2013

Other Budget Issues

| Last Updated: | 4/11/2013 |

| Budget Issue: | Governor's proposal to suspend Interagency Child Abuse and Neglect Reporting (ICAN) mandate |

| Program: | Department of Social Services |

| Finding or Recommendation: | Reject Governor's proposal to suspend the ICAN mandate and establish a workgroup to develop alternatives for the Legislature to consider that would: (1) reduce future reimbursable costs under the mandate and (2) consider alternative reimbursement methods for funding the mandated activities. |

Further Detail

Background

The Child Abuse and Neglect Reporting Act (CANRA) requires individuals in certain professional occupations (who are referred to as “mandated reporters”) to report child abuse and neglect to specified law enforcement agencies or county welfare and probation departments. The CANRA further requires local law enforcement, county welfare, and probation agencies (hereafter referred to collectively as “child protective agencies”) to forward certain reports of child abuse and neglect to the Department of Justice (DOJ) for entry into the state’s central child abuse and neglect reporting system, the Child Abuse Central Index (CACI). Since the 1980 enactment of CANRA, the law has been amended several times to include additional mandated reporters and specify additional reporting and investigative requirements of child protective agencies. As discussed below, the Commission on State Mandates (CSM) has determined that several provisions of CANRA impose a state mandate on local governments.

State Law Prescribes a Process to Identify Reimbursable Mandates. State law establishes the mandate determination process, which has three phases. In the first phase, a local government files a test claim with the CSM alleging that a new state law or regulation creates a reimbursable mandate and the CSM holds hearings to determine whether or not a reimbursable state mandate exists. If the CSM determines that a reimbursable state mandate exists, the process moves into the second phase, in which the CSM—with input from the local government claimant, Department of Finance, and other interested parties—adopts a methodology (“parameters and guidelines”) for local governments to follow in claiming state reimbursement. In the final phase, which occurs at least six months after completion of the second, local governments submit initial claims for reimbursement. These claims, which typically include costs for multiple years, beginning with the fiscal year preceding the filing date of the initial test claim, serve as the basis for the statewide cost estimate that the CSM reports to the Legislature. Pursuant to state law, the presentation of the CSM’s statewide cost estimate to the Legislature triggers the Legislature’s constitutional obligation to fund, repeal, or suspend the mandate. If the Legislature decides to fund the mandate, it must appropriate funds in the budget bill to pay the full amount reflected in the statewide cost estimate, which consists of costs incurred by local governments in all prior years. Conversely, if the Legislature repeals or suspends the mandate, the state, while still liable for local government costs in years prior to the repeal or suspension, may defer reimbursement for prior-year local government costs to a later date. Under state law, local governments are not required to comply with mandates that are suspended in that year’s budget act.

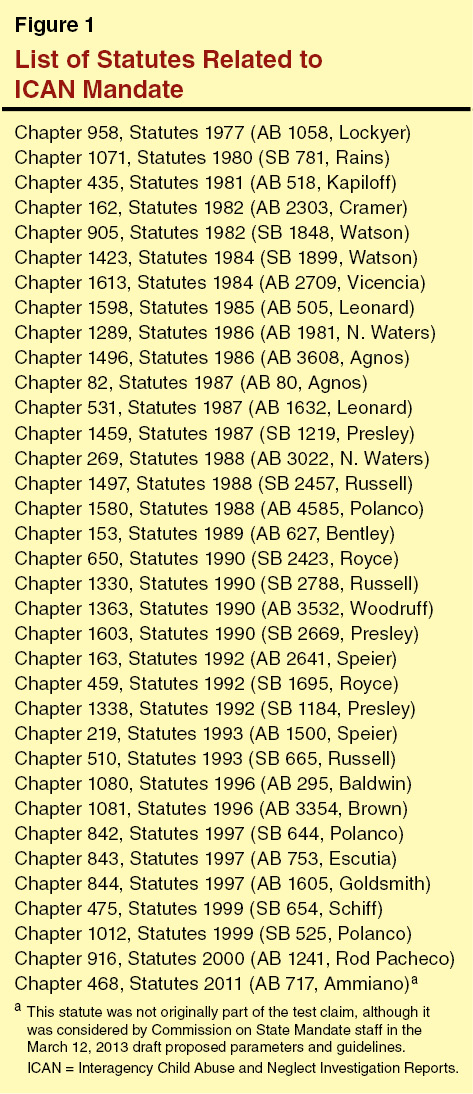

CSM Finds That Several Provisions of CANRA Are State Mandates. In December 2007, the CSM found that the reenactment of previous child abuse reporting requirements in CANRA, and several subsequent amendments to CANRA (see Figure 1 for full list of chaptered legislation), created a reimbursable state mandate primarily for child protective agencies. The CSM determined that the following activities required by CANRA—collectively known as the Interagency Child Abuse and Neglect Investigation Reports (ICAN) mandate—create a reimbursable state mandate for child protective agencies:

- Distributing the mandated report form to mandated reporters.

