LAO Contact

March 13, 2020

Review of the Draft 2020 High-Speed Rail Business Plan

- Introduction

- High‑Speed Rail Project Overview

- Project Funding and Expenditures to Date

- 2019 PUR and Project Status

- Draft Business Plan Updates Project Delivery Plan

- Draft Business Plan Updates Schedule, Cost, and Funding Projections

- Draft Business Plan Identifies Next Steps for Project

- Key Oversight Issues—Schedule Appears Ambitious

- Key Oversight Issues—Funding May Not Be Adequate

- Key Oversight Issues—Operating Subsidy Expected

- Key Oversight Issues—Success of Interim Service Depends on Various Factors

- Key Oversight Issues—Proposed Approach Does Not Provide Flexibility

- Legislature Faces Key Decision

- Conclusion

Executive Summary

On February 12, 2020, the California High‑Speed Rail Authority (HSRA) released a draft of its 2020 business plan, which provides updated information on its approach to delivering the state’s high‑speed rail project. Specifically, the draft plan continues HSRA’s proposal—first articulated in 2019—to construct a rail segment from Merced to Bakersfield. Additionally, it describes HSRA’s plan to use a third‑party public entity to run interim high‑speed rail service on that segment. HSRA’s plan to focus on the Merced‑to‑Bakersfield segment is informed by its updated estimates of project costs and funding availability, as well as by the results of a study performed by its consultant, the Early Train Operator (ETO), which concluded that Merced to Bakersfield was preferable to the other alternatives it considered for launching interim high‑speed rail service.

In this report, we identify a number of key issues for legislative oversight. First, we point out that the near‑ and long‑term schedules identified in the draft 2020 business plan appear ambitious. Second, we identify some near‑ and long‑term funding challenges confronting the project. Third, we raise concerns that HSRA’s plan to use a third‑party public entity to operate interim service from Merced to Bakersfield appears to be inconsistent with the spirit of Proposition 1A. Forth, we identify some of the key assumptions made by the ETO that affect its assessment of alternatives. Fifth, we identify some key actions that HSRA plans to take in the coming months that will significantly limit the state’s flexibility to change its approach to the project in the future.

With these issues in mind, the Legislature will want to consider whether it is comfortable with HSRA’s proposed approach, would like an alternative approach, or would like to preserve its flexibility to change the project in the future. It will be important for the Legislature to provide direction soon given that HSRA is poised to make key decisions—such as entering into major contracts—that will reduce flexibility to change the project if legislative priorities change, costs increase, or planned funding does not materialize.

Introduction

The California High‑Speed Rail Authority (HSRA)—an independent authority consisting of a nine‑member board appointed by the Legislature and Governor—is responsible for planning and constructing an intercity high‑speed train system that would link the state’s major population centers. State law requires HSRA to prepare a business plan every even year that provides certain key information about the planned high‑speed rail system. On February 12, 2020, HSRA released a draft of its 2020 business plan. The authority must adopt a final business plan by May 1 following public review and comment on the draft plan. State law also requires HSRA to provide a project update report (PUR) every odd year that provides certain updated information, such as on costs and schedule. The HSRA released its most recent PUR on May 1, 2019.

In this report, we (1) provide an overview of the high‑speed rail project, including its funding sources, progress made to date, and a summary of changes made in the 2019 PUR; (2) describe the major features of the draft 2020 business plan; (3) identify key oversight issues for the Legislature to consider at this stage of the project; and (4) provide options given that the project is at a critical decision point.

High‑Speed Rail Project Overview

In this section, we provide a broad overview of the high‑speed rail project, including a summary of the key statutory requirements that apply to the project, as well as a summary of HSRA’s general approach to delivering the project, as reflected in its 2018 business plan.

Establishment of HSRA and Statutory Requirements

HSRA Created in Statute in 1996

- Chapter 796 of 1996 (SB 1420, Kopp) established HSRA to plan and construct a high‑speed rail system that would link the state’s major population centers. HSRA is governed by a nine‑member board appointed by the Legislature and Governor.

Voters Approved Proposition 1A in 2008

- In November 2008, voters approved Proposition 1A, which authorized the state to sell $10 billion in general obligation bonds to partially fund the system, as well as related projects.

- Proposition 1A also specified certain criteria and conditions that the system must ultimately achieve. For example, the measure requires that the system must be designed to be capable of specified travel times along certain routes, such as nonstop travel from San Francisco to Los Angeles within two hours and forty minutes. The measure also specifies that passenger rail service operated by HSRA, or pursuant to its authority, will not require an operating subsidy.

HSRA Required to Provide Annual Updates

- State law requires HSRA to prepare a business plan every even year that provides certain key information about the planned high‑speed rail system and serves as the guiding policy document for HSRA. Specifically, HSRA must adopt a final business plan by May 1 every even year, and a draft of the plan is required at least 60 days prior for public review and comment.

- The biennial business plan must include the following:

- Construction Plan. The business plan must include a description of the type of train service HSRA is developing, the timing and order for building various segments of the system, estimated schedules for completing environmental clearance, and estimated capital costs of constructing the system.

- Funding Information. The plan is required to include information on the funding HSRA anticipates receiving to construct the system, such as from state bond funds and federal funds.

- Risks to Completing the System. The plan must include information on the risks faced by the project, such as risks related to financing, ridership, and construction.

- State law also requires HSRA to provide a PUR by May 1 of every odd year that provides certain updated information, such as on costs and schedule. Unlike business plans, PURs are not required to be formally adopted by HSRA.

