December 21, 2018

Assessing California's Climate Policies—Transportation

- Introduction

- Background

- Key Takeaways From Review of Major Policies

- Light‑Duty Vehicles

- Heavy‑Duty Vehicles

- Low Carbon Fuels

- Vehicle Miles Traveled

- Conclusion

Executive Summary

Overview of Report. Chapter 135 of 2017 (AB 398, E. Garcia) requires our office to annually report on the economic impacts and benefits of California’s statutory greenhouse gas (GHG) emission goals—statewide emissions to 1990 levels by 2020 and to 40 percent below 1990 levels by 2030. This report provides our assessment of the effects, of major policies in the transportation sector intended to help meet these goals, as well as identifies some key issues for the Legislature to consider as it makes future policy and budget decisions. In a companion report, Assessing California’s Climate Policies—An Overview, we describe the general types of economic effects of state climate policies, key challenges in measuring these effects, and broad issues for the Legislature to consider when designing and evaluating its climate policies.

State Has Many Policies to Reduce Transportation Emissions. Transportation is the largest source of California’s GHG emissions—mostly from light‑duty passenger vehicles. Emissions declined from 2006 to 2016, but have increased slightly in recent years. As we discuss in this report, the state has many policies in place to reduce GHG emissions in the transportation sector. The major categories of programs include (1) reducing emissions from light‑duty vehicles, (2) reducing emissions from heavy‑duty vehicles, (3) increasing the use of lower carbon fuels, and (4) reducing the number of vehicle miles traveled. These programs are intended to work in a variety of ways. For example, some programs provide financial assistance incentives to reduce the cost of adopting lower emission technologies, while other programs are designed to increase the costs of using higher emission technologies. Some programs are targeted towards consumers of fuel, while other programs are targeted towards vehicle manufacturers and fuel producers.

Key Takeaways From Review of Major Policies. In this report, we assess each of the four major categories of programs in terms of their costs and benefits, as well as identify key issues for legislative consideration. Based on our review, we identified several important takeaways. Broadly, we find that:

- Overall Economic Impacts and Benefits Are Unclear. The overall effects of the state’s policies aimed at reducing transportation GHGs are largely unclear. The Legislature might want to consider options to facilitate a more consistent evaluation of these policies, such as requiring regular retrospective evaluations of these policies and prioritizing policies that are designed in ways that facilitate evaluation.

- Large Number of Policies Targeting Transportation Emissions Creates Challenges. Although implementing multiple programs could be justified in some instances, the wide range of programs creates several challenges, including (1) interactions whereby emission reductions from one policy offset those from a different policy, (2) challenges in evaluating the net effects of each policy, (3) a potential lack of coordination among policies, and (4) higher administrative costs.

- Policies Are Relatively Costly Ways to Reduce GHGs, but Could Be Valuable in Limited Instances. The state’s transportation‑specific policies are generally much more costly ways to reduce emissions than carbon pricing policies, such as cap‑and‑trade. As a result, the Legislature might want to consider relying more heavily on cap‑and‑trade to achieve low‑cost GHG reductions. In some limited instances, there is a rationale for targeted policies that complement carbon pricing—such as those that promote public zero‑emission vehicle fueling infrastructure and that promote technological innovation. Some policies might also be justified based on their ability to reduce co‑pollutants.

- Effect on Emissions in Other Jurisdictions Unclear. The effect of California’s transportation policies on emission reductions in other jurisdictions is especially difficult to quantify. In concept, policies such as those aimed at supporting technological innovation seem most likely to achieve “spillover” benefits from reductions in other jurisdictions.

Introduction

Chapter 135 of 2017 (AB 398, E. Garcia) requires our office to report annually on the economic impacts and benefits of the state’s greenhouse gas (GHG) limits. This report is one of two 2018 reports that fulfill this requirement. In a companion report, Assessing California’s Climate Policies—An Overview, we provide conceptual overview of the overall effects of the state’s GHG reduction policies. In this report, we assess in more detail the effects of the state’s major GHG policies aimed at reducing emissions from the transportation sector, specifically policies focused on light‑duty vehicles, heavy‑duty vehicles, low carbon fuels, and vehicle miles traveled (VMT). Our assessment is largely based on our review of available program data, agency reports, and academic studies. We begin the report by providing background information on California’s major GHG policies in the transportation sector and summarizing some of the key takeaways from our review. Then, for each group of policies, we (1) provide an overview of the policies, (2) assess the economic costs and benefits of those policies, and (3) identify issues for the Legislature to consider as it continues to modify and develop policies to achieve its statewide GHG goals.

Background

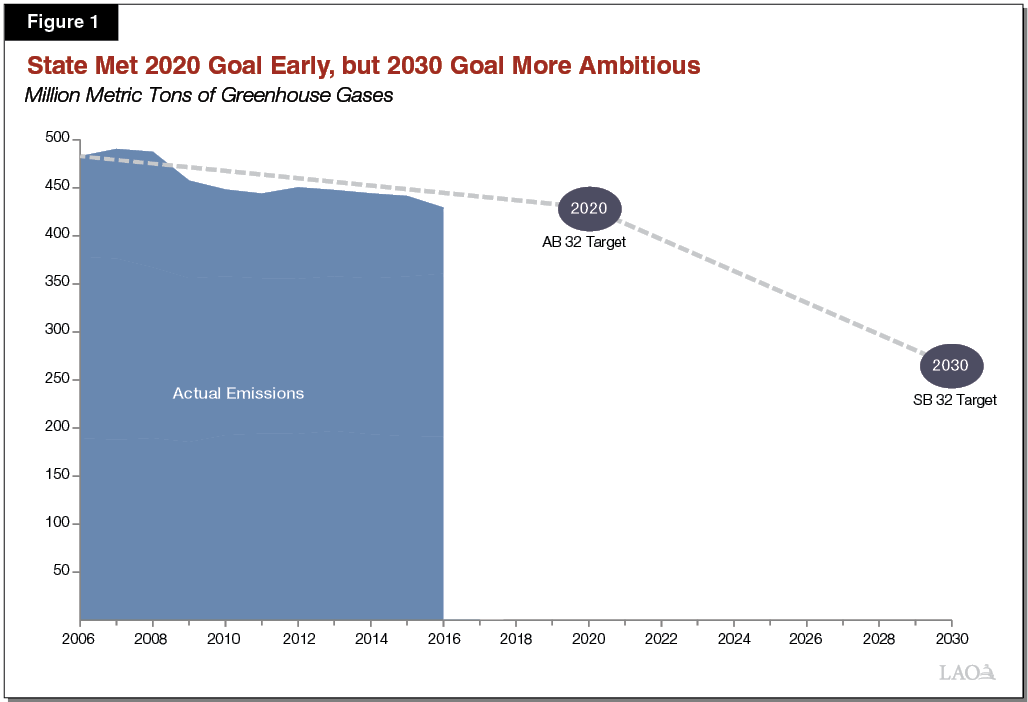

State Has Ambitious GHG Reduction Goals. Chapter 488 of 2006 (AB 32, Núñez/Pavley) established the goal of limiting GHG emissions statewide to 1990 levels—431 million metric tons of carbon dioxide equivalent (CO2e)—by 2020. In 2016, Chapter 249 (SB 32, Pavley) extended the limit to 40 percent below 1990 levels—259 million metric tons CO2e—by 2030. As shown in Figure 1, emissions have decreased since AB 32 was enacted and were already below the 2020 target in 2016. However, the rate of reductions needed to reach the SB 32 target are much greater.

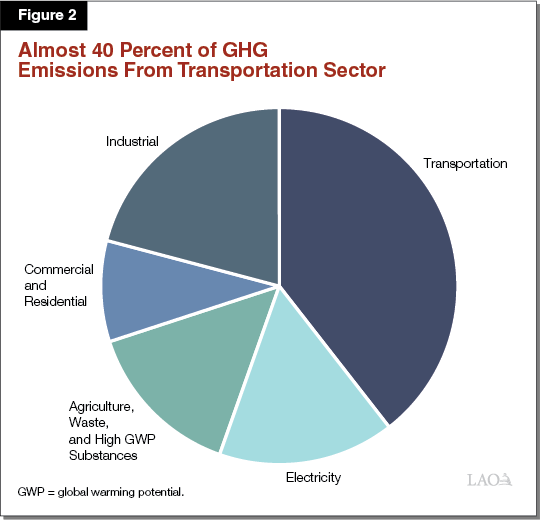

Transportation Is Largest Source of State GHG Emissions. The California Air Resources Board (CARB) maintains a GHG inventory that estimates emissions from most sectors of the state. According to the inventory, there were 429 million tons CO2e emitted in California in 2016. As shown in Figure 2, these emissions came from a variety of sectors, with transportation being the largest source of emissions (39 percent).

We note that CARB’s emission estimates for the transportation sector are based on tailpipe emissions only and do not include emissions associated with the extraction or production of gasoline or diesel products—also known as “upstream” emissions. To the extent that these activities occur in California (as does much of the refining activity for fuel sold in the state), the inventory reflects estimates for those emissions in other sectors (such as industrial sector). In addition, the estimates assume no net carbon dioxide emissions from combusting biofuels, such as ethanol used in cars and biodiesel for trucks.

