LAO Contact

March 1, 2018

The 2018-19 Budget

The Administration’s Proposition 55 Estimates

- Introduction

- The Medi‑Cal Formula Under Proposition 55

- LAO Findings

- Considerations for a Future Medi‑Cal Allocation

Summary

Proposition 55 (2016). Proposition 55, which extended tax rate increases on high‑income earners, aimed to increase funding for Medi‑Cal under a formula administered by the Department of Finance (DOF). This is the first year the department is required to produce estimates of Medi‑Cal funding under these provisions. In this brief, we provide background on the measure’s language and describe how DOF has interpreted it.

The Medi‑Cal Formula. The Proposition 55 Medi‑Cal formula has three major inputs. First, it directs DOF to estimate the upcoming year’s available revenues. Second, it subtracts from this total the constitutional minimum funding level for schools and community colleges. Third, the formula subtracts an estimate of the “workload budget,” which is defined as the costs of continuing to provide state services (“currently authorized services”) in place on January 1, 2016. If a surplus results from this calculation, half is to be dedicated to Medi‑Cal.

Administration’s Approach Results in No Additional Funding to Medi‑Cal. In 2018‑19, the administration’s Proposition 55 calculation identifies a $1.9 billion deficit, and so provides no additional funds to Medi‑Cal. In administering the calculation, the administration makes two key choices that lead to this result. First, the administration’s decision to subtract $3.5 billion from available revenues to account for its proposed optional reserve deposit significantly reduces the calculation’s starting point, eliminating a surplus that would have directed funds to Medi‑Cal. Second, the administration’s workload budget approach is based on a broad definition of currently authorized services, which also has the effect of reducing the amount of potential funds for Medi‑Cal under the measure. Other interpretations of these two matters could increase available funds for Medi‑Cal under the measure—this year or in the future.

Calculation This Year Will Set Precedent for Future Years. Estimates under the Medi‑Cal funding formula this year will have implications for how the calculation is interpreted and administered in future years. This can affect the amount of Medi‑Cal funding for over a decade to come. Different decisions about the measure could result in more or less funding for Medi‑Cal by hundreds of millions—or even billions—of dollars in the future.

Introduction

Proposition 55 (2016) extended tax rate increases on high‑income earners from 2018 until 2030 (which voters originally passed on a temporary basis in 2012 as part of Proposition 30). Revenues raised by the measure benefit the General Fund. These revenues increase required spending on schools and community colleges through the funding requirements under Proposition 98 (1988) and increase reserve requirements and debt payments under Proposition 2 (2014). In addition, Proposition 55 aimed to increase funding for Medi‑Cal, the state’s health insurance program for low‑income Californians, through a formula administered by the Department of Finance (DOF).

This is the first year DOF is required to produce estimates of funding requirements for Medi‑Cal under the formula set forth in Proposition 55. In this report, we lay out the key elements of this calculation, as set out in the measure. We describe each of these elements by (1) providing background on the measure’s language and (2) describing how DOF has interpreted and administered the components of the calculation. We conclude with some high‑level findings about the implications of the administration’s method of implementation in its first year.

The Medi‑Cal Formula Under Proposition 55

In this section, we first provide an overview of the Medi‑Cal funding formula in Proposition 55, including the bottom line results from the administration’s calculation in 2018‑19. We then discuss each of the three major inputs into the calculation in turn.

Overview of the Formula

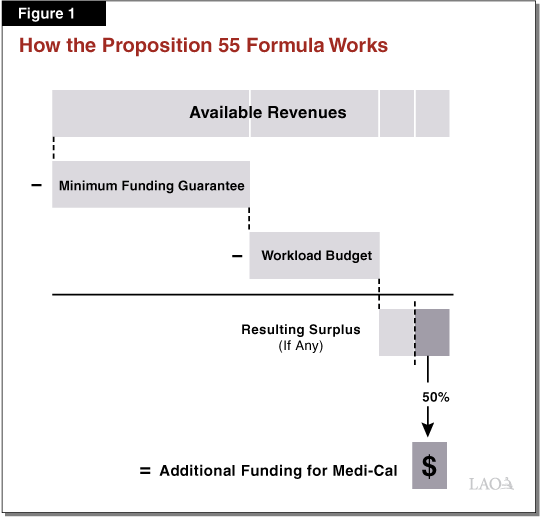

Proposition 55 Formula Features Three Major Inputs. The Proposition 55 formula has three major inputs, which are shown in Figure 1. First, the measure directs DOF to estimate the upcoming year’s available revenues. Second, it subtracts from this total the constitutional minimum funding level for schools and community colleges. Third, the formula then subtracts an estimate of the “workload budget” costs of government programs that were in place as of January 1, 2016. Put simply, the workload budget is the cost of continuing to provide state services in place at that time.

