LAO Contact

November 18, 2021

Update on the Progress of the

CalSTRS Funding Plan

Summary

This post provides an update on the progress of the California State Teachers’ Retirement System (CalSTRS) funding plan, which has the goal of paying down CalSTRS’ Defined Benefit (DB) program’s unfunded actuarial obligation (UAO) by the mid-2040s. This update is based on CalSTRS’ most recent actuarial valuation (for the fiscal year ending June 30, 2020), which reflects investment returns of 3.9 percent, while also considering future impacts of CalSTRS’ historic investment returns in 2020-21 of 27.2 percent. This unprecedented year-over-year volatility in CalSTRS’ investment returns will result in significant changes to the DB program’s overall UAO and to the shares assigned to the state and employers—underscoring the complexity of the funding plan and the outsized effects of investment return volatility on the state’s share of UAO. Given this context, and other issues we raise in this post, we recommend the Legislature take action soon to make a few key changes to the funding plan. Specifically, we recommend the Legislature amend statute to: (1) allow the state’s contribution rate to increase by more than is currently allowed, (2) determine a fixed proportional division of UAO between the state and employers, and (3) enable CalSTRS to develop a standard amortization policy to address future UAO.

Introduction

We begin by describing the changes to UAO and contribution rates in 2021-22, based on the most recent actuarial valuation. We then describe the potential effects of the 2020-21 investment returns and other factors. We conclude by revisiting the three longer-term recommendations we raised for the Legislature’s consideration in our March 2021 publication, Strengthening the CalSTRS Funding Plan, using the extreme volatility in investment returns to illustrate how those recommendations would strengthen CalSTRS’ ability to successfully pay down UAO—both the state’s share and employers’ share—by 2046.

For more detailed information about the provisions of the funding plan, refer to our March publication.

Changes to UAO Based on 2019-20 Valuation

Investment Returns in 2019-20 Fell Below Actuarially Assumed Rate. Due to the unprecedented fiscal effects of the coronavirus disease 2019 (COVID-19) pandemic, CalSTRS’ assets netted 3.9 percent returns in the 2019-20 fiscal year. While these returns fell short of CalSTRS’ actuarially assumed rate of 7 percent, the system recovered somewhat from initial larger losses earlier in 2020 as the global economy essentially ground to a halt in response to the pandemic.

Payroll Growth in 2019-20 Also Lower Than Actuarially Assumed Rate. Growth in teacher payroll reached 2.8 percent during the valuation period, below the actuarially assumed rate of 3.5 percent annual payroll growth. This valuation period marked the first time in several years that the number of actively working teachers decreased, from around 451,000 as of June 2019 to around 448,000 as of June 2020. The decrease in actively working teachers reflects a surge in retirements reported by CalSTRS in 2020. Specifically, in the second half of 2020, CalSTRS reported retirements had increased 26 percent over the same period in 2019. Whether schools ultimately will replace these retired teachers remains to be seen.

Funded Ratio Improved While Total UAO Increased Slightly. The 2019-20 valuation reflects a slight improvement in the DB program’s funded ratio, which increased from 66 percent as of June 2019 to 67 percent as of June 2020. UAO increased marginally from $105.7 billion to $105.9 billion, reflecting that the program’s total obligations grew slightly more than total assets did in absolute terms. Figure 1 summarizes these changes.

Figure 1

Defined Benefit Program Total UAO

(Dollars in Billions)

|

Valuation for the |

Valuation for the |

Change From |

|

|

Assets |

$205.0 |

$216.2 |

$11.2 |

|

Obligation |

310.7 |

322.1 |

11.4 |

|

UAO |

105.7 |

105.9 |

0.2 |

|

Funded ratio |

66% |

67% |

1 point |

|

UAO = unfunded actuarial obligation. |

|||

State’s Share of UAO Decreased as a Result of Supplemental Contributions. Pursuant to the provisions of the funding plan, responsibility for paying down UAO is divided between the state and employers according to a set of complex calculations (which we explain in our previous report here). Based on these calculations, which CalSTRS’ actuaries complete each year, the state’s share of UAO decreased by around $1.6 billion. This decrease in UAO is due primarily to a budgetary action taken by the state in 2019-20. Specifically, the state used $1.1 billion Proposition 2 (2014) required debt payment funding to make a supplemental payment to CalSTRS toward the state’s share of UAO. Figure 2 summarizes changes in the state’s share of UAO, as well as changes to the employers’ share, which we describe in the next paragraph.

