LAO Contact

February 13, 2017

The 2017-18 Budget

Cap-and-Trade

Executive Summary

California’s Cap‑and‑Trade Program

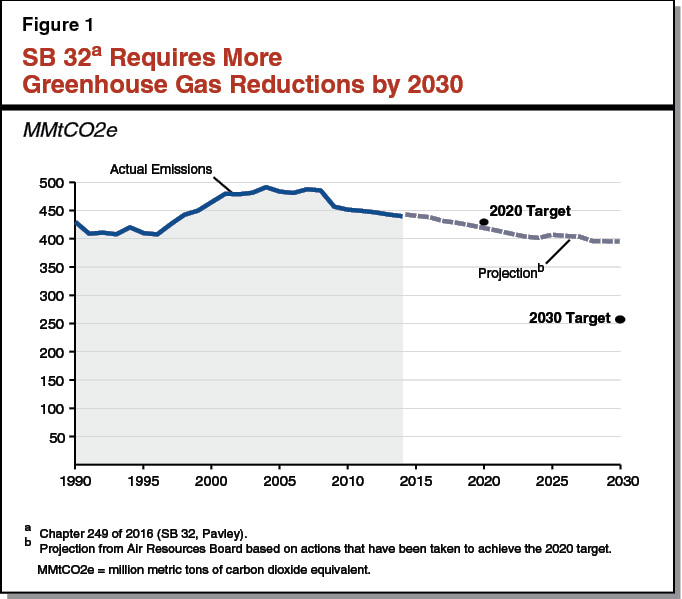

SB 32 Established 2030 Greenhouse Gas (GHG) Target. The Global Warming Solutions Act of 2006 (Chapter 488 [AB 32, Núñez/Pavley]) established the goal of limiting statewide GHG emissions to 1990 levels by 2020. The legislation directed the Air Resources Board (ARB) to adopt regulations to achieve the maximum technologically feasible and cost‑effective GHG emission reductions by 2020. In 2016, Chapter 249 (SB 32, Pavley) established an additional target of reducing emissions by at least 40 percent below 1990 levels by 2030.

Cap‑and‑Trade Aims to Limit Emissions and Encourage Cost‑Effective Reductions. Assembly Bill 32 authorized ARB to implement a market‑based mechanism—known as a cap‑and‑trade program—through 2020. Under the cap‑and‑trade program, ARB issues a limited number of “allowances” (essentially, emission permits), which large GHG emitters can purchase at a state‑run auction or on the private market. (ARB also gives some allowances away for free.) From an economic perspective, the primary advantage of a cap‑and‑trade program is that the market sets a price for GHG emissions, which creates a financial incentive for businesses and households to implement the least costly emission reduction activities.

Legal Uncertainty Around Cap‑and‑Trade. Currently, there is a court case challenging ARB’s authority to auction allowances and raise revenue through 2020. There is also legal uncertainty whether ARB has the authority to operate the cap‑and‑trade program beyond 2020 and whether extending the authority to auction allowances beyond 2020 would require a two‑thirds vote of the Legislature given changes to the definition of taxes and fees under Proposition 26 (2010).

Governor Proposes Extending Cap‑and‑Trade With Two‑Thirds Vote

The Governor’s 2017‑18 budget proposes to spend $2.2 billion in cap‑and‑trade auction revenue on activities intended to reduce GHGs. However, $1.3 billion would only be spent after the Legislature enacted—with a two‑thirds urgency vote—new legislation extending the ARB’s authority to operate a cap‑and‑trade program beyond 2020. Under the Governor’s proposal, the Department of Finance (DOF) would have authority to select the specific programs within each category of activities that would receive funding. In addition, under the Governor’s proposal, DOF would have the authority to adjust downward allocations to discretionary programs proportionally based on available funds.

LAO Recommendations

In this report, we make recommendations in response to three critical questions raised by the Governor’s proposal:

- Should cap‑and‑trade be authorized beyond 2020?

- Is a two‑thirds vote needed to extend cap‑and‑trade?

- How should the Legislature use cap‑and‑trade revenue?

Authorize Cap‑and‑Trade Beyond 2020 Because Likely Most Cost‑Effective Approach. We recommend the Legislature authorize cap‑and‑trade (or a carbon tax) beyond 2020 because it is likely the most cost‑effective approach to achieving the state’s 2030 GHG emissions target. If the Legislature approves cap‑and‑trade, we recommend the Legislature (1) strengthen the allowance price ceiling because there is potential for substantial price volatility associated with the lower cap and (2) provide clearer direction to ARB regarding the criteria that the board should use to determine whether complementary policies should be adopted. We also recommend the Legislature continue to take steps to ensure oversight and evaluation of major climate policies by establishing an independent expert committee.

Approve With a Two‑Thirds Vote to Ensure Ability to Design Effective Program. Although cap‑and‑trade could be extended with a simple majority vote, we recommend the Legislature approve cap‑and‑trade (or carbon tax) with a two‑thirds vote because it would provide greater legal certainty and ensure ARB has the ability to design an effective program. For example, a two‑thirds vote would provide legal certainty regarding ARB’s authority to auction allowances—a method for distributing allowances that is generally recommended by economists. A two‑thirds vote would also allow the Legislature to remove the current requirement that cap‑and‑trade auction revenues can only be used on activities that reduce GHG emissions.

Broaden Allowable Uses of Revenue to Include Other Legislative Priorities. With a two‑thirds vote, we recommend the Legislature broaden the allowable uses of auction revenue because it would give the Legislature flexibility to use the funds on its highest priorities. The Legislature could use the funds to (1) offset higher energy costs for households and businesses by providing tax reductions or rebates; (2) promote other climate‑related policy goals, such as climate adaptation activities; and/or (3) support other legislative priorities unrelated to climate policy. In our view, returning the revenue to businesses and consumers by reducing taxes or providing rebates could become a particularly important option if allowance prices—and, consequently energy costs for households and businesses—increase substantially in the future.

When finalizing its 2017‑18 cap‑and‑trade spending plan, we also recommend the Legislature (1) reject the administration’s proposed language making spending contingent on future legislation, (2) consider alternative strategies for dealing with revenue uncertainty, and (3) allocate funds to specific programs rather than providing DOF that authority.

Introduction

The Global Warming Solutions Act of 2006 (Chapter 488 [AB 32, Núñez/Pavley]), commonly referred to as AB 32, established the goal of limiting statewide greenhouse gas (GHG) emissions to 1990 levels by 2020. One of the policies the state adopted to achieve this goal was a cap‑and‑trade program. The program is meant to establish a limit on emissions from major sources and provide incentives for cost‑effective emission reductions. Chapter 249 of 2016 (SB 32, Pavley) established an additional GHG target of at least 40 percent below 1990 levels by 2030. However, it is unclear whether the Air Resources Board (ARB) has the legal authority to operate cap‑and‑trade beyond 2020.

The cap‑and‑trade program generates revenue which is used to support programs intended to reduce GHGs. The Governor’s 2017‑18 budget proposes a $2.2 billion cap‑and‑trade expenditure plan, contingent on the Legislature extending the authority for ARB to operate cap‑and‑trade beyond 2020 with a two‑thirds urgency vote. In this report, we provide background information on California’s GHG policies and the role of cap‑and‑trade. We also provide comments and recommendations related to three critical questions that merit legislative consideration:

- Should cap‑and‑trade be authorized beyond 2020?

- Is a two‑thirds vote needed?

- How should the Legislature use cap‑and‑trade revenue?

Background

State GHG Targets and Policies

AB 32 and the Scoping Plan. Assembly Bill 32 established the goal of limiting GHG emissions statewide to 1990 levels by 2020. The legislation directed ARB to adopt regulations to achieve the maximum technologically feasible and cost‑effective GHG emission reductions by 2020. Assembly Bill 32 further authorized ARB to implement a market‑based declining annual emissions limit through 2020. In addition, to the extent feasible, ARB must:

- Design regulations in a manner that is equitable, minimizes costs, and maximizes benefits to California.

- Ensure that activities undertaken to comply with regulations do not disproportionately impact low‑income communities.

- Ensure that activities complement efforts to achieve regional air quality standards.

- Minimize the extent to which emissions are shifted out of state because companies move the production of goods due to higher costs associated with regulations (referred to as “leakage”).

ARB is required to develop a Scoping Plan to achieve the emission targets and update the plan periodically. The first Scoping Plan was approved by ARB in 2008, and the first update to the Scoping Plan was approved in 2014. These scoping plans included a wide variety of regulations intended to help the state meet its GHG goal, including cap‑and‑trade, a low carbon fuel standard (LCFS) intended to reduce the carbon intensity of transportation fuels, energy efficiency programs, and the 33 percent renewable portfolio standard (RPS) for retail electricity sales. In order to meet the 1990 target, the 2014 Scoping Plan update projected that the regulations would reduce emissions by 78 million metric tons of carbon dioxide equivalent (MMtCO2e) in 2020—roughly 15 percent below what annual emissions are estimated to have been without the regulations.

