LAO Contact

February 23, 2023

The 2023-24 Budget

Department of Justice Budget Proposals

- Overview

- DNA Identification Fund Backfill

- Funding For Firearm‑Related Workload

- Additional Resources for Legal Work

Summary

In this brief, we analyze Governor’s budget proposals for the Department of Justice (DOJ) related to (1) the Bureau of Forensic Services (BFS), (2) firearms workload, and (3) legal workload.

Recommend Requiring BFS Users to Partially Support BFS and Providing Requested General Fund Backfill for Only One Year. The Governor proposes an ongoing $53.4 million General Fund backfill to the fund supporting BFS to address declines in the fund’s revenues from criminal fines and fees. We find that requiring users of BFS services to partially support BFS operations is a better option for maintaining support for the bureau as it minimizes the impact on the General Fund and results in the users having incentive to prioritize what workload is submitted to BFS. Accordingly, we recommend the Legislature require (1) users of BFS services to partially support BFS beginning in 2024‑25 and (2) DOJ develop a plan for calculating each agency’s share of the BFS services it uses. To allow for this new funding structure to be implemented, we recommend the Legislature provide the proposed General Fund backfill—but only for one year.

Recommend Supporting Firearm Workload From Dealers Record of Sale (DROS) Special Account Rather Than General Fund. The Governor’s budget proposes $6.9 million in 2023‑24 ($6.3 million General Fund and $573,000 from the DROS Special Account), declining to $3.5 million annually in 2026‑27, to support seven budget proposals related to increased firearm workload. We find the proposals reasonable, but recommend that they be funded by the DROS Special Account as it appears to be an allowable use of the fund and the fund can support the proposals.

Recommend Requiring Annual Reporting on Legal Workload and Providing Requested Funding on a Two‑Year Basis. The Governor’s budget proposes $24.5 million in 2023‑24 ($15 million General Fund and $9.5 million special funds), decreasing to $20.6 million annually in 2027‑28, to support 18 budget proposals implementing enacted legislation and increasing legal activities in key areas (such as pursuing more antitrust litigation). We find that implementing the enacted legislation and increasing legal activities in key areas would increase DOJ’s workload. However, we also find that there is insufficient information on how DOJ prioritizes its existing resources and the extent to which litigation proceeds are available to support DOJ workload. This makes it difficult for the Legislature to determine whether DOJ truly needs additional resources or if the workload could be supported with existing resources or litigation proceeds. Accordingly, we recommend the Legislature (1) direct DOJ to report annually on its legal workload beginning January 2025 and (2) provide the requested funding on a two‑year basis to support the increased workload while the recommended report is completed and analyzed to determine appropriate funding levels in the future.

Overview

Under the direction of the Attorney General, DOJ provides legal services to state and local entities; brings lawsuits to enforce public rights; and carries out various law enforcement activities, such as seizing firearms and ammunition from those prohibited from owning or possessing them. DOJ also provides various services to local law enforcement agencies, including providing forensic services to local law enforcement agencies in jurisdictions without their own crime laboratory. In addition, the department manages various databases including the statewide criminal history database.

As shown in Figure 1, the Governor’s budget proposes $1.2 billion to support DOJ operations in 2023‑24—an increase of $9 million (less than 1 percent) over the revised amount for 2022‑23. About half of the proposed funding supports DOJ’s Division of Legal Services, while the remainder supports the Division of Law Enforcement and the California Justice Information Services Division (CJIS). Of the total amount proposed for DOJ operations in 2022‑23, nearly 40 percent—$486 million—is from the General Fund. This is an increase of $18 million (or 3.9 percent) from the revised 2022‑23 General Fund amount.

Figure 1

Department of Justice Budget Summary

(Dollars in Millions)

|

2021‑22 |

2022‑23 |

2023‑24 |

Change From 2022‑23 |

||

|

Amount |

Percent |

||||

|

Legal Services |

$553 |

$645 |

$659 |

$14 |

2.1% |

|

Law Enforcement |

252 |

319 |

327 |

8 |

2.5 |

|

California Justice Information Services |

250 |

264 |

252 |

‑13 |

‑4.7 |

|

Totals |

$1,056 |

$1,229 |

$1,238 |

$9 |

0.7% |

DNA Identification Fund Backfill

Background

Overview of BFS. BFS provides criminal laboratory services—such as DNA testing, alcohol and controlled substances analysis, and on‑site crime scene investigative support. Ten regional laboratories provide services generally at no charge for local law enforcement and prosecutorial agencies in 46 counties that do not have access to those services. BFS also assists the 12 counties and 8 cities that operate their own laboratories where BFS offers services their laboratories lack. (Local agencies also contract with private or other governmental laboratories for services.) Additionally, BFS operates the state’s DNA laboratory as well as the state’s criminalistics training institute.

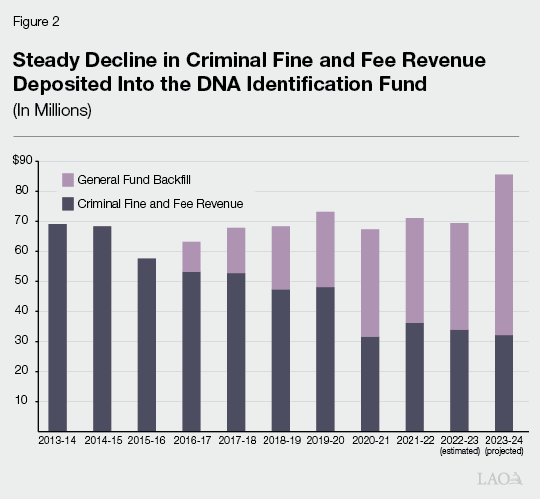

Funding for BFS. BFS receives support from various sources, but primarily from the DNA Identification Fund—a state special fund that receives criminal fine and fee revenue—and the state General Fund. As shown in Figure 2, the amount of criminal fine and fee revenue deposited into the DNA Identification Fund has steadily declined over the past decade—from a high of $69 million in 2013‑14 to $34 million in 2022‑23 (a decline of 51 percent). To help address this steady decline and to maintain the level of services provided by BFS, the state has provided General Fund support to backfill the reduction in criminal fine and fee revenue deposited in the DNA Identification Fund since 2016‑17.

DOJ Required to Report in 2022 on Potential Funding Options Other Than State General Fund. The 2021‑22 budget package required DOJ to provide a report by March 10, 2022 that identifies various options—other than the state General Fund—to support BFS annual operations. The budget package specifically directed DOJ to consider an option that would require sharing costs with local agencies that make use of BFS services based on the specific type of forensic services sought, the speed of the service, the size of the agency, and any other factors DOJ chooses to include.

In response to the above requirement, DOJ provided a report to the Legislature on March 10, 2022. The department identified the following options to support BFS operations: (1) a general tax increase, (2) allowing the surcharge added to criminal history background check fees to also cover BFS costs (and adjusting the surcharge accordingly), (3) increasing the specific fee added when individuals are convicted of criminal offenses which generates the revenue deposited into the DNA Identification Fund, (4) requiring the judicial branch to provide funding to support BFS as it similarly is supported by criminal fine and fee revenue and forensic science is important to courts, and (5) requiring nonlocal government entities (such as the California Department of Corrections and Rehabilitation or CDCR) pay for their share of BFS services. Additionally, DOJ discussed the benefits and drawbacks of various methods for implementing a cost‑sharing model with local agencies. Such methods included establishing: (1) an hourly rate for services provided, (2) a flat fee by type of service provided, (3) a flat fee by county, and (4) a hybrid flat fee‑hourly rate model. After its assessment of the cost‑sharing model and alternative funding options, DOJ maintained that it believes a General Fund backfill is the best approach for supporting BFS annual operations.