In recent years, roughly 90 percent of emissions from the transportation sector have come from on‑road sources, specifically passenger vehicles (69 percent) and heavy‑duty vehicles (22 percent). The remaining emissions have come from a variety of other sources, including ships, airplanes, and rail.

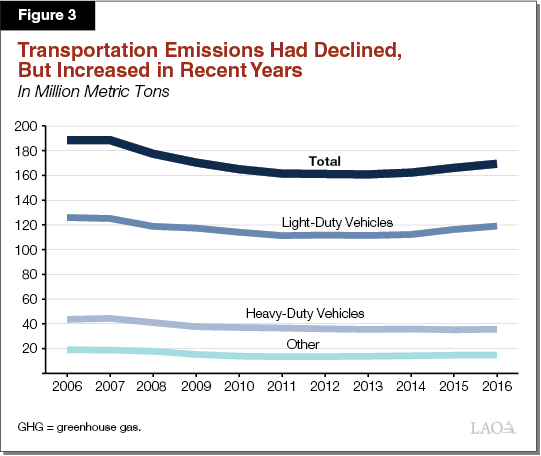

Transportation Emissions Have Been Increasing in Recent Years. Figure 3 shows the level of emissions from the transportation sector from 2006 to 2016 (most recent available data). As shown in the figure, overall transportation emissions declined by 14 percent from 2007 to 2011. This includes emission declines from light‑duty vehicles, medium‑ and heavy‑duty vehicles (together referred to as heavy‑duty vehicles), and other types of transportation. However, transportation emissions have increased since 2013, primarily from light‑duty vehicles. These overall trends are affected by a range of factors, including economic conditions and state policies (such as those intended to reduce emissions).

State Has Many Policies to Reduce Transportation Emissions. The state has many policies in place to reduce GHG emissions in the transportation sector. For the purpose of this report, we have categorized the major state transportation‑related programs into four major categories: (1) reducing emissions from light‑duty vehicles, (2) reducing emissions from heavy‑duty vehicles, (3) increasing the use of lower carbon fuels, and (4) reducing VMT. As discussed in more detail later in this report, these programs are intended to work in a variety of ways. For example, some programs provide financial (or other) incentives to reduce the costs of adopting lower‑emission technologies, while other programs are designed to increase the costs of using higher‑emission technologies. Some programs are targeted towards consumers of fuels (individual drivers, businesses, and governments that rely on vehicles), while other programs are targeted towards vehicle manufacturers and fuel producers. Figure 4 summarizes the various programs designed to reduce GHG emissions in the transportation sector.

Figure 4

State Oversees Various Programs Designed to Reduce Greenhouse Gas (GHG) Emissions in Transportation Sector

|

Light‑Duty Vehicle Programs |

|

|

|

|

|

|

|

Heavy‑Duty Vehicle Incentives |

|

|

|

|

|

Low Carbon Fuels |

|

|

Vehicle Miles Traveled |

|

In addition to the major state programs identified in Figure 4, the state oversees certain programs that are smaller in scale, as well as some programs that primarily are targeted at other goals, such as reducing criteria air pollutants. There are also a number of other state programs that—while not targeted specifically at the transportation sector—could impact GHG emissions in this sector. The clearest example of this is the state’s cap‑and‑trade program. In addition, there are a number of federal programs and policies that are designed to reduce transportation emissions. While the above programs could impact GHG emissions, this report primarily focuses on the state’s major transportation programs.

Key Takeaways From Review of Major Policies

Based on our review of the various polices designed to reduce GHG emissions in the transportation sector, we identified several important takeaways. Broadly, we find that (1) overall economic effects, including effects on GHG emissions, are unclear; (2) the large number of different policies creates various challenges for such things as program coordination and evaluation; and (3) the policies are generally more costly strategies to reduce GHGs than alternatives, such as cap‑and‑trade, although they could provide other important benefits in certain limited circumstances.

Overall Economic Impacts and Benefits Are Unclear. The overall effects of the state’s policies aimed at reducing transportation GHGs—both positive and negative—are largely unclear. The amount and quality of available information about each major program varies significantly, but, in many cases, the available research on major effects is limited. Most notably, there are very few retrospective analyses—conducted by outside researchers or state agencies—that isolate the effects of each policy from other important factors such as economic conditions and other policies. As we discuss in our companion report, these types of analyses are often difficult for a variety of reasons. For example, controlling for other factors that affect emissions (such as economic conditions) and quantifying implicit and indirect effects often require advanced statistical methods. In our view, such analyses are critical for understanding the actual effects of state policies. In our assessment of each major category of policies later in this report, we identify areas for future research that could help address key gaps in knowledge.

The Legislature might want to consider taking various steps to facilitate greater, more consistent evaluation of state climate policies. For instance, the Legislature could require agencies to use an independent expert review panel to comment on the estimated costs and benefits of programs before they are adopted. It could also require departments to conduct retrospective evaluations of major programs after they are implemented. As part of this process, the Legislature might also want to require state agencies to establish a plan for this retrospective evaluation before the program is implemented. These additional evaluation activities would likely result in additional state costs, but could improve the available information on the effects of these programs. Finally, the Legislature could (1) prioritize policies that lend themselves to an evaluation of costs, such as market‑based policies where credit prices provide information on program costs, or (2) design programs in a way that facilitate evaluation, such as piloting programs in certain parts of the state.

Large Number of Policies Targeting Transportation Emissions Creates Challenges. The wide range of state (and federal) programs intended to reduce emissions can overlap and interact in complex ways. For example, there are a wide variety of policies aimed at promoting light‑duty zero‑emission vehicles (ZEVs) such as battery electric vehicles. These include a few different types of consumer rebates for ZEV purchases, a regulation requiring manufacturers to produce a minimum number of ZEVs, and funding for charging and refueling infrastructure. There are likely some limited cases where more than one program is needed to effectively achieve a policy goal. For instance, separate (but coordinated) policies meant to encourage both vehicle purchases and charging infrastructure might be justified. However, having multiple programs often creates several problems or challenges, such as:

- Interactions With Other Policies. In some cases, emission reductions from one policy could be offset by increases in emissions from other policies. For example, in some cases, interactions between state transportation‑specific policies might interact with other policies—such as the state cap‑and‑trade program, the federal Renewable Fuel Standard (RFS), or federal fuel efficiency standards—in ways that “reshuffle” emissions to other jurisdictions, rather than reduce net emissions. This is an inherent challenge in implementing GHG reduction policies at the state‑level. As a result, the Legislature might want to consider funding more research on the relationship between different state and federal policies to better understand: (1) how they interact with one another and (2) the net effects of each policy.

- More Difficult to Evaluate Programs. These interactions also make it difficult to evaluate the effects of each policy. For example, although we know ZEV sales are increasing, it is difficult to evaluate the effects of any one policy. In turn, this makes it difficult to determine which policy the state should expand to achieve future state goals most effectively.

- Potential Lack of Coordination. The existence of multiple programs and administering agencies can make state coordination difficult. For example, three different state agencies administer different heavy‑duty vehicle and infrastructure incentive programs—many of which fund similar types of activities. Given the potential lack of coordination, it is not clear whether funds are allocated to the highest priority projects. In addition, having multiple programs could also create confusion among potential program recipients.

- Increased Administrative Costs. More programs tends to increase administrative overhead costs. At the time of this report, CARB had not provided updated information on the administrative costs of its major programs. However, based on available information, state administrative costs are likely at least in the low tens of millions of dollars annually. (These costs are relatively small compared to magnitude of the overall economic effects.)

Policies More Costly Than Cap‑and‑Trade . . . We recommend the Legislature consider limiting its GHG policies to those that achieve its policy goals most cost effectively, particularly as these goals become more ambitious in future years. Most notably, there is a broad consensus among economists that economy‑wide carbon pricing—cap‑and‑trade or a carbon tax—is the most cost‑effective way to reduce emissions. In contrast, some of the major policies aimed at reducing emissions in the transportation sector—such as the low carbon fuel standard (LCFS) and financial incentives for ZEVs—appear to be much more costly. As a result, the Legislature might want to consider modifying or eliminating some of the more costly programs and, instead, relying more heavily on cap‑and‑trade (or a carbon tax) to encourage the lowest‑cost emission reductions. In practice, this would likely lead to higher cap‑and‑trade allowance prices, but lower overall costs of GHG reductions.

. . . But Well‑Targeted Complementary Policies Could Be Valuable in Limited Instances. In some limited instances, there may be a strong rationale for additional state policies to complement a carbon price. Notably, in some cases, there are other “market failures” that would prevent businesses, households, or governments from taking low‑cost emission reduction activities, even with a carbon price in place. For example, there could be “network effects” related to electric vehicle deployment—meaning the demand for ZEVs and charging and refueling stations is partially dependent on the availability of each other. Other policies to address market failures could include research and development funding for new technologies or providing more information to consumers about the products they purchase.

