LAO Contact

January 28, 2021

Increasing Oversight of the State Litigation Deposit Fund

- Introduction

- Background

- Limited Opportunity for Oversight of LDF

- LAO Recommendations

- Conclusion

- Appendix

Executive Summary

Department of Justice (DOJ) Primarily Responsible for State Litigation. DOJ is the primary entity that represents the State of California in litigation. This includes pursuing legal proceedings against individuals or entities that violate state laws. Such proceedings can be resolved in various ways, including requiring payments to the state in exchange for the state ending its pursuit of legal action (these payments are also known as litigation proceeds).

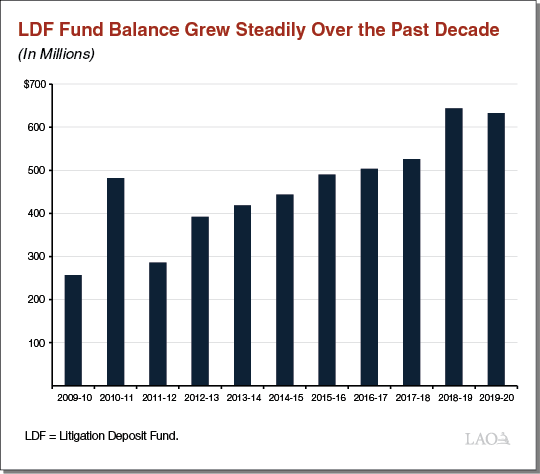

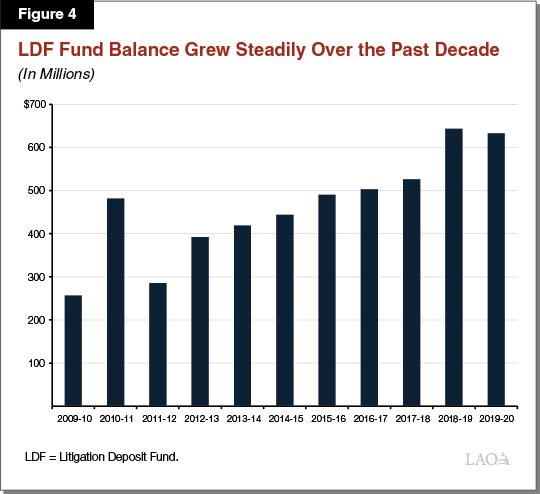

Litigation Proceeds Deposited in Litigation Deposit Fund (LDF). The LDF is a state special fund created to receive certain litigation proceeds. The fund primarily supports payments to individuals and entities harmed by those breaking the law, as well as transfers to DOJ special funds to support DOJ litigation‑related costs. As shown in the figure below, the amount of money in the LDF at the end of the year has grown significantly over the past decade—reaching $633 million at the end of 2019‑20. This is because funds remain in the LDF until DOJ decides to make an allocation. The LDF was created to hold monies in trust, and thus is not reflected in or considered as part of the state budget. Instead, state law places the fund under the control and administration of DOJ and only requires quarterly reporting to the Legislature.

Limited Opportunity for Oversight of LDF. We find that current state law and DOJ practices related to the fund limit the opportunity for the Legislature to conduct effective oversight of the LDF. Specifically, there is:

- Little meaningful information provided on the LDF.

- Little transparency on the level of resources available for transfer to the state General Fund, DOJ special funds, or other funds.

- Little incentive for DOJ to transfer LDF funds to the special funds that support its self‑initiated litigation as these funds are included in the annual budget process and subject to greater oversight.

- Limited opportunity for ongoing legislative oversight over legal workload initiated by DOJ.

- Significant flexibility for DOJ in determining the use of legislatively appropriated funding over time.

Given that DOJ is primarily responsible for allocation decisions that it could directly benefit from, it is important that the Legislature has the opportunity and necessary information to conduct oversight to ensure these litigation proceeds are used consistent with its priorities and state law.

Recommendations to Increase Oversight of LDF and Use of Litigation Proceeds. To address the above concerns, we offer several recommendations to increase legislative oversight of the LDF and how LDF funds transferred to DOJ special funds are used. Specifically, we recommend:

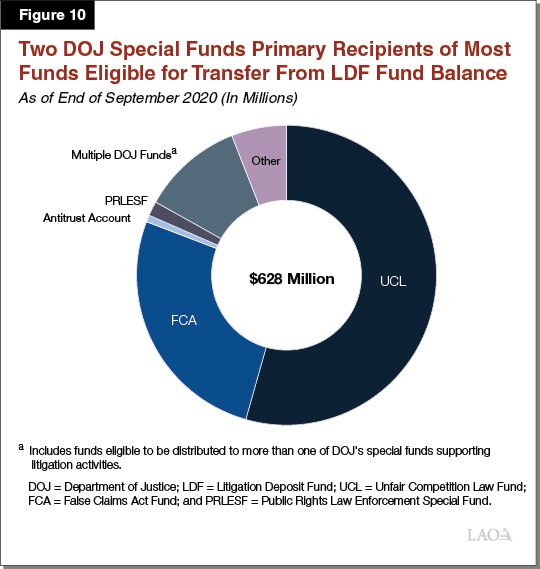

- Requiring DOJ to transfer all eligible funds—which we estimate to be around $628 million as of the end of September 2020—from the LDF to the appropriate DOJ special funds, rather than continuing to allow DOJ to retain funds in the LDF.

- Requiring LDF allocations occur within a specified amount of time, which would ensure the Legislature receives timely information on the total level of litigation proceeds potentially available for use and prevent the re‑accumulation of funds in the LDF.

- Reconsidering existing state law requiring an automatic transfer from the LDF‑supported Antitrust Account to the state General Fund when monies in the account exceed $3 million, thus providing the Legislature with more choices on how Antitrust Account monies may be used.