- Accepting reports from mandated reporters when the agency lacks jurisdiction, and forwarding the report to the agency with jurisdiction.

- Referring, or “cross-reporting,” to other child protective agencies all reports of known instances of: (1) child abuse and neglect and (2) child deaths that are suspected to be related to child maltreatment.

- Investigating child abuse and neglect reports to determine if they are substantiated, inconclusive, or unfounded, and submitting a report to DOJ for cases that are not unfounded for entry in CACI.

- Notifying suspected child abusers of CACI reports related to them that are made to DOJ and informing mandated reporters of case disposition upon completing a child abuse or neglect investigation.

- Holding due process hearings for individuals listed on CACI.

- Making “relevant information” available to a child custodian, guardian ad litem, appointed dependency court counsel, or licensing agency when a child protective agency is investigating child maltreatment and receives information from CACI.

- Keeping investigation records for reports made in CACI for as long as the child maltreatment record remains in CACI.

Additionally, the CSM found that the following activities required by CANRA create a reimbursable state mandate for child protective and other agencies that use CACI:

- Obtaining the original investigative report used to make the CACI report, and making an independent evaluation of the quality and sufficiency of the report as it relates to the agency’s investigation, prosecution, employment, licensing, or child placement decisions.

- Notifying relative caretakers that they are in CACI if this information becomes available when an agency evaluates the placement of children with relatives.

Subsequent Legislation Reduced Scope of Mandated Activities. Following the 2007 CSM decision, Chapter 468, Statutes of 2011 (AB 717, Ammiano), specified that as of January 1, 2012, local law enforcement agencies no longer are required to report child abuse and neglect cases to CACI. As many of the ICAN mandated activities related to CACI reporting (including investigations and preparation of the CACI report), Chapter 468 significantly limited the scope of the ICAN mandate for local law enforcement agencies. By no longer requiring local law enforcement agencies to report to CACI, Chapter 468 reduced the requirements of this mandate related to notifying individuals when CACI reports are made about them, administering due process hearings for CACI reports, and retaining files for reports occurring after January 1, 2012. Additionally, Chapter 468 limited the number of reports that county welfare agencies are required to make to CACI to only those cases that are substantiated (prior law also required forwarding inconclusive reports).

Draft Parameters and Guidelines. The CSM released draft parameters and guidelines for reimbursement of the ICAN mandate on March 12, 2013 and is scheduled to consider them at its hearing on April 19, 2013. With one exception, the draft parameters and guidelines generally provide for a scope of reimbursable activities that is significantly less broad than some parties assumed based on the commission’s 2007 statement of decision. For example, the proposed parameters and guidelines provide reimbursement for only those investigations required to substantiate a report of child maltreatment pursuant to CANRA. Further, the proposed parameters and guidelines do not provide reimbursement for investigative activities carried out by employees of child protective agencies acting in their capacity as mandated reporters. The draft further specifies that pursuant to Chapter 468, after January 1, 2012, law enforcement agencies are not eligible for reimbursement for activities related to child maltreatment investigations, file retention, and notifying individuals reported to CACI. In one respect, however, the parameters and guidelines are broader than parties would have assumed based on the commission’s 2007 decision. Specifically, consistent with Chapter 468’s amendments to CANRA (effective January 1, 2012), the draft parameters and guidelines allow local governments to claim reimbursements for their costs to provide due process hearings for individuals reported to CACI.

Governor’s Proposal

The Governor’s budget proposes to suspend the ICAN mandate in 2013-14. Suspending this mandate would make local compliance with the provisions of the statutes (see Figure 1 below) related to the ICAN mandate optional in 2013-14. As discussed below, because there is no statewide cost estimate for this mandate at this time, the Governor’s proposal would not result in any budgetary savings in 2013-14.

LAO Analysis

Suspension of ICAN Mandate Presents Several Concerns for Child Welfare System. The child abuse and neglect reporting required under the ICAN mandate represents, in most cases, a critical component of the state’s child welfare system in that it affects how child abuse and neglect reports are received, how local governments share information about such reports, and the core functionality of CACI as a tool to identify suspected child abusers. For this reason, we believe that suspension of the ICAN mandate could:

- Weaken System of Child Abuse and Neglect Reporting. The ICAN mandate requires local governments to share information between agencies, assist mandated reporters in reporting child abuse and neglect, and submit reports to CACI. While local governments could voluntarily continue these activities if the mandate were suspended in 2013-14, it is unknown how many agencies would continue these activities. Cross-reporting child abuse and neglect between local law enforcement and child welfare agencies is a critical component of the state’s child welfare system. Suspending the ICAN mandate could reduce the number of child abuse and neglect reports received, and could lead to undetected child abuse and neglect. Additionally, the provisions of the ICAN mandate that relate to assisting mandated reporters in making child maltreatment reports (through providing the mandated reporter form and accepting mandated reports even when a department lacks jurisdiction, and forwarding the report to the responsible agency), makes it easier for mandated reporters to report child abuse and neglect. In absence of this assistance from child protective agencies, it is possible that some reports of child abuse may not be filed.