Half of Any Surplus Allocated to Medi‑Cal. If a surplus results from this third step, half of it, up to $2 billion, is dedicated to increase spending on Medi‑Cal. If a deficit results, there is no additional funding for Medi‑Cal. Through this formula, Proposition 55 aims to provide additional funds to Medi‑Cal when General Fund revenues exceed constitutionally required spending for schools and existing services.

Under Administration’s Calculation, No Additional Funding for Medi‑Cal in 2018‑19. While the Governor’s 2018‑19 budget plan proposes allocating billions of surplus General Fund dollars to discretionary reserve deposits and some new spending, its Proposition 55 formula calculation identifies a $1.9 billion deficit. (In large part, this is due to the administration’s treatment of reserve deposits, as described below.) As a result, the administration’s calculation—summarized in Figure 2—provides no additional funds for Medi‑Cal in 2018‑19 under Proposition 55.

Figure 2

Department of Finance’s Medi‑Cal

Calculation Under Proposition 55

(In Billions)

|

Available revenues |

$129.8 |

|

Minimum funding guarantee |

‑54.6 |

|

Workload budget |

‑77.1 |

|

Resulting Deficit |

‑$1.9 |

Calculation Will Be Finalized at Budget Act. Proposition 55 requires the administration to produce the Medi‑Cal calculation by June 30th of each year, the day before the new fiscal year starts. As such, the administration’s current calculation represents a point in time, reflecting the Governor’s January budget plan.

Available Revenues

The first part of the formula is an estimate of General Fund revenues in the upcoming fiscal year. Specifically, the measure requires DOF to estimate “available General Fund revenues,” including the incremental increases in General Fund revenues that result from the measure.

In Other Budgetary Contexts, Revenue Estimates Reflect the Effect of Transfers. In planning documents and other budgetary formulas, “General Fund revenues” includes, most notably, proceeds of taxes, but also other revenues from licenses and fees, and the net effect of transfers and loans. Each year, the General Fund makes transfers and loans from and to other state accounts, known as special funds. Transfers and loans can be either positive, if they are benefiting the General Fund, or negative, when they are made out of the General Fund.

Proposition 2 Requires Annual Transfer to Reserves. Each year, Proposition 2 requires a minimum annual deposit into the state’s rainy day fund. From a budgetary accounting perspective, this deposit is reflected as a negative transfer—out of the General Fund and into the Budget Stabilization Account (BSA). Under the administration’s current revenue estimates, the constitutional deposit this year would be $1.5 billion. In addition, the Governor proposes depositing an additional, optional deposit of $3.5 billion into the BSA. In the budget’s official accounting, both of these deposits are reflected as a negative transfer out of the General Fund, reducing total revenues by the same amount.

Administration’s Approach Uses Revenues Net of Optional Deposit. In the Proposition 55 calculation, the administration reflects the 2018‑19 proposed optional deposit into the BSA as a negative transfer in available revenues. This action reduces available revenues by $3.5 billion.

“Available Revenues” Arguably Should Include Optional Deposit. Under an alternative approach, optional deposits would be included as available revenues rather than counted as a negative transfer. Proposition 55 does not define “available General Fund revenues.” In our view, this term could be more reasonably interpreted to mean any revenues that are not committed to specific purposes under the State Constitution or existing statute. Using this definition, “available” refers to resources that are available for legislative priorities, including spending increases, tax reductions, and optional transfers to reserves. Taking this approach makes the $3.5 billion optional reserve deposit proposed by the administration available, resulting in a surplus that would provide $800 million to Medi‑Cal (see Figure 3). (Constitutional deposits under Proposition 2 would still reduce General Fund revenues.)