- Requiring increased LDF reporting, such as information on the costs and litigation proceeds associated with each resolved case and how proceeds may be used.

- Increasing oversight of the use of LDF monies transferred to DOJ special funds, such as by requiring robust annual reports by each DOJ litigation section or unit supported by litigation proceeds.

Introduction

The Department of Justice (DOJ), under the direction of the Attorney General, is the primary entity that represents the State of California in litigation. This includes initiating investigations and pursuing legal proceedings against individuals or entities that do not comply with state laws. Such proceedings can be resolved in various ways, including requiring payments to the state in exchange for the state ending its pursuit of legal action. The Litigation Deposit Fund (LDF) is a state special fund created to receive such payments (also known as litigation proceeds). The fund primarily supports payments to individuals and entities harmed by those breaking the law as well as litigation‑related costs.

In this report, we (1) provide background on the LDF and how it is administered, (2) review the Legislature’s oversight of the LDF and the use of litigation proceeds, and (3) make recommendations to facilitate increased legislative oversight.

Background

DOJ Primarily Responsible for State Litigation

Attorney General Designated as State’s Chief Law Officer. The California Constitution designates the Attorney General as the state’s chief law officer and specifies various duties for the Attorney General. One duty is to prosecute violations of state law when the Attorney General believes state law is not being adequately enforced. In addition, state law generally requires the Attorney General to represent state agencies and their employees in judicial proceedings. Unless specifically exempted by state law (as is the case for the University of California Board of Regents and the California Department of Transportation), state agencies must generally obtain written consent from the Attorney General before using in‑house counsel (meaning their own legal staff) or contracting with outside counsel. Additionally, statute authorizes the Attorney General to investigate and prosecute violations of certain state laws. For example, the Attorney General is authorized to enforce state laws prohibiting unlawful, unfair, or fraudulent business practices as well as false or misleading advertising.

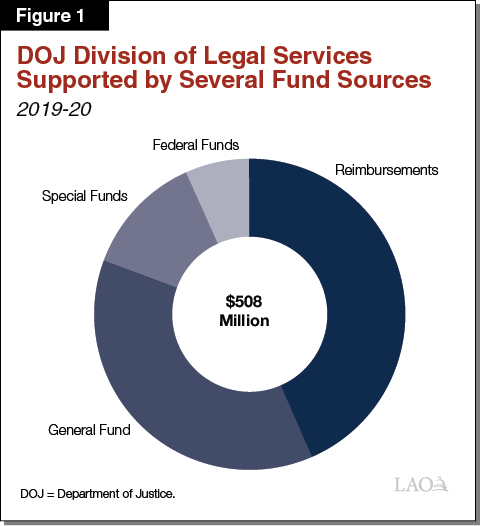

DOJ Division of Legal Services Responsible for Most DOJ Litigation. The agency of the Attorney General—the California DOJ—consists of three major divisions: Legal Services, Law Enforcement, and California Justice Information Services. The Division of Legal Services is responsible for most of DOJ’s litigation activities. In 2019‑20, about half of DOJ’s budget—$508 million—supported this division. As shown in Figure 1, the largest share of the budget comes from reimbursements—generally from state agencies receiving DOJ legal services. About $64 million (or 13 percent) comes from special funds including litigation proceeds.

The Division of Legal Services is further divided into three subdivisions—Civil Law, Criminal Law, and Public Rights. About 40 percent of the funding provided to the Division of Legal Services in 2019‑20 supported the Division of Civil Law; while the Divisions of Criminal Law and Public Rights were each supported by about 30 percent of the total funding. Each of these subdivisions then has its own subsections or units. For example, the Division of Public Rights includes an Antitrust Section, Consumer Law Section, and Environment Section.

DOJ Litigation Initiated in Two Major Ways. There are two primary ways DOJ litigation can be initiated. Specifically, litigation can be initiated by:

- State agencies can request DOJ initiate legal action, defend or represent them in legal actions filed by others, or provide legal advice. DOJ typically bills state agencies for their costs. Currently, DOJ charges $220 per hour for attorney services, $205 per hour for paralegal services, and $195 per hour for analyst services. State agencies generally pay for these costs from their own budgets which can consist of General Fund and/or special fund dollars, such as licensing fee revenue. Such payments are reflected as reimbursements to DOJ’s budget. To the extent additional resources are needed, state agencies (and DOJ) will seek additional funding or increased expenditure authority from the Legislature.

- DOJ can self‑initiate legal actions, as well as defend or represent the state as a whole in actions filed by others. These costs are generally paid for from DOJ’s budget through General Fund dollars or special funds, including litigation proceeds. To the extent additional resources are needed, DOJ will seek additional funding or increased expenditure authority from the Legislature.

DOJ Has Flexibility Over Litigation Workload. DOJ has flexibility over its litigation workload, particularly with respect to self‑initiated litigation, within existing resources. This is because DOJ is the sole decision‑maker on which cases it pursues based on its priorities. In contrast, DOJ has less flexibility over litigation workload initiated by state agencies. This is because decisions on whether to pursue legal action are either determined by the state agency, or in partnership with the state agency. This means DOJ cannot fully control such workload.

DOJ Self‑Initiated Litigation Process

This report focuses on a portion of DOJ’s self‑initiated workload, specifically, when DOJ chooses to take legal action against an individual or entity for violating state laws. The process for pursuing such legal action consists of the four key steps below.

Determining Whether to Initiate a Case. DOJ first determines whether to initiate (or file) a case. This includes identifying whether there is a violation of state law, investigating the potential violation, and determining whether there is significant public impact. To the extent DOJ determines that there is sufficient proof, DOJ will initiate a case.

