LAO Contact

January 3, 2017

Ten Years Later:

Progress Towards Expending the 2006 Bond Funds

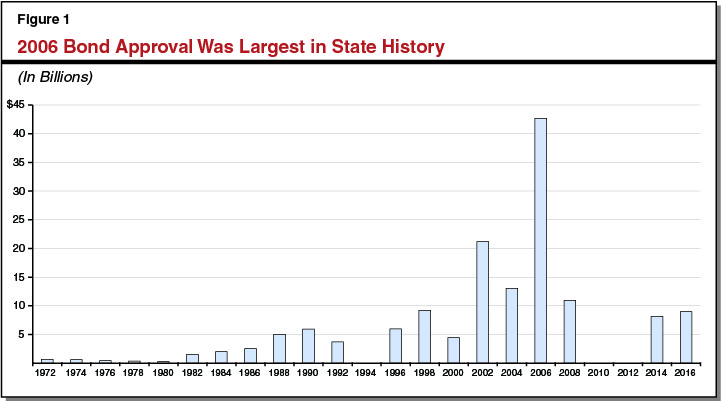

Unprecedented Amount of Bond Funds Approved in 2006. In November 2006, voters approved over $42 billion in bonds for the following major infrastructure-related purposes: transportation (Proposition 1B), housing (Proposition 1C), K-12 and higher education (Proposition 1D), flood control (Proposition 1E), and natural resources (Proposition 84). As shown in Figure 1, the 2006 election was the biggest single approval of bonds in state history—close to twice the size of the next largest year (2002). With the exception of Proposition 84—which was placed on the ballot through the initiative process—these bonds were placed on the ballot by the Legislature. In some cases, the Legislature expressed its desire for these funds to be spent within about a decade. For example, Propositions 1B and 1C included language expressing legislative intent that those bonds be spent over the next decade. Additionally, the Legislature included a requirement in Proposition 1E that all the funds be appropriated by the Legislature within a ten-year period.

Ten Years Later, Most Funds Have Been Provided to Projects, but Billions Still Unspent. As of November 2016, it has been ten years since voters approved the 2006 bonds. At this significant milestone, the Legislature and other key stakeholders might assume that the state has fully spent the 2006 bonds. In fact, as shown in Figure 2, state agencies administering these bonds have expended about $36 billion—84 percent—of the total amount authorized. Notably, there is significant variation among the six bonds in the pace of expenditures. For example, the state has spent over 95 percent of Proposition 1D education bonds, but only about 60 percent of Proposition 1E flood and Proposition 84 resources bonds. We note for the purposes of this post, we assume that bond funds are spent close to when bonds are sold, since that is typically how the state tries to manage bonds.

Figure 2

Percent of Bonds Sold as of November 1, 2016

(Dollars in Billions)

|

Proposition Number |

Bond Act |

Amount Authorized |

Amount Issued |

Percent Sold |

|

1B |

Highway Safety, Traffic Reduction, Air Quality, and Port Security Bond Act |

$19.9 |

$18.1 |

91% |

|

1C |

Housing and Emergency Shelter Trust Fund Act |

2.9 |

2.1 |

74 |

|

1D |

Kindergarten-University Public Education Facilities Bond Act |

10.4 |

10.0 |

96 |

|

1E |

Disaster Preparedness and Flood Prevention Bond Act |

4.0a |

2.3 |

57 |

|

84 |

Safe Drinking Water, Water Quality and Supply, Flood Control, River and Coastal Protection Bond Act |

5.3a |

3.2 |

61 |

|

Totals |

$42.5 |

$35.7 |

84% |

|

|

aReflects amount authorized by voters as adjusted by Proposition 1 (2014). |

||||

Variety of Reasons Some Expenditures Are Lagging. The design characteristics of bond measures as well as various other factors can affect how long it takes for bonds to be expended. Based on our discussions with administering agencies and other stakeholders, we identify some of these major factors below.

Coordination With Other Entities. Coordination with nonstate entities—such as federal or local governments—can make projects more complicated to complete, adding several years to project timelines in some cases. Challenges include requirements to acquire permits from multiple agencies and gaining funding commitments from other entities to share in project costs. For example, a major reason cited for delays in expending Proposition 1E funds is that flood control projects often require permitting and funding from multiple state, local, and federal entities, which can take years for individual projects.

Size and Complexity of Projects Funded. Larger and more complex projects can take a long time to complete. Since bonds are often not sold until projects are close to completion, the state can be slower to expend bond funds for these types projects. For instance, the types of flood control projects funded by Propositions 1E and 84 are often large and have unique design characteristics that require significant time to plan and construct.

Multiple Funding Allocations. It can take longer to expend funds if they are awarded through a competitive process, particularly if there are multiple funding rounds. Sometimes these multiple grant rounds are by design—for example, to better ensure that funding only goes to the highest quality projects. In other cases, multiple funding rounds are necessary because funds are not spent by their initial recipients (because projects come in under budget or do not move forward) and must be reallocated through new funding rounds. For example, a major reason that bond funds from Propositions 1B, 1C, and 1D remain unspent is that not all of the awarded funds were spent by their initial recipients, and remaining funds will be reallocated to new projects.

New Programs. It can also take longer to expend bond funds for new programs that require the adoption of new statutory guidance or regulations. For example, much of the Proposition 1C housing bonds that remain are for the Housing-Related Parks Program. This program was delayed in part because it was not fully defined in statute until 2008 and was subsequently revised in 2012 to improve its operations.

External Market Conditions. Starting in late 2008, the state put bond sales on hold due to the state’s cash flow challenges during the Great Recession. This delayed projects across all of the 2006 bonds, often by about a year.

Quick Expenditures Are Often Expected and Can Be Desirable . . . There is often strong interest in providing bond funds quickly, as reflected in the language of some of the 2006 bonds. Additionally, there are some policy rationales for distributing bond funds expeditiously. Bonds are approved for infrastructure improvements or expansions that are a public priority. Additionally, infrastructure demands can change over time. However, the state generally has limited ability to change the purpose of how bond funds are spent without voter approval. Thus, lengthy delays in expending bond funds can mean that those expenditures might reflect outdated, rather than current, priorities.

. . . But Slow Bond Expenditures Not Always Problematic. Given the intent language of some of the 2006 bonds, some might expect all of the bonds approved in 2006 would have been sold by now. However, as described above, the history of the November 2006 bonds highlights that there are a number of reasons for lags in selling bonds that are not necessarily problematic or within the control of state agencies. Specifically, in some cases, these lags reflected: (1) the design characteristics of the bonds and the programs within them, such as a focus on new programs; (2) a deliberate approach to administering bonds, such as providing multiple competitive funding rounds; and (3) factors largely outside of the state’s control, such as the broad economic downturn in the late 2000s.

Lessons for Crafting Future Bonds. The factors that led to lags in expenditure of bonds in 2006 could apply to future bonds as well. Accordingly, if crafters of future bonds prioritize quick expenditure of funds, they could consider whether there are opportunities to deemphasize the characteristics that are associated with slow expenditures without trading off other key priorities, such as ensuring that dollars go to the most worthy and cost-effective projects. For example, in some cases, there might be opportunities to fund existing programs rather than create new programs to expedite bond expenditures. We note that, in other cases, it may be less feasible to design bonds to go out quickly without affecting other priorities. For instance, if a bond were to require a lower than typical financial contribution from local and federal governments, this could result in the state funding fewer projects overall than if those other entities were contributing as much to the projects’ costs.