LAO Contact

May 8, 2018

The 2018-19 Budget

California Earned Income Tax Credit Education and Outreach

After California adopted a state earned income tax credit (EITC) in 2015, fewer than half the number of individuals claimed the credit than the administration initially projected. To expand awareness of this benefit among low-income California workers—many of whom are not required to file state income tax returns—the 2016‑17 and 2017‑18 budgets provided $2 million General Fund for grants to third parties for state EITC education and outreach activities. The administration did not propose additional funds for EITC education and outreach grants in the Governor’s 2018‑19 budget proposal. In this post, we explain the federal and state tax credits, describe how grantees used state funds, and comment on how the Legislature might prioritize any future state-funded outreach activities.

Background

The Federal EITC

A Fully Refundable Credit Based on Earned Income. The federal EITC is a provision of the U.S. income tax code that allows taxpayers earning less than a certain amount (about $45,000 for single taxpayers with two children) to reduce their federal tax liability. The amount of the credit depends on taxpayers “earned income” (which primarily includes wages and self-employment income), filing status, and the number of qualifying dependent children. The amount of the federal credit initially rises with earnings, such that the greater the filer’s earnings, the larger the credit. The federal EITC peaks and is then flat for a range of income—between $14,040 and $18,340, for example, in the case of single filers in 2017 with two children. The credit then gradually phases out for higher levels of earnings.

The federal EITC benefit can be significant. The average credit last year was $3,176 for filers with dependent children. Filers with fewer qualifying children receive lesser amounts. The benefit for filers with no qualifying dependent children is much smaller (the maximum credit for such individuals is $510). The tax credit is fully refundable—meaning that if the amount of a taxpayer’s EITC is greater than his or her liability before applying the credit, then the federal government pays the taxpayer that difference.

Reduces Poverty and Generally Encourages Work. The EITC reduces poverty by increasing the after-tax income of low-income individuals and families. In addition, because the amount of the credit initially rises with earnings—which increases the value of additional work—it also has been shown to encourage work, particularly among low-wage and low-skilled single parents. (See our December 2014 report, Options for a State Earned Income Tax Credit, for more information about the design and effectiveness of the federal EITC.)

California’s State EITC

California EITC Builds on the Federal EITC. In 2015, California created a state EITC. The California EITC supplements the federal EITC for working individuals and families with very low earnings (less than $14,161 in 2016). California’s EITC also phases out at a lower maximum income than the federal EITC. Originally, the state EITC allowed only wage income and excluded self-employment income. In addition, eligible filers must be a U.S. citizen or resident alien and be at least age 25 if they do not have a qualifying child (these last two restrictions are based on the federal EITC).

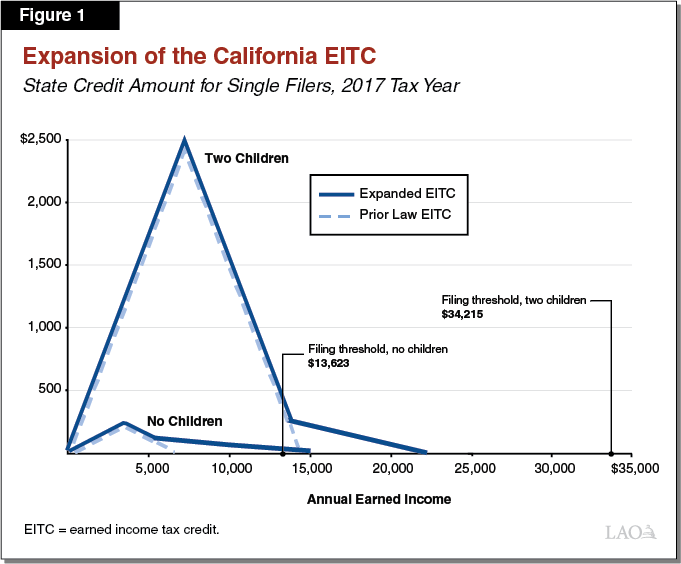

California Expanded State EITC in 2017. The 2017 budget package expanded the state EITC to include self-employment income and increased the income level at which the credit phases out completely (to roughly $22,300). Figure 1 below shows the credit amount available to single filers under the prior-law EITC (dashed line) and the expanded EITC (solid line). The expanded EITC keeps the same structure at the lower end of the income range, but phases out the credit more slowly for those tax filers with relatively higher incomes.

