January 28, 2021

The 2021-22 Budget

Business Tax Incentives

Summary

Governor’s Budget Proposals. The Governor’s budget proposes several changes to taxation to support businesses, largely one‑time increases in existing tax credits and exclusions:

- Elective S Corporation Tax. This proposal would give the owners of S corporations a new option for restructuring their state income taxes that would enable them to reduce their federal income taxes.

- Sales Tax Exclusion. A $100 million increase in the 2021 cap on sales tax exclusions awarded by the California Alternative Energy and Advanced Transportation Financing Authority (CAEATFA).

- Main Street Credit. $100 million General Fund for the Main Street Small Business Tax Credit (Main Street Credit), a tax credit for small businesses that increase their number of employees.

- California Competes. $430 million General Fund for California Competes to provide two types of assistance aimed at attracting or retaining businesses to California ($250 million for grants and $180 million for tax credits over two years).

LAO Recommendations. Using the evaluation framework outlined in this report, we offer the following recommendations on the Governor’s proposals:

- Explore Alternative Approaches to Elective S Corporation Tax. The general concept behind the Governor’s proposal has merit, but alternatives warrant the Legislature’s consideration. We suggest that the Legislature consider such alternatives in the policy committee process.

- Reject Proposed Increase in Cap on CAEATFA Exclusions. Roughly two‑thirds of the cost of this proposal would be borne by local governments. Additionally, the proposal’s benefits would be neither timely nor directed towards the businesses hit hardest by the pandemic.

- Expand Main Street Credit Proposal. Among the Governor’s proposals, this one is best suited to assisting the businesses hit hardest by the pandemic. Consequently, we suggest that the Legislature prioritize expanding this program. For example, the Legislature could broaden eligibility and increase the value of the credit.

- Reject Proposed Expansions of California Competes. These proposals would not assist the businesses hit hardest by the pandemic. The idea of adding grants to California Competes raises questions that require significant Legislative deliberation. Due to these concerns and others, we suggest that the Legislature instead focus on expanding the Main Street Credit proposal.

Introduction

Summary of Proposals. The Governor’s budget proposes several changes to taxation of businesses, largely one‑time increases in existing tax credits and exclusions:

- Elective S Corporation Tax. This proposal would give the owners of S corporations a new option for restructuring their state income taxes that would enable them to reduce their federal income taxes.

- Sales Tax Exclusion. CAEATFA administers a sales tax exclusion for purchases of equipment for certain manufacturing activities. CAEATFA may award no more than $100 million of exclusions per year. This proposal would raise the 2021 cap on awards by an additional $100 million.

- Main Street Credit. $100 million General Fund for the Main Street Credit, a tax credit for small businesses that increase their number of employees.

- California Competes. $430 million General Fund for California Competes to provide two types of assistance aimed at attracting or retaining businesses to California ($250 million for grants and $180 million for tax credits over two years).

Primary Goal: Support Economic Recovery. The Governor’s stated goal for these proposals is “to support California business owners as they reopen their doors, rehire staff, and expedite the state’s economic recovery.” In our view, this goal is appropriate. Our evaluation of the Governor’s proposals focuses primarily on their likely effectiveness with regard to the stated goal, with particular attention to the state’s role as one among multiple levels of government.

Report Roadmap. The second section of this report lays out our general framework for evaluating these proposals. The third section summarizes our recommendations. Each of the remaining sections focuses on one of the four proposals listed above.

Framework For Evaluating Proposals

Which Level of Government Would Forgo Revenue?

As a starting point, we advise the Legislature to group tax incentives into three categories depending on the level of government that would forgo revenue under the proposal. This approach can help policymakers compare each proposal to alternatives that would use the same fiscal resources.

- Proposals That Reduce Federal Revenues. Sometimes the state can take actions that reduce Californians’ federal tax payments, thus increasing their after‑tax incomes. From a strictly California‑focused standpoint—in particular, one that places little weight on federal revenue losses—such policies have relatively low fiscal and economic costs. Consequently, the Legislature may regard them more favorably than state‑funded proposals.

- Proposals That Reduce Local Revenues. When the state spends money, it generally cannot draw upon revenues designated for local governments. The state can, however, fund state economic policies with local revenues—for example, by exempting certain purchases from local sales taxes. Although the state technically can use such policies to circumvent restrictions on its ability to appropriate local revenues, doing so is not consistent with the spirit of those restrictions. Accordingly, we suggest that the Legislature generally avoid enacting or expanding such locally funded state policies.

