LAO Contact

February 13, 2023

The 2023-24 Budget

Proposed Budget Solutions in Transportation Programs

Summary

Governor Proposes $4 Billion in Multiyear Budget Solutions From Transportation Programs. In response to the multibillion‑dollar budget problem the state is facing, the Governor’s 2023‑24 budget proposes $4 billion in multiyear budget solutions from the recent General Fund augmentations provided to transportation programs in the 2022‑23 budget package. The Governor relies on three main strategies to provide General Fund relief from transportation programs: (1) $2.2 billion in program reductions, (2) $1.3 billion in funding delays, and (3) $500 million in cost shifts to other funding sources. Overall, the Governor’s budget would sustain $8.7 billion, or 80 percent, of the $10.9 billion in total augmentations intended for transportation programs. The Governor also proposes language that would allow $1 billion of the proposed reductions in the budget year to be administratively restored in January 2024. This would only occur if the administration determines that budget resources are able to support the state’s baseline costs and all of the programs selected for the “trigger restoration,” which total $3.8 billion across the budget.

Recommend Legislature Direct Administration Not to Prematurely Solicit Applications and Award Program Funding. While the 2022‑23 budget package included the intent to provide funding for transportation programs in 2023‑24 and future years, the authority to spend this funding still is contingent on each year’s annual budget legislation and, therefore, has not yet been provided to the corresponding departments. Despite this absence of spending authority, in certain cases, departments are prematurely taking steps to allocate these funds for specific projects. We find that these actions limit the Legislature’s ability to solve the current budget problem by creating a dynamic where the Legislature would then need to consider whether it should cut funding that local agencies (1) had already applied for and/or (2) had already been promised. Accordingly, we recommend the Legislature direct the administration to not prematurely solicit applications and award program funding before the Legislature grants spending authority.

Recommend Legislature Adopt Package of Transportation Budget Solutions Based on Its Priorities, Including Identifying Additional Options in Case They Are Needed. We recommend the Legislature develop its own package of budget solutions based on its highest priorities and guiding principles. In several cases, we find the Governor’s proposals to be reasonable, but so too would alternative decisions the Legislature could make instead of or in addition to the Governor’s selections. Given the distinct possibility of worse fiscal conditions, we also recommend the Legislature begin to prepare now for the likely need to solve for a deeper revenue shortfall when it adopts its final budget this summer. Finally, we recommend the Legislature reject the Governor’s trigger restoration proposal. We find that the trigger is unlikely to occur and minimizes the Legislature’s authority and flexibility to respond to changing revenue conditions and evolving spending priorities.

Introduction

In response to the multibillion‑dollar budget problem the state is facing, the Governor’s 2023‑24 budget proposes $4 billion in multiyear budget solutions from the recent General Fund augmentations provided to transportation programs. In this brief we (1) provide background on the recent funding augmentations in transportation from both state and federal funds, as well as on the state’s budget problem; (2) describe the Governor’s proposed transportation budget solutions; (3) discuss our assessment of the Governor’s proposals; and (4) offer recommendations for how the Legislature could craft its own package of solutions, including suggestions for potential additional reductions should the budget condition make them necessary.

Background

Overview of California’s Transportation System. California’s transportation system consists of streets, highways, railways, airports, seaports, bicycle routes, and pedestrian pathways. All of these various modes provide people and businesses the ability to access destinations and move goods and services throughout the state. Funding for the state’s transportation system comes from numerous local, state, and federal sources, as well as private investments. State funding primarily comes from various fuel taxes and vehicle fees that are dedicated to specified transportation purposes. In 2023‑24, total state transportation funding from these sources is estimated to be $14.7 billion. (This does not include revenues from vehicle fees that support the Department of Motor Vehicles and the California Highway Patrol.) Most of this funding is dedicated to maintaining, rehabilitating, and improving state highways and local streets and roads, with a smaller amount supporting transit operations and capital improvements.

State Provided $6.1 Billion in General Fund Augmentations for Transportation in 2022‑23. As shown in Figure 1, the 2022‑23 budget package provided $6.1 billion from the General Fund across 2021‑22 and 2022‑23 for various departments to implement activities intended to support the state’s transportation system. This included $5.4 billion as part of a Transportation Infrastructure Package and $670 million in a Supply Chain Package. (Not displayed in the figure, the Transportation Infrastructure Package also provided essentially all of the remaining unappropriated Proposition 1A bond funds—$4.2 billion—for the high‑speed rail project in 2021‑22.) Both packages also included agreements to provide additional General Fund in the outyears—including $2.8 billion in 2023‑24—for a five‑year total of $10.9 billion. These total amounts represent a significant dedication of General Fund resources for transportation programs, which historically have been supported primarily by state special funds (made up of revenues from fuel taxes and vehicle fees) and federal funding. Figure 2 provides a brief description of the programs that were augmented as part of the 2022‑23 budget package.