Governor’s Proposal

Increases DNA Identification Fund Support for BFS. The Governor’s budget proposes $17.3 million in increased annual funding from the DNA Identification Fund to support BFS. This amount includes $10 million to restore BFS’s historical level of spending authority from the fund. In prior years, the budget partially addressed the DNA Identification Fund’s shortfall by reducing the bureau’s expenditure authority from the fund by $10 million and redirecting $10 million General Fund previously budgeted for CJIS to support BFS. CJIS then received a backfill from the Fingerprint Fees Account (FFA). (The FFA could not directly backfill BFS due to statutory limits on how the funds in FFA can be used.) As such actions are no longer sustainable due to the condition of the FFA, the Governor’s budget proposes to restore the DNA Identification Fund to its historical expenditure levels. The proposed increase also includes $7.3 million for BFS to support equipment replacement ($5.8 million) and facility maintenance ($1.5 million).

Provides General Fund Backfill of DNA Identification Fund. The Governor’s budget proposes to transfer $53.4 million General Fund on an ongoing basis to the DNA Identification Fund to backfill reductions in criminal fine and fee revenue deposited into the fund and to support the increased BFS funding levels discussed above. The Governor’s budget also proposes provisional budget language authorizing the Department of Finance to transfer additional General Fund to the DNA Identification Fund if revenues deposited into the fund decline further and are insufficient to support BFS. This transfer could only occur 30 days after written notification is provided to the Legislature. To the extent that this proposed language is included in the annual budget act, the General Fund would be permanently responsible for backfilling the DNA Identification Fund to ensure there is sufficient funding to support BFS.

Assessment

Governor’s Proposal Would Permanently Address Ongoing Decline in DNA Identification Fund Revenues. The Governor’s proposal would fully address the ongoing decline in DNA Identification Fund revenues and provide BFS with a stable level of funding. This is because the General Fund would be permanently responsible for supporting any BFS costs that cannot be supported by the DNA Identification Fund.

Increased DNA Identification Fund Support for BFS Reasonable. We find that the Governor’s proposed level of funding for BFS generally appears reasonable as DOJ has provided sufficient workload justification for the total level of funding provided for the bureau’s operations as well as the ongoing need for equipment replacement and facility maintenance.

Requiring Users of BFS Services to Partially Support BFS Merits Consideration. As noted above, DOJ was directed to provide the Legislature with funding alternatives to support BFS that did not include the General Fund. Upon our review of DOJ’s March 2022 report on such alternative funding options, we conclude that requiring users of BFS services to partially support BFS operations is the best option.

Specifically, we find that directing local governments to partially support BFS operations merits consideration for the following reasons:

- BFS Provides Certain Local Governments Substantial Benefits. City and county law enforcement and prosecutorial agencies are predominantly responsible for collecting and submitting forensic evidence for testing as well as using the evidence to pursue criminal convictions in court. However, certain counties and cities benefit significantly more than others. Specifically, while 12 counties and 8 cities currently use their own resources to support local criminal laboratories, 46 counties generally do not have to use any of their resources for criminal laboratory services. This is because BFS is effectively subsidizing the agencies in these counties with tens of millions of dollars in services annually. As such, the current system is inequitable.

- Local Governments Lack Incentive to Use BFS Services Cost‑Effectively. BFS’s current funding structure provides the agencies it serves with little incentive to use its services in a cost‑effective manner. Since BFS does not charge for its services, these local agencies lack incentive to prioritize what forensic evidence is collected and submitted for testing. Their submissions instead are generally only limited by BFS’s overall capacity and service levels, as determined by the amount of funding provided to the bureau in the annual state budget. In contrast, counties and cities that use their own resources to support their labs—or those that decide they want to pay a private laboratory for testing—have greater incentive to carefully prioritize what evidence should be tested and how quickly it should be done.

Similarly, we find that requiring nonlocal government entities pay for their share of BFS also merits consideration. As previously mentioned, this was a funding option identified in DOJ’s March 2022 report. Specifically, DOJ notes that nearly 34 percent of BFS workload in 2020 was for nonlocal governmental entities—with the California Highway Patrol and CDCR as major users. Requiring nonlocal government entities pay for their share of services encourages entities to consider what evidence is submitted, why it is submitted, and whether it should be submitted to DOJ or another entity. We note that this could require some level of increased resources for state agencies that receive BFS services. However, this would reduce the General Fund backfill needed to support BFS.

Most Other Potential Alternative BFS Funding Options Identified by DOJ Raise Concerns. In our review of DOJ’s March 2022 report, we identified various concerns about the viability of some of the potential funding options identified. Specifically, we have concerns related to the following options:

- General Tax Increase. A general tax increase would effectively be an increase in General Fund resources as such taxes are typically deposited into the state’s General Fund to support various purposes. As such, this does not represent an alternative other than simply using the General Fund. As noted above, the Legislature requested options other than the General Fund to support BFS.

- Criminal History Background Check Fee Increase. These fees are typically assessed to cover DOJ’s costs for providing criminal history information for employment, licensing, or certification purposes—including the maintenance of the systems from which the criminal history information is obtained. BFS work does not seem as if it would be consistent with the intent of these fees. For example, it is unclear the extent to which applicants seeking background checks would benefit from BFS services.

- Criminal Conviction Fee Increase. Given the state’s complex formula for distributing criminal fine and fee revenue, there is no guarantee that increasing this specific fee will actually increase the amount of revenue deposited in the DNA Identification Fund annually. This is because the complex formula dictates the order in which special funds receive criminal fine and fee revenue that is collected. Given the fund’s priority order in this formula, it is not certain that it would receive the expected revenues as funds with a higher‑priority order could receive the bulk of any additional revenue collected.

- Requiring Judicial Branch Support. While forensic science is a key component of evidence in criminal cases, the judicial branch is not responsible for determining whether a criminal case is to be filed and the type and quality of evidence provided to prosecute such cases. In fact, this is a responsibility of local prosecutors and law enforcement rather than the judicial branch who is responsible for fairly and objectively adjudicating such cases.

Recommendations

Forensic services are important to various agencies in the investigation and prosecution of criminal cases. Accordingly, it is important that BFS receives relatively stable funding to process its workload. This has been challenging in recent years due to the continual decline in revenue in the DNA Identification Fund. The Governor’s budget proposes to stabilize funding by providing an ongoing General Fund backfill to the DNA Identification Fund. In contrast, we recommend below an alternative approach that minimizes the impact on the General Fund and results in users of BFS services having incentive to prioritize the workload that is submitted.

Specifically, we recommend the Legislature require (1) users of BFS services to partially support BFS beginning in 2024‑25 and (2) DOJ to develop a plan for calculating each agency’s share of the BFS services it uses. To allow for this new funding structure to be implemented, we recommend the Legislature approve the total funding level proposed in the Governor’s budget to support BFS and provide the proposed General Fund backfill—but only for one year. We discuss each of our recommendations in greater detail below.

Require Users of Forensic Services to Partially Support BFS Beginning in 2024‑25. Given the substantial benefit that local agencies receive from BFS services, we recommend the Legislature require local governments to partially support BFS beginning in 2024‑25. Agencies that receive services from BFS would be required to pay for a portion of the services they receive—providing greater incentive to prioritize workload to DOJ. Additionally, this would also be more equitable than the existing system in which certain local governments receive services at no charge, while others pay to operate their own laboratories. Delaying this change to 2024‑25 provides time for the implementation of a new funding structure and to allow agencies to adapt to the new funding framework.

