Ryan Woolsey

February 18, 2026

The 2026‑27 Budget

Food Assistance Programs

Summary. In this post, we provide background on CalFresh, the California Food Assistance Program (CFAP), and other food assistance programs. We analyze the Governor’s proposed food assistance budget and describe potential impacts of H.R. 1, also known as the One Big Beautiful Bill Act. Finally, we provide an update on estimates for the Legislature’s previous action to expand CFAP to undocumented immigrants in 2027-28.

Background

CalFresh and CFAP

CalFresh Provides Federally Funded Nutrition Assistance to Low-Income Californians. CalFresh is California’s version of the federal Supplemental Nutrition Assistance Program (SNAP), which provides monthly food assistance to qualifying low-income households. To be eligible, households generally must earn less than 200 percent of the federal poverty level. CalFresh benefits can be used to buy most groceries and some prepared food at participating vendors, which include most grocery and convenience stores. Benefit amounts vary by household and depend on various factors including household size, income, and costs for housing and utilities. In 2024-25, about 5.5 million Californians received a total of over $12.5 billion in CalFresh benefits, all of it federally funded, with an average monthly benefit of about $192 per person.

CalFresh Administration Is Funded by the State, Counties, and Federal Government. CalFresh is overseen at the state level by the California Department of Social Services (CDSS) and administered locally by county human services departments. Although CalFresh benefits are paid by the federal government, costs to administer the program are shared by state, county, and federal governments. Currently, 50 percent of administrative costs are covered by the federal government, 35 percent by the state, and 15 percent by counties.

Payment Error Rate Measures Accuracy of Benefit Calculations. As part of its oversight of the SNAP program, the federal government calculates the payment error rate, which measures the extent to which benefit payments are higher or lower than they should be based on individual household circumstances. In general, payment errors are caused by many factors. Rules for determining CalFresh eligibility and calculating benefit amounts are complex. CalFresh recipients sometimes provide incomplete or inaccurate information needed to correctly calculate benefits, often unintentionally. Counties also make administrative errors when determining eligibility and calculating benefits. California’s most recent payment error rate, for federal fiscal year 2023-24, is about 11 percent. (The comparable national error rate is similarly about 11 percent.) Payment error rates in California and nationally have risen in recent years, particularly since the COVID-19 pandemic.

CFAP Provides State-Funded Food Assistance to Certain Legally Present Noncitizens. In 1996, Congress passed a welfare reform bill that, among other things, restricted federal food assistance for certain noncitizens. Most notably, some legally present noncitizens (primarily legal permanent residents) were rendered ineligible for federally funded nutrition assistance until they had resided in the country for five years. The federal government gave states the option to use the CalFresh benefit delivery infrastructure (including federally supported payment systems) to provide state-funded food assistance to populations affected by this 1996 policy change, provided the state reimburses the federal government for related costs. In response, California established CFAP. CFAP benefits are equal to those provided by CalFresh. In 2024-25, CFAP provided $135 million in food assistance to about 63,000 people, for an average benefit of about $180 per person.

Subject to Appropriation, CFAP to Be Expanded to Additional Income-Eligible Noncitizens. Some noncitizens, including those who are undocumented, are currently ineligible for CFAP based on immigration status. Recent spending plans included funding to expand CFAP to all income-eligible noncitizens aged 55 and older, regardless of immigration status. Implementation was initially expected in October 2025. However, as a budget solution, the 2024-25 spending plan delayed the expansion implementation by two years. Upon appropriation by the Legislature, benefit distribution for recipients made newly eligible through the expansion is to begin in 2027-28.

H.R. 1 Makes Significant Changes Impacting CalFresh and CFAP

H.R. 1 was passed by Congress and signed by the President in July 2025. H.R. 1 introduces multiple significant changes to CalFresh and CFAP that are expected to result in reduced enrollment, lower benefits, and higher state costs.