- Proposals That Reduce State Revenues. Most commonly, state tax incentives reduce state revenues. We advise the Legislature to weigh these proposals against other potential uses of state funds.

Key Questions

To compare each proposal to alternatives, we suggest that the Legislature consider these questions:

- Does the proposal target the businesses that have been most severely affected by the pandemic?

- Does the policy complement federal efforts or duplicate them?

- How quickly and completely will the appropriation or allocation translate into actual income, spending, or investment?

- By how much does the policy reduce revenue? What are the alternative uses of this revenue?

- What are the administrative costs? How costly or difficult is it for businesses to participate?

Summary of Recommendations

Federally Funded Proposal

Explore Alternative Approaches to Elective S Corporation Tax. The general concept behind the Governor’s proposal has merit: to restructure state tax payments of certain business owners in a way that reduces their federal taxes without reducing state tax collections. The Legislature has various options, however, for carrying out the general aim of the Governor’s proposal. Alternative approaches could benefit a broader group of taxpayers or increase state revenues without reducing the after‑tax incomes of Californians. These alternatives warrant the Legislature’s consideration. Given the complexities of this issue and its limited relevance to the state budget, we suggest that the Legislature consider such alternatives in the policy committee process.

Locally Funded Proposal

Reject Proposed Increase in Cap on CAEATFA Exclusions. Roughly two‑thirds of the cost of this proposal would be borne by local governments. Additionally, the proposal’s benefits would be neither timely nor directed towards the businesses hit hardest by the pandemic.

State‑Funded Proposals

Expand Main Street Credit Proposal. Among the Governor’s proposals, this one is best suited to assisting the businesses hit hardest by the pandemic. Consequently, we suggest that the Legislature prioritize expanding this program. For example, the Legislature could broaden eligibility and increase the value of the credit.

Reject Proposed Expansions of California Competes. These proposals would not assist the businesses hit hardest by the pandemic. The idea of adding grants to California Competes raises questions that require significant legislative deliberation. Due to these concerns and others raised by these proposals, we suggest that the Legislature instead focus on expanding the Governor’s Main Street Credit proposal.

Elective Tax on S Corporations

Background

Most S Corporation Income Taxed at Individual Level. Corporations with 100 or fewer shareholders (owners) may choose to incorporate as “S corporations.” S corporations do not pay the federal corporate income tax. Instead, their tax treatment resembles noncorporate entities such as partnerships and limited liability companies (LLCs). Specifically, they first distribute (or pass through) their income to their shareholders, who then report it on their individual income tax returns. California taxes S corporation income similarly, except that the state also imposes a 1.5 percent tax on the income of S corporations at the entity level. This 1.5 percent rate is lower than the 8.84 percent rate paid by “C corporations,” whose income (other than dividends paid to shareholders) is not taxed at the individual level.

Federal Deduction for State and Local Taxes Limited to $10,000. Federal personal income tax filers may deduct up to $10,000 of state and local taxes (SALT) from their taxable income. Prior to the 2017 federal tax changes, there was no upper limit on the amount of state and local taxes a filer could deduct.

New Proposed Federal Rule Excludes Entity‑Level Taxes From $10,000 Limit. In November, the federal Internal Revenue Service introduced regulations specifying that state and local taxes on partnership and S corporation income imposed at the entity level (that is, before the business distributes income to individual owners) do not count against each individual owner’s $10,000 SALT deduction. The owner’s federal taxable income declines by the full amount of their share of the business’s state or local entity‑level tax, because the distributions reported on personal income tax (PIT) returns include only post‑tax business income.

Proposal

New Optional Entity‑Level Tax Would Be Refunded on PIT. The Governor proposes to allow California PIT filers with income from S corporations (but not partnerships or LLCs) to pay an optional 13.3 percent tax at the entity level. This 13.3 percent rate is equal to the top PIT marginal rate. In return, the filer would receive a nonrefundable credit for their full share of the new S corporation tax. For example, if an S corporation equally split among ten shareholders pays an entity‑level tax of $100,000, each shareholder would receive a PIT credit of $10,000.

Reduction in Total Federal and State Taxes for S Corporation Shareholders. For many individuals with S corporation income, electing to pay the new S corporation tax would reduce their total federal and state taxes. The new state S corporation tax would reduce these taxpayers’ federal taxable income, resulting in lower federal taxes. At the same time, they would receive a state PIT credit to compensate for the increased cost of the new S corporation tax. For most taxpayers with incomes of $1 million or more, the state PIT credit would fully offset the cost of the new S corporation tax. For most of those with incomes below $1 million, the credit would offset most, but not all, of the increased cost. Regardless, total federal and state taxes would go down for both groups.