Although some of these market failures almost certainly exist, we found limited evidence to suggest that the current mix of policies are effectively addressing these failures. The Legislature might want to direct agencies to ensure that any GHG reduction policy beyond carbon pricing is based on strong evidence that a market failure exists and the policy is effectively targeted at addressing that identified market failure.

We also note that some of the transportation policies—although not cost‑effective tools for reducing GHGs—might still be worthwhile based on the other benefits they provide (such as reducing co‑pollutants). If so, the Legislature will want to ensure that these policies are effectively targeted toward achieving these non‑GHG benefits and that the overall benefits outweigh the costs.

Effect on Emissions in Other Jurisdictions Unclear. Given California’s small contribution to global GHG emissions, the Legislature might want to give extra consideration to GHG policies that encourage reductions in other parts of the world. Unfortunately, the effect of California’s transportation policies on emission reductions in other parts of the world is difficult for our office to evaluate. In general, targeted policies aimed at supporting technological innovation—such as incentives for pilots and demonstrations of new technologies—seem more likely to encourage these types of “spillover” benefits than policies that address issues that are more California‑specific, such as land use and transportation planning in California.

In the following sections of this report, we (1) provide background on each of the state’s major transportation policies aimed at reducing GHGs, (2) provide our assessment of the available information on their costs and benefits, and (3) identify key issues for legislative consideration.

Light‑Duty Vehicles

CARB estimates that 70 percent of GHG emissions from California’s transportation sector—and 28 percent of all GHG emissions in California—come from light‑duty vehicles (specifically, cars and trucks that weigh 8,500 pounds or less). As discussed in detail below, the state oversees several programs designed to reduce emissions from light‑duty vehicles, including (1) financial and other incentives for consumers to purchase and use more fuel‑efficient and ZEVs, (2) regulations on auto manufacturers to sell more of these vehicles, and (3) increased financial support for additional ZEV charging and refueling stations.

Several of the state’s programs are specifically targeted at increasing the deployment of ZEVs, such as battery electric and hydrogen fuel cell vehicles. (Please see nearby box for a more detailed description of the different types of ZEVs.) The emphasis on ZEVs is consistent with state policies, including Chapter 530 of 2014 (SB 1275, de León) and Executive Order B‑48‑18, which set targets of 1 million ZEVs on California roads by 2023 and 5 million ZEVs by 2030, respectively. There are currently about 400,000 ZEVs registered in California, which is just over 1 percent of total light‑duty vehicles in the state (and about half of all ZEVs nationally). We estimate that if the state reached the goal of 5 million ZEVs by 2030, their share of the total fleet would have to increase to about 15 percent.

Different Types of Low‑ and Zero‑Emission Vehicles

There are a number of different technologies used by automobile manufacturers to meet state requirements for low‑ and zero‑emission vehicles (ZEVs).

ZEVs. A full ZEV has no tailpipe exhaust of any criteria pollutant or greenhouse gas (GHG). The different types of ZEVs include:

- Battery Electric Vehicle—Relies solely on a battery to propel the vehicle and has to be recharged from an external power source.

- Fuel Cell Vehicle—Uses an electrochemical reaction to combine hydrogen fuel and oxygen to produce electricity to propel the vehicle, with water being the other byproduct of the reaction. (Also referred to as fuel cell electric vehicles.)

- Neighborhood Electric Vehicle—Low‑speed battery electric vehicles.

Other Types of Reduced Emission Vehicles. There are several categories of vehicles that have lower GHG and other air pollutant emissions compared to typical cars. Some of these categories are or have been qualifying vehicles for some of the state’s emission reduction programs.

- Extended Range Battery Electric Vehicle—Utilizes an electric battery as its main power source for propulsion, but also has an auxiliary power unit (fueled by gasoline, for example) that can be utilized when the main power source is depleted.

- Hybrid Electric Vehicle (HEV)—Combines a conventional internal combustion engine with an electric‑propulsion system. Consequently, HEVs are at times powered by gasoline and at other times by an electric battery.

- Hydrogen Internal Combustion Engine (HICE)—Uses hydrogen as the onboard fuel source for combustion, rather than gasoline.

- Plug‑in Hybrid Electric Vehicle (PHEV)—Uses a battery that can be recharged by plugging into an external power source—a type of HEV.

- Transitional ZEV—Is a category of vehicles with 90 percent fewer tailpipe emissions than average gasoline powered cars, as well as meets other requirements. Can include PHEVs and HICEs.

Overview of Light‑Duty Programs

Clean Vehicle Rebate Project (CVRP)

Provides Consumer Rebates. CVRP is intended to increase deployment of ZEVs by reducing the cost to consumers of obtaining these vehicles. Specifically, the program provides rebates for the purchase or lease of ZEVs by eligible individuals, businesses, nonprofits, and government agencies in California. As shown in Figure 5, the amount of the rebate ranges from $900 to $5,000, depending on the type of vehicle purchased. Vehicles that qualify for the rebate are plug‑in hybrid electric, battery electric, and hydrogen fuel cell cars and motorcycles. Since 2016, lower‑income households—those with incomes at or below 300 percent of the federal poverty level—can receive an additional $2,000 rebate. High‑income households—over $300,000 gross annual income for joint filers, for example—are ineligible to receive the rebate.

Figure 5

CVRP Rebate Amount Based on Type of Technology

|

Technology Type |

Examples |

Amounta |

|

Hydrogen fuel cell |

|

$5,000 |

|

||

|

Battery electric |

|

2,500 |

|

||

|

||

|

||

|

Plug‑in hybrid electric |

|

1,500 |

|

||

|

||

|

Zero‑emission motorcycles |

|

900 |

|

||

|

aApplicants from lower‑income households can receive an additional $2,000. High‑income households are ineligible to receive the rebate. CVRP = Clean Vehicle Rebate Project. |

||

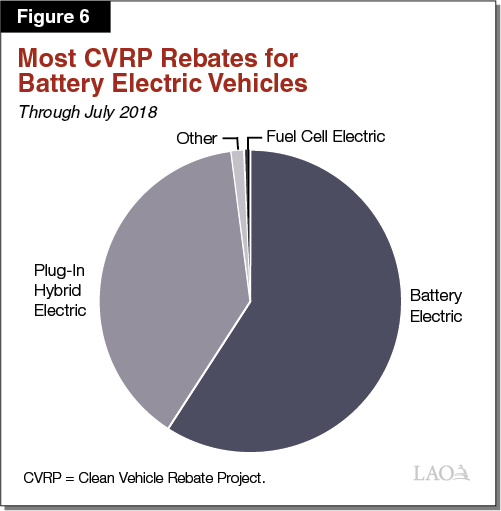

Rebates to Date. As of November 2018, the program had provided a total of $589 million in rebates to 264,000 consumers since it began in 2010. CVRP rebates are currently funded entirely from the Greenhouse Gas Reduction Fund (GGRF), which is supported by proceeds of the state’s cap‑and‑trade program on GHG emissions. As shown in Figure 6, most rebates have been for battery electric vehicles.

Clean Cars 4 All Program

Rebates to Replace Higher Polluting Vehicles. The Clean Cars 4 All Program offers rebates to certain consumers who retire their existing, older vehicles that have failed smog tests and purchase newer vehicles that meet specific requirements. Replacement vehicles eligible for the rebate include ZEVs as well as certain non‑ZEVs and can include used vehicles. The program also provides an additional incentive to consumers who reside in or near a disadvantaged community. (For purposes of state climate policies, disadvantaged communities are defined by the California Environmental Protection Agency (EPA) based on various measures of environmental and socioeconomic conditions within each census tract.)

Currently, the program operates in two of the air districts in the state that have not reached federal air quality standards—the San Joaquin Valley Air Pollution District and the South Coast Air Quality Management District—though CARB is considering whether to expand the program into other areas of the state. In total, the financial incentive ranges from $2,500 to $9,500 per vehicle. As shown in Figure 7, the specific amount a consumer is eligible to receive depends on household income, the choice of replacement vehicle, and whether the consumer lives in or near a disadvantaged community. Consumers can participate in both the Clean Cars 4 All Program and CVRP if they meet the eligibility requirements for both programs.