- Reduce the Effectiveness of CACI. In suspending the requirement that child protective agencies (except law enforcement agencies, for which the requirement was eliminated in 2012) report substantiated cases of child abuse and neglect to CACI, the effectiveness of CACI as a tool to identify individuals previously suspected of child maltreatment is potentially weakened. It is conceivable that at least some portion of child welfare and probation agencies would no longer report child abuse and neglect to CACI if the mandate were suspended, although the extent to which this would occur is unknown.

- Undermine Due Process Rights of Individuals Reported to CACI. Suspending the ICAN mandate could also potentially undermine the due process rights of individuals reported to CACI. The ICAN mandate requires that agencies that make reports to CACI retain their investigative files, inform individuals when they are reported to CACI, and hold due process hearings for individuals contesting their CACI status. Suspending the ICAN mandate could reduce the ability of individuals who are inappropriately reported to CACI to dispute their reports and have their names removed from CACI.

No Near-Term State Savings from Suspending Mandate. As of March 2013, the ICAN mandate is in the second phase of the mandate determination process: development of parameters and guidelines. At this stage, the Constitution does not require the Legislature to provide funding for a mandate in the annual budget, and in fact, no estimate of this mandate’s cost is available. Based on the usual timeline for commission mandate determinations, we expect that the constitutional funding requirement for this mandate will become applicable in the 2014-15 fiscal year. Thus, the Governor’s proposal to suspend the ICAN mandate in 2013-14 would not affect the state’s 2013-14 budget. Suspending the mandate, however, would reduce the total bill for this mandate that will ultimately be presented to the Legislature (likely not until 2014-15) because local governments would not be eligible for reimbursement for activities carried out in 2013-14.

Lack of Cost Information Complicates Decision…Based on a review of prior, somewhat similar state mandates, we think that the annual costs for the ICAN mandate in 2013-14 could be in the range of a few million dollars to the low tens of millions of dollars. However, we caution that any estimate of annual costs for the ICAN mandate is subject to significant uncertainty at this time. The lack of reliable information on the costs of the ICAN mandate will make it very difficult for the Legislature to weigh the benefits of the mandated activities against their costs.

…Nonetheless, Drawbacks of Suspension Appear to Outweigh Costs. While costs for the ICAN mandate in 2013-14 are subject to significant uncertainty, the drawbacks of suspending the entire ICAN mandate without carefully considering actions to mitigate the potential adverse effects on the child welfare system are clear. In our view, based on information available and in light of the concerns arising from a suspension as discussed above, the drawbacks of suspension outweigh the reasonably anticipated increase in state costs payable in future years associated with keeping the mandate operative in 2013-14.

Recommendations

Reject the Governor’s Proposal. Because the drawbacks of suspending the ICAN mandate appear to outweigh the costs of keeping the mandate operative in 2013-14, we recommend the Legislature reject the Governor’s proposal to suspend the ICAN mandate in 2013-14. As discussed above, rejecting the Governor’s proposal would have no fiscal effect in 2013-14, but would add an unknown amount—associated with local government costs of carrying out the ICAN mandate in 2013-14—to the total reimbursement for prior year costs that the state must provide in the future.

Establish a Workgroup to Evaluate the ICAN Mandate. In 2014-15, the Legislature likely will be faced with a decision as to whether to pay this mandate’s full statewide cost estimate (the total cost of operating this mandate since 1999-00) or suspend the mandate. For this reason, we recommend that the Legislature establish a workgroup consisting of representatives from the Department of Finance, Department of Social Services, Department of Justice, county representatives, legislative staff, child welfare advocates, and other individuals with technical expertise in mandates to evaluate the ICAN mandate, develop options to limit its costs, and consider alternative reimbursement methods for funding its activities. We would suggest that the workgroup present recommended alternatives to the Legislature by the summer of 2013. Under this timeframe, the Legislature would have time to evaluate these options and potentially take actions to modify the ICAN mandate and its associated future year costs before the end of this year’s legislative session. At a minimum, we suggest the workgroup consider these questions:

- Would it be more appropriate and cost-effective for state agencies, instead of local governments, to carry out some of the mandated activities—such as file retention or administration of due process hearings?

- Could any of the mandated activities be made optional for local governments without causing undue harm to the child welfare system?

- Could the state provide local governments incentives to continue performing currently mandated activities instead of maintaining the statutes that require the activities?

- Could any current state funding streams to counties and cities—such as 2011 realignment funds or Proposition 172 sales tax revenues—be used to help offset the costs of the ICAN mandate?