Figure 2

Defined Benefit Program Division of UAO

(Dollars in Billions)

|

Valuation for the Period |

Valuation for the Period |

Change From |

||||||

|

Amount |

Percent |

Amount |

Percent |

Amount |

Percentage |

|||

|

State’s share of UAO |

$33.1 |

31.3% |

$31.5 |

29.7% |

‑$1.6 |

‑1.6% |

||

|

Employers’ share of UAO |

72.4 |

68.5 |

74.0 |

69.9 |

1.6 |

1.4 |

||

|

Unallocated UAO |

0.2 |

0.2 |

0.4 |

0.4 |

0.2 |

0.2 |

||

|

Total UAO |

$105.7 |

100.0% |

$105.9 |

100.0% |

$0.2 |

— |

||

|

UAO = unfunded actuarial obligation. |

||||||||

Employers’ Share of UAO Increased. While the state’s share of UAO decreased, employers’ share increased by around $1.6 billion, based on CalSTRS’ annual calculations. This change is due to negative amortization (essentially meaning the annual contribution was insufficient to cover interest that accrued during the year), which has been the case as the initial increases in the employer contribution rate have been phased in—as dictated in statute by the funding plan. CalSTRS anticipated this effect for the first several years of the funding plan, as the employer rate ramped up. (The statutorily prescribed initial phase in was completed in 2020-21, and 2021-22 marks the first year that the CalSTRS board can exercise its authority to set the employer rate—within the rate-setting limitations of the funding plan.) Figure 2 above summarizes changes to employers’ share of UAO.

DB Program Contribution Rates in 2021-22

State’s Rate Increased by Maximum Allowed. In line with the CalSTRS funding plan and board policy, each year CalSTRS sets the state’s contribution rate (within its statutory authority) based on what contribution level is required to pay down the state’s share of UAO by 2046. As such, based on CalSTRS’ actuarial valuation for the fiscal year ending June 30, 2020, the CalSTRS board exercised its authority to increase the state’s rate for 2021-22 by the maximum allowed 0.5 percent of payroll. Changes in contribution rates from 2020-21 to 2021-22 are summarized in Figure 3.

Figure 3

Defined Benefit Program Contribution Rates

Percent of Creditable Compensation

|

2020‑21 |

2021‑22 |

||||

|

State |

Schools |

State |

Schools |

||

|

Rate collected by CalSTRS |

7.828% |

19.10% |

8.328% |

19.10% |

|

|

Effect of supplanting payments made by the state on schools’ |

N/A |

‑2.95 |

N/A |

‑2.18 |

|

|

Effective Rate Paid |

7.828% |

16.15% |

8.328% |

16.92% |

|

|

CalSTRS = California State Teachers’ Retirement System and N/A = not applicable. |

|||||

Employers’ Rate Unchanged in Anticipation of 2020-21 Actuarial Experience. Beginning in fiscal year 2021-22, CalSTRS has the authority to set the employers’ contribution rate (within its statutory authority) based on what contribution level is required to pay down employers’ share of UAO by 2046. (As described above, an initial ramp up of rates through 2020-21 was set in statute as part of phasing in the funding plan.) According to the actuarial valuation for the fiscal year ending June 30, 2020, CalSTRS actuaries determined that the employers’ contribution rate in 2021-22 could be lowered by the maximum allowed 1 percent of payroll, for a total DB program rate of 18.1 percent of payroll. However, in anticipation of needing to increase the employers’ contribution rate in future years based on actuarial experience in 2020-21, CalSTRS ultimately chose not to adjust the employers’ contribution rate downward for 2021-22—maintaining the 2020-21 contribution level of 19.1 percent of payroll. This decision will help reduce volatility in employers’ rate and increase the likelihood that employers will be able to pay down their share of UAO by 2046. We note that the effective rates paid by employers are offset in 2019-20, 2020-21, and 2021-22 by supplanting payments made by the state on employers’ behalf. Changes in contribution rates from 2020-21 to 2021-22 are summarized by Figure 3 above.