Figure 1

Recent and Planned Augmentations for Transportation Programs

General Fund (In Millions)

|

Program |

Department |

2021‑22a |

2022‑23 |

2023‑24 |

2024‑25 |

2025‑26 |

Totals |

|

Transportation Infrastructure Package |

$5,400 |

— |

$2,100 |

$2,000 |

— |

$9,500 |

|

|

TIRCP |

CalSTAb |

$3,650c |

— |

— |

— |

— |

$3,650 |

|

Active Transportation Program |

Caltransd |

1,050 |

— |

— |

— |

— |

1,050 |

|

Grade separation projects within TIRCP |

CalSTA/Caltranse |

350 |

— |

— |

— |

— |

350 |

|

Local climate adaptation programs |

Caltransb |

200 |

— |

— |

— |

— |

200 |

|

Highways to Boulevards Pilot Program |

Caltrans |

150 |

— |

— |

— |

— |

150 |

|

Population‑based TIRCP |

CalSTA |

— |

— |

$2,000 |

$2,000 |

— |

4,000 |

|

Clean California Local Grant Program |

Caltrans |

— |

— |

100 |

— |

— |

100 |

|

Supply Chain Package |

— |

$670 |

$650 |

$50 |

$10 |

$1,380 |

|

|

Port and Freight Infrastructure Program |

CalSTA |

— |

$600 |

$600 |

— |

— |

$1,200 |

|

Supply chain workforce campus |

CWDB |

— |

30 |

40 |

$40 |

— |

110 |

|

Port operational improvements |

GO‑Biz |

— |

30 |

— |

— |

— |

30 |

|

Increased commercial driver’s license capacity |

DMV |

— |

10 |

10 |

10 |

$10 |

40 |

|

Totals |

$5,400 |

$670 |

$2,750 |

$2,050 |

$10 |

$10,880 |

|

|

aFunding provided in summer 2022 but accounted for as part of 2021‑22 budget. bCTC also provided small amount of total funding in 2022‑23 and 2023‑24 for administrative‑related activities. cIncludes $300 million dedicated to adapting certain rail lines to sea‑level rise, as well as $1.8 billion for projects in Southern California and $1.5 billion for projects in Northern California. dCTC also has role in allocating funding to projects. eCalSTA is responsible for awarding funds, but a portion of funding is included in Caltrans’ budget to reflect awards to projects on the state highway system. |

|||||||

|

TIRCP = Transit and Intercity Rail Capital Program; CalSTA = California State Transportation Agency; Caltrans = California Department of Transportation; CWDB = California Workforce Development Board; Go‑Biz = Governor’s Office of Business and Economic Development; DMV = Department of Motor Vehicles; and CTC = California Transportation Commission. |

|||||||

Figure 2

Overview of Recently Augmented Transportation Programs

|

Program |

Description |

|

Transportation Infrastructure Package |

|

|

Transit and Intercity Rail Capital Program (TIRCP) |

Competitive program that funds transit and intercity rail improvements that reduce greenhouse gas emissions, vehicle miles traveled, and congestion. |

|

Active Transportation Program |

Competitive program that funds projects that encourage the use of active modes of transportation such as biking and walking. |

|

Grade separation projects with TIRCP |

Recent budget set‑aside within TIRCP for projects that create a physical separation between railroad tracks and roadways, generally to improve safety. |

|

Local climate adaptation programs |

Includes (1) a new competitive program that funds capital projects that adapt transportation infrastructure to climate change and (2) a resumption of a competitive program that funds the development of climate adaptation plans. |

|

Highways to Boulevards Pilot Program |

New competitive pilot program that funds the planning or implementation of projects that convert or transform underutilized state highways. |

|

Population‑based TIRCPa |

New set‑aside within TIRCP that provides formula funding directly to regional agencies to fund transit and intercity rail improvements that reduce greenhouse gas emissions, vehicle miles traveled, and congestion. |

|

Clean California Local Grant Program |

Competitive program initiated in 2021‑22 that funds litter abatement and beautification projects. |

|

Supply Chain Package |

|

|

Port and Freight Infrastructure Program |

New competitive program that funds projects that improve the movement of goods to and from ports. |

|

Supply chain workforce campus |

Funding to establish a new workforce training campus at the Port of Los Angeles. |

|

Port operational improvements |

New competitive program that funds operational and process improvements at ports. |

|

Increased commercial driver’s license capacity |

Funding for the Department of Motor Vehicles to temporarily increase the state’s capacity to issue commercial driver’s licenses by leasing space to establish dedicated commercial drive test centers. |

|

aChapter 71 of 2022 (SB 198, Committee on Budget and Fiscal Review) included statutory language indicating that this specific augmentation for TIRCP should be allocated to regional agencies based on population. |

|

Federal Infrastructure Investment and Jobs Act (IIJA) Providing Additional Funding for California. In November 2021, the federal government enacted IIJA, which authorized $1.2 trillion across federal fiscal years 2022 to 2026 for various types of infrastructure, such as transportation, water, and energy. Within IIJA, a new five‑year federal surface transportation reauthorization replaced the expired Fixing America’s Surface Transportation (FAST) Act. In total, IIJA authorized $567 billion in spending for federal transportation programs over the five‑year period. Funding will go towards both existing and new federal transportation programs (formula and competitive) that support highways, transit, rail, and freight.