Project Delivery

Project Divided Into Multiple Segments, Beginning With the Initial Construction Segment (ICS)

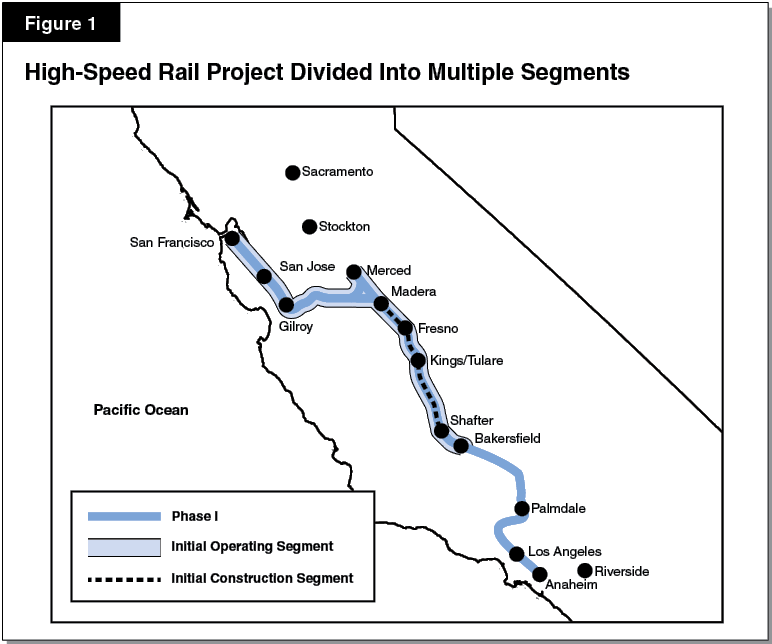

- HSRA plans to construct the system in two phases. Phase I would provide service from San Francisco to Anaheim. HSRA currently projects Phase I being completed in 2033.

- As shown in Figure 1, delivery of Phase I is divided into segments, including an initial operating segment from San Francisco to Bakersfield—commonly referred to as the Valley‑to‑Valley line.

- The Valley‑to‑Valley line is itself divided into multiple segments, including the ICS. The ICS extends for 119 miles through the Central Valley from Madera (about 25 miles north of Fresno) to Poplar Avenue in Shafter (about 20 miles north of Bakersfield).

- Phase II would connect the system to Sacramento and San Diego. There is no time line for the completion of Phase II.

Bookend and Connectivity Projects

- In addition, HSRA has initiated a variety of projects on commuter rail lines. These include “bookend projects” along the proposed high‑speed rail alignment in the San Francisco Bay Area and Southern California. For example, a significant bookend project is the planned electrification of the Caltrain Corridor in the San Francisco Bay Area, which would allow for high‑speed rail to share Caltrain’s tracks. HSRA has committed $714 million toward this project, which has a total cost of about $2 billion. The project is anticipated to be completed by 2022.

- Additionally, they include “connectivity projects,” which provide benefits to existing commuter rail systems that connect to the high‑speed rail system.

Project Funding and Expenditures to Date

In this section, we summarize the major sources of funding available to the high‑speed rail project and the project’s expenditures to date.

Proposition 1A Bonds

- Proposition 1A authorized the state to sell about $10 billion in general obligation bonds—$9 billion for the high‑speed rail system itself, with the remainder to support the connectivity projects. (Of this $9 billion, HSRA has set aside $1.1 billion as contributions to locally administered bookend projects.)

- The state must repay these bonds over time—with interest—from sources such as weight fees and the state General Fund.

- To date, the Legislature has appropriated $5.5 billion from Proposition 1A, and about $4 billion has been spent—$3.2 billion on the high‑speed rail project (including bookend projects) and about $760 million on connectivity projects.

Federal Funds

- The federal government has awarded HSRA two grants totaling $3.5 billion.

- First, the state received $2.6 billion in American Recovery and Reinvestment Act (ARRA) funds in 2009. HSRA fully expended the ARRA funds and expects to fulfill a state match requirement sometime before December 2022.

- Second, the state received a $929 million grant from the federal High‑Speed Intercity Passenger Rail program in 2010 (FY10 Federal Grant), which expires at the end of 2022. The state must meet certain conditions under this grant agreement, including (1) completing its match to the ARRA grant before spending these funds, (2) using the funds to support the construction of a segment useable for intercity passenger rail by 2022, and (3) completing all environmental reviews for Phase I by 2022.

- The agreement for the FY10 Federal Grant allows the federal government to terminate the grant under certain conditions, such as if the state fails to make reasonable progress on the project.

- On May 16, 2019, the federal government terminated the FY10 Federal Grant under this provision, and indicated that it also is considering all options for seeking the return of the ARRA grant. HSRA is currently challenging the federal government’s termination decision in court.

Cap‑and‑Trade Auction Revenues

- The state operates a cap‑and‑trade program intended to limit the emission of greenhouse gases (GHGs). The program generates revenues from the auctioning of GHG “allowances.” (Essentially, each allowance is a permit to emit one ton of carbon dioxide equivalent.)

- In 2014, the state began providing cap‑and‑trade auction proceeds for the high‑speed rail project. This includes a one‑time appropriation of $650 million in 2014‑15, as well as the continuous appropriation of 25 percent of cap‑and‑trade revenues beginning in 2015‑16. Currently, the cap‑and‑trade program is authorized through 2030.

- To date, the project has received about $3.2 billion in cap‑and‑trade revenues and spent about $750 million of these funds.

2019 PUR and Project Status

In this section, we discuss some key features of the 2019 PUR—which proposed some significant revisions to the 2018 business plan—and provide some background on recent project activities.

Some Key Features of the 2019 PUR

Additional Construction Beyond ICS to Merced and Bakersfield

- The 2019 PUR proposed extending the ICS by roughly 50 miles—20 miles south from Shafter to Bakersfield and 30 miles north from Madera to Merced. (Under this approach, HSRA would construct the ICS as previously planned, but would also construct extensions to Merced and Bakersfield.)

