LAO Contact

June 4, 2020

The 2020-21 Budget

Addressing Revenue Uncertainty in the 2020‑21 Cap-and-Trade Expenditure Plan

Cap-and-trade auction revenue is deposited in the Greenhouse Gas Reduction Fund (GGRF) and allocated to various state programs—including programs that are continuously appropriated under current state law and discretionary programs allocated funding through the annual state budget. As we noted in our recent post, the final quarterly auction in 2019‑20—which was held in May 2020—generated very little revenue after raising several hundred million dollars per auction over the last few years. This outcome and a combination of market factors—including overall economic conditions and a substantial bank of unused allowances that has built up in the cap-and-trade program—lead many who follow the cap-and-trade market to believe that allowances in the upcoming auctions could also be undersold. In this post, we (1) discuss a few potential 2020‑21 revenue scenarios, (2) summarize the Governor’s May Revision GGRF expenditure plan, and (3) identify key issues for the Legislature to consider as it develops a 2020‑21 GGRF spending plan in a period of high revenue uncertainty. (For more background information on the state’s cap-and-trade program, see our report Cap-and-Trade Extension: Issues for Legislative Oversight.)

Wide Range of Revenue Scenarios Possible

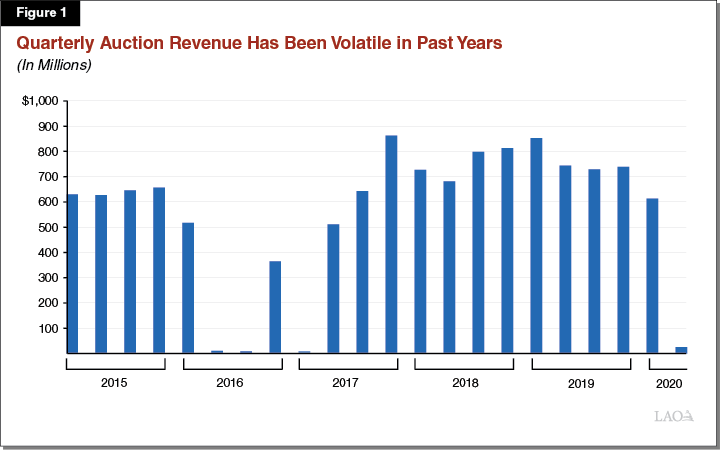

Auction Results Tied to Market Activity. Auction revenue is determined by cap-and-trade market conditions at the time of each auction. Prices for allowances sold at auctions closely track prices for allowances sold on the secondary market (where private parties buy and sell allowances). Significant auction revenue volatility occurs when secondary market prices drop below the auction floor price and private entities can purchase allowances on the secondary market for cheaper than what they have to pay at the auction. When this occurs, the state often does not sell all of its allowances. For example, when secondary market prices dropped below minimum auction prices for a few different periods in 2016 and 2017, the state generated $10 million or less in three out of four auctions, as shown in Figure 1.

Recent Results and Economy Suggest Increased Possibility of Low Revenue in Future Auctions. Secondary market prices were below the auction floor price in the weeks leading up to the recent May 2020 auction. Given recent cap-and-trade market conditions, there is significant uncertainty about how much GGRF revenue the state will collect from 2020‑21 auctions. As a result, in our view, the Legislature should be considering a wide range of plausible revenue scenarios in 2020‑21 as it develops its GGRF expenditure plan. If private companies and investors decide to delay or limit allowance purchases at multiple upcoming auctions (due to poor economic conditions, for example), the state could generate only limited revenue in the fiscal year. It is also possible that most or all of the allowances offered at future auctions sell and state revenue exceeds current budget assumptions. We note that, at the time of this post, secondary market prices are above the auction floor price—suggesting the possibility of higher revenue at upcoming auctions.

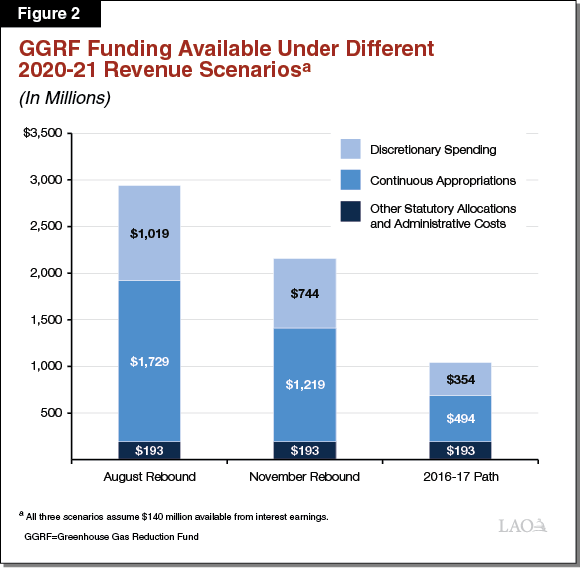

Figure 2 shows three potential auction scenarios meant to illustrate some of the revenue uncertainty and how it might affect the amount available for programmatic spending in 2020‑21. Importantly, these scenarios do not reflect the entire range of possible auction outcomes—it is possible that annual revenue could be higher or lower. Our three scenarios are:

August Rebound ($2.8 Billion)—Beginning in the August 2020 auction (and continuing through the remaining auctions), all allowances offered for sale are purchased at prices slightly above the auction floor price.

