LAO Contact

September 26, 2022

The 2022-23 California Spending Plan

Judiciary and Criminal Justice

The 2022-23 budget provides $18.7 billion from the General Fund for judicial and criminal justice programs, including support for program operations and capital outlay projects, as shown in Figure 1. This is an increase of $852 million, or 5 percent, above the revised 2021-22 spending level.

Figure 1

Judicial and Criminal Justice Budget Summary

General Fund (Dollars in Millions)

|

2020‑21 |

2021‑22 |

2022‑23 |

Change from 2021‑22 |

||

|

Amount |

Percent |

||||

|

Department of Corrections and Rehabilitation |

$12,461 |

$13,862 |

$13,796 |

‑$66 |

‑0.5% |

|

Judicial Branch |

2,058 |

3,047 |

3,500 |

453 |

14.9 |

|

Department of Justice |

353 |

415 |

439 |

23 |

5.7 |

|

Board of State and Community Corrections |

178 |

412 |

782 |

371 |

90.1 |

|

Other Departmentsa |

108 |

159 |

229 |

70 |

44.1 |

|

Totals, All Departments |

$15,158 |

$17,894 |

$18,746 |

$852 |

4.8% |

|

aIncludes Office of the Inspector General, Commission on Judicial Performance, Victim Compensation Board, Commission on Peace Officer Standards and Training, State Public Defender, funds provided for trial court security, and debt service on general obligation bonds. |

|||||

|

Note: Detail may not total due to rounding. |

|||||

Judicial Branch

The budget provides $5.5 billion for the judicial branch in 2022-23—an increase of $415 million (8 percent) from the revised 2021-22 level. This amount includes $3.5 billion from the General Fund and $499 million from the counties, with most of the remaining balance from fine, penalty, and court fee revenues. The General Fund amount is a net increase of $453 million (15 percent) from the revised 2021-22 amount. Funding for trial court operations is the single largest component of the judicial branch budget, accounting for about 70 percent of total spending. In addition to the amounts above, the budget also includes $220 million in new or reauthorized lease revenue bond authority.

Judicial Council and State Courts. The budget provides Judicial Council and the state courts with a $64.2 million General Fund augmentation for various activities. This includes:

- $34.7 million in 2022-23 (increasing to $40.3 million annually beginning in 2025-26) for judicial branch information technology (IT) modernization projects.

- $15 million in 2022-23 (decreasing to $3.8 million annually beginning in 2023-24) for collecting, processing, analyzing, and reporting judicial branch data.

- $8.3 million for increased costs for the Courts of Appeal Court-Appointed Counsel Program.

- $6.2 million in 2022-23 (decreasing to $4 million annually beginning in 2023-24) for various other purposes—including $1.2 million for ongoing training, technical assistance, and legal support to courts on water, environment, and climate change legal issues.

Baseline Support for Trial Court Operations. The budget includes a $205 million General Fund augmentation in baseline support for trial court operations. This amount includes $100 million to increase funding equity between the trial courts. Specifically, these funds will be used to ensure that all trial courts have at least 84.5 percent of their workload budget needs met, as estimated by Judicial Council. The augmentation also includes $84.2 million to provide a 3.8 percent inflationary adjustment to address increased trial court operation costs. Finally, it includes $20.8 million for increased trial court health and retirement benefit costs. (We note the budget package also sets aside a similar amount to fund any further increases in the cost of these benefits that occur during 2022-23.)

New Judgeships. The budget includes $39.9 million General Fund in 2022-23 (decreasing to $39.1 million annually beginning in 2023-24) for 23 new trial court judgeships and associated staff. The judgeships will be allocated to individual trial courts based on workload need. (The budget package separately provides counties, who provide trial court security, $2.7 million General Fund in 2022-23—increasing to $3.2 million annually beginning in 2023-24—for security costs associated with these new judgeships.) As discussed in more detail below, the budget also includes funding to modify and build out courtrooms for these judgeships.

Backfill of Fine and Fee Revenue. The budget provides $256.8 million General Fund ($10 million one time) to backfill various declines in fine and fee revenue. This amount includes:

- $151.5 million to backfill an ongoing decline in various fine and fee revenues collected to support trial court operations. This is a $13 million increase from the revised backfill level in 2021-22.