- The 2019 PUR no longer assumed a specific funding approach for completing the Valley‑to‑Valley line. (Under the 2018 business plan, HSRA assumed that the cap‑and‑trade program would be extended through 2050 and the Legislature would authorize actions necessary to securitize these revenues in order to provide the additional funds necessary to complete the Valley‑to‑Valley line.)

Interim Electrified High‑Speed Service From Merced to Bakersfield

- The 2019 PUR proposed operating electrified high‑speed service on the Merced‑to‑Bakersfield segment when it is completed in 2029. This service would operate on an interim basis until the Valley‑to‑Valley segment is complete. Once this interim service is operational, the 2019 PUR assumes that all other passenger rail service on this corridor would cease.

- During this interim service, passengers traveling to the San Francisco Bay Area or Sacramento would transfer at Merced to nonelectric (diesel) trains operated by the Altamont Corridor Express (ACE) or the San Joaquins, respectively. (Passengers would also have to transfer to a bus service at Bakersfield to continue south to the Los Angeles area until the full Phase I is complete.)

Revised Approach Driven by Consultant Analysis

- The 2019 PUR’s proposal to extend the ICS to Merced and Bakersfield was informed by the results of a study by a consultant retained by the HSRA, known as the Early Train Operator (ETO).

- HSRA retained this ETO to compare the benefits of providing interim high‑speed passenger rail service between the San Francisco‑to‑Gilroy and Merced‑to‑Bakersfield segments. Based on certain assumptions (which we discuss in more detail later in this report), the ETO concluded that the Merced‑to‑Bakersfield segment was the preferred option for launching early interim high‑speed rail service over the San Francisco‑to‑Gilroy option.

Revised Approach Also Driven by Funding Availability

- HSRA’s proposed approach, as reflected in the 2019 PUR, assumed that it would have access to between $20.5 billion and $23.5 billion through 2030 from bond funds, federal funds, and cap‑and‑trade auction revenue.

- This funding level would be sufficient to support HSRA’s revised project cost estimate of $20.4 billion to (1) construct the ICS ($12.4 billion); (2) complete other work necessary to launch interim operations from Merced to Bakersfield ($4.8 billion); and (3) complete other associated work, such as the environmental work for the balance of Phase I and bookend projects ($3.2 billion).

- Notably, the $12.4 billion for the ICS represented an increase of $1.8 billion compared to the 2018 business plan. This increase was due in large part to an increase in the contingency for this segment. According to HSRA, this larger contingency resulted from a change in methodological approach that sets the project cost estimate such that there is a greater likelihood that costs would remain within budget.

Status of Project Activities

Environmental Reviews

- Under the California Environmental Quality Act and the National Environmental Policy Act, HSRA must assess the extent to which the project could cause significant environmental impacts.

- As shown in Figure 2, HSRA has completed the environmental reviews for the Fresno‑to‑Bakersfield and Merced‑to‑Fresno sections, with the exception of the Central Valley Wye. HSRA is in the process of completing the remaining environmental reviews for Phase I, as required under the federal grant agreements.

Figure 2

Anticipated Schedule for Completing Environmental Reviews of High‑Speed Rail Project

|

Project Section |

Date |

|

Phase I |

|

|

San Francisco to San Jose |

August 2021 |

|

San Jose to Merced |

May 2021 |

|

Merced to Fresno |

Completed |

|

Portion requiring separate review: Central Valley Wye |

September 2020 |

|

Fresno to Bakersfield |

Completed |

|

Portion requiring separate review: locally generated alternative |

Completed |

|

Bakersfield to Palmdale |

April 2021 |

|

Palmdale to Burbank |

January 2022 |

|

Burbank to Los Angeles |

June 2021 |

|

Los Angeles to Anaheim |

February 2022 |

|

Phase II |

|

|

Los Angeles to San Diego |

To be determined |

|

Merced to Sacramento |

To be determined |

Right‑of‑Way Acquisition

- As of December 2019, HSRA had identified 2,042 parcels of land necessary for construction of the ICS. HSRA has acquired 1,545 of these parcels, leaving 497 parcels to be acquired. HSRA anticipates acquiring these remaining properties by February 2021.

- HSRA has not begun acquiring parcels outside of the ICS.

Construction

- In 2015, HSRA initiated construction of the civil works (such as grading, overpasses, and other foundational infrastructure) on the ICS. Thus far, the HSRA has completed several major structures, such as the construction of the Fresno River Bridge and Tuolumne Street Bridge, and the realignment of a portion of State Route 99. HSRA currently estimates it will complete the ICS civil works and tracks by the end of 2022.

Draft Business Plan Updates Project Delivery Plan

On February 12, 2020, HSRA released a draft business plan for public review and comment. This draft 2020 business plan updated the project’s delivery plan. In the next three sections, we summarize various aspects of the updated plan, which is largely consistent with the plan outlined in the 2019 PUR. In this section, we summarize the updated plan for delivering the project, which focuses on the Merced‑to‑Bakersfield segment.

Continues Plan to Extend to Merced and Bakersfield

Merced‑to‑Bakersfield Segment Driven Partly by Funding Availability

- Like the 2019 PUR, the draft 2020 business plan proposes to focus the state’s efforts on constructing the segment between Merced and Bakersfield, in addition to the ICS.

- HSRA proposes to launch interim high‑speed passenger service on this Merced‑to‑Bakersfield segment by 2029.

- This approach is informed by updated cost and funding assumptions, which we describe in more detail in the next section of this report.

Includes Analysis From Consultants

ETO Analysis Includes Additional Ridership Comparisons

- The HSRA board directed the ETO to perform additional work (referred to as a Side‑by‑Side Study) to compare key benefits—such as ridership—associated with three alternatives (1) the Merced and Bakersfield extensions, (2) San Francisco Bay Area bookend and related projects, and (3) Los Angeles region bookend and related projects.