Recent Legislation Established 2030 GHG Targets and Policy Direction. Senate Bill 32 established an additional GHG target of at least 40 percent below 1990 levels by 2030, as shown in Figure 1. In addition, Chapter 250 of 2016 (AB 197, E. Garcia) directs ARB to prioritize regulations that result in direct GHG emission reductions, including emission reductions at large stationary sources and from mobile sources. Assembly Bill 197 also establishes a Joint Legislative Committee on Climate Change Policies. The committee is tasked with collecting facts and making recommendations to the Legislature on state policies related to climate change and is authorized to establish a panel of experts to provide an independent analysis of the state’s policies.

The Legislature has adopted additional policies intended to help achieve the 2030 GHG target. For example, Chapter 547 of 2015 (SB 350, de León) requires a 50 percent RPS and doubling energy efficiency savings in electricity and natural gas by 2030. In addition, Chapter 395 of 2016 (SB 1383, Lara) requires ARB to implement a strategy to reduce methane emissions by 40 percent, hydrofluorocarbon gases by 40 percent, and anthropogenic black carbon by 50 percent below 2013 levels by 2030. These types of emissions are also known as short‑lived climate pollutants. ARB is currently in the process of updating its Scoping Plan to identify the policies that will be used to achieve the additional reductions needed to meet the 2030 GHG target.

Cap‑and‑Trade

Purpose of Market‑Based Mechanisms. Cap‑and‑trade is one commonly discussed market‑based approach to reducing GHG emissions. (The other market‑based approach most commonly discussed is a carbon tax.) Cap‑and‑trade differs from other regulatory approaches, such as traditional command‑and‑control regulations. Under traditional regulations for reducing emissions, government requires businesses to install a certain type of emission reduction technology or meet a certain minimum emissions standard. When discussed in relation to market‑based approaches, these regulatory approaches are sometimes referred to as direct regulations or complementary policies. In contrast, a market‑based approach like cap‑and‑trade adds a financial cost to producing GHGs, which provides a financial incentive for private businesses and consumers to reduce emissions. The private sector has flexibility to determine which emission reduction activities are least costly and whether the costs of the activities are less than the financial cost of continuing to emit GHGs.

Description of Cap‑and‑Trade. The cap‑and‑trade regulation places a “cap” on aggregate GHG emissions from large GHG emitters, such as large industrial facilities, electricity generators and importers, and transportation fuel suppliers. Capped sources of emissions are responsible for roughly 80 percent of the state’s GHG emissions. The cap declines over time, ultimately arriving at the target emission level in 2020. To implement the cap‑and‑trade program, ARB issues carbon allowances equal to the cap, and each allowance is essentially a permit to emit one ton of carbon dioxide equivalent. Entities can also “trade” (buy and sell on the open market) the allowances in order to obtain enough to cover their total emissions. Some entities will end up reducing their emissions if the number of allowances available is less than the number of emissions that would otherwise occur. Entities can also purchase “offsets” to cover their emissions. Offsets are GHG emission reduction projects undertaken by entities not subject to the state’s cap‑and‑trade program (uncapped sources), such as forestry projects that reduce GHGs. Covered entities can use offsets—rather than allowances—to cover up to 8 percent of their emissions.

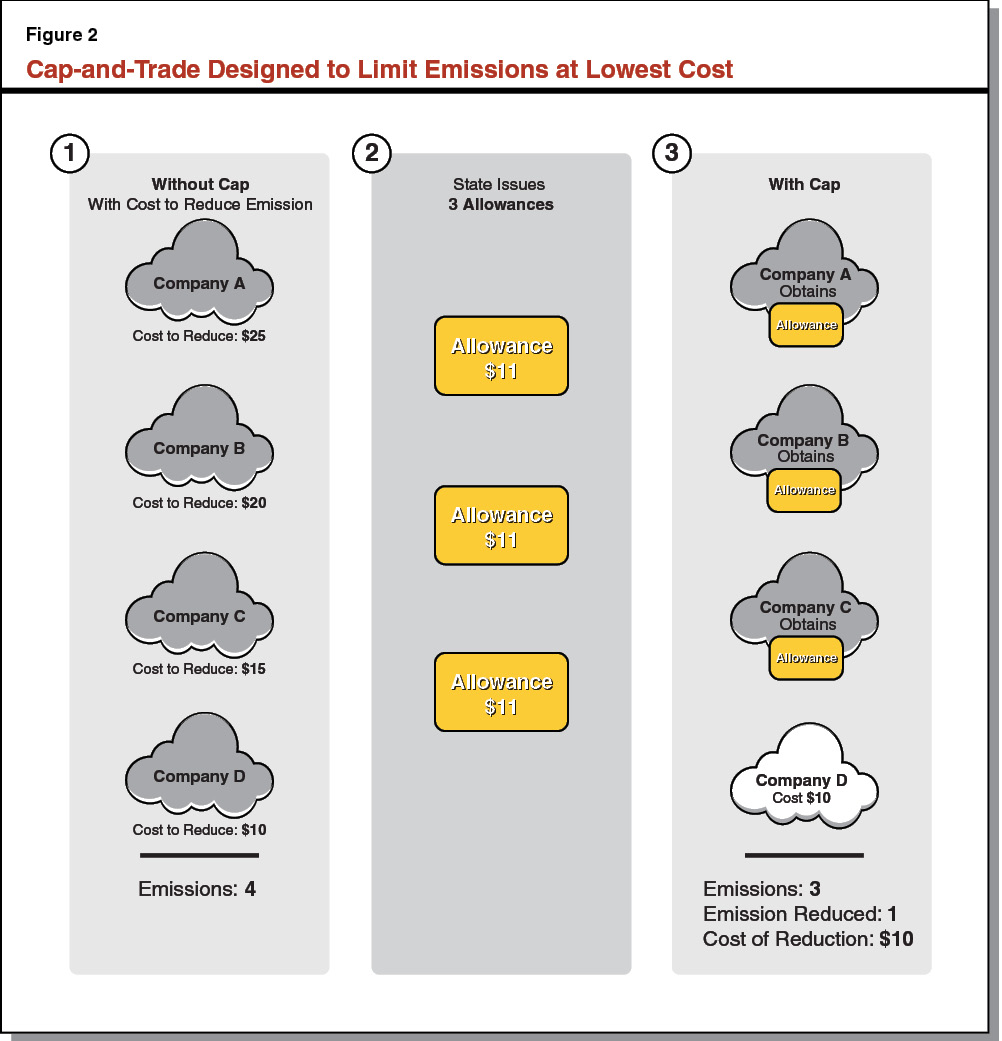

Cap Intended to Provide Emissions Certainty. From a GHG emissions perspective, one of the primary advantages of a cap‑and‑trade regulation is that the cap ensures total GHGs from major sources of emissions do not exceed the limit established by the state. As long as GHG emissions are accurately measured and the regulation is adequately enforced, the number of emissions cannot exceed the number of allowances (or the cap). Figure 2 shows a simplified example of how the cap ensures emissions do not exceed the number of allowances issued by the state. Without establishing a cap, Companies A, B, C, and D would each have one emission. To establish a cap, the state issues three allowances. As a result, only three companies can obtain an allowance and continue to emit, while one company is forced to reduce its emission.

Allowance Price Provides Incentive for Cost‑Effective Emission Reductions. From an economic perspective, the primary advantage of a cap‑and‑trade program is that it creates a financial incentive to identify the least costly emission reduction activities. The supply and demand of allowances in a trading market generally determine the price of an allowance. In our example, each company would only purchase an allowance if the allowance price (in this case, $11) is lower than their cost to reduce their emission. As shown in the example in Figure 2, some emitters (Company D in this case) will reduce emissions because it is less costly ($10) for them to do so than purchase an allowance. Remaining emitters will purchase an allowance and continue to emit because allowances are cheaper than reducing emissions. In theory, the level of overall emission reductions is achieved at the lowest cost possible—$10 in our example. This is because the allowance price provides an economic incentive to find the mix of emission reductions and allowance purchases that minimize costs.

It is important to note that, while covered entities (such as electricity generators and transportation fuel suppliers) pay the direct costs of purchasing allowances, at least a portion of the costs are passed on to customers and other businesses in the form of higher product prices. As a result, a wide variety of businesses and households have a financial incentive to use less GHG‑intensive products. For example, transportation fuel suppliers must purchase allowances associated with the emissions from gasoline consumption, but those costs are generally passed on to consumers in the form of higher gasoline prices. As gasoline prices increase, businesses and households have an incentive to reduce gasoline consumption. The higher prices are key to ensuring that businesses and consumers have an incentive to consume fewer GHG‑intensive products. However, it also means that households and businesses that continue to consume these products, such as gasoline, will pay more for those goods and services.

ARB Designed Cap‑and‑Trade to Be a Backstop to Ensure State Meets GHG Target. The mix of measures in the Scoping Plan—including both cap‑and‑trade and complementary regulations—are intended to achieve the aggregate emission reduction target by 2020. In the Scoping Plan update in 2014, about 70 percent of emission reductions in 2020 were expected to result from complementary measures. Only the remaining 30 percent of the projected GHG emission reductions were projected to come from the ARB’s cap‑and‑trade regulation. The actual emissions reductions achieved under the cap‑and‑trade program, however, could be significantly different than those estimates. That is because the cap serves as a “backstop” to achieve GHG emissions targets in the covered sectors, regardless of programmatic or economic changes that affect emissions. For example, if energy efficiency programs fail to meet their planned emissions targets, the cap would encourage additional GHG reductions from other sources to ensure overall emissions do not exceed the specified limit. Alternatively, if technological advancements or slow economic growth result in lower than projected emissions, the cap is needed to reduce fewer emissions in order to stay below the limit.

