In This Report

LAO Contact: Ann Hollingshead

February 19, 2016

The 2016-17 Budget

The Governor's Reserve Proposal

Summary

The Governor’s 2016–17 budget proposal reflects a state fiscal position that continues to improve. However, an economic downturn would result in the deterioration of this favorable situation, perhaps rapidly and in the near future. To help prepare the state for the next downturn, the Governor proposes building more reserves than are constitutionally required. In this publication, we summarize the administration’s estimate for constitutionally required reserve deposits in this year’s budget process. We then analyze the administration’s strategy for building additional reserves. While we concur with the Governor’s overall approach of building a robust level of total reserves, we find that his proposal to deposit optional amounts into the state’s rainy day fund would limit legislative control. At the same time, keeping optional amounts in the reserve over which the Legislature has more control could trigger tax provisions that would reduce reserves. To allow the Legislature to effectively build reserves while preserving legislative control we offer two alternatives: (1) create a new reserve fund, or (2) prepay some 2017–18 bond debt service.

Background

State Has Two Budget Reserves. The state has two budget reserves: the Special Fund for Economic Uncertainties (SFEU) and the Budget Stabilization Account (BSA). Both reserves help insulate the budget from situations where revenues underperform budget assumptions. The SFEU is the state’s discretionary budget reserve—that is, the Legislature at any time can appropriate funds in the SFEU for any purpose by majority vote. Unlike the SFEU, use of funds in the state’s rainy day fund—the BSA—is more restricted. The State Constitution has specific rules regarding how and when the state must make deposits into or may make withdrawals from the BSA.

Budget Stabilization Account

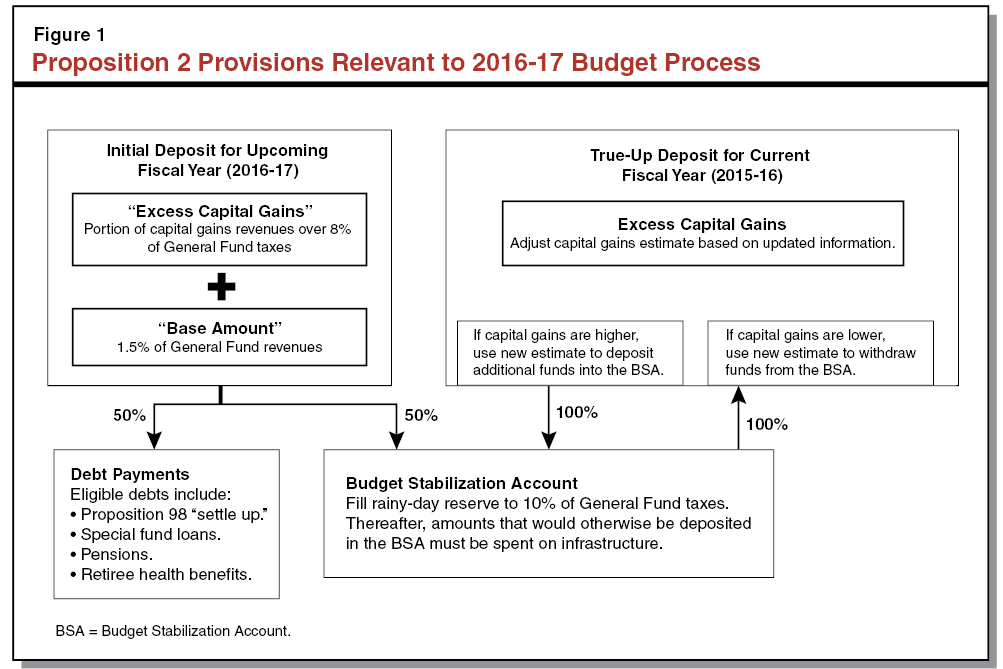

Proposition 2. Proposition 2 (2014) establishes a minimum amount that the state must use to build reserves and pay down debts each year. That amount is determined as follows. First, the state must set aside 1.5 percent of General Fund revenues (we refer to this as the “base amount”). Second, the state must set aside a portion of capital gains revenues that exceed a specified threshold (we refer to this as “excess capital gains”). The state combines these two amounts and then allocates half of the total to pay down eligible debts and the other half to increase the balance of the BSA. While debt payments are mandatory, Proposition 2 allows the state to reduce reserve deposits in a “budget emergency,” as we describe in more detail below.