Expands Work Requirement. Able-bodied adults without dependents (ABAWDs) generally are limited to three months of CalFresh assistance in a three-year period unless they work or participate in qualifying activities for at least 20 hours per week. Until recently, California had a statewide waiver exempting all CalFresh recipients from the requirement based on economic conditions in the state. This effectively means that there were no work restrictions or time limits for the ABAWD population in California. H.R. 1 expands the ABAWD work requirement by:

Applying it to adults through age 64, rather than 54.

Applying it to adults caring for dependents aged 14 and older, rather than 18 and older.

Eliminating exemptions for former foster youth, veterans, and homeless individuals. (These exemptions were already scheduled to sunset in 2030.)

Tightening rules for waivers based on economic conditions, ending California’s statewide waiver. (The state is seeking waivers under the tighter rules on a county-by-county basis and has obtained waivers for several counties.)

CDSS estimates that there are about 954,800 individuals that fit the expanded ABAWD criteria (compared to about 345,400 individuals who are estimated to meet the prior criteria). Of these, CDSS estimates approximately 845,000 individuals that will become subject to the work requirement beginning June 2026 and not qualify for an exemption. Of these, about 665,500 are estimated to not meet the requirement, becoming at risk of losing food assistance. Any discontinuances would gradually occur over 12 months as affected recipients undergo annual recertification.

Narrows Noncitizen Eligibility. H.R. 1 disqualifies certain noncitizen groups from being eligible for CalFresh assistance, including asylees, refugees, parolees, battered noncitizens, and trafficking victims, among others. This change was effective upon enactment of H.R. 1 but is yet to be implemented in California. Implementation is expected in April 2026. CDSS estimates that about 72,000 individuals enrolled in CalFresh or CFAP will lose assistance because of this change.

Shifts Benefit Costs to the State. Beginning October 2027, H.R. 1 requires states to cover a portion of what now are federally funded CalFresh benefits. This state share is only imposed on states that have a payment error rate of 6 percent or higher. As shown in Figure 1, the amount of the state share depends on how much the state’s error rate exceeds 6 percent. Based on the state’s most recently measured payment error rate of 11 percent, the state would have a 15 percent share of CalFresh benefit costs, resulting in about $2 billion in new annual costs.

Figure 1

State Shares of CalFresh Benefit Costs for

Different Payment Error Rates

|

Payment Error Rate |

State Share of |

Approximate Annual |

|

Less than 6% |

— |

— |

|

From 6% to less than 8% |

5% |

$650 million |

|

From 8% to less than 10% |

10 |

1.3 billion |

|

10% or greater |

15 |

2 billion |

H.R. 1 determines the state’s initial share of benefit costs for federal fiscal year 2027-28 (October 2027 through September 2028) based on the payment error rate in either federal fiscal year 2024-25 or 2025-26, at the state’s option. While not yet published, the state’s payment error rate for federal fiscal year 2024-25 (the most recently ended federal fiscal year) likely is not significantly lower than the 11 percent rate for 2023-24. Consequently, the state’s opportunity to mitigate increased benefit costs likely depends on the payment error rate in 2025-26, the current federal fiscal year. For 2028-29 and later federal fiscal years, the payment error rate from three years prior will be used. This means that the payment error rate in the current federal fiscal year will also determine the state’s share of CalFresh benefit costs in federal fiscal year 2028-29.

Increases State and County Share of Administrative Costs. Beginning October 2026, H.R. 1 reduces federal support for administrative costs from 50 percent to 25 percent. State law requires counties to cover 30 percent of the nonfederal share, meaning that the county share will increase to 22.5 percent and the state share will increase to 52.5 percent, as shown in Figure 2. This change is expected to result in annual ongoing costs of about $480 million for the state and $190 million for counties.

Figure 2

CalFresh Administration Funding

Responsibilities

|

Current |

Beginning October 2026 |

|

|

Federal |

50.0% |

25.0% |

|

State |

35.0 |

52.5 |

|

Counties |

15.0 |

22.5 |

Ends Nutrition Education Funding. Prior to H.R. 1, California received annual funding—$132 million in the most recent year—to support nutrition education activities through the California Department of Public Health, the California Department of Aging, higher education institutions, and nonprofit organizations. H.R. 1 ends this nutrition education funding effective October 2025. The state may continue to use prior-year nutrition education funding through September 2026.