- $77 million, on net, to backfill changes related to the civil assessment. State law authorizes a civil assessment for individuals who fail to pay court-ordered criminal fines and fees or appear without good cause. The budget package requires civil assessment revenues (about $100 million annually) be deposited into the state General Fund instead of the Trial Court Trust Fund. The budget package also changed state law to reduce the amount of civil assessment that could be imposed from a maximum of $300 to a maximum of $100. On net, these two changes require a $67 million backfill to maintain trial court funding levels. Additionally, the budget package waives civil assessments owed prior to July 2022 and provides $10 million one time to backfill the associated revenue loss.

- $18 million to backfill reduced civil fee revenue from increasing the threshold in various ways for lower-income individuals to automatically qualify for a waiver of such fees. For example, individuals who have a monthly income of 200 percent or less of the federal poverty level (rather than 125 percent previously) will now be eligible for automatic fee waivers.

- $10.3 million to backfill revenue losses related to 17 fees that were eliminated by Chapter 257 of 2021 (AB 177, Committee on Budget). The eliminated fees that impact the judicial branch are generally related to the collection of restitution or other criminal assessments.

Excess Property Tax Offset. The budget includes a $128.4 million reduction in General Fund support for trial court operations in 2022-23 in order to reflect the availability of property tax revenue in accordance with Control Section 15.45 and Section 2578 of the Education Code. Such funds are remitted to the state by counties that collect more property tax than state law allows them to spend on education. This reduction is $12.9 million greater than the revised 2021-22 level.

Other Budget Adjustments. The budget also includes various other General Fund augmentations. Some of the major adjustments include the following:

- $40 million one time for a court-based program to enforce court orders removing firearms and ammunition from those prohibited from possessing them—with the prioritization of prohibitions stemming from domestic violence and gun violence restraining orders as well as other civil orders. The program will operate at up to six trial courts to be selected by Judicial Council. Each court receiving funding is required to partner with at least one law enforcement agency within the county and to use at least 30 percent of its funding for law enforcement costs. Finally, the budget requires Judicial Council to report annually on the program and to contract for an external evaluation due no later than March 1, 2025.

- $33.2 million annually in 2022-23 and 2023-24 (decreasing to $1.6 million annually beginning in 2024-25) to implement and maintain remote access to court proceedings as required by Chapter 526 of 2021 (AB 716, Bennett). One-time funds will be used to upgrade courtroom audio and video capabilities.

- $30 million in increased support for dependency counsel, increasing total support to $186.7 million annually. The budget also authorizes up to an additional $30 million augmentation if federal reimbursements are lower than expected.

- $30 million one time for eviction-related legal services and assistance for renters in landlord-tenant rental disputes and homeowners facing foreclosure.

- $20 million annually in 2022-23 through 2024-25 for the California Court Appointed Special Advocate (CASA) Association to expand local CASA program capacity as well as to support recruitment, training, and data collection.

- $15 million one time for legal services and assistance to indigent individuals facing consumer debt-related issues during the COVID-19 pandemic.

- $5.9 million in 2022-23 (increasing to $37.7 million annually beginning in 2023-24) for court costs associated with implementing the new Community Assistance, Recovery, and Empowerment (CARE) Act program. This program would allow certain individuals to file a civil petition to seek a court-ordered plan for the provision of medication, housing, and other services to adults with certain severe mental illness. The courts would conduct hearings to oversee the preparation and implementation of, and compliance with such plans. The program would be phased in with implementation in seven counties by October 2023, and in all remaining counties by December 2024. This funding is contingent on the adoption of accompanying legislation through the legislative policy process. Such legislation was adopted through Chapter 319 of 2022 (SB 1338, Umberg).

Facilities. The budget provides a total of $111 million General Fund ($95.6 million one time) for various judicial branch facility modifications in 2022-23. This amount includes:

- $56.3 million one time for fire, life safety, and other modifications at three existing courthouses—two in San Diego County ($45 million) and one in Orange County ($11.3 million).

- $24.3 million one time to modify courthouses in seven counties (Fresno, Kern, Madera, Placer, Riverside, San Bernardino, and Stanislaus) to accommodate 17 of the 23 new judgeships included in the budget.

- $15.4 million to address increased trial court facility modification needs. The budget also includes $4 million in reimbursement authority to allow the judicial branch to receive payments from counties for the county share of facility modification project costs.

- $15 million one time to provide court users with access to lactation rooms in any courthouse in which a lactation room is provided for court employees.

