The 2019-20 Budget:

California's Fiscal Outlook

See a list of this year's fiscal outlook material, including the core California's Fiscal Outlook report, on our fiscal outlook budget page.

LAO Contact

November 14, 2018

The 2019-20 Budget

California’s Fiscal Outlook

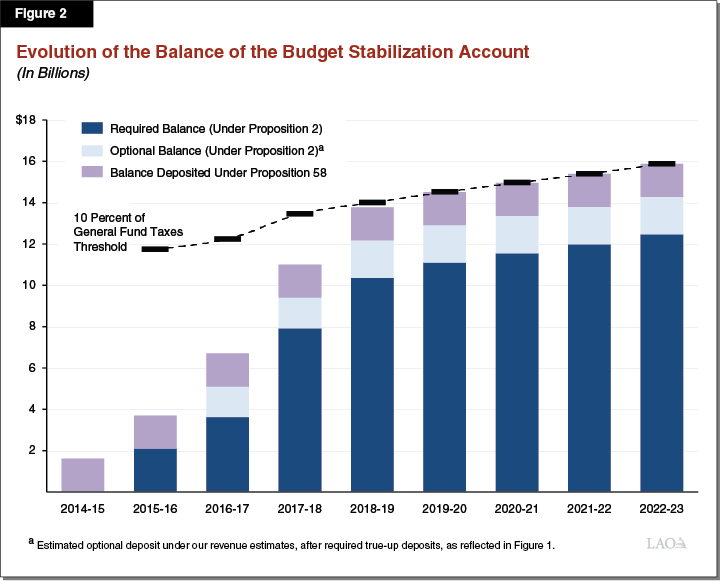

Evolution of the Balance of the Budget Stabilization Account

The budget has a few general purpose reserve accounts. The largest of these is the Budget Stabilization Account (BSA), which is governed by constitutional rules under Proposition 2 (2014). This post discusses the various types of deposits the Legislature has made into the BSA that now compose its balance. We also present our projections of the estimated balance in the BSA under our recently published The 2019‑20 Budget: California’s Fiscal Outlook.

Reserve Deposits Under Proposition 58

Proposition 58 Governed BSA Deposits From 2004 to 2014. With the approval of Proposition 58 in 2004, voters created the BSA. Proposition 58 required the state to make an annual deposit into the BSA. (The Governor could suspend the deposit with an executive order.) Proposition 58 required BSA deposits to increase from 1 percent of General Fund revenues in 2006‑07 to 3 percent in 2008‑09 and every year thereafter.

Proposition 58 Required Deposits Until BSA Reached Certain Size. Under Proposition 58, deposits into the BSA were no longer required if the fund reached $8 billion or 5 percent of General Fund revenues, whichever was larger. Proposition 58 explicitly permitted the Legislature to transfer amounts into the BSA so that its balance exceeded either of these thresholds.

Deposit Made Under Rules of Proposition 58 in 2014‑15 Budget Package. In the 2014‑15 budget package, the Legislature made a deposit into the BSA of $1.6 billion under the rules of Proposition 58. (Before this transfer the BSA had no balance.) When the Legislature planned this deposit in the 2014‑15 Budget Act, it already had approved the placement of a constitutional amendment on the ballot to amend the rules of the BSA—Proposition 2.

Reserve Deposits Under Proposition 2

Proposition 2 Now Governs BSA Deposits. In November 2014, voters approved Proposition 2. In addition to other changes, Proposition 2 created a set of formulas that specified minimum annual amounts the state must deposit into the BSA and use to pay down certain debts. Under the measure, the state must set aside two amounts: (1) 1.5 percent of General Fund revenues and (2) a portion of capital gains revenues that exceed a specified threshold. From these two amounts, the state must allocate half to increase the balance of the BSA and the other half to pay down debts.

Proposition 2 Also Created New Rules Withdrawing Funds From the BSA. Under the rules of Proposition 2, the Legislature can only make a withdrawal from the BSA if the Governor has first called a budget emergency. The Governor may only call a budget emergency if one of two conditions holds: (1) estimated resources in the current or upcoming fiscal year are insufficient to keep spending at the level of the highest of the prior three budgets, adjusted for inflation and population (a “fiscal budget emergency”), or (2) in response to a natural or man-made disaster. In the case of a fiscal budget emergency, the Legislature may only withdraw the lesser of: (1) the amount needed to maintain General Fund spending at the highest level of the past three enacted budget acts, or (2) 50 percent of the BSA balance.

Constitution Requires “True Up” of BSA Deposits. Under Proposition 2’s true-up provisions, the state reevaluates each year’s BSA deposit twice: once in each of the two subsequent budgets. The state does this because initial estimates of future capital gains revenues are highly uncertain. This process attempts to align those original estimates of required deposits with actual revenues. Under these reevaluations, the state revises the BSA deposit up (down) if excess capital gains taxes are higher (lower) than the state’s prior estimates.

Infrastructure Spending Required When the BSA Reaches Specific Threshold. Under Proposition 2, the state must make deposits into the BSA until its balance reaches a threshold of 10 percent of General Fund taxes. Each year that General Fund tax revenues grow, this 10 percent threshold also grows. As such, in each of these years, the state is required to make deposits into the BSA to bring the fund to the revised estimate of 10 percent of General Fund taxes. Any additional required deposits that would bring the BSA above 10 percent of General Fund taxes must be spent on infrastructure.

Optional Reserve Deposits

Legislature Has Made Two Optional Deposits Into the BSA. In recent years, the Legislature has elected to deposit additional amounts into the BSA—above the constitutionally required minimums. In particular, the Legislature deposited an additional $2 billion into the BSA in 2016‑17 and an additional $2.6 billion in 2018‑19. The language of Proposition 2 does not speak to these optional deposits. Consequently, it is not clear: (1) which, if any, of the withdrawal rules in Proposition 2 apply to these funds, or (2) whether these deposits count toward the 10 percent threshold. Moreover, it is not clear whether these rules also apply to the $1.6 billion deposit made before the passage of Proposition 2.

Optional Deposits Have Been Used to Fund True-Up Deposits. The optional deposit legislation in both 2016‑17 and 2018‑19 indicated those deposits would be used for any true-up deposits for that year and the prior year. For example, the $2 billion optional deposit made in 2016‑17 was used to fund estimated true-up deposits for 2015‑16 and 2016‑17. As Figure 1 shows, this means that $500 million of the initial $2 billion deposit is “constitutionally required” (under the true-up provisions) and the remainder is optional. Under our recent Fiscal Outlook revenue estimates for 2017‑18 and 2018‑19, the initial $2.6 billion optional deposit made in 2018‑19 would now be mostly constitutionally required, with only $320 million still considered optional. (That is because our estimates of capital gains revenues for 2017‑18 and 2018‑19 are now higher than the budget act estimates by billions of dollars.)

Figure 1

Estimated Amount of Optional Deposits Is $1.8 Billion

|

Initial optional deposit in 2016–17 |

$2,000 |

|

Less: final true up in 2015–16 |

–232 |

|

Less: final true up in 2016–17 |

–280 |

|

Final Optional 2016–17 Deposit |

$1,488 |

|

Initial optional deposit in 2018–19 |

$2,611 |

|

Less: estimated true up for 2017–18 |

–1,592 |

|

Less: estimated true up for 2018–19 |

–698 |

|

Estimated Optional 2018–19 Deposit |

$320 |

|

Total Amount of Optional Deposits |

$1,808 |