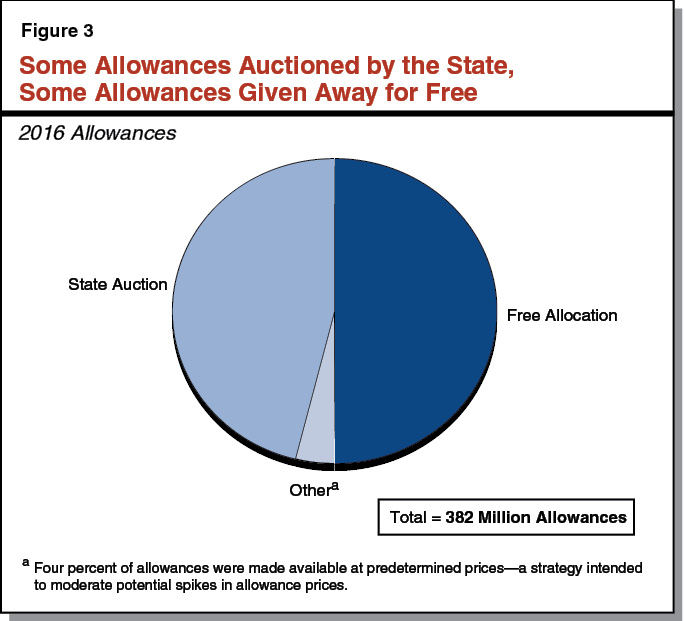

Some Allowances Auctioned, Some Given Away for Free. One important aspect of implementing a cap‑and‑trade program is determining how to distribute allowances. In theory, allowances can be issued in one of three general ways: (1) they can be given away for free, (2) they can be auctioned by the state, or (3) some portion can be freely allocated while the other portion is auctioned. As shown in Figure 3, ARB offered 46 percent of 2016 allowances at auctions and gave 50 percent away for free. (Four percent of allowances are made available at predetermined prices—a strategy intended to moderate potential spikes in allowance prices.) Of the 50 percent of allowances given away for free, most were given to investor‑owned utilities (IOUs) (16 percent), certain industrial emitters (14 percent), natural gas suppliers (12 percent), and publicly owned utilities (8 percent). State law and regulation require IOUs to auction their allowances and most of the resulting revenue must be credited to their industrial, small businesses, and residential electricity customers. ARB allocates free allowances to certain energy‑intensive trade‑exposed industries based on how much of their product (not GHG emissions) they produce in California. The more they produce in California, the more free allowances they receive. This strategy is intended to prevent emissions leakage.

Cap‑and‑Trade Auction Revenue

Auctions Have Generated $4.4 Billion in State Revenue. ARB has conducted 17 quarterly cap‑and‑trade auctions since November 2012—generating roughly $4.4 billion in state revenue. Beginning January 1, 2015, transportation and natural gas fuel suppliers were required to obtain allowances for the GHG emissions associated with the combustion of their fuels. Since transportation fuel suppliers are not given free allowances, the number of state‑auctioned allowances increased substantially in 2015—resulting in auctions raising significantly higher amounts of state revenue. However, as we discuss later in this report, there was a substantial reduction in demand for allowances offered at quarterly auctions in 2016. This drop in demand was likely due, at least in part, to an oversupply of allowances and legal uncertainty about the future of the program. As a result, quarterly state revenue has been volatile.

State Law Requires Auction Revenue Be Used to Reduce GHGs. Statutes enacted in 2012 direct the use of auction revenue to GHG reduction activities. For example, Chapter 807 of 2012 (AB 1532, Perez) requires auction revenues be used to further the purposes of AB 32. Revenues must be used to facilitate GHG emission reductions in California. In addition to reducing GHGs, to the extent feasible, funds must be used to achieve other goals, such as:

- Maximizing overall economic, environmental, and public health benefits to the state.

- Complementing efforts to improve air quality.

- Lessening the effects of climate change on the state (also known as climate adaptation).

- Directing investment toward the most disadvantaged communities and households in the state.

To address this last goal, Chapter 830 of 2012 (SB 535, de León), as amended by Chapter 369 of 2016 (AB 1550, Gomez), requires that at least 25 percent of auction revenue be allocated to projects that are located in disadvantaged communities and benefiting low‑income individuals living in disadvantaged communities (as determined by the Office of Environmental Health Hazard Assessment).

How Auction Revenue Has Been Spent so Far. The state has used auction revenue to fund various programs and projects. For revenue collected in 2015‑16 and beyond, statute continuously appropriates (1) 25 percent for the state’s high‑speed rail project, (2) 20 percent for affordable housing and sustainable communities grants (with at least half of this amount for affordable housing), (3) 10 percent for intercity rail capital projects, and (4) 5 percent for low carbon transit operations. The remaining 40 percent is available for annual appropriation by the Legislature. Statute also requires that an outstanding loan of $400 million in auction revenues to the General Fund be repaid to the high‑speed rail project when needed by the project. As illustrated in Figure 4, the state will have spent about $3.8 billion from auction revenues through 2016‑17.

Figure 4

Cap‑and‑Trade Spending Through 2016‑17

(In Millions)

|

Program |

Agency |

2013‑14 |

2014‑15 |

2015‑16 |

2016‑17 |

Total |

|

High‑speed raila |

High‑Speed Rail Authority |

— |

$250 |

$458 |

$250b |

$958 |

|

Affordable housing/sustainable communities |

Strategic Growth Council |

— |

130 |

366 |

200b |

696 |

|

Low carbon vehicles |

Air Resources Board |

$30 |

200 |

95 |

363 |

688 |

|

Transit and intercity rail capital |

Transportation Agency |

— |

25 |

183 |

235b |

443 |

|

Low‑income weatherization and solar |

CSD |

— |

75 |

79 |

20 |

174 |

|

Transit operations |

Caltrans |

— |

25 |

92 |

50b |

167 |

|

Transformational Climate Communities |

Strategic Growth Council |

— |

— |

— |

140 |

140 |

|

Agricultural energy and efficiency |

Food and Agriculture |

10 |

25 |

40 |

65 |

140 |

|

Sustainable forests and urban forestry |

Forestry and Fire Protection |

— |

42 |

— |

40 |

82 |

|

Green infrastructure |

Natural Resources Agency |

— |

— |

— |

80 |

80 |

|

Waste diversion |

CalRecycle |

— |

25 |

6 |

40 |

71 |

|

Water efficiency |

DWR |

30 |

20 |

20 |

— |

70 |

|

Wetlands and watershed restoration |

Fish and Wildlife |

— |

25 |

2 |

— |

27 |

|

Active transportation |

Caltrans |

— |

— |

— |

10 |

10 |

|

Black carbon woodsmoke |

Air Resources Board |

— |

— |

— |

5 |

5 |

|

Other technical assistance and administration |

Various |

2 |

10 |

14 |

24 |

50 |

|

Totals |

$70 |

$852 |

$1,354 |

$1,522 |

$3,800 |

|

|

aDoes not include $400 million loan repayment from General Fund that is allocated to high‑speed rail in future years under current law. bEstimated continuous appropriation based on $1 billion 2016‑17 revenue estimate in Governor’s budget. CSD = Community Services and Development; Caltrans = Department of Transportation; and DWR = Department of Water Resources. |

||||||

Legal Uncertainty Around Cap‑and‑Trade

Current Authority to Auction Allowances Challenged in Court. There is currently a court case challenging whether the state can continue collecting revenue from cap‑and‑trade auctions. In a lawsuit against ARB, plaintiffs argue that AB 32 did not provide ARB the authority to auction allowances and collect state revenue. (Plaintiffs do not dispute ARB’s authority to operate a cap‑and‑trade program and give allowances away for free.) They further argue that even if the Legislature gave ARB the authority to collect auction revenue, such revenue constitutes an illegal tax. The California Constitution requires that any increases in state taxes be approved by a two‑thirds vote of the Legislature. Previous court decisions have determined that certain types of “charges,” such as regulatory fees, are not considered taxes and require only a simple majority vote. The plaintiffs argue that auction revenues are tax revenues and, since AB 32 was not passed with a two‑thirds vote, the state is collecting auction revenues illegally. In November 2013, the superior court ruled that the charges from the auction have characteristics of a tax as well as a fee, but that, on balance, the charges constitute legal regulatory fees. This ruling has been appealed and a decision from the state’s third appellate court is expected in the next couple of months.

Authority to Operate Program Beyond 2020. The administration indicates that it believes it currently has authority to extend cap‑and‑trade beyond 2020. However, an opinion provided by Legislative Counsel released last year stated its view that current law does not provide such authority because AB 32 only explicitly authorizes cap‑and‑trade through 2020.

Vote Threshold Needed to Authorize Auctions Beyond 2020. Even if the courts rule that current auctions are not a tax, the vote threshold needed to pass new legislation that provides ARB authority to auction allowances is unclear. This is because the current case challenges whether the auctions authorized by legislation passed in 2006 are a tax under Proposition 13 (1978). In 2010 (after the enactment of AB 32), voters passed Proposition 26, which changed the definition of a tax in a way that could change whether auction revenues are considered a tax or not. Therefore, even if the courts ruled that the current auctions are not a tax under Proposition 13, any new law authorizing the auctions would be evaluated under the requirements of Proposition 26.