- The ETO concluded that the Merced‑to‑Bakersfield segment is the preferred option for launching early interim high‑speed rail service.

- Specifically, the ETO estimated that this alternative would generate an increase of 4.8 million annual riders along the Merced‑to‑Bakersfield segment, as well as various connecting services, such as ACE and the San Joaquins. This would represent a more than doubling of projected combined ridership on these services compared to what they would have otherwise been in 2029.

- This projected ridership increase is roughly double the ridership increase that the ETO estimated would result from the San Francisco Bay Area or Los Angeles region alternatives (1.9 million and 2.5 million additional riders annually, respectively).

Also Incorporates Feedback From Financial Consultant

- HSRA retained a second consultant, KPMG, to perform a Business Case Study of the proposed interim high‑speed service between Merced and Bakersfield.

- This study looked at various aspects of HSRA’s plan for interim service, including its funding, costs, ridership projections, revenue forecasts, business model, and risk mitigation strategies.

- This analysis found various benefits from completing the Merced‑to‑Bakersfield segment. For example, it found that the segment would enhance mobility and prevent infrastructure from remaining idle prior to the completion of the Valley‑to‑Valley line.

- However, the analysis also identified a number of key assumptions in the ETO analysis, as well as other risks to the project. (We discuss these assumptions and risks in greater detail later in this report.)

Draft Business Plan Updates Schedule, Cost, and Funding Projections

In this section, we review key updates to the schedule, cost, and funding for the high‑speed rail project that are made as part of the draft 2020 business plan—particularly in terms of how they compare to the assumptions in the 2018 business plan and 2019 PUR.

Schedule Projections

Reflects Delay in Anticipated Completion of Certain Activities

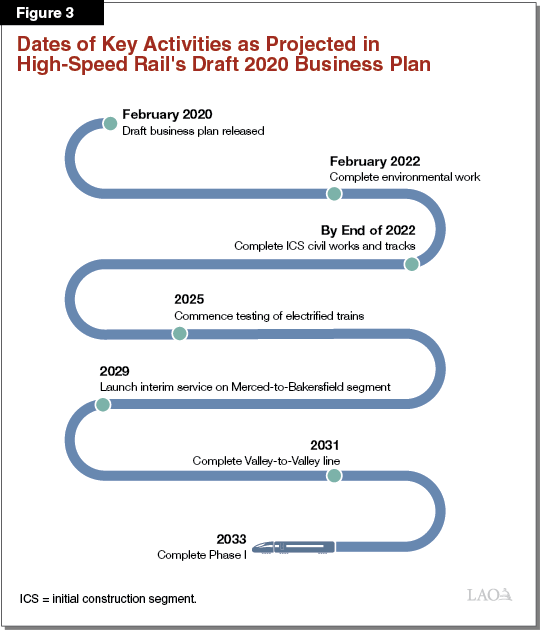

- Under the draft 2020 business plan, some activities are anticipated to occur later than previously expected, including those related to project construction and interim operations, as well as environmental work. Figure 3 displays some key dates reflected in the draft 2020 business plan.

- Specifically, HSRA projects that trains will provide interim service from Merced to Bakersfield by 2029. In comparison, in the 2018 business plan, HSRA anticipated launching interim services on the ICS and the San Francisco‑to‑Gilroy segment by 2027, and the 2019 PUR anticipated providing operating service between Merced and Bakersfield in 2029.

- Additionally, HSRA now anticipates that the Valley‑to‑Valley line will be completed in 2031—two years later than was assumed in the 2018 business plan and 2019 PUR.

- With regard to environmental work, HSRA anticipates completing environmental reviews by February 2022. This is roughly two years later than was expected in the 2018 business plan and eight months later than anticipated in the 2019 PUR.

Cost Projections

Reflects Higher Cost Estimates for Valley‑to‑Valley From Delay

- As shown in Figure 4, the draft 2020 business plan estimates that the total cost to complete Phase I is $80.3 billion, which is about $3 billion higher than the 2018 cost estimate. This cost estimate is about $1.3 billion higher than the 2019 cost estimate.

- According to HSRA, the cost increase since 2018 is a result of two main factors (1) the $1.8 billion cost increase to the ICS reflected in the PUR, largely due to an increase in the size of the contingency, and (2) $1.3 billion in additional construction costs due to the delay in the scheduled completion of the Valley‑to‑Valley line.

Figure 4

HSRA’s Estimated Construction Costs for Phase I

(In Billions)

|

Project Component |

2018 |

Draft 2020 |

Change |

|

Valley‑to‑Valleya |

|||

|

Initial Construction Segment |

$10.6 |

$12.4 |

$1.8 |

|

San Jose to Gilroy |

3.2 |

3.3 |

0.1 |

|

Gilroy to Carlucci Road |

10.2 |

10.9 |

0.6 |

|

Carlucci Road to Madera |

2.4 |

2.5 |

0.1 |

|

San Francisco and Bakersfield extensions |

1.9 |

2.0 |

0.1 |

|

Rolling stock |

1.1 |

1.2 |

0.1 |

|

Heavy maintenance facility |

— |

0.3 |

0.3 |

|

Subtotal, Valley‑to‑Valleyb |

($29.5) |

($32.6) |

($3.0) |

|

San Francisco to San Jose |

$2.1 |

$2.1 |

— |

|

Merced to Wye |

2.4 |

2.4 |

— |

|

Bakersfield to Palmdale |

16.3 |

16.3 |

— |

|

Palmdale to Burbank |

17.5 |

17.5 |

— |

|

Burbank to Los Angeles |

1.5 |

1.5 |

— |

|

Los Angeles to Anaheim |

3.6 |

3.6 |

— |

|

Balance of heavy maintenance facility |

0.2 |

0.2 |

— |

|

Additional rolling stock |

4.1 |

4.1 |

— |

|

Total Phase I Costs |

$77.3 |

$80.3 |

$3.0 |

|

aThe Valley‑to‑Valley line extends from San Francisco to Bakersfield. bIncludes a portion of the costs associated with the Merced extension. The Merced and Bakersfield extensions are anticipated to cost a total of $4.8 billion. This includes $2.5 billion for the Merced extension, $1.4 billion for the Bakersfield extension, and $900 million for trains and other costs. HSRA = High‑Speed Rail Authority. |