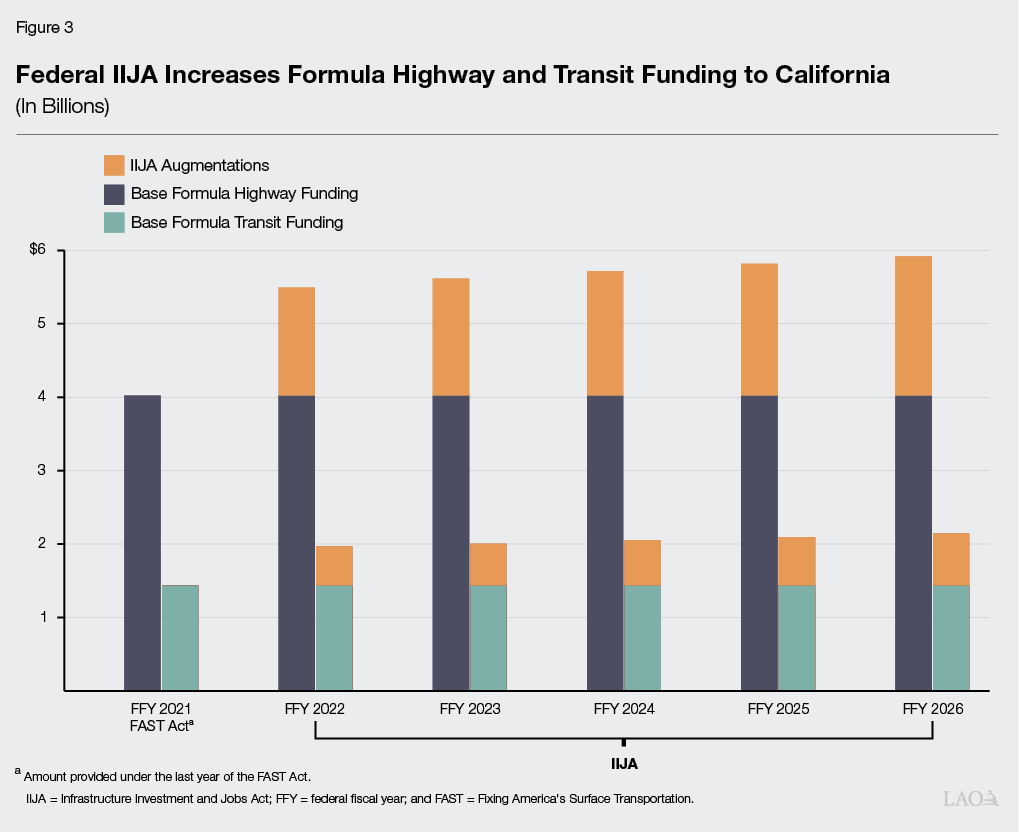

As shown in Figure 3, IIJA will provide the state with a significant increase in formula transportation funding when compared to FAST Act levels—with funding steadily increasing each year over the five‑year period. Specifically, the state is expected to receive a total of $28.6 billion in formula highway funding over the five‑year period, or about $5.7 billion annually. This represents an average annual increase of $1.7 billion, or $8.5 billion more across the five years, compared to FAST Act levels. Formula highway funding is allocated through the state budget process through the California Department of Transportation (Caltrans). Of this amount, 60 percent is used for state activities—such as highway maintenance and rehabilitation—and 40 percent is apportioned to local agencies to address local transportation system needs.

In addition to highway funds, the state is expected to receive a total of $10.3 billion in formula transit funding over the five‑year period, or about $2.1 billion annually. As displayed in Figure 3, this represents an average annual increase of $620 million, or $3.1 billion more across the five years, compared to FAST Act levels. Most of this funding does not flow through the state budget and is provided directly to local agencies. Formula transit funding from the federal government generally focuses on capital improvements, but can also be used for operating expenses under certain circumstances.

State Faces a Multibillion‑Dollar Budget Problem. Due to a deteriorating revenue picture relative to expectations from June 2022, both our office and the administration have anticipated that the state faces a budget problem in 2023‑24. A budget problem—also called a deficit—occurs when funding for the upcoming budget is insufficient to cover the costs of currently authorized services. Estimates of the magnitude of this shortfall differ based on how “baseline” spending is defined—the administration estimates a $22 billion problem whereas our office estimates that the Governor’s budget addresses an $18 billion problem. Regardless of these technical definitions, it is clear that—absent a major and unexpected jump in state revenues—the state faces the task of “solving” the budget problem. The Governor proposes to address the problem primarily through reducing spending, and targets the climate, resources, environment, and transportation policy areas for the largest proportional share of these solutions. We discuss the overall budget condition in our recent report, The 2023‑24 Budget: Overview of the Governor’s Budget.

Budget Outlook Could Actually Be Even Worse. While the administration estimates that the Governor’s proposal would balance the state budget for the coming year, it projects operating deficits of $9 billion in 2024‑25, $9 billion in 2025‑26, and $4 billion in 2026‑27. That is, if the Governor’s budget projections are accurate, the state would have to address deficits of these amounts in each of these future years. Moreover, our office’s estimates suggest there is a good chance that revenues will be lower than the administration’s projections for 2022‑23 and 2023‑24. Given this downside risk, in our overview report we recommend that the Legislature (1) plan for a larger budget problem and (2) address this larger problem by reducing more one‑time and temporary spending.

