106 |

1,178 |

71 |

6 |

|

Other county/realignment funds |

1,215 |

1,216 |

1 |

—b |

|

Totals |

$7,087 |

$7,192 |

$104 |

1% |

|

aTANF carry‑forward is a non‑add item for display purposes only. This amount is included in Federal TANF block grant funds. |

||||

|

bLess than 0.5 percent. |

||||

|

TANF = Temporary Assistance for Needy Families. |

||||

…But Back Up Again in Budget Year. The Governor’s budget proposes $1.5 billion from the General Fund for CalWORKs in 2026-27, a year-over-year increase of $368 million (33 percent). Here again the increase is primarily because the Governor’s budget assumes there will be no remaining unspent TANF funds in 2026-27 to offset General Fund costs as is the case in 2025-26.

LAO Assessment

Technical Adjustments Often Occur in CalWORKs Budget to Account for Unspent TANF Funds. When CalWORKs expenditures turn out to be less than budgeted, the state can have unspent TANF funds carry over to later years. The state’s typical practice is to use unspent TANF funds to replace General Fund spending in CalWORKs. The amount of unspent TANF funds that will be available for a given year often is not known when the budget for that year is passed. Budget projections are revised when unanticipated TANF funds are identified. This dynamic is at play in the 2026-27 Governor’s Budget, which newly identifies $270 million in prior-year unspent TANF funds. Before accounting for other changes in spending levels, this unspent TANF funding results in a downward swing in General Fund dollars in CalWORKs in 2025-26. This is followed by a swing back upward in 2026-27 because whether there will be additional unspent TANF funds to offset costs in 2026-27 is not yet known. This volatility in General Fund spending should be viewed as a technical issue rather than having any relation to changes in policy or program service levels.

