LAO Contact

Key Terms Related to Pension Funds

- Creditable Compensation

- Contribution Rates

- Actuarial Assumptions

- Actuarial Losses

- Normal Cost of Benefits

- Actuarially Required Contribution Rates

- Amortization Period

- Pension Fund Assets

- Pension Fund Obligations

- Unfunded Actuarial Obligation (UAO)

- Funded Status

- Public Employees’ Pension Reform Act (PEPRA)

March 10, 2021

Strengthening the CalSTRS Funding Plan

- Introduction

- Background

- Certain Aspects of the Funding Plan May Impede Its Likelihood of Success

- Risks to Funding Plan Recently Have Become More Apparent

- Recent Budget Actions and Proposals to Address State’s Share of UAO

- LAO Comments and Recommendations

- Conclusion

- Appendix

Executive Summary

CalSTRS Funding Plan Marks State Accomplishment... Prior to the passage of the funding plan for the California State Teachers’ Retirement System (CalSTRS) (Chapter 46 of 2014 [AB 1469, Bonta]), actuaries projected the system’s assets would be depleted within a few decades. With the aim of fully eliminating the Defined Benefit Program’s unfunded actuarial obligation (UAO) by 2046, the funding plan divides responsibility for UAO between the state and employers, and increases CalSTRS’ authority to adjust required contribution rates to meet the plan’s goal. To date, the plan has set CalSTRS on track to pay down almost all UAO by 2046. The existence of the funding plan represents a significant accomplishment for the state and has put CalSTRS on a much more sustainable path toward securing the fiscal health of the Defined Benefit Program for current and future members.

…But Certain Aspects of the Plan May Impede Its Success. Now that the funding plan has been in place for several years, some of its implementation complexities and challenges have become more apparent. Specifically: (1) CalSTRS uses highly complex, theoretical formulas to assign responsibility for UAO to the state and employers; (2) the state’s share of UAO is sensitive to volatility while CalSTRS holds only limited authority to adjust the state’s contribution rate in response; (3) volatility results in relatively minor, but counterintuitive, impacts on employers’ contribution rate; and (4) CalSTRS’ ability to address UAO becomes increasingly difficult over time, and essentially ends when the funding plan provisions expire in 2046. These challenges and complexities risk impeding CalSTRS’ ability to achieve full funding by 2046 and to continue securing the Defined Benefit Program’s fiscal health beyond the duration of the plan. The plan’s complexities also make legislative oversight of the funding plan’s progress challenging.

Recent Economic Uncertainty and Budget Actions Underscore Challenge of CalSTRS’ Limited Rate‑Setting Authority. Due to extreme market volatility in 2019‑20 caused by the coronavirus disease 2019 pandemic, CalSTRS did not meet its investment return assumption for the year (the system experienced an actuarial loss of 3.1 percent). This loss means CalSTRS will need to continue to increase the state’s contribution rate by the maximum amount allowed in future years to pay down accrued UAO. At the same time, to help address the state’s projected budget problem in 2020‑21, the 2020‑21 Budget Act suspended CalSTRS’ authority to increase the state’s contribution rate for one year. This budget action resulted in one‑time savings for the state, but creates an ongoing gap between the state’s contribution rate and what it would have been in absence of the suspension, potentially making it more difficult for the state to pay down its share of UAO by 2046. The administration has proposed one‑time supplemental payments to offset this gap for one year, but the ongoing gap remains unaddressed. Moreover, CalSTRS’ inability to increase the state’s rate quickly enough results in more UAO accruing, and the state paying more over time to address it.

Recommend Legislature Consider a “Catch‑Up” Mechanism in the Near Term. To address this ongoing disparity, the Legislature could consider allowing CalSTRS to increase the state’s rate more quickly—either beginning in 2021‑22 or in a future year once the state has addressed current pandemic‑related challenges. This increased authority could be in place for a limited time while the state’s rate and contributions catch up to what they would have been absent any suspension.

In the Longer Term, Recommend Legislature Consider Addressing the Plan’s Underlying Challenges. To increase transparency and oversight, increase the likelihood that the state will be able to fully pay down its share of CalSTRS UAO by 2046, potentially help the state achieve significant long‑term savings, and allow CalSTRS to effectively address future losses and UAO, we recommend that the Legislature consider addressing some of the underlying challenges to the plan. Specifically, we recommend that the Legislature consider the following changes: (1) allow CalSTRS to increase the state’s contribution rate by more than is currently allowed; (2) eliminate the complex theoretical calculations currently used to determine assets and obligations assigned to the state and employers in favor of a fixed proportional division of UAO; and (3) make the provisions of the funding plan ongoing, allowing CalSTRS to develop an amortization policy to address future losses in line with industry best practices.

Introduction

For several years, the state and school employers have significantly increased their contributions to the California State Teachers’ Retirement System’s (CalSTRS’) Defined Benefit Program as a result of the 2014 CalSTRS Funding Plan, which aims to fully fund the program by 2046. Prior to the passage of this legislative plan, the Defined Benefit Program was headed toward insolvency. To date, the plan has set CalSTRS funding on a more sustainable path. However, recent economic volatility and state budget actions have underscored some risks to the plan’s longer‑term success. Additionally, since the plan has been in place for several years now, some of its implementation complexities have become more apparent.

In this report, we: (1) provide background on CalSTRS and the funding plan, (2) lay out some aspects of the funding plan that may impact its ultimate success, (3) put these risks into context given recent economic volatility as well as recent state budget actions, (4) describe the Governor’s 2021‑22 proposals for supplemental payments to CalSTRS, and (5) offer the Legislature some immediate and longer‑term considerations. Additionally, we include a glossary that defines key pension fund terms used throughout this report (refer to the Appendix).

Background

In this section, we provide background on the CalSTRS system, Defined Benefit Program, and 2014 funding plan.

CalSTRS Defined Benefit Program

CalSTRS Is World’s Largest Educator‑Only Pension System. Established in 1913, CalSTRS is the nation’s second largest pension system (the largest is the California Public Employees’ Retirement System), and the largest educator‑only pension system in the world. CalSTRS administers benefits programs for more than 975,000 members—equivalent to roughly 2.5 percent of California’s population—whose service as educators is not eligible for federal Social Security participation. Members are prekindergarten through community college public educators, including current, former, and retired teachers and administrators, as well as their beneficiaries. CalSTRS’ largest program is the Defined Benefit Program, which provides members with retirement, disability, and survivor benefits, with individuals’ benefits determined based on age, service credit, and final compensation.