Similarly, we recommend the Legislature require nonlocal government agencies to partially support BFS by paying for a portion of the services they receive from their operational budgets. For example, CDCR could be directed to pay for their share of BFS services from their operational budget. This would provide CDCR with incentive to consider what evidence, and the amount of evidence, that is submitted. (We note that this would be similar to the DOJ Legal Division billing state agencies for the costs of providing legal advice and service.) Alternatively, the Legislature could designate specific portions of the General Fund it provides to BFS as being exclusively to provide services for each entity—effectively capping the amount of service the entity would receive. Because this amount would be limited, it would similarly provide an incentive for these entities to consider what evidence is submitted and why it is submitted.

Require DOJ to Develop Plan for Calculating User Share of BFS Support. We recommend the Legislature direct DOJ to submit a plan for calculating each agency’s share of the BFS services it uses—including operating and facility costs—and report on this plan no later than October 1, 2023 to allow for its consideration as part of the 2024‑25 budget. We also recommend the Legislature provide DOJ with direction on how much of BFS operation revenues should come from local, state, and other agencies (such as one‑third or one‑half) as well as whether the Legislature plans to directly appropriate a specific General Fund amount to support a certain level of services for state agencies. This would generally reduce the amount of General Fund needed to support BFS costs on an ongoing basis.

DOJ would have flexibility in calculating each agency’s share of the BFS services it uses—including operation and facility costs—based on consultation with stakeholders and after considering various factors (including equity concerns). For example, DOJ could require agencies pay more or less based on various factors—such as the specific type of forensic service sought, the speed of the service, or the size of the agency.

We acknowledge that developing such a plan may be difficult. However, our recommendation would increase users’ incentive to ensure such BFS services are used cost‑effectively and would promote equity among local governments. Additionally, under such a plan, the amount of General Fund backfill needed in 2024‑25 and in future years would be less than currently proposed.

Approve Funding Level and Provide Backfill for One‑Year. We recommend the Legislature approve the total funding level proposed in the Governor’s budget to support BFS. However, to provide DOJ and the agencies receiving BFS services time to implement and adapt to a new funding structure, we recommend only approving the requested $53.4 million General Fund for one year. This would ensure existing BFS service levels are maintained as the new funding structure is implemented.

Funding For Firearm‑Related Workload

Background

Overview of DOJ Firearm and Ammunition Responsibilities. DOJ’s Bureau of Firearms (BOF) is primarily responsible for the regulation and enforcement of the state’s firearm and ammunition laws. This includes conducting background checks for individuals seeking to purchase firearms and ammunition, licensing firearm and ammunition vendors, conducting vendor compliance investigations, ensuring lawful possession of firearms and ammunition, and administering various other firearms and ammunition programs. BOF engages in various activities related to these responsibilities. For example, BOF has enforcement teams who are primarily responsible for investigating the illegal purchase or possession of firearms and ammunition, as well as seizing them from individuals who are prohibited from owning or possessing them.

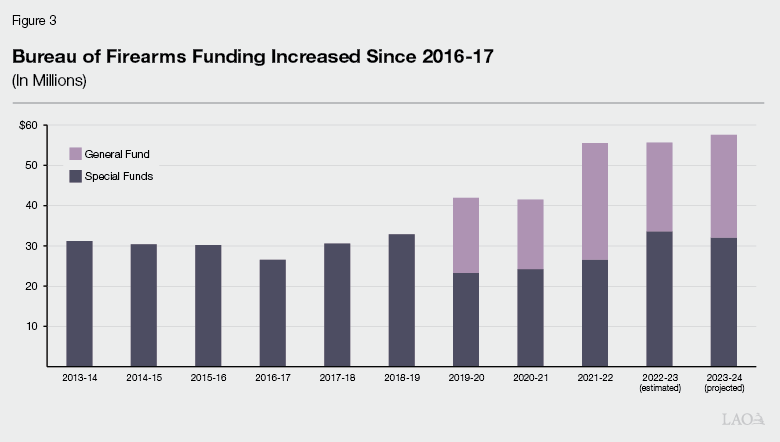

Overall BOF Funding and General Fund Support Increased Over Past Decade. As shown in Figure 3, support for BOF has increased over the past decade from $31.2 million in 2013‑14 to $55.7 million in 2022‑23—an increase of $24.4 million (or 78 percent). During this period, BOF also shifted from being fully supported by various special funds and began receiving General Fund support in 2019‑20. Of the total $55.7 million provided to BOF in 2022‑23, $22 million (or 40 percent) was from the General Fund and $33.6 million (or 60 percent) was from various special funds. Most of the General Fund is used to support the enforcement teams—which has been the case since 2019‑20 when the budget packaged shifted full support of these teams over to the General Fund. (We also note that CJIS separately receives millions of dollars annually from various fund sources to maintain and update various databases, such as the Automated Firearms System which tracks firearm serial numbers, needed to support BOF’s activities.)

DROS Special Account. State law authorizes DOJ to charge various fees related to firearms and ammunition that are deposited into one of several state special funds to support BOF programs and activities. For example, an individual purchasing a firearm currently pays fees totaling $37.19—a $31.19 fee deposited into the DROS Special Account (the “DROS fee”), a $5 fee into the Firearm Safety and Enforcement Special Fund, and a $1 fee into the Firearm Safety Account. State law also authorizes DOJ to administratively increase some of these fees to account for inflation as long as the fee does not exceed DOJ’s regulatory and enforcement costs. State law authorizes revenues deposited into each of these special funds to be used for various purposes.

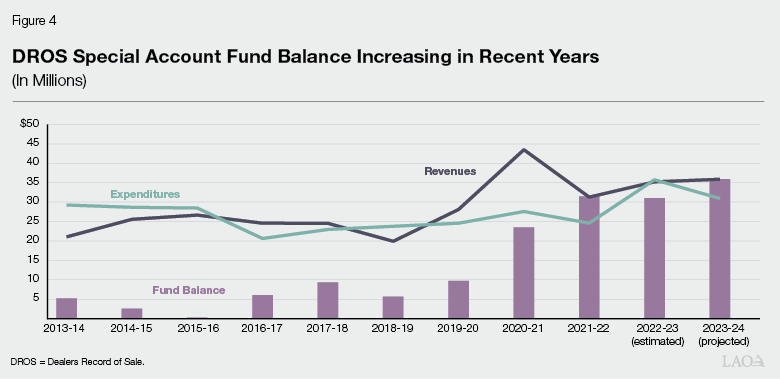

State law authorizes the DROS Special Account to support a wide range of BOF programs and activities (as well as CJIS activities needed to support BOF workload). As shown in Figure 4, revenues often fluctuate from year to year, generally reflecting changes in fee levels and the number of firearms sold. DROS Special Account expenditures routinely exceeded revenues prior to 2019‑20—resulting in the use and decline of the fund balance. To help ensure sufficient revenues would be available to support BOF workload, Chapter 736 of 2019 (AB 1669, Bonta) enabled DOJ to increase the DROS fee charged from $19 to $31.19. This resulted in DROS Special Account revenues generally exceeding expenditures in recent years—thereby allowing the fund balance to steadily increase. The Governor’s budget estimates $35.9 million in DROS Special Account revenues in 2023‑24 and expenditures of $30.9 million, resulting in a fund balance of $35.9 million at the end of the year.