Looking Ahead: 2020-21 Actuarial Experience

CalSTRS Experienced Much Higher Than Assumed Investment Returns in 2020-21... CalSTRS next actuarial valuation—reflecting 2020-21 investment returns, payroll growth, and other factors impacting CalSTRS’ UAO and required contribution rates—will not be available until the spring 2022. However, CalSTRS announced after the close of the fiscal year that the system’s assets returned 27.2 percent in 2020-21, bringing the total fund value to $308.6 billion as of June 30, 2021. This investment return experience is well above CalSTRS’ assumed rate of 7 percent.

…And Lower Than Assumed Payroll Growth. At the same time, 2020-21 likely will be another year when growth in teacher payroll falls below CalSTRS’ assumed annual rate of 3.5 percent. This anticipated lower payroll growth likely will be driven by continued higher teacher retirement rates in light of the COVID-19 pandemic. Additionally, retirements’ impact on payroll growth may not be immediately offset by new teacher hiring, as schools face uncertainty around how best to address the ongoing impacts of the pandemic on in-person learning, as well as projected enrollment declines.

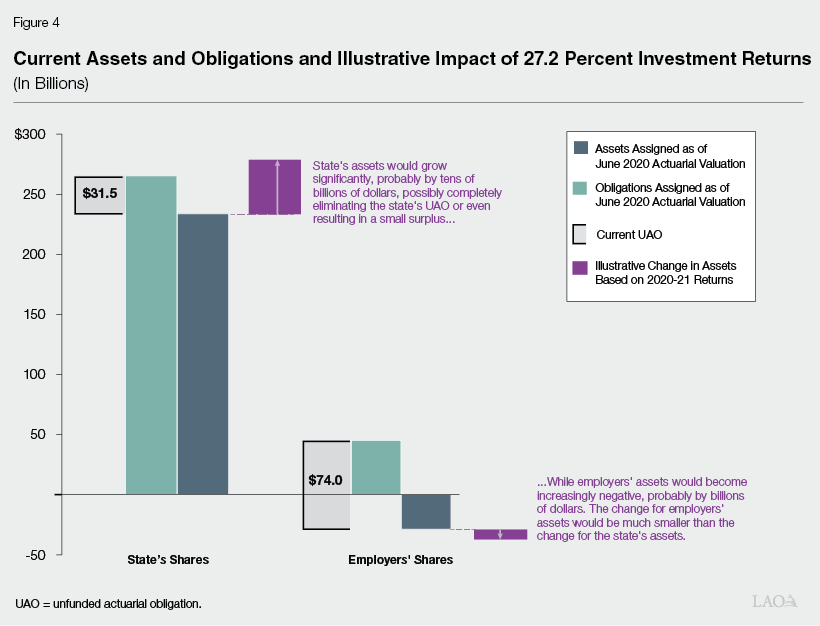

Division of UAO and Contribution Rates in 2022-23 Will Reflect These Factors. As a result of the complex calculations used to determine the state’s share and employers’ share of total UAO (which we explain in our previous report here), volatility in investment returns has an outsized impact on the state’s share. Specifically, when CalSTRS’ assets return more than the actuarially assumed 7 percent, theoretical assets assigned to the state increase more than CalSTRS’ real assets, and the state’s share of UAO decreases significantly. The corresponding contribution rate required for the state to be able to pay down its share of UAO by 2046 decreases accordingly.