Figure 7

Clean Cars 4 All Program Incentive Based on Replacement Vehicle, Income, and Location

|

Income Levela |

Conventional |

Hybrid Electric |

Plug‑In Hybrid Electric |

Battery Electric |

Alternative Transportationb |

|

|

(20+MPG) |

(35+MPG) |

|||||

|

Residing in or Near Disadvantaged Community |

||||||

|

Above moderate |

— |

— |

— |

$5,500 |

$5,500 |

$2,500 |

|

Moderate |

— |

— |

$5,000 |

7,500 |

7,500 |

3,500 |

|

Low |

$4,000 |

$6,500 |

7,000 |

9,500 |

9,500 |

4,500 |

|

All Others |

||||||

|

Above moderate |

— |

— |

— |

$2,500 |

$2,500 |

$2,500 |

|

Moderate |

— |

— |

$3,500 |

3,500 |

3,500 |

3,500 |

|

Low |

$4,000 |

$4,000 |

4,500 |

4,500 |

4,500 |

4,500 |

|

aModerate‑income level is defined as from 226 percent through 300 percent of the federal poverty level. bIncludes transit passes and is available in lieu of a replacement vehicle. MPG = miles per gallon. |

||||||

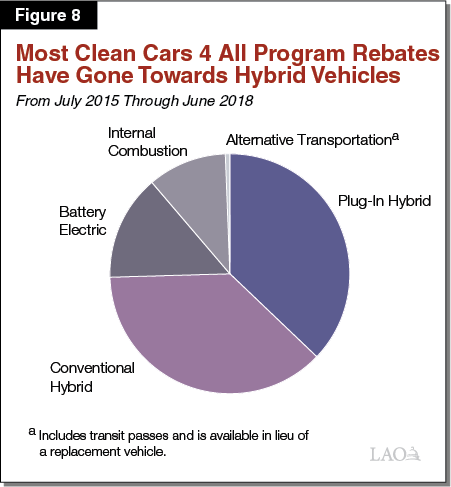

Over 3,000 Rebates to Date. In the first three years of the program—through June 2018—the program provided about 3,700 incentives totaling $28 million. Funding for the program comes through a combination of vehicle‑related fees and GGRF. As shown in Figure 8, over two‑thirds of the replacement vehicles have been standard hybrids or plug‑in electric hybrids.

Single‑Occupant Vehicle Decals

Allow Solo Drivers in Carpool Lanes. This program is designed to provide consumers a nonfinancial incentive to purchase and use ZEVs. State law allows qualifying electric, plug‑in hybrid, and hydrogen fuel cell vehicles to use high‑occupancy vehicle (HOV) lanes even when only a single occupant is in them. The Department of Motor Vehicles (DMV) issues decals for cars identified by CARB as meeting the definition of a ZEV. (Previously, conventional hybrid vehicles were also eligible for decals.) Higher‑income earners who purchase a hydrogen fuel cell vehicle are required to choose between receiving the decal or the rebate available through CVRP. (Higher‑income earners who purchase an electric or plug‑in electric vehicle are eligible for the decal but not the rebate.)

400,000 Decals Issued to Date. Since the program began in 2001, the state has issued about 400,000 clean air decals. Very few decals were issued in the early years of the program, and conventional hybrid vehicle owners received most of the decals in mid‑ and late‑2000s. In more recent years, the total number of decals issued has increased significantly with most of these being for electric and plug‑in electric vehicles.

Clean Car Standards

State and Federal Regulations to Reduce Fleet Emissions. The Legislature adopted Chapter 200 of 2002 (AB 1493, Pavley), which required CARB to develop regulations to reduce emissions from each auto manufacturer’s fleet of passenger cars and light‑duty trucks (sometimes referred to as the clean car standards or “Pavley Standards”). California’s standards, which first took effect in 2009, are currently aligned with emission standards set by the federal EPA and fuel economy standards set by the National Highway Traffic Safety Administration (NHTSA). United States EPA and CARB have established maximum average emission rates (grams of C02e per mile) that apply to each car manufacturer’s entire fleet of (1) cars and (2) light‑duty trucks. These emission standards are scaled based on the size of each car or truck so that larger vehicles face a less strict standards compared to smaller vehicles. The emission standards are scheduled to become more stringent each year through 2025.

To comply with the standard, manufacturers estimate the emissions for each vehicle model and compare it to the standard established for that vehicle size, generating credits for vehicles with lower emissions than the standard and deficits for vehicles with higher emissions than the standard. At the end of each year, each manufacturer is evaluated based on its entire fleet of new cars sold. If the average emissions rate is at or below the standard, the manufacturer is in compliance. The regulation also gives flexibility for auto manufacturers that do not comply in a given year. For example, they can buy credits from other manufacturers that overcomply with the regulation or use excess credits that were banked from previous years. If a manufacturer does not comply with the regulation in one of these ways, it faces a financial penalty.

Manufacturers have several options for how to modify their fleet over time in order to maintain compliance with the regulation. For example, they can modify individual vehicles in ways to reduce emissions. This can include making changes that increase the fuel economy of the vehicle, such as by making the vehicle lighter or more aerodynamic. It can also include other technological changes to the engine to make it more efficient or reduce leaks from air conditioning systems. In addition, manufacturers can change the mix of vehicles they sell by promoting and selling more low‑ and zero‑emission vehicles.

ZEV Mandate

Regulation Requires Increased ZEV Sales. This CARB regulation is designed to increase the number of ZEVs sold in California. CARB first established the program in 1990, and it has been modified several times in subsequent years. The current regulation, established in 2012, is intended to result in an increasingly higher number of ZEVs being sold in California by auto manufacturers. To implement the regulation, CARB assigns a different ZEV credit—ranging from zero points to 4 points—to each qualifying vehicle model sold in California based on its technology and distance range. For example, a fuel cell vehicle with a range of more than 350 miles would receive a full 4 points, while a plug‑in hybrid electric vehicle with an all‑electric range of more than 80 miles per charge would receive a maximum of 1.3 points. In addition, under the regulation manufacturers have other constraints on the amount of their compliance obligation that can be met through transitional ZEVs (generally, plug‑in hybrid electric vehicles).

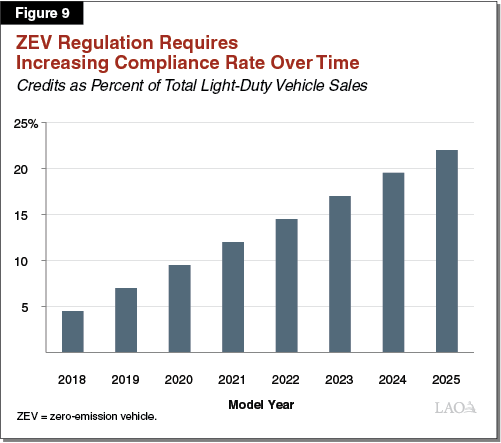

The regulation includes an annual requirement that each medium and large manufacturer generates or acquires a certain number of credits (expressed as a percentage of total cars sold). Figure 9 shows how this annual compliance requirement increases over time. Manufacturers can bank credits generated in prior years, as well as buy excess credits generated by other manufacturers to ensure they have enough to meet the annual requirements. Manufacturers that do not meet their annual targets are required to make up the deficit in subsequent years or face a financial penalty.

Manufacturers Have Generated Excess Credits to Date. Auto manufacturers have overcomplied with the mandate’s regulatory requirements to date. Through 2017, they have generated a net balance of 1.2 million unused credits, which can be used for future compliance. For context, we estimate manufacturers will need to have roughly 100,000 credits to meet the 4.5 percent regulatory requirement in 2018.

Public ZEV Infrastructure Funding

Increased Spending on Charging and Refueling Stations. The goal of this effort is to build more electric charging and hydrogen refueling stations for the public to use. In so doing, the expectation is that consumers will view the challenge of finding refueling opportunities as less of a barrier to owning and driving a ZEV. Various state entities are responsible for implementing or overseeing the implementation of vehicle charging stations and hydrogen refueling stations that can be accessed by different segments of the public (versus installing charging stations at individuals’ homes). This includes installation of ZEV infrastructure along major transportation routes (such as highways), as well as at apartment buildings, commercial locations, and publicly owned office buildings.

Over $1 Billion in Spending. The largest public light‑duty ZEV infrastructure efforts overseen by state agencies are summarized in Figure 10. As shown, there is over $1 billion already spent or planned to be spent on ZEV infrastructure over the next several years. This funding comes from a variety of sources, including electricity ratepayers, private corporations (in response to legal settlements), and state funds. This spending is estimated to result in tens of thousands of additional charging and refueling stations throughout the state.

Figure 10

Major State Zero‑Emission Vehicle (ZEV) Infrastructure Programs

|

Program |

Agency |

Funding |

Description |

|

|

Amount |

Source |

|||

|

Volkswagen (VW) settlement |

California Air Resources Board |

$800 million over ten years |

Volkswagen |

A 2016 settlement requires VW to invest $800 million in ZEV projects—mostly for ZEV fueling infrastructure—in California over ten years. The first two rounds of spending will invest about $270 million to construct over 3,000 charging stations. |

|

Alternative and Renewable Fuel and Vehicle Technology Program |

California Energy Commission |

$275 million through 2018‑19 |

Vehicle fees |

Spent about $40 million annually for public ZEV infrastructure in past years. Recent budget actions increased that amount to $114 million in 2018‑19. Has funded about 7,000 electric charging and hydrogen refueling stations funded to date, and increased spending could result in more than an additional 10,000. |

|

Investor‑owned utilities plans |

California Public Utilities Commission (CPUC) |

$230 million since 2016 |

Ratepayers |

Since 2016, CPUC has approved about $230 million for ZEV infrastructure pilot projects, primarily at multifamily residential, workplace, and other public locations. Estimated to result in over 12,000 charging stations. |

|

NRG settlement |

CPUC |

$100 million (one time) |

NRG Energy |

A 2012 settlement requires the energy company NRG to install at least 200 public fast‑charging stations and infrastructure for up to 10,000 privately owned charging stations at residences and workplaces. |

|

Vehicle charging at state buildings |

Department of General Services |

$90 million over four years |

State General Fund and special funds |

The department has a plan to install 6,200 charging stations at state buildings for employees and the state fleet. |

|

Vehicle charging on state highways |

Department of Transportation |

$20 million (one time) |

Fuel taxes |

The 2017‑18 budget included $20 million to install over 30 electric vehicle fast chargers along highway corridors. |

Assessment of Costs and Benefits: Light‑Duty Programs

Based on our review of the literature and discussions with academic and other experts in the field, it is impossible to draw definitive conclusions regarding the amount of costs and benefits associated with each of the light‑duty programs described above. Largely, this is because of two factors. First, program administrators have not been required to develop and update cost and benefit information for all of the individual programs. Second, even where some of these estimates have been developed, the various evaluation complexities described earlier in this report make it challenging to validate those estimates. Consequently, we find it difficult to compare the costs and benefits of each of these programs to each other or other GHG reduction programs. Despite these research challenges, we identify below some useful research findings about the potential effects of these programs.