Most Eligible Recipients Not Required to File State Income Taxes. Nearly all households that are eligible to claim a state EITC are not required to file state income taxes because, as we show in the above figure, their incomes are below the filing threshold. (In contrast, many eligible individuals are required to file a federal income tax return because the filing thresholds are much lower.) Consequently, some of those eligible for a state credit may not know the state EITC is available—or that they are eligible—due to not filing a state return. The U.S. Internal Revenue Service (IRS), the state tax agencies, and many other organizations have ongoing efforts to increase the number of eligible individuals and families claiming the federal and state EITCs.

Fewer Claims for State EITC Than Expected. The administration estimated that 825,000 tax filers would qualify for the California EITC in 2015—the first year the credit was available. However, only 385,546 filers, or less than half the estimate, claimed the state EITC on their income tax returns for tax year 2015. (Personal income tax returns typically are filed between January and April of the year following the tax year—returns for tax year 2015 are filed in early 2016.) Claims did not significantly increase for tax year 2016, when 385,910 filers claimed the EITC.

Claims Significantly Increased for 2017. Consistent with last year’s expansion of the state EITC, about 1.3 million 2017 tax year filers have claimed the state EITC through April of this year. Of this total, we estimate that 330,000 filers would have been eligible for the state EITC absent the expansion. The remaining filers became eligible due to the recent changes. Specifically, over 400,000 of this year’s filers had self-employment income, which was not previously included. In addition, about 530,000 filers’ income exceeded the previous limits. As illustrated in the above figure, those with higher incomes receive smaller credits. As a result, the average amount of the credit this year—$226 per claim—is less than half the average credit last year.

Most Tax Returns Prepared With Assistance of Others. The Franchise Tax Board (FTB) administers state income tax law and processes all returns claiming the state EITC. According to FTB, preparers assisted 61 percent of the tax filers who submitted returns claiming the EITC this year. This is an increase from 56 percent last year. While the majority of these preparers were professional paid tax preparers, about 3 percent of filers received assistance at no cost through a federal program that we discuss below. The remaining returns were self-prepared. Most of these self-prepared returns were completed using tax preparation software and filed electronically. FTB provides a service called CalFile that allows California taxpayers to prepare and file their state income tax return online at no cost. However, fewer than 6,000 returns claiming the EITC for 2017, or 0.4 percent, were prepared using CalFile.

EITC Education and Outreach

Various Organizations Conduct EITC Education and Outreach

Volunteer Income Tax Assistance (VITA) Program. The VITA program is an IRS initiative that supports free federal and state tax preparation assistance to individuals with a limited income (generally under $54,000). In 2018, there were more than 850 VITA sites in California. Partner organizations—like nonprofits—provide facilities for VITA volunteers to do tax preparation. As of April 16, 2018, about 279,000 federal income tax returns and 273,000 state income tax returns had been filed at VITA sites in California. Of these, about 61,000 of the federal tax returns claimed the federal EITC and 42,000 of the state tax returns claimed the California EITC. (The number of state EITC claims is lower because it phases out at a lower income than the federal EITC.)

Partner Organizations Raise Awareness About the EITC. Many community-based organizations and other state and local government agencies (such as school districts and county social services offices) engage in efforts to raise awareness about the state and federal EITC and help eligible individuals file their income tax returns. Historically, the state has not provided funding for these specific activities, which include:

Maintaining websites with information about the EITC, providing free online tax preparation services, and hosting online calculators to help individuals estimate their EITC benefits.