The budget also includes spending for capital outlay projects. Specifically, it includes $161.4 million one-time General Fund to support various projects. This amount includes $131.8 million for pre-construction activities for five new projects (Fresno, Los Angeles Santa Clarita, Plumas Quincy, San Luis Obispo, and Solano). It also includes $29.6 million to build out empty courtrooms in four counties (Kings, Sacramento, San Joaquin, and Sutter) to accommodate 5 of the 23 new judgeships included in the budget. Additionally, the budget includes $238 million one time in new and reauthorized authority for pre-construction and construction activities for seven previously approved projects. This amount consists of $18 million from the General Fund for four projects (Butte Juvenile Hall, Monterey Fort Ord, San Bernardino Juvenile Dependency, and Shasta Redding) and $220 million in lease revenue bond authority for three projects (Lake Lakeport, Mendocino Ukiah, and Stanislaus Modesto). We note that much capital-related spending—both in the judicial branch and other areas of the budget—is excluded from the state appropriations limit. (For more on this, please see our State Appropriations Limit Spending Plan post.)

California Department of Corrections and Rehabilitation

The budget provides $14.4 billion (mostly from the General Fund) for the California Department of Corrections and Rehabilitation (CDCR). This is a net decrease of $22 million (less than one-half of 1 percent) from the revised 2021-22 level. This decrease primarily reflects reduced costs associated with responding to COVID-19. This reduced spending is partially offset by additional spending, including (1) one-time funding for capital outlay projects, (2) an ongoing augmentation to expand and modify substance use disorder treatment in state prisons, and (3) an ongoing augmentation to account for increased utilization of leave by correctional staff. (The net decrease in spending does not reflect growth in employee compensation costs in 2022-23 because such costs are accounted for elsewhere in the budget.) In addition to the amounts above, the budget package also reflects (1) $29.5 million in increased lease revenue bond authority for one existing project, and (2) $100 million in reduced lease revenue bond authority due to the cancellation of one previously authorized project.

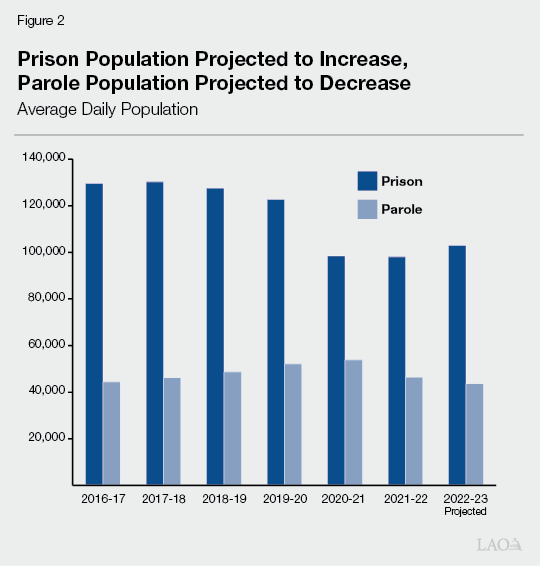

Adult Correctional Population. Figure 2 shows the recent and projected changes in the prison and parole populations. As shown in the figure, the prison population is projected to increase by about 4,900 (5 percent) from 98,000 in 2021-22 to 102,900 in 2022-23. The parole population is projected to decrease by about 2,900 (6 percent) from 46,500 in 2021-22 to 43,600 in 2022-23.

Health Care. The budget includes various augmentations related to correctional health care. Some of the major adjustments include the following:

- $240.1 million one time ($198.9 million California Emergency Relief Fund [CERF] and $41.2 million in reimbursement authority) for COVID-19 response and mitigation‑related activities, such as testing and vaccine distribution. (We note that CERF is supported exclusively by transfers from the General Fund.)

- $126.6 million General Fund in 2022-23 (increasing to $162.5 million in 2024-25 and ongoing) to expand the number of people assessed and treated through the existing Integrated Substance Use Disorder Treatment Program. The funding will also support various modifications to the program, such as new programming and treatment options.

- $47.1 million General Fund in 2022-23, $76.3 million in 2023-24, and $40.4 million in 2024-25 to treat Hepatitis C patients.

- $10.6 million net increase to implement the California Advancing and Innovating Medi-Cal (CalAIM) Justice-Involved Initiative within CDCR. This net increase results from a $12.9 million increase in reimbursement authority in 2022-23 (increasing to $40.5 million by 2026-27 and ongoing) offset by a $2.3 million General Fund reduction in 2022-23 (increasing to a $29.9 million reduction by 2026‑27 and ongoing). The CalAIM Justice-Involved Initiative seeks to provide targeted Medi-Cal services to eligible people 90 days prior to release from prison. (For more information about CalAIM, please see our Health spending plan post.)

