LAO Contact

February 20, 2018

The 2018-19 Budget

Department of General Services

The Department of General Services (DGS) provides a variety of services to state departments, such as procurement, management of state-owned and leased real estate, management of the state’s vehicle fleet, printing, administrative hearings, legal services, development of building standards, and oversight over school construction. The department generally funds its operations through fees charged to client departments. The Governor’s budget proposes $1.1 billion from various funds for support of DGS in 2018‑19. This is a decrease of $812 million, or about 42 percent, from current-year estimated expenditures. This decrease primarily reflects $851 million in one-time funding provided in 2017‑18 to construct the new Natural Resources and O Street Buildings, as mentioned below.

This analysis includes reviews of the following 2018‑19 budget proposals for DGS: (1) the construction of three state office buildings in the Sacramento area—Richards Boulevard, Bateson, and Unruh projects; and (2) Zero-Emission Vehicles.

Construction of Sacramento Office Buildings: Richards Boulevard, Bateson, and Unruh Projects

LAO Bottom Line. The Governor’s budget includes $29.6 million from the General Fund for the initial planning phase—known as the performance criteria phase—for three capital outlay projects. These projects include constructing a new state office building on Richards Boulevard and renovating the existing Bateson and Unruh Buildings, at a total cost of roughly $1.3 billion. We recommend the Legislature reject the proposal to construct the Richards Boulevard project because it is not a cost-effective way to address the state’s office building needs. We also recommend requiring DGS to report on alternatives to reduce the costs of the two proposed renovation projects. Finally, we recommend that the Legislature continue to seek additional information from the administration on its strategy for state office space in Sacramento before approving funding for the construction of these projects.

Background

Administration Developed a State Office Building Strategy for Sacramento. As part of the 2014‑15 budget, the administration proposed and the Legislature approved funding for a study of state office buildings in the Sacramento area, which was to include assessments of the condition of state facilities (Facility Condition Assessments), a plan for sequencing the renovation or replacement of state office buildings in Sacramento (State Office Building Strategy), and a plan for funding these activities.

DGS completed the State Office Building Strategy in March 2016 and made some minor revisions to it in January 2018. The State Office Building Strategy includes building three new state office buildings and renovating eight existing state office buildings within about ten years. The new buildings proposed were (1) the O Street Building (also known as the Food and Agriculture Annex), (2) a new Natural Resources Building (also known as the P Street Building), and (3) a new building at the printing plant site on Richards Boulevard. (In addition to these projects, the State Office Building Strategy also proposes replacing or renovating the State Capitol Annex in consultation with the Legislature’s Joint Committee on Rules.)

Legislature Funded Initial Projects in 2016‑17 and 2017‑18. The 2016‑17 and 2017‑18 Budget Acts included about $870 million in funding—mostly from lease revenue bonds—for the O Street and new Natural Resources Buildings. The 2017‑18 Budget Act also provided $909,000 in General Fund for the preliminary plans phase of a project to demolish the existing printing plant. In late 2017, the administration selected firms to perform the final design and construction of the O Street and new Natural Resources Building projects, and DGS currently anticipates that it will complete these projects in 2021.

Governor’s Proposal

The Governor’s proposed budget for 2018‑19 includes $29.6 million from the General Fund for the initial planning phase—known as the performance criteria phase—for the construction of three office building projects in the Sacramento area that are part of the administration’s State Office Building Strategy: (1) a new complex at Richards Boulevard, (2) renovation of the Bateson Building, and (3) renovation of the Unruh Building. The total estimated cost of these three projects is about $1.3 billion, with the remaining design and construction phases of the projects anticipated to be funded from lease revenue bonds. The Governor’s specific proposals include:

Construction of Richards Boulevard Building ($18.1 Million). The budget provides $18.1 million from the General Fund for the performance criteria phase of a project to construct a complex of four buildings with a total of 1 million net usable square feet at the former printing plant site. The estimated total cost of project is about $1 billion. Three buildings would be medium rise (5 floors) and one building would be high rise (up to 29 floors). While most of the building complex would be office space, it would also include other space such as for retail and a childcare center. The proposed tenants of the new building include the California Department of Tax and Fee Administration (CDTFA); the Board of Equalization (BOE); and various departments within the Business, Consumer Services, and Housing Agency (such as the Department of Consumer Affairs). (We note that the budget also proposes $815,000 for working drawings for the demolition of the existing printing plant.)