Budget Emergency Provisions Limit Legislative Control Over BSA Reserve. Under Proposition 2, the Legislature can only reduce the BSA deposit, or make a withdrawal from the BSA reserve, in the case of a budget emergency. A budget emergency can only occur upon declaration by the Governor and majority votes of both houses of the Legislature. The Governor may call a budget emergency in two cases: (1) if estimated resources in the current or upcoming fiscal year are insufficient to keep spending at the level of the prior three budgets, adjusted for inflation and population (a “fiscal budget emergency”) or (2) in response to a natural disaster. In the case of a fiscal budget emergency, the Legislature may only withdraw the lesser of: (1) the amount needed to maintain General Fund spending at the highest level of the past three enacted budget acts, or (2) 50 percent of the BSA balance.

Constitution Requires “True Up” of BSA Deposits. Under Proposition 2’s true–up provisions, the state reevaluates each year’s BSA deposit twice: once in each of the two subsequent budgets. The state does this because initial estimates of future capital gains revenues are highly uncertain. This process attempts to align those original estimates with actual revenues. Under these reevaluations, the state revises the BSA deposit up or down if excess capital gains taxes are higher or lower than the state’s prior estimates. This year, as shown in Figure 1, the state will make its first true–up deposit for 2015–16, in addition to an initial deposit for 2016–17. The state does not revisit its estimate of the base amount in the true–up calculation; it only revisits the excess capital gains component of the estimate. In addition, the state does not adjust debt payments when new capital gains estimates are available later, which means that all of the revised estimate affects reserves rather than debt payments.

Constitutional Deposits Continue Until BSA Reaches Maximum Size. Under Proposition 2, the state must put money into the BSA until its total reaches a maximum amount of 10 percent of General Fund taxes. Currently, this maximum level is about $12 billion. Once the BSA reaches this maximum, funds that would have been transferred into the BSA must be expended on building and maintaining infrastructure.

Administration’s Estimates for 2016–17 Required Reserves. The administration estimates that constitutionally required deposits into the BSA will total $2.6 billion in 2016–17. This includes a $1 billion true–up deposit for 2015–16 and a $1.6 billion initial deposit for 2016–17. These deposits would build on the BSA’s current balance of $3.5 billion. The administration also estimates Proposition 2 will require $1.6 billion in debt payments, which we will discuss in more detail in an upcoming publication. (We detail the administration’s Proposition 2 estimates in the Appendix.)

Estimates for 2016–17 Initial Deposit and 2015–16 True–Up Deposit Will Change. The estimates of required BSA reserve deposits will change when the administration releases its revised budget plan in May 2016. Moreover, during next year’s 2017–18 budget process, the state will revisit both of this year’s deposit estimates again in a second true–up deposit for 2015–16 and a first true–up deposit for 2016–17.

Special Fund for Economic Uncertainties

SFEU Is the State’s Discretionary Reserve. Like the BSA, SFEU reserves help minimize actions necessary to address a budget shortfall arising from revenues underperforming budget assumptions. Unlike the BSA, the Legislature can appropriate all funds in the SFEU at any time and for any purpose. That is, SFEU funds are not subject to the restrictions that apply to the BSA. This means, for example, that the Legislature could use SFEU funds to cover a revenue shortfall that may be too small to trigger Proposition 2’s fiscal budget emergency. Moreover, the Legislature could use funds from the SFEU to cover an unexpected increase in program costs or to augment programs in a future budget. The 2015–16 budget plan assumed 2015–16 would end with a $1.1 billion SFEU reserve.

