LAO Contact

February 11, 2022

The 2022‑23 Budget

Analysis of the Governor’s CalWORKs Proposals

Summary. In this post, we provide some basic background on the California Work Opportunity and Responsibility to Kids (CalWORKs) program, an update on recent program changes and caseload trends, and an overview of the Governor’s CalWORKs budget proposals.

Background

CalWORKs was created in 1997 in response to the 1996 federal welfare reform legislation that created the federal Temporary Assistance for Needy Families (TANF) program. CalWORKs provides cash grants and job services to low‑income families. The program is administered locally by counties and overseen by the state Department of Social Services.

CalWORKS Provides Cash Assistance to Low‑Income Families. Grant amounts generally are adjusted for family size, income level, and region. Recipients in high‑cost counties receive grants that are 4.9 percent higher than recipients in lower‑cost counties. As an example, a family of three in a high‑cost county that has no other earned income currently receives $925 per month, whereas a similar family in a lower‑cost county receives $878 per month. In 2021‑22, the administration estimates the average CalWORKs grant amount to be $717 per month across all family sizes and income levels. These grants are funded through a combination of federal TANF block grant funding, state General Fund, and county dollars. Families enrolled in CalWORKs typically are also eligible for CalFresh food assistance and Medi‑Cal health coverage.

Lifetime Limit on Aid to Adults Scheduled to Increase From 48 to 60 Months. When CalWORKs first was established, adults in the program could collect cash assistance for a total of 60 months (the maximum allowed for recipients of federal TANF funding). Starting in 2011, California reduced this to a 48‑month time limit. (The 2020‑21 spending plan included language to restore the original 60‑month limit starting in May 2022.) Adults who exceed the time limit are no longer included as part of the CalWORKs caseload for purposes of determining the family’s grant amount. (Children and other eligible adults in these families continue to receive assistance.) This has the effect of reducing the family’s monthly grant amount, typically by about $100 to $200 per month for each ineligible member. Throughout the public health emergency caused by COVID‑19, the state has suspended these lifetime limits. Consequently, additional months on aid during the COVID‑19 pandemic do not count against an adult’s 48‑month lifetime limit, though they do still count against the 60‑month maximum set by federal law.

Work Participation Requirements Scheduled to Become More Flexible. Although federal law generally requires adults receiving TANF funding to participate in certain work‑related activities, California historically has allowed some recipients greater flexibility in selecting work‑related activities that suit their individual needs. Starting in 2012, all adults on CalWORKs were allowed to meet the more flexible state standards for up to 24 months while receiving aid. The 2020‑21 spending plan included language to increase the duration of this flexibility. Effective May 1, 2022, all adults will be allowed to meet these more flexible state standards during their entire time on aid.

In More Than One‑Half of Cases, Family Size Differs From CalWORKs Assistance Unit (AU) Size. Monthly CalWORKs grant amounts are set according to the size of the AU. The size of the AU is the number of CalWORKs‑eligible people in the household. Grant amounts are adjusted based on AU size—larger AUs are eligible to receive a larger grant amount—to account for the increased financial needs of larger families. In about 35 percent of CalWORKs cases, everyone in the family is eligible for CalWORKs and therefore the AU size and the family size are the same. In the remaining 65 percent of cases, though, one or more people in the family are not eligible for CalWORKs and therefore the AU size is smaller than the family size.

Family Members May Be Ineligible for CalWORKs for Several Reasons. Most commonly, people are ineligible for CalWORKs because they (1) exceeded the lifetime limit on aid to adults, (2) currently are sanctioned for not meeting some program requirements, or (3) receive Supplemental Security Income/State Supplementary Payment (SSI/SSP) benefits (state law prohibits individuals from receiving both SSI/SSP and CalWORKs). Additionally, many individuals are ineligible due to their immigration status. Undocumented immigrants, as well as most immigrants with legal status who have lived in the United States for fewer than five years, are ineligible for CalWORKs.