GHG Emission Reductions

Estimated GHG Reductions for Consumer Rebate Programs Uncertain. A rebate can be expected to increase consumer demand for a ZEV because the rebate effectively reduces the price the consumer has to pay for the vehicle. There are a number of studies that find that rebates do increase ZEV (or other low‑emission vehicle) purchases in California and elsewhere. The amount of additional demand estimated varies across studies, and the effectiveness of different programs is likely affected by the structure of the program—including the size of the rebate and eligibility rules—and market demand, which can vary by location. While researchers find that rebates increase the number of ZEVs purchased, they also identify several reasons why the effectiveness of rebates to increase demand, as well as reduce net GHG emissions, can be limited. Most importantly, some individuals receiving a ZEV rebate would have purchased a ZEV even in the absence of the California rebate. These consumers are sometimes referred to as “free‑riders.” This might be because consumers believe that the long‑term operational savings of owning and operating a ZEV—such as from reduced fuel costs—outweigh the additional upfront costs to purchase the vehicle. In addition, certain consumers are less likely to depend on a rebate for their purchase decisions if they are relatively wealthy and/or if they want to be “early adopters” of a technology. In fact, survey data compiled by the Center for Sustainable Energy—which administers the CVRP for CARB—shows more than half of consumers who received a CVRP rebate reported that they would have purchased a ZEV even if the program did not exist.

In addition, the effectiveness of a ZEV rebate on GHG emissions could be further limited even in cases where a consumer would not have purchased a ZEV otherwise. Specifically, this could occur when a consumer would have purchased a non‑ZEV, highly fuel‑efficient vehicle instead of a ZEV. This might occur, for example, with a consumer that is specifically interested in reducing his/her “carbon footprint” but where the ZEV price is too high without the rebate. In such cases, the rebate does have the effect of encouraging a new ZEV purchase, but the net reductions associated with buying a ZEV rather than a highly fuel‑efficient vehicle might not be that significant.

For the two rebate programs—CVRP and Clean Cars 4 All Program—CARB has issued GHG reduction estimates. Specifically, CARB estimates that both programs would result in about six tons of GHG emission reductions over the lifetime of each vehicle. In reviewing the GHG estimates for these two programs, we note that they rely on certain assumptions that are subject to significant uncertainty that would offset each other to some degree. On the one hand, the GHG reduction benefits estimated may be understated because they assume that those benefits are achieved for only the first couple of years of the vehicle’s life, rather than for the full life of the vehicle. On the other hand, we find that the estimates include a significant methodological shortcoming that could overstate the GHG reduction benefits. Specifically, the department’s analytical approach to estimating benefits implicitly assumes that none of the participating consumers would have purchased a qualifying vehicle in the absence of the program. It is difficult to know exactly which participants were incentivized by the program to replace their old vehicle or to purchase a more efficient vehicle, making it difficult for us to estimate how overstated the department’s estimates for these programs are.

Consumer Surveys Suggest That Decals Incentivize ZEV Purchases. Regarding the single‑occupancy decals, we did not find any studies that estimate the emissions reduction benefits associated with the decal program. Thus, it is unclear what level of GHG emission reductions are being achieved by the program as a whole or by the specific vehicle types covered by the program. Despite no formal analysis of the state’s program, several surveys and studies suggest that the availability of HOV decals is a strong motivator for some consumers to purchase and use ZEVs. For example, a survey of approximately 19,000 CVRP recipients between 2012 and 2015 found that 17 percent said that having HOV lane access was their primary motivation for purchasing an electric vehicle. Other research has found consistent results, including that used cars with HOV decals sell for more than the same vehicle without an HOV decal, providing a monetary estimate of the value of the decals.

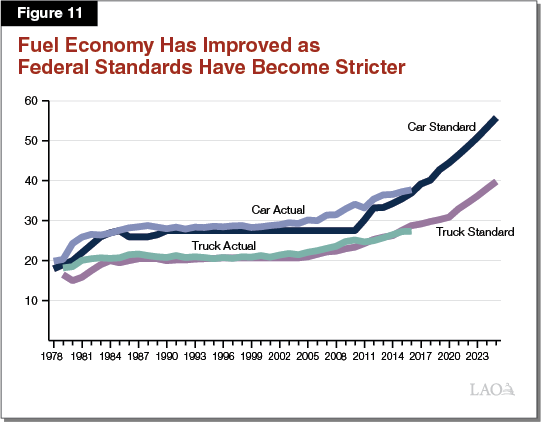

History of Fuel Efficiency Standards Show Positive Incremental Effects. The state’s clean car standards are currently aligned with the federal government’s standards to reduce emissions and increase fuel efficiency from light‑duty cars and trucks. These federal fuel efficiency standards were first established in the 1970s and have been made incrementally stricter over time. Most analysts find that these standards have had a real and significant effect on emissions. This effect is most clearly shown in Figure 11, which displays how average fuel economy has increased over time in very close relationship to the federal standards. The U.S. EPA and CARB estimate that under the current regulations, average GHG emissions will decrease to 175 grams per mile by 2025, which is less than one‑third of the average emission levels in 1975.

It is important to note that this correlational data is not conclusive. There could be other factors that contribute to improving fuel efficiency over time, especially consumer demand for fuel savings, such as when gas prices increase. In fact, researchers do find that consumer demand for more fuel‑efficient cars increases when gas prices rise. (Similarly, demand for less fuel‑efficient cars increase when gas prices fall.) However, gas prices can rise and fall unexpectedly, and researchers suggest that the standards can have an important longer‑term impact on auto manufacturers’ planning processes by setting clear expectations for future emissions levels. This is important for manufacturers because it can take several years to design and integrate new technologies into their vehicle models.

A 2017 analysis by CARB, U.S. EPA, and NHTSA estimated that the existing emission standards will reduce lifetime GHG emissions from all model year 2021 through 2025 vehicles sold in the nation by about 100 million metric tons per model year (540 million metric tons total). (In 2016, GHG emissions in the U.S. were over 6 billion metric tons.) We note that these estimates are subject to substantial uncertainty for several reasons. Importantly, they presume that the regulations will be implemented successfully. The federal government has proposed to repeal the current plan to make the standards stricter in out‑years. As we discuss in greater detail below, if implemented, this repeal likely would significantly reduce future emission reductions that could be achieved from both the federal and state standards.

Analytical Basis for ZEV Infrastructure Based on Potential Market Failure. Developing estimates for the GHG emissions reductions associated with spending on public ZEV infrastructure is challenging because the programs are intended to address the network effect that the demand for ZEVs and recharging and refueling stations is partially dependent on the availability of each other. In other words, consumers are less likely to buy and use ZEVs if they have concerns that there will not be sufficient infrastructure to support their driving patterns, often referred to as “range anxiety.” However, the market is less likely to invest in this infrastructure if it is not confident that a sufficient number of consumers will be driving ZEVs in the future to make the investment pay off. The spending on ZEV infrastructure overseen by state agencies is intended to address this problem by (1) reducing the costs of installing ZEV infrastructure and (2) increasing consumer demand for ZEVs by reducing range anxiety. We note that a report by National Renewable Energy Laboratory (NREL) analyzing several of the California Energy Commission’s (CEC’s) programs attempted to estimate the “market transformation” effects of spending on ZEV infrastructure. It estimated the emission reductions associated with this spending in a nascent market to be substantial. However, the report notes that these estimates “are based on data that is relatively more uncertain and the estimation approaches are inherently more theoretical.”

Currently, most of the state agencies overseeing these programs have not issued estimates of the GHG reductions they anticipate achieving. We note that the NREL analysis of the commission’s past spending of about $160 million on ZEV infrastructure estimated that this spending would result in direct emissions reductions of about 150,000 tons annually. We note, however, that this estimate assumed that none of the charging and refueling infrastructure funded by this program would have occurred in the absence of the program. In other words, the study assumed that without this funding, drivers would have driven gasoline‑powered vehicles instead of ZEVs.

