Ballot Pages

A.G. File No. 2017-048

January 5, 2018

Pursuant to Elections Code Section 9005, we have reviewed the proposed statutory initiative related to health insurer financial reserves (A.G. File No. 17-0048, Amendment No. 1).

Background

Commercial Health Insurance Products Vary. The structure of commercial health insurance products available in the state varies widely. Some key differences in how health coverage can be structured are listed below:

- Degree of Medical Care Management. Traditionally, health insurance has provided reimbursement for covered medical expenses with little or no oversight by the insurer of what covered services are received or which medical provider is used. This traditional form of insurance is sometimes referred to as “indemnity” coverage. More commonly today, health insurance has features of “managed care,” in which the insurer has some degree of involvement in arranging for medical care. For example, some insurers may negotiate lower prices with certain providers. This arrangement is known as a “preferred provider organization,” or PPO. Other insurers, known as “health maintenance organizations” or HMOs, have greater oversight over medical services utilization and contract with a set of providers to provide covered medical services for individuals that have coverage. In some cases, HMOs pay contracted medical providers a flat fee per insured individual, or “capitation” payment, rather than reimbursement for each medical service provided.

- Integration With Service Delivery. In some cases, the operations of HMOs are integrated with medical providers in what is known as an “integrated health system,” so that a single entity is responsible for paying for and providing medical care to individuals that enroll in coverage. One notable example of an integrated health system in California is Kaiser Permanente. In California, Kaiser Permanente consists of (1) the Kaiser Foundation Health Plan, the largest commercial health insurer by enrollment in the state; (2) medical provider groups that have an exclusive contract with the Kaiser Foundation Health Plan; and (3) a hospital system that has an exclusive contract with the Kaiser Foundation Health Plan.

- Group Size. Commercial health insurance may also be purchased in a variety of settings. Employers commonly contract with insurers to obtain health coverage for employees as a benefit. For employers with more than 100 employees, the market for health insurance is known as the “large-group” market. For employers with 100 or fewer employees, the market is known as the “small-group” market. Individuals may also purchase coverage directly from insurers through the “individual market.”

Health Insurers Regulated by One of Two State Agencies. In general, HMOs and most other forms of managed care are regulated by the California Department of Managed Health Care (DMHC) pursuant to the provisions of the Knox-Keene Health Care Service Plan Act of 1975. Indemnity and PPO health insurance products generally have been regulated by the California Department of Insurance (CDI) pursuant to the provisions of the California Insurance Code. However, there is some overlap in the jurisdictions of DMHC and CDI. Pursuant to state law, the DMHC regulates two major PPOs. Currently, the vast majority of individuals with health coverage in California are covered by an insurer that is regulated by DMHC. As of September 2017, DMHC regulated 74 full-service health plans (insurers that cover all the basic and essential benefits required by the Knox-Keene Act). The CDI regulates about 25 health insurers.

Minimum Reserve Requirements. Both DMHC and CDI have minimum financial reserve requirements that health insurers must meet. These requirements are intended to avoid situations in which an insurer may become insolvent due to unforeseen financial challenges. For insurers regulated by DMHC, the reserve requirement is defined in terms of “tangible net equity” (TNE), or an insurer’s net equity (the amount by which total assets exceed total liabilities), with some adjustments (for example, the deduction of intangible assets such as goodwill). Each insurer has a minimum TNE threshold that is determined based on a combination of factors including the amount of an insurer’s premium revenues and expenditures. For insurers regulated by CDI, the reserve requirement is defined in terms of “risk-based capital” (RBC), which determines minimum reserve thresholds using a different formula that accounts for the risk profile of the insurer.

DMHC-Regulated Insurers Subject to Corporate Income Tax. Insurers that are regulated by DMHC are subject to a tax on their net income through the state corporate income tax. In 2016, legislation was enacted that reauthorized and restructured the managed care organization (MCO) tax, which is now paid by insurers regulated by DMHC (with some exceptions). As part of the MCO tax legislation, the net income from health coverage of insurers subject to the MCO tax was made exempt from the corporate income tax. The provisions of the MCO tax legislation, including exemptions from the corporate income tax, are set to expire in July 2019.