- $8.6 million in 2022-23 (increasing to $10.5 million in 2024-25 and ongoing) to expand the California Prison Industry Authority’s Healthcare Facilities Maintenance program, which provides janitorial services to prison health care facilities.

Funding to Address Staff Misconduct. The budget includes $97.6 million General Fund in 2022-23 and $7.8 million in 2023-24 and ongoing to install and operate fixed video surveillance cameras at ten prisons and deploy body-worn cameras on officers at four prisons. The department expects that these cameras will help provide objective evidence related to allegations of staff misconduct in addition to other operational benefits. The budget also includes $35.4 million General Fund in 2022-23 (increasing to $36.8 million in 2023-24, and generally decreasing to $34 million annually by 2026-27) for CDCR to revise its process for handling allegations of staff misconduct made by people in prison or on parole, as well as members of the public. (As discussed further below, the budget also provides funding for the Office of the Inspector General [OIG] to oversee this revised process.) In addition, the budget includes $6.2 million General Fund in 2022-23 (increasing to $11.8 million in 2025-26 and ongoing) for CDCR to conduct more timely and thorough investigations into staff misconduct reported by employees and to strengthen the department’s staff discipline process.

Rehabilitation-Related Funding. The budget provides various General Fund augmentations related to rehabilitation. These include (1) $40 million annually for three years to expand capacity in residential facilities in the community that provide rehabilitative programming to eligible people nearing the end of their sentences or on parole; (2) $20 million one time to establish the Rehabilitative Investment Grants for Healing and Transformation program in order to expand capacity of community-based organizations that provide in-prison programming; (3) $10.6 million annually for three years to continue the Returning Home Well Program, which provides emergency transitional housing services to people on parole; and (4) $4 million annually in 2022-23 and in 2023-24 and $2 million in 2024-25 for community providers to deliver restorative justice programming in prisons.

Other Budget Adjustments. The budget also includes various other General Fund adjustments. Some of the major adjustments include:

- $29.2 million to account for increased utilities and waste removal costs. On an ongoing basis, the department’s utilities and waste removal funding will be adjusted to account for future cost changes using the California Consumer Price Index.

- $19.5 million in 2022-23 (decreasing to $1.4 million in 2023-24 and ongoing) to develop an IT system for centrally storing records—including e‑mails, personnel files, video, and audio recordings—which CDCR may be required to release under various circumstances, such as pursuant to the California Public Records Act or due to litigation.

- $12.6 million in 2022-23 (increasing to $18.5 million in 2023-24 and decreasing to $1.7 million in 2024-25 and ongoing) to install new cellphone interdiction technology at 20 prisons.

- $11.5 million in 2022-23 (increasing to $16.1 million in 2023-24, and $17.5 million in 2024-25 and ongoing) to cover the cost of a statewide contract for certain software applications, including e-mail and data storage.

- $9.5 million ongoing to support temporary light-duty or modified work assignments for staff who have temporary medical conditions that prevent them from being able to perform one or more essential functions of their regular positions.

Facilities. The budget provides two General Fund augmentations for facility improvements at various prisons: (1) $2 million in 2022-23 and $71 million in 2023-24 to replace roofs at two prisons, and (2) $22.2 million one time for accessibility improvements at four prisons.

The budget also includes an additional $407.8 million General Fund to support various capital outlay projects. This includes (1) $182.4 million to replace the heating, ventilation, and air conditioning system at Ironwood State Prison in Blythe, which was previously approved to be financed with lease revenue bonds; (2) $82.9 million for the construction of a jail in Monterey County, which was previously approved to be financed with lease revenue bonds; (3) $67.6 million in increased funding for ongoing construction of health care facilities at various prisons; (4) $15.3 million to construct a new cognitive behavioral treatment classroom at the California State Prison, Sacramento in Represa; and (5) $14.3 million to construct air cooling infrastructure in certain housing units at the Substance Abuse Treatment Facility and State Prison in Corcoran.

The budget includes an additional $29.5 million in lease revenue bond authority to construct a 50-bed mental health crisis facility at the California Institution for Men in Chino. This brings the total lease revenue bond authority for the construction of the project to $120.6 million. In addition, the budget package reflects a $100 million reduction in lease revenue bond authority, which was previously intended to support the construction of a jail in Los Angeles County. (We note that the budget instead provides $100 million General Fund for Los Angeles County to support access to community-based treatment and housing for individuals found incompetent to stand trial for misdemeanor charges. For more information, please see our Health spending plan post.)