Federal, State, and County Governments Share CalWORKs Costs. Federal law allows for a degree of state flexibility in the use of federal TANF funds. The state receives $3.7 billion annually for its TANF block grant, about $2 billion of which goes to CalWORKs (an additional $1 billion helps fund aid for some low‑income college students and the remainder helps fund a variety of smaller human services programs). To receive its annual TANF block grant, the state must spend a maintenance‑of‑effort (MOE) amount from state and local funds to provide services for families eligible for CalWORKs. This MOE amount is $2.9 billion. State and federal CalWORKs funding generally is allocated to the counties, all of whom directly serve eligible families. In addition to funding for cash grants, counties receive several other funding allocations to administer and operate CalWORKs. The main funding allocation—known as the “single allocation”—currently funds employment services, eligibility determination, and administrative costs.

Under State Law, Local Revenue Growth Automatically Triggers CalWORKs Grant Increases. Following a major realignment of state and local responsibilities in 1991, some funds generated by the state sales tax and vehicle license fee accrue to a special fund with a series of subaccounts which pay for a variety of health and human services programs. Under state law, sufficient revenue growth in the Child Poverty and Family Supplemental Support Subaccount triggers an increase in CalWORKs cash grant amounts. In the past, this account funded grant increases of 5 percent in 2013‑14 and 2014‑15, of 1.43 percent in 2016‑17, and 5.3 percent in 2021‑22. In addition, this account has funded the repeal of the maximum family grant policy starting in 2016‑17.

2021‑22 Budget Act Made Several Changes to CalWORKs Program, All of Which Still Appear on Schedule. Among the most notable changes made to CalWORKs in the most recent budget are:

- Augmented the single allocation by $68.3 million above its normal, caseload‑determined amount.

- Increased the earned income disregard for applicants (or the amount CalWORKs applicants can earn before further income effects their eligibility for the program) from $90 to $450 per month. (The 2022‑23 budget includes $79.5 million General Fund to implement this change starting in March 2023.)

- Used $203 million in federal funding to provide a one‑time pandemic relief payment of $640 to each CalWORKs family in July 2021.

- Effective January 1, 2022, increased the amount of child support that could be “passed through” to CalWORKs families from $50 to $100 a month for small families, and from $50 to $200 for larger families (those with two or more children). (Under state and federal law, additional child support payments made beyond this pass‑through level are retained by the state as reimbursement for the state and federal costs of CalWORKs.)

- Provided $3 million in 2021‑22 and an additional $10 million for 2022‑23 to conduct racial equity and implicit bias trainings for county‑level CalWORKs staffers. These trainings commenced in November 2021.

- Increased the additional monthly stipend provided to pregnant women on CalWORKs from $47 to $100, and also allowed women to become immediately eligible upon verification of their pregnancies (as opposed to waiting until the second trimester). The eligibility change occurred on July 1, 2021, and the enhanced stipend is scheduled to begin May 1, 2022. (In 2022‑23, the Governor includes $10.6 million for these changes.)

- Restricted counties from collecting older overpayments made to CalWORKs recipients (specifically, overpayments that are more than two years old). Because this change is scheduled for July 1, 2022, the Governor’s budget includes $2 million for this purpose.

CalWORKs Caseload May Be Reaching an Inflection Point

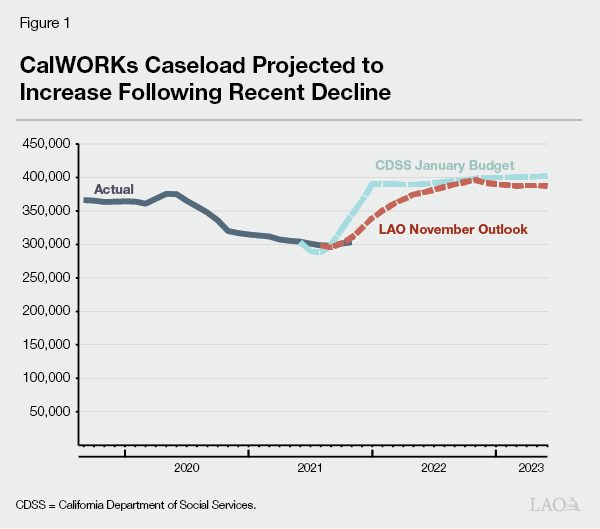

Caseload Has Mostly Decreased at a Historic Rate Throughout the Current Pandemic. Figure 1 shows how CalWORKs caseload decreased rapidly between June 2020 and September 2021. We have discussed this decrease in previous posts. The bottom line is that this decrease is anomalous by historic standards, as CalWORKs caseload historically has increased during times of higher unemployment. This anomaly possibly is due to the unprecedented economic assistance provided to individuals by both the state and federal governments throughout the pandemic.