CalSTRS Benefits Are Legally Protected. Both the U.S. and California Constitutions contain a clause—known as the Contract Clause—that prohibits the state or its voters from impairing contractual obligations. In the context of pension benefits, California courts have ruled for many decades that the Contract Clause generally prohibits reductions to pension benefits accrued by governmental employees for work already performed. In addition, the courts have determined that these benefits generally are promised to employees on the day they are hired. In the case of both past and future pension benefit accruals, pension benefits for current governmental employees can be reduced only in rare circumstances—generally, when governmental employers provide a benefit that is comparable and offsets the pension contract that is being impaired or when employers previously have reserved the right to modify pension arrangements. As such, CalSTRS benefits generally are considered guaranteed for current members, and the fiscal health of the CalSTRS system is essential to the state’s ability to provide those benefits.

Teachers’ Retirement Fund Receives Contributions and Generates Returns. The Teachers’ Retirement Fund is a special trust fund that receives contributions from CalSTRS members, school employers, and the state, and additionally generates significant returns over time through investment in diverse assets. Investment returns comprise the majority of funding for CalSTRS benefits payments, covering around 61 percent of total benefits payments currently. As of December 2020, the market value of CalSTRS’ investment portfolio totaled nearly $280 billion.

CalSTRS Board Oversees the Fund. The 12‑member Teachers’ Retirement Board administers the Teachers’ Retirement Fund. California’s Constitution entrusts state pension boards with overseeing their systems’ investment policies and ensuring that benefit payments are made on time and according to law. Importantly, the Teachers’ Retirement Board is responsible for establishing the state’s and employers’ annual contribution rates, based on actuarial requirements. (The board’s contribution rate‑setting authority is limited by the law, which we describe in more detail later on in this report.)

CalSTRS Funding Plan

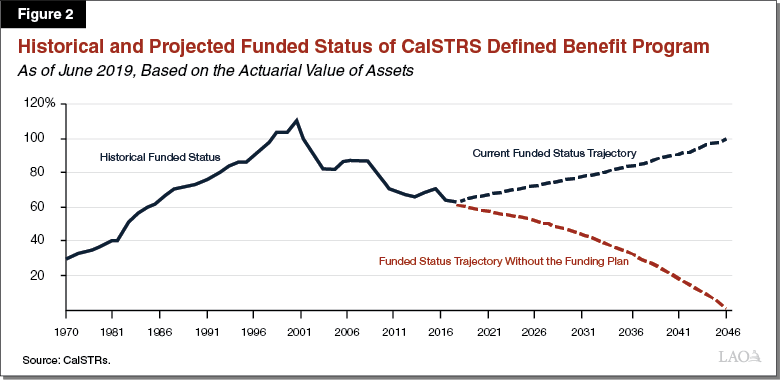

Defined Benefit Program Was Headed Toward Insolvency... Prior to 2014, contribution rates for CalSTRS’ Defined Benefit Program were set in statute, and the board had virtually no authority to adjust those rates. Accordingly, even as actuarially required contribution rates changed over the years in response to investment performance, shifts in the teacher and retiree population, and other changes, CalSTRS rates remained essentially static. While the Defined Benefit Program briefly exceeded fully funded status as a result of the historically strong stock market in the 1990s, the program’s funding condition began to deteriorate in the early 2000s due to decisions made in the late 1990s and early 2000s to increase benefits and decrease contributions to the Defined Benefit Program (and that deterioration was exacerbated by the 2001 and 2008 recessions, along with changes in CalSTRS’ actuarial assumptions). At the time of the funding plan development, actuaries projected the program would be fully depleted of assets by the mid‑2040s.

…Until Funding Plan Established a More Sustainable Path Forward. In response to this alarming projection, in 2014, the Legislature passed the CalSTRS Funding Plan (Chapter 47 of 2014 [AB 1469, Bonta]) with the goal of fully funding the Defined Benefit Program by 2046. To fully fund the Defined Benefit Program, the plan had to address the unfunded actuarial obligation (UAO)—or the difference between the program’s assets and the assets required to pay benefits—that had accrued since the early 2000s. To reach this goal, the funding plan phased in significantly higher contribution rates from employers and the state over several years. (Members’ contributions also increased, but less significantly.) Under the funding plan, the state and employers each pay a fixed base contribution rate, in addition to a supplemental rate that the board may adjust annually (with limitations, which we describe in more detail later in this report) to eliminate UAO by 2046. Since its passage, the funding plan has set the Defined Benefit Program on a much more sustainable path and has allowed CalSTRS to make progress toward the goal of fully funding the program. According to CalSTRS’ most recent actuarial valuation, for the period ending June 30, 2019, the program has reached 66 percent funded status and actuaries project achieving 99.9 percent funded status by 2046. The funding plan is in effect through June 30, 2046, after which point the pre‑funding plan provisions would return. Figure 1 summarizes the changes to contribution rates and the board’s rate‑setting authority made by the funding plan, and Figure 2 illustrates the Defined Benefit Program’s historical and projected funded status.

Figure 1

Funding Plan Changes to Defined Benefit Program Contribution Rates and Board Authority

All Percentages Refer to Percent of Creditable Compensation

|

Entity |

Prior to Funding Plan |

Funding Plan Changes |

|

State |

|

|

|

Employers |

|

|

|

Members |

|

|

|

aThe 2020‑21 budget suspends CalSTRS’ ability to increase state’s rate for the 2020‑21 fiscal year. In absence of this suspension, the state’s rate would have increased by 0.5 percent effective July 1, 2020. bEmployers’ supplemental rate does not reflect supplanting payments made by the state as part of the 2019 and 2020 budgets, which effectively lower the rate that employers pay for 2019‑20, 2020‑21, and 2021‑22 due to payments made by the state on behalf of employers. |

||

Certain Aspects of the Funding Plan May Impede Its Likelihood of Success

In this section, we describe some key components of the CalSTRS funding plan and explain why certain components risk impeding CalSTRS’ ability to achieve full funding of the Defined Benefit Program by the end of the plan. Figure 13 at the end of this section summarizes the plan’s complexities and challenges, which we describe in detail below.