Figure 3

Medi‑Cal Calculation Under

Proposition 55 With Optional Deposit

(In Billions)

|

Available revenues |

$133.3 |

|

Minimum funding guarantee |

‑54.6 |

|

Workload budget |

‑77.1 |

|

Resulting Surplus |

$1.6 |

|

Additional Funding for Medi‑Cal |

$0.8 |

Minimum Education Funding Guarantee

In the second portion of the calculation, the measure directs DOF to subtract from available revenues an estimate of the “minimum funding guarantee of Section 8 of Article XVI” of the California Constitution.

Proposition 98 Defines Constitutional Minimum Funding Level for K‑14 Education. Proposition 98 governs most state funding for schools and community colleges. The measure establishes formulas for a minimum annual funding requirement in Article XVI of the constitution. This minimum funding level is commonly referred to as the minimum guarantee. Each year the minimum guarantee rises or falls with a variety of inputs related to the economy, student attendance, and state revenues. The Legislature can provide more than the minimum funding level, but these funding increases generally result in increases in the minimum guarantee in future years.

Administration Indicates It Will Use Constitutional Minimum Funding Level. Representatives of the administration have indicated to us that, for each year of the calculation, they will use the constitutional minimum funding level as the input to the Proposition 55 calculation. This means that if the Governor were to propose or the Legislature to enact a level higher than the constitutional minimum, the calculation would reflect the lower constitutional level, not the higher appropriated level. Moving forward, however, the next year’s calculation would reflect the higher minimum guarantee resulting from the prior‑year’s appropriation. This interpretation seems consistent with the measure’s language on a “constitutional minimum.”

Workload Budget

The third step of the Proposition 55 calculation is to identify the costs of the workload budget or the estimated costs in the upcoming year of providing services authorized in the 2015‑16 budget.

Proposition 55 References “Workload Budget” From January 1, 2016. Proposition 55 defines the workload budget with the meaning set forth in Government Code §13308.05, as it read and “was interpreted by the Department of Finance on January 1, 2016.” Under this section of Government Code, the workload budget is defined as the budget‑year cost of “currently authorized services,” adjusted for a variety of factors including enrollment, caseload, population, and the nine others listed in the nearby box. Proposition 55 adds that currently authorized services must be interpreted as those that were “currently authorized” as of January 1, 2016.

Government Code §13308.05

Allowable Adjustments to the Workload Budget. In addition to changes related to caseload, enrollment, and population, Government Code §13308.05 allows for adjustments to the workload budget that are related to the following: (1) statutory cost‑of‑living adjustments, (2) chaptered legislation, (3) one‑time expenditures, (4) the full‑year costs of partial‑year programs, (5) costs incurred pursuant to constitutional requirements, (6) federal mandates, (7) court‑ordered mandates, (8) state employee merit salary adjustments, and (9) state agency operating expense and equipment cost adjustments to reflect price increases.

Workload Budget in Early 1990s. Government Code §13308.05 was originally passed in 1990. It was enacted with a series of statutes that were aimed to make across‑the‑board cuts to General Fund programs when the budget faced a shortfall. Specifically, the measures required automatic reductions up to 4 percent if General Fund revenues were insufficient to cover the costs of the “workload budget” as defined in Government Code §13308.05. The workload budget calculation took the prior‑year’s General Fund expenditures and adjusted them for changes listed above. These automatic reduction provisions were triggered and enacted only once (in the 1991‑92 budget package) before they were repealed in 1996.

Statutory Workload Budget Language Developed for Different Purpose. Government Code §13308.05 provides a framework for determining the upcoming year’s workload budget costs—that is, the cost of continuing to provide already authorized services. As discussed in the nearby box, Government Code §13308.05 was originally developed in 1990 to determine whether current services could be afforded. Specifically, the 1990 statute considered currently authorized services on a year‑to‑year rolling basis—allowing the Legislature to determine whether the budget could afford its recently authorized commitments. Proposition 55 applies this statute framework very differently. Proposition 55—which references Government Code §13308.05 as it was written in 1990—ties the definition of authorized services to a single point in time in the past (January 1, 2016), locking in a given set of services that are not adjusted for policy changes.