Governor’s Proposal

The Governor’s budget proposes $6.9 million in 2023‑24 ($6.3 million General Fund and $573,000 from the DROS Special Account)—declining to $3.5 million annually beginning in 2026‑27 ($3.3 million General Fund and $179,000 from the DROS Special Account)—to support DOJ firearm workload. As shown in Figure 5, the proposed funding would support seven budget proposals, including five related to workload resulting from recently enacted legislation.

Figure 5

Summary of Governor’s Firearm Workload Proposals

|

Workload |

Proposed Resources |

Description |

|

Recently Enacted Legislation |

||

|

Chapter 76 of 2022 (AB 1621, Gipson) |

21 positions (11 limited term) and $2.8 million General Fund in 2023‑24, declining to $1.2 million annually in 2025‑26 |

AB 1621 requires any person possessing an unserialized firearm, as well as new residents within 60 days of arrival in the state, to apply to DOJ for a unique identification mark. The legislation also modifies the definition of firearm precursor parts and generally prohibits the sale or possession of unserialized firearm precursor parts. DOJ seeks resources to address this increased workload. |

|

Chapter 142 of 2022 (AB 2156, Wicks) |

$911,000 General Fund in 2023‑24 |

AB 1621 prohibits any person from manufacturing firearms without being licensed by the state and requires people manufacturing between 4 and 49 firearms in a calendar year now be licensed. The legislation also prohibits any person who is not licensed as a firearm manufacturer from manufacturing any firearm or precursor part using a 3D printer. DOJ requests resources to update firearms systems to enforce these provisions. |

|

Chapter 138 of 2022 (AB 228, Rodriquez) |

5 positions and $797,000 General Fund in 2023‑24, declining to $738,000 annually in 2024‑25 |

AB 228 requires DOJ generally inspect firearm dealers at least every three years and audit a sampling of 25 percent to 50 percent of each record type. DOJ seeks resources to address this increased workload. |

|

Chapter 696 of 2022 (AB 2552, McCarty) |

1 limited‑term position and $408,000 ($12,000 General Fund and $396,000 DROS) in 2023‑24, declining to $191,000 ($12,000 General Fund and $179,000 DROS) annually in 2025‑26 |

AB 2552 requires DOJ conduct enforcement and inspections at a minimum of one‑half of all gun shows or events in the state, public posting of certain violations, and annual reporting to the Legislature on enforcement activities. Also authorizes inspection of any firearm precursor part vendors at gun shows or events. DOJ seeks resources to address this increased workload. |

|

Chapter 995 of 2022 (SB 1384, Min) |

1 limited‑term position and $177,000 DROS in 2023‑24 and $164,000 in 2024‑25 |

AB 1384 requires licensed firearms dealers to have a digital video surveillance system on business premises and to carry a general liability insurance policy. DOJ seeks resources to develop regulations for dealers to certify these conditions are met. |

|

Other Workload |

||

|

Firearm Compliance Support Section Workload |

3 positions and $342,000 General Fund in 2023‑24, declining to $307,000 annually in 2024‑25 |

DOJ requests resources to support increased carry concealed weapons licensing and Automated Firearms System workload. |

|

Microstamping and Law Enforcement Transfera |

5 positions and $1.5 million General Fund in 2023‑24, declining to $1.1 million annually in 2026‑27 |

DOJ requests additional resources, above the level provided as part of the 2021‑22 budget, to complete changes to existing firearms databases in order to implement previously enacted legislation related to the microstamping of handguns and the tracking of unsafe handguns. |

|

aContinued implementation of Chapters 289 of 2020 (AB 2699, Santiago) and 292 of 2020 (AB 2847, Chiu). |

||

|

DOJ = Department of Justice and DROS = Dealers Record of Sale Special Account. |

||

Assessment

Proposals Reasonable, but Could Be Funded by DROS Special Account Rather Than General Fund. We find the level of funding requested in the Governor’s proposals to be generally reasonable to support increased workload and/or is necessary to implement enacted legislation. However, we believe that all of the requested resources could be funded by the DROS Special Account rather than the General Fund. This is because the workload appears to be allowable uses of DROS Special Account revenues. Additionally, there appears to be sufficient DROS Special Account revenues and fund balance to support this workload. Specifically, DROS Special Account annual revenues are currently about $5 million higher than expenditures and the fund balance is estimated to be $35.9 million at the end of 2023‑24. This is sufficient to support the $6.3 million in increased support requested in 2023‑24 as well as the $3.3 million in requested ongoing support. We note that DOJ indicates that it is seeking General Fund resources to support these proposals in order to ensure that there are sufficient resources in the DROS Special Account to support future proposals—most notably a project to replace 17 firearms and ammunition databases and systems, which is currently in the planning process. However, those proposals have not been presented to the Legislature for consideration at this time.

Furthermore, we note that funding such workload from the DROS Special Account instead of the General Fund means that additional General Fund would be available to support other legislative priorities. This includes helping to balance the state budget in 2023‑24 as well as to address projected out‑year deficits under the Governor’s budget.

Recommendation

Fund the Proposals Entirely From DROS Special Account. We recommend the Legislature approve the request for additional funding support as such monies are needed to support increased workload and to implement enacted legislation. However, we recommend the Legislature provide the requested resources entirely from the DROS Special Account, as the account has sufficient revenues to support them in the near term. This recommendation would “free up” ongoing General Fund support relative to the Governor’s budget—$6.3 million in 2023‑24, declining to $3.3 million ongoing beginning in 2026‑27. This is helpful as the Legislature may prefer a different package of budget solutions to balance the 2023‑24 budget than the ones proposed by the Governor or need to consider additional solutions given the heightened risk of revenue shortfalls, as well as the projected out‑year deficits that would occur under the Governor’s proposed budget.

Additional Resources for Legal Work

The Governor’s budget includes 18 proposals for increased resources to support DOJ legal workload. In this section, we first an provide an overview of these proposals, some overarching comments assessing the proposals collectively, and recommendations to address our identified concerns. We then provide some more specific comments related to two of the proposals.

Discussion of Governor’s Overall Proposals

Background

Attorney General Designated as State’s Chief Law Officer. The California Constitution designates the Attorney General—who leads DOJ—as the state’s chief law officer and specifies various duties for the Attorney General. One duty is to prosecute violations of state law when the Attorney General believes state law is not being adequately enforced. In addition, state law generally requires the Attorney General to represent state agencies and their employees in judicial proceedings. Unless specifically exempted by state law (as is the case for the University of California Board of Regents and the California Department of Transportation), state agencies must generally obtain written consent from the Attorney General before using in‑house counsel (meaning their own legal staff) or contracting with outside counsel. Additionally, statute authorizes the Attorney General to investigate and prosecute violations of certain state laws. For example, the Attorney General is authorized to enforce state laws prohibiting unlawful, unfair, or fraudulent business practices as well as false or misleading advertising.

