LAO Contact

April 28, 2020

COVID-19

Federal COVID-19-Related

Funding to California

This post summarizes recent federal legislative and other actions to allocate funding to respond to the coronavirus disease 2019 (COVID-19).

Federal Legislation and Actions Provided for Coronavirus-Related Funding. Recent federal legislation has directed funding to states, local governments, and other entities to respond to the COVID-19 emergency. This legislation includes: the Coronavirus Preparedness and Response Act; the Families First Coronavirus Response Act; and the Coronavirus Aid, Relief, and Economic Security (CARES) Act. In addition, the federal emergency declarations also provide additional funding to states and local governments to reimburse them for certain costs. In recent days, Congress also passed the Paycheck Protection Program and Health Care Enhancement Act, however, we have generally not included the effects of this most recent legislation in this post.

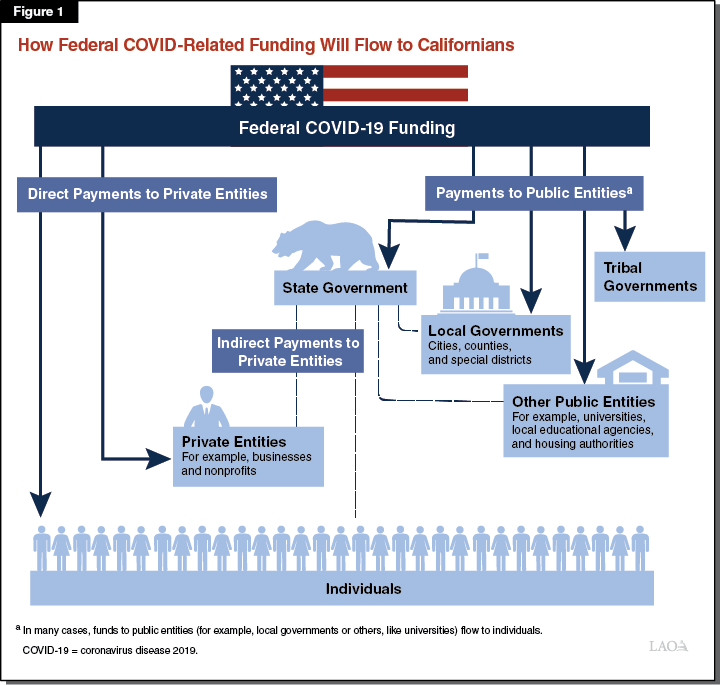

How Federal COVID-Related Funding Will Flow to Californians. As shown in Figure 1, we categorize federal funding according to the two major channels through which they reach Californians. These channels are:

Payments to Public Entities. Payments to governments and other public entities are shown on the right side of Figure 1. These include payments to the state government, local governments (including cities, counties, and special districts), tribal governments, and other public entities (like housing authorities, school districts, and other local educational agencies). These payments are the focus of the first part of this post.

Direct Payments to Private Entities. Payments to nonpublic entities are shown on the left side of Figure 1. These include payments to private entities (including businesses and nonprofits) and payments made directly to individuals. These payments are the focus of the second part of this post.

Estimates in This Post Reflect Our Current Understanding. The tables in this post reflect our best estimates and current understanding. Where possible, we rely on estimates from a relevant state department or directly from the federal government. However, in many cases, the estimates of amounts that will flow to California are still unknown or could continue to change. For example, in some cases, federal funding will be provided on a competitive grant basis, meaning that the eligible entities will not know how much funding they will receive until the grant applications are accepted. In other cases, the amount of funding will depend on unpredictable factors, like the number of individuals who participate in a program or broader economic or public health conditions.

Payments to Public Entities

This section displays our estimates of the amount of funding that will pass through a public entity in California (illustrated on the right side of Figure 1). The first section describes funding allocated to public entities in the state, for example, the state government, local governments, other public entities like school districts and tribal governments. The second section describes funding that passes through a public entity but is ultimately used by private entity, like a business or an individual.