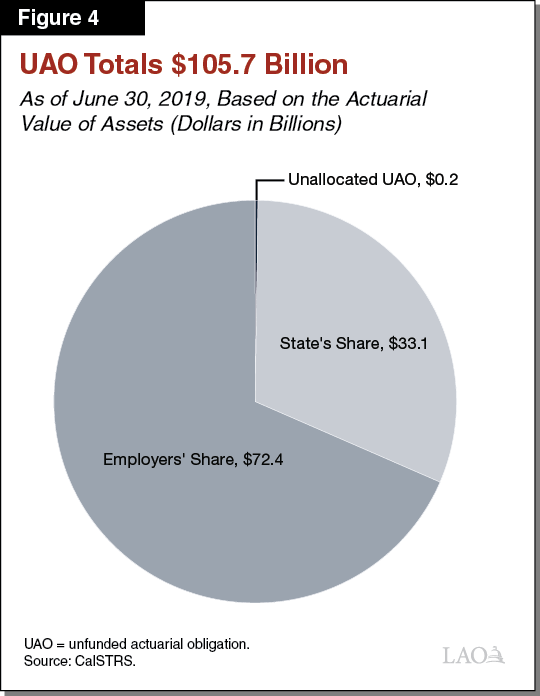

Theoretical Assets and Obligations

Exceedingly Complex Formulas Assign Responsibility for UAO to the State and Employers… In addition to significantly increasing the state’s and employers’ contribution rates and broadening the board’s authority to adjust rates in order to eliminate the program’s UAO by 2046, the funding plan stipulates that responsibility for paying down UAO be shared between the state and employers. Prior to the funding plan, there was no formal division of responsibility for paying down UAO. To implement the funding plan, CalSTRS’ actuaries annually calculate assets and obligations for the state and employers based on theoretical “alternate universes,” determining what CalSTRS’ assets and obligations hypothetically would be had the state made different decisions in the past. Theoretical assets and obligations are calculated for the state based on what is referred to as the “1990 benefit structure,” while those calculated for employers are based on the “post‑1990 benefit structure.” (We describe these structures more fully in Figure 3.) Based upon these theoretical calculations, the state and employers each are assigned an amount of UAO they are responsible for paying down. The state’s and employers’ amounts do not necessarily sum to CalSTRS’ total UAO; a small portion of CalSTRS’ UAO remains unallocated under the funding plan.

Figure 3

Structures CalSTRS Uses to Calculate and Assign Responsibility for Assets, Obligations, and UAO

|

Responsible Entity |

Structure Used |

|

State |

|

|

Employers |

|

|

Unallocated |

|

|

UAO = unfunded actuarial obligation. |

|

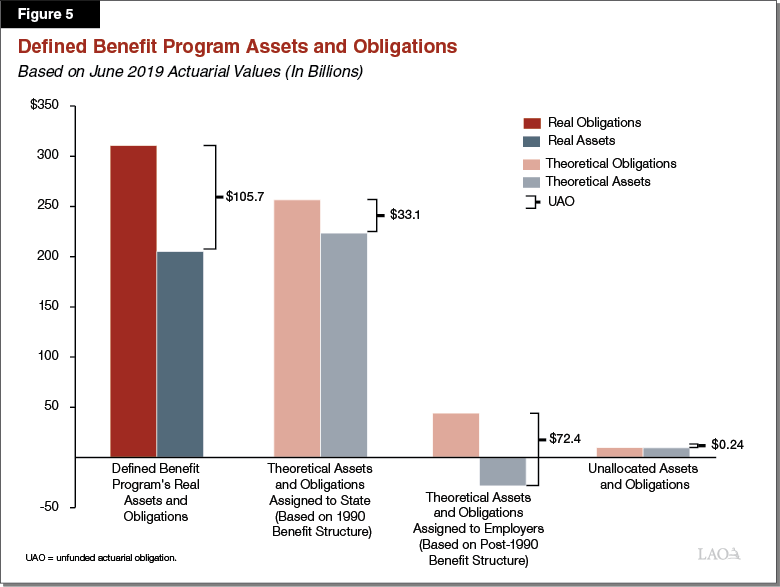

Each year, these structures become increasingly complex as CalSTRS accounts for an additional year of data and hypothetical difference between real experience and the theoretical structures. As of the actuarial valuation for the period ending June 30, 2019, CalSTRS’ total UAO is $105.7 billion. Based on the 1990 benefit structure, $33.1 billion UAO is assigned to the state (representing about one‑third of total UAO), while based on the post‑1990 benefit structure, $72.4 billion UAO is assigned to employers (representing about two‑thirds of total UAO). In addition, actuaries calculated a small portion of the total UAO as the responsibility of neither the state nor employers. Figure 4 illustrates the current division of UAO.

…Resulting in Complicated and Counterintuitive Effects on Contribution Rates. Although the state’s share of UAO (as determined by the 1990 benefit structure) currently is only about half the size of the employers’ share (as determined by the post‑1990 benefit structure), the state’s contribution rate is much more sensitive to volatility in investment returns compared to employers’ contribution rate. (The state’s rate is currently about five times more sensitive than employers’ rate.) This sensitivity is due to the 1990 benefit structure—which the state is responsible for—having theoretical assets that exceed the Defined Benefit Program’s current, real assets. Specifically, when CalSTRS experiences investment returns that are greater than (or less than) the assumed rate of return (currently 7 percent), the actuarial gains (or losses) are larger for the theoretical asset value assigned to the state, relative to the actual gains (or losses) experienced by the system’s true assets. Therefore, the state’s actuarially required contribution rate based on the 1990 benefit structure decreases more in response to higher‑than‑assumed investment returns—and increases more in response to lower‑than‑assumed investment returns—relative to what changes would be required if the state’s rate were based on the Defined Benefit Program’s actual assets. We explain this outcome in more detail in the box and illustrate assets and obligations in Figure 5.

Outcomes of CalSTRS’ Theoretical Calculations

Why Are the Theoretical Assets Calculated Via the 1990 Benefit Structure Greater Than the Program’s Actual Assets? During the 1990s, the Defined Benefit Program experienced a brief surplus resulting from historic stock market growth. In response to that windfall, the state cut required contributions to the program and simultaneously increased members’ pension benefits. If these changes had not been made, the Defined Benefit program today would be better funded because: (1) required benefits payments would be lower and (2) more contributions would have been made to the program. Accordingly, under the 1990 benefit structure, the value of assets that the California State Teachers’ Retirement System (CalSTRS) theoretically would have is higher, while obligations theoretically would be lower.