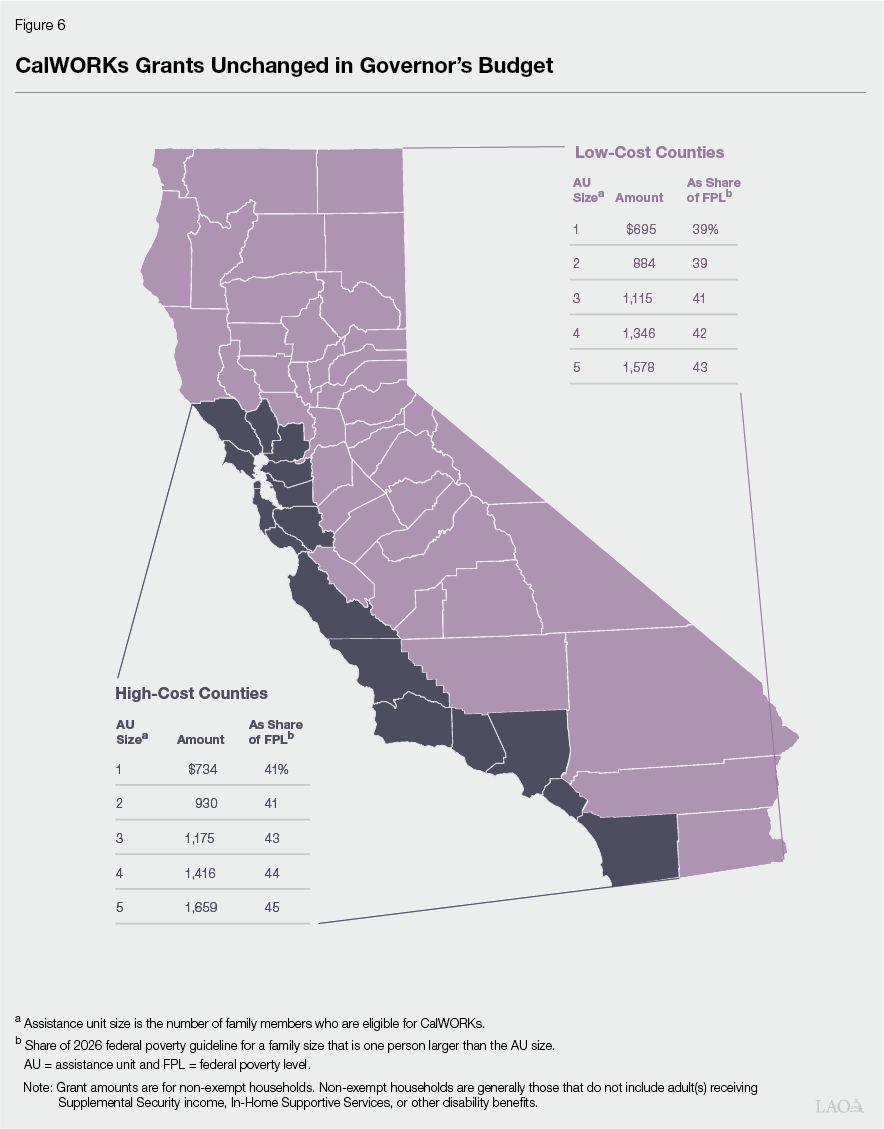

TANF Carry-In Significantly Reduced Relative to Recent Years. As shown in Figure 3, the amount of TANF used to support CalWORKs has changed from year to year. During the COVID-19 pandemic the state significantly overestimated CalWORKs caseload and spending, largely due to unprecedented federal and state policy responses that led to historically unusual enrollment trends. Overestimates led to a large amount of unspent TANF—$767 million—estimated to be available to reduce state spending in CalWORKs in 2022-23. Similarly, $664 million in unspent TANF funds was estimated to be available in 2024-25. With $270 million in unspent TANF identified for 2025-26, the level of carried-over funding is decreasing. As already noted, the Governor’s budget projects no unspent TANF available in 2026-27. Given the long history of technical adjustments in the CalWORKs budget, it is possible that there will be additional unspent TANF identified for 2026-27. However, the amount of such carry-in funding is uncertain. We do not recommend any adjustments to the proposed budget related to unspent TANF funds at this time.

Federal TANF Program Provides Flexible Funding. Federal law gives states significant flexibility in how they use TANF block grant funds and related MOE expenditures. In general, expenditures are required to be consistent with four purposes of the federal TANF program, which include:

Providing assistance to needy families so that children can be cared for in their own homes.

Reducing the dependence of needy parents by promoting job preparation, work, and marriage.

Preventing and reducing the incidence of out-of-wedlock pregnancies.

Encouraging the formation and maintenance of two-parent families.

The state may also use TANF funds for activities that were allowable under TANF’s predecessor program, Aid to Dependent Families with Children, including some child welfare services expenditures. Finally, the state can transfer up to 10 percent of its annual TANF block grant to the SSBG, to be used for a variety of purposes, such as providing developmental services through Regional Centers.

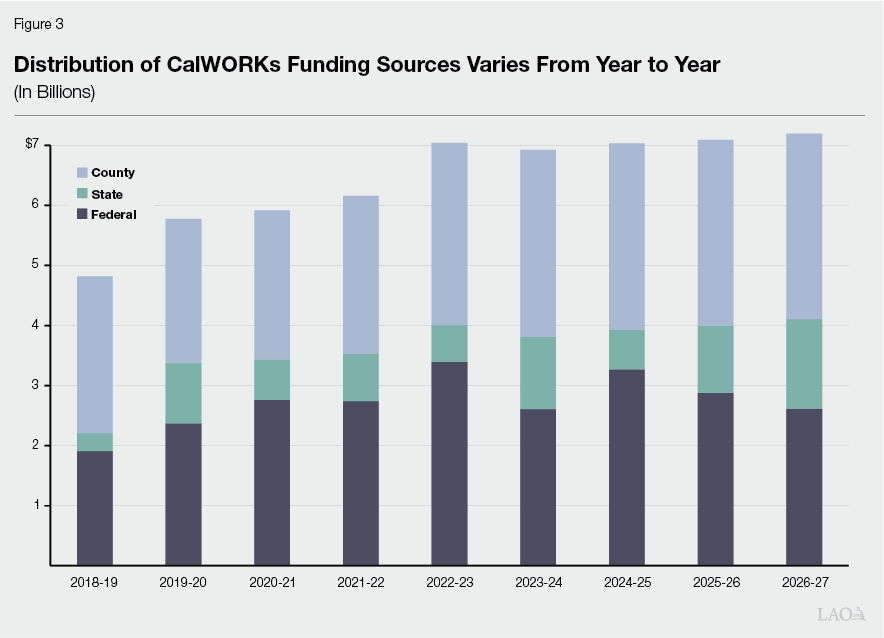

TANF and Related MOE Spending Involve More Than Just CalWORKs. The state utilizes the flexibility provided by federal law by allocating TANF funds to a number of programs beyond CalWORKs. The state also counts significant state expenditures outside of CalWORKs toward meeting its MOE requirement. Figure 4 accounts for the proposed use of California’s $3.7 billion in TANF funds in 2026-27. It also identifies the $6.3 billion in state and local expenditures identified as countable as MOE expenditures, more than satisfying the state’s $2.8 billion requirement.

Oversight of Funding Freeze Risk Is Warranted. It is unclear how the legal questions around the federal funding freeze will be resolved. Should the freeze be implemented, the state could be faced with losing access to federal TANF funding for weeks or longer. Based on our understanding of how TANF funds flow to the state, California would likely start experiencing funding shortfalls and programmatic impacts within weeks of a freeze. The Legislature may wish to ask the administration at budget hearings to provide more information on the impacts of an extended funding freeze on CalWORKs, and other programs that receive TANF funding.