Renovation of the Bateson Building ($5.2 Million). The budget provides $5.2 million from the General Fund for the performance criteria phase of a project to renovate the Bateson Building—a 215,000 net useable square foot building constructed in 1981. (This building is expected to be vacant after the current tenant departments relocate to the new O Street Building.) The total cost of the project is estimated at $161 million. The proposed tenants of the renovated building include various departments currently in leased space, such as the Department of Parks and Recreation, Department of Water Resources, and Department of Forestry and Fire Protection.

Renovation of the Unruh Building ($6.3 Million). The budget provides $6.3 million from the General Fund for the performance criteria phase of a project to renovate the Unruh Building—a 125,000 net usable square foot building constructed in 1929. (This building will be vacant after the current tenants temporarily relocate to the Bonderson Building, which is expected to occur after the Bonderson Building’s tenant departments relocate to the new Natural Resources Building currently under design and construction.) The total cost of the Unruh project is estimated at $90 million. The State Treasurer’s Office—the building’s major tenant—is expected to relocate back to the Unruh Building after completion of the renovation.

LAO Assessment

Richards Boulevard Building Is Not Cost-Effective Way to Meet State’s Office Needs. Typically, it would seem to be more financially beneficial for the state to own buildings that it anticipates occupying for a long period of time. However, in practice, whether this is the case for any specific project depends on how the savings from fewer leases compares to the cost of the new state space. For the Richards Boulevard Building, we compared the estimated savings the state will achieve by moving some departments from their current space (mostly in private leased buildings) to the proposed state-owned property, as well as estimated how long it would take for those savings to fully offset the additional state construction and operating costs for the new facility (referred to as the “payback period”). We estimate it would likely take over 80 years for the lease savings to offset the construction and operating costs. By that point, we expect that the building would be beyond its useful life (absent a substantial renovation). The administration currently estimates that the payback period for this building will be much shorter—45 years. (We note that this is a revised estimate from the 30 years identified in the department’s budget proposal, which DGS subsequently determined included certain errors.) Based on our review, however, DGS’ 45-year estimate is based on some assumptions that do not appear to be realistic, including:

No Discounting of Future Savings and Costs. The administration’s estimate does not take into account that money today is more valuable than money in the future (often referred to as the “time value of money”) through a technique called discounting future cash flows. This is a standard practice used when cash flows occur over time. In particular, because the future savings associated with reduced leasing costs are not discounted, they appear to be greater than they really are.

High Interest Rate Assumption. The state often pays for some of the costs of tenant improvements at leased facilities over time with interest. The administration assumes that the interest rate the state pays for spreading these tenant improvement costs over time is 8 percent. This is well above the state’s typical cost of borrowing, and thus it would not make sense for the state to pay an interest rate this high. Accordingly, this makes the cost of leasing in the future appear greater than it is likely to be.

Low Inflation Rate on State Costs. The administration assumes cost of operating and maintaining state buildings grows at 0.5 percent per year, which is very low considering likely increases in the costs of state staff and equipment due to inflation and other factors. In recent years, rates DGS charges to maintain and operate most buildings have increased by about 6 percent per year.

When these assumptions are modified, the payback period increases significantly. For example, if we assume that the state (1) discounts future cash flows by 3 percent annually, (2) finances tenant improvements by roughly its typical long-term cost of borrowing (the state’s cost of short-term borrowing is typically even lower than this), and (3) experiences cost increases in its operations and maintenance of state buildings of 2.5 percent annually, the payback period for the project grows significantly to over 80 years.

Additionally, DGS’ analysis assumes that the new office building will be about 15 percent smaller than the current space used by its future tenants. The administration argues that it can achieve this reduction due to various space efficiencies. If, however, these space efficiencies do not materialize, the lease savings could be smaller and, thus, the payback period would be even longer.