Large SFEU Balance Triggers Automatic Reserve Reductions. California has two statutes that trigger reductions in the state’s sales tax rate if balances in the SFEU reach a certain threshold. Under either statute, the state’s sales tax rate would automatically decline by one–quarter cent for one calendar year, equal to around $1.5 billion. Under the first statute, the trigger would occur if the Director of Finance projects the SFEU to exceed about 4 percent of General Fund revenues (currently, about $5 billion) in the prior and current year. Under the second statute, the trigger would occur if (1) the “General Fund reserve” exceeds about 3 percent of revenues (currently, $4 billion) and (2) actual General Fund revenues between May 1st and September 30th exceed the administration’s forecasted amounts. These provisions make it challenging for the Legislature to build discretionary reserves because, if the SFEU reaches one of these thresholds, its balance will automatically shrink.

Back to the TopGovernor’s Reserve Proposal

Governor Proposes Over $10 Billion in Reserves. In addition to $4.6 billion in reserves assumed in the 2015–16 budget, the administration estimates that constitutionally required deposits in the 2016–17 budget process will total $2.6 billion. Under these assumptions, the Legislature enters the 2016–17 budget process with an estimated $7.1 billion in required reserves. In addition to these balances, the Governor proposes increasing reserves by an optional $3.1 billion. This includes an increase in the balance of the SFEU by $1.1 billion and an optional deposit of $2 billion into the BSA. Under the Governor’s proposal, the SFEU balance would grow to $2.2 billion. Meanwhile, the BSA balance would grow to $8 billion, $4 billion below the current maximum BSA balance. As shown in Figure 2, under the Governor’s plan, by the end of 2016–17 reserves would total $10.2 billion.

Figure 2

Governor Proposes Reserves of Over $10 Billion

(In Billions)

|

Reserves Assumed in 2015–16 Budget |

$4.6 |

|

Required Reserves |

|

|

BSA true–up deposit for 2015–16 |

$1.0 |

|

BSA initial deposit for 2016–17 |

1.6 |

|

Subtotal, Required Reserves |

($2.6) |

|

Optional Reserves |

|

|

2016–17 proposed increase in SFEU |

$1.1 |

|

2016–17 additional BSA deposit |

2.0 |

|

Subtotal, Optional Reserves |

($3.1) |

|

Total Reserve Balances |

$10.2 |

|

BSA = Budget Stabilization Account and SFEU = Special Fund for Economic Uncertainties. |

|

Optional $2 Billion Deposit Subject to Proposition 2 Rules. Under the Governor’s proposal, the $2 billion optional BSA deposit would be subject to the rules of Proposition 2. First, this deposit would be accessible only in a budget emergency. Second, the Legislature could only access up to half of these funds in the first year of a budget emergency. Finally, this deposit would be subject to the maximum reserve level for the BSA.

Governor Proposes Using $2 Billion Optional BSA Deposit in Case of Future True Ups. The Governor proposes that the Legislature use the $2 billion optional BSA deposit for meeting reserve requirements for 2015–16 and 2016–17 that exceed current estimates. That is, these funds would be available in the June 2015 budget plan or in future budgets to cover higher BSA deposit requirements. If future revisions and true ups are less than $2 billion, the administration proposes that the outstanding funds remain in the BSA.

Back to the TopLAO Comments

Governor’s Proposal

Placing Additional $2 Billion in BSA Would Limit Legislative Control. As we noted above, once the Legislature deposits funds into the BSA, it may only access those funds if specific budget emergency conditions exist and the Governor calls a budget emergency. Moreover, even in the case of a budget emergency, the amount of a withdrawal may not exceed 50 percent of the BSA balance in the first year. These requirements limit the Legislature’s ability to access these funds for small revenue shortfalls that do not trigger a budget emergency, unanticipated expenditure increases, or for any other legislative priorities. Moreover, if the conditions for a budget emergency exist but the Governor chooses not to call a budget emergency, the Legislature would be precluded from accessing any portion of the funds.