Determining How to Initiate a Case. If DOJ decides to file a case, the department then determines how and when to file the case in state court. DOJ has flexibility to determine which state laws it claims are being violated. For example, in situations where a case can be pursued as a violation of multiple state laws, DOJ may choose to pursue the case under only some of the laws for strategic reasons. This is because the state law(s) under which a case is pursued provides a framework for how DOJ is able to prosecute the case and what relief and remedies can be sought. For example, DOJ might initiate a case against a business for bid rigging (a type of price fixing) as a violation of the state’s unfair competition laws, anti‑trust laws, or both. A legal document filed with the court to initiate a case will specify the specific pieces of state law DOJ believes have been violated, how these laws have been violated, and what remedies or relief are being sought (such as attorney fees or civil penalties). In certain cases, DOJ may choose to work with other litigants, such as other states or district attorneys. This can also impact how and when the case is pursued as agreement from all parties is generally required.

Resolving Cases. DOJ can resolve cases by dropping them, reaching agreement (or settling) outside of court, or through a court decision after a trial. Settling the case or obtaining a court decision after winning a trial typically results in a legal agreement dictating terms that must be fulfilled by the entity sued by DOJ. For example, the entity may be required to stop behaving in a particular manner, provide restitution, and/or pay a civil penalty. The terms required by a court decision are generally tied to remedies permitted by the state laws found to have been violated. In contrast, DOJ has significant flexibility when settling cases—particularly if DOJ is not working with other litigants—as the specific terms are generally whatever DOJ and the entity that was sued agree to based on their respective interests.

To the extent that agreements require payments, the agreements generally specify when and how the payments are to be made and how the payments are to be used. For example, an agreement may detail specific amounts that must go to a particular entity (such as DOJ) or be used for particular purposes (such as enforcement of environmental protection laws or housing‑related grants). The level of detail, however, can vary by case. For example, a legal agreement might only specify the broad purposes the funds can be used for. In cases where there is not a lot detail, DOJ has some flexibility in determining how the money can be used. For example, DOJ can determine that the monies related to a specific case could be used by the state to enforce both unfair competition laws and false claims laws—rather than just unfair competition laws. The use of payments can also be governed by the specific state laws that were alleged or determined to have been violated. For example, payments related to violations of the state’s unfair competition laws must be used for the enforcement of consumer protection laws. However, when DOJ receives such funding, it has flexibility in determining the specific activities that are funded to enforce consumer protection laws.

Overseeing Compliance With Legal Agreements. DOJ generally oversees compliance with the legal agreements, including ensuring litigation proceeds are received and used consistently with state law and the agreements. In certain cases where an agreement or state law provides flexibility in the use of litigation proceeds, DOJ will determine how the proceeds can be used unless the Legislature and the administration choose to dictate more specifically how such monies are to be used. For example, state law was adopted in 2020 that dictated the use of $331 million in National Mortgage Settlement litigation proceeds. Specifically, $300 million for housing counseling and mortgage assistance and $31 million for tenant defense in landlord‑tenant disputes.

LDF

Litigation Proceeds Deposited in LDF Absent Specific State Laws. Litigation proceeds are deposited into the LDF in cases where the state is a party to the legal action and no other state statutes specifically provide for (1) the handling and investing of the money and (2) how any earned interest is distributed. (The state generally earns interest from the investment of monies that are held prior to allocation.) Monies in the LDF are allocated for use in two major ways:

- Court‑ordered payments as documented in legal agreements to individuals or entities (such as state agencies) harmed by the actions of the entity that was sued.

- Transfers to various special funds—most notably to DOJ special funds to cover current and future litigation costs. (As we discuss in more detail below, these special funds may also receive funding from other sources as well.)

State law requires that any monies remaining in the LDF that are not needed to satisfy court‑ordered payments as documented in legal agreements or to support DOJ’s litigation costs be transferred to the state General Fund no later than July 1 of each fiscal year.