Assessment

Increases After‑Tax Income of Californians Without Cost to the State. The Governor’s proposal would increase after‑tax incomes of certain California business owners at little cost to the state. In fact, the administration estimates that their proposal could result in a modest increase in state revenue—up to $20 million per year. Filers who pay a top rate below 13.3 percent will see a small net increase in state taxes, which in most cases would be more than offset by a decline in federal taxes.

Benefits Would Be Concentrated Among Small Number of High‑Income Filers. In 2018, more than 75 percent of total income from S corporations and partnerships went to filers with more than $500,000 of income. Taxpayers with incomes over $500,000 make up about 2 percent of all taxpayers.

Proposal Raises Several Questions. There are several ways the state could restructure business owners’ taxes to achieve the general aim of the Governor’s proposal. Below, we offer some questions to help the Legislature think through whether it may prefer an alternative approach:

- Should Partnerships and LLCs Be Included? The administration has expressed concern about extending the proposal to other pass‑through entities such as partnerships and LLCs on the grounds that their ownership structures are frequently more complicated than those of S corporations, which would make it difficult to trace each filer’s prorated share of the entity‑level tax back to the correct business. The Legislature could consider alternative approaches to this issue, such as expanding the proposal to include partnerships or LLCs that list only individuals as owners.

- Should the Tax Have a Graduated Rate Structure? The Legislature may want to consider giving the proposed entity‑level tax a graduated rate structure such as the one used for the PIT, as opposed to taxing all entity‑level income at a flat rate of 13.3 percent. Relative to the Governor’s proposal, this option should result in greater tax savings for individuals with incomes below $1 million.

- Should the Tax Result in a Larger State Revenue Increase? As structured, the Governor’s proposal would result in a limited revenue gain for the state. Alternative approaches, however, could result in larger revenue increases for the state while still providing overall tax savings to business owners. For example, using the Governor’s structure but setting the new PIT credit at 11 percent (as opposed to 13.3 percent) of an individual’s S corporation income could result in state revenue gains in the hundreds of millions of dollars per year while still increasing shareholders’ after‑tax income. This would provide less relief for the affected pass‑through businesses, but would allow the state to fund other efforts that are consistent with the Governor’s stated goal of promoting economic recovery.

- Should Mental Health Funds Be Held Harmless? Proposition 63 of 2004 established a 1 percent surcharge (part of the 13.3 percent top PIT rate) on incomes above $1 million. The proceeds from this surcharge are deposited in the Mental Health Services Fund (MHSF) and used to fund local mental health programs. While we still have limited detail on the Governor’s proposal, PIT revenue for the MHSF could drop, depending on how it is structured. If the Legislature moves forward with a proposal like the Governor’s, we suggest it include a mechanism to hold the MHSF harmless.

Federal Tax Policy Is Especially Uncertain at This Time. The recent transition of the federal administration and shift of control in the U.S. Senate create some uncertainty about the future of the $10,000 SALT limit. There is a chance federal leaders will seek to modify or repeal the limit. If they lifted the SALT limit entirely, the motivation for adopting a proposal like the Governor’s would be eliminated.

Recommendation

Explore Alternative Approaches to Achieve Aims of Governor’s Proposal. The general concept behind the Governor’s proposal has merit: to restructure state tax payments of certain business owners in a way that reduces their federal taxes without reducing state tax collections. There are various ways, however, the Legislature could carry out the general aim of the Governor’s proposal. These alternatives warrant the Legislature’s consideration. Given the complexities of this issue and its limited relevance to the state budget, we suggest that the Legislature consider such alternatives in the policy committee process.

CAEATFA Exclusion

Background

California’s Sales Tax. California charges a sales tax on retail sales of tangible goods. The overall rate ranges from 7.25 percent to 10.5 percent depending on citywide and countywide rates, with a statewide average of 8.6 percent. The rate includes:

- 3.94 percent for the state’s General Fund.

- 3.31 percent to 6.56 percent for various local programs, including 1.06 percent to counties for criminal justice, mental health, and social services under 2011 Realignment.