|||

Does Not Revise Cost Estimates for Constructing Remainder of Phase I

- The draft 2020 business plan does not reevaluate the cost estimates for the full Phase I of the project to reflect the revised approach to setting contingencies that it applied to the Merced‑to‑Bakersfield segment or other factors.

- HSRA indicates that it did not apply its revised approach beyond the Merced‑to‑Bakersfield segment because other portions of the project are still in the very early stages of development.

Funding Projections

Identifies Funding From Various Sources for Merced‑to‑Bakersfield Segment

- As shown in Figure 5, HSRA estimates available total project funding of between $20.6 billion and $23.4 billion through 2030. This estimate is very similar to that included in the 2019 PUR, but lower than was assumed in 2018. (This is because the 2018 business plan assumed the extension of cap‑and‑trade through 2050 and securitization of these revenues would provide additional funding.)

- HSRA estimates this funding will be sufficient to cover the estimated $20.4 billion costs to construct the Merced‑to‑Bakersfield segment and complete other associated work necessary to support the project.

Figure 5

HSRA’s Estimated Funding Available and Costs

(In Billions)

|

Funding |

Amount |

|

Federal Funds |

|

|

ARRA |

$2.6 |

|

FY 10 Federal Grant |

0.9 |

|

Subtotal, federal funds |

($3.5) |

|

State Funds |

|

|

Proposition 1A (non‑bookends) |

$7.4 |

|

Proposition 1A (bookends) |

1.1 |

|

Cap‑and‑trade received through November 2019 |

3.2 |

|

Future cap‑and‑tradea |

5.5 to 8.3 |

|

Subtotal, state funds |

($17.2 to $20.0) |

|

Total Funding Available |

$20.6 to $23.4 |

|

Costs |

Amount |

|

Merced to Bakersfield construction |

|

|

Initial Construction Segment |

$12.4 |

|

Incremental costs for Merced to Bakersfieldb |

4.8 |

|

Other Costs |

1.1 |

|

Bookends |

1.3 |

|

Phase I environmental balance |

0.8 |

|

Total Costs |

$20.4 |

|

aAssumes between $500 million and $750 million in annual cap‑and‑trade revenues to HSRA through 2030. bIncludes Merced and Bakersfield extensions, train sets, and other associated activities necessary to initiate passenger rail service. |

|

|

HSRA = High‑Speed Rail Authority; ARRA = American Recovery and Reinvestment Act; and FY10 Federal Grant = 2010 High‑Speed Intercity Passenger Rail grant. |

|

Assumes—but Does Not Identify—Additional Funding for Remainder of Phase I

- The 2020 business plan continues to suggest that the state’s goal is to complete Phase I. However, draft 2020 business plan does not identify specific funding sources to construct the rest of Phase I beyond the Merced‑to‑Bakersfield segment.

Draft Business Plan Identifies Next Steps for Project

In this section, we review the key next steps for the project identified in the draft 2020 business plan.

Key Upcoming HSRA Actions

Track and Systems Contract

- HSRA plans to award a track and systems contract in September 2020 for the entire Valley‑to‑Valley line.

- The contract would include the construction of track and associated systems (such as electric catenary systems and signal systems), as well as 30 years of maintenance of the track and systems infrastructure.

- Notably, the contract is anticipated to be broken into five geographic segments, each with a separate notice to proceed. The first notice to proceed would include all the proposed work—such as track, catenary systems, and 30 years of maintenance—for the ICS. The contractor could proceed with all of these aspects of the ICS upon issuance of the first notice to proceed, but could not perform track and systems work beyond the ICS without explicit approval from HSRA in the form of a second notice to proceed.

- This contract is anticipated to be HSRA’s most expensive and longest contract for the project to date. The capital (non‑maintenance) portion of this first notice to proceed alone is anticipated to have a contract value of $1.6 billion.

Rolling Stock Procurement

- HSRA plans to enter into a contract to purchase electric trains in 2020. This contract is anticipated to include the delivery and certification of six high‑speed electric trainsets and construction of a heavy maintenance facility (HMF), as well as 30 years of maintenance of these trains and the HMF.

- The 2020 draft business plan assumes that rolling stock for the Merced‑to‑Bakersfield interim service will cost roughly $700 million.

Right‑of‑Way Acquisition

- HSRA also anticipates taking various other key actions outside of the ICS in 2020, such as the acquisition of parcels and the completion of various preconstruction and planning activities. For example, pending board approval of the 2020 business plan, HSRA intends to begin acquiring the parcels needed for the Merced and Bakersfield extensions as soon as possible. Additionally, HSRA anticipates pursing strategic property acquisitions in other areas, such as Millbrae, San Jose, and the Pacheco Pass.

Third‑Party Public Entity to Operate Interim Service

HSRA Would Lease Track and Rolling Stock to Third‑Party Public Entity

- HSRA does not anticipate being the operator of the proposed interim high‑speed service from Merced to Bakersfield.

- Instead, HSRA plans to lease the right to use its tracks and trainsets to a third‑party public entity, such as the San Joaquin Joint Powers Authority, which currently oversees the ACE and San Joaquins services.