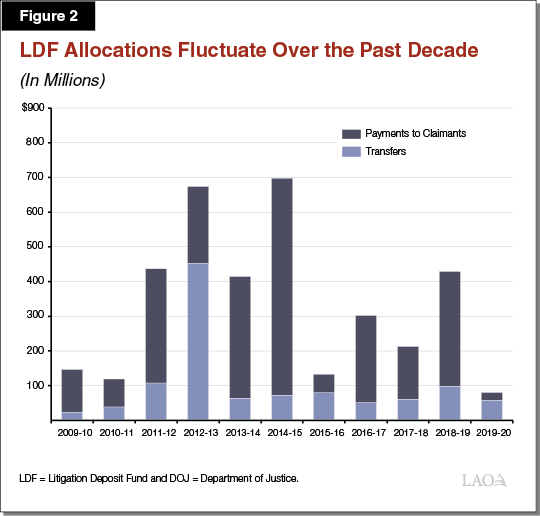

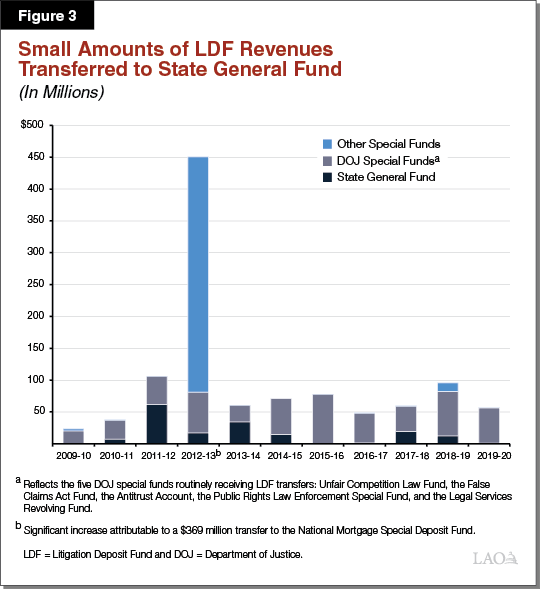

LDF Deposits and Allocations Vary Over Time. Deposits of litigation proceeds into the LDF, as well as the amount of funds actually allocated from the LDF, vary over time. Deposits were generally in the hundreds of millions of dollars annually over the past decade—but ranged significantly from $779 million in 2012‑13 to $69 million in 2019‑20. As shown in Figure 2, total LDF allocations also fluctuated over the past decade. (As we discuss below, not all LDF deposits are allocated in the year that they are received.) Most allocations are generally payments made to those claiming harm (such as individuals or government entities), which ranged from $625 million in 2014‑15 to $23 million in 2019‑20. Transfers to the General Fund, DOJ special funds that fund litigation, and other DOJ and non‑DOJ special funds (such as the Aliso Supplemental Environmental Project Fund) ranged from $451 million in 2012‑13 to $21 million in 2009‑10. As shown in Figure 3, of the total amount transferred, the amount transferred to the General Fund was comparatively low—ranging from $62 million in 2011‑12 to a little more than $4,000 in 2015‑16.

LDF Fund Balance Growing Over Time. As shown in Figure 4, the LDF fund balance—or the amount of money remaining in the fund at the end of the year after all revenues have been received and all allocations have been made—has grown significantly and relatively steadily over the past decade. At the end of 2019‑20, the fund balance was $633 million. This is an increase of $189 million (or 43 percent) over the last five years and $376 million (or 146 percent) over the last ten years. As we discuss below, DOJ determines when allocations are made from the LDF. Funds remain in the LDF fund balance until allocated.

DOJ Responsible for Administering LDF. Because the LDF was created to hold monies as a trust fund, it is not reflected in or considered part of the state budget, similar to other state funds with this status. State law places the fund under the control and administration of DOJ. Specifically, state law requires DOJ maintain accounting records for the fund—including records of individual deposits and allocations. State law also authorizes DOJ to make allocation decisions whenever, and to whomever, it deems appropriate as long as the decisions are consistent with the terms of underlying legal agreements or state law. Until such allocations are made, monies remain in the LDF fund balance. Only a transfer to one of its special funds—the Legal Services Revolving Fund (LSRF) (discussed in more detail below)—requires approval by the Department of Finance (DOF).

DOJ Required to Provide Quarterly Reports. While the LDF is not considered annually as part of the state budget, DOJ is required to provide quarterly reports to the Chair of the Joint Legislative Budget Committee, the Chairs of the Assembly and Senate fiscal committees, and the Director of DOF. These reports generally include the beginning and ending fund balance for the LDF, the number of deposits received and amount of interest earned, allocations to those claiming harm, and the amount used for DOJ litigation costs (represented by the amount transferred to certain DOJ special funds).

DOJ Special Funds Receiving LDF Revenues

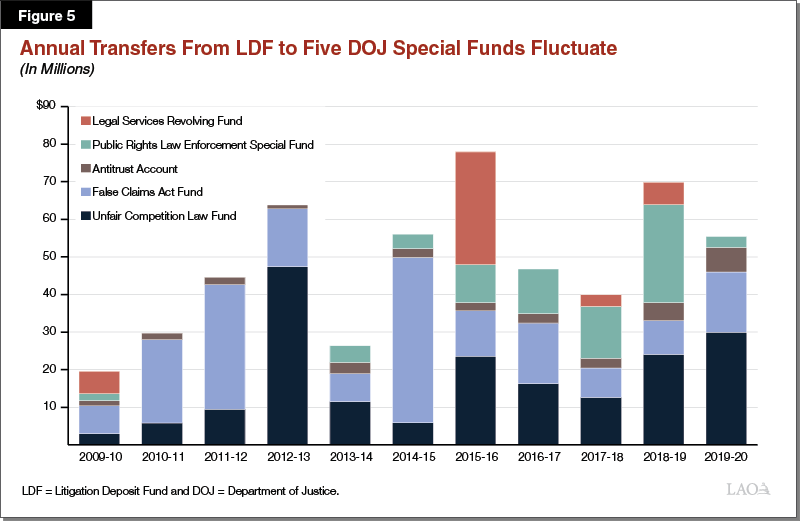

LDF Revenues Primarily Transferred to Five DOJ Special Funds. LDF revenues are primarily transferred annually to four DOJ special funds: the Unfair Competition Law (UCL) Fund, the False Claims Act (FCA) Fund, the Antitrust Account, and the Public Rights Law Enforcement Special Fund (PRLESF). A fifth DOJ special fund—the LSRF—receives less regular transfers. As discussed above, state law can specify what types of litigation proceeds shall be transferred into these funds and provides guidelines for how such proceeds are to be used. We discuss each of the five special funds in more detail below.

- UCL. State law requires the state’s share of litigation proceeds from cases related to unlawful, unfair, or fraudulent business practices, as well as false or misleading advertising, be deposited into the UCL. LDF transfers are the primary revenue source for the UCL. Proposition 64 (2004) amended state law to require the UCL to exclusively support the enforcement of consumer protection laws by the Attorney General.

- FCA. State law requires the state’s share of litigation proceeds from cases related to knowingly presenting or facilitating a fraudulent claim for payment be deposited into the FCA. LDF transfers are the primary revenue source for the FCA. These funds are used by the Attorney General to investigate and prosecute false claims. FCA funds used to support certain activities qualify the state for federal funds. Specifically, federal law requires state Medicaid Fraud Control Units investigate fraudulent payments and act on complaints of abuse and neglect of patients in facilities paid by Medicaid. State funding—such as FCA funds—supporting such activities can draw down significant federal funds. For example, in 2019‑20, this unit is estimated to receive $34 million in federal funds.