Back to the TopGovernor’s Proposal

As shown in Figure 5, the budget proposes to spend $2.2 billion in cap‑and‑trade revenue in 2017‑18. This would be supported from $1.5 billion in auction revenue assumed to be collected in 2017‑18 and almost $700 million in unallocated prior‑year collections. Consistent with current law, 60 percent ($900 million) of projected 2017‑18 revenue would be continuously appropriated. Under the Governor’s proposal, the remaining $1.3 billion in proposed discretionary spending would be spent only after the Legislature enacted—with a two‑thirds urgency vote—new legislation extending the ARB’s authority to operate a cap‑and‑trade program beyond 2020.

Figure 5

Proposed 2017‑18 Cap‑and‑Trade Expenditure Plan

(In Millions)

|

Program |

Amount |

|

Continuous Appropriations |

|

|

High‑speed rail |

$375 |

|

Affordable housing and sustainable communities |

300 |

|

Transit and intercity rail capital |

150 |

|

Transit operations |

75 |

|

Subtotal, Continuous Appropriations |

($900) |

|

Discretionary Spending |

|

|

Public transit and active transportation projects |

$500 |

|

Clean transportation and petroleum use reduction |

363 |

|

Transformative Climate Communities |

142 |

|

Carbon sequestration |

128 |

|

Short‑lived climate pollutants |

95 |

|

Energy efficiency and renewable energy |

28 |

|

Subtotal, Discretionary Spending |

($1,255a) |

|

Total |

$2,155 |

|

aDoes not total due to rounding. |

|

In addition to the continuously appropriated programs, the budget would provide $500 million in auction revenues to support the Governor’s transportation funding package. The remaining $755 million would be allocated for other categories of activities—rather than provided to specific departments and programs—designed to reduce GHG emissions. Under the Governor’s proposal, the Department of Finance (DOF) would have authority to select the specific programs within each category that would receive funding. In addition, under the Governor’s proposal, DOF would have the authority to adjust downward allocations to discretionary programs proportionally based on available funds.

Back to the TopLAO Assessment

In this section, we provide our comments and recommendations related to three critical questions that the Governor’s proposal raises:

- Should cap‑and‑trade be authorized beyond 2020?

- Is a two‑thirds vote needed to extend cap‑and‑trade?

- How should the Legislature use cap‑and‑trade revenue?

Figure 6 provides a summary of our main recommendations.

Figure 6

Summary of LAO Recommendations

|

|

|

|

|

|

|

|

|

Should Cap‑and‑Trade Be Authorized Beyond 2020?

The first key decision facing the Legislature is whether to authorize cap‑and‑trade beyond 2020. In making this decision, the Legislature will want to consider the following issues: (1) the role of the cap‑and‑trade program so far, (2) the different options and key considerations for achieving the state’s 2030 GHG targets, (3) the merits of market‑based mechanisms—such as cap‑and‑trade or a carbon tax—as a tool for achieving state GHG targets cost‑effectively, and (4) the significance of a one specific design feature—an allowance price ceiling—in the cap‑and‑trade program. Below, we assess each of these issues and make specific recommendations based on our assessment.

Emissions Below Cap During Initial Years of Program

As the Legislature considers the proposal to extend cap‑and‑trade beyond 2020, understanding the outcomes of the program so far can provide valuable information about the potential effects of extending the program. Different aspects of the cap‑and‑trade program have been the subject of much research and analysis. However, to our knowledge, a robust study of the overall statewide effects of the cap‑and‑trade program so far has not been conducted. Such a study would be complex and the data available to complete the study might be somewhat limited. For example, advanced statistical techniques would be needed to determine which activities to reduce emissions were the result of cap‑and‑trade, rather than other policies or changes in economic conditions. In addition, emissions data is only available for the first three years of the program. As a result, the overall effects of the program are still somewhat uncertain. Based on the information and analysis that we have reviewed, we provide our assessment of the likely effects of the program so far.

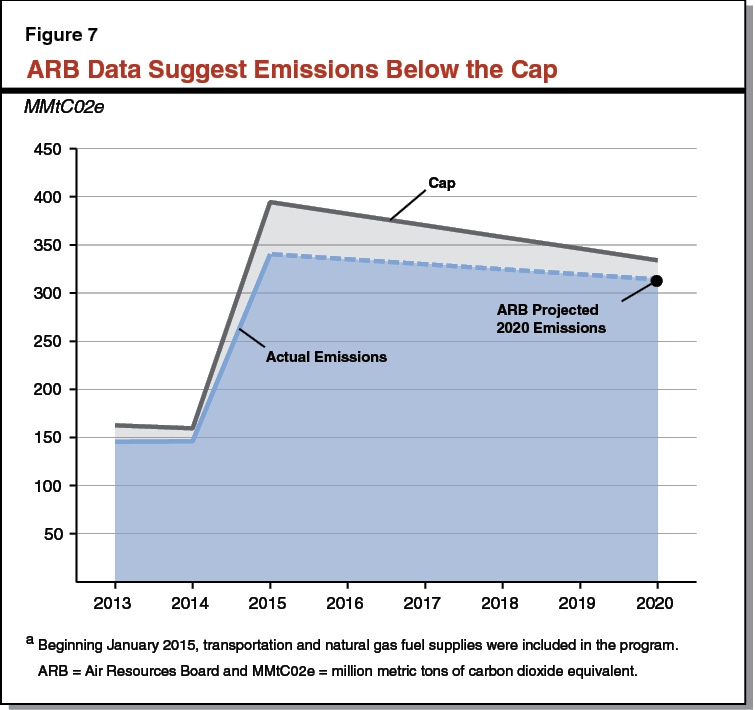

GHG Emissions Likely Below the Cap in Early Years Due to Other Factors. The cap is likely not having much, if any, effect on overall emissions in the first several years of the program. As shown in Figure 7, emissions have actually been below the cap for the first few years of the program (2013 through 2015) suggesting, therefore, that the cap has not had to contain total emissions. Furthermore, future projections—including ARB’s emissions projections and studies conducted by academic economists—suggest emissions could remain below the cap through 2020. Low demand for allowances at recent auctions also suggests emissions are below the cap. The reasons why emissions might be lower than previously anticipated are not entirely clear, but two likely contributing factors are (1) lower‑than‑expected economic growth due to the 2008 recession and (2) the presence of a wide variety of complementary policies. All else equal, lower economic activity results in fewer emissions. In addition, complementary policies reduce emissions from covered entities and reduce the level of emission reductions needed from the cap as a backstop to meet the state’s established target. To the extent these are the primary contributing factors, it means emissions are likely below the cap for reasons other than the cap‑and‑trade regulation itself.

Minimum Allowance Price Likely Having Some Effect on Emissions. In theory, the level of the cap is the most important factor affecting overall emissions. However, since the cap has likely not been limiting emissions in the early stages of the program, other aspects of the program have likely had a more significant effect on emissions so far. The minimum price for allowances established by ARB is one such program feature. The current market price for trading allowances—over $13 per ton—is likely driven by ARB’s minimum price ($13.57 in the February 2017 auction). The $13 allowance price provides some incentive for GHG reductions. For example, if current allowance prices are fully passed on to consumers, they result in about a 12‑cent increase in gasoline prices. This higher price likely encourages some minor reductions in fuel consumption and GHGs relative to what would have occurred without the program. However, the price is not high enough to incentivize the types of changes in investments decisions that are likely needed to meet the state’s more aggressive 2030 GHG goals, such as a substantial shift away from purchasing gasoline powered vehicles to electric vehicles.

Benefits and Costs Vary Across Households, Businesses, and Regions. The program has had distributional effects because certain households and businesses have benefitted while others have been adversely affected. For example, many households and businesses are paying higher prices for energy—such as gasoline and electricity. This is how the program is intended to operate. It also means these households and businesses have less money to spend on other things. On the other hand, some businesses and/or households benefit from receiving free allowances or some of the auction revenue that is collected by the state. For example, major utilities use auction revenue to provide customer bill credits and the Legislature allocates state auction revenue to programs. These programs provide various benefits to California households and businesses. The overall net effect of these different effects are unclear and likely vary by household, business, and region.

Effects on Other Legislative Goals Unclear. Information on the effect of the regulation on other, non‑GHG legislative goals is also limited. For example:

- Local and Regional Air Quality. Based on our review of the literature, there is limited evidence of the effects of cap‑and‑trade regulation on co‑pollutants. Given the limited role the cap has had on GHG emissions so far, it is unlikely that the regulation has had a major effect on co‑pollutants. As we have discussed in other reports, the effects of programs receiving cap‑and‑trade expenditures on co‑pollutants are also unclear at this time.

- Emissions Leakage. Research on the effects of the regulation on overall emissions leakage is also limited. So far, ARB has allocated a relatively high share of free allowances to energy‑intensive trade exposed industries. Combined with relatively modest allowance prices, this approach has likely mitigated large‑scale statewide leakage concerns. It is possible that certain industries or businesses have been affected—either positively or negatively—by the ARB’s strategy for allocating free allowances.