This section is organized according to the user or beneficiary of the funds, not the initial recipient. For example, some federal funds provided for education will be passed through California’s Department of Education—at the state level—but will be used by school districts. Those funds are included in the figure describing funds used by “other public entities.” Similarly, cash and cash-like benefits that pass through the state government, but are allocated to individuals—such as unemployment insurance benefits—are shown in the figure related to “individuals.”

Direct Payments to Public Entities

Funding to State Government. Figure 2 shows our estimate of federal COVID-19-related funding that the state will use for administration of state programs and state-provided services. Our current estimate of the total, quantifiable funding to the state government is roughly $20 billion. This amount is likely to evolve substantially in the coming months. The two largest allocations provide the broadest budgetary benefit for the state. First, we estimate the state will receive about $9.5 billion from the Coronavirus Relief Fund (CRF) to respond to the costs of the public health emergency (which we discussed in more detail in this post). The federal government has released specific guidance on the possible uses of these funds. Second, the state anticipates receiving about $5.3 billion in federal reimbursements for the currently estimated $7 billion in direct costs of COVID-19 (reflecting a 75 percent reimbursement rate). The state will receive these reimbursements from the Federal Emergency Management Agency (FEMA) pursuant to the federal disaster declarations. The precise amount of these funds will ultimately depend on the state’s actual costs to respond to COVID-19.

Figure 2

Funding to State Government for Administration and State‑Provided Services

(In Millions)

|

Federal Legislation |

State Department |

Program |

Description |

Amount to California |

|

Various |

||||

|

CARES Act—Coronavirus Relief Fund |

Various |

Various |

Funds to respond to the public health emergency. |

$9,512.6 |

|

CARES Act |

Various |

Various |

Eligible state costs from COVID‑19 disaster declarations. |

5,250.0a |

|

Health |

||||

|

FFCRA |

DHCS |

Medi‑Cal |

Increase in federal share of cost for Medicaid of 6.2 percentage points. |

$8,800.0b |

|

FFCRA |

DHCS |

Medi‑Cal |

Provide free COVID‑19 testing for the uninsured through Medi‑Cal. |

UK |

|

CARES Act and CPRSAA |

CDPH |

Public health |

Epidemiology, lab capacity, surveillance, infection control, and surge staffing. |

105.2c |

|

CARES Act |

DHCS |

Behavioral health |

Emergency grant funding for mental health and substance use. |

UK |

|

FFCRA |

DHCS |

Medi‑Cal |

Temporary extension of Money Follows the Person demonstration. |

UKd |

|

CARES Act |

CDPH |

Public health |

To supplement existing grants for HIV/AIDS programs. |

1.5 |

|

CARES Act |

EMSA |

Public health |

Capacity of poison control centers to respond to calls. |

0.6 |

|

Social Services |

||||

|

FFCRA |

DDS |

Developmental services |

Increase in federal share of cost for Medicaid of 6.2 percentage points. |

$769.0b |

|

FFCRA |

DSS |

In‑home supportive services |

Increase in federal share of cost for Medicaid of 6.2 percentage points. |

1,645.0b |

|

Housing and Homelessness |

||||

|

CARES Act |

HCD |

Housing |

Community development activities to revitalize neighborhoods. |

$216.0 |

|

CARES Act |

HCD |

Homelessness |

Various activities to address homelessness. |

75.0 |

|

Unemployment Insurance |

||||

|

FFCRA |

EDD |

UI |

Emergency grants to cover additional UI workload. |

$117.0 |

|

CARES Act |

EDD |

UI |

Grants for administration and promotion of work sharing programs. |

12.0 |

|

Other |

||||

|

CARES Act |

BSCC |

Criminal Justice |

For state and local criminal justice agencies to respond to COVID‑19. |

$58.5e |

|

CARES Act |

Military |

Emergency response |

Various military department costs such as logistics and medics. |

48.0 |

|

CARES Act |

OES |

Emergency response |

Emergency preparedness and certain response activities. |

3.6f |

|

Total Quantifiable Fundingg |

$26,625.1 |

|||

|

aBased on administration’s current estimate of disaster‑related costs and assumes 75 percent Federal Emergency Management Agency reimbursement. bBased on program cost estimates and assumptions that enhanced federal Medicaid match will be in effect through December 2021. These amounts will change depending on actual program costs and the duration of enhanced federal match. cAdditional amounts will likely be available, but are unknown at this time. dInitial rough estimate—low tens of millions of dollars. eA share of these funds will be required to be shared with local governments. fEstimate to state based on typical pass‑through amounts to locals. gExcludes funding that is currently unknown. |