Health Benefits for State and Local Government Employees and Retirees. Like other employers, the state, California’s two public university systems, and many local governments in California provide health benefits for their employees and related family members and for some of their retired workers. Typically, state and local governments contract with commercial health insurers to provide health coverage. Together, state and local governments pay tens of billions of dollars for employee and retiree health benefits each year.

Proposal

Prohibits Rate Increases for Some Insurers When Reserves Equal or Exceed Specified Cap. The measure prohibits health insurers from increasing rates on “covered policies”—a term defined by the measure—if the insurer has reserves equal to or above a specified cap. For most insurers (including those regulated by DMHC and CDI), the cap would be five times the DMHC minimum TNE requirement. Insurers regulated by CDI do not currently calculate minimum TNE thresholds and do not report their TNE levels, but would be newly required to report this information to CDI under the provisions of this measure. The measure defines covered policies to include commercial coverage sold in the individual, small-group, and large-group markets. Covered policies do not include specialized coverage (coverage for services in a single specialized area of health care, such as dental) or coverage provided through government programs such as Medicare or Medicaid (known as Medi-Cal in California). Insurers that provide commercial coverage to fewer than 100,000 individuals are exempt from the provisions of the measure.

Alternative Reserve Cap for Insurers Affiliated With Blue Cross Blue Shield Association. The measure provides for an alternative reserve cap for insurers that are affiliated with the Blue Cross Blue Shield Association, a national association of independent and locally operated insurers including Anthem Blue Cross and Blue Shield of California. For these two insurers, the measure prohibits rate increases for covered policies only if reserves equal or exceed five times the greater of the DMHC minimum TNE requirement or 300 percent of the applicable minimum RBC threshold, known as the authorized control level.

Places Additional Restrictions on Integrated Health Systems. The measure requires that insurers that operate as part of an integrated health system report to DMHC transfers of cash or assets between the insurer and other entities in the integrated health system, and would require that cash or assets transferred away from the insurer be counted toward the reserves of the insurer unless the insurer received goods and services equal to the fair market value of the transferred cash or assets. The measure further requires DMHC to make a referral to the Attorney General if an insurer that is part of an integrated health system substantially increases payments to medical providers within the integrated health system, in order to investigate whether the increased payments are intended to evade the cap on reserves.

Requires Report to Legislative Committees. The measure also requires any insurer that reports reserves above the cap to its regulator additionally to submit a report to the health committees in the state Senate and Assembly with specified information, including a justification for the insurer’s level of reserves. A tax-exempt insurer would additionally be required to justify how its level of reserves is consistent with its tax-exempt status.