Administration and Our Office Both Project Caseload to Resume Growing in Current Year. Throughout this pandemic, both the administration and our office have struggled with how to project CalWORKs caseload changes because recent trends have directly contradicted historical norms. Based on each of our investigations into these caseload dynamics, we have independently decided to assume caseload would resume growing in line with historic trends beginning around September 2021, when federal enhancements to unemployment insurance expired. Because we both share this untested assumption, our two caseload forecasts are nearly identical through 2022‑23.

Recent Data Suggest Caseload May Be Growing, but Still Too Soon to Tell. At the time of writing, the most recent caseload data available are from October 2021, just one month past our assumed inflection point. Consistent with this assumption, caseload does appear to have increased by about 2,000 cases a month in both September and October. Although this is a marked change from the previous decrease (which averaged about 3,000 fewer cases per month), it still lags the pace of caseload growth assumed by both our office and the administration (about 10,000 cases added per month). We will continue to monitor the caseload as more data becomes available in the coming months.

Budget Overview

Total CalWORKs Spending Projected to Increase Alongside Growing Caseload. As shown in Figure 2, the Governor’s budget proposes $6.9 billion in total funding for the CalWORKs program in 2022‑23, a net increase of $291 million (4 percent) relative to the most recent estimate of current‑year spending. This increase is the net effect of higher underlying costs due to growing caseload partially offset by the expiration of some one‑time funding for COVID‑19 relief to both individuals and counties. Although caseload and overall costs are expected to increase in CalWORKs, the funding for county administration is proposed to decline. There are a number of reasons this could be the case, and we are continuing to work with the administration to understand whether the decrease is justified.

Figure 2

CalWORKs Budget Summary

All Funds (Dollars in Millions)

|

2021‑22 |

2022‑23 |

Change From 2021‑22 |

||

|

Amount |

Percent |

|||

|

Number of CalWORKs cases |

353,974 |

398,409 |

44,435 |

13% |

|

Cash grantsa |

$3,457 |

$3,880 |

$423 |

12% |

|

Single Allocation |

||||

|

Employment services |

$1,138 |

$1,182 |

$44 |

4% |

|

Cal‑Learn case management |

15 |

18 |

3 |

17 |

|

Eligibility determination and administration |

679 |

624 |

‑55 |

‑8 |

|

Subtotals |

($1,832) |

($1,824) |

‑($8) |

(‑) |

|

Stage 1 child care |

$384 |

$451 |

$68 |

18% |

|

Other allocations |

||||

|

COVID‑19 relief payments |

$203 |

— |

‑$203 |

— |

|

Home Visiting Program |

89 |

$97 |

8 |

9% |

|

Housing Support Program |

285 |

285 |

— |

— |

|

Other |

313 |

314 |

1 |

— |

|

Subtotals |

($889) |

($695) |

‑($194) |

‑(22%) |

|

Otherb |

$5 |

$7 |

$2 |

41% |

|

Totals |

$6,567 |

$6,857 |

$291 |

4% |

|

a Does not include the cost of an estimated 7.3 percent grant increase funded by certain realignment revenues, which the Governor’s budget projects beginning in October 2022. We roughly estimate this would increase cash grants by about $200 million in 2022‑23. b Primarily includes various state‑level contracts. |

||||

General Fund Accounts for Small, But Growing, Share of CalWORKs Costs. Figure 3 shows how CalWORKs costs are shared between federal, state, and local revenue sources. The budget proposes a notable increase in the amount of General Fund going towards CalWORKs (77 percent), although the state still accounts for a fairly small share of overall program costs (19 percent). This increase reflects costs from the growing caseload, nearly all of which are borne by the General Fund.