It is important to note that our findings do not imply cap‑and‑trade has been a failure (or a success). Rather, our key takeaway from the existing literature and discussions with program experts is that the overall effects of the program so far are somewhat unclear, but, most likely, the effect on GHGs has been limited because the cap has not yet been put in a position to reduce emissions. In addition, it is worth noting that the effects of other complementary GHG policies that have been implemented so far are similarly unclear.

Legislature Has Different Options for Achieving 2030 Target

The Legislature has different policy options to meet the 2030 GHG target. In January, the ARB staff released its 2017 Scoping Plan update that included five potential approaches to achieving the 2030 target. In our view, the document provides a good starting point for discussions about potential approaches. Our office has not had an opportunity to conduct a detailed review of ARB’s methods and assumptions used to estimate emission reductions and costs. As a result, at this time, we caution the Legislature against placing too much emphasis on the details of the emissions and costs estimates included in the plan. Below, we (1) describe the significant uncertainty around the GHG reductions and costs needed to achieve the 2030 target and (2) describe the policy options ARB identifies for achieving the target.

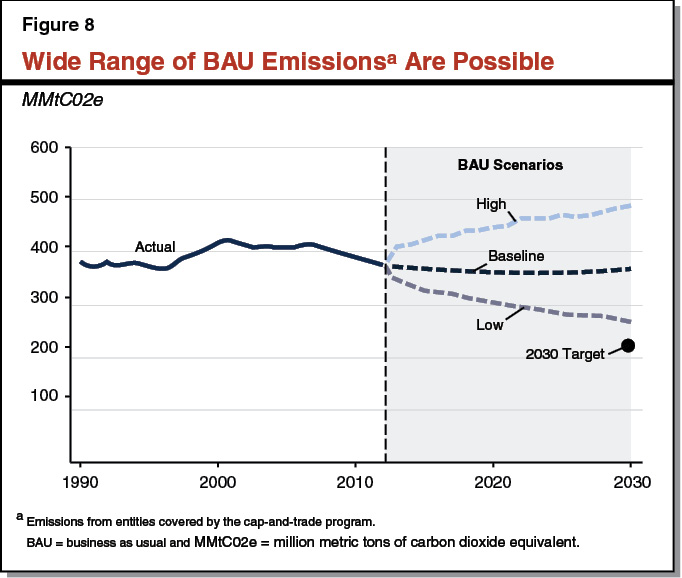

GHG Reductions and Costs Needed to Meet 2030 Target Are Highly Uncertain. The state’s 2030 GHG target is 40 percent lower than the 2020 target. Consequently, it could be substantially more difficult for the state to meet the new target. The emissions reductions from state policies—including cap‑and‑trade and/or other policies—needed to meet the target are highly uncertain. This is because the level of reductions needed depends on what emissions would be without additional state action—otherwise known as business as usual (BAU) emissions. Under ARB’s current projections, state policies—including those that have already been adopted by the Legislature—will have to reduce emissions by 132 MMtCO2e (33 percent) below BAU emissions in 2030. BAU emissions are highly uncertain and depend on a variety of other factors that are difficult to predict, including economic growth and technological advances. For example, Figure 8 shows one projection of the potential range of BAU emissions that is based on preliminary modeling done by ARB’s economic advisors. In a low BAU scenario, state policies would need to achieve relatively few reductions because emissions would be decreasing even in the absence of state actions. Conversely, in a high BAU scenario, state policies would need to achieve many more emission reductions than projected.

There is also significant uncertainty about the overall costs of meeting the state’s GHG goals. First, the overall cost depends on the number of emission reductions the state would need to achieve to meet its goal, which, as discussed above, is uncertain. Second, even if the state could predict BAU emissions perfectly, the costs of different policies needed to reduce emissions are difficult to predict. For example, the future costs of policies meant to reduce gasoline consumption depend on such factors as future gasoline prices and costs for alternative vehicle technologies—both of which are difficult to predict.

ARB Scoping Plan Identifies Alternative Approaches to Achieve 2030 Target. The five alternatives presented in the January 2017 Scoping Plan are summarized in Figure 9. Under all alternatives, ARB assumes emission reductions from implementing policies that have already been adopted—such as a achieving a 50 percent RPS, doubling energy efficiency, and implementing SB 1383 to reduce short‑lived climate pollutants. Each alternative approach also assumes reductions from implementing ARB’s Mobile Source Strategy (to meet federal air quality standards for criteria pollutants) and the administration’s Sustainable Freight Action Plan (to improve and make more efficient the state’s system for transporting goods). Below, we describe the main differences between the ARB’s proposed approach and the four alternatives identified in the Scoping Plan.

- Proposed Approach: Cap‑and‑Trade, Plus Other Selected Measures. The approach recommended by ARB staff includes (1) extending cap‑and‑trade, (2) increasing the LCFS carbon intensity reduction from the current goal of 10 percent to 18 percent, and (3) implementing a new regulation that requires refineries to reduce GHG emissions by 20 percent by 2030 (the 20 percent refinery measure).

- Alternative 1: No Market‑Based Mechanism. Instead of a cap‑and‑trade program, this approach includes a wide variety of direct regulations and incentive programs that would focus on specific industries and sources of emissions.

- Alternative 2: Carbon Tax, Plus Other Selected Measures. This approach is similar to the ARB’s proposed approach, except a carbon tax would be implemented instead of cap‑and‑trade.

- Alternative 3: Cap‑and‑Trade Only. This approach would only involve extending cap‑and‑trade.

- Alternative 4: Cap‑and‑Tax, Plus Other Selected Measures. Instead of cap‑and‑trade, ARB would implement a policy it describes as “cap‑and‑tax.” Under this approach, each entity currently covered under cap‑and‑trade would be required to reduce its emissions by a set amount each year (without allowance trading) and also pay a tax for each metric ton of GHG emissions it releases each year.

Figure 9

January Scoping Plan Alternatives to Achieve 2030 Goal

|

Options For Meeting 2030 Goals |

Estimated Cost Per Ton |

|||||

|

Proposal: Cap‑and‑Trade + Others |

Alternative 1: |

Alternative 2: |

Alternative 3: |

Alternative 4: |

||

|

Policies Enacted by the Legislature |

||||||

|

50 percent RPS |

✓ |

✓ |

✓ |

✓ |

✓ |

$100 to $300 |

|

Double energy efficiency |

✓ |

✓ |

✓ |

✓ |

✓ |

‑550 to ‑$300 |

|

Reduce SLCPs |

✓ |

✓ |

✓ |

✓ |

✓ |

N/A |

|

Demand response |

✓ |

✓ |

✓ |

✓ |

✓ |

‑200 |

|

Additional Scoping Plan Measures |

||||||

|

Market‑based approaches |

||||||

|

Extend cap‑and‑trade |

✓ |

✓ |

25 to 85 |

|||

|

Carbon tax |

✓ |

50 |

||||

|

Complementary Policies |

||||||

|

Mobile Source Strategy and Sustainable Freight Initiative |

✓ |

✓ |

✓ |

✓ |

✓ |

Less than 50 |

|

Reduce refinery emissions by 20 percent |

✓ |

✓ |

✓ |

✓ |

70 to 200 |

|

|

Reduce refinery emissions by 30 percent |

✓ |

70 to 200 |

||||

|

Increase LCFS to 18 percent |

✓ |

✓ |

✓ |

✓ |

250 |

|

|

Increase LCFS to 25 percent |

✓ |

400 |

||||

|

Increase RPS to 60 percent |

✓ |

300 to 450 |

||||

|

Reduce emissions from oil production by 25 percent |

✓ |

70 to 200 |

||||

|

Reduce other industrial emissions by 25 percent |

✓ |

70 to 200 |

||||

|

Increase renewable natural gas by 5 percent |

✓ |

300 to 1500 |

||||

|

ZEVs and vehicle retirement incentivesa |

✓ |

‑150 to 200 |

||||

|

Energy efficiencyb |

✓ |

100 to 200 |

||||

|

Other |

||||||

|

Cap‑and‑tax |

✓ |

N/A |

||||

|

aIn addition to what is included in the Mobile Source Strategy and Sustainable Freight Initiative. bIn addition to doubling energy efficiency savings, as required by Chapter 547 of 2015 (SB 350, de León). RPS = renewable portfolio standard; SLCPs = short‑lived climate pollutants; N/A = not available; LCFS = low carbon fuel standard; and ZEVs = zero emission vehicles. |

||||||

ARB Staff Proposes Cap‑and‑Trade Extension, Plus Other Direct Measures. As discussed earlier, ARB estimates that the additional policies in its Scoping Plan update will collectively need to reduce GHG emissions by 132 MMtCO2e to meet the 2030 target. Figure 10 provides the estimated emission reductions associated with each of the basic measures included in ARB’s proposed approach. ARB staff proposes to extend cap‑and‑trade, in part, because it provides entities compliance flexibility to identify the least costly emission reduction opportunities. Other benefits ARB cites are (1) certainty that the state meets its GHG targets by establishing an overall limit on emissions, (2) flexibility to allocate free allowances to help prevent emissions leakage, and (3) ability to link with other programs and encourage emission reductions in other jurisdictions.