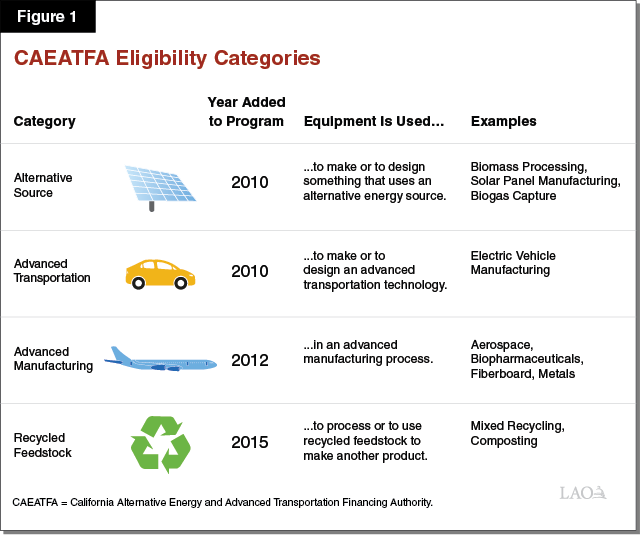

CAEATFA Exclusion. CAEATFA administers a sales tax exclusion for purchases of equipment for the four types of activities listed in Figure 1. Participants in this program can buy equipment without paying any portion of the sales tax—state or local. (Our office published a detailed report on the program, Evaluation of a Sales Tax Exemption for Certain Manufacturers, in 2018).

Exclusion Overlaps With Another Program. In addition to the CAEATFA exclusion, the state offers a partial exemption that allows manufacturers and some other types of businesses to buy equipment without paying the 3.94 percent state General Fund portion of the sales tax. Most purchases made under the CAEATFA exclusion would be eligible for the partial exemption, but some (such as many recycling facilities) would not. (Businesses cannot apply both discounts to the same purchase.) Figure 2 compares key features of the CAEATFA exclusion and the partial exemption.

Figure 2

Comparing Two Sales Tax Policies

|

Feature |

CAEATFA Exclusion |

Partial Exemption |

|

Exemption from state General Fund sales tax? |

Yes. |

Yes. |

|

Exemption from other parts of sales tax? |

Yes. |

No. |

|

Aggregate cap? |

Statutory hard cap: CAEATFA cannot award more than $100 million of exemptions per year (roughly $1.2 billion of equipment). Cap binding since 2015. |

None. In 2019, purchasers applied $270 million of exemptions to $6.9 billion of equipment. |

|

Individual cap? |

Regulatory soft cap: $10 million of exemption per year (roughly $115 million of equipment). |

Statutory hard cap: $200 million of equipment per year (roughly $8 million of exemption). |

|

How to claim. |

Submit extensive application, wait for staff review and board meeting vote, then purchase equipment. |

Fill out one‑page certificate, then purchase equipment. |

|

CAEATFA = California Alternative Energy and Advanced Transportation Financing Authority. |

||

CAEATFA Exclusion Is Oversubscribed. CAEATFA awards the sales tax exclusion at monthly board meetings. Chapter 677 of 2012 (SB 1128, Padilla) prohibits CAEATFA from approving more than $100 million of exclusions in any calendar year. This cap has become more binding over time. Before 2019, exclusions were available for most of the year. In 2019, awards hit the cap in July. In 2020 and 2021, the program already had received applications for more than $100 million by the first application deadline—before the calendar year had even begun.

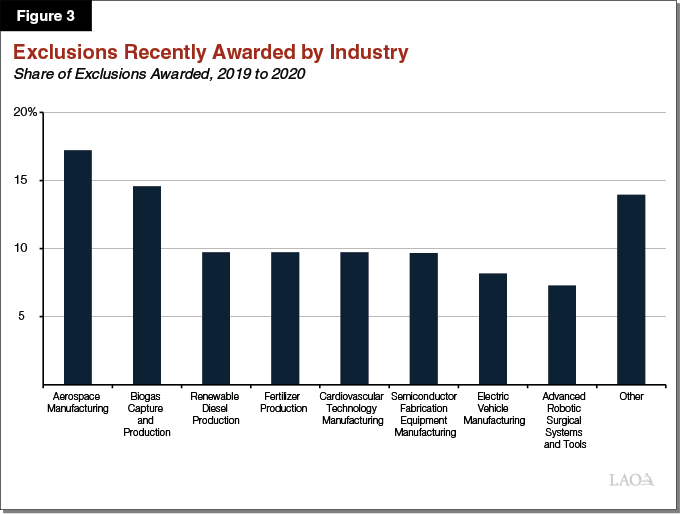

Recent Awards Have Gone to Various Types of Manufacturers. Historically, Tesla accounted for a large share of CAEATFA exclusions. In the last couple of years, however, CAEATFA has awarded exclusions to manufacturers across a variety of industries, as illustrated in Figure 3.