The long payback period is in part a result of the high costs of the project—$800 per gross usable square foot ($1,000 per net useable square foot). This amount is well over some other similar projects, including (1) a recent DGS-commissioned study estimating the cost to rebuild the BOE Building and (2) the cost of constructing private sector projects. DGS cites various factors for the higher cost of constructing the Richards Boulevard project than comparable private sector buildings. When comparing to private sector costs, DGS indicates that the statutory requirement that it pay prevailing wages to construction workers can make state projects significantly more expensive. Additionally, the proposed project includes retail and extra child care space, which also increase costs. DGS also states that the BOE estimate was not as fully developed as its estimate for the Richards Boulevard project. In addition, DGS indicates that the construction cost of the proposed project is similar to the projected costs on a per square foot basis to construct the O Street and new Natural Resources Buildings.

The long payback period is also in part due to the substantial costs associated with operating and maintaining state buildings. Simply operating and maintaining state buildings alone—not including any costs associated with constructing them—typically costs the state just under $2 per square foot per month, which is only a little less than the average rental rate on the leases that would be terminated when the state moves departments into the Richards Boulevard Building (about $2.30 per square foot per month).

Bateson and Unruh Building Renovations Also Appear Expensive. In our view, it is reasonable for the state to invest in the repair and renovation of its physical assets in order to ensure that they can continue to provide services for years to come. The Facility Condition Assessments determined that the Unruh and Bateson Buildings were in poor condition and ranked them as the fifth and sixth worst condition state office buildings in Sacramento, respectively. Thus, it appears reasonable to pursue a renovation of these buildings. However, we find that the cost per square foot of the proposed renovations appears to be high. Specifically, the building renovations are anticipated to cost $750 per net useable square foot ($550 per gross square foot). DGS indicates the estimated costs largely are based on the construction component of the renovation of the Library and Courts Building, a historic building that was comprehensively restored in 2013. However, the total cost of the two proposed renovations is actually about 50 percent higher on a square footage basis than the costs for the Library and Courts Building. After adjusting for inflation in construction costs, the Library and Courts Building cost about $550 per net usable square foot ($350 per gross square foot). Moreover, the Library and Courts Building renovation was a somewhat more expensive renovation compared to other recent state renovation projects because of the historic nature of the building and special restoration details that were incorporated into the project. Specifically, in the 2000s, the state renovated a couple other buildings at a total cost (after adjusting for inflation in construction costs) of about $450 per net usable square foot ($330 per gross square foot).