Unclear True Ups Can Be Prefunded in the BSA. Proposition 2 does not envision prefunding future true ups using existing BSA balances. Rather, the provisions of Proposition 2 state that true–up deposits are transferred from the General Fund. Given these constitutional rules, it is not at all clear that the Constitution allows for true ups to be prefunded in the BSA as the administration proposes. If the Legislature accepts the Governor’s proposal but later is unable to use BSA balances for true ups, the Legislature may be forced to use even more discretionary resources for future true–up deposits.

Alternatives

Consider Other Options for Additional Reserves. The Governor’s emphasis on reserves in this budget is appropriate. Prioritizing reserves now will help the state weather the next recession with minimal disruption to public programs. However, the Governor’s proposal to deposit an additional $2 billion into the BSA would limit the Legislature’s control over those funds. Normally, leaving these additional funds in the SFEU would be one logical alternative to this proposal. As we have noted, however, a large SFEU balance would trigger automatic reductions in that reserve. Given this constraint, and if the Legislature wishes to use these funds to build more reserves, we offer two alternatives below that would allow the Legislature to build more reserves while preserving legislative control.

Create New Reserve Fund. Rather than depositing additional funds into the BSA or leaving them in the SFEU, the Legislature could create a new reserve fund. The Legislature could determine the rules for the use of these funds as it considers appropriate, including whether the new reserve should be counted in the sales tax trigger calculations. Like the Governor’s proposal, the Legislature could apply these funds toward meeting future true–up requirements, but still maintain flexibility over when and how to use them in the future.

Use Additional Funds to Prepay Some 2017–18 Bond Debt Service. Each year, the state must pay debt service on its outstanding bonds. For example, the 2015–16 budget provided about $5 billion from the General Fund for general obligation bond debt service this fiscal year. Under this option, the Legislature could use $2 billion—or any other amount that it considers appropriate—to prepay a portion of the 2017–18 bond debt service. Prepaying debt service in this way would free up a like amount of resources in the 2017–18 budget. During the 2017–18 budget process, the Legislature would have the choice to either continue to prepay a portion of an additional year of debt service (2018–19)—that is, defer the savings another year—or to use the savings in the 2017–18 budget for any legislative priority. As with the alternative above, the funds could also be used to meet future true–up requirements. Similar to a reserve, this option would preserve legislative control over these funds while retaining them for the state’s future needs, should revenues unexpectedly decline.

Back to the TopConclusion

Establish a Reserve Target. The Governor has proposed a $10 billion reserve for the end of 2016–17. We encourage the Legislature to establish its own target for budget reserves for the end of 2016–17, and the Governor’s reserve level is a good starting point. There is, however, no “right” level of reserves. In determining its reserve target, the Legislature will want to consider its own priorities and its own determination of the future likelihood and magnitude of an economic downturn.

Plan for Unforeseeable Budgetary Risks. California has enjoyed remarkable economic growth over the past several years and its budget position continues to improve. However, the state may be reaching the end of this long economic expansion. Given the state’s volatile revenue structure and other unforeseeable risks, we encourage the Legislature to adopt a robust target for budget reserves for the end of 2016–17.

Maximize Legislative Control. After the Legislature determines its target level of budget reserves for the end of 2016–17, we advise it to prioritize legislative control in deciding where to keep its reserves. There are trade–offs associated with reserving additional funds in either the SFEU or the BSA. The Legislature has limited control over funds in the BSA. Meanwhile, leaving reserves in the SFEU may limit the Legislature’s ability to build discretionary reserve balances. In this report, we have outlined two alternatives for building additional reserves. These alternatives would allow the Legislature to effectively build reserves in preparation for the next economic downturn while preserving legislative control.