Restrictions on Use of Standard Utility Allowance (SUA). The SUA is an option used in the CalFresh benefit determination that simplifies the calculation and often results in a household receiving a larger monthly CalFresh benefit. One way to qualify for using the SUA is to receive a state-funded utility assistance payment of at least $20.01 annually. Prior to H.R. 1, California provided such a utility payment to maximize household CalFresh benefits. Effective November 2025, H.R. 1 restricts the use of state-funded utility assistance payments in this way to only households with elderly or disabled members. This means that fewer households will be able to use the SUA, leading to reduced monthly benefits. 525,000 individuals are estimated to eventually have their CalFresh benefits reduced from this change.

Other Impacts. H.R. 1 places limits on future revisions to the “Thrifty Food Plan” developed by the federal government that determines maximum CalFresh benefit amounts. Going forward, adjustments will be based only on inflation. H.R. 1 also rescinds a recent federal requirement that internet costs be factored into benefit calculations. This requirement had not yet been implemented in California, but if it had been, it would have had the effect of increasing CalFresh benefits.

2025-26 Spending Plan Provided Funding to Begin to Address H.R. 1 Implementation. Funding includes:

$39.9 million ($20.1 million General Fund) for CDSS to pursue data and technology changes and outreach to CalFresh beneficiaries to reduce the payment error rate and limit increased state costs for CalFresh benefits.

Upon approval of the Department of Finance, up to $15 million General Fund to implement federal guidance on H.R. 1 implementation as it is released and up to $20 million to support county implementation of changes to the ABAWD requirement. These items have not yet been approved for release by Department of Finance.

Other Food Assistance Programs

Other Programs and Pilots Provide Supplemental Benefits and Emergency Food Support. Beyond CalFresh and CFAP, the state administers some additional, primarily federally funded, nutrition support programs. Examples include the SUN Bucks program, which provides federally funded summertime food benefits to children in households that qualify for free or reduced-price school meals. The Emergency Food Assistance Program (TEFAP) is a federal program that provides commodities for food banks to support Californians during emergencies or to supplement other nutrition programs. The Emergency Food for Families and CalFood programs provide additional food commodities and funding for food banks.

2025-26 Budget Act Provided Additional One-Time Funding. One-time allocations included:

$72 million General Fund for CalFood, on top of the typical $8 million ongoing appropriation.

$36 million General Fund for the Fruit and Vegetables Pilot. This pilot, created in 2018, seeks to develop a way to increase the purchase and consumption of fresh fruits and vegetables by CalFresh recipients. The one-time funding in 2025-26 resulted in the pilot being relaunched.

$7.4 million General Fund for diaper and wipe distribution at select food banks.

Budget Overview and Assessment

CalFresh and CFAP

Enrollment and Benefits Projected to Decline. As shown in Figure 3, the Governor’s budget estimates that total funding for CalFresh and CFAP will be $15.9 billion ($1.1 billion General Fund) in 2025-26 and $15.5 billion ($1.4 billion General Fund) in 2026-27. The 2026-27 estimates represent a 3 percent decline in total spending, but a net 30 percent increase in General Fund spending. Both the year-over-year decline in total spending and the significant increase in General Fund spending are primarily driven by changes related to H.R. 1.