||||

|

Notes: Excludes amounts below $1 million. CARES = Coronavirus Aid, Relief, and Economic Security; COVID‑19 = coronavirus disease 2019; FFCRA = Families First Coronavirus Response Act; DHCS = Department of Health Care Services; UK = Unknown; CPRSAA = Coronavirus Preparedness and Response Supplemental Appropriations Act; CDPH = California Department of Public Health; HIV/AIDS = human immunodeficiency virus/acquired immunodeficiency syndrome; EMSA = Emergency Medical Services Authority; DDS = Department of Developmental Services; DSS = Department of Social Services; HCD = California Department of Housing and Community Development; EDD = Employment Development Department; UI = unemployment insurance; BSCC = Board of State and Community Corrections; and OES = California Governor ’s Office of Emergency Services. |

||||

Funding to Local Governments. Figure 3 shows our estimate of federal COVID-19-related funding that local governments will use for the administration of programs and locally provided services. “Local governments” include cities, counties, and special districts. Most of this funding will be allocated directly to local governments, but some funding will pass through the state. Further, while much of this funding is available broadly to local governments in the state, some funding is dedicated to specific localities. For example, CRF funding is also available to local governments in California, but only for those with populations of at least 500,000 or above. Similar to the state, local governments in California are eligible to apply for partial reimbursement for local costs to respond to COVID-19, pursuant to the federal disaster declaration. We have not included an estimate of the amount of funding that will ultimately provide by FEMA for this purpose because it will depend on the amount of local costs incurred. Our current estimate of the total, quantifiable funding to local governments is nearly $8 billion. The actual amount will differ substantially from this total, for example, as local governments request reimbursements from FEMA.

Figure 3

Funding to Local Government for Local Government Provided Services

(In Millions)

|

Federal Legislation |

Entities |

Description |

Amount to California |

|

Various |

|||

|

CARES Act—Coronavirus Relief Fund |

Countiesa |

Funds to respond to the public health emergency. |

$4,488.5 |

|

CARES Act—Coronavirus Relief Fund |

Citiesb |

Funds to respond to the public health emergency. |

1,320.1 |

|

CARES Act |

Cities and counties |

Eligible local costs from COVID-19 disaster declarations. |

UK |

|

Health |

|||

|

CARES Act |

Counties and other local governments |

Delay scheduled reduction in federal disproportionate share hospital funding. |

$510.0 |

|

CARES Act and CPRSAA |

Los Angeles County |

Epidemiology, lab capacity, surveillance, infection control, and surge staffing. |