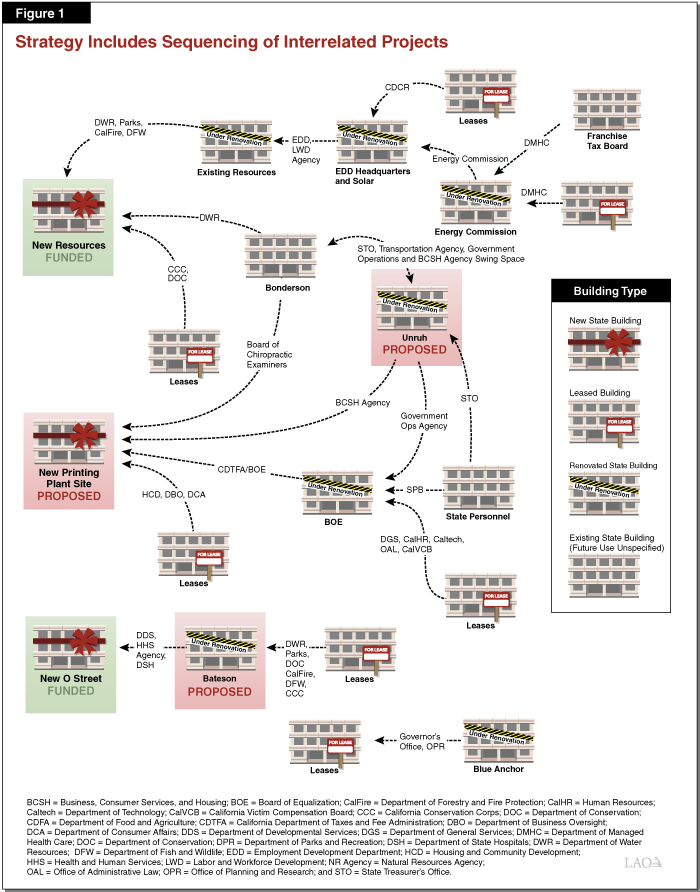

Proposed Projects Are Part of Larger Strategy That Lacks Key Information . . . The projects in the State Office Building Strategy—including those currently proposed for funding—are generally interrelated as shown in Figure 1. This is because the administration is proposing to strategically sequence building renovations by successively conducting staff moves and building renovations, in order to reduce costs and disruptions associated with moving departments into and out of temporary space. Because projects are sequenced, it is critical to consider how any proposed projects fit into the larger plan, and whether pursuing that larger plan is consistent with legislative priorities before moving forward with funding individual projects. However, the administration has not provided key information that would be necessary to assess the State Office Building Strategy, such as a funding plan with an estimate of costs of strategy and an analysis of alternatives to the proposed strategy. (See our publication, The Administration’s Sacramento Office Building Construction Strategy: Ensuring Robust Oversight for a more complete discussion of this issue.)

. . . But if These Projects Are a Guide, Full Plan Will Be Very Expensive. Because the administration has not provided a funding plan that identifies the cost of the strategy, it is not clear how much it will cost to complete. However, if we assume the costs of future renovation projects will be similar on a square footage basis to these projects, we estimate the full cost of the plan will be about $3.4 billion, as shown in Figure 2. This includes close to $900 million in projects already approved, $1.3 billion in projects proposed as part of the Governor’s 2018‑19 budget, and $1.2 billion for the remaining five projects that are in the Statewide Office Building Strategy. This total does not include the State Capitol Annex—since its costs are currently unknown and it is proceeding separately from the rest of the plan. The total also does not include other projects that are likely to be proposed in the future but are not currently included in the strategy because they are outside of the plan’s ten-year planning window. These projects include the renovation or replacement of the Personnel and Bonderson Buildings, which were rated the Sacramento office buildings in second and third worst condition as part of the Facility Condition Assessments. If the State Capitol Annex and the projects outside the study’s planning window were included, we expect that the total cost of the Sacramento Office Building projects could surpass $4 billion.

Figure 2

Estimated Costs of Plan for Sacramento Office Buildingsa,b

(Dollars in Millions)

|

Buildings |

Sacramento Office Building Rankingc |

Square Footage (Net Useable) |

Estimated Cost |

|

In Progress |

|||

|

Build new Natural Resources building |

N/A |

700,000 |

$597 |

|

Replace O Street building |

N/A |

255,000 |

274 |

|

Subtotals, in Progress |

955,000 |

($871) |

|

|

Proposed in 2018‑19 |

|||

|

Build new Richards Boulevard building |

N/A |

1,000,000 |

$1,033 |

|

Renovate Bateson building |

6 |

215,000 |

161 |

|

Renovate Unruh building |

5 |

125,000 |

90 |

|

Subtotals, Proposed |

1,340,000 |

($1,284) |

|

|

In Sequencing Plan, but Not Yet Proposed for Funding |

|||

|

Renovate Resources building |

1 |

520,000 |

$390 |

|

Renovate BOE building |

12 |

479,000 |

360 |

|

Renovate EDD Headquarters and solar |

4, 8 |

455,000 |

340 |

|

Renovate Blue Anchor building |

9 |

17,000 |

15 |

|

Renovate Energy Commission building |

10 |

125,000 |

90 |

|

Subtotals, Other Projects in Plan |

1,596,000 |

($1,195) |

|

|

Total Estimated Costs |

3,891,000 |

$3,350 |

|

|

aFor in progress and proposed projects, project costs are the administration’s estimates. For projects not yet proposed, costs are the LAO’s estimate assuming the cost per square foot of renovations is similar for future renovations as for those proposed in 2018‑19. bDoes not include the State Capitol Annex or other projects that are likely, but not currently included in the plan because they are outside of the plan’s ten‑year planning window. cRanking based on condition of building as assessed by the Facility Condition Assessments. A rank of 1 indicates that a building is in the worst condition. BOE = Board of Equalization and EDD = Employment Development Department. |

|||

Additionally, we note that there are significant state office building needs in other portions of the state as identified in Facility Condition Assessments conducted on behalf of DGS, as well as many other infrastructure needs across the state. For example, the administration’s 2018-19 Infrastructure Plan includes an estimate that the state needs to address $67 billion in deferred maintenance across various departments.