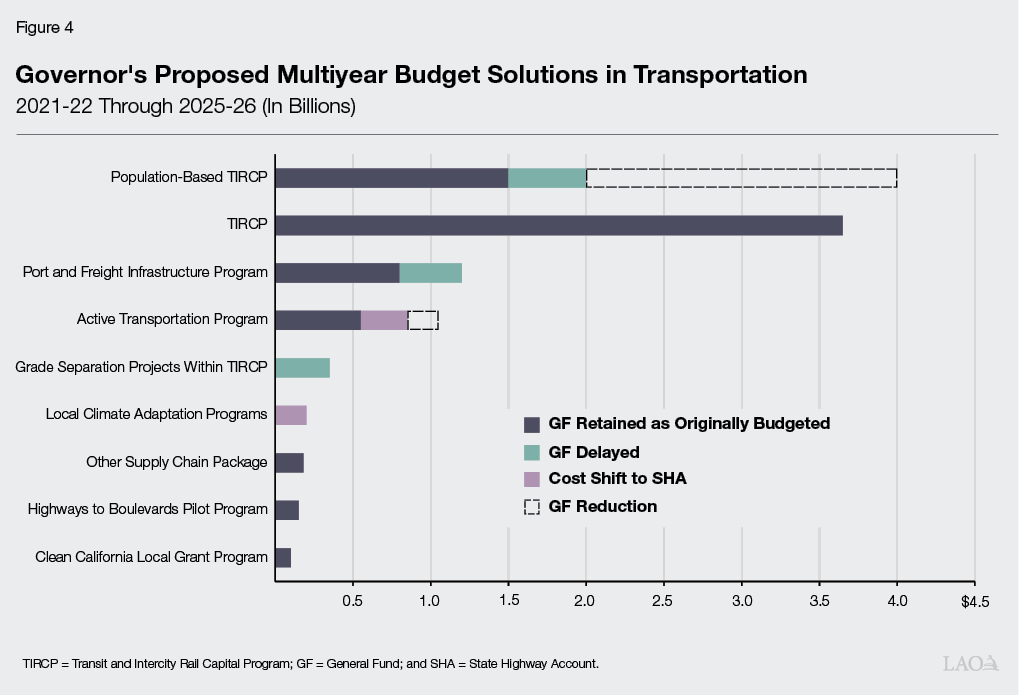

Governor’s Proposals

Proposes Several Multiyear Budget Solutions in Transportation. The Governor proposes about $4 billion in multiyear budget solutions from transportation programs—all coming from the recent General Fund augmentations for transportation in the 2022‑23 budget package. As shown in Figure 4, the Governor relies on three main strategies to provide General Fund relief: (1) $2.2 billion in reductions (reduces or eliminates funding for a program), (2) $1.3 billion in delays (shifts funding for a program with the intent of providing the same amount in a specified future year), and (3) $500 million in cost shifts (reduces or eliminates the General Fund for a program, but backfills it with funding from a different source).

Proposed Solutions Affect Multiple Programs. In total, the Governor’s budget would sustain $8.7 billion, or 80 percent, of the total augmentations intended for transportation programs. The proposed multiyear solutions would affect several programs in various ways. Figure 5 provides an overview of the solutions, which we describe in more detail below. The net programmatic effect of the Governor’s proposed solutions across the five years is a funding reduction of $2.2 billion. As shown in the figure, the Governor would leave planned funding for several transportation programs unaffected, including the largest single appropriation ($3.7 billion for the Transit and Intercity Rail Capital Program, or TIRCP), as well as some funding not yet provided but intended for the budget year (such as $100 million for the Clean California Local Grant Program). (The Governor also does not propose any changes to the $4.2 billion in Proposition 1A bond funds provided to the high‑speed rail project in summer 2022.) The specific solutions proposed by the Governor include:

- Population‑Based TIRCP. The Governor proposes to (1) reduce funding in 2023‑24 by $1 billion, (2) reduce funding in 2024‑25 by $1 billion, and (3) delay $500 million from 2024‑25 to 2025‑26. This would have the net effect of halving the intended support for the program ($2 billion instead of $4 billion) along with extending the timing of when the remaining amounts are provided.

- Active Transportation Program (ATP). The Governor proposes to (1) reduce the amount of General Fund provided by $500 million and (2) partially backfill this decrease with $300 million from the State Highway Account (SHA). (SHA is largely supported by fuel excise taxes and primarily is used to fund highway maintenance and rehabilitation projects.) This would result in a net reduction of $200 million for ATP in 2022‑23. However, because the full $500 million has already been awarded for specific projects, the administration indicates that it would apply the proposed $200 million reduction to future ATP grant‑award cycles, resulting in fewer projects in the outyears. (The administration would use other ATP funds and cash‑management strategies to delay the impacts of the reduction and avoid disruption for current projects.)

- Grade Separation Projects. The Governor proposes to delay the full amount provided—$350 million—to 2025‑26. This program is a set‑aside within the non‑population‑based TIRCP.

- Local Climate Adaptation Programs. The Governor proposes to shift the full $200 million provided to these programs from the General Fund to SHA in 2022‑23.