- Antitrust Account. State law created the Antitrust Account to receive litigation proceeds for violations of federal and/or state antitrust laws, such as anticompetitive business mergers. LDF transfers are the primary revenue source for the Antitrust Account. State law requires that any monies in excess of $3 million be transferred to the General Fund.

- PRLESF. State law requires litigation proceeds from a wide range of violations of state law—such as anti‑discrimination, tobacco, and environmental laws—be deposited into the PRLESF. LDF transfers are the primary revenue source for the PRLESF. These funds must support the investigation and prosecution of any laws the Public Rights Division has enforcement authority over.

- LSRF. The Legislature established the LSRF primarily for the deposit of payments to DOJ from state agencies who were billed for DOJ legal services. Such reimbursements are the primary revenue source for this fund. LDF transfers, when made, generally represent only a small portion of LSRF revenues. Funds transferred from the LDF are to be used for certain investigation and litigation activities taken on behalf of state agencies employing DOJ legal services.

As shown in Figure 5, tens of millions of dollars are transferred from the LDF annually into these DOJ special funds—ranging from nearly $20 million in 2009‑10 to $78 million in 2015‑16. The largest transfers tended to go to the UCL and the FCA. Transfers to these two funds accounted for at least half of the total transferred to the above DOJ special funds each year over the past decade. Not all of the special funds, however, received transfers every year. Specifically, both the PRLESF and LSRF did not receive transfers in certain years.

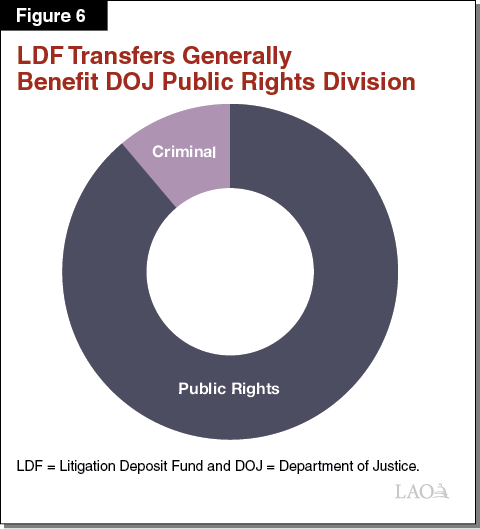

Transfers Generally Benefit Public Rights Division. As shown in Figure 6, most LDF transfers to the above funds support DOJ’s Public Rights Division. This is because this division is generally tasked with safeguarding and protecting Californians’ rights broadly, meaning that many LDF‑related cases fall within its jurisdiction. In 2019‑20, around $54 million in transferred litigation proceeds supported DOJ litigation workload. Of this amount, $48 million (or nearly 90 percent) supported the Public Rights Division. The remaining amount supported the Division of Criminal Law. (We note that both of these divisions also receive funding from other fund sources, such as the General Fund.)

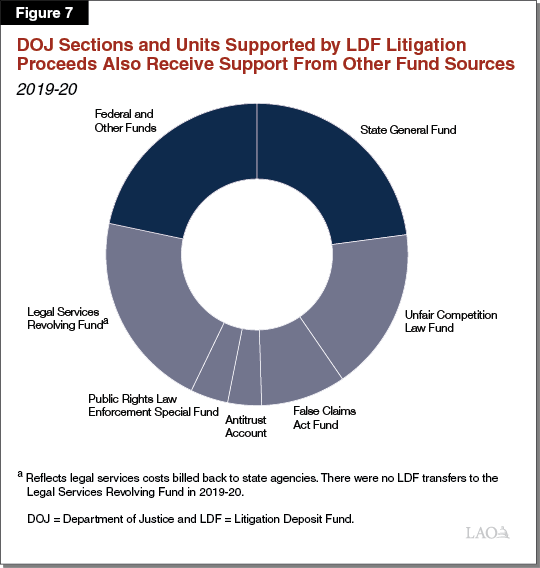

At least 15 DOJ litigation sections or units received support from LDF transfers in 2019‑20. (We note a couple other sections or units, such as the Charitable Trust Section, also received funds from the LDF in recent years prior to 2019‑20.) All of the 15 units are subdivisions of the Public Rights Division, except for the Bureau of Medi‑Cal Fraud and Elder Abuse, which is a unit in the Criminal Law Division. As shown in Figure 7, these sections and units generally receive support from other funds as well—including a total of $36 million from the General Fund in 2019‑20. The level and mix of funding for these various sections and units can vary annually based on DOJ funding decisions. For example, the Antitrust Section received around $5 million more in support from the UCL in 2019‑20 than in prior years, while primary support for the Privacy Enforcement and Protection Unit shifted from the PRLESF to the UCL in 2019‑20. A more detailed breakdown of funding by fund source for each section or unit is provided in the Appendix of this report.

Legislature Has Greater Oversight of These Funds. Except for the LSRF, these DOJ special funds receiving LDF transfers are not trust funds and thus are included and considered as part of the annual state budget process. Accordingly, annual budget documents provided to the Legislature include fund condition statements reflecting revenues, expenditures, and the overall health of the fund. Additionally, the state budget reflects a specific appropriation from these funds to support DOJ. When DOJ would like to change the level of spending from these special funds, the Legislature must review and approve such requests as part of the annual budget process. This helps the Legislature exercise oversight of expenditures from these funds. While the request for additional spending authority from these funds may reflect anticipated LDF revenues, the Legislature does not receive information on the LDF when reviewing requests from these special funds as part of the annual budget process.

Limited Opportunity for Oversight of LDF

Through our review of the LDF and DOJ, we find that current state law and DOJ practices related to the fund limit the opportunity for the Legislature to conduct effective oversight of the LDF. Figure 8 provides a summary of our specific findings, which we discuss in more detail below.