Figure 10

ARB Staff Proposed Scoping Plan Estimated Emission Reductions

MMtCO2e

|

Range of 2030 GHG Reductionsa |

|

|

Policies Enacted by Legislature |

|

|

RPS to 50 percent |

13‑15 |

|

Double energy efficiency |

12‑14 |

|

Short‑Lived Climate Pollutant Strategy |

17‑35 |

|

Demand response |

2 |

|

Plans Developed by Administration |

|

|

Sustainable Freight Action Plan and Mobile Source Strategy |

12‑14 |

|

Additional Scoping Plan Measures |

|

|

LCFS Stringency increased to 18 percent |

4 |

|

New 20 percent refinery measure |

2‑5 |

|

Cap‑and‑trade extension |

45‑100 |

|

Total Needed to Meet 2030 Target |

132 |

|

aCompared to ARB’s business as usual projection for 2030. ARB = Air Resources Board; MMtCO2e = million metric tons of carbon dioxide equivalent; GHG = greenhouse gas; RPS = renewable portfolio standard; and LCFS = low carbon fuel standard. |

|

The primary rationale ARB provides for including the 20 percent refinery measure is to be responsive to AB 197 direction to prioritize direct emission reductions. ARB also indicates that it may reduce co‑pollutants in some of the most polluted and disadvantaged communities in the state. Based on our initial review of the plan, the rationale for including a more stringent LCFS is less clear, but ARB indicates that this proposal is part of its Mobile Source Strategy intended to help the state meet its federal regional air quality standards.

Market‑Based Approaches Likely Most Cost‑Effective

Below, we discuss why market‑based mechanisms are likely the most cost‑effective approach to achieving the state’s GHG reduction goals. In our view, achieving these goals in a cost‑effective manner becomes increasingly important as the state seeks to achieve more aggressive—and potentially more costly—2030 GHG reduction targets. We also discuss the limited information available on how effective different policies would be at achieving other legislative goals—such as reducing local air pollutants or preventing leakage.

Market‑Based Mechanisms Less Costly Than Other Measures. In the most recent Scoping Plan update, ARB estimates cap‑and‑trade would be one of the least costly approaches to meeting the 2030 goals. According to the ARB’s estimates, the refinery regulation ($70 to $200 per ton of emission reduction) and the more stringent LCFS ($250 per ton) would be much more costly than either cap‑and‑trade ($25 to $85 per ton) or a carbon tax ($50 per ton).

As noted above, we caution the Legislature about giving too much weight to these specific estimates. However, there is a large body of academic literature—including both theoretical and empirical studies—that indicates market‑based mechanisms are more cost‑effective strategies to reducing emissions than direct regulatory measures. The potential for lower costs stems from the fact that the regulated emissions sources generally have better information about which compliance strategies minimize costs for them than even the best‑informed regulator could have. Emissions sources facing relatively high costs to reduce emissions can potentially minimize their costs by choosing not to reduce their emissions, instead deciding to buy allowances (under cap‑and‑trade) or pay the tax (under the carbon tax). Emissions sources that can reduce their emissions relatively cheaply are given an economic incentive to do so, as an alternative to buying allowances or paying the tax.

Carbon Tax and Cap‑and‑Trade Address Different Types of Uncertainty. Although carbon taxes and cap‑and‑trade are both designed to encourage cost‑effective reductions, there are trade‑offs between these two approaches. A carbon tax provides relative certainty about the maximum cost of reductions because the per‑ton cost of emitting is, by definition, the dollar amount of the per‑ton emissions tax. However, there is less certainty about the quantity of emissions reductions that will result. Should regulators set the emissions tax too low, emissions may exceed targets. If regulators set the emissions tax too high, then regulated emissions sources may act to reduce emissions beyond what is required to meet the targets. In contrast to a carbon tax, a cap‑and‑trade program provides relative certainty to the regulator that over the life of the program GHG emissions will not exceed the limit. However, because the price of an allowance is determined by market forces, the cost of compliance for an emitter is less certain under a cap‑and‑trade program. The preferred approach between the two depends, in large part, on the extent to which policy makers are more concerned about emissions certainty or cost certainty.

It is also possible to design programs in ways that combine aspects of cap‑and‑trade and a carbon tax. For example, a cap‑and‑trade program that includes price floors (minimum allowance prices) and price ceilings (maximum allowance prices) can provide greater price certainty, but somewhat less emissions certainty. (We discuss price ceilings in more detail below.) Alternatively, a carbon tax rate could be adjusted upward or downward in future years if statewide emissions are above or below certain thresholds. This would enhance emission certainty and reduce price certainty.

Effects of Market‑Based Mechanisms and Direct Regulations on Other Goals Are Less Clear. Based on our initial review, there is limited evidence about how different GHG reduction policies would affect other goals the Legislature has identified, such as reducing pollution that contributes to regional and local air quality. Assembly Bill 197 requires ARB to estimate the reductions in co‑pollutants associated with different measures proposed in the Scoping Plan. The estimates provided by ARB assume that the level of GHG reductions from each policy will result in a proportional reduction in co‑pollutants. However, as ARB acknowledges, it is unclear whether such a relationship exists in all cases. Further, the design and implementation of each policy could have a significant effect on co‑pollutants. For example, choices about the extent to which out‑of‑state offsets can be used for compliance or how auction revenue is used could affect the level of co‑pollutants in California.

With respect to emissions leakage, it is unclear whether market‑based mechanisms or direct regulations would be preferred. In large part, the effects depend on the specific design of the program. For example, cap‑and‑trade has the potential to drive significant leakage, but the allocation of free allowances to certain industries can potentially minimize such leakage. It is less clear how the state would prevent leakage under alternative direct regulations that target trade‑exposed industries.

Cap‑and‑Trade Design Features Warrant Legislative Consideration

The potential benefits and costs of a cap‑and‑trade program depend, in large part, on the design of the program. (As discussed above, we think both types of market‑based mechanisms—cap‑and‑trade and a carbon tax—merit legislative consideration. However, for the remainder of this report, we focus on cap‑and‑trade because that is the proposal currently before the Legislature.) If the Legislature extends cap‑and‑trade, it will want to ensure the program is designed in a way that is consistent with legislative goals and priorities. There is no one “right” way to design a cap‑and‑trade program. The specific design involves many different technical decisions, as well as some key policy choices. In our view, ARB has made a reasonable effort to balance the various policy trade‑offs in the particular design of the cap‑and‑trade program so far. Under the Governor’s proposal, ARB would continue to have broad authority to design the program.

Given the inherent policy trade‑offs involved, there are a number of key design features that warrant review and potentially additional direction from the Legislature. These include strategies for allocating allowances, the use of offsets, and linking the program with other jurisdictions. We discussed many of these key design features and the major trade‑offs in our 2012 report, Evaluating the Policy Trade‑Offs in ARB’s Cap‑and‑Trade Program. Below, we highlight one key issue that we think the Legislature should make a high priority as it considers the Governor’s proposal to extend the program: price volatility, particularly extreme price increases.

Options for Reducing Extreme Price Increases. The basic options for limiting the potential that prices in a cap‑and‑trade market exceed a predetermined level are:

- Hard Price Ceiling. The state could set an upper limit on allowance prices and allow businesses to buy an unlimited number of allowances at the predetermined maximum price. This would ensure that market prices do not exceed the maximum price, but the level of emissions would exceed the cap if businesses purchased these additional allowances.

- Soft Price Ceiling. The government could make available a small share of allowances at a specified price. This could moderate potential price spikes while also ensuring emissions do not exceed the cap. The specified price is considered a “soft” ceiling because it is still possible for market prices for allowances to exceed the ceiling if all of the additional allowances are purchased. ARB has adopted this approach by depositing a limited number of allowances in its Allowance Price Containment Reserve and making them available at three different price tiers (currently $51 to $63).

Economic Advisors Suggest Potential Price Volatility, Recommend Stronger Price Ceiling. Based on modeling on cap‑and‑trade through 2020 done by a group of economic advisors to ARB, there is potential for significant price volatility in the cap‑and‑trade market. The researchers found that allowance prices are likely to be either near the minimum price established by ARB or the soft price ceiling, but not as likely to be in the intermediate range (for example, $30). In addition, it is possible that future prices could exceed the current soft price ceiling. Some of the factors that contribute to potential price volatility are (1) BAU emissions uncertainty and (2) the presence of complementary policies. In light of this volatility, the economic advisors recommended strengthening the price ceiling by issuing additional (perhaps unlimited) allowances at some predetermined price.

Trade‑Offs Associated With Establishing Stronger Price Ceiling. High allowance prices are not an inherently bad outcome and, in fact, might be necessary to encourage the types of activities that are needed to reach the state’s GHG goals. However, a stronger price ceiling has several advantages. First, it ensures more predictable allowance prices, which helps businesses and households make more effective decisions about potential long‑term GHG reduction investments. Second, a strong price ceiling could serve as a more effective cost‑containment mechanism by ensuring prices, and thereby GHG reduction costs, do not exceed a threshold that policy makers deem unreasonable. Finally, according to the economic advisors, a stronger price ceiling would help reduce the risk of market price manipulation because, if prices cannot exceed a certain level, it limits the potential for market participants to obtain a large share of allowances to drive up market prices.