- Port and Freight Infrastructure Program. The Governor proposes to delay a portion of the $600 million scheduled for 2023‑24. This would be done by maintaining $200 million in 2023‑24 and providing additional allotments of $200 million in both 2024‑25 and 2025‑26.

Figure 5

Governor’s Proposed Changes to Transportation Funding

(In Millions)

|

Program |

Department |

Total |

Proposed Changes |

New |

|||

|

2021‑22 |

2023‑24 |

2024‑25 |

2025‑26 |

||||

|

Transportation Infrastructure Package |

$9,500 |

‑$1,050 |

‑$500 |

‑$1,500 |

$850 |

$7,300 |

|

|

Population‑based TIRCP |

CalSTA |

$4,000 |

— |

‑$1,000 |

‑$1,500 |

$500b |

$2,000 |

|

TIRCP |

CalSTA |

3,650 |

— |

— |

— |

— |

3,650 |

|

Active Transportation Program |

Caltrans |

1,050 |

‑$500 |

300a |

— |

— |

850 |

|

Grade separation projects with TIRCP |

CalSTA/Caltrans |

350 |

‑350 |

— |

350b |

350 |

|

|

Local climate adaptation programs |

Caltrans |

200 |

‑200 |

200a |

— |

— |

200 |

|

Highways to Boulevards Pilot Program |

Caltrans |

150 |

— |

— |

— |

— |

150 |

|

Clean California Local Grant Program |

Caltrans |

100 |

— |

— |

— |

— |

100 |

|

Supply Chain Package |

$1,380 |

— |

‑$400 |

$200 |

$200 |

$1,380 |

|

|

Port and Freight Infrastructure Program |

CalSTA |

$1,200 |

— |

‑$400 |

$200 |

$200 |

$1,200 |

|

Supply chain workforce campus |

CWDB |

110 |

— |

— |

— |

— |

110 |

|

Commercial driver’s license capacity |

DMV |

40 |

— |

— |

— |

— |

40 |

|

Port operational improvements |

GO‑Biz |

30 |

— |

— |

— |

— |

30 |

|

Totals |

$10,880 |

‑$1,050 |

‑$900 |

‑$1,300 |

$1,050 |

$8,680 |

|

|

aFunding shifted to State Highway Account. bDelayed from a prior year. |

|||||||

|

Note: All amounts are General Fund unless specified. |

|||||||

|

TIRCP = Transit and Intercity Rail Capital Program; CalSTA = California State Transportation Agency; Caltrans = California Department of Transportation; CWDB = California Workforce Development Board; DMV = Department of Motor Vehicles; and Go‑Biz = California Governor’s Office of Business and Economic Development. |

|||||||

Proposes Trigger Restoration for Population‑Based TIRCP Reduction Should State Revenues Rebound. The Governor’s budget includes language that would allow the proposed $1 billion reduction to the population‑based TIRCP in 2023‑24 to be administratively restored in January 2024. In order for this restoration to occur, the administration would have to determine that the state has sufficient resources to fund its baseline costs and all of the programs the administration has selected for the trigger. The trigger restoration list totals $3.8 billion across the budget.

Assessment

Given Magnitude of Recent One‑Time Augmentations, Identifying Budget Solutions From Transportation Programs Is Appropriate. The Legislature directed a considerable portion of the state’s recent budget surpluses towards transportation programs. These investments support several priorities, such as improving the state’s transportation system, encouraging projects intended to help the state meet its climate goals, and assisting local agencies in drawing down additional federal funds from IIJA. The state focused most of its recent General Fund augmentations on one‑time and limited‑term activities—both within the transportation sector and in other areas of the budget—in order to provide some underlying flexibility if economic conditions changed. As such, helping to solve the current budget problem by focusing on these one‑time and limited‑term augmentations is appropriate. Moreover, revisiting these recent augmentations likely is necessary if the Legislature wants to avoid cutting ongoing General Fund‑supported programs across the budget. Although making reductions in transportation will result in fewer of the activities that the Legislature intended for the state to conduct, even reduced amounts still will represent significant augmentations compared to historical levels for these programs. This is particularly true since many of these activities have not typically received General Fund support. Through careful prioritization, the state can continue to support its priorities within transportation even at moderately reduced spending levels.

Governor’s Budget Represents One Set of Priorities, but Legislature Could Apply Its Own Decision‑Making Criteria. The Governor’s budget represents one approach the state could take in solving the current budget problem. However, this approach represents the Governor’s overall priorities and reflects the Governor’s criteria for determining which programs should be sustained or reduced. The Legislature has numerous options for dealing with the budget problem, while also sustaining funding for its highest priorities—both within transportation and in other policy areas. For instance, the Legislature could (1) choose a different mix of actions across transportation programs, and/or (2) identify a different mix of actions across policy areas, such as adopting more solutions in one part of the budget and providing additional support in other policy areas. In evaluating which transportation programs might be the best candidates for budget solutions, the Legislature may want to consider the following questions:

- How Important Is the Activity to Achieving Legislative Priorities and Goals? Is the activity an important component of meeting the Legislature’s priorities? Does the funding target vulnerable or underserved communities that may not have resources to undertake the activity on their own? Does the activity represent a core state responsibility? Does compelling evidence exist that a program is effective at meeting its intended outcomes?