Conversely, volatility in investment returns has a much smaller—but counterintuitive—impact on employers’ share of UAO. Specifically, when CalSTRS’ assets return more than the actuarially assumed 7 percent, the negative assets assigned to employers grow, and employers’ share of UAO increases (albeit to a much lesser degree than the state’s share of UAO decreases). As such, the contribution rate required of employers to pay down their relatively larger share of UAO will increase (again, to a much lesser degree than the state’s rate will change).

Lower than assumed payroll growth will impact both the state and employers’ required contribution rates in that a higher rate is required in order for CalSTRS to be able to collect the same dollar amount needed to pay down UAO. At the same time, the normal cost of benefits paid by both the state and employers will be lower as a result of lower payroll.

State’s Share of UAO Projected to Be Eliminated Within a Few Years. Based on the 27.2 percent investment returns in 2020-21, CalSTRS’ actuaries now project that the state’s share of UAO will decrease very significantly—and will be fully eliminated in a few years—while employers’ share of UAO will increase somewhat. (Because CalSTRS employs a smoothing methodology—that is, the system phases in large changes over a few years—the state’s contribution rate will not immediately reflect the full effect of this drastic change in UAO.) Figure 4 shows the current division of UAO between the state and employers, displayed as the difference between the green bars (indicating current obligations) and blue bars (indicating current assets). The arrows provide an illustrative example of the currently projected effects of 2020-21 investment returns on the state’s and employers’ UAO—by illustrating the directionality and relative size of anticipated changes in assets.

State’s Required Contribution Rate Also Projected to Decrease Significantly. Once the state’s share of UAO is eliminated, the funding plan dictates that the state’s supplemental contribution rate would be repealed, at which point the state would contribute only the base rate of 2.017 percent for its share of DB program normal costs. (Given that CalSTRS’ actuaries now project the state’s share of UAO will be fully eliminated in the next few years, this would mean that the state’s rate would drop to 2.017 percent well before the current end of the funding plan. From that point, if new UAO were to accrue prior to the end of the funding plan, CalSTRS would be able to increase the state’s rate by up to 0.5 percent of payroll annually. We discuss these implications later on in this publication.)

Employer Share of UAO Projected to Increase. While 2020-21’s historically high 27.2 percent investment returns are projected to eliminate the state’s share of UAO, employers’ share of UAO is projected to increase by billions of dollars. This counterintuitive effect is the result of the complex theoretical calculations used to divide responsibility for UAO between the state and employers (again, refer to our previous report for more detail about these calculations). Accordingly, employers’ required contributions will reflect this increase—meaning the employer rate will need to remain higher for future years relative to what CalSTRS previously had projected.

Longer Term, UAO and Contribution Rates Will Vary Based on Many Factors. Importantly, UAO is impacted by factors beyond investment returns—such as payroll growth and demographic trends—and new UAO may accrue in future years. Ultimately, required contribution rates over the course of the funding plan will depend on the extent to which CalSTRS meets its assumptions over time. In addition, CalSTRS’ next complete review of its actuarial assumptions is scheduled to occur in 2023. If CalSTRS adjusts its assumptions—for example, by lowering its assumed investment return rate or payroll growth assumption—these changes also would impact UAO and contribution rates both for the state and employers.

Recommendations

In our recent report, Strengthening the CalSTRS Funding Plan, we laid out three longer-term recommendations for the Legislature’s consideration. Below, we use the recent volatility in investment returns to provide illustrative examples as to how our recommendations would strengthen CalSTRS’ ability to successfully pay down UAO—both the state’s share and employers’ share—by 2046. Furthermore, we recommend the Legislature consider making these adjustments to the funding plan soon—before CalSTRS fully phases in the impacts of the 27.2 percent investment returns.