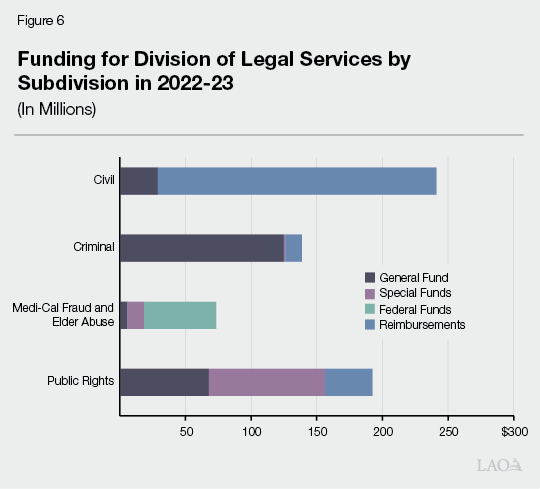

DOJ Division of Legal Services Responsible for Most DOJ Litigation. DOJ consists of three major divisions: Legal Services, Law Enforcement, and California Justice Information Services. The Division of Legal Services is responsible for most of DOJ’s litigation activities. In 2022‑23, $645 million (or 53 percent) of DOJ’s budget supported this division. This funding comes from various sources—about 40 percent from reimbursements (generally from state agencies receiving DOJ legal services), 35 percent from the state General Fund, 16 percent from state special funds (including litigation proceeds, which are generally payments to the state in exchange for the state ending its pursuit of legal action), and 9 percent from federal funds.

The Division of Legal Services is further divided into four subdivisions—Civil Law, Criminal Law, Medi‑Cal Fraud and Elder Abuse, and Public Rights. Of the total amount of funding provided to support the division in 2022‑23:

- $241 million (or 37 percent) supported Civil Law.

- $139 million (or 21 percent) supported Criminal Law.

- $73 million (or 11 percent) supported Medi‑Cal Fraud and Elder Abuse.

- $193 million (or 30 percent) supported Public Rights.

As shown in Figure 6, the sources of such funding supporting each subdivision varies. For example, Civil Law is predominantly supported by reimbursements in contrast to the other three subdivisions. Each of these subdivisions then generally has its own sections or units. For example, the Public Rights Subdivision includes an Antitrust Law Section and Consumer Protection Section.

DOJ Litigation Initiated in Two Major Ways. DOJ legal workload can be initiated in two primary ways. Specifically, litigation can be initiated as follows:

- State agencies can request DOJ initiate legal action, defend or represent them in legal actions filed by others, or provide legal advice. DOJ typically bills state agencies for their costs, which are reflected as reimbursements in DOJ’s budget. (These reimbursements are deposited into a special fund, the Legal Services Revolving Fund [LSRF].) State agencies generally pay for these costs from their own budgets, which can consist of General Fund and/or special fund dollars, such as licensing fee revenue.

- DOJ can self‑initiate legal actions, as well as defend or represent the state as a whole in actions filed by others. These costs are generally paid for from DOJ’s budget through General Fund dollars or special funds.

DOJ Has Flexibility Over Legal Workload. DOJ has flexibility over its litigation workload, particularly with respect to self‑initiated litigation, within existing resources. This is because DOJ is the sole decision‑maker on which cases it pursues based on its priorities. Specifically, DOJ has flexibility in determining whether to initiate a case, how the case is initiated, and how cases are resolved. In contrast, DOJ has less flexibility over litigation workload initiated by state agencies. This is because decisions on whether to pursue legal action and how such cases are resolved are either determined by the state agency, or in partnership with the state agency. This means DOJ cannot fully control such workload.

DOJ Administers State Litigation Deposit Fund (LDF). The LDF is a state special fund created to receive litigation proceeds in cases where the state is a party to the legal action and no other state statutes specifically provide for (1) the handling and investing of the money and (2) how any earned interest is distributed. (The state generally earns interest from the investment of monies that are held prior to allocation.) The fund primarily supports payments to individuals and entities harmed by those breaking the law, as well as transfers to DOJ special funds to support DOJ litigation‑related costs. State law requires that any monies remaining in the LDF that are not needed to satisfy court‑ordered payments as documented in legal agreements or to support DOJ’s litigation costs be transferred to the state General Fund no later than July 1 of each fiscal year.

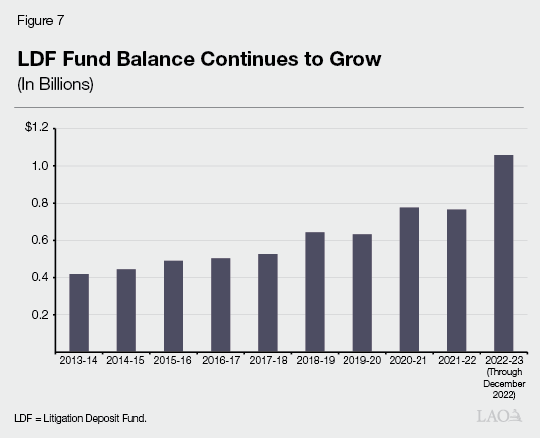

Deposits of litigation proceeds into the LDF, as well as the amount of funds actually allocated from the LDF, vary over time. As shown in Figure 7, the LDF fund balance—or the amount of money remaining in the fund at the end of the year after all revenues have been received and all allocations have been made—has grown significantly and relatively steadily over the past decade. As of the end of December 2022, the LDF fund balance was just under $1.1 billion.

Because the LDF was created to hold monies as a trust fund, it is not reflected in or considered part of the state budget, similar to other state funds with this status. Instead, DOJ is only required to report quarterly to the Legislature on the number of deposits received, the amount of interest received, the amount disbursed to claimants, and the amount used to support DOJ litigation costs. State law places the fund under the control and administration of DOJ. Specifically, state law requires DOJ maintain accounting records for the fund and generally authorizes DOJ to make allocation decisions whenever, and to whomever, it deems appropriate as long as the decisions are consistent with the terms of underlying legal agreements or state law. Until such allocations are made, monies remain in the LDF fund balance.

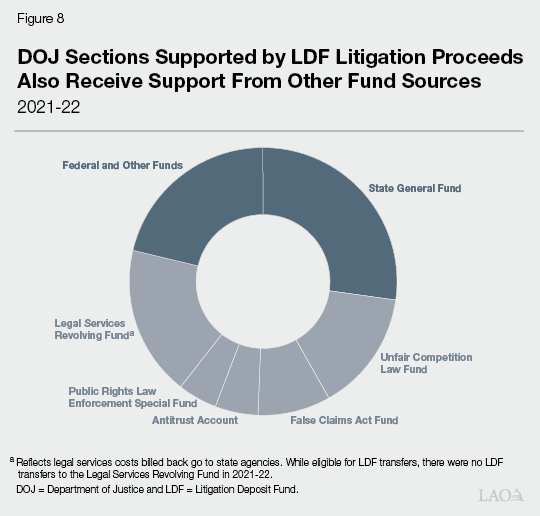

LDF Monies Used to Support Some DOJ Litigation Activities. Tens of millions of dollars in LDF monies are regularly transferred each year to four DOJ special funds: the Unfair Competition Law (UCL) Fund, the False Claims Act Fund, the Antitrust Account, and the Public Rights Law Enforcement Special Fund (PRLESF). State law specifies what types of litigation proceeds can be transferred into these funds and provides guidelines for how such proceeds are to be used. For example, state law requires the state’s share of litigation proceeds from cases related to unlawful, unfair, or fraudulent business practices, as well as false or misleading advertising, be deposited into the UCL Fund to exclusively support the enforcement of consumer protection laws by the Attorney General. Most transfers to these DOJ special funds support work of roughly a dozen sections within the Public Rights Division as well as the Medi‑Cal and Elder Abuse Division. As shown in Figure 8, these sections generally receive support from other funds as well, including the state General Fund. The specific level and mix of funding for these various sections can vary annually based on DOJ funding decisions.

Governor’s Proposal

Additional Resources to Support Increased Legal Workload. The Governor’s budget proposes $24.5 million in 2023‑24 ($15 million General Fund and $9.5 million from the LSRF, Antitrust Account, and UCL Fund)—decreasing to $20.6 million annually in 2027‑28—to support increased legal workload. As shown in Figure 9, this amount would support 18 proposals across the Civil Law, Criminal Law, and Public Rights Divisions. A description of each of these proposals is in Figure 10.