47.6c |

|

CARES Act and CPRSAA |

Countiesd |

Supplemental grants for county-run, federally funded health centers. |

14.0 |

|

CARES Act |

Cities and counties |

To supplement existing grants for HIV/AIDS programs. |

4.0 |

|

CARES Act |

Local governments |

Expanded grant funding for community behavioral health clinics. |

UK |

|

Housing and Homelessness |

|||

|

CARES Act |

Cities and countiese |

Various activities to address homelessness. |

$88.0 |

|

CARES Act |

Cities and countiese |

Community development activities to revitalize neighborhoods. |

19.0 |

|

Other |

|||

|

CARES Act |

Airportsf |

Airport capital projects. |

$1,089.0 |

|

CARES Act |

Countiese |

Election-related costs in 2020. |

36.0 |

|

CARES Act |

Cities and counties |

Criminal justice agencies’ response to COVID-19. |

35.2 |

|

CARES Act |

Countiese |

Various child welfare activities. |

4.9 |

|

CARES Act |

Cities and counties |

Emergency preparedness and certain response activities. |

4.4g |

|

Total Quantifiable Fundingh |

$7,660.7 |

||

|

aIncludes: Alameda, Contra Costa, Fresno, Kern, Los Angeles, Orange, Riverside, Sacramento, San Bernardino, San Diego, San Francisco, San Joaquin, San Mateo, Santa Clara, Stanislaus, and Ventura Counties. bIncludes: Fresno, Los Angeles, Sacramento, San Diego and San Jose. cAdditional amounts will likely be available, but are unknown at this time. dIncludes: Alameda, Contra Costa, Ventura, Monterey, Sacramento, San Bernardino, San Mateo, Santa Barbara, Santa Clara, Santa Cruz, and Solano Counties eWill be allocated through a state department. fIncluded in the local government category for simplicity, but some airports are not special districts. gEstimate based on typical pass-through amounts to locals. hExcludes funding that is currently unknown. |

|||

|

Notes: Excludes amounts below $1 million. |

|||

|

CARES = Coronavirus Aid, Relief, and Economic Security; COVID-19 = coronavirus disease 2019; UK = unknown; and CPRSAA = Coronavirus Preparedness and Response Supplemental Appropriations Act. |

|||

Funding to Other Public Entities. Figure 4 shows our estimate of federal COVID-19-related funding that other public entities will use to administer programs and provide services. “Other public entities” includes school districts, community colleges, public universities, joint power authorities, public housing agencies, transit providers, and many others. The figure indicates cases where the funding flows through the state versus allocated directly to the entity in question. As the figure shows, the largest areas of federal funding to other public entities are for transportation and education. Our current estimate of the total, quantifiable funding to other public entities is about $8 billion. This amount can change in the coming months as better information becomes available.

Figure 4

Funding to Other Public Entities

(In Millions)

|

Federal Legislation |

State Department |

Entities |

Description |

Amount to California |

|

Transportation |

||||

|

CARES Act |

(N/A - direct)a |

Transit providers |

Offset losses from decreased ridership and other revenues, sanitize vehicles, and protect workers. |

$3,738.2 |

|

CARES Act |

(N/A - direct) |

Joint Power Authorities |

State-supported Amtrak services. |

UK |

|

Education and Child Care |

||||

|

CARES Act—Education Stabilization Fund |

(N/A - direct) |

Community colleges and universities |

Various COVID-19 expenses and student financial aid.b |

$1,707.2 |

|

CARES Act—Education Stabilization Fund |

CDE |

School districts |

Various educational and COVID-19 response activities.c |

1,647.3 |

|

CARES Act—Education Stabilization Fund |

CDE |

School districts, community colleges, and universities |

Grants to institutions most impacted by COVID-19. |

355.2 |

|

CARES Act |

CDE |

Child care providers |

Fund child care for essential workers and/or cover costs to maintaining the operation of child care programs. |

350.3 |

|

CARES Act |

(N/A - direct) |

Head Start grantees |

For existing grantees to operate supplemental summer programs and pay for one-time COVID-19-related costs. |

78.0 |

|

CARES Act |

CDE |

School districts, colleges, and universities |

Clean and disinfect affected schools. Assist in counseling and distance learning. |