Figure 8

Summary of LAO Findings

|

|

|

|

|

Little Meaningful Information Provided on LDF. The Legislature only receives the statutorily required quarterly reports submitted by DOJ. However, these reports generally provide limited information. For example, the reports generally provide only two line items related to revenue—one summarizing the total amount deposited and one summarizing the total amount of interest earned during the period. Similarly, with regard to expenditures, the report only includes one line item summarizing the total amount paid to claimants as well as line items for each transfer from the LDF.

Without additional information, it is difficult for the Legislature to assess and draw conclusions about DOJ litigation activities. For example, it is unclear how many legal cases are being resolved, when these cases were initiated, how much has been spent on these cases, and which cases have litigation proceeds that are being transferred to the various DOJ special funds. To the extent that the Legislature received such information, it would be able to actively monitor how effectively DOJ is using state resources in pursuing litigation. It would also facilitate discussions of how litigation proceeds should be used in the future, similar to how it reviews other state funds.

Lack of Transparency on Level of Resources Available for Transfer. DOJ has significant discretion over the timing of transfers to the General Fund, its special funds, or other funds, even in cases where state law and/or legal agreements require their transfer. Additionally, DOJ exerts decision‑making authority over transfers to these funds (such as how much to transfer) with little legislative or other oversight, with one exception. The only exception is that DOF must approve any transfers to the LSRF. However, state law specifies DOJ’s written request for an LSRF transfer is deemed approved if DOF does not take action within 30 days of receipt of the request.

DOJ has used this discretion to limit annual transfers to its special funds to the amount that it estimates will be spent each year from those funds to support DOJ litigation activities. This means that such special funds sometimes appear barely solvent, even though additional funds could potentially be transferred from the LDF. Instead, these funds remain in the LDF fund balance. However, since the quarterly reports do not include information on how the funds in the LDF balance may be used, there is a lack of transparency on the total level of resources potentially available for transfer to each of DOJ’s special funds. This can make it difficult for the Legislature to make budget‑related decisions, such as whether litigation proceeds retained in the LDF fund balance can be used to support DOJ litigation costs supported by other fund sources or whether the Legislature would like to direct DOJ to increase its enforcement of existing or new laws.

Lack of Incentive to Transfer LDF Funds to DOJ Special Funds. Because of the lack of transparency on the level of resources available for transfer, DOJ generally has little incentive to transfer LDF litigation proceeds to its special funds. This is because retaining the funds in the LDF makes it difficult for the Legislature and administration to determine whether funds are available for other budget purposes. This could include authorizing loans or transfers to the General Fund, replacing existing General Fund support with litigation proceeds, and/or increasing enforcement or other activity on a one‑time or ongoing basis. Keeping funds in the LDF thus increases the likelihood that the funds will remain available to fund DOJ litigation activities based on its priorities. Additionally, state law requires any monies in excess of $3 million in the Antitrust Account be transferred to the General Fund. By retaining the funds in the LDF to ensure the Antitrust Account fund balance remains below that threshold, DOJ retains the monies for future litigation activities rather than benefiting the General Fund as intended by state law.

Little Opportunity for Ongoing Legislative Oversight Over DOJ Self‑Initiated Workload. Unlike DOJ litigation workload initiated by state agencies, there is little ongoing legislative oversight of DOJ’s self‑initiated workload supported by LDF litigation proceeds. State agencies, who are billed for DOJ legal services, have an incentive to monitor legal costs—such as by monitoring how much time and resources are used on cases and how cases are resolved—because they are ultimately responsible for paying such costs. State agencies also have the incentive and opportunity to discuss the status and approach on cases with DOJ on an ongoing basis. This external oversight, along with discussions with DOJ over the litigation workload, helps control costs and ensures funding is used in a cost‑effective and productive manner.

In contrast, self‑initiated workload is generally pursued based on DOJ priorities with little external oversight. This means that such workload is not as rigorously evaluated. It also increases the risk that costs associated with such workload could grow unnecessarily quickly and that funding is not used to maximize state benefit.

This oversight is particularly important as DOJ decisions in self‑initiated cases impact the deposit of monies into the LDF. As discussed above, DOJ has significant flexibility in determining how legal actions are pursued and resolved. This establishes the legal framework that dictates the monetary payments (or other remedies) that DOJ can seek and where received payments could be transferred. For example, if DOJ chooses to pursue a case solely under the state’s unfair competition laws, the state’s share of litigation proceeds must be deposited into the UCL unless otherwise specified in the legal agreement. If a case is pursued as violations of multiple state laws and/or the legal agreement does not include specific payment requirements, DOJ can have control over how litigation proceeds are split between funds. As a result, DOJ influences how much is deposited in the LDF and whether those deposited funds may be transferred to the General Fund, DOJ special funds, or elsewhere. Limited legislative oversight makes it difficult for the Legislature to ensure that cases are being pursued and resolved consistent with its priorities. For example, while the Legislature might want DOJ to prioritize pursuing cases in ways that create General Fund revenues, DOJ could be pursuing cases in ways that benefit the special funds that support its work.

DOJ Has Significant Flexibility Over Use of Appropriated Funding Over Time. DOJ is generally required to request and justify augmentations for self‑initiated workload supported by its special funds as part of the budget process. These budget requests may seek funding for a particular section or unit (such as the Consumer Law or Antitrust Section) and/or purpose (such as implementation of a specific new law). However, the annual budget bill allocates funding to DOJ’s three major divisions (such as the Division of Legal Services) rather than to specific purposes or individual sections or units (such as Consumer Law within the Public Rights Division). This means that, over time, DOJ can—without legislative approval—shift resources budgeted for one purpose to another or budgeted to a particular section/unit to another so long as the resources remain within the same division. This provides DOJ with significant flexibility in the type, number, and mix of cases it pursues annually. While a certain amount of flexibility is necessary to ensure DOJ is able to quickly respond to violations as they occur to mitigate their negative impact, it could make it difficult to track how DOJ is using provided resources over time.