Figure 9

Summary of 2023‑24 Legal‑Related Budget Proposals by Requested Fund Source

(In Millions)

|

Budget Proposal |

Legal Section and Division |

2023‑24 |

2024‑25 |

2025‑26 |

2026‑27 |

2027‑28 |

|

General Fund |

||||||

|

Outside Co‑Counsel |

Torts (Civil) |

$3.0 |

$3.0 |

$3.0 |

$3.0 |

— |

|

Chapter 739 of 2022 (AB 256, Kalra): Criminal Procedure Discrimination |

AWT (Criminal) |

2.2 |

2.1 |

0.8 |

0.8 |

— |

|

Chapter 806 of 2022 (AB 2778, McCarty): Race‑Blind Charginga |

Various (Criminal) |

0.8 |

2.4 |

2.4 |

2.4 |

$2.4 |

|

Chapter 98 of 2022 (AB 1594, Ting): Firearm Civil Suits |

Consumer (PRD) |

0.6 |

0.6 |

0.6 |

0.6 |

0.6 |

|

Chapter 269 of 2022 (AB 587, Gabriel): Social Media Companies Terms of Service |

Consumer (PRD) |

0.7 |

0.6 |

0.6 |

0.6 |

0.6 |

|

Chapter 320 of 2022 (AB 2273, Wicks): California Age‑Appropriate Design Code Act |

Consumer (PRD) |

0.9 |

1.2 |

1.1 |

1.1 |

1.1 |

|

Chapter 642 of 2022 (AB 1837, Bonta): Residential Real Property Foreclosure |

Consumer (PRD) |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

|

Chapter 700 of 2022 (AB 2879, Low): Cyberbullying Online Content |

Consumer (PRD) |

0.3 |

0.4 |

0.4 |

0.4 |

0.4 |

|

Chapter 857 of 2022 (SB 301, Skinner): Online Marketplaces |

Consumer (PRD) |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

|

Chapter 326 of 2020 (AB 1506, McCarty): Police Practices Division |

CRES (PRD) |

1.8 |

1.8 |

1.8 |

1.8 |

1.8 |

|

Chapter 555 of 2022 (AB 1287, Bauer‑Kahan): Gender Price Discrimination |

CRES (PRD) |

0.3 |

0.3 |

0.3 |

0.3 |

0.3 |

|

Chapter 750 of 2021 (AB 1084, Low): Gender Neutral Retail Departments |

CRES (PRD) |

0.3 |

0.5 |

0.5 |

0.5 |

0.5 |

|

Chapter 854 of 2022 (AB 655, Kalra): California Law Enforcement Accountability Reform Act |

CRES (PRD) |

0.3 |

0.3 |

0.3 |

0.3 |

0.3 |

|

Chapter 986 of 2022 (SB 863, Min): Domestic Violence Death Review Teams |

CRES (PRD) |

1.5 |

1.1 |

1.1 |

1.1 |

1.1 |

|

Chapter 475 of 2022 (AB 923, Ramos): Government‑to‑Government Consultation Actb |

IGLS (PRD) |

0.3 |

0.3 |

0.3 |

0.3 |

0.3 |

|

Housing Strike Force |

Land and CRES (PRD) |

1.0 |

0.9 |

0.9 |

0.9 |

0.9 |

|

Subtotal, General Fund |

($15.0) |

($16.6) |

($15.2) |

($15.2) |

($11.4) |

|

|

Special Funds |

||||||

|

Legal Services Revolving Fund |

||||||

|

Housing Strike Force |

Land and CRES (PRD) |

$0.4 |

$0.4 |

$0.4 |

$0.4 |

$0.4 |

|

Antitrust Account |

||||||

|

Antitrust Gasoline Pricing, Agriculture, and Technology Enforcement |

Antitrust (PRD) |

$4.0 |

$3.9 |

$3.9 |

$3.9 |

$3.9 |

|

Unfair Competition Law Fund |

||||||

|

Antitrust Gasoline Pricing, Agriculture, and Technology Enforcement |

Antitrust (PRD) |

$4.0 |

$3.9 |

$3.9 |

$3.9 |

$3.9 |

|

Wage Theft Criminal Prosecutions |

WRFLS (PRD) |

1.1 |

1.1 |

1.1 |

1.1 |

1.1 |

|

Subtotal, Special Funds |

($9.5) |

($9.2) |

($9.2) |

($9.2) |

($9.2) |

|

|

Totals, All Funds |

$24.5 |

$25.8 |

$24.4 |

$24.4 |

$20.6 |

|

|

aAlso reflects associated Research Center Costs. bAdjusted to reflect only legal‑related portion of the request. |

||||||

|

Consumer = Consumer Protection Section; Torts = Torts and Condemnation Section; CRES = Civil Rights Enforcement Section; AWT = Appeals, Writs and Trials Section; PRD = Public Rights Division; Land = Land Use and Conservation Section; WRFLS = Worker Rights and Fair Labor Section; and IGLS = Indian and Gaming Law Section. |

||||||

Figure 10

Description of 2023‑24 Legal‑Related Budget Proposals

|

Budget Proposal |

Description |

|

Recently Enacted Legislation |

|

|

Chapter 739 of 2022 (AB 256, Kalra): Criminal Procedure Discrimination |

Authorizes people to file a petition alleging that the state sought or obtained a criminal conviction or sentence on the basis of sex, ethnicity, or national origin and for the court to impose specified remedies (such as vacating the conviction). Also authorizes the use of nonstatistical evidence to demonstrate racial bias and requires the court to consider systemic and institutional racial bias and racial profiling when assessing evidence of racial bias. The Department of Justice (DOJ) requests resources to address such petitions from past convictions that are subsequently appealed. |

|

Chapter 806 of 2022 (AB 2778, McCarty): Race‑Blind Charging |

Beginning January 2024, requires DOJ develop and publish “race‑blind charging” guidelines for agencies prosecuting felonies or misdemeanors to implement a process which redacts suspect, victim, or witness racial identifying information from charging documents received from law enforcement agencies. Beginning January 2025, requires such prosecuting agencies implement versions of the DOJ guidelines. DOJ requests resources to develop these guidelines and to complete redaction and race‑blind reviews of DOJ criminal cases. |

|

Chapter 98 of 2022 (AB 1594, Ting): Firearm Civil Suits |

Beginning July 2023, requires firearm industry members comply with a specified standard of conduct—such as to implement reasonable controls to prevent firearm‑related loss or theft. Prohibits firearm industry members from manufacturing, marketing, importing, or selling firearm‑related products that are abnormally dangerous and likely to create an unreasonable risk of harm to public health and safety. Authorizes a person suffering harm because of a firearm industry member’s conduct to seek court relief. Authorizes DOJ, city attorneys, and county counsel to bring civil actions for violations and allows the court to award damages, attorney’s fees and costs, and injunctive or other relief. DOJ requests resources to investigate and pursue such cases. |

|

Chapter 269 of 2022 (AB 587, Gabriel): Social Media Companies Terms of Service |

Requires a social media company post their terms of service, including certain specific information, for each social media platform it owns or operates and report certain information semiannually to DOJ beginning January 2024. Requires DOJ make such reports publicly available on its website. Authorizes DOJ and select city attorneys to seek civil penalties. For DOJ actions, penalty revenues are split equally between the state General Fund and the county in which the judgment was entered. DOJ requests resources to post reports on its website as well as to investigate and pursue such cases. |

|

Chapter 320 of 2022 (AB 2273, Wicks): California Age‑Appropriate Design Code Act |