Why Do the Theoretical Assets Calculated Via the Post‑1990 Benefit Structure Currently Result in a Negative Amount? As described above, the state increased CalSTRS’ members’ benefits while decreasing contributions to the Defined Benefit Program in the 1990s. The changes essentially decreased the system’s funding health—specifically by reducing the extent to which the assets could pay benefits—relative to what it would have been in absence of the changes. This effective loss is the responsibility of employers, given that it occurs under the post‑1990 benefit structure. Eventually—likely in 20 years or so—the post‑1990 benefit structure assets will result in a positive value.

In parallel, volatility in investment returns results in a smaller but opposite impact on employers’ contribution rate. This counterintuitive effect is due to employers’ theoretically negative assets calculated based on the post‑1990 benefit structure. Specifically, employers’ actuarially required contribution rate increases slightly in response to higher‑than‑assumed investment returns, and decreases slightly in response to lower‑than‑assumed investment returns. (Again, we explain this outcome in more detail in the nearby box and illustrate assets and obligations in Figure 5.) In other words, employers benefit somewhat—due to a slightly lower actuarially required contribution rate—when CalSTRS’ investments perform below the actuarially assumed level. As long as the theoretical assets assigned to employers remain a negative value, this counterintuitive relationship between investment returns and employers’ contribution rate will persist.

Figure 5 illustrates the amounts and relative sizes of the Defined Benefit Program’s actual and theoretical assets, obligations, and UAO, as of CalSTRS’ actuarial valuation for the period ending June 30, 2019.

Complexity Makes Funding Plan Difficult to Track. The structures described above result in changes to the proportional division of UAO each year when CalSTRS’ actuaries update their projections. Due to these annual fluctuations, as well as the sheer complexity of the structures and calculations themselves, the funding plan’s progress can be difficult for the state, employers, and other stakeholders to understand and track.

Funding Plan Does Not Include Provisions to Pay Down Unallocated UAO. As described above, the theoretical assets and obligations assigned to the state and employers do not precisely match CalSTRS’ total UAO. This portion of UAO left over—assigned neither to the state nor employers—may grow over time. There is no plan in place to address this unallocated UAO.

Board’s Limited Authority to Adjust State’s Contribution Rate

Limited Authority Results in More Increases Over a Longer Period to Pay Down UAO. As described previously, the funding plan sets the goal of fully funding the Defined Benefit Program by 2046, and provides CalSTRS with limited authority to adjust the state’s and employers’ contribution rates to reach that goal. Within the confines of this limited authority—allowing the board to increase the state’s contribution rate by no more than 0.5 percent of creditable compensation each year and employers’ contribution rate by no more than 1 percent of creditable compensation each year—in any given year, CalSTRS can make up for small actuarial losses and keep the funding plan on track. Addressing larger losses must be done over multiple years, however, meaning more UAO may accrue over time.

Given the volatile nature of the state’s actuarially required contribution rate based on the 1990 benefit structure, the board’s current limited authority poses challenges only related to the state’s rate. Specifically, CalSTRS cannot increase the state’s rate quickly enough to compensate for lower‑than‑assumed investment returns when those actuarial losses exceed approximately 1 percentage point in a given year (in other words, when CalSTRS’ real investment returns are 6 percent or lower). Figure 6 provides some illustrative examples of actuarial investment losses and impacts on the state’s contribution rate.

Figure 6

Illustrative Hypothetical Loss Scenarios

(Dollars in Millions)

|

Scenario 1 |

Scenario 2 |

Scenario 3 |

Scenario 4 |

Scenario 5 |

|

|

Assumed return |

7.0% |

7.0% |

7.0% |

7.0% |

7.0% |

|

Actuarial experience |

6.0 |

5.0 |

4.0 |

3.0 |

2.0 |

|

Actuarial loss |

1.0 |

2.0 |

3.0 |

4.0 |

5.0 |

|

Implication for change in state’s rate |

0.5 |

1.0 |

1.5 |

2.0 |

2.5 |

|

Number of years of maximum increase required to make up for loss |

1 |

2 |

3 |

4 |

5 |

|

Underfunding amount accrued in intervening years |

— |

$175 |

$525 |

$1,050 |

$1,750 |

|

Notes: Each scenario represents a hypothetical loss in a single year. All percentages represent percentage of CalSTRS creditable compensation. Underfunding amount represents the difference between current policy and full rate setting authority, assuming CalSTRS would adjust rates to make up for loss in the following year. Assumes creditable compensation remains around $35 billion each year. |

|||||

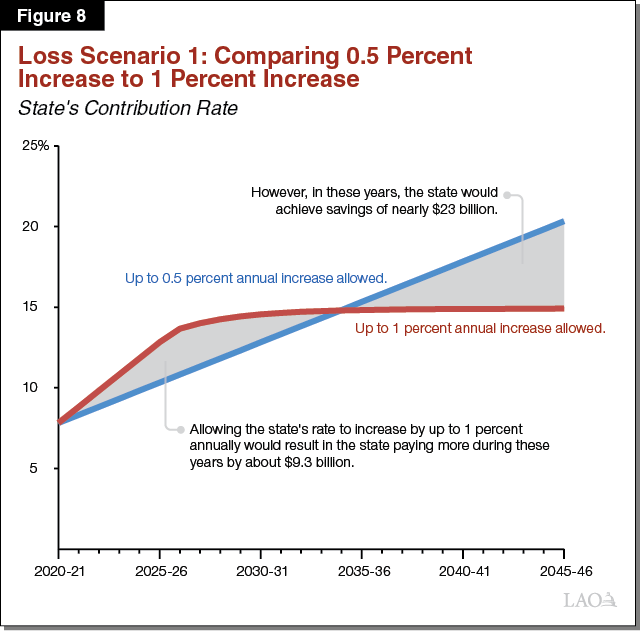

Limited Authority Also Results in State Paying More Over Time. As described above, CalSTRS addresses unfunded liabilities by increasing rates, and the limitations on the board’s rate‑setting authority mean accrued UAO must be addressed over a longer period of time. When CalSTRS cannot increase the state’s rate as quickly as needed, the underfunded amount compounds and accrues UAO, which CalSTRS addresses by continuing to increase the state’s contribution rate over time. Every additional year that the state’s rate is actuarially required to increase equates to a higher dollar amount that the state must pay. For example, if the state’s rate were actuarially required to increase by 0.5 percent of creditable compensation every year throughout the entirety of the funding plan, the state’s contribution rate in 2046 would be more than 20 percent.