LAO Recommendations

Reject Funding for Richards Boulevard Project. We recommend that the Legislature reject the administration’s request to fund the Richards Boulevard project because it does not appear to be a cost-effective approach to meeting the state’s office building needs. Instead, we recommend that the Legislature direct the administration to come forward with an alternative proposal. This alternative proposal could include, for example, the sale of the Richards Boulevard property or the construction of a new building that is more cost-effective. For example, it could potentially be more cost-effective to build a smaller, medium rise building at the site that does not include some of the proposed amenities, such as retail space.

Require DGS to Report on Renovations’ High Costs and Possible Alternatives. We recommend that the Legislature require DGS to report at budget hearings on two key aspects of the renovation proposals. First, DGS should report on the reasons for the apparent high costs of the two proposed renovation projects. This could include, for example, information on the scopes of the proposed renovations and how those affect estimated costs. Second, DGS should identify potential alternative scopes that could reduce the costs of these projects. For example, while the current proposals are for comprehensive renovations, the Legislature could consider somewhat less substantial renovations, which should be less costly. This information would assist the Legislature in assessing which buildings to renovate, as well as the scope of renovations it wishes to pursue given available funding and other pressing infrastructure needs in the state.

Seek Additional Information From Administration on Sequencing Strategy. We continue to recommend that the administration provide additional information on its strategy for state buildings in the Sacramento area. This information should include, for example, an evaluation of the strategy’s costs and alternatives. A clear description of the various options that are available—and the associated costs—would help the Legislature determine whether it would like to proceed with the administration’s larger plan to undertake office building renovations and replacements or take an alternative approach. To the extent that the Legislature has priorities for particular buildings it would like to have addressed, it could direct the administration to consider alternatives that focus on those priorities. For example, if the Legislature prioritizes addressing the needs of the BOE Building, it could direct the administration to consider options for addressing that building. We note that the administration’s current strategy includes moving the current occupants of the BOE Building—CDTFA and BOE—into the Richards Boulevard Building in order to facilitate the renovation of the BOE Building. However, if the Legislature chooses not to move forward with the Richards Boulevard Building, but would like to move forward with the renovation of the BOE Building, other potential options could exist—such as moving CDTFA and/or BOE either temporarily or permanently into the existing Resources or Employment Development Department Buildings (after they are vacated and renovated). The Legislature will want to have this information on the strategy’s alternatives and associated costs prior to making final decisions on providing any additional funding for construction and renovation projects in the strategy, including the projects proposed for funding in 2018-19.

Zero-Emission Vehicles

LAO Bottom Line. The Governor proposes $15.6 million—half from the General Fund and half from the Service Revolving Fund (SRF)—on a one-time basis to support the installation of charging stations for zero-emission vehicles (ZEVs) at state government facilities consistent with an administration expansion plan and recent legislation. We recommend that the Legislature consider using other funding sources—most notably the Greenhouse Gas Reduction Fund (GGRF)—rather than General Fund to support this activity.

Background

2017-18 Budget Included Funds for ZEV Charging Stations for State Fleet. The Governor’s 2016 ZEV Action Plan (Action Plan) established the goal that 50 percent of the state’s annual light-duty fleet purchases be ZEVs by 2025. (We estimate that the state purchases about 1,700 light-duty vehicles per year.) This goal has since been codified by Chapter 628, Statutes of 2017 (SB 498, Skinner). The Action Plan also establishes the administration’s goal of creating charging availability in at least 5 percent of the state’s workplace parking spaces—totaling over 5,000 charging stations—by 2025.

The 2017-18 Budget Act provided $6.7 million on a one-time basis—half from the General Fund and half from the SRF—and three positions for DGS to begin implementing the Governor’s goals for ZEV fleet and workplace charging stations at state facilities. (SRF funding comes from reimbursements from departments’ special fund budgets.) Prior budgets also provided limited funding for ZEV charging stations at state facilities. Specifically, the Legislature authorized a total of $1.6 million in 2014-15 and 2015-16 from the Alternative and Renewable Fuel and Vehicle Technology Program (ARFVTP) funds for such charging stations.