Beginning July 2024, requires businesses that provide an online service or product likely to be accessed by children comply with certain privacy requirements—including the completion of a data protection impact assessment for any new service or product which must be provided to DOJ within five business days upon written request. Authorizes DOJ to seek civil penalties for any violations and requires that any penalties, fees, and expenses recovered be deposited into the Consumer Privacy Fund, with the intent that they be used to fully offset costs incurred by DOJ. DOJ requests resources to conduct investigations and pursue cases, to review complaints and impact assessments, and other activities. |

|

Chapter 642 of 2022 (AB 1837, Bonta): Residential Real Property Foreclosure |

Makes various changes to processes and requirements related to the sale of residential properties. Requires a trustee or its authorized agent send specific information to DOJ if the winning bidder at a trustee sale of property pursuant to a power of sale under a mortgage or deed of trust is an eligible tenant buyer, prospective owner‑occupant, or other eligible bidder and requires DOJ publish a summary of such information on its website. Authorizes DOJ, county counsel, city attorneys, and district attorneys bring legal action to enforce specific residential property foreclosure sale procedures and requirements. DOJ requests resources to process the submitted data, respond to requests for information, and assist with investigations and legal cases. |

|

Chapter 700 of 2022 (AB 2879, Low): Cyberbullying Online Content |

Requires social media platforms disclose all cyberbullying reporting procedures in its terms of service and provide an online mechanism to report cyberbullying or any content that violates existing terms of service. Beginning September 2023, authorizes DOJ to seek civil penalties and injunctive relief for violations. DOJ requests resources to investigate and pursue such cases. |

|

Chapter 857 of 2022 (SB 301, Skinner): Online Marketplaces |

Requires online marketplaces to require their high‑volume third‑party sellers report certain specific information, to verify the provided information, to suspend future sales of third‑party sellers that do not comply with reporting and other specified conditions, and to comply with certain recordkeeping procedures. Beginning July 2023, authorizes DOJ to seek civil penalties, reasonable attorney’s fees and costs, and preventative relief (such as an injunction) for violations. DOJ requests resources to investigate and pursue such cases. |

|

Chapter 326 of 2020 (AB 1506, McCarty) |

Requires DOJ investigate officer‑involved shootings resulting in the death of an unarmed citizen. Also requires DOJ review, upon the request of a local law enforcement agency, the agency’s use of deadly force policies and make recommendations. DOJ requests resources to review use of force policies and make recommendations. |

|

Chapter 555 of 2022 (AB 1287, Bauer‑Kahan) |

Prohibits a person or business from charging a different price for any two goods that are substantially similar if the difference is based on the gender of the people for whom the goods are marketed and intended. Authorizes DOJ to seek a court order, after providing 5‑day notice to the defendant, to prevent the continuation of such practices and allows the court to impose civil penalties. DOJ requests resources to investigate and pursue such cases |

|

Chapter 750 of 2022 (AB 1084, Low) |

Requires retail department stores physically located in the state with a total of 500 or more employees that sells childcare items or toys to maintain a gender neutral section area in which a reasonable selection shall be displayed. Beginning January 2024, authorizes DOJ, district attorneys, or city attorneys seek civil penalties and reasonable attorney’s fees and costs for violations of the law. DOJ seeks resources to process, investigate, and pursue such cases as well as any other legal violations that emerge. |

|

Chapter 854 of 2022 (AB 655, Kalra) |

Requires public agencies investigate any complaint alleging its employed peace officers engaged in membership in a hate group, participated in hate group activity, or advocated public expressions of hate and requires DOJ develop guidelines for investigation and adjudication of these complaints by local agencies. DOJ requests resources to develop such guidelines, responding to inquiries, providing technical assistance to local agencies, and enforce compliance. |

|

Chapter 986 of 2022 (SB 863, Min) |

Authorizes interagency domestic violence death review teams to assist local agencies identify and review domestic violence near‑death cases. Subject to available funding, requires DOJ develop by January 2025 a protocol to facilitate communication between persons conducting autopsies and those involved in domestic violence case to ensure such domestic violence incidences, near‑deaths, and deaths are recognized and surviving family members receive appropriate services. Adds near‑deaths to the domestic violence related data that may be collected and reported annually. DOJ requests resources to develop this protocol, to collect near‑death domestic violence data, to facilitate the sharing of data, and to issue an annual report on an ongoing basis. |

|

Chapter 475 of 2022 (AB 923, Ramos) |

Encourages state agencies to consult on a government‑to‑government basis with tribes within 60 days of a tribal request and designates specific state officials (including the Attorney General) authorized to represent the state in such consultations. Requires these designated state officials complete an annual training on such consultations. DOJ seeks additional resources to provide legal advice and representation in tribal issues. |

|

Special Funds |

|

|

Outside Co‑Counsel |

DOJ requests resources to pay for private legal services to assist in the state’s defense in two pending cases related to state pandemic eviction‑related laws. |

|

Housing Strike Force |

DOJ requests resources to support increased housing‑related litigation workload‑‑specifically related to land use, conservation, and civil rights—of its Housing Strike Force. |

|

Antitrust Gasoline Pricing, Agriculture, and Technology Enforcement |

DOJ requests resources to support increased workload to investigate and prosecute antitrust violations in the technology, gasoline and oil, and agriculture sectors. |

|

Wage Theft Criminal Prosecutions |

DOJ requests resources to support increased workload for wage theft criminal investigations and prosecutions as well as other labor‑related violations. |

Fourteen Proposals Seeking to Implement Legislation. The Governor’s budget proposes $11 million General Fund in 2023‑24 (decreasing to $10.4 million annually in 2027‑28) to support Criminal Law Division and Public Rights Division implementation of 14 pieces of enacted legislation. Some of these proposals require DOJ take certain actions. For example, beginning July 2023, Chapter 326 of 2020 (AB 1506, McCarty) requires DOJ review law enforcement agencies’ use of deadly force policies (upon agency request) and provide specific and customized recommendations. Other proposals authorize—but do not require—DOJ to take action. For example, beginning July 2023, Chapter 857 of 2022 (SB 301, Skinner) requires online marketplaces to mandate their high‑volume, third‑party sellers to (1) report specific information, (2) verify the provided information, (3) suspend future sales of third‑party sellers that do not comply with reporting and other specified conditions, and (4) comply with certain recordkeeping procedures. DOJ is authorized to seek civil penalties, reasonable attorney’s fees and costs, and preventative relief (such as an injunction) for violations.

Four Proposals for Two Specific Cases and Other Legal Workload. The Governor’s budget proposes $13.4 million in 2023‑24 ($4 million General Fund and $9.5 million from various special funds)—decreasing to $10.2 million annually in 2027‑28—for four budget proposals supporting DOJ legal workload. One proposal would provide General Fund resources for the Civil Law Division to pay for private legal services to assist DOJ in defending the state in two pending cases related to state pandemic eviction‑related laws. The remaining three proposals would provide the Public Rights Division with additional legal resources for housing‑related legal workload for its Housing Strike Force, for antitrust legal workload for its Antitrust Law Section, and for wage theft criminal prosecutions by its Worker Rights and Fair Labor Section. (We provide more specific comments for two of these proposals—increased resources for the Housing Strike Force and the Antitrust Law Section—later in this analysis.)