The primary downside to a hard price ceiling is that there is less certainty that emissions will remain below the cap because the state would have to issue additional allowances if market prices exceeded the ceiling. This is an important trade‑off for the Legislature to consider. However, there may be other ways to reduce the additional emissions that could result from the hard price ceiling. For example, the state could potentially use some of the auction revenue from the sale of the additional allowances to purchase less costly allowances in other jurisdictions.

LAO Recommendations

Authorize Cap‑and‑Trade Beyond 2020. We recommend the Legislature authorize a market‑based mechanism to meet its 2030 GHG goals. This could be either a cap‑and‑trade program, as proposed by the Governor, or a carbon tax. Either approach is likely to be a cost‑effective way to achieve the state’s GHG targets. Without a market‑based approach, the state would likely have to implement more costly policies. Given the advantages of such an approach, the Legislature might want to direct the administration to implement cap‑and‑trade (or a carbon tax), rather than simply providing it the option of implementing it as is the case under current law.

Strengthen the Price Ceiling. We recommend the Legislature direct ARB to strengthen the allowance price ceiling. This is consistent with a recommendation from ARB’s own economic advisors. This approach creates some risk that overall emissions would exceed the limit established by ARB. However, it would reduce price volatility and potentially help limit the overall costs of the program. This is especially important given the significant uncertainty around the future costs of meeting the state’s more aggressive 2030 GHG goals. The Legislature should also consider specifying the level of the price ceiling. This price ceiling could be higher or lower than the current one. The Legislature would want to set the price ceiling at a level at which any higher market prices would be deemed to be too costly to businesses and households.

Provide Clearer Direction on Role of Complementary Policies. We recommend the Legislature direct ARB to include complementary, or direct, measures in the Scoping Plan only if it can adequately demonstrate that they would achieve a specific legislative goal more effectively than market‑based approaches. Complementary policies are generally much more costly approaches to reducing GHGs. It is possible that these policies achieve other legislative goals—such as reducing more co‑pollutants in disadvantaged communities—or provide more efficient incentives for GHG reduction activities in certain circumstances. However, ARB provides limited evidence that the proposed complementary policies present such trade‑offs and, thus, why they would be preferred to market‑based approaches. Alternatively, instead of implementing complementary policies targeted at GHG reductions, the Legislature could establish new policies or expand existing policies that more directly target these other goals.

Ensure Oversight and Evaluation of Major Climate Policies. We recommend the Legislature take steps to ensure there is adequate oversight and evaluation of state climate policies. To date, there have been no robust evaluations of the overall statewide effects—including on GHG reductions, costs, and co‑benefits—of most of the state’s major climate policies and spending programs. As we have recommended in previous reports, the Legislature should consider creating an independent committee of outside experts, including academic researchers and economists, to provide ongoing guidance to the administration and the Legislature and help evaluate California’s climate policies. Such a committee appears to be consistent with the authority AB 197 provided to establish the Joint Legislative Committee on Climate Change Policies to create an independent panel of experts.

Is a Two‑Thirds Vote Needed to Extend Cap‑and‑Trade?

The Governor proposes to extend the cap‑and‑trade program beyond 2020 with a two‑thirds vote. The Governor states that the rationale for requesting a two‑thirds vote for an extension is to enact the measure immediately with an urgency clause in order to provide greater certainty to the market regarding the ongoing nature of the cap‑and‑trade program. While providing greater market certainty would be beneficial, we find that the two‑thirds vote raises larger legal and policy questions. Below, we compare a cap‑and‑trade program with a two‑thirds vote to one that is authorized with a simple majority vote.

Two‑Thirds Vote Would Provide More Certainty and Flexibility

Cap‑and‑Trade Could Be Extended With a Simple Majority Vote. The Legislature could authorize cap‑and‑trade beyond 2020 with a simple majority vote. This would eliminate the legal uncertainty about ARB’s ability to operate the program beyond 2020. However, there would continue to be legal uncertainty about ARB’s ability to auction allowances. It is important to note that the legal uncertainty would likely continue even if the courts ruled in favor of the state in the case challenging ARB’s authority to auction allowances. This is because the plaintiffs are challenging ARB’s current authority provided under Proposition 13. However, new legislation authorizing auctions would be subject to Proposition 26 requirements.

The ability to auction allowances is an important design feature of a cap‑and‑trade program. If the courts determined that ARB could not auction allowances, the ARB would have to give all of the allowances away for free. This would limit the state’s flexibility to design the most effective program. In theory, the method of distributing allowances has no direct effect on the overall level of emissions or cost of emission reductions. This is because the overall level of emissions cannot exceed the number of allowances issued, regardless of how the allowances are initially distributed. Also, each company still has an incentive to reduce emissions if doing so is less than the price of an allowance in the market. However, the distribution of allowances can have significant indirect effects, such as effects on leakage of emissions to outside of California and how the costs and benefits of the program are distributed.

In general, economists recommend auctioning allowances rather than giving them away for free. This is because auctions are considered a more transparent, equitable, and efficient method of distributing allowances. (For more detailed information on the potential benefits of auctioning allowances, please see the box.) The primary exception to this recommendation is giving away allowances for free to certain industries to prevent leakage. Free allocations to prevent leakage can help ensure the program is reducing overall emissions by ensuring emissions are not simply shifted to other states or countries.

Economic Advisory Committee Recommended Auctioning Allowances

Economists generally recommend auctioning allowances, rather than giving them away for free. For example, an economic advisory committee established by the Air Resources Board in 2010 recommended relying principally on auctioning as the mechanism for distributing allowances. Some of the advantages of auctions include:

- Easier Treatment for New Entrants. Auctions treat new and existing companies equally because they all have to purchase allowances. New companies see the same cost as competitors when entering the market. In contrast, giving allowances away for free could create an advantage for existing companies if free allowances are based on previous production in California.

- Maintains Price Signal. Under auctions, companies that have to pay for allowances will often pass those costs on to customers in the form of higher prices. From an economic perspective, this is an advantage because it provides an incentive for households and businesses to identify cost‑effective opportunities to reduce emissions. In contrast, free allocations based on a company’s production can prevent product prices from rising. This reduces the incentive for consumers to buy less greenhouse gas (GHG)‑intensive products. If consumers no longer have a financial incentive to purchase less GHG‑intensive products then other, more expensive, reduction activities might need to be undertaken.

- Avoids Windfall Profits for Companies. In certain circumstances, giving allowances away for free can result in “windfall profits” for certain companies if the value of the allowances they receive is significantly greater than the costs of complying with the regulation. This may be viewed as an unfair distribution of allowance value. Windfall profits for companies do not occur under auctions.

- Opportunities to Reduce Taxes. Auction revenue can be used to provide economic benefits. For example, in theory revenue could be used to reduce broad‑based taxes (such as income or sales taxes), which could help reduce negative impact on economic activity.

The one instance in which the committee recommended giving allowances away for free was to prevent leakage for certain industries. Allocating free allowances to certain companies based on their level of production can reduce companies’ incentive to shift production to other states. Under this approach, the state effectively provides these companies a subsidy for each unit of production in California—in the form of free allowances—to encourage them to continue to produce in California. While this can be an effective strategy for reducing leakage, the committee also noted that the state could accomplish the same objective by auctioning the allowances and using the resulting revenue to encourage production in California. For example, the state could use the revenue to provide targeted tax breaks to certain industries.

In addition, even if the courts determined ARB could auction allowances beyond 2020 under legislation passed with a simple majority vote, the Legislature would likely be required to spend the revenue on activities that reduce GHG reductions. This is because the state would have to maintain a nexus between the fee paid and how the resulting revenue is used, as required under Proposition 26. As we discuss in more detail below, this requirement limits the Legislature’s flexibility to use the funds on its highest priorities.

Two‑Thirds Vote Would Give Greater Ability to Design an Effective Program. Extending the cap‑and‑trade program with a two‑thirds vote would remove legal uncertainty about ARB’s authority to auction allowances. The ability to auction allowances would allow the state to operate a more effective program for the reasons discussed above. In addition, a two‑thirds vote would allow the Legislature to remove the requirement that cap‑and‑trade auction revenues be limited to use on activities that reduce GHG emissions. Instead, as we discuss in more detail below, the Legislature could authorize a broader set of allowable uses for those revenues based on its priorities.

LAO Recommendations

Approve Cap‑and‑Trade With a Two‑Thirds Vote. We recommend the Legislature approve cap‑and‑trade (or a carbon tax) with a two‑thirds vote. Extending cap‑and‑trade with a two‑thirds vote would remove legal uncertainty about the ARB’s ability to auction allowances, which is generally seen as an important feature of a well‑design cap‑and‑trade program. Also, with a two‑thirds vote, the Legislature could broaden the allowable uses of the funds and have greater flexibility to use the revenue on its highest priorities.

How Should Cap‑and‑Trade Revenue Be Used?

As the Legislature considers how to use cap‑and‑trade auction revenue, it is important to keep in mind that the primary goal of a cap‑and‑trade program is to provide an economy‑wide incentive for businesses and consumers to undertake cost‑effective emission reductions. This is accomplished through establishing a price on emissions, not spending auction revenue. From an economic perspective, auction revenues are often thought of as a by‑product of cap‑and‑trade programs, not the goal of the program. Below, we discuss (1) the administration’s revenue assumptions and how various factors could affect future revenue, (2) potential options for using revenue if the program is approved with a two‑thirds vote, and (3) our concerns about the Governor’s proposed approach to spending auction revenue.