One Possible Interpretation of Workload Budget

Below, we present one possible interpretation of the definition of the workload budget in the context of Proposition 55.

Start With Enacted 2015‑16 Budget and Adjust for Allowable Changes. Under this interpretation of the workload budget, DOF would begin with an estimate of the actual expenditure level from the 2015‑16 Budget Act. Then, the department would adjust that level for the list of allowable changes under the measure. In general, these adjustments fall into two categories:

- Certain Cost Increases of Existing Services. Government Code §13308.05 references caseload, enrollment, and population as allowable adjustments to the workload budget calculation. In addition, it allows for statutory cost‑of‑living adjustments and price increases for operating and equipment. Together, these represent ordinary cost increases associated with continuing to provide authorized services.

- Increases in Costs Outside of Legislature’s Control. The code section also allows for a second type of adjustments, which generally could be considered increases in costs that are imposed on the state outside of the Legislature’s control. These include federal and court mandates and costs incurred pursuant to constitutional requirements.

Under this method, only explicitly allowable adjustments would be made to increase workload budget costs. For example, if a program was providing a service to certain people ages 18 to 25, the state could increase the workload budget to account for a projected increase in that age cohort. (Similarly, it could not make such an adjustment if the state extended the service to people ages 26 to 30.) Adjusting the expenditures in the 2015‑16 budget package in each subsequent year for these allowable changes would together result in an estimate of the workload budget in 2018‑19.

Exclude the Effects of Chaptered Legislation. This approach excludes the effects of chaptered legislation under the logic that its inclusion would undermine the measure’s intent. In the original 1990s application of the workload budget concept, chaptered legislation was included as a required adjustment to currently authorized services. This accounted for changes in current law since the prior fiscal year, which made sense in the context of a calculation that considered currently authorized services on a year‑to‑year rolling basis. Transferring this concept to the Proposition 55 calculation is problematic because it ties the definition of authorized services to a single point in time in the past. Reflecting the effects of all subsequent chaptered legislation, most notably the annual budget act and associated trailer bills, would make the workload budget equal to whatever the state enacted in any year. This would render the calculation mostly meaningless.

Administration’s Approach to Interpreting Workload Budget

Administration’s Approach Adjusts 2018‑19 Proposed Budget. The administration takes a very different approach to the workload budget than the one described above. The administration’s calculation begins with its proposed 2018‑19 General Fund expenditure level. From that amount DOF subtracts a small number of program expenditures that it determined were not currently authorized services in 2015‑16. The administration argues that services should be excluded when they are entirely new services provided by the state. Examples of programs DOF excluded from the workload budget are:

- Health Care Workforce Augmentation. This 2016‑17 budget plan provided $100 million over three years to provide additional medical residency slots for primary care physicians. The General Fund cost of this program in 2018‑19 is therefore $33.3 million.

- Medically Tailored Meals Pilot Program. The 2017‑18 budget package established this program to provide medically tailored meals to Medi‑Cal patients with chronic diseases. The 2018‑19 General Fund cost of this program is $2 million.

Figure 4 lists the small number of other programs—totaling $37.3 million—that the administration excluded from the $77 billion workload budget. Under this interpretation, all other legislative and policy changes the state has made since January 1, 2016 are workload budget changes.

Figure 4

Programs Excluded From Department of Finance’s

Workload Budget

(In Millions)

|

Program |

2018‑19 Cost |

|

Oversight of Immigration Detention Facilities |

$1.0 |

|

Health Care Workforce Augmentation |

33.3 |

|

Diabetes Prevention Program |

5.0 |

|

Medically Tailored Meals Pilot Program |

2.0 |

|

Parkinson’s Disease Registry |

1.0 |

|

Eliminate Statewide Fingerprinting Imaging System |

‑5.8 |

|

Arts for At‑Risk Youth |

0.8 |

|

Total |

$37.3 |

Administration Broadly Interprets Currently Authorized Services. The list of programs in Figure 4 is short because DOF interprets currently authorized services very broadly. Specifically, the administration has:

- A Broad Interpretation of “Authorized Services.” In some cases, the administration appears to be interpreting currently authorized services to mean any services of the general type that were in place on January 1, 2016, even if the specific service was not funded or available at that time. For example, in 2017‑18, the state created the Emergency Child Care Bridge Program, which allows foster families to access subsidized child care funding immediately. The administration includes this program in workload budget under the rationale that the state has long provided funding for foster services and related support for foster parents, even if this particular service—immediate access to subsidized child care—is new.