Economic Costs

Consumer Financial Incentives Involve Opportunity Costs. Providing state funding for any program involves an “opportunity cost”—that is, the funding is not available for some other purpose. This is certainly true for the light‑duty programs receiving state funding. In fact, in economic terms, the opportunity cost is the primary cost associated with the two rebate programs. The CVRP and Clean Cars 4 All Programs are funded by cap‑and‑trade auction revenues and vehicle registration revenues. The state has historically used these two revenue sources to support a variety of activities, including other emission reduction programs. Therefore, to the extent that these programs do not encourage as many new ZEV and low‑emission vehicle purchases as hoped or expected, the main cost of the program is the opportunity cost to use these funds in other ways, such as (1) increased spending on other strategies that are more cost‑effective at reducing GHG emissions or (2) lower vehicle registration fees. Consequently, looking at the cost‑effectiveness of these programs is very important to ensure that the spending is targeted to the most effective programs possible. Based on CARB data, CVRP results in a state financial cost of over $400 per ton of GHGs reduced. Primarily because the rebate amounts are much higher on average, the Clean Cars 4 All Program costs about $900 per ton of GHGs reduced, according to CARB. As discussed above, these estimates are uncertain because they are based on assumptions that could both underestimate and overestimate emission reductions.

Clean Car Standards and ZEV Mandates Shift Costs to Purchasers of Higher Emission Vehicles. Improving fuel efficiency and developing technologies that can reduce GHG emissions results in additional costs for auto manufacturers. In order to remain profitable, they have to recover these costs in their vehicle sales. Increased prices, however, would have the effect of reducing consumer demand. Therefore, in order to ensure that they meet the minimum annual sales levels required under the Clean Cars Standards and ZEV regulations, manufacturers will (1) discount prices on the vehicles that help them meet the regulations and (2) make up those costs by increasing prices on other vehicles in their fleet. This has the effect of providing a financial subsidy for purchasers of the vehicles targeted by the regulations—lower‑emitting vehicles and ZEVs—while effectively taxing purchasers of higher‑emitting vehicles.

The analysis done by CARB and federal agencies for the Clean Car Standards and federal fuel efficiency standards estimates that the average per vehicle cost to meet the model year 2025 standards for light‑duty cars and trucks will be around $900. The actual costs will vary by vehicle and across manufacturers’ fleets, and each manufacturer could take different strategies to how they distribute those costs across their fleets.

ZEV Infrastructure Costs Partly Borne by Various Tax and Fee Payers. As described above, the costs to implement ZEV infrastructure programs are being paid from a variety of sources. In the case of the CEC and utility programs, these programs are funded through higher vehicle fees and utility rates, thereby increasing what individuals and businesses have to pay. For the CalTrans and DGS programs, the funding is coming from existing state taxes and fees. So, spending from these programs represent an opportunity cost of not being able to spend these funds on other allowable purposes or lower taxes and fees. In contrast, the spending by Volkswagon and NRG is coming from those corporations consistent with settlement agreements designed to offset the negative emission effects of their past actions.

Other Benefits and Costs

Other Air Pollutant Reductions. An important co‑benefit associated with consumers using more ZEVs and other types of fuel‑efficient vehicles is the reduction in other air pollutants that can be achieved. Unlike GHG emissions, which have an impact on global climate change, the effects of other air pollutants tend to be more local. Therefore, the air pollution reductions associated with these programs are particularly important in some areas of California with particularly poor air quality, such as the Central Valley and areas of Southern California which are not currently meeting federal clean air standards.

For example, CARB’s 2018‑19 Funding Plan provides estimated reductions for CVRP. Specifically, it estimates that each CVRP rebate reduces less than one one‑hundredth of a ton of criteria pollutants (NOx, PM 2.5, and ROG). In addition, the assessment done for the Clean Car Standards and federal fuel efficiency standards estimates that by 2030, those standards will result in a net reduction of almost 50,000 tons of criteria and toxic pollutants in the U.S. annually. In recent years, annual emissions of criteria pollutants has exceeded 100 million tons nationally.

Consumer Savings. Another benefit cited for consumers that drive more fuel‑efficient vehicles, including ZEVs, is that their ongoing costs of ownership will be lower, largely because of reduced fuel and maintenance costs. In some estimates, these future savings are estimated to outweigh the increased purchase costs of these vehicles. While there is consensus in the literature that these vehicles do have reduced fuel costs, the amount of savings is very dependent on the projected gasoline prices, as well as the specific vehicle being evaluated and individuals’ driving patterns.

Agencies have estimated operating savings for some light‑duty programs. For example, the 2018 Initial Statement of Reasons for the Clean Cars 4 All Program estimated annual operating savings to consumers of between about $800 and $2,000, largely from reduced fuel costs. The assessment completed for the Clean Cars Standard estimates savings in the same range—an average of $1,600 per 2025 vehicle model.

VMT. Researchers point to the potential that some of these programs could contribute to additional VMT and congestion. One example of this is the Clean Car Standards, which—by requiring cars to become more fuel efficient—have the effect of reducing the cost of driving. Consequently, it becomes less expensive to drive, and consumers will drive more. This “rebound effect” can contribute to increased congestion (as well as offset some of the GHG and other air pollutant reductions associated with the program). Studies over the years have estimated different sizes of the rebound effect, and the assessment completed for the Clean Car Standards and federal fuel economy standards assumes a 10 percent rebound effect. In other words, for every 10 percent improvement in fuel economy, the assessment assumes that drivers will increase VMT by 1 percent.

Safety. Some researchers have raised questions regarding whether an increase in the share of the fleet that is made up of ZEVs could have a negative effect on driver and passenger safety, including a risk of increased fatalities. The concern is that these vehicles tend to be smaller and lighter than other vehicles and, thus, might be more badly damaged in collisions. To date, the research on this issue is somewhat mixed. Researchers generally find that collisions between larger, heavier vehicles and smaller, lighter vehicles is more dangerous for the smaller vehicle and increases the probability of fatalities in the smaller vehicle. On the other hand, one of the potential effects of the Clean Car Standards and federal fuel economy standards could be to make larger vehicles—such as SUVs and light‑duty trucks—lighter than they would otherwise be, which could contribute to overall driver safety. Consistent with that, research suggests that the trend towards smaller, lighter vehicles (such as driven by federal fuel economy standards) has correlated with increased crash frequency but has not resulted in increased fatalities.

Other Issues for Consideration: Light‑Duty Programs

In this section, we highlight a few additional issues that are important in understanding the costs and benefits of light‑duty programs, as well as in considering how to shape future policies. Specifically, we discuss (1) the likelihood of programs becoming more costly in the future, (2) the potential effects of proposed changes to federal regulations, and (3) potential issues for future research.

State’s Ambitious Goals Mean Program Costs Likely to Increase Over Time

As discussed above, we generally do not have conclusive information on the costs and benefits of the state’s existing light‑duty programs. Importantly, the current costs and benefits are not static. That is, meeting the state’s ambitious GHG goals, including by significantly increasing the number of ZEVs, will most likely lead to higher costs in the future. These costs include the increased spending associated with providing more rebates for ZEV purchases, as well as more indirect costs such as more congestion in HOV lanes. In addition, as the state’s Clean Car Standards and ZEV mandate become stricter over time, this could lead to increasing manufacturer costs that are ultimately borne by consumers. The potential magnitude of these costs could vary widely depending on technology advancements and consumer demand.

While the magnitude of future costs is highly uncertain, the potential for high costs makes it important that administering agencies more consistently evaluate the costs and benefits of their programs. This should include the evaluation of programs in light of the state’s cap‑and‑trade program, which also incentivizes deployment of lower‑emission vehicles, including ZEV, by putting a price on carbon emissions. More consistent evaluation of programs’ costs and benefits would better assist the Legislature in its future policymaking decisions regarding how to allocate limited resources.

Proposed Federal Changes Could Undermine State Programs

Federal Administration Proposes to Freeze Current Auto Emission Standards. The U.S. EPA and NHTSA have proposed to freeze (at the 2020 levels) existing federal regulations that are scheduled to make automobile fuel economy and emission standards stricter for model years 2021 through 2025. The proposal would also revoke the federal waiver that allows California to set its own emission standards. California’s standards through 2025 currently align with the federal standards previously authorized. If the federal government continues to pursue its proposed changes, many analysts believe that there could be years of litigation before the issues are resolved.

Less Strict Federal Standards Could Undermine Effectiveness of State’s Program. If the federal proposal is ultimately implemented, it would mean that California could no longer implement its efforts to reduce emissions through the Clean Car Standards and ZEV mandate. Importantly—and not as intuitively—the effectiveness of the state’s Clean Car Standards could be jeopardized in a scenario where the federal standards were frozen but California was allowed to continue operating its program under the existing waiver. This is because California’s stricter standards would make it easier for auto manufacturers to comply with federal standards in other states. In other words, emissions reductions achieved in California would be at least partially offset by fewer emission reductions being made in other states. On net, this means that California’s stricter standards would not reduce total GHG emissions as much as otherwise estimated.