Participants Often Do Not Use the Full Amount Awarded. The benefits and costs of the program depend on the amount of exclusions ultimately used. For each dollar of exclusions awarded, the administration estimates that participants use a total of $0.60 within five years, on average.

Proposal and Direct Fiscal Effects

One‑Time Increase in Annual Cap. The Governor proposes raising the 2021 aggregate cap on awarded exclusions from $100 million to $200 million on a one‑time basis. If CAEATFA did not allocate all of the additional funds by the end of 2021, the remaining portion would roll over to 2022.

Estimated Direct Fiscal Effect: $38 Million. The administration estimates that the proposed increase in the annual cap would have a direct fiscal cost to the state and local governments totaling $38 million over a five‑year period, starting in 2021‑22. This estimate is less than $100 million for two reasons:

- Based on historical usage rates, the administration estimates that participants would use $60 million of the additional $100 million awarded.

- The overlap with the partial exemption would offset an estimated $22 million of the General Fund revenue loss resulting from the additional exclusions used.

Breakdown of Direct Fiscal Effect. The overall $38 million effect includes:

- $5.6 Million General Fund Revenue Loss. Net of the partial exemption, the administration estimates that the additional exclusions would reduce General Fund revenues by $5.6 million.

- $7.5 Million Backfill to 2011 Realignment. Article XIII, Section 36(d) of California’s Constitution requires the state to reimburse, or “backfill,” the 2011 Realignment fund for revenue losses resulting from actions such as the one proposed. Consequently, the Governor’s proposal anticipates General Fund payments to 2011 Realignment totaling $7.5 million.

- $24.7 Million Revenue Loss for Local Programs. Aside from 2011 Realignment, the administration’s estimates suggest that the proposal would reduce local sales tax revenues by $24.7 million.

Assessment

Direct Fiscal Estimates Reasonable. The estimates described above provide suitable inputs for the Legislature’s fiscal calculations.

Proposal Primarily Locally Funded. After the General Fund backfill to 2011 Realignment, local governments would bear roughly two‑thirds of the direct fiscal cost of the proposal.

Proposal Does Not Target Hardest‑Hit Businesses. The pandemic has forced many businesses to reduce their operations or close. These adverse effects have been especially severe for businesses in the travel, retail, food and hospitality, health and wellness, and personal care services sectors. The CAEATFA exclusion offers assistance primarily to the manufacturing sector, which has not been among the hardest‑hit sectors of the economy.

Allocation Process Is Complex. To use the CAEATFA exemption, equipment purchasers must fill out extensive applications, wait for board approval, and submit periodic reports to CAEATFA. These requirements make participation more costly, but they have led to greater transparency than the state typically provides regarding the use of tax expenditures.

Benefits Occur Gradually. Historically, the usage rate of exclusions has peaked one to two years after the participant receives the award. As a result, many of the benefits of exclusions awarded in 2021 will not materialize quickly enough to address the current economic crisis.

Recent Regulations Try to Manage Awards Within Cap. In 2019 and 2020, CAEATFA issued emergency regulations to address various issues, including the growing demand for exclusions. We highlight some of the key regulations in Figure 4. These regulations provide some examples of the many options available to CAEATFA and to the Legislature for managing awards within the $100 million annual cap.

Figure 4

Recent Regulations Try to Manage Awards Within Cap

|

|

|

|

|

Recommendation

Recommend Rejecting Governor’s Proposal. As noted above, the Governor’s proposal relies primarily on local funding. By rejecting this proposal, the Legislature would allow local governments to exercise their own judgment regarding the best use of these resources. Furthermore, the CAEATFA exclusion does not provide rapid relief to the businesses most severely affected by the pandemic and economic crisis.

Main Street Credit

Background

Legislature Created $100 Million Credit for Businesses Hurt by Pandemic in 2020. In September 2020, the Legislature created the Main Street Credit, which provides income or sales tax credits to eligible small businesses that added jobs in the second half of 2020. Each eligible business receives a credit of $1,000 for each new job. Eligibility is restricted to firms that meet two conditions: (1) they have 100 or fewer employees and (2) their gross receipts dropped by at least half between the second quarter of 2019 and the second quarter of 2020. These eligibility criteria were patterned, in part, after the federal Employee Retention Credit (ERC). The state capped the total amount of credits available to all businesses at $100 million and allotted the credits on a first‑come, first‑served basis.