For example, DOJ received approval to establish a new Healthcare Rights and Access Section within the Public Rights Division as part of the 2020‑21 budget. The budget included $6.9 million—$3.7 million from the Antitrust Account and $3.2 million from the UCL—to support this new section. Prior to approval of this request, however, the department began redirecting in 2019‑20 $1.8 million from the UCL to support this section that would otherwise have been available for other cases within the Public Rights Division.

This flexibility means that while the Legislature may approve a funding increase to address a specifically identified purpose (including implementing legislation), the funding may not continue to be used for that purpose in the long run—particularly as litigation priorities or needs change over time. Without regular oversight of such workload, it is difficult to ensure that funding continues to be used consistent with legislative priorities.

LAO Recommendations

In order to address the concerns discussed above, we recommend that the Legislature increase its oversight of the LDF and how LDF funds transferred to DOJ special funds are used. Figure 9 provides a summary of our specific recommendations.

Figure 9

Summary of LAO Recommendations

|

|

|

|

|

Require DOJ to Transfer All Eligible Funds From LDF Fund Balance. We recommend the Legislature require DOJ to transfer all eligible litigation proceeds from the LDF fund balance to the appropriate special funds (such as the UCL) rather than continuing to allow DOJ to retain funds in the LDF fund balance. This requirement would apply to all funds that DOJ has any decision‑making authority over. As a result, the only monies that would remain in the LDF would be those pending allocation to specific individuals or narrowly defined purposes, as well as funds tied to cases that are awaiting final resolution.

Under our recommendation, we estimate most of the total $635 million fund balance as of the end of September 2020 would be transferred—primarily to DOJ special funds. Of this amount, we estimate that $628 million would likely be transferred, with most being transferred to either the UCL or the FCA as shown in Figure 10. Requiring this transfer would ensure that all proceeds are appropriately categorized for use pursuant to state law. For example, a transfer to the UCL would ensure those monies are used consistent with state law requiring that such funds be used for consumer protection purposes. This would also increase legislative oversight of the LDF as these monies would be transferred to funds that could be regularly reviewed and appropriated as part of the budget process.

Additionally, we recommend the Legislature direct DOJ to report on the amount transferred that faces additional restrictions on its use—such as monies required by legal agreements to be used for purposes narrower than existing statutory requirements on the fund. This would help the Legislature determine how the litigation proceeds could (or should) be used once they are in the special funds. This could include identifying the appropriate level of funding to provide to DOJ and whether funds are available for other purposes (such as transfer to the General Fund).

Require LDF Allocations to Occur Within a Specified Amount of Time. We recommend the Legislature direct DOJ to make future LDF allocations—both payments and transfers—within a specified amount of time. For example, the Legislature could direct DOJ to complete LDF allocations within three months after a legal agreement resolving a case is finalized or after payment is received. To the extent the allocations do not occur within the designated time period, DOJ would need to justify why the allocations did not occur.

Our recommendation would prevent the re‑accumulation of a large LDF fund balance. It would also permanently eliminate DOJ’s ability to avoid making LDF transfers to DOJ special funds moving forward. Additionally, legislative oversight would increase as DOJ’s discretion over LDF funds would be drastically reduced. This is because the only funds left in the LDF fund balance should be those ineligible for transfer for which there is little DOJ decision‑making authority (such as payments to harmed individuals). Oversight would also increase as timely transfers of litigation proceeds to special funds would ensure the Legislature receives timely information on the total level of litigation proceeds potentially available for use. As these funds are regularly reviewed as part of the budget process, the Legislature’s ability to provide oversight would substantially increase.

Reconsider Automatic Transfer From Antitrust Account to the General Fund. We recommend the Legislature reconsider whether monies above $3 million in the Antitrust Account should automatically be transferred to the General Fund. As the Antitrust Account is the only DOJ special fund with such a requirement, removing this requirement could eliminate incentive for DOJ to pursue litigation under other state laws—such as UCL‑related laws—that do not have similar constraints. It could also remove the incentive to negotiate specific terms in legal agreements that make antitrust litigation proceeds generally unavailable for use. It also could provide the Legislature with greater ability to specifically choose how to use such funds. For example, the Legislature might want to allow Antitrust Account revenues to accumulate to ensure there are sufficient revenues to address fluctuations in litigation proceeds received annually—such as if a large number of ongoing cases are complex and require a long time to resolve. Removing this requirement does not eliminate the Legislature’s ability to subsequently transfer monies from this fund—or other DOJ special funds—to the General Fund. Instead, it provides the Legislature with more choices on how Antitrust Account monies may be used.

Require Increased LDF Reporting. We recommend the Legislature require increased quarterly reporting on the LDF to ensure more meaningful information is provided to facilitate increased oversight. Specifically, the increased reporting should, at minimum, include the following:

- Fiscal terms and/or statewide benefit associated with any new litigation proceeds received.

- Costs and litigation proceeds associated with each resolved case.

- Cases associated with each special fund transfer.

- A list of litigation proceeds that are ineligible for transfer along with an explanation for why they are ineligible.

- Breakdown by case of what litigation proceeds remain in the LDF fund balance and the reasons they remain in the balance.

Such information would allow for greater and more meaningful oversight over of the LDF and DOJ’s administration of the fund. For example, this would help the Legislature ensure that LDF monies are appropriately being transferred out. It would also help the Legislature monitor the types and number of cases being pursued and the level of state benefit achieved from these legal actions. The Legislature would also have the ability to use this information to inform budgetary decisions and to determine whether additional changes to state law are necessary to improve the effective use of litigation proceeds.