Figure 3

CalFresh and CFAP Budget Summary

Dollars in Millions

|

2025‑26 |

2026‑27 |

Change from 2025‑26 to 2026‑27 Proposed |

||

|

Amount |

Percent |

|||

|

CalFresh Households |

3,300,109 |

3,222,974 |

‑77,135 |

‑2% |

|

Benefits |

||||

|

CalFresh benefitsa |

$13,158 |

$12,749 |

‑$409 |

‑3% |

|

CFAP benefitsb |

122 |

73 |

‑50 |

‑41 |

|

Subtotals |

($13,280) |

($12,822) |

(‑$458) |

(‑3%) |

|

Administration |

||||

|

Federal Share |

$1,310 |

$835 |

‑$474 |

‑36% |

|

State Share |

959 |

1,332 |

372 |

39 |

|

County Share |

372 |

522 |

151 |

40 |

|

Subtotals |

($2,641) |

($2,689) |

($49) |

(2%) |

|

Totals |

$15,921 |

$15,511 |

‑$410 |

‑3% |

|

aCalFresh Benefits are 100 percent federally funded. The Governor’s Budget estimates an average monthly benefit of about $330 per household. CalFresh benefits also include replacement benefits. SUN Bucks benefits are excluded from this figure and are included in Figure 7. bCFAP benefits are 100 percent General Fund. The Governor’s Budget estimates an average monthly benefit of about $365 per household. CFAP benefits also include replacement benefits. |

||||

|

CFAP = California Food Assistance Program. |

||||

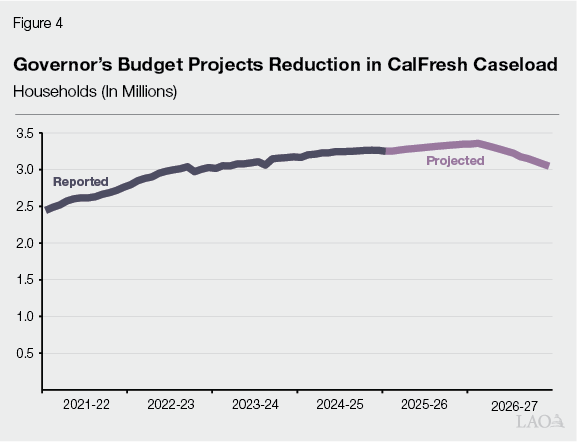

Caseload Projections Are Reasonable, Though Subject to Significant Uncertainty. Figure 4 displays actual and projected CalFresh enrollment through 2026-27. The downward trend in enrollment beginning around the start of 2026-27 is driven by H.R. 1 changes, most notably implementation of the expanded ABAWD work requirement. We find the projections reasonable, but note they are subject to significant uncertainty and will require reevaluation as major H.R. 1 policy changes roll out.

H.R. 1 Impacts

H.R. 1 Projected to Result in Reduced Enrollment and Benefits… The Governor’s budget reflects initial assumptions, based on administrative data, about the likely impact of implementing H.R. 1 policies. Figure 5 displays the estimated number of individuals impacted by major H.R. 1 policies, along with the associated loss in benefits. These impacts are uncertain and will need to be reevaluated as implementation rolls out.

Figure 5

Estimated H.R. 1 Impacts on CalFresh and CFAP Recipients

Dollars in Millions

|

Affected Individuals |

Lost Benefits |

||||||

|

2025‑26 |

2026‑27 |

Ongoing |

2025‑26 |

2026‑27 |

Ongoing |

||

|

ABAWD work requirement |

|||||||

|

Expanded population |

— |

193,700 |

424,700 |

— |

$475 |

$1,251 |

|

|

End of statewide waiver |

— |

108,600 |

240,800 |

— |

283 |

753 |

|

|

Subtotal |

— |

302,300 |

665,500 |

— |

$758 |

$2,004 |

|

|

Noncitizen eligibility change |

— |

54,200 |

72,000 |

— |

$127 |

$168 |

|

|

SUAS restrictiona |

197,000 |

504,000 |

525,000 |

$62 |

$236 |

$246 |

|

|

aIndividuals affected reflect LAO adjustment of Governor’s budget assumed households. Lost benefits do not include the loss of the $20.01 annual utility subsidy. |

|||||||

|

Note: 2025‑26 and 2026‑27 population and benefit impacts reflect Governor’s budget assumptions. Ongoing impacts are LAO estimates based on Governor’s budget assumptions. Individuals may be impacted by more than one H.R. 1 policy. |