- Would the Solution Cause Major Disruptions? Has the funding been appropriated? Has the funding been committed to specific projects or grantees? How far along is the activity in being implemented? Would pulling back state funding affect the ability to access other funding, such as federal funds?

- Is the Funding Crucial to Addressing Urgent and Pressing Needs? What is the current demand for the funds? How likely is it that delaying or not conducting the activity could lead to negative long‑term outcomes?

- What Other Resources Might Be Available? Are other funding sources available to help accomplish the activities at some level, either from previous budget appropriations, special funds, or federal funds? What implications might result from potential fund shifts, such as for the programs that funding might otherwise have supported?

Reductions to Population‑Based TIRCP Are Reasonable Given Budget Problem. Given the magnitude of the budget problem facing the Legislature in the budget year (and the outyears), we find the Governor’s proposals to reduce and delay funding for the population‑based TIRCP to be reasonable. While providing $2 billion less than planned would result in fewer overall capital improvements to transit and rail systems, under the Governor’s proposal, transit agencies still would receive a significant increase in state General Fund support—$2 billion over a three‑year period—when compared to recent years. This funding would be in addition to the federal fund augmentations transit agencies are anticipated to receive from IIJA. As mentioned previously, state transit agencies can expect to receive $3.1 billion in additional formula transit funding over the five‑year period, representing an average annual increase of $620 million compared to previous levels. As such, even with the Governor’s proposed reduction, transit agencies would still be receiving more net funding than their historical levels.

Population‑Based TIRCP Not Currently Structured to Address Transit Operational Funding Issues. Some transit agencies have raised concerns about operational funding shortfalls, in part due to persistent declines in ridership and evolving commute patterns that began during the pandemic. (Operational costs for transit agencies are supported by local, state, and federal funds, as well as from passenger fares and fees.) However, the population‑based TIRCP funding the Governor proposes reducing—as currently structured in statute—can only be used for capital improvements. As such, the Legislature should not view maintaining—or reducing—this funding as meaningfully affecting transit agencies’ operational funding challenges one way or another, at least as it is currently structured. Based on its priorities, the Legislature could look at options for providing additional flexibility around program requirements to allow transit agencies to use the population‑based TIRCP funding for some operational expenses, but this would require statutory changes and a reprioritization of the program. Even if the Legislature were to authorize such a shift in funding usage, this would need to be viewed as a temporary relief measure, given that the funding is one‑time in nature. In some cases, transit agencies will need to address the underlying sources of their operating budget pressures with more sustainable solutions.

Proposed Fund Shifts Would Minimize Disruption and Maintain Legislative Priorities. Overall, we find that shifting program costs for ATP and the local climate adaptation programs from the General Fund to SHA have merit for several reasons. First, the proposed fund shifts would minimize disruptions to the current programs. This is particularly true for ATP, which has already committed $630 million of the roughly $1.1 billion augmentation to local agencies, and local agencies are in the process of submitting plans for the remainder. (As mentioned earlier, the administration can use other ATP funds and cash‑management strategies to delay the impacts of the proposed $200 million reduction, but a deeper cut would impact current projects.) Similarly, departments have begun to receive applications for the local climate adaptation programs. Local agencies have already started applying for funding from the planning program and are expected to submit applications for the capital program in March 2023. Backfilling the proposed reductions with SHA funds would minimize disruption for the local projects for which planning is already well underway.

Second, we find that the proposed fund shifts would help to achieve budget solutions while maintaining activities the Legislature has indicated are among its key priorities. For instance, during the 2022‑23 budget negotiations, the Legislature advocated for more than doubling the $500 million for ATP that the Governor had originally proposed. This funding was intended to help address the roughly $1.5 billion backlog of high‑scoring projects that had applied to the program in previous years but were not funded due to limited resources. Similarly, the local climate adaptation programs were budget items that originated from the Legislature in order to address current and future climate change impacts.

Using SHA to Backfill Reductions in Other Programs Means Less for Highways… While utilizing SHA funds to backfill General Fund reductions would come with some benefits, this approach is not without trade‑offs. In particular, any reductions from SHA would ultimately result in less funding available for state highway maintenance and rehabilitation projects. This is because SHA is one of the main funding sources for Caltrans’ State Highway Operation and Protection Program (SHOPP), which supports capital projects that rehabilitate and reconstruct the state highway system. In the budget year, the program is estimated to have about $5 billion for projects through a combination of state and federal funds (including additional funding from IIJA). The Governor’s proposed fund shifts would reduce funding available for SHOPP by $500 million. The funding changes likely would not impact projects planned for the budget year, but would result in fewer projects in the future.

…However, Significant Increase in Federal Funds Can Help Make Up for Shifts. Given the increase in formula highway funding the state is expected to receive from IIJA, the impacts of shifting funding away from SHA are less significant than they would have been otherwise. This provides the Legislature with some additional flexibility to shift funds from SHA to support other transportation purposes. (The revenues that support SHA—such as fuel excise taxes—are constitutionally protected and can only be used on transportation‑related expenditures.) As mentioned earlier, 60 percent of the formula highway funding California receives is used for state activities and 40 percent is apportioned to local agencies to address local transportation system needs. Under IIJA, the state‑used portion is expected to be augmented by $5.1 billion over the five‑year period, or about $1 billion annually. Caltrans plans to use most of this funding for SHOPP projects. Therefore, while the proposed $500 million SHA fund shift would decrease available funding for SHOPP, the recent federal fund augmentations would still enable the program to spend at funding levels exceeding its recent baseline.