Fiscal Effects

Various Possible Responses by Affected Insurers

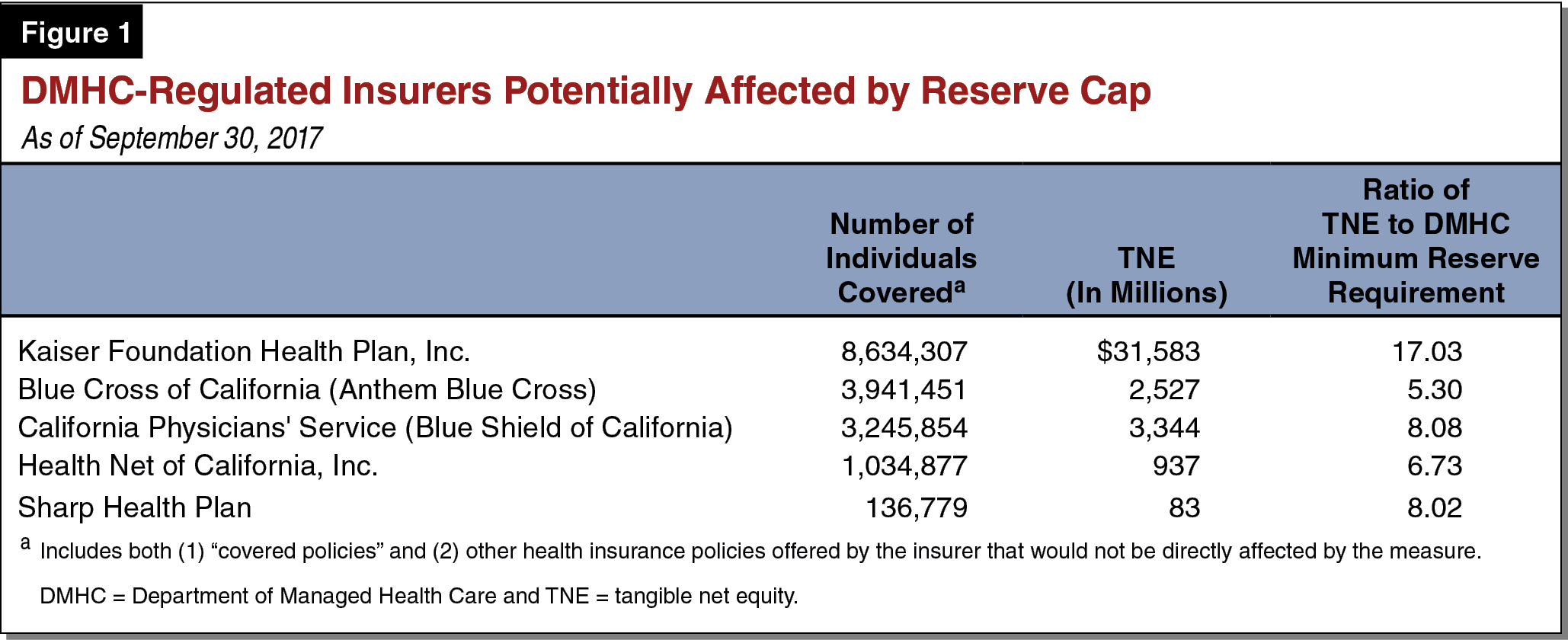

Measure Would Affect a Select Number of Health Insurers. Based on financial disclosures filed with DMHC at the end September 2017, five insurers (1) had covered policies, (2) provided commercial health insurance to a total of at least 100,000 individuals, and (3) had TNE of at least five times the DHMC minimum threshold. These insurers are listed in Figure 1. As noted above, Anthem Blue Cross and Blue Shield of California would not be prohibited from raising rates unless their reserves exceeded either the TNE-based cap or the alternative RBC-based cap, whichever is greater. While Figure 1 shows that Anthem Blue Cross and Blue Shield of California could potentially be affected by the TNE-based reserve cap, it is unclear whether their reserves would be below the RBC-based cap and whether they would be immediately affected by this measure. It also is unclear how many CDI-regulated insurers would be affected by the measure.

Integrated Health Systems Would Be Disproportionately Affected. As described previously, TNE includes the value of physical assets, such as land, buildings, and equipment, in addition to more liquid assets that insurers may hold to protect against uncertain fiscal conditions in the future, such as cash or investments. Integrated health systems, because they provide health care services directly, typically have higher levels of TNE (in the form of land, facilities, and equipment) relative to DMHC’s minimum requirement than insurers that are not part of an integrated health system. As a result, integrated health systems would be more likely to be subject to rate freezes under this measure.

As an example, as of the end of September 2017, the Kaiser Foundation Health Plan had TNE of about $32 billion, reflecting $73 billion in assets (including $25 billion in property and equipment and $48 billion in other assets), offset by $41 billion in total liabilities. Under the provisions of this measure, Kaiser Foundation Health Plan would be unable to raise rates if it had TNE above about $9 billion. In order bring reserves under the cap specified by this measure, Kaiser would need to reduce its assets (or bring on additional liabilities) in the amount of about $22 billion.