Department of Justice

The budget provides $1.2 billion for the Department of Justice (DOJ) in 2022-23—an increase of $18.5 million (2 percent) from the revised 2021-22 level. This amount includes $439 million from the General Fund—a net increase of $23 million (6 percent). (The net increase does not reflect changes in employee compensation costs in 2022-23 because such costs are accounted for elsewhere in the budget.)

Bureau of Forensic Service (BFS). The budget includes $35.4 million one-time General Fund to backfill a decline in criminal fine and fee revenue used to support BFS. It also authorizes the Director of the Department of Finance to augment this backfill if additional monies are needed to maintain BFS operations.

Legal Resources. The budget includes $24.4 million in 2022-23 (decreasing to $18 million annually beginning in 2027-28) from the General Fund and various special funds for additional legal resources. These resources will support increased oversight of Medi-Cal fraud and charities as well as the implementation of various enacted legislation (such as legislation related to criminal resentencing). This amount includes a $7.8 million augmentation in 2022-23 (decreasing to $7.1 million annually beginning in 2023-24) from the General Fund, the False Claims Act Fund, and federal funds for increased resources for the Medi-Cal Fraud and Elder Abuse Program.

Law Enforcement Activities. The budget includes $21.1 million General Fund in 2022-23 (decreasing to $13.8 million annually beginning in 2026-27) for various law enforcement-related activities. These include the following:

- $7.8 million in 2022-23 (decreasing to $6.7 million ongoing beginning in 2023-24) for regional task forces to address fentanyl manufacturing, distribution, and trafficking by organized criminal enterprises. The budget authorizes DOJ to coordinate with the Department of Health Care Services and the Military Department to support these task forces.

- $6 million annually in 2022-23 through 2024-25 (generally decreasing to $500,000 annually beginning in 2026-27) for the investigations and prosecutions of organized retail crime.

- $5 million to maintain the DOJ Task Force Program. The budget also requires DOJ submit a report assessing the program by April 2023.

- $2.3 million in 2022-23 (decreasing to $1.6 million annually beginning in 2023-24) for continued implementation of Chapter 326 of 2020 (AB 1506, McCarthy). This augmentation supports additional investigative personnel and equipment for DOJ investigations (and potential prosecutions) of police officers who are involved in shootings that resulted in the death of an unarmed citizen. This augmentation increases total funding for such purposes to $17.9 million in 2022-23.

Firearms. The budget provides a total of $8 million in 2022-23 (decreasing to $1.5 million annually beginning in 2025-26)—mostly from the Dealers Record of Sale (DROS) Special Account—for the maintenance of firearm technology systems and the implementation of firearm-related legislation. This amount includes $5.2 million one-time DROS for the next phase of a technology project to modernize the state’s firearms systems.

Other Budget Adjustments. The budget includes various other General Fund adjustments. Some of the notable adjustments include:

- $5 million one time for grants to Girl Scouts Councils in California for background checks of volunteers.

- $4.5 million in 2022-23 (decreasing to $2.2 million annually beginning in 2023‑24) for the final implementation and ongoing maintenance of a tiered sex offender registry as required by Chapter 541 of 2017 (SB 384, Wiener and Anderson).

- $2.5 million one time to support the work of the state’s Reparations Task Force created by Chapter 319 of 2020 (AB 3121, Weber).

Board of State and Community Corrections

The budget provides $1 billion for the Board of State and Community Corrections (BSCC) in 2022-23—an increase of $331 million (48 percent) from the revised 2021-22 level. This amount includes $782 million from the General Fund—a net increase of $371 million (90 percent). This increase is primarily due to limited-term funding provided in 2022-23 for various grant programs.

Grant Funding. The budget includes General Fund augmentations for BSCC to administer various grant programs. These include:

- $100 million one time to counties to fund renovations, repairs, and improvements to county juvenile facilities.

- $85 million annually for three years to support competitive grants for local law enforcement to combat organized retail, motor vehicle, and cargo theft.

- $50 million one time for grants to city and county law enforcement agencies to support officer wellness and mental health.

- $25 million one time to support competitive grants to local law enforcement agencies for gun buyback programs.