Alternatively, if CalSTRS were able to increase the state’s rate more quickly to address UAO more immediately, the state could owe more in the near‑term relative to what it would owe under a 0.5 percentage point annual increase. However, the state could avoid compounding losses, and the state’s rate likely would peak at a lower level and would require less significant ongoing increases through 2046—resulting in significant overall savings to the state.

The impact is similar to the effects of a homeowner paying principal and interest on a mortgage: when a homeowner pays a lower principal amount, interest on the outstanding balance compounds over time, and the homeowner pays more in totality. If the homeowner paid down the principal balance more quickly, ultimately, they would accrue less interest and achieve savings over the life of the mortgage.

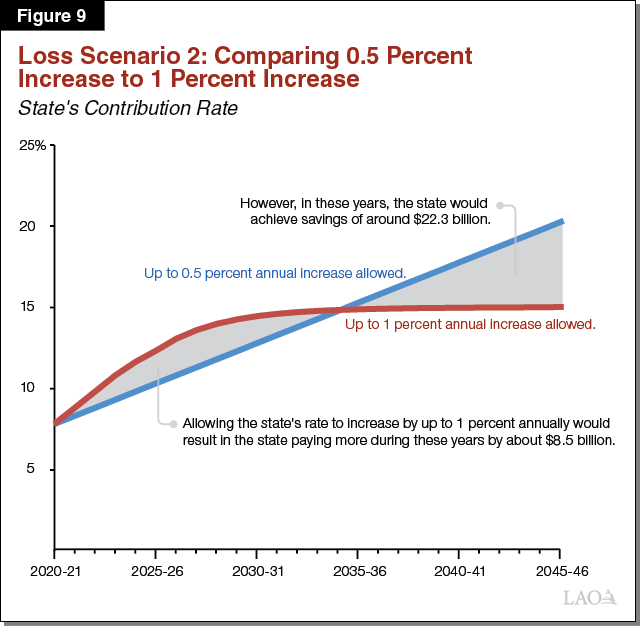

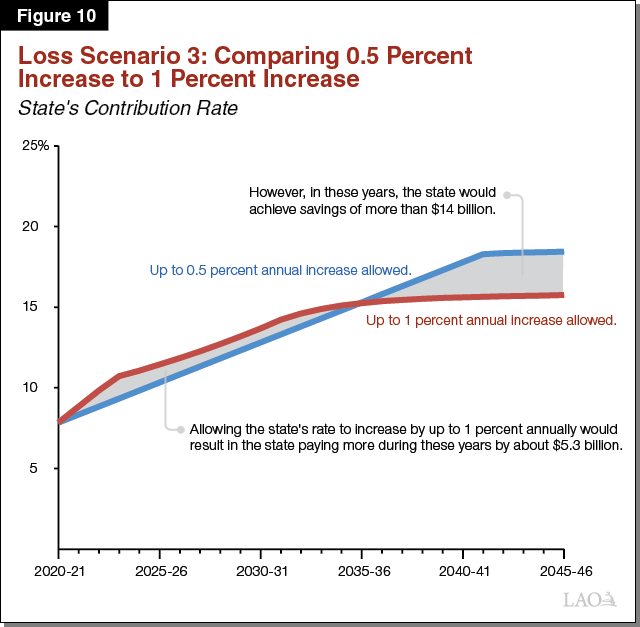

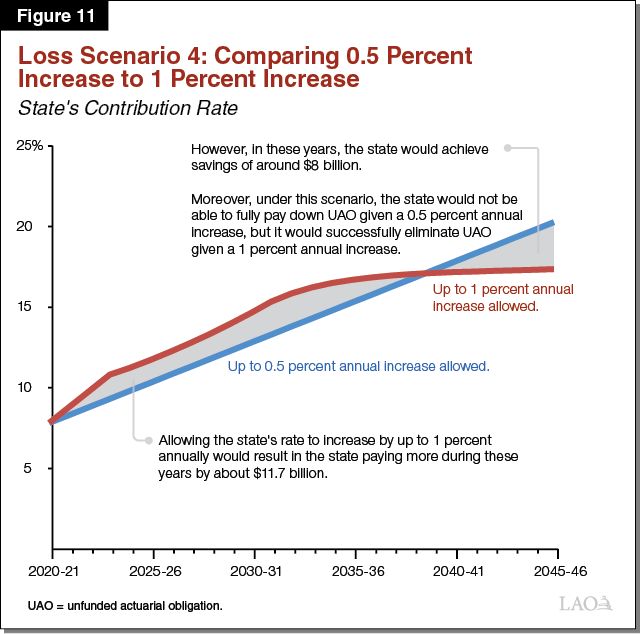

Figure 7, along with Figures 8 through 11 below, demonstrate how allowing the state’s contribution rate to increase more quickly could result in savings over time. Specifically, Figure 7 lays out four hypothetical loss scenarios and the differences in the state’s contribution rates and amounts given an annual rate increase of up to 0.5 percent compared to an annual increase of up to 1 percent. Figures 8 through 11 illustrate these four scenarios, depicting the long‑term savings the state would achieve if CalSTRS could increase the state’s rate by up to 1 percent annually. The nearby box explains in more detail how to read those figures.

Figure 7

Savings Achieved by Allowing State’s Rate to Increase by Up to 1 Percent Annually, Compared to 0.5 Percent Annual Increase

Illustrative Investment Loss Scenarios

|

Scenario 1 |

Scenario 2 |

Scenario 3 |

Scenario 4a |

|

|

Investment return experience |

4.5% |

5.5% |

6.25% |

6.0% |

|

Period of loss |

3 years |

5 years |

10 years |

10 years |

|

0.5 Percent Annual Increase Allowed (Current Law) |

||||

|

State’s contribution rate in 2045‑46 |

20.328% |

20.328% |

18.488% |

20.328% |

|

Total amount contributed by state through 2045‑46 |

$208.2 billion |

$208.2 billion |

$204.7 billion |

$208.2 billion |

|

State’s remaining UAO at end of funding plan |

— |

— |

— |

$24.7 billion |

|

1 Percent Annual Increase Allowed (Alternative to Current Law) |

||||

|

State’s contribution rate in 2045‑46 |

14.915% |

15.024% |

15.792% |

17.409% |

|

Total amount contributed by state through 2045‑46 |

$194.5 billion |

$194.3 billion |

$195.9 billion |

$211.9 billion |

|

State’s remaining UAO at end of funding plan |

— |

— |

— |

— |

|

Savings Achieved by Alternative |

||||

|

Overall Savings in Terms of State Contributions Through 2045‑46 |

$13.7 billion |

$13.8 billion |

$8.8 billion |

‑$3.7 billion |

|

Savings Plus Remaining UAO |

$13.7 billion |

$13.8 billion |

$8.8 billion |

$21.0 billion |

|

aUnder scenario 4, nearly $25 billion UAO would remain unaddressed at the conclusion of the funding plan given a maximum annual increase of 0.5 percent of payroll. If the state’s rate could increase by up to 1 percent of payroll, the state would pay more through 2046 in order to successfully pay down this UAO. |