- A Broad Interpretation of “Currently.” In some cases, the administration appears to interpret currently to include any programs authorized at any time prior to 2016, even if the program was not in place on January 1, 2016. For example, the state eliminated Denti‑Cal benefits for nearly all adult beneficiaries when it faced budget problems in the late 2000s. The state restored some of these benefits before January 1, 2016, but did not restore all of the rest of them until 2017‑18. Nonetheless, the administration included the full cost of providing these benefits in the workload budget.

Examples of Services That an Alternative Approach Would Exclude. There are many categories of services and benefits that the administration includes in its workload budget that an alternative reading of the calculation would exclude. For example:

- New Services Within Existing Programs. In 2017‑18, the Legislature expanded the scope of the Immigration Services Funding grant program to include deportation defense services, previously not an allowable use of grant funds, and increased support for the program by $15 million over the prior year. The administration includes these enhancements in the workload budget under the rationale that funding for immigration services is a longstanding state service, and, as such, the 2017‑18 funding change represents an enhancement of historical services, rather than funding for a new service.

- Benefit Increases Associated With Existing Services. Prior to 2016‑17, a child born in a family that had received continuous CalWORKs assistance for more than the preceding ten months was excluded for purposes of determining the amount of the family’s grant. As a result, the family did not receive an increase to their monthly grant to reflect the birth of the child. This policy, referred to as the “maximum family grant,” was ended as part of the 2016‑17 budget. This change increased the grants of families that had previously been affected by the policy. The administration includes the roughly $70 million General Fund cost of this change in workload budget under the rationale that it expands existing services, rather than providing a new service.

- One‑Time Programs. The 2014‑15 budget first provided $3 million in one‑time state funds for precision medicine research. The Legislature again provided $10 million in one‑time funding for this purpose in 2016‑17 and 2017‑18. In the 2018‑19 budget plan, the Governor proposes providing $30 million for precision medicine, again on a one‑time basis. The administration includes these 2018‑19 proposed costs in the workload budget under the rationale that precision medicine funding was originally provided before 2016 and in ensuing years.

- Legislation That Increases the State Cost of Existing Services. Since January 1, 2016, the Legislature has passed a variety of laws that increase the costs of existing state services, but are not adjustments explicitly allowed in the workload budget definition of Government Code §13308.05. For example, in the spring of 2016 the Legislature passed legislation that increased the statewide minimum wage over a period of several years. The higher minimum wage increases the wages of service providers for some human services programs. We estimate this has led to low hundreds of millions of dollars in higher General Fund spending on those programs in 2018‑19. The administration included these costs in the workload budget under the rationale that this legislation increases the costs of existing services, rather than providing a new service.

- Administration’s 2018‑19 Budget Proposals. In our Overview of the Governor’s Budget publication, we identified that the Governor used $1.2 billion for various discretionary spending proposals. These funds were dedicated to several uses, including to trial courts for construction and operations and to counties for new voting systems. All of this proposed spending is included in the administration’s workload budget for 2018‑19. That is because, under DOF’s interpretation, these proposals are related to services that the state had already authorized as of January 1, 2016.

Alternative Reading Could Lead to Millions or Billions in Lower Workload Budget Costs. Under an alternative reading of the measure, none of the costs listed above would be included in the workload budget. These examples, along with other similar ones, would result in lower workload budget costs of hundreds of millions—potentially over a billion—dollars. Under the administration’s current estimates and interpretation of available revenues, workload budget costs would have to be at least $1.9 billion lower in order for the formula to yield increased funding for Medi‑Cal in this calculation. As such, a different interpretation of the workload budget may not—alone—lead to more Medi‑Cal spending in 2018‑19, but could result in increased Medi‑Cal funding under the measure in future years.

LAO Findings

Measure is Difficult to Interpret and Implement. The workload budget portion of the Medi‑Cal formula under Proposition 55 references a section of law that was passed in the 1990s for a very different purpose. Along with the general conceptual difficulty of defining a workload budget in the first place, this means that some features of the Proposition 55 calculation are difficult to interpret and implement.