Potential Issues for Future Research

Identify Design Features to Make Rebate Programs Most Effective. Based on the findings above, we believe there are a couple of key research questions the Legislature and administration may want to pursue regarding the state’s rebate programs. For example, are there ways to reduce the free rider problem, such as by targeting rebates (or information campaigns) to consumers who are less likely to purchase ZEVs currently? There could be lessons learned on this question from upcoming studies on the Clean Cars 4 All Program, which is targeted to lower‑ and middle‑ income consumers. As discussed above, higher‑income individuals may be more likely to buy ZEVs even in the absence of rebates.

Another design feature of the Clean Cars 4 All Program worthy of further analysis is that the program permits the purchase of used vehicles and non‑ZEVs (conventional hybrids and internal combustion engine vehicles). On the one hand, both of these program characteristics mean that consumers can participate in the program even if they are not purchasing new ZEVs, which would seem to incentivize the purchase of a broader set of cleaner vehicles. On the other hand, these design features incentivize purchases where the per vehicle emission benefits are probably not as great as for ZEVs because (1) older cars will not have as long of a useful life on average as new cars and (2) even highly efficient gasoline powered and hybrid vehicles result in more GHG and other emissions in California than ZEVs. To the best of our knowledge, there is not yet any clear evidence about the net benefits of these different design characteristics.

Another potentially important design feature of Clean Cars 4 All Program is that it requires the retirement of an older vehicle. It might be worth evaluating the extent to which this requirement increases the emissions benefits of the program compared to a typical rebate program that allows existing vehicles to stay on the road.

Better Understanding the Interactions Among Different Programs. As discussed earlier in this report, a significant complication to evaluating the costs and benefits of climate change programs is having multiple programs targeting the same types of emission reductions. This is certainly true in the area of light‑duty vehicles, where there are multiple attempts to promote ZEVs by (1) providing financial incentives and nonfinancial incentives, (2) placing minimum sales requirements on manufacturers, and (3) increasing the convenience and reducing costs associated with recharging and refueling. Consequently, it is often very difficult to evaluate whether, for example, a particular consumer purchases a ZEV because they received a rebate, had access to an HOV lane, felt less range anxiety because of greater proximity to infrastructure, and/or the manufacturer lowered the sale price of the vehicle in order to meet regulatory requirements. In addition, as we discuss later in this report, the LCFS program provides additional incentives for ZEV purchases. In many cases, several or all of these factors could influence an individual consumer to purchase a ZEV, but it is difficult to disentangle which factors were most important. Consequently, it is more difficult for policymakers to determine which policies are likely to accomplish the greatest benefits at the lowest cost. Given the complicated way that these programs can interact, there would be value in research designed at disentangling those effects. In many cases, this likely requires designing programs with this sort of evaluation in mind. For example, piloting program changes in certain regions (rather than implementing them statewide) can make it easier to evaluate the effects of those changes.

One example of where there could be duplication across programs that we have not seen studied is between the CVRP rebates and ZEV mandate. The state’s ZEV mandate requires auto manufacturers to sell increasing numbers of ZEVs in California. One way for manufacturers to comply with this requirement is to lower prices on ZEVs to encourage greater consumer demand. However, the CVRP also reduces the vehicle price to encourage increased demand. So, to the extent that the CVRP increases demand, manufacturers do not have to reduce their prices. It is unclear which program—CVRP or the ZEV mandate—is more cost‑effective at increasing ZEV sales and reducing emissions. In addition, an important implication of this potential duplication is how the reduction in ZEV prices is paid for, whether from cap‑and‑trade auction revenues (the fund source for CVRP) or by purchasers of non‑ZEVs.

Address Potential Information Barriers to ZEV Deployment. Research indicates that a significant share of the population is not familiar with the current state of ZEV capabilities or many of the specific ZEV models available. In addition, there is debate in the literature regarding the degree to which consumers underestimate the longer‑term fuel savings associated with driving a ZEV. Some researchers have pointed to these information issues as important challenges to ZEV deployment and have suggested that more efforts should be made to educate consumers. This might be an area ripe for additional research to better test how public outreach and education campaigns might be effective (and potentially lower cost) ways to better inform consumers about the benefits of ZEVs, particularly for individuals or targeted groups who would not otherwise purchase one of these vehicles.

Determine How Infrastructure Spending Is Best Targeted. Researchers seem to agree that there are market failure‑based reasons for some public spending on ZEV infrastructure. However, it would be valuable to have more definitive research into a couple of key questions around how much and where to place that infrastructure.

- First, how can public subsidies for infrastructure be best targeted given different driving patterns in different communities. For example, most research to date suggests that the vast majority of charging will happen at people’s homes and workplaces. To what extent should those locations be targeted for public subsidies versus other locations—such as highway corridors, travel destinations, gas stations, and commercial centers—to better spur utilization?

- Second, how will ongoing advancements in rapid charging technology—both in the infrastructure and vehicles—affect how consumers are most likely to utilize chargers?

- Third, in the longer term, at what point will ZEV deployment be sufficient and ZEV infrastructure profitable enough that public subsidies are no longer necessary?

Heavy‑Duty Vehicles

There are a wide variety of types of medium‑ and heavy‑duty vehicles and equipment. On‑road vehicles—such as trucks, delivery vans, and buses—account for 9 percent of overall GHG emissions and 22 percent of emissions from the transportation sector. Other equipment used for freight (such as cranes), agriculture (such as tractors), construction (such as excavators), certain railroad activities (such as switch locomotives), and ships account for another 3 percent of statewide emissions. Hereafter, we refer to the combined emissions from the above different types of equipment—both on‑road and off‑road—as heavy‑duty vehicle emissions. The vast majority of these vehicles use diesel fuel.

The Legislature has not adopted statewide goals for the number of zero‑emission heavy‑duty vehicles deployed by a certain year. We note, however, that the 2016 Governor’s Sustainable Freight Action Plan establishes targets of improving freight system efficiency by 25 percent and deploying over 100,000 vehicles and equipment capable of zero‑emission operation by 2030. There are currently over 500,000 total heavy‑duty freight vehicles in California and over 10,000 are capable of zero‑emission operations. In addition, Chapter 524 of 2014 (SB 1204, Lara) requires CARB, in consultation with CEC, to develop a strategy for financial incentives for heavy‑duty vehicles with a goal of supporting new technologies through the commercialization process.

The state has several different programs to reduce heavy‑duty vehicle emissions. In this section, we focus on state programs that provide financial incentives for new or upgraded heavy‑duty vehicles. Although CARB is also implementing (or developing) regulations that target heavy‑duty emissions, we do not discuss these regulations in this report for various reasons. In particular, the regulations are driven primarily by federal policy, have a relatively small effect on statewide GHG emissions, and/or are primarily focused on reducing local and regional air pollutants.

Overview of Heavy‑Duty Incentive Programs

The state has a wide range of heavy‑duty incentive programs. Most of these programs target multiple pollutants—including GHGs, as well as NOx and PM—making it difficult to know which programs would have otherwise been implemented if the Legislature had not adopted GHG limits. Below, we discuss the major incentive programs where: (1) GHG reductions are a primary goal and/or (2) funding comes from the GGRF, which receives revenue through a state GHG reduction program (cap‑and‑trade). We exclude several other programs that are primarily focused on NOx and/or PM emissions, including the Carl Moyer Program (non‑GGRF), Proposition 1B (2006), and the Volkswagen Settlement Mitigation Trust Fund. We also exclude funding that is allocated primarily for transit, which we discuss in a later section of this report.

Figure 12 summarizes the major heavy‑duty incentive programs. The programs are administered by CARB, CEC, and the California Public Utilities Commission (CPUC). Total funding authorized for these programs over the last several years exceeds $2 billion, with over $1 billion authorized in 2018‑19. Each program generally falls into one of four categories: (1) demonstrations and pilots, (2) early commercial deployment of new technologies, (3) programs focused on reducing local pollution through fleet turnover, and (4) installing fueling or charging infrastructure.

Figure 12

Major GHG Heavy‑Duty Vehicle Incentive Programs

(In Millions)

|

Agency |

2018‑19 |

Totala |

|

|

Demonstrations and Pilots |

$88 |

$522 |

|

|

Freight Demonstrations |

CARB |

55 |

238 |

|

Advanced Freight and Fleet Technologies |

CEC |

18 |

144 |

|

Zero‑Emission Truck and Bus Pilots |

CARB |

— |

85 |

|

Rural School Bus Pilots |

CARB |

15 |

55 |

|

Early Commercial Deployment |

125 |

553 |

|

|

Clean Truck and Bus Vouchers (HVIP and Low‑NOx Engines) |

CARB |

125 |

366 |

|

School Bus Replacement Program |

CEC |

— |

75 |

|

Natural Gas and Propane Vehicle Deployment |

CEC |

— |

72 |

|

Zero‑Emission Off‑Road Freight Vouchers |

CARB |

— |

40 |

|

Local Pollution Reductions |

377 |

762 |

|

|

AB 617 local programs to reduce emissions |

CARB |

245 |

495 |

|

Agricultural equipment replacements |

CARB |

132 |

267 |

|

Fueling Infrastructure |

592 |

614 |

|

|

IOU Electric Vehicle Charging |

CPUC |

592b |

592 |

|

Natural Gas Fueling |

CEC |

— |

22 |

|

Totals |

$1,182 |

$2,451 |

|

|

aTotal funding for CARB programs since 2012‑13 and funding for CEC programs since 2009‑10. bFunding approved by CPUC in 2018 will be spent over next several years. GHG = greenhouse gas; CARB = California Air Resources Board; CEC = California Energy Commission; HVIP = Hybrid and Zero‑Emission Truck and Bus Voucher Incentive Program; IOU = investor owned utility; and CPUC = California Public Utilities Commission. |

|||

Demonstrations and Pilots

Several programs focus primarily on demonstrations and pilots for technologies and equipment that are not yet commercially available. They are part of CARB’s overall strategy for using financial incentives to support new heavy‑duty technologies over the next few years. (Please see the nearby box for additional information regarding CARB’s strategy.) Some examples of projects that have received funding through these pilots and demonstrations include:

- Battery electric, plug‑in hybrid electric, and low‑NOx freight equipment used at various ports and goods distribution centers.