||||

|

Notes: Data provided by CalSTRS. State’s contribution rate reflects percent of creditable compensation. Assumes teacher payroll would grow by 3.5 percent annually, in line with CalSTRS’ actuarial assumption. |

||||

|

UAO = unfunded actuarial obligation. |

||||

How to Interpret Figures 7 Through 11

Each scenario represents a deviation between the California State Teachers’ Retirement System’s (CalSTRS’) actuarial assumption for investment returns—that CalSTRS’ assets will return 7 percent annually—and a hypothetical market experience. In all four scenarios, we assume the hypothetical lower‑than‑assumed rate of return would begin in 2020‑21 and would continue for the period shown in Figure 7. Beyond that period, we assume CalSTRS would achieve 7 percent investment returns through the end of the funding plan. In Figures 8 through 11, the blue lines show how the state’s rate would need to increase through 2046 to pay down accrued unfunded actuarial obligation under current law, which allows CalSTRS to increase the state’s rate by up to 0.5 percent of creditable compensation each year. The red lines depict how the state’s rate would differ over time if CalSTRS were able to increase it by up to 1 percent of creditable compensation each year. In all four scenarios, the red lines increase more quickly but then level off, while the blue lines continue to increase steadily into the 2040s. The areas of the graphs where the red lines are above the blue lines represent periods when the state would pay more in a given year if a 1 percent annual increase were allowed. Conversely, areas of the graphs where the blue lines are above the red lines represent periods when the state would pay less in a given year if a 1 percent annual increase were allowed. As shown, under all four scenarios, a 1 percent annual increase would result in the state paying more up front—for at least a decade or so—but by the end of the funding plan would result in the state savings billions of dollars each year.

Ultimately, Limited Authority Makes Meeting Funding Plan Goal of Paying Down State’s Share of UAO Less Likely. CalSTRS actuaries estimate that, within the terms of the funding plan, the system has some capacity to absorb some additional years of loss while allowing the state to successfully pay down its share of UAO by 2046. However, larger losses, or losses over a longer period or occurring closer to 2046, could mean that—even if the state’s rate continues to increase by the maximum allowed each year through the end of the funding plan—the state might not be able to pay down its share of UAO by the end of the funding plan period. (This would be the case under loss scenario 4, shown in Figures 7 and 11 above.) Figure 12 lays out a few potential loss scenarios that CalSTRS could withstand and still be able to eliminate the state’s share of UAO under the current provisions of the funding plan—but that would require the state’s rate to continue increasing through 2046 and assumes that for all other years CalSTRS would meet all actuarial assumptions.

Figure 12

System Capacity to Absorb Loss: State’s Share of UAO

Illustrative Investment Loss Scenarios That Could Occur While Allowing State to Pay Down Its Share of UAO by 2046

|

Investment Return Experience Beginning in 2020‑21 |

Period of Loss |

State’s Rate Must Continue to Increase by the Maximum Through Year |

State’s Rate in 2045‑46 |

Total Amount Contributed by State Through 2045‑46 |

State’s Remaining UAO at End of Funding Plan |

Frequency of Loss in a Given Year Over Past 25 Yearsa |

|

|

Scenario 1 |

4.50% |

3 years |

2045‑46 |

20.328% |

$208.2 billion |

— |

32% |

|

Scenario 2 |

5.50 |

5 years |

2045‑46 |

20.328 |

$208.2 billion |

— |

36 |

|

Scenario 3 |

6.25 |

10 years |

2041‑42b |

18.488 |

$204.7 billion |

— |

36 |

|

aReflects how often a loss of similar magnitude or greater has occurred in any one year over the past 25 years. bUnder scenario 3, the state’s rate would increase by the maximum allowed each year through 2041‑42, then continue increasing by less than the maximum each year through 2045‑46. |

|||||||

|

Note: Data provided by CalSTRS. |

|||||||

|

UAO = unfunded actuarial obligation. |

|||||||

Funding Plan Set to End in 2046

Plan Expiration Date Also May Make It More Difficult to Achieve Goal. Because the provisions of the funding plan are set to expire in 2046, the time horizon over which CalSTRS can pay down UAO, including addressing any new actuarial losses, decreases each year. For example, if the system does not meet its investment return assumption in 2021‑22, the board has 25 years over which it can increase contribution rates (the actual time period needed would depend on the size of the loss). However, if the system experiences a loss in the early 2040s, it has only a few years to increase contribution rates in response to that loss. Depending on the size of the loss, the system may not be able to fully pay down accrued UAO prior to the end of the plan period, at which point contribution rates would default to pre‑funding plan levels.

Summary

Summary of Funding Plan Complexities and Challenges. Although the 2014 funding plan has facilitated significant progress in terms of CalSTRS’ ability to address UAO, after several years of the funding plan being in place, some key challenges have been revealed. A few aspects of the funding plan may impede the likelihood of its success, and also may result in challenges for stakeholders to oversee the plan’s progress. Figure 13 summarizes the funding plan’s complexities and key challenges.

Figure 13

Summary of Funding Plan Complexities and Challenges

|

|

|

|

|

UAO = unfunded actuarial obligation. |

Risks to Funding Plan Recently Have Become More Apparent

In this section, we describe how recent economic volatility, coupled with a state budget action in 2020‑21, underscores the risks to the ultimate success of CalSTRS’ funding plan.

CalSTRS Actuaries Recommended Increasing State Rate for 2020‑21. In May 2020, the CalSTRS board voted to increase the state’s contribution rate in 2020‑21 by the maximum allowed amount (0.5 percent of creditable compensation) to ensure the state remained on track to meet the funding plan goal of eliminating its share of CalSTRS’ UAO by 2046. Additionally, actuaries projected at that time it would be necessary for the board to continue increasing the state’s rate by the maximum allowed amount for two to three more years to continue accounting for accrued UAO.

