March 2020 State Tax Collections

April 20, 2020

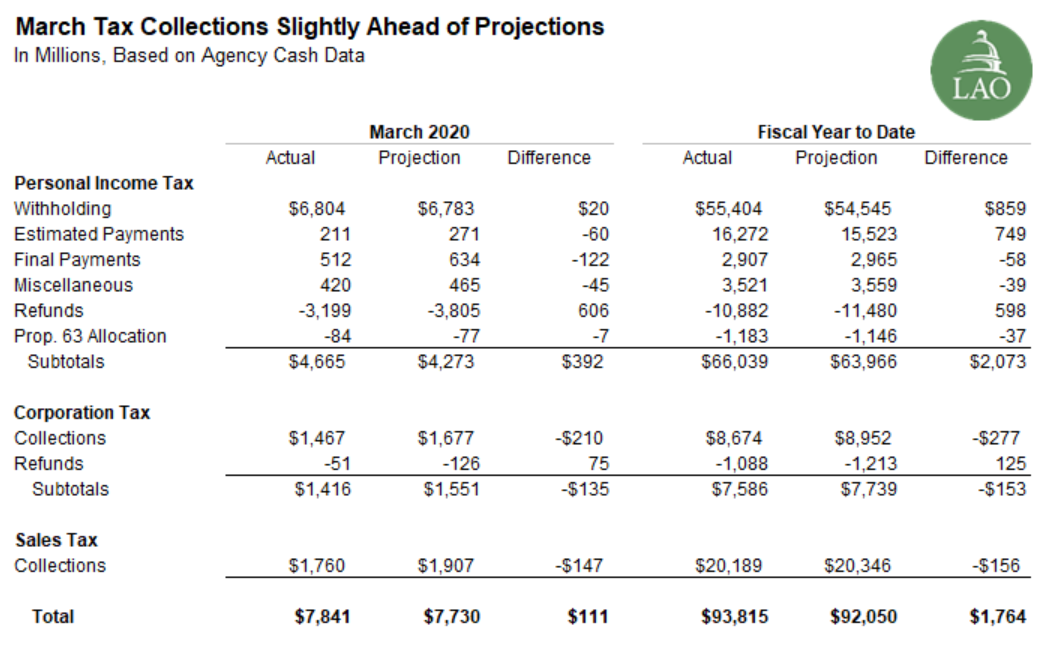

March revenue collections from the state’s three largest taxes—the personal income tax, corporation tax, and sales tax—were ahead of Governor’s Budget projections by $111 million. Many components of these revenue streams—including personal income tax estimated and final payments, corporation tax estimated payments, and sales tax collections—were down in March. These underperforming components were more than offset by lower than anticipated payments to taxpayers for personal income tax and corporation tax refunds. Refunds may be lower than anticipated, in part, because taxpayers are delaying filling out their 2019 tax returns. Taxpayers may be waiting to do their taxes both because of delays in federal and state tax deadlines and because of general uncertainty created by the COVID-19 pandemic.