|||||||

|

CFAP = California Food Assistance Program; ABAWD = able‑bodied adults without dependents; and SUAS = State Utility Assistance Subsidy. |

|||||||

…And Increased State and County Administrative Costs. The Governor’s budget also estimates administrative impacts on the state and counties related to H.R. 1 implementation. As shown in Figure 6, these impacts include some new funding for higher workload and automation changes, partially offset by reductions accounting for recipients leaving the program due to H.R. 1 policies. The Governor’s budget also accounts for a significant increase in state and county costs for CalFresh administration due to H.R. 1 changes in shares of cost. The administrative impacts of H.R. 1 will be addressed more fully in a separate analysis.

Figure 6

Estimated H.R. 1 Impacts on CalFresh and CFAP Administration

(Dollars in Millions)

|

2025‑26 |

2026‑27 |

||||||||

|

Total |

Federal |

General Fund |

County |

Total |

Federal |

General Fund |

County |

||

|

ABAWD Work Requirement |

|||||||||

|

New administration and automation costs |

$8.4 |

$4.2 |

$3.0 |

$1.2 |

$78.4 |

$24.3 |

$38.0 |

$16.1 |

|

|

Caseload impact |

— |

— |

— |

— |

‑78.6 |

‑24.4 |

‑38.1 |

‑16.1 |

|

|

Subtotals |

($8.4) |

($4.2) |

($3.0) |

($1.2) |

(‑$0.2) |

(‑$0.1) |

(‑$0.1) |

(—a) |

|

|

Noncitizen Eligibility Change |

— |

— |

— |

— |

‑$12.1 |

‑$2.5 |

‑$7.9 |

‑$1.7 |

|

|

SUAS Restriction |

‑$5.5 |

‑$2.7 |

‑$2.0 |

‑$0.8 |

‑$15.6 |

‑$4.8 |

‑$7.6 |

‑$3.2 |

|

|

Total Administrative Cost Changes |

$2.9 |

$1.5 |

$1.0 |

$0.4 |

‑$27.9 |

‑$7.4 |

‑$15.6 |

‑$4.9 |

|

|

Increased State and County Share of Costb |

— |

— |

— |

— |

— |

‑$502 |

$359 |

$143 |

|

|

aLess than $500,000. bEstimated H.R. 1 administrative impacts related to the ABAWD work requirement, noncitizen eligibility change, and SUAS restriction already reflect the increased state and county share of cost. Those impacts are also reflected in this line, resulting in minor overlap. |

|||||||||

|

CFAP = California Food Assistance Program; ABAWD = able‑bodied adult without dependents; and SUAS = State Utility Assistance Subsidy. |

|||||||||

H.R. 1 Heightens Difficult Trade-Offs in Constrained State Fiscal Environment. The Governor’s budget addresses the mandatory aspects of H.R. 1, but it does not propose any action to replace loss benefits for those affected by H.R. 1. The state faces significant structural budget deficits. Addressing these will require difficult trade-offs. In view of these challenges, it will not be possible for the state to backfill all the losses created by H.R. 1 in food assistance programs and elsewhere in the state budget absent significant other actions. Doing so would require the identification of billions of dollars in increased revenues and programmatic reductions elsewhere in the state budget.

Planned CFAP Expansion

Subject to Appropriation, Budget Maintains Delayed Implementation of CFAP Expansion. The Governor’s budget continues to assume CFAP’s expansion to all income-eligible individuals age 55 and older regardless of immigration will occur in 2027-28, subject to an appropriation in next year’s budget. The administration has most recently estimated that the cost to implement the expansion would eventually reach $169 million (all from the General Fund) and provide assistance to 74,000 people once fully phased in.