Sustaining TIRCP Funding Would Minimize Disruptions. Overall, we find the Governor’s proposal to sustain the $3.7 billion provided to the non‑population‑based TIRCP to be reasonable. The program has already begun awarding funding to local agencies and is expected to finish awards in the coming months. As such, reducing funding through the budget act this summer would cause significant disruptions for those local projects. Moreover, as part of the statutory guidance for the program, the Legislature directed the California State Transportation Agency (CalSTA) to prioritize funding projects where state funds could leverage additional local and federal funds—particularly the additional competitive funding made available under IIJA. Reducing funding for the program therefore could jeopardize local agencies’ ability to draw down federal funds.

Administration’s Plans to Solicit Applications and Award Program Funds Early Limits Legislature’s Flexibility to Navigate Budget Problem. As shown in Figure 1, the 2022‑23 budget package included agreements to provide significant additional funding for transportation programs in 2023‑24 and 2024‑25. While the budget agreement included the intent to provide this future funding, the authority to spend this funding is contingent on each year’s annual budget legislation, and therefore, has not yet been provided to the corresponding departments. Until it grants such spending authority, the Legislature retains the authority to determine whether the intended amounts should be sustained or modified. This is particularly important for the amounts agreed to for the budget year, since the state faces a budget problem and the Legislature needs to identify spending changes that will enable it meet its constitutional requirement to pass a balanced budget. Given how significantly the budget condition has changed from when these commitments were made, the Legislature will need to consider and reevaluate all potential future spending with a fresh perspective; the state cannot afford to maintain all of its previous spending intentions.

Despite the fact that departments do not yet have the authority to spend funding planned for future appropriations, CalSTA and Caltrans are prematurely taking steps to allocate funds for the Port and Freight Infrastructure Program and the Clean California Local Grant Program. Currently, CalSTA is in the process of awarding all the planned funding for the Port and Freight Infrastructure Program, including the $600 million intended to be appropriated in 2023‑24. The agency has already received applications from local agencies and plans to award this funding later this spring. That is, the agency will commit specific funding amounts to local agencies before the Legislature has legally authorized such spending. Moreover, committing these funds now is inconsistent with the Governor’s proposal to delay a share of this funding and instead provide $200 million annually from 2023‑24 through 2025‑26. Similarly, Caltrans is in the process of accepting applications from local agencies for the $100 million intended for the Clean California Local Grant Program in 2023‑24. While the department does not plan to make funding awards until after the next fiscal year begins, it still is having local agencies apply now for funding it does not yet have the legal authority to spend.

These activities are problematic for several reasons. First, having local agencies go through the process of planning projects and applying for funds that may not ultimately be appropriated to a department—as Caltrans is for the Clean California Local Grant Program—is both unfair and creates the potential for wasted time and resources. Second, taking the additional step of committing funding to local agencies when a department does not yet have the legal authority or certainty that the Legislature will ultimately provide this funding—as CalSTA is for the Port and Freight Infrastructure Program—creates unnecessary funding risks to local projects. Third, these practices make solving the budget problem more difficult for the Legislature. Specifically, they create a dynamic where the Legislature would then need to consider whether it should cut funding that local agencies (1) had already applied for and/or (2) had already been promised. This places the responsibility for the potential resulting disruption on the Legislature’s shoulders despite the fact that it was the administration’s premature actions that created the expectations at the local level.

Additional Solutions May Be Needed if Budget Problem Worsens. As discussed earlier, recent economic data and our fiscal outlook suggest that the Governor’s revenue estimates have a high likelihood of being overly optimistic. Should that prove to be the case, the Legislature will need to identify additional solutions in order to meet its constitutional requirement to pass a balanced budget. While it has several options for crafting such solutions—including from within other policy areas and using tools other than spending reductions—given the magnitude of the recent one‑time investments in transportation programs, the Legislature likely will want to consider making additional reductions in this area.

Legislature Could Consider Other Programs for Alternative or Additional Budget Solutions. As noted in Figure 5, the Governor would leave several programs unaffected by reductions. Should the Legislature want to consider alternative or additional budget solutions than those proposed by the Governor, we believe the following programs merit consideration:

- Highways to Boulevards Pilot Program. The Legislature could consider reducing funding for the Highways to Boulevards Pilot Program, which received $150 million in the 2022‑23 budget package. In some cases, the information the state is seeking to obtain from this pilot program could be achieved through the federal Reconnecting Communities Pilot Program—a new five‑year IIJA program that will provide roughly $200 million annually in competitive grants for similar activities. The Legislature could consider reducing this program now and then providing funding in the future when budget conditions improve. This would allow the state to incorporate findings from the federal pilot. While California communities are not guaranteed federal funding, many of the projects that would apply for the state program likely would also be eligible for the federal program. We note that the state program has equity‑driven goals in that it supports increased access to biking, walking, transit, and green space in underserved communities, which makes it a priority for legislative focus. However, given that the federal program focuses on similar activities, the Legislature could potentially utilize savings from this program to sustain funding for some of its other high‑priority equity programs across the budget that might otherwise be reduced.