Revenue Projections Plausible, but Significant Uncertainty Remains

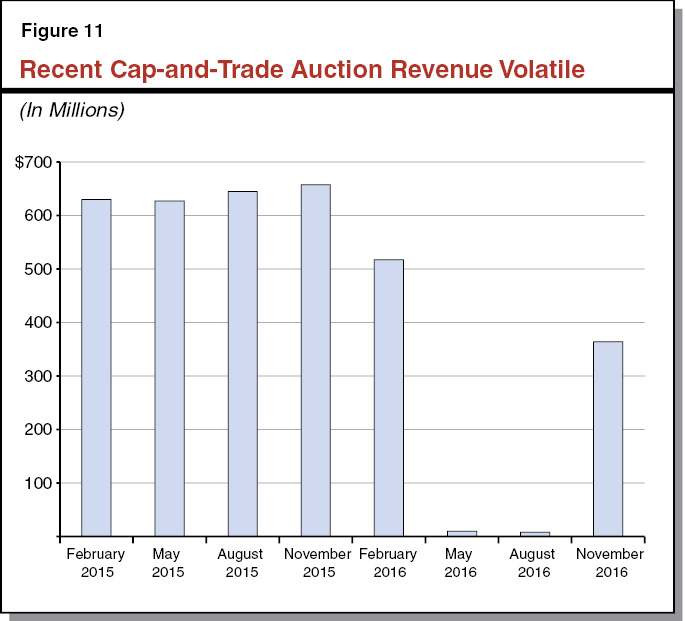

The Governor’s budget assumes $1 billion in auction revenue in 2016‑17 and $1.5 billion in 2017‑18. In our view, the administration’s revenue assumptions are plausible, but there is substantial uncertainty. Figure 11 shows the volatility in quarterly auction revenue over the last couple of years since fuel suppliers were required to obtain allowances. Notably, there was a substantial decrease in revenue collected at the May and August 2016 auctions. Several factors likely contribute to this volatility, including (1) an oversupply of allowances because emissions are below the cap, (2) uncertainty related to the ongoing court case challenging the legality of state‑auctioned allowances, and (3) uncertainty about ARB’s legal authority to continue cap‑and‑trade beyond 2020. Results from the next two auctions will be available by June and provide some additional revenue clarity before the Legislature adopts a budget for 2017‑18. However, estimates of 2017‑18 revenue will continue to be subject to substantial uncertainty.

Actions by the courts or the Legislature that provide legal clarity about the future of the program could have significant effects on future auction revenue. For example, the Legislature extending the program with a two‑thirds vote would provide greater certainty that the program would exist beyond 2020. We note that ARB has proposed regulatory changes to extend the program beyond 2020. Under these proposed changes, allowances can be banked and used for post‑2020 compliance. If the cap is expected to limit emissions beyond 2020, a statutory extension of the program would very likely increase demand for allowances and state revenue. The change in market conditions could happen almost immediately after the Legislature takes action, or possibly even before. In light of some of the potential price volatility explained earlier, and the more substantial role cap‑and‑trade might play in the future, annual state revenue could be billions of dollars higher than assumed in the Governor’s budget.

Two‑Thirds Vote Gives Flexibility to Broaden Potential Uses of Revenue

Under current law (and potentially under future court decisions), the state can only spend auction revenue on activities that facilitate GHG reductions. However, as we discussed in our 2016 report Cap‑and‑Trade Revenue: Strategies to Promote Legislative Priorities, this requirement creates some significant policy challenges. First, if a cap‑and‑trade program is in place, spending auction revenue only on GHG reductions is not necessary to meet the state’s GHG goals and likely increases the overall costs of emission reduction activities. This is because, if the cap is limiting emissions, spending on GHG reductions interacts with the regulation in a way that changes the types of emission reduction activities, but not the overall level of emission reductions. Second, the requirement to spend on GHG reductions limits the Legislature’s flexibility to use the revenue in a ways that could achieve other goals.

Authorizing the program with a two‑thirds vote would give the Legislature ability to remove the requirement that auction revenue be used only on activities that reduce GHGs. The Legislature could use the funds to (1) offset higher costs for households and businesses associated with higher energy prices by providing tax reductions or rebates, (2) promote other climate‑related policy goals, such as climate adaptation activities, and/or (3) promote other legislative priorities unrelated to climate policy. Returning the revenue by reducing other taxes or providing rebates could become even more important if allowance prices increase in the future—thereby increasing energy costs for households and businesses.

Broadening the allowable uses of the revenue would almost certainly make the auctions a tax under Proposition 26. As such, it raises some questions about what additional constitutional requirements might affect the state’s collection and use of cap‑and‑trade revenues. For example, if auction proceeds are tax revenues, they would count towards the state’s appropriations limit established by Proposition 4 in 1979.

Governor’s Proposal Limits Legislative Authority

Governor’s Proposal Unnecessarily Restricts Legislature’s Spending Authority. The issues of ongoing authority for cap‑and‑trade and how to spend auction revenues are related, and it is reasonable to consider them together. For example, as described above, extending cap‑and‑trade with a two‑thirds vote would give the Legislature a much wider range of spending options to consider. However, the Governor’s proposal unnecessarily restricts Legislative spending authority. The Legislature does not have to make budget allocations in 2017‑18 contingent on future legislation to extend cap‑and‑trade. It currently has the authority to appropriate this funding regardless of whether it adopts the Governor’s proposed policy change to extend cap‑and‑trade.

Proposed Control Section Gives Too Much Spending Authority to Administration. The Governor’s budget allocates $1.3 billion in discretionary funding through what is known as a control section. As currently proposed, the control section specifies the amount that would go to general types of activities—such as carbon sequestration, energy efficiency, or short‑lived climate pollutants—but it would give DOF the authority to allocate the funds to specific departments and programs. It is not clear which departments or programs would receive the funds or whether the allocations made by DOF would be consistent with the Legislature’s priorities. According to DOF, the administration anticipates revising the proposal to allocate funds to more specific programs based on discussions with the Legislature.

The control section also directs DOF to make quarterly allocations on a proportional basis to the different categories based on the amount of available funds. According to DOF, this provision was included to ensure allocations did not exceed revenue in light of the revenue uncertainty. In our view, the administration’s concern about potential revenue uncertainty is reasonable. However, the Legislature has other options to address revenue uncertainty. For example, the Legislature could allocate the funds that are available at the end of 2016‑17, plus a small portion of expected 2017‑18 revenue. Another option would be for the Legislature to use funding “buckets” that designate which programs receive allocations first, and which programs receive allocations only if sufficient revenue is collected.

LAO Recommendations

Broaden Allowable Uses of Revenue. We recommend that the Legislature broaden the potential uses of auction revenue by removing the requirement that auction revenue be spent on GHG reduction activities. This would give the Legislature flexibility to use the revenue to offset higher costs for households or business or spend the auction revenue on its highest priorities. This approach would almost certainly require a two‑thirds vote of the Legislature. We suggest the Legislature make a high priority spending strategies that would offset higher future energy costs associated with the program, such as reducing other taxes or providing rebates to households and businesses. This is because collecting revenue for state programs is not a goal of the program and extending the program to 2030 could result in a significant increase in energy costs. In addition, if the Legislature broadens the potential uses of the funds, we recommend that it consider how all revenue should be prioritized—including the portion of revenue that is that is currently continuously appropriated—because there could be higher priority uses that are not allowed under the current legal requirements.

Reject Language Making Spending Contingent on Future Legislation. We recommend rejecting the proposed budget bill language that would make cap‑and‑trade allocations contingent on legislation extending the cap‑and‑trade program. It is reasonable to consider how to spend auction revenue in the context of a broader discussion about the long‑term future of the cap‑and‑trade program. However, the proposed language unnecessarily restricts legislative spending authority. If a decision is not made about the future of cap‑and‑trade by the time the 2017‑18 budget is passed, the Legislature should still consider allocating auction revenues based on its spending priorities.

Consider Alternative Strategies for Dealing With Revenue Uncertainty. We recommend the Legislature consider alternative approaches to dealing with auction revenue uncertainty. The administration’s proposal to give DOF authority to adjust allocations proportionally addresses a reasonable concern, but the Legislature might want to prioritize certain programs over others. Accordingly, we recommend the Legislature consider various options, such as using funding buckets to ensure the highest priority programs receive allocations first.

Allocate Funds to Specific Programs. We recommend the Legislature allocate funds to specific departments and programs, rather than allocating to general categories of programs and providing DOF authority to select specific programs (as proposed by the Governor). The current proposal delegates to DOF spending authority that is more appropriately the Legislature’s. Making this modification would ensure the allocations are consistent with legislative goals and priorities.

Conclusion

The Governor’s proposal raises a wide variety of important policy and oversight issues for the Legislature to consider. Based on our review of the available information, we recommend the Legislature authorize cap‑and‑trade (or a carbon tax) beyond 2020 with a two‑thirds vote, provide additional direction to ARB intended to improve the design of the program and ensure the polices it implements are consistent with legislative goals and priorities, and broaden the potential uses of the revenue so it can be used to promote the Legislature’s highest priorities.