Future Cost of CFAP Expansion Depends on Complex and Uncertain Demographic Changes. Estimates of the cost of benefits for the undocumented population are generally subject to considerable uncertainty. Undocumented individuals can be challenging to accurately identify in survey data. Survey data are usually a few years old at the time they become available, making it challenging to reflect more recent dynamics in estimates. Recent developments make such estimates especially uncertain at this time. First, the number of undocumented immigrants in the United States grew significantly from 2021 through 2024. The share of this growth in California is less clear and the impacts are only just beginning to emerge in survey data, but California’s undocumented population likely grew as well. Second, increased immigration enforcement by the federal government starting in 2025 likely partially offsets some of the growth in the undocumented population, including in California. Further, increased immigration enforcement may reduce take-up of public benefits to an uncertain degree.

Expansion Costs Likely Higher Than Previously Estimated. Overall, we believe the recent developments just described mean that previously developed estimates of CFAP expansion costs likely understate what costs ultimately would be. Of note, full-scope coverage in Medi-Cal was expanded to cover otherwise eligible individuals age 50 and older regardless of immigration status in May 2022, during growth in undocumented populations. As of October 2025, the 50 and older Medi-Cal expansion population included about 444,000 individuals, considerably higher than originally projected for this population. While some aspects of eligibility determination processes differ between Medi-Cal and CalFresh, the income thresholds for the two programs are similar. Based on this Medi-Cal administrative data, we estimate that the number of individuals that ultimately would enroll in the CFAP expansion for ages 55 and older would likely be between 104,000 and 264,000. We estimate this would result in ongoing General Fund food assistance costs of between $250 million and $630 million, assuming full ramp-up in 2029-30. (The time to full ramp-up is also subject to significant uncertainty for the same reasons already noted, such that costs in the initial year may be significantly less than at full-ramp-up.) We note that these costs add to out-year deficits identified by the Governor, since we understand the Governor’s budget does not include any CFAP expansion costs in its multiyear baseline since the expansion is subject to future appropriation.

Other Food Assistance Programs

Budget Includes $1.6 Billion for Other CDSS Food Programs. Figure 7 displays estimated and proposed funding for other food assistance programs in the Governor’s budget. The 2026-27 proposal reflects a decrease of $285 million total funds ($124 million General Fund) compared to 2025-26. Major drivers of the decrease include:

$148 million less federally funded SUN Bucks due to a technical shift in the timing of benefit issuance that results in fewer issuances in 2026-27 (this does not mean that less people are receiving benefits).

$40 million less federal TEFAP funding, primarily reflecting the end of temporary local food purchase funding that was made available by the federal government following the American Rescue Plan Act of 2021.

$36 million reduction from the end of one-time funding for the CalFresh Fruit and Vegetable Pilot. Consistent with the one-time nature of the appropriation, the Governor’s budget does not propose additional funding for the pilot. During 2025-26, one-time funding has allowed for restarting the pilot, providing up to $60 per month in matching funds when purchasing fruits and vegetables at participating farmers markets and retailers. As of the beginning of January 2026, over 31,000 households earned matching funds, averaging about $48 per household.

$72 million reduction from the end of the one-time funding augmentation for CalFood. The Governor’s budget returns CalFood funding to the ongoing amount of $8 million annually in 2026-27. CDSS anticipates all funding being used by the end of 2025-26.

$7.4 million reduction from the end of one-time funding for diaper and wipe distribution. Consistent with the one-time nature of the appropriation, the Governor’s budget does not propose additional funding.

Figure 7

Funding for Other CDSS‑Administered State and Federal Food Assistance Programs

In Millions

|

Program |

Description |

2025‑26 |

2026‑27 Proposed |

|||||

|

Total |

Federal |

State |

Total |

Federal |

State |

|||

|

SUN Bucksa |

Provides summer food benefits to school‑aged children qualified for free or reduced‑price meals. |

$864 |

$826 |

$38 |

$716 |

$680 |

$37 |

|

|

CACFPb |

Reimburses food served at some child care centers, day care homes, and adult day care centers. |

697 |

687 |

9 |

721 |

712 |

10 |

|

|

TEFAP and Emergency Food For Familiesc |

Distributes domestically grown foods to food banks and emergency feeding organizations. Emergency Food for Families supplements existing TEFAP funds. |