Conducting publicity—including advertising across media channels (including social media), conducting interviews, and writing editorials—that increases community awareness about the EITC generally and specific free tax preparation events.

Distributing printed materials—such as pamphlets, flyers, and posters—to low-income families at schools, libraries, and other community centers.

Ongoing FTB Funding for EITC Outreach. Since the 2015‑16 Budget Act, FTB has received $900,000 annually for EITC education and outreach. FTB primarily uses these resources to print and distribute educational fliers, posters, and brochures to schools, libraries, community centers, and free tax preparation sites. These materials are produced in English and four other languages. FTB also engages in ongoing efforts to educate tax preparers about the state EITC and, like other organizations, FTB conducts publicity across media channels to raise awareness about the state EITC and free tax preparation services.

One-Time Special EITC Outreach Efforts in 2016. As the state EITC was a new benefit for the 2015 taxable year, FTB conducted two special efforts to contact individuals directly that appeared to be eligible for the state EITC. During the filing season for 2015, FTB contacted 90,000 individuals who had not filed state taxes in prior years but who appeared to potentially qualify for the state EITC based on their 2014 federal tax information. This trial effort was largely unsuccessful—fewer that 1,200 of those contacted subsequently filed a state tax return and, of these, only a handful actually claimed a state EITC. Later, after the end of the filing season, the Legislature requested that FTB reach out to taxpayers that filed and appeared eligible for the credit but did not claim it. FTB contacted 53,750 state income tax filers. About 7,500 taxpayers filed an amended return claiming the EITC, receiving a total of $4.5 million in refunds.

Grants Awarded to Expand EITC Awareness

State Awarded EITC Outreach Grants in 2016 and 2017. Given less than half as many filers as expected were claiming the state EITC, the Legislature augmented FTB’s budget in 2016‑17 and 2017‑18 by $2 million for grants to other organizations to expand awareness of the EITC. Lacking experience with this type of grant making, FTB signed an interagency agreement with the Department of Community Services and Development (CSD) to administer the grant process.

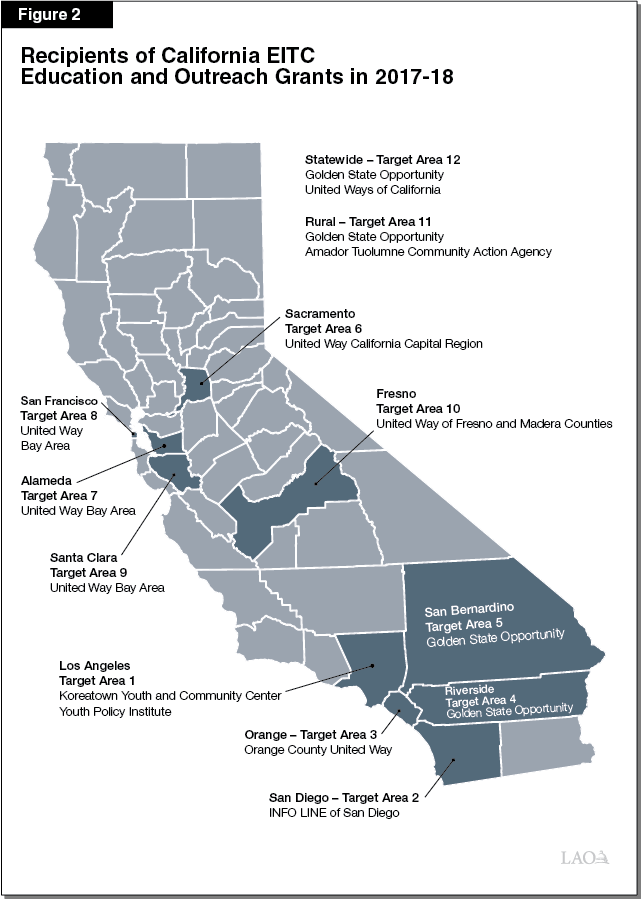

Grant Application Process. In both years, CSD solicited and reviewed grant applications to fund new or expanded EITC education and outreach activities in 12 target areas. As shown in Figure 2 below, the target areas are primarily the ten counties with the highest estimated proportion of eligible California residents not claiming the state EITC. CSD awarded grants based on the applicants’ demonstrated experience conducting similar outreach campaigns and a capacity to engage difficult to reach populations, among other factors. For 2017‑18, CSD awarded 15 grants in total to the 10 community-based organizations listed on the map. (Grants were awarded by target area and organizations were allowed to submit separate applications for more than one target area.)