UK |

|

CARES Act |

(N/A - direct) |

School districts, colleges, universities, and others |

Improve distance learning and telemedicine in rural areas. |

UK |

|

Health |

||||

|

CARES Act |

DHCS |

UC medical centers |

Delay scheduled reduction in federal disproportionate share hospital funding. |

$140.0 |

|

CARES Act |

(N/A - direct) |

UC medical centers |

To supplement existing grants for HIV/AIDS programs. |

1.2 |

|

Emergency Response |

||||

|

CARES Act |

(N/A - direct) |

Firefighting agencies |

Purchase personal protective equipment. |

UK |

|

Nutrition Assistance |

||||

|

CARES Act and FFCRA |

CDA |

Area Agencies on Aging |

Additional funding for OAA nutrition programs. |

$75.3 |

|

CARES Act |

CDE |

School districts |

Reimbursements for meals for children while school is not in session. |

UK |

|

Other |

||||

|

CARES Act |

CDA |

Area Agencies on Aging |

Funding for caregiver, elder abuse prevention, and supportive services. |

33.3 |

|

CARES Act |

(N/A - direct) |

Public housing agencies |

Operational activities at public housing agencies. |

16.0 |

|

CARES Act |

CDA |

Area Agencies on Aging |

Funding for Aging and Disability Resource Centers. |

3.0 |

|

Total Quantifiable Fundingd |

$8,145.0 |

|||

|

aA small share—$95 million—is administered by Caltrans specifically for rural districts bA share of these funds can be used by students for basic necessities such as food and housing. c10 percent set aside for the state permitted. dExcludes funding that is currently unknown. |

||||

|

Notes: Excludes amounts below $1 million. Several entities listed in this table include a mix of public and private entities. For example, our estimates of funding to universities includes both private and public institutions. Similarly, child care providers and Head Start grantees include a mix of public and private entities. |

||||

|

CARES = Coronavirus Aid, Relief, and Economic Security; N/A = not applicable; UK = Unknown; COVID-19 = coronavirus disease 2019; CDE = California Department of Education; DHCS = Department of Health Care Services; FFCRA = Families First Coronavirus Response Act; CDA = California Department of Aging; OAA = Older Americans Act; and Caltrans = California Department of Transportation. |

||||

Funding to Tribal Governments. Figure 5 shows our estimate of federal COVID-19-related funding that tribal governments will use for the administration of programs and to provide services. Similar to state and local governments, tribal governments are eligible for CRF funds, with an estimate of $63 million in CRF funding available to tribes in California. Figure 5 excludes a some funding amounts that fall below the $1 million threshold for these figures.

Figure 5

Funding to Tribal Governments for Tribal‑Provided Services

(In Millions)

|

Federal Legislation |

Program |

Description |

Amount to California |

|

CARES Act—Coronavirus Relief Fund |

Various |

Funds to respond to the public health emergency. |

$63.0 |

|

CARES Act and FFCRA |

Senior nutrition |

Additional funds to tribes for OAA Native American nutrition services. |

3.1 |

|

Notes: Excludes amounts below $1 million. |

|||

|

CARES = Coronavirus Aid, Relief, and Economic Security; FFCRA = Families First Coronavirus Response Act; and OAA = Older Americans Act. |

|||

Indirect Payments to Private Entities and Individuals

Payments to Private Entities (Through State Government). Figure 6 shows our estimate of federal COVID-19-related funding that will flow through the state government, but will be used by private entities. In this case, private entities include, for example, domestic violence service providers, food banks, and other nonprofits.

Figure 6

Funding to Nonprofits and Other Non‑Public Entities (Provided Through State Government)

(In Millions)

|

Federal Legislation |

State Department |

Entities |

Description |

Amount to California |

|

CARES Act and FFCRA |

DSS |

Food banks |

Deliver food and administrative funding. |

$102.0 |

|

CARES Act |

CSD |

Various |

Various programs to assist low‑income individuals. |

88.0 |

|

CARES Act |

DOR |

Independent living centers |

Supplemental funding for existing grant recipients. |

8.6 |

|

CARES Act |

OES |

Providers |

Grants to domestic violence service providers. |

5.0a |

|

CARES Act |

DSS |

Nonprofits |

Grants to provide shelter and services to homeless and runaway youth. |

2.5 |

|

CARES Act |

Arts Council |

Nonprofits |

Grants for arts and other organizations. |

UK |

|

aRough estimate. |

||||

|

Notes: Excludes amounts below $1 million. CARES = Coronavirus Aid, Relief, and Economic Security; FFCRA = Families First Coronavirus Response Act; DSS = Department of Social Services; CSD = Community Services and Development; ; DOR = Department of Rehabilitation; OES = Governor’s Office of Emergency Services; and UK = unknown. |