Federal Credit Based on Retention of Employees, Not Addition. The federal government created the ERC in March 2020 as part of the Coronavirus Aid, Relief, and Economic Security Act. The ERC provided firms with 100 or fewer employees a credit for 50 percent of wages paid to employees they retained in 2020 (up to $5,000 per employee). Similar to the Main Street Credit, businesses are eligible for the ERC if their quarterly gross receipts dropped by at least half compared to the same quarter in 2019. Firms with smaller drops in gross receipts were eligible if they had to suspend or curtail operations in response to governmental shutdown orders.

Federal Eligibility Criteria Changed for 2021. In December 2020, the federal government expanded the ERC and extended it through the first half of 2021. To be eligible for the extended ERC, a business’s 2021 quarterly gross receipts must be at least 20 percent below the same quarter in 2019. Firms founded in 2020 also are eligible if their 2021 quarterly gross receipts are at least 20 percent below the same quarter in 2020. The new law increased the share of employees’ wages eligible for the credit from 50 percent to 70 percent (up to $7,000 per employee). Firms also may take the credit in each quarter in which they incur a loss in gross receipts, as opposed to just once a year.

Proposal

Another $100 Million Proposed for Tax Year 2021. The Governor proposes to make $100 million available for a credit similar to the Main Street Credit in 2021. The Administration has said that it plans to pattern the credit after the newly extended federal ERC, but has not yet provided new statutory language.

Assessment

Credit Relatively Well‑Targeted to Businesses Affected by Pandemic… Compared to other proposals in the Governor’s package, this proposal is relatively well‑targeted to businesses impacted by the pandemic for two reasons. First, eligibility is limited to businesses that have experienced a drop in gross receipts during the pandemic. Second, the credit is available to many businesses in the hardest‑hit industries, such as travel, retail, food and hospitality, health and wellness, and personal care services.

…However, Leaves Out New Businesses in Affected Sectors. One limitation, however, of tying eligibility to a drop in gross receipts from the prior year is that new businesses would not be able to qualify, as these businesses did not have gross receipts in 2019 or early 2020. Nonetheless, new businesses in heavily impacted industries may face challenges with expanding and hiring new employees in the coming months.

Not All Main Street Credits Claimed. Nearly 10,000 businesses applied for a total of $56 million of Main Street Credits in 2020. This suggests that, despite a fair amount of interest among businesses, the credit could have been set at a higher value without exhausting the $100 million allocation.

Recommendation

Expand Governor’s Proposal. As this proposal is better targeted to businesses most in need of assistance, we suggest the Legislature focus its resources on expanding this program. For example, the Legislature could supplement the Governor’s $100 million by (1) rolling over unused funds from the 2020 Main Street Credit and (2) redirecting $250 million from the Governor’s California Competes grant proposal to this program. This would provide for a roughly $400 million credit program. Given this larger pot of money, we would suggest the Legislature expand the Governor’s proposal by:

- Broadening Eligibility to Other Impacted Businesses. We suggest considering which groups of businesses impacted by the pandemic would not be served either by the Governor’s proposal or by the federal ERC. One example is newly formed businesses in heavily impacted sectors. An option to include these businesses would be to allow new businesses to qualify for the credit if they are in certain sectors—based on their North American Industry Classification System code. Such an approach, however, could create additional administrative responsibilities for the California Department of Tax and Fee Administration and the Franchise Tax Board (FTB).

- Increasing the Value of the Credit. We also suggest increasing the value of the credit beyond $1,000 per employee. One option would be to set the credit at a percentage of wages paid to each new employee—as with the ERC. For example, if funding for the credit program were increased to $400 million, the value of the credit could be increased to 40 percent of wages (up to $4,000 per employee) and still provide credits for roughly twice as many new hires as the Main Street Credit.

California Competes

Program Provides Financial Incentives to Attract or Retain Businesses

California Competes Is an Economic Development Incentive Program. The Governor’s Office of Business and Economic Development (GO‑Biz) administers California Competes, a program intended to attract or retain businesses that are considering making new investments in California. Companies seeking tax credits apply to GO‑Biz, and the administration negotiates tax credit agreements with selected applicants. GO‑Biz awards up to $180 million in credits each fiscal year, plus any unallocated or recaptured credits from the prior year. (The state may recapture the credit if the taxpayer does not satisfy the terms of the agreement.) Businesses can use these credits to reduce their tax liabilities for the PIT or the corporation tax. In 2019, the California Competes credit reduced state General Fund revenues by $38 million.