Figure 3

CalWORKs Funding Sources

(Dollars in Millions)

|

2021‑22 |

2022‑23 |

Change From 2021‑22 |

||

|

Amount |

Percent |

|||

|

Federal TANF block grant funds |

$3,138 |

$2,786 |

‑$352 |

‑11% |

|

State General Fund |

745 |

1,320 |

575 |

77 |

|

Realignment and other county fundsa |

2,684 |

2,750 |

67 |

2 |

|

Totals |

$6,567 |

$6,857 |

$291 |

4% |

|

aPrimarily various realignment funds, but also includes county share of grant payments, about $60 million. |

||||

|

TANF = Temporary Assistance for Needy Families. |

||||

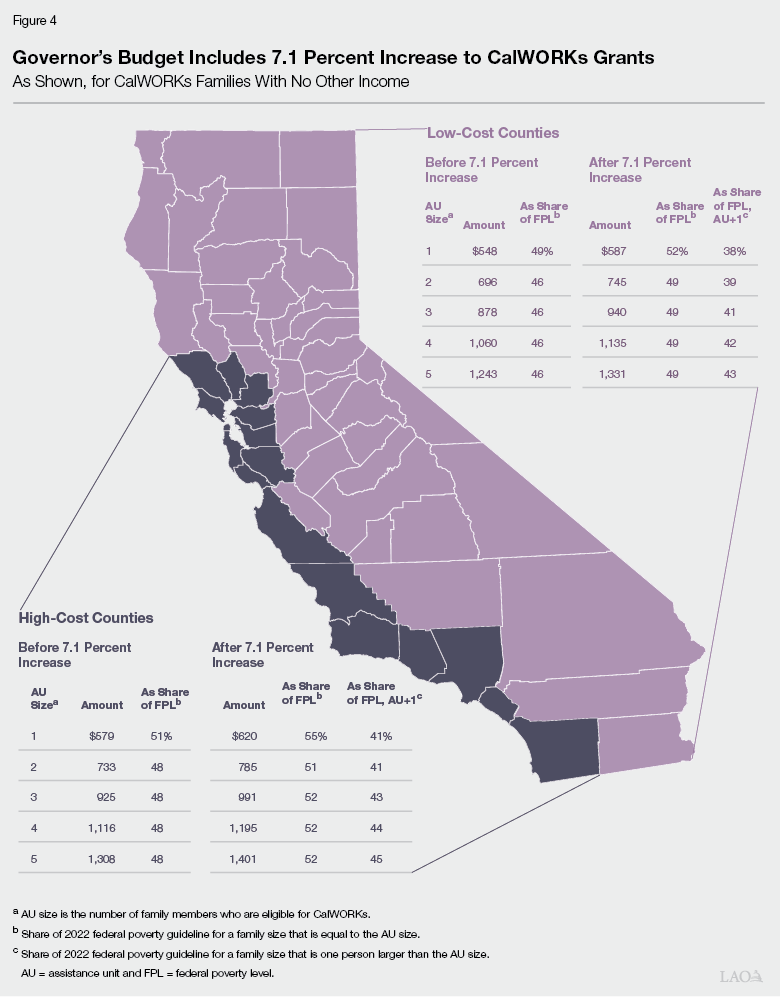

Budget Estimates 7.1 Percent Grant Increase Triggered by Local Revenue Growth. The administration estimates a budget year cost of $201 million (annual cost of $268 million) to fund a 7.1 percent increase to cash grants starting in October 2022. This increase was triggered and will be funded by revenue growth in the Child Poverty and Family Supplemental Subaccount. As part of the 2018‑19 Budget Act, the Legislature set a goal to increase CalWORKs grants to 50 percent of the federal poverty level for a family that is one person larger than the AU size. Figure 4 shows this increase would raise grants for all AU sizes in high‑cost counties to between 40 percent and 45 percent of the federal poverty level for a family one person larger than the AU size, and to slightly lower levels for families in lower‑cost counties. The administration has emphasized that this is their current estimate of the size of the grant increase that could be afforded by the subaccount, but that they will be updating (and possibly changing) the estimated size of the grant increase at the May Revision.

Administration’s Caseload, Grant Increase Forecasts Appear Reasonable. Our office independently forecasts CalWORKs caseload as well as grant increases triggered by growth in realignment revenue. Though our estimates for both figures have often diverged widely from the administration’s in the past, at this time, our two offices broadly agree on both forecasts. We will revisit both these forecasts in the spring when additional data are made available.