CalSTRS Experienced Actuarial Loss for 2019‑20. Due to extreme market volatility in 2019‑20 caused by the coronavirus disease 2019 pandemic, CalSTRS did not meet its investment return assumption for the year. Specifically, CalSTRS investments returned 3.9 percent in 2019‑20, compared to the assumed 7 percent rate, meaning CalSTRS experienced an actuarial loss of 3.1 percentage points. As noted in the preceding paragraph, the state’s rate already was scheduled to increase by the maximum allowed amount in 2020‑21 and for the following two to three years. The loss CalSTRS experienced in 2019‑20 means the state’s rate likely will continue to be actuarially required to increase beyond that period, probably for an additional three years or so.

2020‑21 Returns Remain Unclear. At this point in time, given ongoing market volatility, CalSTRS’ 2020‑21 investment returns are unknown. However, year‑to‑date returns are positive and CalSTRS likely would meet or exceed its 7 percent assumption should current trends continue. CalSTRS’ long‑term investment return expectation remains 7 percent.

2020‑21 Budget Suspended Board’s Ability to Increase State’s Contribution Rate. At the time of the 2020‑21 May Revision, the administration estimated the state faced a significant budget problem that required reductions in many areas across state government. In response to the budget problem, one of the actions taken as part of the 2020‑21 Budget Act was to suspend the CalSTRS board’s authority to increase the state’s Defined Benefit Program contribution rate in 2020‑21 (in other words, the board’s vote to increase the state’s rate did not go into effect). This action resulted in estimated one‑time General Fund savings of $169 million in 2020‑21.

2020‑21 Budget Action Underscores Challenge Imposed by CalSTRS’ Limited Rate‑Setting Authority. Given CalSTRS’ limited authority to increase the state’s contribution rate, in addition to the pre‑existing actuarial need to increase the state’s rate for several years, the 2020‑21 suspension may make it more difficult for the state to reach the goal of fully funding the Defined Benefit Program by 2046. Specifically, because of the 2020‑21 suspension, the state’s contribution rate beginning July 1, 2020 is 0.5 percentage points lower than it would have been in absence of the suspension. (We note that the administration took one‑time action in 2020‑21 to offset this action and proposes additional one‑time action for 2021‑22. We describe these measures in more detail in the next section.) To the extent that the system continues to accrue UAO, this lower rate increases the risk that the funding plan may not meet its goal. In other words, the budget action magnifies the risk that—even if CalSTRS’ board is able to increase the state’s rate by the maximum of 0.5 percentage points every year through 2046—the state’s contributions would be insufficient to completely pay down its share of UAO by the end of the funding plan. Additionally, the state may need to pay more to CalSTRS over time.

Recent Budget Actions and Proposals to Address State’s Share of UAO

This section outlines the state’s recent supplemental payments for the state’s share of CalSTRS’ UAO, as well as the administration’s related proposal for 2021‑22.

Similar to Past Actions, the Governor’s 2021‑22 Budget Proposes Some Steps to Help Funding Plan Stay on Track. Since 2019‑20, the state has made supplemental payments that help pay down the state’s share of CalSTRS’ UAO. The administration proposes similar actions in 2021‑22. Past actions and proposed actions include:

- 2021‑22 Budget Proposes to Use Required Debt Payment Funding for CalSTRS. In 2019‑20 and 2020‑21, the state allocated part of its required debt payment funding (pursuant to Proposition 2 [2014]) to CalSTRS. Specifically, the state made supplemental payments of $1.1 billion in 2019‑20 and $297 million in 2020‑21 toward the state’s share of CalSTRS’ UAO. The 2021‑22 Governor’s Budget proposes to use approximately $410 million of required debt payment funding for the same purpose. We note that the 2021‑22 proposed payment is in line with our previous recommendations for allocating Proposition 2 debt payments. More information about our previous recommendations can be found in our March 2020 Proposition 2 analysis here.

- 2021‑22 Includes a Proposal to Make One‑Time State General Fund Payment. The administration also proposes to allocate $173 million General Fund in 2021‑22 as a one‑time additional payment to CalSTRS.

LAO Comments and Recommendations

2021‑22 Budget

Proposed Supplemental Payment to CalSTRS in 2021‑22 Merits Consideration, but Would Not Address Underlying Challenges. In light of the 2020‑21 budget action, which holds the state’s contribution rate flat in the current year, the administration’s proposed additional state General Fund payment of $173 million to CalSTRS in 2021‑22 makes sense as a way to offset the lower state rate for one year. The proposed amount—equivalent to 0.5 percent of estimated creditable compensation—effectively would make up for the fact that the state’s rate will be 0.5 percentage points lower in 2021‑22 than it would have been in absence of the 2020‑21 rate increase suspension. (Additionally, the administration’s proposal to allocate some required Proposition 2 debt payment funding to CalSTRS would prevent added UAO from accruing in 2021‑22 and is consistent with our past recommendation.) However, the proposed one‑time payments would not address ongoing issues. In future years, the state’s rate will continue to be 0.5 percentage points lower relative to what it would have been. Furthermore, the underlying long‑term risks to CalSTRS’ funding plan remain.

Suggest Legislature Also Consider “Catch‑Up” Mechanism. Considering the various challenges facing the CalSTRS funding plan described in this report, the Legislature may wish to consider implementing a catch‑up mechanism, either in addition to or instead of the Governor’s proposed one‑time $173 million General Fund payment. Specifically, the Legislature could consider allowing CalSTRS to increase the state’s rate more quickly—either beginning in 2021‑22 or in a future year once the state has addressed current pandemic‑related challenges. For example, the Legislature could consider allowing CalSTRS’ board to increase the state’s rate by up to 0.75 percent or 1 percent of creditable compensation annually (or some other amount greater than the currently allowed 0.5 percent) for a limited time while the state’s rate and contributions catch up to what they would have been absent any suspension.

Longer‑Term Considerations

In the Longer Term, Consider Addressing Risks to Funding Plan Permanently. While the recommendations above would help relieve some pressures on the funding plan in the short term, the underlying structural aspects of the funding plan that could impede its likelihood of success in the longer term would remain unchanged. To ensure that the fiscal health of the pension system for California’s educators remains secure in the long term, the Legislature could consider some changes to the provisions of the CalSTRS funding plan.