Affected Insurers Could Potentially Respond to Reserve Cap in a Variety of Ways. Insurers that would be affected by this measure could take various actions in response, or multiple responses in combination. Some of these potential responses include the following:

- Forego Rate Increases. An affected insurer could forego rate increases while reserves are above the cap specified by the measure. Since the costs of health care typically rise each year, freezing rates would in many cases cause affected insurers to bring in less money than they spend, over time reducing their reserves. Foregoing rate increases would be a less desirable alternative for insurers. For example, a rate freeze could reduce insurers’ perceived creditworthiness and reduce their access to debt financing. Because of this, we expect that rate freezes would be temporary and would last only until insurer losses bring reserves below the cap or insurers employ other strategies that may take more time (described below) to bring reserves below the cap or avoid the cap entirely. Once any rate freezes end, we expect that insurers would increase rates to “catch up” with increases in health care costs that have taken place since rates were frozen, bringing rates near or equal to what they would have been absent any rate freezes.

- Directly Reduce Reserves to Avoid Rate Freezes. Alternatively, insurers might directly reduce reserves to avoid rate freezes. For example, insurers might consider ways to provide one-time grants to foundations or to contracted providers to pursue improvements to health care service delivery. For-profit insurers might provide dividends to shareholders.

- Restructure Operations to Avoid Application of the Cap. Other insurers might attempt to restructure operations to avoid the reserve cap. For example, insurers with affiliates in other states might develop strategies to shift assets out of state, possibly by contracting with out-of-state affiliates to perform certain administrative activities (like customer service call centers) rather than operating those activities in California. For the Kaiser Foundation Health Plan, it might be difficult to reduce assets sufficiently to come under the reserve cap, since such a significant portion of its assets are in the form of property and equipment. In order avoid rate freezes, Kaiser Permanente might eventually spin off its hospital system to remove these assets from the Kaiser Foundation Health Plan’s TNE, fundamentally changing its operations as an integrated health system.

- Reduce or Discontinue Operations in California. Finally, if the responses above are not practical or desirable, some affected insurers might choose to reduce or discontinue operations in the state.

Fiscal Impacts Would Depend on Insurer Responses

State and Local Government Costs for Employee Health Coverage. This measure would affect the cost of health care coverage in the state, including costs to state and local government employers. The impact would depend on the various responses described above, making it difficult to predict how government finances would be affected on average over time. For example, state and local government employers could have reduced employee health care costs in the short run to the extent that affected insurers forego rate increases in response to the measure. We assume any savings from avoided rate increases would be temporary, as insurers take additional steps over time to either avoid the reserve cap or reduce reserves to come below the cap, and subsequently increase rates to reflect increases in health care costs while rates were frozen.

Other possible insurer responses have the potential to increase costs for state and local governments. Specifically, limiting insurer reserves could increase the risk of insolvency and reduce the number of insurers offering health coverage in the state, potentially leading to reduced competition in insurance markets and higher costs for employee health care, including for state and local government employers. Further, in recent years the health care industry has moved toward greater integration. The measure’s disproportionate impact on integrated health systems might discourage integrated health systems from forming or continuing operations when such integration would have been more efficient, potentially increasing the cost of employee health care, including for state and local government employers. These costs, while uncertain, could potentially be significant over time.

Potential State Revenue Impacts. If provisions in the MCO tax legislation related to exemptions from the corporate income tax are not renewed, insurers that forego rate increases because of the provisions of this measure would likely have less net income or potentially operating losses and would pay less in state corporate income taxes than they otherwise would. We estimate the net impact of the measure on state revenues would be relatively minor.

State Administrative Costs

The DMHC and CDI would incur costs from new workload related to administering the provisions of this measure. We estimate that these costs would be likely be minor and would be covered by increases to existing fees paid by the insurance industry. The Attorney General could also have increased costs related to investigations of whether increased reimbursement rates in integrated health systems constitute evasion of the reserve cap. These costs would depend on the extent to which DMHC makes referrals to the Attorney General pursuant to the measure. The number and potential cost of investigations by the Attorney General are uncertain, but we estimate they would likely be minor.

Summary of Fiscal Effects

This measure would result in the following major fiscal impact:

- Uncertain average annual effects over time on state and local government costs for employee health coverage, ranging from potential net savings in the short run to potentially significant net costs in the long run.