- Under this structure, the third‑party public entity would be required to pay HSRA at least the authority’s contract costs for maintenance and any other ongoing costs of operations. (This third‑party public entity may contract with another operator, such as Amtrak, to run the service.)

- After the completion of the Valley‑to‑Valley segment, HSRA would change its operating plan and take over the responsibility for operating the service from the third‑party public entity.

Taxpayers Expected to Assume Revenue Risk

- During the interim service, HSRA is not anticipated to bear the revenue risk for the service. Instead, this risk is anticipated to be borne by the third‑party public entity—and ultimately the entity that provides its funding.

- Specifically, to the extent that ridership revenues for the interim service are not sufficient to cover costs—including operations and maintenance—the third‑party public entity would be expected to cover those costs from state or local funding sources. Notably, the operating losses from the existing San Joaquins service are currently funded by the state, and the Business Case Study also assumes the state would fund any operating losses from the interim high‑speed rail service.

- The ETO’s analysis concludes that the Merced‑to‑Bakersfield interim service would require an operating subsidy of roughly $54 million annually. The analysis notes that this subsidy is less than the subsidy it anticipates would be needed for rail service in the Central Valley absent high‑speed rail.

Key Oversight Issues—Schedule Appears Ambitious

In reviewing the draft 2020 business plan, we identified several key oversight issues that merit legislative consideration. In this section, we discuss the ambitious nature of the schedule identified in the draft 2020 business plan.

Near‑Term Schedule

Track Contract Relies on Complex Approach

- Under the proposed track and systems contract, the contractor will be expected to construct track in five mile, nonconsecutive segments.

- HSRA indicates this approach is needed to meet the federal requirement to complete a segment usable for intercity passenger rail by 2022. This is because—due to project delays—the track‑and‑systems contractor will need to begin its work before HSRA has completed all of the right‑of‑way acquisitions and construction of civil works for the ICS.

- While this approach is expected to expedite the completion of track and systems, it will add significant complexity to the work performed by the track‑and‑systems contractor and is likely to raise the costs of the contract.

Little Margin for Error in Meeting Federal Grant Deadline

- HSRA currently estimates that the ICS track will be completed by the end of 2022 in order to meet the 2022 deadline for federal grant agreements. This leaves little margin for error if property acquisitions or civil works are delayed.

- In order to meet the federal grant deadline for construction work, HSRA will have to significantly increase its spending rate, including for construction and environmental work. Specifically, according to a January 2020 HSRA report, it will have to spend about $185 million per month to meet the federal grant deadline. The authority’s spending has averaged less than half of that amount—about $76 million per month—over the past year and only an average of $112 million per month over the past three months.

- Additionally, there is only a small margin for error in the time line for completion of environmental documents for Phase I prior to the 2022 federal grant deadline. As we noted previously in this report, the draft 2020 business plan assumes that these documents will be completed by February 2022. However, the time line for completing these documents has been delayed substantially in recent years. Given these past delays, it would not be surprising if further delays occur, potentially raising risks that the state would have difficulty meeting the federal grant deadline.

Long‑Term Schedule

Schedule for Valley‑to‑Valley Line and Phase I Appears Ambitious

- HSRA’s current schedule assumes that the project has access to full funding. However, HSRA has not identified funding for completion of segments beyond Merced to Bakersfield. Given the lack of identified funding, the ability of HSRA to complete the portions of the project beyond the Merced‑to‑Bakersfield segment on the schedule currently envisioned is highly uncertain.

Key Oversight Issues—Funding May Not Be Adequate

In this section, we discuss some near‑ and long‑term funding challenges confronting the high‑speed rail project.

Near‑Term Funding Challenges

Actual Costs for Merced‑to‑Bakersfield Segment Could Be Higher Than Anticipated

- To date, there have been significant cost increases related to the construction work on the ICS. For example, the current value of the major ICS civil works construction contracts (including contingencies) are roughly 70 percent higher on average than originally planned.

- Given the project’s past history of cost increases and the inherent cost risks associated with large and complex construction projects, there is risk that the project may continue to experience cost increases.

- In particular, the Merced and Bakersfield extensions are still at the early stages of design. Accordingly, these portions of the project are likely to be subject to a greater uncertainty than the portions that are closer to completion.

Unclear if Expected Funding for Merced‑to‑Bakersfield Segment Will Materialize

- HSRA’s funding plan for the Merced‑to‑Bakersfield segment also relies on funding sources that are subject to substantial uncertainty.

- It assumes that the state will retain the $3.5 billion of federal grants that the federal government might ultimately rescind. Additionally, the funding plan relies on estimates of future cap‑and‑trade revenues through 2030, which, while reasonable, are subject to uncertainty. This is because they depend on the results of the state’s quarterly auctions of cap‑and‑trade allowances, which can fluctuate due to factors such as market demand.

- To the extent that the state has to return some or all of the federal funds, expected cap‑and‑trade revenues do not materialize, or project costs are significantly higher than estimated, the state would need to identify other funds sources—such as the General Fund—to help pay for the Merced‑to‑Bakersfield segment and other related HSRA commitments.

Unclear if Timing of Funding for Merced‑to‑Bakersfield Will Align With Project Needs

- The Business Case Study identified a risk that, even if the total amount of funding available to the authority is sufficient to cover its estimated costs for Merced to Bakersfield and associated work, the funding availability may not align with the project’s cash needs.

- For example, the Business Case Study finds that if cap‑and‑trade revenues are on the low end of the HSRA’s projected range, HSRA will have cash flow deficits in certain years.