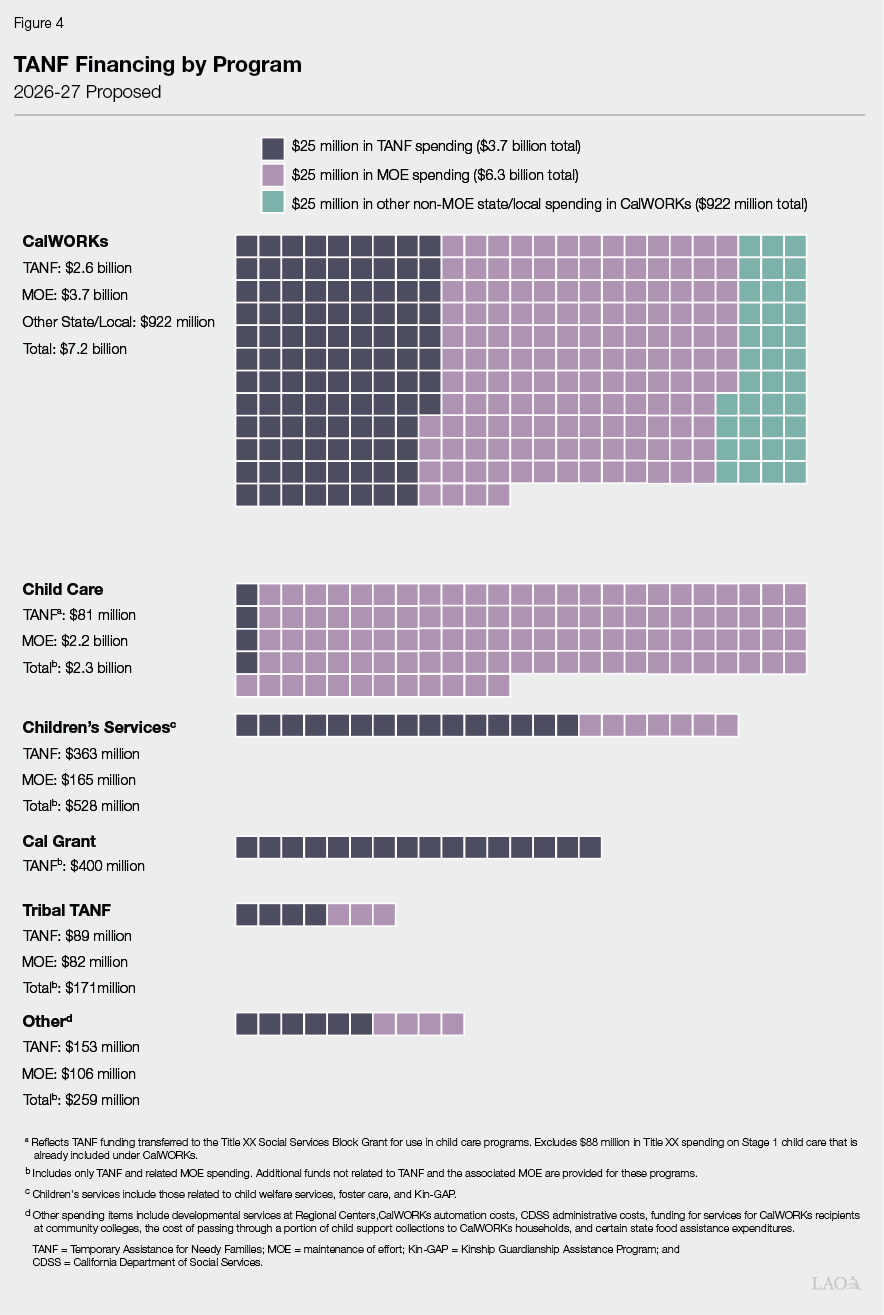

CalWORKs Caseload

Caseload Growth Has Slowed. As shown in Figure 5, the CalWORKs caseload has steadily grown from early in 2021-22, coinciding with the expiration of enhanced federal Unemployment Insurance benefits following the COVID-19 pandemic. In recent months, caseload growth has slowed and may have peaked.

LAO Assessment

Caseload Estimate Is Reasonable. The Governor’s budget projects a caseload of 356,744 in 2025-26 and 360,137 in 2026-27, a year-over-year increase of about 1 percent. We find this projection reasonable but will revisit the administration’s projections at the May Revision when more data are available.

Automatic Grant Increases

Realignment Revenues Projected to Be Insufficient for Automatic Grant Increase in 2026. The Governor’s budget revises downward projected realignment revenue growth in 2025-26. This means that less realignment revenue is expected to be allocated to the Child Poverty and Family Supplemental Subaccount than previously expected. The administration expects that the cost of previously approved grant increases funded from the subaccount will be covered in 2025-26 by unspent realignment funds carried in from prior years. However, the administration does not propose any additional grant increase from realignment funds in 2026.

LAO Assessment

Realignment Projections Appear Reasonable. At this time, the administration’s projections for realignment funds in CalWORKs are within reason. We will revisit these projections at the May Revision.

Grants Still Not Estimated to Meet Legislature’s Goal for All Recipients. As part of the 2018-19 Budget Act, the Legislature set a goal to increase CalWORKs grants to 50 percent of the federal poverty level (FPL) for a family that is one person larger than the number of people in the family for which the grant amount is calculated. (Many CalWORKs families have unaided members who are excluded from the grant calculation because they are ineligible for assistance for various reasons.) Figure 6 displays how current CalWORKs grant levels compare to the FPL for a household of one larger than the number of aided members in the CalWORKs family. Because the FPL is adjusted each year for inflation while grants are unchanged, progress toward the Legislature’s goal erodes slightly.