Increase Oversight of Use of LDF Funds Transferred to DOJ Special Funds. We recommend that the Legislature increase its oversight over DOJ’s self‑initiated workload supported by LDF funds transferred to DOJ special funds. We recognize that some flexibility and discretion is needed for DOJ to adapt to changing business and other practices over time, to quickly pursue cases that have the potential for public harm, and to strategically pursue cases to achieve the best outcome. However, oversight is needed to ensure DOJ priorities align with statewide policy and budgetary priorities. As the Legislature has the responsibility for appropriating funding annually to reflect such priorities, the Legislature is best equipped to conduct oversight to ensure that funding is being used in a cost‑effective manner consistent with state priorities and that appropriate levels of funding are provided.

At a minimum, we recommend the Legislature increase its oversight by requiring DOJ provide robust annual reports by each litigation section or unit supported by litigation proceeds. Information required to be provided for each section/unit in these reports could include:

- A general description of the estimated workload associated with any new cases potentially investigated or litigated.

- A list of all cases in progress and the amount of DOJ staff hours and other costs spent on them.

- A list of investigations or cases dismissed or resolved as well as the total amount spent and the state benefit achieved from such cases.

- Fund source(s) for which all costs have or will be supported.

- An estimate of the average amount of litigation proceeds for the year.

Such annual reporting would help the Legislature monitor how cost‑effectively DOJ uses budgeted resources to support its litigation workload. It would also help the Legislature determine whether broader policy changes or actions are needed to control litigation costs, ensure monies are spent cost‑effectively, and potentially intervene if DOJ litigation choices are not in line with legislative priorities. Finally, this information could help inform the Legislature’s decisions on the appropriate level of funding needed to support DOJ litigation workload as well as the appropriate sources for such funding. For example, the Legislature could decide to provide the Consumer Law Section with 75 percent of funding for the section from the UCL and 25 percent from the General Fund in one year based on its anticipated workload. In another year, the Legislature could determine that the section should be fully supported by the UCL instead. Budgeting in this manner could maximize the availability of General Fund resources for other statewide priorities, while ensuring DOJ activities are not constrained by statutory restrictions on any of the DOJ special funds receiving LDF transfers.

Conclusion

The LDF receives and allocates tens of millions of dollars in litigation proceeds annually and has accumulated hundreds of millions of dollars in its balance with limited oversight. Given that DOJ is primarily responsible for allocation decisions that it could directly benefit from, it is important that the Legislature has the opportunity and necessary information to conduct oversight to ensure these litigation proceeds are used in a cost‑effective and productive manner consistent with state law, legal agreements, and legislative priorities. This can include ensuring that the state maximizes the use of litigation proceeds and reducing the need for General Fund resources, which can be redirected to other state priorities. The recommendations laid out in this report offer the Legislature a menu of potential key actions that could be taken to ensure there is meaningful oversight of the LDF.

Appendix

Summary of DOJ Sections/Units Receiving LDF Support in 2019‑20

(In Millions)

|

State General Fund |

UCL |

FCA |

Antitrust Account |

PRLESF |

LSRFa |

Federal and Other Funds |

Total |

|

|

Division of Public Rights |

||||||||

|

Antitrust |

$5.9 |

$6.8 |

— |

$5.7 |

— |

— |

— |

$18.3 |

|

Children’s Justice |

0.5 |

— |

— |

— |

$2.7 |

— |

— |

3.2 |

|

Civil Rights Enforcementb |

8.4 |

— |

— |

— |

— |

— |

— |

8.4 |

|

Worker’s Rights and Fair Labor |

0.8 |

— |

— |

— |

0.8 |

— |

— |

1.6 |

|

Consumer Protection |

4.0 |

11.8 |

— |

— |

— |

— |

— |

15.8 |

|

Mortgage Fraud |

— |

0.2 |

— |

— |

— |

— |

— |

0.2 |

|

Privacy Enforcement and Protection |

— |

0.7 |

— |

— |

— |

— |

— |

0.7 |

|

False Claims |

— |

— |

$8.3 |

— |

— |

— |

— |

8.3 |

|

Energy |

— |

1.8 |

— |

— |

— |

— |

— |

1.8 |

|

Corporate Fraud/Responsibility |

— |

— |

— |

— |

2.5 |

— |

— |

2.5 |

|

Environment |

3.6 |

4.5 |

— |

— |

— |

$3.5 |

— |

11.6 |

|

Healthcare Rights and Access |

1.7 |

1.8 |

— |

— |

— |

— |

— |

3.5 |

|

Land |

5.5 |

— |

— |

— |

— |

6.6 |

$0.2 |

12.3 |

|

Natural Resources |

0.6 |

— |

— |

— |

0.3 |

23.2 |

0.1 |

24.2 |

|

Subtotals |

($31.0) |

($27.5) |

($8.3) |

($5.7) |

($6.3) |

($33.2) |

($0.3) |

($112.3) |

|

Division of Criminal Law |

||||||||

|

Medi‑Cal Fraud and Elder Abuse |

$4.9 |

— |

$6.0 |

— |

— |

— |

$33.7 |

$44.7 |

|

Subtotals |

($4.9) |

(—) |

($6.0) |

(—) |

(—) |

(—) |

($33.7) |

($44.7) |

|

Grand Totals |

$35.9 |

$27.5 |

$14.3 |

$5.7 |

$6.3 |

$33.2 |

$34.0 |

$156.9 |

|

aReflects legal services costs billed back to state agencies. There were no LDF transfers to the LSRF in 2019‑20. bCivil Rights Enforcement did not receive LDF revenues in 2019‑20, but has in the past. |

||||||||

|

DOJ = Department of Justice; LDF = Litigation Deposit Fund; UCL = Unfair Competition Law Fund; FCA = False Claims Act Fund; PRLESF = Public Rights Law Enforcement Special Fund; and LSRF = Legal Services Revolving Fund. |

||||||||