Program Has Features Intended to Address Some Common Concerns. Our office and others have raised concerns about the effectiveness of state financial incentives for hiring or business investment. (We analyzed the program in a 2017 report, Review of the California Competes Tax Credit, and in a 2020 report, Assessing Recent Changes to California Competes.) The California Competes program has some features intended to address these concerns:

- Competitive Application Process. GO‑Biz allocates the credits through a competitive application process. For example, only 56 of the 375 companies that applied to the program during the 2019‑20 fiscal year were successful. GO‑Biz evaluates each application based on various factors, such as the number of jobs proposed, the amount of investment proposed, and whether the business is located in an area with high unemployment.

- Applicants Must Explain How Credit Will Influence Hiring and Investment Choices. Since 2018, GO‑Biz must disqualify any business that cannot credibly explain how the credit will directly affect its business decisions here. While such assessments are subjective, GO‑Biz appears to make a good faith effort to fulfill this requirement.

- Businesses Must Meet Hiring and Investment Commitments. Successful applicants negotiate written agreements with GO‑Biz that specify hiring and investment targets over a five‑year period. The businesses may not claim the credit until they first meet their hiring and investment commitments. The state recaptures credits from businesses that do not comply with the terms of the agreements. Depending on the agreement terms, the state may recapture only part of the amount. For example, if a business had committed to hiring 100 new employees but only hired 80, the state might recapture 20 percent of the tax credits.

Latest Round Differed From Prior Periods

More Businesses Applied for Credits in 2020. GO‑Biz usually holds three application periods each fiscal year. California Competes received an average of 145 applications per period during the last two fiscal years. However, California Competes received an unprecedented 451 applications during the first period of the 2020‑21 fiscal year.

GO‑Biz Awarded Bigger Agreements to Fewer Businesses. In this round, GO‑Biz negotiated credit agreements with four applicants. All four agreements were for relatively large amounts—between $5.2 million and $29.8 million. Go‑Biz typically awards around 20 agreements per application period for lower amounts. The average agreement in the prior two years was for $3.3 million.

Governor Proposes to Expand California Competes in Two Ways

Expand Existing Program by $180 Million Over Two Years. The Governor proposes to increase the total amount of California Competes credits that GO‑Biz may award in 2020‑21 and 2021‑22 by $90 million per year. The administration estimates that the resulting reductions in General Fund revenue would be $10 million in 2021‑22, $35 million in 2022‑23, $50 million in 2023‑24, and $85 million in later years.

Create $250 Million California Competes Grant Program. The Governor’s budget includes $250 million one‑time General Fund to allow the California Competes program to provide cash grants. GO‑Biz would award grants, instead of credits, using the existing California Competes application and evaluation processes. The administration could pay grants to successful applicants either in full upon approval or in increments based on hiring and investment milestones. In addition to existing program criteria, an applicant would need to meet one of the following criteria to qualify for a grant:

- Establish at least 500 net new jobs.

- Make a significant infrastructure investment, as defined by the director of GO‑Biz.

- Commit to a high‑need or high‑opportunity area of the state

- Receive a designation from the Director of GO‑Biz that the application is a strategic priority to the state.

If a business violated the terms of its agreement, including not meeting its hiring and investment commitments, GO‑Biz would instruct FTB to recapture the grant. FTB would attempt to collect the amount in the same manner that FTB attempts to collect a delinquent tax liability.

Assessment of Overall California Competes Proposal

Does Not Target Industries Most Severely Affected by the Pandemic. The pandemic has forced many businesses to reduce their operations or close. Businesses in the travel, retail, food and hospitality, health and wellness, and personal care services sectors have been especially hard hit. The majority of California Competes awards go to businesses in three industries: (1) manufacturing; (2) professional, scientific, and technical services; and (3) financial services. Of the four companies awarded tax credit agreements in November 2020, for example, two are manufacturers and two are financial services companies. While the pandemic has affected these industries in many ways, they generally have not been affected to the same degree as industries that require close contact.

Despite Program Features, Concern About Effectiveness Remains. State financial incentives—which may include tax credits or grants—can influence business decisions. The state, however, will never be able to distinguish perfectly between business decisions that result from a financial incentive on the one hand, and decisions that businesses would have made irrespective of the incentive on the other hand. In the latter scenario, the incentive is a financial windfall for the business. As described above, some features of California Competes reflect well‑intended efforts to address this issue, but such efforts inevitably have serious limitations.