- Clean California Local Grant Program. The Legislature could also consider reducing some or all of the $100 million intended for the Clean California Local Grant Program in 2023‑24. This program first began when Caltrans received General Fund resources of $148 million in both 2021‑22 and 2022‑23 as part of a larger state initiative to clean up litter and beautify areas near transportation infrastructure. Many of the previously funded projects still are underway, working towards their required completion date of June 2024. The Legislature could reduce funding for the program and wait to review reported outcomes from the completed projects before deciding whether additional funding is warranted in the future.

- Grade Separation Projects. The Legislature could also consider reducing the $350 million provided for grade separation projects supported under TIRCP. As mentioned earlier, the Governor proposes delaying this funding from 2022‑23 to 2025‑26. The Legislature could instead convert the proposed delay to a reduction to capture savings and avoid exacerbating the state’s out‑year budget problem. This program has existing annual funding of about $450 million that would allow the state to still complete some—albeit fewer—grade separation projects. The Legislature could revisit funding these activities in 2025‑26 should budget resources allow without making the commitment for such spending now.

Governor’s Trigger Restoration Approach Not Realistic, Minimizes Legislative Authority. The Governor identifies the $1 billion reduction for the population‑based TIRCP in 2023‑24 as being eligible for restoration should resources exceed expectations by January 2024. The trigger restoration for this program would only occur if there are sufficient resources to restore the full $3.8 billion budget‑wide trigger restoration list. As discussed earlier, not only do the Governor’s revenue estimates assume insufficient funds to trigger such a restoration, but the Governor also forecasts a $9 billion budget deficit for 2024‑25 that will need to be addressed. Given that our revenue outlook is less optimistic than the Governor’s, we find it unlikely the trigger will be met. Specifically, we estimate there is about a one in three chance that the state will be able to afford the Governor’s budget as proposed for 2022‑23 and 2023‑24, and an even lower chance the state could afford the Governor’s budget plus the trigger restorations. Accordingly, we believe the proposed trigger restorations to the population‑based TIRCP funding—and other programs subject to the trigger—should not be viewed as items that could potentially be restored, but rather as pure reductions. Additionally, no automatic trigger is needed to make midyear funding augmentations—the Legislature already has this ability through its authority to pass midyear spending bills. As such, we find that the Governor’s proposal is structured in a way that reduces legislative authority and flexibility.

Recommendations

Direct Administration Not to Prematurely Solicit Applications and Award Program Funding Before the Legislature Grants Spending Authority. We recommend that the Legislature direct CalSTA to cease its plans to prematurely award funding for the Port and Freight Infrastructure Program. The agency should not commit funds to local agencies when it does not yet have the legal authority to do so or certainty that the state budget will ultimately provide this funding. We also recommend that the Legislature direct Caltrans to delay its application process for the Clean California Local Grant Program until the funding is appropriated. Waiting until after the budget act is passed would prevent additional local agencies from going through the process of planning projects and applying for funds that may not ultimately be appropriated to the department. While these directives might cause some disruptions given the departments’ plans are underway, ultimately, our recommended approach would both minimize potential greater disruption for local agencies and preserve the Legislature’s tools in solving the current budget problem.

Adopt Package of Budget Solutions Based on Legislature’s Priorities. We recommend the Legislature develop its own package of budget solutions based on its highest priorities and guiding principles. In the brief, we identify key questions the Legislature could use in developing its own budget solutions. In several cases, we find the Governor’s proposals to be reasonable, but so too would alternative decisions the Legislature could make instead of or in addition to the Governor’s selections.

Use Spring Budget Process to Identify Additional Potential Budget Solutions in Transportation. Given the distinct possibility of worse fiscal conditions, we recommend the Legislature begin to prepare now for the likely need to solve for a deeper revenue shortfall when it adopts its final budget this summer. Specifically, in addition to weighing the Governor’s proposed solutions and substituting its own alternatives, we recommend the Legislature identify additional reductions for a greater total amount of solutions than those proposed by the Governor. In this brief we identify other potential reductions for transportation programs that are not proposed by the Governor. While this process will be challenging—and, likely, unpleasant—taking the time to consider, research, and select potential options over the spring will better prepare the Legislature to make decisions in May and June when it will not have much time to gather information and carefully consider program trade‑offs before the budget deadline.

Reject Governor’s Trigger Restoration Approach, Maintain Legislative Flexibility. We also recommend the Legislature reject the Governor’s trigger restoration proposal—both for the population‑based TIRCP funding and all other non‑transportation programs subject to the trigger. Given the current revenue forecast and the “all or nothing” structure of the proposal, we believe the likelihood of the state receiving sufficient funds to activate the trigger is low. We also find that the proposal minimizes the Legislature’s authority and flexibility to respond to changing revenue conditions and evolving spending priorities. We therefore recommend the Legislature instead focus its efforts on adopting the level of solutions needed to balance the 2023‑24 budget. Then, as revenues become clearer over the coming year, it can make midyear changes—including augmentations if possible, or additional reductions if needed—through its existing authorities, such as passing midyear spending bills.