- Allow CalSTRS to Increase State’s Rate by More than 0.5 Percent Annually. Due to the 1990 benefit structure, the most significant risk to the funding plan currently is that the state will not be able to pay down its assigned UAO by 2046 given the board’s limited authority to increase the state’s contribution rate. To address this challenge, the Legislature could amend the funding plan provisions to allow the state’s rate to increase by more than 0.5 percent of creditable compensation annually. While this change would mean the state could pay more to CalSTRS in the near term, it also would strengthen CalSTRS’ ability to pay down UAO by 2046 and ultimately could generate savings in the long term.

- Eliminate the Complex Theoretical Calculations. The exceedingly complex theoretical calculations employed by CalSTRS result in an ever‑changing proportional division of UAO between the state and employers, extra sensitivity to investment returns in terms of the state’s contribution rate, and counterintuitive (but less significant) impacts on employers’ contribution rate. Combined, the complexities of the funding plan may pose challenges to effective legislative oversight of the plan’s progress. To eliminate these complexities, the Legislature could consider directing CalSTRS to determine a fixed proportional split of total UAO between the state and employers (this split could be based on benefits that were in place as of 1990, or based on some other calculation). Simplifying these aspects of the funding plan could help improve legislative oversight, lessen the volatile effects of investment returns on the state’s actuarially required contribution rate, and align impacts of investment returns across the state’s and employers’ actuarially required contribution rates. In addition, a fixed proportional split would result in more predictable changes to both the state’s and employers’ contribution rates in response to future actuarial gains and losses.

- Make Provisions of Funding Plan Ongoing. Finally, part of the risk to the funding plan’s success stems from its expiration in 2046. Under funding plan provisions, CalSTRS’ time horizon to address accrued UAO decreases each year and makes it very unlikely that CalSTRS will be able to offset losses that occur near the current plan end date. The Legislature could consider amending the funding plan to make provisions ongoing (we note this could apply to current provisions or the modified provisions we note for consideration above). Given an indefinite time horizon, rather than a constantly shrinking one, CalSTRS could adopt a standardized amortization period (for example, a 20‑year time line) to address accrued UAO. For any new losses, liabilities could be isolated and eliminated over a separate fixed period. These approaches would better align with industry best practices for paying down UAO, and strengthen CalSTRS’ ability to continue ensuring the fiscal health of the pension system for the state’s educators in the long term, beyond 2046.

Conclusion

The 2014 CalSTRS funding plan divides responsibility for the Defined Benefit Program’s UAO between the state and employers and aims to eliminate that UAO by 2046. To date, the plan has significantly increased contributions from the state and employers to achieve this goal, and is on track to pay down most UAO over the next few decades. The existence of the funding plan represents a significant accomplishment for the state and has put CalSTRS on a much more sustainable path. However, certain aspects of the funding plan impact its likelihood of success—most notably CalSTRS’ limited authority to increase the state’s contribution rate, which is particularly sensitive to volatility in investment returns. Over the past few years, these challenges to the funding plan have become more apparent, and the state has taken one‑time actions to help keep the funding plan on track. We recommend the Legislature continue to take action in 2021‑22 to help ensure the plan’s success. In the longer term, to increase transparency and oversight, increase the likelihood that the state will be able to fully pay down its share of CalSTRS accrued UAO by 2046, potentially help the state achieve significant long‑term savings, and allow CalSTRS to effectively address future losses and UAO, we recommend that the Legislature consider addressing some of the underlying challenges to the plan.

Appendix

Glossary of Key Terms Related to Pension Funds

Throughout this report, we refer to terms commonly used when describing pension funds. We define those key terms here, in reference to the California State Teachers’ Retirement System (CalSTRS).

Creditable Compensation. Amount of public educator payroll that counts toward CalSTRS’ benefits calculations. Creditable compensation includes educators’ salaries, as well as other eligible pay, such as pay earned for teaching a summer school class.

Contribution Rates. The amounts that the state, employers, and members are required—by law and given board authority—to contribute to CalSTRS, calculated annually as a percentage of creditable compensation.

Actuarial Assumptions. Assumptions that actuaries make related to investment returns, membership and payroll growth, age of retirement and life expectancy for retirees, and other aspects that impact CalSTRS’ projected benefits payments, contributions, and revenues. For example, CalSTRS currently assumes that investments will generate an annual return of 7 percent, and that teacher payroll will grow by 3.5 percent each year.

Actuarial Losses. Occur when the system fails to meet actuarial assumptions. For example, when CalSTRS’ investments fail to return 7 percent in a given year (for example, actual returns are 6 percent), CalSTRS experiences an actuarial loss.

Normal Cost of Benefits. For CalSTRS, the normal cost of a member’s Defined Benefit Program benefits is the annual cost applied to each year of the member’s service that is necessary to adequately fund the benefits over time.

Actuarially Required Contribution Rates. Based on actuarial assumptions, the system’s actuaries determine how much contributors must pay to cover the normal cost of benefits and to pay down any UAO, often over a certain amortization period.

Amortization Period. The time horizon over which the system makes up for losses (by increasing contributions). Because the provisions of the current CalSTRS funding plan will end in 2046, essentially, CalSTRS’ maximum amortization period decreases each year.

Pension Fund Assets. The accumulated contributions of the state, employers, and members, in addition to investment returns, that can be used to pay benefits. Assets can be measured in terms of their actuarially determined value or their market value.

Pension Fund Obligations. Obligations, or liabilities, represent the cost of benefits that the system owes based on accrued service for active and retired members.

Unfunded Actuarial Obligation (UAO). When pension fund obligations exceed assets, the system has an unfunded actuarial obligation, also called an unfunded actuarial accrued liability.

Funded Status. An expression of the size of the system’s assets relative to obligations, often conveyed as a percentage. For example, CalSTRS is 66 percent funded as of its most recent actuarial valuation. This means the system’s assets can cover approximately two‑thirds of its total obligations.

Public Employees’ Pension Reform Act (PEPRA). PEPRA of 2013 (Chapter 296 of 2012 [AB 340, Furutani]) made changes to pension benefits structures for public employees, including teachers. As a result, CalSTRS’ benefits for members hired prior to when PEPRA took effect (January 1, 2013) are different from benefits for those hired after PEPRA took effect (January 1, 2013 and later). CalSTRS members who are not subject to PEPRA are also referred to as “2% at 60” members, while those subject to PEPRA are also referred to as “2% at 62” members.