High Recapture Rate Raises Concerns. GO‑Biz recaptures credits from businesses that did not achieve their negotiated hiring or investment commitments by the end of their five‑year agreements. Over the past year, hundreds of agreements have ended. Overall, the state recaptured roughly one‑third of the dollar amount of credits awarded ($122 million) during the first three years of the program. Ideally, credit recaptures should be unusual, but the state has recaptured all or part of the credits from the majority the California Competes agreements that have ended. The high recapture rate suggests that many businesses with tax credit agreements could not accurately predict their future hiring and investment choices. Additionally, the high recapture rate raises new concerns about the number of new private‑sector jobs created by this program. Public data about the tax credit agreements and recaptures are limited. A better understanding of the high recapture rate could help the Legislature improve California Competes or similar programs in the future.

Businesses Seem to Be Struggling to Use Tax Credits. GO‑Biz has awarded $1.2 billion in credits since 2014. Of this amount, after accounting for the five‑year structure of the tax credit agreements and the credit recaptures, we estimate that business have earned roughly $500 million in California Competes tax credits. The amount of credits that taxpayers have actually used—about $160 million—is significantly lower. Many taxpayers with California Competes credits appear to not owe a sufficiently large amount of state tax to use all of the credits they have earned.

Assessment of Proposed Grants

Growing Businesses Often Have Low Taxes, and Credit Not Refundable. When new businesses are growing rapidly, they often do not have positive tax liabilities because their deductions from wages, interest, and depreciation may greatly exceed their revenue. In 2019, only about one‑quarter of the state corporation taxpayers owed more than the $800 minimum franchise tax. Like all of the state’s business tax credits, California Competes credits are not refundable. That said, if a taxpayer owes less tax than the amount of their credit, they may carry the balance forward for up to six years. Even then, some businesses might not be able to use the full amount of the credits they have earned.

Proposed Grants Respond to This Issue but Raise Significant Questions. The administration correctly notes that not all taxpayers benefit from tax credits. Grants are one way to address this issue, but there may be others. For example, the state could allow a portion of the tax credits to be transferable or refundable. The state also could temporarily allow taxpayers who cannot use credits to sell some of them back to the state at a discount. Even these more modest changes would represent a significant shift in the state’s longstanding approach to economic development incentives.

How Would State Manage Risks of Grants? The existing California Competes program does not allow businesses to claim credits until they achieve their hiring and investment commitments. The high recapture rate noted above indicates that this caution has been justified. We suggest that the Legislature consider the risk to the state from paying grants in full upon the approval of the California Competes agreement. FTB could have difficulty recovering grant funds from certain businesses, such as those with minimal assets or under bankruptcy protection. The Legislature could consider putting in place additional guardrails, such as setting a maximum grant amount or requiring that grants only be paid upon the business meeting its commitments.

Growing Companies Have Unprecedented Access to Private Funding. Another advantage of a grant over a tax credit is that the business does not have to wait to receive the money. Under current economic conditions, however, the types of businesses served by California Competes—in particular, businesses that are expanding—have good private sector financing options. Growing businesses can raise funds in two ways: they can sell stock equity or borrow money from a bank (or a non‑depository lender). Despite the challenging economic conditions because of the pandemic, this is a remarkably good time for businesses to raise capital through either approach. There were nearly 1,600 initial public offerings in the United States in 2020, a 42 percent increase over 2019. With the stock market at all‑time highs, many other corporations raised capital by selling additional shares of stock. At the same time, interest rates are at historically low levels, making borrowing inexpensive.

Recommendation

Reject Proposed One‑Time Expansions of California Competes. California Competes is not a suitable vehicle for addressing the economic effects of the pandemic because it does not target the hardest‑hit industries. Furthermore, because the hiring and investment agreements cover a five‑year period, the timing of any potential economic benefits does not address the urgency of the current economic situation. While the Governor’s grant proposal responds to this timing issue to some extent, it raises other important issues for the Legislature to consider. As discussed elsewhere in earlier parts of this report, another program—the Main Street Credit—gives the Legislature a better way to use General Fund resources to help businesses during this economic crisis.

Conclusion

The Governor’s budget proposes several changes to taxation to support businesses. Two key factors for evaluating these proposals are: (1) which level of government would forgo revenue, and (2) which businesses would receive assistance. Based on these criteria and others, we recommend that the Legislature prioritize expansion of the Main Street Credit, explore alternative structures for an elective S Corporation tax, and reject the proposed one‑time expansions of the CAEATFA exclusion and California Competes.