Back to the TopAppendix

Administration Estimates Proposition 2 Requirements for 2016–17 Are $3.1 Billion. Figure A1 summarizes the administration’s Proposition 2 estimates. There are two components that determine the total Proposition 2 requirements each year. First, the base amount is equal to 1.5 percent of General Fund revenues and transfers. The administration estimates this amount to be $1.9 billion. Second, excess capital gains equal capital gains taxes exceeding 8 percent of General Fund taxes, minus the amount by which those revenues increase the Proposition 98 minimum guarantee. The administration estimates that $1.2 billion in excess capital gains will be captured by Proposition 2 in 2016–17. As shown in the figure, the administration estimates the total Proposition 2 requirement in 2016–17 is $3.1 billion. Of this total, half would be deposited into the BSA while the other half must be allocated to pay down eligible debts.

Figure A1

Summary of Administration’s 2016–17 Proposition 2 Requirements

(In Millions)

|

Base amount |

$1,863 |

|

Excess capital gains captured by Proposition 2 |

1,249 |

|

Totals, Proposition 2 Requirement |

$3,112 |

|

Deposit into Budget Stabilization Account |

$1,556 |

|

Debt payments |

1,556 |

Administration Estimates $1 Billion True–Up Requirement for 2015–16. Under Proposition 2’s true–up provisions, the state reevaluates each year’s initial BSA deposit twice: once in each of the two subsequent budgets. Under these reevaluations, the state revises the BSA deposit up (or down) if excess capital gains taxes are higher (or lower) than the state’s prior estimates. In other words, if the initial estimate was too low, the Legislature must make an additional BSA deposit, whereas if the estimate was too high, the difference is transferred back into the General Fund. As shown in Figure A2, the administration estimates that Proposition 2 requires the state to make a $995 million true–up deposit into the BSA in the 2016–17 budget.

Figure A2

Administration’s Estimates of Proposition 2 True Up for 2015–16

(In Millions)

|

Total taxes from capital gains |

$13,377 |

|

Amount equal to 8 percent of all General Fund taxes |

–9,616 |

|

Subtotal, Capital Gains Taxes Over 8 Percent Threshold |

($3,761) |

|

Less Proposition 98 share |

–$810 |

|

Subtotal, Excess Capital Gains Captured by Proposition 2 |

($2,951) |

|

Less capital gains portion of debt appropriations made in 2015–16 budget |

–$978 |

|

Less capital gains portion of previous BSA deposit |

–978 |

|

Total, True–Up Deposit Into the BSA |

$995 |

|

BSA = Budget Stabilization Account. |

|

Administration’s Estimates for 2016–17 Required Reserves. Under the administration’s estimates, the state would deposit $2.6 billion into the BSA reserve in 2016–17. This consists of the $1.6 billion deposit for 2016–17 and the $995 million true–up deposit for 2015–16 described above. Combined with the $1.6 billion BSA deposit made in 2014–15, and the $1.9 billion deposit made in the June 2015 budget package, the BSA would end 2016–17 with a $6 billion balance. In addition, the Governor proposes an optional $2 billion BSA deposit. As shown in Figure A3, these deposits would together bring the estimated BSA balance to about $8 billion by the end of 2016–17.

Figure A3

Governor Proposes BSA Reserve of $8 Billion

(In Billions)

|

Pre–Proposition 2 balance |

$1.6 |

|

2015–16 Budget Act deposit |

1.9 |

|

2015–16 true–up deposit (estimated) |

1.0 |

|

2016–17 Budget Act deposit (estimated) |

1.6 |

|

Total Required BSA Estimated Balance |

$6.0 |

|

2016–17 optional deposit (proposed) |

$2.0 |

|

Total Proposed BSA Balance |

$8.0 |

|

BSA = Budget Stabilization Account. |

|