- Specifically, about $18 billion (or nearly 90 percent) of the $20.4 billion in costs for the Merced‑to‑Bakersfield segment and associated activities are anticipated to be needed by 2023‑24. However, HSRA’s funding plan relies in part on revenues from cap‑and‑trade auctions, which are not available up‑front. Instead, these revenues are anticipated to be provided to the HSRA at a roughly constant rate through 2030 as the state conducts its auctions of emissions allowances.

- HSRA indicates it is in discussions with the Department of Finance regarding potential approaches to addressing these potential cash flow issues. One approach, for example, could include securitizing the project’s anticipated future cap‑and‑trade revenues. (This approach would likely require various legislative actions, such as authorizing a General Fund backfill if cap‑and‑trade revenues are lower than anticipated.)

Long‑Term Funding Challenges

Actual Project Costs for Remainder of Project Could Also Be Even Higher Than Current Estimates

- There is also a high level of uncertainty regarding the cost estimates for the rest of Phase I. This is because (1) there is inherent uncertainty regarding the cost of a capital project of this scale and complexity and (2) these portions of the project are in the early planning stages.

- Additionally, the draft 2020 business plan only applies the revised, more conservative approach to setting a contingency level to the Merced‑to‑Bakersfield segment. If HSRA applied this revised approach to the full Phase I of the project, we would expect that the estimated baseline budget would be higher than the current $80.3 billion estimate, potentially by billions of dollars.

No Funding Plan Beyond Merced to Bakersfield

- As previously mentioned, HSRA has not specifically identified how the over $60 billion in estimated construction costs for the portions of Phase I beyond the Merced‑to‑Bakersfield segment would be funded. Thus, there is significant risk that the state would have to cover the large majority of any funding gap. Additionally, if project costs are ultimately higher than anticipated, this funding gap would be even greater.

Key Oversight Issues—Operating Subsidy Expected

In this section, we discuss how HSRA’s plan to use a third‑party public entity to operate interim service from Merced to Bakersfield appears to be inconsistent with the spirit of Proposition 1A.

Subsidy of Interim Service Appears Inconsistent With Spirit of Proposition 1A

- HSRA’s proposal to use a third‑party public entity to operate the Merced‑to‑Bakersfield interim service in order to facilitate compliance with Proposition 1A does not appear to be consistent with the spirit of the measure.

- The intent of the measure’s requirement that passenger train service provided by HSRA, or pursuant to its authority, not require an operating subsidy appears to be to ensure that passengers of the system—rather than the general public—pay for the full cost of its ongoing operations and maintenance.

- However, under HSRA’s proposed approach, the state (and general taxpayers) is anticipated to pay for whatever portion of the system’s operating costs that is not recovered from passenger fares—estimated at roughly $54 million annually.

- Even though HSRA is not anticipated to receive this subsidy directly under its proposed approach—as it would be provided to the third‑party public operator—this does not change the practical effect that the state would likely bear a portion of the system’s operating costs, at least during interim service.

Key Oversight Issues—Success of Interim Service Depends on Various Factors

In this section, we discuss how some of the key assumptions made by the ETO could affect its assessment of alternatives for interim high‑speed rail service, including on the proposed Merced‑to‑Bakersfield segment.

ETO Analysis Based on Various Assumptions, Some of Which Appear Optimistic

- The ETO’s Side‑by‑Side Study was based on various assumptions. A few of these key assumptions, which were identified in KPMG’s Business Case Study, include:

- Completion of Other Capital Projects. The analysis assumes the completion of other transportation capital projects, such as the rerouting of the existing San Joaquins service so it would serve a new station planned for high‑speed rail. Currently, San Joaquins serves a station in Merced that is 1.2 miles from the HSRA’s planned station in Merced. However, HRSA has not yet identified a funding source for this new project.

- Perfect Reliability. The analysis assumes that high‑speed rail, as well as the connecting train and bus services, will operate with 100 percent reliability. However, the Business Case Study notes that the current San Joaquins service operates at a roughly 75 percent reliability.

- All Transit Trips Along Segment Done by High‑Speed Rail. The analysis assumes all transit trips between Merced, Madera, Fresno, Hanford, and Bakersfield use high‑speed rail. However, in practice, some riders may choose to use other modes of transport—such as buses—rather than high‑speed rail, particularly for shorter trips. Additionally, this assumes that the San Joaquins terminates its existing service south of Merced. However, there are trade‑offs to the termination of this service, since high‑speed rail will not serve some of the local communities currently served by the San Joaquins. For example, the San Joaquins currently has three stations between Fresno and Bakersfield, but high‑speed rail will only have one station in this segment.

If Assumptions Overly Optimistic, Could Affect Relative Conclusion Regarding Preferred Alternative

- Should the assumptions identified in the ETO’s Side‑by‑Side Study not materialize, interim high‑speed rail service would likely not be able to generate the ridership benefits, and associated operational revenues, estimated by the ETO.

- Specifically, the KPMG Business Case Study reports that the ETO performed a low case scenario with less favorable assumptions—including no changes to existing ACE, San Joaquins, and bus services. Under this scenario, the projected increase in ridership from the Merced‑to‑Bakersfield segment dropped substantially (from 4.8 million annual riders to 2.3 million annual riders).

- For comparison, the ETO estimated that the alternative for Los Angeles area bookend and other projects would result in roughly 2.5 million additional riders. This estimate would also depend on the specific assumptions made, but the ETO did not perform a sensitivity analysis on this alternative to examine how its results would change under different assumptions.

- We note that a separate ridership analysis of Los Angeles area projects performed by Metrolink estimated that such projects would result in average annual ridership increases of roughly 5.3 million. The reasons for the discrepancy between the ridership increases in the Los Angeles region estimated by ETO and Metrolink are not clear.

- Accordingly, it is possible that, under different assumptions, the ETO’s comparison of the benefits of the Merced‑to‑Bakersfield segment to options in the Los Angeles area and San Francisco Bay Area could be substantially different.