November Rebound ($2 Billion). No state allowances are purchased at the August 2020 auction. Beginning in the November 2020 auction, all allowances offered for sale are purchased at prices slightly above the auction floor price.

2016‑17 Path ($900 Million). This scenario is similar to the auction results during 2016‑17 when secondary market prices were frequently below the auction floor price. We assume auction results are as follows: (1) no state allowances purchased at the August 2020 auction, (2) half of state allowances are purchased at the November 2020 auction at the floor price, (3) no state allowances are purchased at the February 2021 auction, and (4) all state allowances purchased at slightly above the floor price at the May 2021 auction.

Three Scenarios Provide Differing Funding Amounts for Programs. Under these three scenarios, funds available for continuously appropriated and discretionary programs would vary significantly. The amount available for discretionary GGRF programs ranges from $1 billion to $354 million. We estimate that it would take roughly $2.7 billion in auction revenue—a couple hundred million more than the administration assumes—to fund the entire $965 million discretionary expenditure plan proposed by the administration for 2020‑21 (discussed below).

Governor’s May Revision Proposal

Includes $2.7 Billion Cap-and-Trade Spending Plan. Consistent with the Governor’s January budget proposal, the May Revision plan assumes $2.5 billion in auction revenue in 2020‑21 (plus an additional $140 million in interest income). In addition, the May Revision essentially maintains the same cap-and-trade expenditure plan proposed in the Governor’s January budget. As shown in Figure 3, this plan includes $965 million for discretionary programs.

Figure 3

May Revision Cap‑and‑Trade Expenditure Plan

(In Millions)

|

Program |

Department |

2020‑21 |

|

Continuous Appropriationsa |

$1,551 |

|

|

High‑speed rail |

High‑Speed Rail Authority |

592 |

|

Affordable housing and sustainable communities |

Strategic Growth Council |

474 |

|

Transit and intercity rail capital |

Transportation Agency |

237 |

|

Transit operations |

Caltrans |

118 |

|

Safe drinking water programb |

State Water Board |

130 |

|

Statutory Allocations and Ongoing Administrative Costs |

$193 |

|

|

SRA fee backfill |

CalFire/Conservation Corps |

80 |

|

Manufacturing sales tax exemption backfillc |

N/A |

42 |

|

State administrative costs |

Various |

71 |

|

Discretionary Spending Commitments |

$965 |

|

|

Air Toxic and Criteria Pollutants (AB 617) |

$235 |

|

|

Local air district programs to reduce air pollution |

Air Resources Board |

200 |

|

Local air district administrative costs |

Air Resources Board |

25 |

|

Technical assistance to community groups |

Air Resources Board |

10 |

|

Forests |

$208 |

|

|

Healthy and resilient forests (SB 901) |

CalFire |

165 |

|

Prescribed fire and fuel reduction (SB 901) |

CalFire |

35 |

|

Fire safety and prevention legislation implementation (AB 38) |

CalFire |

8 |

|

Low Carbon Transportation |

$350 |

|

|

Heavy‑duty vehicle and off‑road equipment programs |

Air Resources Board |

150 |

|

Clean Vehicle Rebate Project |

Air Resources Board |

125 |

|

Low‑income light‑duty vehicles and school buses |

Air Resources Board |

75 |

|

Agriculture |

$88 |

|

|

Agricultural diesel engine replacement and upgrades |

Air Resources Board |

50 |

|

Dairy methane reductions |

Food and Agriculture |

20 |

|

Healthy Soils |

Food and Agriculture |

18 |

|

Other |

$84 |

|

|

Workforce training for a carbon‑neutral economy |

Workforce Development Board |

33 |

|

Climate change research and technical assistance |

Strategic Growth Council |

25 |

|

Waste diversion and recycling |

CalRecycle |

15 |

|

Energy Corps |

Conservation Corps |

7 |

|

Coastal adaptation |

Various |

4 |

|

Total |

$2,709 |

|

|

aAllocations based on Governor’s estimate of $2.5 billion in 2020‑21. bIncludes $12 million allocation in budget act. cGovernor’s estimate. |