Allow CalSTRS to Increase State’s Rate by More Than 0.5 Percent Annually. Due to the 1990 benefits structure used to calculate the state’s share of UAO, the state bears the full risk of investment return volatility—with assets assigned to the state increasing more than CalSTRS’ real assets in response to higher-than-assumed returns and decreasing more than CalSTRS’ real assets in response to losses. At the same time, CalSTRS’ ability to increase the state’s contribution rate is limited to 0.5 percent annually. Given the 27.2 percent returns that CalSTRS experienced in 2020-21, CalSTRS projects the state’s share of UAO will be eliminated within a few years. As described above, at that point, the state’s required contribution rate would fall to 2.017 percent.

However, between then and the end of the funding plan in 2046, CalSTRS may experience lower-than-assumed investment returns in any number of years, resulting in new losses and the accrual of new UAO. Responsibility for paying down that UAO would fall to the state. Due to the limitations that the funding plan places on CalSTRS’ ability to increase the state’s contribution rate (allowing a maximum increase of 0.5 percent annually), once the state’s rate drops down to the base, it could take many years to increase the state’s rate to required levels to pay down any new UAO that is accrued in future years. To help ensure CalSTRS could more successfully address future UAO and eliminate the state’s portion by 2046, we recommend the Legislature amend the funding plan to allow CalSTRS to increase the state’s rate by more than 0.5 percent annually. We recommend making these changes before the impacts of the 27.2 percent investment return are phased in. By making these changes soon, should the state’s UAO increase, CalSTRS would be able to adjust rates more swiftly, thereby reducing further increases in unfunded liabilities.

Eliminate the Complex Theoretical Calculations in Favor of a Proportional Split of UAO. The exceedingly complex theoretical calculations employed by CalSTRS result in an ever‑changing proportional division of UAO between the state and employers, extra sensitivity to investment returns in terms of the state’s contribution rate, and counterintuitive (but less significant) impacts on the employers’ contribution rate. CalSTRS’ 27.2 percent investment returns in 2020-21 provide an extreme example of the complex and counterintuitive effects of these calculations. Specifically, as a result of the 27.2 percent investment returns, CalSTRS projects the state’s share of UAO will be eliminated in a few years. At the same time, employers’ share of UAO is projected to increase by billions of dollars.

We recommend the Legislature amend the funding plan to specify a fixed proportional division of UAO between the state and employers. By eschewing the current complex UAO calculations and adopting a fixed proportional division of UAO between the state and employers, the Legislature would be able to lessen the volatile effects of investment returns on the state’s actuarially required contribution rate, and align impacts of investment returns across the state’s and employers’ actuarially required contribution rates—meaning the state and employers would benefit equitably as a result of years like 2020-21 when CalSTRS enjoys significant gains in assets. In addition, a fixed proportional split would result in more predictable changes to both the state’s and employers’ contribution rates in response to future actuarial gains and losses.

Allow CalSTRS to Adopt a Standard Amortization Policy to Address Future UAO. As we describe in our previous report, part of the risk to CalSTRS’ current funding plan’s success stems from its expiration in 2046. Under funding plan provisions, CalSTRS’ time horizon to address accrued UAO decreases each year and makes it very unlikely that CalSTRS will be able to offset losses that occur near the current plan end date. As described above, in light of CalSTRS’ 27.2 percent investment returns in 2020-21, actuaries project the state’s share of UAO will be eliminated well in advance of 2046—resulting in the state’s DB program contribution rate dropping to 2.017 percent. From that point, CalSTRS’ ability to collect sufficient contributions from the state to address any new future UAO will be constrained by its limited authority to increase the state’s rate by only 0.5 percent annually. To ensure CalSTRS can continue to address UAO throughout the entire duration of the funding plan and longer term, we recommend the Legislature allow CalSTRS to adopt a standardized amortization period (for example, a 20‑year time line) to address new accrued UAO (while maintaining the current funding plan goal of paying down existing UAO by 2046). For any new losses, liabilities could be isolated and eliminated over a separate fixed period. This would allow CalSTRS to address new liabilities over a standard time horizon, rather than facing a constantly shrinking time line to address all UAO by 2046.