- Electric tractors in the Central Valley, with an accompanying electric truck outfitted with an ability to charge the tractors at remote locations.

- A hydrogen fuel cell ferry providing passenger service in the Bay Area.

State’s Strategy to Support New Vehicle Technologies

The state’s primary strategy for using financial incentives to support new technologies is described in the California Air Resources Board’s (CARB’s) annual Three‑Year Investment Strategy for Heavy‑Duty Vehicles and Off‑Road Equipment. (The strategy is developed in consultation with the California Energy Commission.) Senate Bill 1204 requires CARB to, among other things, establish an overarching vision for how the state can move technologies through the commercialization process. The figure below summarizes the priority projects identified in the 2018‑19 investment strategy. The funding amounts are for planning purposes only and actual amounts will depend on future legislative appropriations. According to CARB, the amounts included in the plan would help support the development of the identified technologies, but would not meet the overall level of funding (both public and private) needed to meet California’s air quality and greenhouse gas (GHG) goals. The plan is based on three concepts:

- Technology Pathways. The plan focuses on technology pathways seen as necessary to meet the state’s 2030 GHG goals and air quality goals. These are zero‑emission technologies (battery electric, fuel cell, and hybrid), low NOx engines, and more efficient engines and operations.

- Stages of Commercialization. The plan provides incentives to technologies across different “stages of commercialization.” These stages are (1) technology design and development and early stage demonstrations, (2) advanced stage demonstrations and pilots, and (3) early market entry. CARB assesses the status of different technologies and applications, and where they might fall into one of these categories.

- Expansion of “Beachhead Markets.” The plan prioritizes funding toward beachhead markets—which are successful applications of new technologies that can then be transferred to other market applications. For example, supporting the development and deployment of electric buses, which are showing some early signs of market acceptance, could eventually help transfer to other electric heavy‑duty vehicles.

Summary of CARB’s Three‑Year, Heavy‑Duty Strategy Investment Plan

|

Program |

Funding (In Millions) |

Project Examples |

||

|

2019‑20 |

2020‑21 |

2021‑22 |

||

|

Demonstrations |

$65 to $100 |

$60 to $85 |

$50 to $90 |

ZE/PHEV delivery trucks, longer range heavy‑duty goods movement, construction equipment |

|

ZE/hybrid heavier cargo handling equipment |

||||

|

ZE regional delivery |

||||

|

Pilots |

$170 to $310 |

$185 to $310 |

$200 to $325 |

ZE/PHEV drayage, regional delivery, heavy‑duty trucks, advanced power trains, and |

|

ZE/hybrid heavier cargo handling equipment |

||||

|

Fuel cell transit |

||||

|

Commercial Deployment |

$215 to $325 |

$365 to $545 |

$420 to $580 |

ZE/PHEV drayage and regional delivery ZE/hybrid heavier cargo handling equipment |

|

Low NOx Linehaul trucks |

||||

|

ZE delivery trucks and transit |

||||

|

Total Funding |

$450 to $735 |

$610 to $940 |

$670 to $995 |

|

|

CARB = California Air Resources Board; ZE = zero‑emission, such as battery electric; and PHEV = plug‑in hybrid electric vehicle. |

||||

Early Commercial Deployment of New Technologies

Some programs provide incentives for technologies that have passed the demonstration and pilot stage, and commercial models are starting to become available. These early commercial models are often still more expensive than conventional equipment. The main state program that is used to support technologies through this phase is CARB’s Hybrid and Zero‑Emission Truck and Bus Voucher Incentive Program (HVIP). This program provides incentives for low‑emission equipment that is commercially available, including up to $300,000 for zero‑emission trucks and buses and $30,000 for eligible hybrid trucks and buses. Funds are also available for low‑NOx engines that use renewable fuel, such as natural gas trucks or buses that use renewable natural gas. The incentives are provided on a first‑come, first‑serve basis for qualifying vehicles and technologies.

Programs Focused on Local Pollution Reductions

Some programs are primarily focused on reducing near‑term NOx and PM emissions, rather than promoting new or innovative technologies. Generally, these programs aim to accelerate fleet turnover—or the rate at which old equipment is replaced by newer or upgraded equipment. In many cases, this newer equipment might still use diesel fuel, but the emissions are much lower than the old equipment. (We discuss these programs here because they are primarily supported by revenue from the state’s cap‑and‑trade program.) These programs are:

- AB 617 Local Programs to Reduce Emissions. Since 2017‑18, the Legislature has allocated $495 million GGRF for projects that promote the goals of Chapter 136 of 2017 (C. Garcia, AB 617), which establishes a framework and process for improving air quality in communities with the highest levels of pollution. Funding is allocated to local air districts to reduce diesel emissions, largely through the structure of the existing Carl Moyer Program (which provides incentives for diesel equipment upgrades and has been operating since 1998). In 2018‑19, some of this funding will also go to emission reduction projects at stationary sources.

- Agricultural Equipment Replacement. Since 2017‑18, the Legislature has allocated $247 million—primarily from the GGRF—for agricultural equipment upgrades and replacements. This includes harvesting equipment, heavy‑duty trucks, agricultural pump engines, and tractors. The program is known as the Funding Agricultural Replacement Measures for Emission Reductions program. In 2017‑18, 80 percent of the funding was allocated to the San Joaquin Valley Air Pollution Control District. This program also largely relies on the guidance from the Carl Moyer Program to determine what projects qualify for funding.

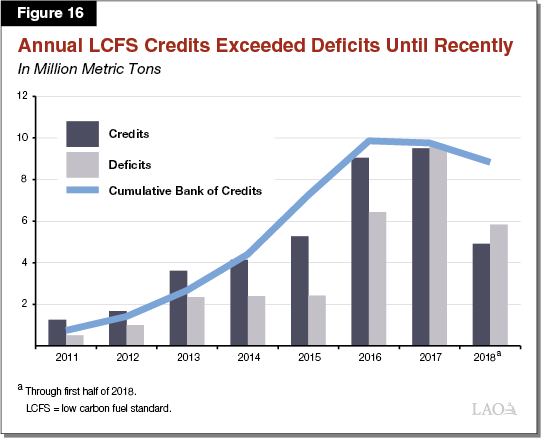

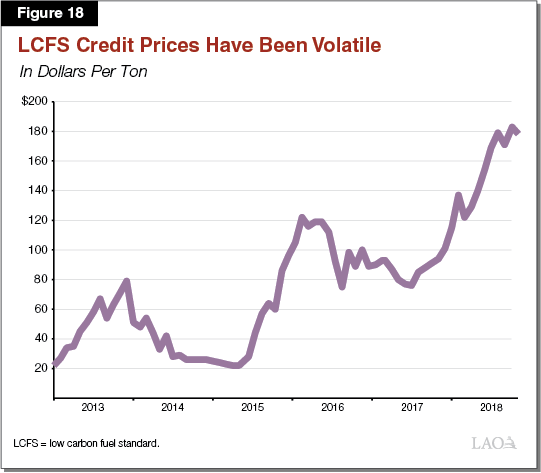

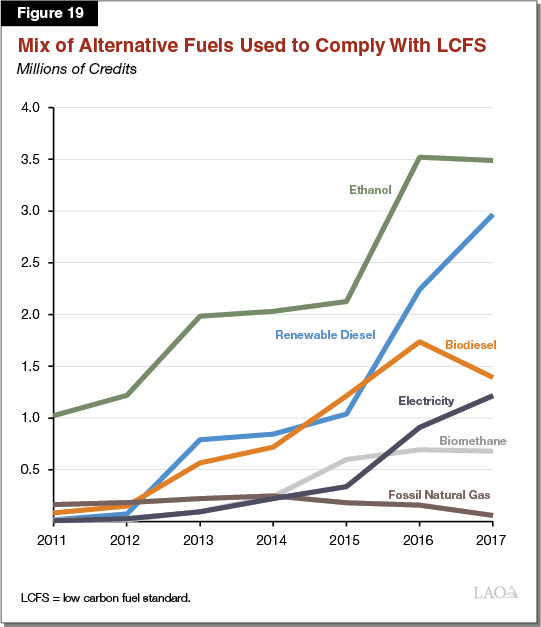

Fueling Infrastructure