||

|

SRA = State Responsibility Area; CalFire = California Department of Forestry and Fire Protection; N/A = not applicable; AB 617 = Chapter 136 Statutes of 2017 (AB 617, C. Garcia); SB 901 = Chapter 626 Statutes of 2018 (SB 901, Dodd); AB 38 = Chapter 391 Statutes of 2019 (AB 38, Wood); CalRecycle = California Department of Resources Recycling and Recovery; and CalEPA=California Environmental Protection Agency. |

||

Makes Discretionary Funding Dependent on Future Revenue and Gives First Priority to Certain Programs. In recognition of revenue uncertainty, the May Revision modifies a budget control section to make discretionary spending contingent on the amount of revenue collected at quarterly auctions in 2020‑21. After providing funding to continuous appropriations (roughly 65 percent of auction revenue), existing statutory allocations, and ongoing administrative costs, the Department of Finance would first allocate available discretionary revenue to the following programs proportionally:

AB 617 incentives to reduce local air pollution (up to $200 million).

Forestry and wildfire-related activities (up to $208 million).

Agricultural diesel engine replacements and upgrades (up to $50 million).

Safe and Affordable Drinking Water Program (up to the amount needed to provide $130 million total funding, including the 5 percent continuous appropriation).

Any remaining revenue available after funding these programs would be allocated to the other discretionary programs proportionally.

Prioritizing Programs Makes Sense Given Revenue Uncertainty

Legislature Might Prioritize Programs Differently. To begin 2020‑21, there is very little GGRF revenue in the fund balance that could be available for new GGRF programmatic allocations. As a result, the amount of money available for new spending in the 2020‑21 budget will largely depend on how much revenue is generated at the four quarterly auctions held in 2020‑21. Given the condition of the fund and the high level of uncertainty about future revenue discussed above, we think making GGRF appropriations contingent on future auction revenue is a reasonable approach. We also think a strategy of identifying programmatic priorities and ensuring the highest priority programs get “first call” on future auction revenue has merit. Many of the programs that the administration has identified as its highest priorities are programs the Legislature has adopted in statute in recent years and, therefore, might be consistent with legislative priorities.

However, the Legislature could consider various modifications to what the Governor proposes. For example, it could amend the budget control section to prioritize a different set of programs for funding. In addition, rather than allocating funding to the remaining discretionary programs proportionally, the Legislature could consider developing additional funding tiers or “buckets” that identify the order in which remaining programs would receive funding, if available.

Issues for Legislative Consideration When Prioritizing Limited Funds. Given the possibility that GGRF funding will be limited in 2020‑21, the Legislature will have to make difficult decisions about how to prioritize different policy goals, such as reducing greenhouse gases, promoting new technologies, assisting climate adaptation activities, improving local air quality, and enhancing forest management and fire protection. In addition to these considerations, some questions the Legislature might want to consider when structuring its GGRF expenditure plan are:

How Much Carryover Funding Is Available From Prior Years? Typically, some programs get a few years to spend GGRF funds. Some of these programs might have a significant amount of unspent (carryover) funds from prior years. We have asked the administration to identify programs with large amounts of carryover funding from prior years and the administration has indicated that additional time is needed to collect this information for most programs. If the administration is able to provide this information in a timely manner, the Legislature could prioritize new allocations to high-priority programs that do not have a significant amount of carryover funding.

Does It Make Sense to Expand Programs? The Governor’s expenditure plan includes $25 million to expand various climate research and adaptation activities, if sufficient revenue is available. However, such an expansion might be difficult to implement in 2020‑21 given the uncertainty about how much funding will ultimately be available. The Legislature might want to wait until another year to expand these programs when there could be more funding certainty.

Do Certain Programs Benefit From Greater Funding Stability? For example, programs that are aimed at promoting a market for newer technologies—such as electric vehicles or zero-emission trucks—might benefit from more consistent funding that provides market signals for long-term private investments in these newer technologies. Additionally, there may be other programs at the local level, such as local air district implementation of AB 617, where state funding might be needed to maintain staff and ongoing administrative activities. On the other hand, programs that allocate money to projects through one-time grants might be able to more easily scale their programs to different funding levels.

How Much Funding Can a Program Spend in the Next Year? The coronavirus disease 2019 (COVID-19) pandemic, and related actions to address the pandemic, might make it more difficult for certain programs to spend money in the next year. For example, social distancing and economic factors might (1) reduce the demand for certain rebates or vouchers or (2) limit the number of new projects that could be implemented, for example, if there are short-term disruptions in the availability of materials or equipment. The Legislature could direct the administration to provide information on the potential market or operational impacts COVID-19 might have on programs’ ability to spend the funding in the next year.

Are Continuous Appropriations Still Consistent With Legislature’s Priorities? The Legislature should consider both continuous appropriations and discretionary spending when identifying its priorities and developing a funding strategy. For example, if the Legislature considers certain discretionary programs higher priority than certain continuously appropriated programs, it could give those discretionary programs first call on 2020‑21 revenue.