Administration’s Interpretation Reduces Additional Funding to Medi‑Cal. In administering the calculation, the administration makes a variety of choices that result in less funding for Medi‑Cal (relative to an alternative approach). In particular, the administration (1) reduces the amount of available revenues by all BSA deposits, rather than just required deposits, reducing the amount of available revenues, and (2) makes a variety of choices that result in a larger workload budget, which reduces the available surplus under the calculation. Changing the administration’s interpretation of both available revenues and the workload budget would lead to more payments to Medi‑Cal under Proposition 55.

Alternative Workload Budget Interpretation More Difficult Over Time. If the administration were to adopt the alternative interpretation of workload budget presented earlier, it would lead to greater administrative complexity. Under the alternative interpretation, the administration would need to track the hypothetical cost increases of programs in the 2015‑16 budget supposing the Legislature had made no policy changes to those programs. The difficulty of making such estimates would increase over time. Depending on how broad or narrow this interpretation was, it could lead to hundreds of individual estimates related to the hypothetical costs of dozens of state programs. As such, there is a trade‑off between a strict interpretation of the measure and the ease of implementing it.

Many Determinations Must Be Made on Case‑by‑Case Basis. Under any interpretation of the measure, each decision about whether a program should be included in or excluded from the workload budget must be made on a case‑by‑case basis. While the administration could use specific criteria or categories to guide its determinations (for example, “exclude benefit increases from the workload budget”), it would still need to make individual assessments about every legislative change to determine whether it fits those criteria. This makes it difficult for both DOF to administer the calculation and for the Legislature to exercise oversight over it.

Measure Gives Significant Discretion to Director of Finance to Implement Formula. Proposition 55 gives the Director of Finance the discretion to determine how to interpret and make estimates under the calculation. In particular, the formula references DOF’s interpretation of the workload budget on January 1, 2016 and explicitly gives the administration the authority to produce the estimates. As such, while the Legislature can always exert its oversight role in evaluating the calculation, the Legislature cannot independently change the calculation as part of its budget package.

Calculation This Year Will Set Precedent for Future Years. The administration of the Medi‑Cal funding formula under Proposition 55 this year will have implications for how the calculation is interpreted and administered in future years. This can affect the amount of Medi‑Cal funding provided under the formula for over a decade to come. As such, in this budget year, we recommend the Legislature ask the administration for a clear explanation of its underlying rationale in interpreting the measure as it has.

Considerations for a Future Medi‑Cal Allocation

Two Options for Using Medi‑Cal Funding. If the Proposition 55 calculation provides funding to Medi‑Cal in the future, questions arise about how that funding should be used. Proposition 55 requires that funds allocated to Medi‑Cal by the formula be used to increase funding for existing programs and services in Medi‑Cal, not supplant existing General Fund support for the program. We describe two possible approaches that could be used exclusively or in combination, and their implications, in the two paragraphs below.

Pay for Year‑Over‑Year Growth in Medi‑Cal Costs. The administration has indicated that, if the Proposition 55 calculation at some point provides additional funding to Medi‑Cal, it may propose to use these funds to cover the amount by which the state’s costs to operate the Medi‑Cal program have grown over the prior year. This approach would not provide new services or increase funding for the program beyond what would have been provided absent Proposition 55 funding. Arguably, however, voter approval of Proposition 55 demonstrated a desire to increase funding to Medi‑Cal beyond what is needed to pay for the costs of the program under current law. As such, this approach could be interpreted as supplanting existing General Fund support for Medi‑Cal.

Augment Medi‑Cal Services. Alternatively, the Legislature could use Proposition 55 funding for Medi‑Cal to augment the program (for example, by increasing provider rates or expanding the scope of services). We note that Proposition 55 funding for Medi‑Cal will vary from year to year. Thus, if the Legislature augments the Medi‑Cal program—on an ongoing basis—using funds allocated under the calculation, the funding in future years may not be sufficient to cover that augmentation. In those years, the Legislature would have to either reduce services or increase General Fund support for Medi‑Cal. One way to address concerns about funding volatility would be to spend funds on one‑time purposes.