Other Viable Alternatives Exist

- The ETO only looked at a few specific alternatives for where to allocate funding. While an analysis of additional alternatives was not required by the HSRA board, it would have been helpful to inform legislative decision‑making. Other options that could be considered include:

- A shorter or longer segment in the Central Valley than is currently proposed (such as an extension to Merced, but not to Bakersfield). Other segment lengths could provide different trade‑offs between project costs and transportation benefits (such as increased ridership).

- Running other zero‑emission trains (such as those powered by hydrogen) instead of electrified trains during interim service. This could provide the environmental benefits of cleaner trains—although with lower top operating speeds—without requiring the funding of electrification.

- A different set of projects in the San Francisco Bay Area and Los Angeles regions than those that were assumed in the ETO’s analysis. Other projects could provide different trade‑offs between project costs and transportation benefits.

Key Oversight Issues—Proposed Approach Does Not Provide Flexibility

In this section, we note that some key actions that HSRA plans to take in the coming months would significantly limit the state’s flexibility to change its approach to the high‑speed rail project in the future.

HSRA Approach Makes Significant Commitments Soon

- Certain actions HSRA plans to take in 2020 will have the effect of committing the state in the longer term, thereby leaving little flexibility for the state to pursue alternative approaches besides interim electrified service between Merced and Bakersfield should it wish to do so. Some of these key actions include:

- Track and Systems Contract. If the state enters into the proposed contract later this year, it would commit the state to completing the infrastructure for electrified service on the ICS in the near term. In practice, this might also commit the state to electrifying a larger segment, since it may be impractical to run electrified service only on the ICS.

- Rolling Stock Procurement. If the state procures electric trains in 2020, as currently envisioned by HSRA, it would commit the state in the near term to running electrified service, unless the state was willing to leave the trainsets idle.

- Right‑of‑Way Acquisitions. HRSA intends to acquire significant numbers of parcels outside of the ICS—such as within the Merced and Bakersfield extensions. This is a necessary step if the state moves forward with these extensions. However, it would commit the state to constructing these extensions unless the state was willing to bear the costs of maintaining these properties for an extended period of time while they are not needed or resell the properties. Reselling unneeded parcels would likely result in a financial loss to the state and unnecessary disruption to the affected property owners.

- Accordingly, under HSRA’s plan, the Legislature will have far fewer viable options next year to change the near‑term plan for project, which it might want to do if costs rise, funding is lower than anticipated, or legislative priorities change.

Legislature Faces Key Decision

The project is at a key decision point. This is because the HSRA has indicated that it plans to move forward this year with various actions that would make it more difficult for the state to select an alternative option in the future rather than the HSRA’s approach of focusing on launching interim service on the Merced‑to‑Bakersfield segment. Accordingly, it will be important for the Legislature to determine if it is comfortable with HSRA’s proposed approach. If the Legislature is not comfortable with this approach, it will want to decide whether it would like HSRA to pursue a specific alternative approach or retain flexibility to consider other approaches in the future. We discuss these two options further below.

We note that the Legislature lacks a natural opportunity to provide clear direction for the project in 2020, since HSRA indicates it does not need to seek an appropriation as part of the 2020‑21 budget. Therefore, direction from the Legislature would likely require legislation.

Legislature Could Pursue Preferred Alternative Approach

- If the Legislature decides that it would like to pursue a different approach from the one proposed by HSRA—such as only completing the scope required by the federal grant agreements in the Central Valley in the near term and using any remaining funding elsewhere on the alignment—it could direct the authority accordingly.

- The Legislature might want to pursue such an alternative approach if, for example, it is not comfortable with the concept of the public providing an operating subsidy during interim service, is concerned about potential cost‑overruns or revenue shortfalls, or prioritizes investments elsewhere on the alignment.

If Legislature Does Not Want to Commit to Specific Approach Now, Could Take Actions to Preserve Flexibility

- If Legislature is not sure what approach it would like to take—for example, because of concerns related to the oversight issues we identify in this report—and would like to preserve flexibility to consider other approaches in the future, it could direct HSRA to take certain actions that would require fewer long‑term commitments. This would likely include taking the following three actions:

- Modifying Proposed Track and Systems Contract. For example, the Legislature could direct HSRA to (1) limit the track and systems contract to only the scope required under the federal grant agreements (track and basic systems for the ICS, but not electrification), or (2) include an “off‑ramp” clause in the track and systems contract by having a separate notice to proceed for any work beyond what is required to meet the federal grant agreements. These approaches would avoid committing the state to electrification at this point.

- Delaying Rolling Stock Procurement. The Legislature could direct HSRA not to move forward with the procurement of electric trainsets at this time. Along with the changes to the track and systems contract identified above, this delay would also be important if the state does not want to commit to electrification at this point.

- Delay Property Acquisitions Outside of the ICS. The Legislature could direct HSRA to delay purchasing property outside of the ICS. This would prevent HSRA from purchasing properties that might not be needed in the near term should the Legislature ultimately want to proceed with a different approach.

Conclusion

- In this report, we raise a number of key issues for legislative oversight, including those related to cost, funding, schedule, and the HSRA’s plan for interim operations.

- With these issues in mind, the Legislature will want to consider whether it is comfortable with HSRA’s proposed approach, would like an alternative approach, or would like to preserve its flexibility.

- It will be important for the Legislature to provide direction soon because HSRA is poised to make key decisions—such as entering into major contracts—that will reduce flexibility to change the near‑term plan for the project if legislative priorities change, costs increase, or planned funding does not materialize.

- Given the very large potential commitments of state funds that are at stake, it is particularly important that these key decisions set the project on a path that is consistent with legislative priorities.