Grants Have Supported New or Expanded EITC Outreach Efforts. Grantees generally used the additional funds to expand their existing EITC education and outreach activities. As part of those outreach activities, CSD required grantees to include information about free tax preparation services. Grantee activities included increased spending on advertising and media outreach, distribution of printed materials, and canvassing—direct contact with individuals in targeted residential neighborhoods. Several of the organizations used the grant funds to hire a consultant or dedicated employee for communications and public relations. Grantees did not directly use the funds to increase the number of free tax preparation services or VITA sites.

Grantees Measured Individuals Reached. As a condition of the grants, the organizations receiving these funds were required to collect statistics on the number of individuals reached for each education or outreach activity, on a monthly basis. While these statistics may reflect the potential increase in knowledge about the EITC, they do not directly measure whether the additional outreach efforts increased the number individuals claiming the state credit. For example, there was no way to measure whether individuals filing a state tax return claiming an EITC received information through one of the grantees.

LAO Comments

EITC Expansion Significantly Increased EITC Claims. The number of EITC claims has increased significantly in the current year, from 386,000 to about 1.3 million. This was more likely the result of the expansion in eligibility than increased outreach. (As we noted previously, the expansion increased claims by approximately 1 million tax filers who would have not been eligible.) At the same time, some of these newly eligible filers may have learned about the state EITC through these outreach efforts.

Limited Information to Evaluate Grants’ Effectiveness. The first year of state EITC education and outreach grants may have increased knowledge of the EITC, but the use of the credit increased by fewer than 400 returns, or about 0.1 percent, from 2015 to 2016. Whether fewer individuals would have filed a tax return without the additional outreach activities is unknown based on the data available. In addition, we do not know how many eligible individuals did not file tax returns (“non-filers”). As a result, there is no benchmark against which to measure whether outreach was successful. That said, understanding why individuals may not be filing could help the Legislature target and prioritize any future state funding for EITC outreach. We discuss possible reasons individuals may not file state tax returns below.

Individuals May Not File for Different Reasons. Individuals likely do not file state tax returns for three primary reasons:

Unaware of the Credit. As noted earlier, many eligible individuals are not required to file state income taxes. As a result, some non-filers may be unaware of the credit and their ability to receive a refund.

Choose Not to File at All. Other non-filers may be aware of the credit, but choose not to file either federal or state tax returns. These individuals may have different reasons for choosing not to file their tax returns. For example, some non-filers might mistrust government, while others might be concerned about the immigration status of a household member.

Deterred by Filing Costs. The last group of non-filers also may be aware of the credit, file a federal tax return, but choose not to file a state tax return for practical, financial considerations. Specifically, those with higher incomes receive smaller credits. For these individuals, the cost of filing a state return—which can be between $30 and $70 using commercial software—may exceed the amount they would receive under the EITC.

Prioritizing Future Education and Outreach Grant Funding. As the Legislature considers whether to provide additional outreach funding, we suggest first considering who is not claiming the EITC and why. Understanding why the credit may be undersubscribed could help determine how to target and prioritize future outreach efforts for the strongest effect on boosting participation. For example, if the Legislature wants to target eligible non-filers who do claim the federal EITC, they may want to prioritize funding to expand awareness of and access to free state filing options such as CalFile and the VITA tax preparation sites. In addition, if the Legislature wants to target those individuals who may be unaware of the credit because they were not eligible in the prior year (usually due to a change in income), they may want to prioritize funding for education and outreach activities that would increase awareness of the credit more generally.