- $20.9 million one time to assist counties with the temporary increase in the population served by county probation departments due to expedited prison releases resulting from Proposition 57 (2016).

- $20 million one time to support a competitive grant program for county probation departments to establish mobile probation service centers.

- $20 million annually for three years for the Adult Reentry Grant program, which provides competitive grants to community-based organizations to support reentry of people released from state prison.

- $10 million annually for three years to support competitive grants to local prosecutors for vertical prosecution of organized retail theft.

- $10 million one time to specified local law enforcement agencies to support a use of force and de-escalation training pilot program for officers.

The budget package also requires BSCC to oversee $45.2 million in grant funds allocated through Control Section 19.56 for various purposes generally related to public safety. This includes $10 million for the Medication-Assisted Treatment (MAT) grant program, which supports MAT substance use treatment services at the county level. The remaining funds are allocated directly to individual local governments and community-based organizations for specific purposes, such as upgrading infrastructure. (For more information on Control Section 19.56, please see the “Targeted Legislative Augmentations” section of our Other Provisions spending plan post.)

Conversion of Jail Construction Financing to General Fund. The budget includes $81.5 million General Fund for the construction of a jail in Fresno County, which was previously approved to be financed with lease revenue bonds. The lease revenue bond authority was awarded to Fresno County through Chapter 42 of 2012 (SB 1022, Committee on Budget and Fiscal Review).

Other Criminal Justice Programs

Allocation of County Backfill Due to Repeal of Criminal Justice-Related Fees. The budget includes $50 million to provide counties with a backfill related to revenues lost from the elimination of 17 fees by Chapter 257 of 2021 (AB 177, Committee on Budget). These fees are generally related to diversion programs as well as to the collection of restitution or other criminal assessments. Funding will be allocated based on each county’s share of the state’s adult population, felony and misdemeanor arrests, and felony and misdemeanor filings. The budget package also requires annual reporting on how such funding was spent as well as one-time reporting on the revenue loss for each individual fee eliminated.

Victim Compensation Board. The budget package includes additional funding and changes related to victim services. For example, the budget provides $23 million one time from the General Fund to support existing Trauma Recovery Centers (TRCs) and to establish a pilot program to operate satellite TRCs in hard-to-reach and/or rural areas. In addition, the budget provides a $7 million augmentation in federal fund authority to reflect an increase in the amount of federal reimbursement the state receives for qualifying victim service expenditures. This funding will be used in various ways, including to increase victim compensation benefit limits for crime scene cleanup costs to $1,709 (from $1,000), funeral and burial costs to $12,818 (from $7,500), and relocation claims to $3,418 (from $2,000).

The budget package also includes additional funding and changes related to the board’s program to compensate people erroneously convicted of a crime. For example, the budget provides a $7 million ongoing General Fund augmentation for the program and statutory changes intended to expedite the award process.

Finally, the budget package includes language that would make various changes affecting the board beginning in 2024-25, contingent on sufficient General Fund resources to support the changes being provided in the 2024-25 budget. These include the following:

- Various changes in victim compensation benefits including (1) increased limits for funeral and burial costs to $20,000, relocation claims to $7,500, and total award size to $100,000 (from $70,000); (2) removal of the reimbursement limit for victims receiving outpatient mental health care; and (3) expansion in eligibility for income loss benefits.

- Changes to the erroneous conviction program that would (1) provide compensation of $70 per day served on parole or supervised release, and (2) annually increase for inflation the existing $140 paid for each day of incarceration and the new $70 per day rate to be paid for parole or supervised release.

- Changes to eliminate restitution fines—criminal fines that are deposited in the Restitution Fund, a key source of support for the board—and backfill the resulting loss in revenue to the fund.

Commission on Peace Officer Standards and Training (POST). The budget provides $22.6 million from the General Fund in 2022‑23 (decreasing to $20.6 million in 2023‑24 and ongoing) to implement Chapter 409 of 2021 (SB 2, Bradford and Atkins). Senate Bill 2 creates a process by which peace officer certification can be suspended or revoked in instances of misconduct, including establishing a Peace Officer Standards Accountability Division within POST. In addition, the budget provides $5 million one time from the General Fund for POST to develop law enforcement wellness programs, training, and research.

OIG. The budget provides an $8.2 million augmentation in 2022-23 (increasing to $15.4 million in 2023-24 and ongoing) to allow OIG to monitor the revised CDCR process for handling staff misconduct allegations. The budget also provides $3.9 million ongoing for additional staff for OIG medical inspections.