||||

Income Support and Cash Assistance to Individuals. Figure 7 shows our estimate of federal COVID-19-related funding that will flow through the state government or other public entities, but will be used by individuals. The figure excludes federal funding that will flow directly to individuals (those funds are described qualitatively in the next section). We define funds as “used by individuals” if the benefit is cash or cash-like, such as financial assistance for food or housing. (The figure therefore excludes “in-kind” benefits, which are shown in other figures in this post.) As the figure shows, the largest amount provided in this category are the increased unemployment insurance (UI) benefits for all standard recipients and the expanded UI benefits for nonstandard recipients. (We describe these funding amounts in more detail here.)

Figure 7

Income‑Support and Cash Assistance to Individuals (Provided Through State Government)

(In Millions)

|

Federal Legislation |

State Department |

Program |

Description |

Amount to California |

|

Unemployment Insurance and Cash Assistance |

||||

|

CARES Act |

EDD |

UI |

$600 increase in weekly UI benefit for all standard recipients. |

$20,000a |

|

CARES Act |

EDD |

UI |

Expand UI benefits—and $600 weekly increase—to freelancers, self‑employed, and gig workers. |

5,000 ‑ 10,000a |

|

CARES Act |

EDD |

UI |

Additional 13 weeks of UI benefits. |

UK |

|

Nutrition Assistance |

||||

|

FFCRA |

DSS |

CalFresh |

Nutrition assistance to qualifying students affected by school closures. |

$1,000a |

|

FFCRA |

DSS |

CalFresh |

Augment April and May monthly nutrition assistance allotments. |

UKb |

|

FFCRA |

CDPH |

WIC |

Additional food assistance. |

78 |

|

Other Income‑Support |

||||

|

CARES Act |

— |

Housing assistance |

Rental subsidies for rent and security deposits. |

$160 |

|

CARES Act |

CSD |

Energy assistance |

Financial assistance to low‑income households for heating, cooling, and other energy needs. |

75 |

|

CARES Act |

CDPH |

Housing assistance |

Housing assistance for people living with HIV/AIDS. |

7 |

|

aRough estimate. bInitial rough estimate—mid hundreds of millions of dollars. |

||||

|

CARES = Coronavirus Aid, Relief, and Economic Security; EDD = Employment Development Department; UI = unemployment insurance; UK = Unknown; FFCRA = Families First Coronavirus Response Act; DSS = Department of Social Services; CDPH = California Department of Public Health; WIC = Women, Infants, and Children; and CSD = Community Services and Development. |

||||

Direct Payments to Private Entities

This section describes, qualitatively, the largest components of federal COVID-19-related funding that we expect to be allocated directly to private entities and individuals in California. (These are the amounts that are illustrated on the left side of Figure 1.)

Assistance to Private Entities, Including Businesses. The largest single source of federal payments to private entities are for financial assistance to businesses. The CARES Act included $377 billion for financial assistance to small businesses—this generally includes businesses and nonprofits with fewer than 500 employees—and $532 billion for financial assistance to air carriers and other large businesses. Of the total assistance to small businesses, the largest piece is $349 billion in forgivable payroll loans. (We described these loans in greater detail in this post.) As of April 16, 98 percent of these funds had been allocated. Of that amount—$33.4 billion or 9.8 percent—was approved for businesses located in California. Congress also recently passed legislation that provides an additional $310 billion for this program, of which businesses in California would receive a share.

Cash Assistance to Individuals. The largest single source of federal payments direct to individuals are for broad-based cash assistance, which was provided in the CARES Act for most Americans. Under the CARES Act, adults earning less than $75,000 in their most recent tax filing are generally eligible for a one-time cash payment of $1,200, and $500 for each child. These payments are phased out starting at $75,000 of income for single adults with no children, such that a single adult is no longer eligible for assistance if they earn $99,000 or more. (We described this cash assistance in greater detail in this post.) Using tax data from 2017, we roughly estimate about 14 million California households will be eligible to receive a total of about $25 billion to $30 billion in direct cash assistance from the CARES Act.