62 |

61 |

1 |

22 |

21 |

1 |

|

|

CSFP |

Provides supplemental food to low‑income persons 60 years of age or older through local agencies. |

11 |

11 |

— |

11 |

11 |

— |

|

|

SNB and TNB Programs |

Provide supplemental or transitional benefits to households that saw a decrease in CalFresh benefits or became ineligible for CalFresh when SSI/SSP recipients became eligible for CalFresh in 2019. |

22 |

— |

22 |

19 |

— |

19 |

|

|

WINS |

Provides a supplemental $10 food benefit to certain CalFresh/CFAP families who are working 20 to 35 hours per week. |

20 |

— |

20 |

19 |

— |

19 |

|

|

CalFresh Minimum Benefit Pilot |

Will provide eligible CalFresh recipients with a minimum monthly benefit of $50 for 12 months. |

10 |

— |

10 |

6 |

— |

6 |

|

|

CalFresh Fruit and Vegetable Pilot |

Provides a dollar‑for‑dollar match up to $60 per month when CalFresh households purchase fruits or vegetables at select farmers’ markets and grocery stores. |

36 |

— |

36 |

— |

— |

— |

|

|

CalFresh Safe Drinking Water Pilot |

Provides certain CalFresh recipients with failing water systems with an additional $50 monthly benefit. |

1 |

— |

1 |

— |

— |

— |

|

|

Diaper Bank |

Provides funding for 11 food banks to distribute diapers and wipes. |

7 |

— |

7 |

— |

— |

— |

|

|

CalFood |

Provides funding for food banks. |

80 |

— |

80 |

8 |

— |

8 |

|

|

TNAP |

Provides grants to eligible tribes and tribal organizations to address food insecurity. |

5 |

— |

5 |

5 |

— |

5 |

|

|

Totals |

$1,814 |

$1,586 |

$229 |

$1,528 |

$1,424 |

$104 |

||

|

aSUN Bucks (formerly Summer EBT program) benefits funding is 100 percent federal. Outreach, administration, and automation funding is 50 percent federal and 50 percent General Fund. bCACFP is federally funded. The state funding is provided through Proposition 98 and non‑Proposition 98 General Fund. cTEFAP is 100 percent federally funded. Emergency Food for Families funding is 100 percent state tax revenue collections. |

||||||||

|

CDSS = California Department of Social Services; CACFP = Child and Adult Care Food Program; CSFP = Commodity Supplemental Food Program; EBT = Electronic Benefits Transfer; TEFAP = The Emergency Food Assistance Program; TNAP = Tribal Nutrition Assistance Program; SNB = Supplemental Nutrition Benefit Program; TNB = Transitional Nutrition Benefit Program; SSI/SSP = Supplemental Security Income/State Supplementary Payment; and WINS = Work Incentive Nutritional Supplement. |

||||||||

H.R. 1 Changes Likely to Increase Food Bank Demand. As already described, H.R. 1 is expected to result in significant disenrollment and loss of CalFresh and CFAP assistance. As these changes roll out, it is likely that demand for assistance from food banks, who serve a role of supplementing CalFresh and CFAP, will increase. Anticipation of such need was the primary motivating factor behind the 2025-26 spending plan’s inclusion of an additional $72 million for the CalFood program.

Food Banks Fund Operations From a Variety of Sources. Operations at individual food banks across the state vary. But in aggregate, the largest source of funding for food banks is private funds and other donations. Food banks report that recently, federal support (primarily through TEFAP) made up about 25 percent funding, the state CalFood program made up about 8 percent, and private funds and other donations made up the rest.

Food Bank Response Constrained by Available Funding. As H.R. 1 changes are implemented, food banks are positioned to offset some of the losses in federal food assistance funding in CalFresh. However, food banks’ response will be limited by available funding as well as infrastructure capacity, making it challenging to fully offset lost federal assistance.