Governor Has Proposed Ambitious ZEV Funding Plan for 2018-19. The Governor’s plan for state fleet and workplace ZEV charging stations at state facilities represents just one part of his larger ZEV efforts. Notably, in addition to his Action Plan, in January 2018, the Governor issued Executive Order B-48-18, which establishes a goal of having 5 million ZEVs in California by 2030. The Governor further proposed allocating $2.5 billion over the next eight years to help reach that goal. (We discuss this proposal in more detail in our report The 2018-19 Budget: Resources and Environmental Protection.) We also note that, in addition to state funds, there are various nonstate sources of funding that are being used for ZEV charging stations, such as court settlements with Volkswagen and NRG Energy, as well as various utility ZEV programs.

Governor’s Proposal

The Governor proposes $15.6 million—half from the General Fund and half from the SRF—on a one-time basis—$1.2 million for the completion of 1,600 assessments of potential charging station locations and $14.4 million for the design and installation of 1,205 charging stations, including 265 stations for the state’s fleet and 940 workplace stations. The Governor’s budget also proposes four positions—one more than authorized in the current year—to oversee the implementation of charging stations at state facilities.

Additionally, the Governor’s budget proposes budget bill language requiring DGS to certify that it has maximized nonstate sources of funding for ZEV activities prior to expending state funds. The language also allows the Department of Finance to augment non-General Fund appropriations in other departments’ budgets by an amount sufficient to reimburse DGS for ZEV activities.

LAO Assessment

Cost of Meeting Goals Is Unknown, but Likely High. DGS estimates spending $94 million from 2017-18 through 2021-22 to install about 6,500 ZEV charging stations at state facilities (about 1,600 fleet stations and 4,900 workplace stations). DGS has not yet identified the full number of stations that will need to be installed in the future to meet the goals for ZEVs at state facilities, and indicates it cannot project costs beyond 2021-22 due to the rapidly changing technology in the ZEV market. However, based on the size of the state’s fleet and number of existing workplace parking spaces, the total number of stations proposed through 2021-22 will almost certainly not be enough for the state to fully meet the 2025 fleet and workplace ZEV goals set by the administration and Chapter 628. Accordingly, while the total cost of meeting the ZEV goals for state facilities is unknown, it will likely be well in excess of the $94 million identified through 2021-22. We note that DGS’ cost estimate includes charging stations, but does not include the cost of purchasing ZEV vehicles themselves.

Other Funding Sources Available for ZEV Charging. Given the substantial cost of the plan for ZEV charging stations at state facilities, the Legislature may wish to consider other available funding sources besides the General Fund. As discussed in our recent report, The 2018-19 Budget: Resources and Environmental Protection, the Governor’s cap-and-trade expenditure plan for 2018-19 allocates $1.3 billion in discretionary GGRF revenues for various activities, including to incentivize private market purchases of ZEV vehicles. In addition, the Governor’s spending plan includes $235 million in 2018-19 (and $900 million over eight years) to install ZEV charging stations throughout the state for private use. These stations are proposed to be funded primarily by ARFVTP funds. It is not clear why all proposed ZEV charging stations could not be funded from special funds.

The department indicates that it has been exploring the use of other funding sources, and its proposed budget bill language is intended to ensure that nonstate funding sources have been maximized prior to expending state funds. However, GGRF and ARFVTF are state funds and would generally only be available if the Legislature makes the appropriation for this purpose in the budget.

LAO Recommendation

Consider Other Funding Sources, Including GGRF. If the Legislature wants DGS to continue its current efforts to increase the number of ZEV charging stations at state facilities, we recommend that the Legislature consider using other funding sources besides the General Fund, such as GGRF and ARFVTF. Notably, using GGRF or ARFVTP funds for ZEV charging stations at state facilities would create some trade-offs by reducing the funds available for other eligible projects. However, given other demands on the General Fund, it is worth fully exploring the use of these funds for this activity before committing General Fund. In order to facilitate the Legislature’s consideration of these sources, we recommend that the Legislature direct the administration to report at budget hearings about these and any other available funding sources and why they were not proposed to be used for ZEV charging stations at state facilities.