LAO Contact

April 3, 2020

COVID-19

Broad-Based Cash Assistance in COVID-19 Recovery Actions

Updated May 3, 2021 to reflect recent COVID-19 relief legislation.

On Friday, March 27, the President signed H.R. 748, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a federal relief act aimed at mitigating the economic and public health consequences of the coronavirus disease 2019 (COVID-19). The CARES Act included direct cash assistance for most Americans. Since the CARES Act, two additional pieces of COVID-19 relief legislation (one passed in December 2020 and the other in March 2021) also included one-time cash assistance to most Californians. In this post, we describe that cash assistance and put it in the broader context of existing income support programs and the economic challenges presented by the current public health crisis. (Everything in this post reflects our best understanding at the time of publication. We will continue to review and may update this post as more information becomes available.)

Public Health Response to COVID-19 Limits Many Californians’ Income. Although the full economic consequences of the current COVID-19 public health crisis will not be known for some time, many Californians already have experienced reduced income. For some Californians, reduced income has resulted from reduced hours or temporary business closures and their incomes are expected to increase soon after current public health measures are eased. For others, reduced income has followed layoffs or other effects expected to be longer-lasting.

State, Federal Government Operate Several Long-Standing Cash Assistance Programs for Targeted Populations. For example, one large, long-standing cash assistance program is the California Work Opportunities and Responsibility to Kids (CalWORKs) program, which supported more than 350,000 low-income families in 2019. Participating families receive cash assistance that varies based on household size, income level, and region. Cash assistance is also provided through the Supplemental Security Incomes/State Supplementary Payment (SSI/SSP) program, which provides cash assistance to low-income aged, blind, and disabled individuals. Another related program is the federal Earned Income Tax Credit (EITC), or its state-funded equivalent CalEITC, which provides refundable tax credits to low-income workers.

State and Federal Government Also Ensure Some Wage Replacement in Specific Situations. One example of a wage replacement program is unemployment insurance (UI), which provides time-limited cash assistance to recently unemployed workers. Other examples include paid family leave and disability insurance. (See our recent post for more information on how COVID-19 relief actions have affected UI.)

Existing Income Support and Wage Replacement Programs Have Limited Reach. Although caseloads in many cash assistance programs tend to grow as overall economic conditions decline (for example, CalWORKs served approximately 70 percent more households during the Great Recession than it does today), none is designed to have a universal reach. For example, individuals without children are not eligible for CalWORKs, whereas those who are still employed can only receive UI under certain conditions.

Federal Government Issued One-Time, Broad-Based Cash Assistance in Last Two Recessions. In 2001, the federal government issued about 90 million checks nationwide, totaling as much as $300 per single adults ($600 for married couples). Then again in 2008, the federal government issued about 125 million checks nationwide totaling between $300 and $600 for single adults ($600 to $1,200 for married couples) and an additional $300 per child. In both cases, these direct cash payments were intended in large part to alleviate the economic stress many households experienced during then current economic downturns.

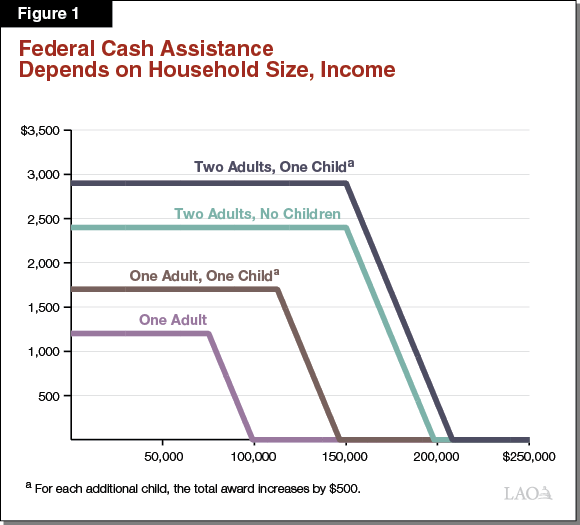

Recent Federal Legislation Includes Broad-Based, One-Time Cash Assistance. Under the CARES Act, adults earning less than $75,000 in their most recent tax filing (2019 for those who have already filed, 2018 otherwise) are eligible for a one-time cash payment of $1,200, and $500 for each child. As Figure 1 shows, these payments are phased out starting at $75,000 of income for single adults with no children ($112,500 for single adults with children, and $150,000 for married couples), such that a single adult is no longer eligible for assistance if they earn $99,000 or more. The administration has publicly set a goal to start processing these payments by April 6.

Some Low-Income Californians Are Not Eligible for Cash Assistance. Although the cash assistance in the CARES Act is far more broad-based than in other cash assistance programs, it is still limited in two important ways. First, only Californians who have already filed federal tax returns for 2018 or 2019 will receive cash assistance. Millions of Californians do not earn enough income to require them to file tax returns. Though some of these Californians nevertheless file taxes (in many cases to qualify for federal tax credits), an unknown number do not. (The federal deadline to file 2019 tax returns was recently extended to July 15, and anyone filing by that date would appear to be eligible for the assistance.) Second, about 800,000 California residents file taxes using an Individual Tax Identification Number (ITIN) rather than a Social Security Number due to their immigration status. The CARES Act renders ITIN filers ineligible for cash assistance.

Would Not Affect Eligibility for Large Means-Tested Programs. Although income typically affects individuals’ eligibility for many social service programs, it is our understanding that the direct payments authorized by the CARES Act will not affect eligibility for the largest of these programs. In particular, subsidized health coverage provided by Medi-Cal, food assistance provided through CalFresh, and cash assistance provided by CalWORKS do not include non-recurring lump sum payments such as these when calculating household income for purposes of program eligibility.

Expected to Provide Roughly $25 Billion to Californians. Using tax data from 2017 (the latest available, although not perfectly representative of 2018 and 2019 returns), we roughly estimate about 14 million California households (or about 85 percent of all tax filers) will be eligible to receive a total of about $25‑30 billion in direct cash assistance from the CARES Act. This assumes all those who qualify—based on 2017 federal returns—would receive the benefit. Although this is our best estimate, we acknowledge that there is uncertainty in the number of individuals who will ultimately receive the CARES Act benefit for two primary reasons. First, the number of eligible federal tax filers in 2018 and 2019 may be more (or less) than the number who filed in 2017. Second, low-income individuals who were not required to file a federal return for 2018 could now file for 2019 in order to receive the benefit. To maximize the benefit to Californians, the state may wish to consider efforts (such as outreach) to increase the number of low-income individuals filing federal tax returns in order to qualify them for the benefit.

Two Subsequent Federal Actions Also Included Broad-Based Cash Assistance. Since the CARES Act, two additional pieces of COVID-19 relief legislation (one passed in December 2020 and the other in March 2021) also included one-time cash assistance to most Californians. Eligibility for these payments was similar across all three rounds of cash assistance, although families that included ITIN filers were only eligible to receive assistance from the March 2021 round. The December round of payments generally provided $600 per individual (both adults and children), while the March round generally provided $1,400 per individual (again including both adults and children).

Two Additional Rounds Provided an Estimated $55 Billion to Californians. Specifically, we estimate the December round provided about $20 billion to Californians, while the March round provided about $35 billion.