Assessment

Legal Workload Would Increase Due to Enacted Legislation and Other Factors... As noted above, some of the budget proposals to implement recently enacted legislation direct DOJ to engage in certain new activities that are expected to generate ongoing workload. For example, Chapter 326 allows for any law enforcement agency to request DOJ review its use of force policies and requires DOJ to provide individualized recommendations. This is new workload that is likely to persist into the future given the number of law enforcement agencies in the state. Similarly, DOJ has demonstrated that the state can benefit from increased legal activity in certain areas—such as housing and wage theft—as it could reduce potential harm to Californians. For example, wage theft‑related legal action can address business practices (such as employee misclassification or tax evasion) that are harmful to workers. DOJ has provided sufficient workload justification for these proposals that suggests additional resources appear to be needed. As such, it would be reasonable to provide the requested funding to support this workload on the assumption that all funding provided for legal activities is currently used efficiently and effectively.

Other budget proposals to implement recently enacted legislation authorize—but do not require—DOJ action. This provides DOJ with discretion on how much workload is generated—such as whether DOJ pursues investigations and litigation as well as how many such cases are initiated. For example, Chapter 857 authorizes DOJ to seek civil penalties and other remedies if online marketplaces do not comply with state law. It is important that DOJ has the ability to enforce such laws and that it do so if the law is violated. However, it is unclear the extent to which sufficient workload would be generated on an ongoing basis. For example, businesses would likely adapt their business practices to comply with Chapter 857 in the coming years. This—along with the threat of potential DOJ litigation—could reduce illegal activity and require little resources for DOJ litigation on an ongoing basis.

...But Unclear Whether Requested Resources Are Needed. As we discuss below, the Legislature currently lacks information on how DOJ prioritizes its workload, how it uses its appropriated funds, and the extent to which LDF or offsetting revenues are available to support DOJ workload. This makes it difficult for the Legislature to determine whether additional resources are truly needed or if the Legislature could instead redirect existing resources to support this workload.

Difficult for Legislature to Monitor How Funding for Legal Workload Is Used Over Time. Annual budgets since 2009‑10 have typically appropriated funding to the entire Legal Division from various fund sources. This means that DOJ has flexibility on how such resources are specifically used across the division. This includes how the legal division is organized (such as how staff are divided into sections) as well as what legal investigations and litigation are pursued based on DOJ priorities.

Such flexibility can be a major benefit to the state as it allows DOJ to pivot quickly to address the issues most likely to significantly impact Californians as well as to focus resources where necessary (such as if a case or investigation moves forward suddenly due to court action). It also allows DOJ to “test” the use of resources in a particular way before approaching the Legislature to seek ongoing funding. For example, because it was a priority for the Attorney General at the time, DOJ established the Bureau of Children’s Justice in 2014‑15—to focus on legal workload related to children (such as school discrimination)—using one‑time settlement revenues and existing positions redirected from the Public Rights Division. The bureau’s work was then used to justify DOJ’s subsequent 2018‑19 budget request, which was approved, for $3.6 million on an ongoing basis from the PRLESF and 14 positions. In contrast, such a test that generated outcomes that were not effective or did not meet legislative expectations or priorities would demonstrate that ongoing funding was not merited.

However, this flexibility can make it difficult to monitor how resources provided to support DOJ’s legal workload are used over time. Some DOJ budget requests seek additional funding for particular purposes. However, over time, it is unclear whether such resources are still being used for that purpose or if the resources have been redirected to other workload that has become a greater priority. For example, DOJ received $6.5 million in increased annual General Fund resources and 31 positions beginning in 2017‑18 for increased workload related to challenging or responding to various federal directives that could significantly impact California in a negative manner. With a different federal administration issuing fewer such directives, it is unclear how this ongoing funding is currently used or whether the activities it is supporting are consistent with legislative priorities. Similarly, while DOJ budget requests seeking additional resources typically focus on a particular section, this flexibility could allow DOJ to shift resources between its subdivisions and sections. A lack of transparency on how legal funding is used across the Legal Division broadly makes it difficult for the Legislature to assess whether additional resources are truly needed or if funding could instead be redirected from other DOJ legal workload on an ongoing or temporary basis.

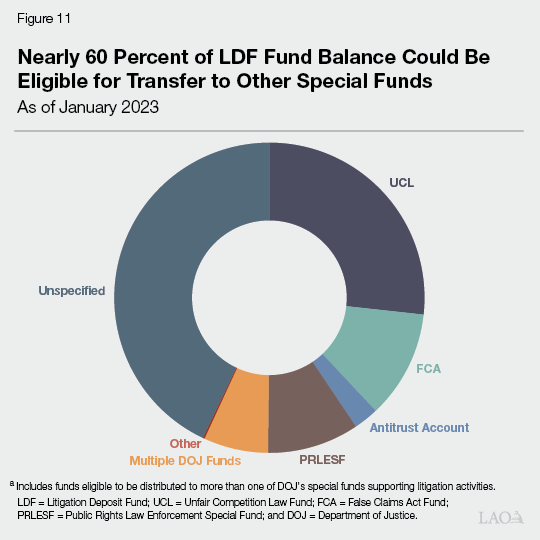

Unclear Whether LDF Could Support Workload Given Limited Opportunity for Legislative Oversight of LDF. As noted above, DOJ legal workload is supported from various fund sources—including the General Fund and various special funds that receive transfers from litigation proceeds deposited into the LDF. It is unclear the extent to which funds in the LDF are eligible for transfer to support DOJ workload. (We define funds eligible for transfer to include all litigation funds that DOJ has decision‑making authority over. Ineligible funds would be monies pending allocation to specific individuals or narrowly defined purposes, as well as funds tied to cases that are awaiting final resolution.) For example, it is possible that LDF funds are available for transfer to the UCL Fund to support the 2023‑24 budget requests for the Consumer Protection Section—in lieu of the General Fund. This uncertainty is generally because current state law and DOJ practices related to the LDF limit the opportunity for the Legislature to conduct effective oversight of the LDF. (Please see our 2021 report, Increasing Oversight of the State Litigation Deposit Fund, for a more detailed discussion on these issues. We summarize our findings in the nearby box.) Based on a review of high‑level, DOJ‑provided data, we estimated that nearly 60 percent of the LDF fund balance could be eligible for transfer to various special funds. The status of the remaining 40 percent is unclear, as shown in Figure 11.

Summary of LAO 2021 Report Findings on the Litigation Deposit Fund (LDF)

Our January 2021 report—Increasing Oversight of the State Litigation Deposit Fund—found that current state law and the Department of Justice (DOJ) practices related to the LDF limit the opportunity for the Legislature to conduct effective oversight of the LDF. Specifically, we found that there is:

- Little meaningful information provided in statutorily required LDF quarterly reports, which makes it difficult for the Legislature to assess and draw conclusions about DOJ litigation activities.

- Little transparency on the level of resources available for transfer from the LDF to the General Fund, special funds, or other funds means the Legislature lacks the necessary information to determine what fiscal resources could be available as it makes budget decisions.

- Little incentive for DOJ to transfer LDF monies to the special funds that support its self‑initiated litigation as these funds are included in the annual budget process and subject to greater oversight.

- Limited opportunity for ongoing legislative oversight over legal workload initiated by DOJ, which means that this workload is not as rigorously evaluated.

- Significant flexibility for DOJ in determining the use of legislatively appropriated funding over time, which can make it difficult to track how DOJ is using provided resources over time.

Maximizing Use of LDF Monies Would Reduce Need for General Fund Resources. To the extent LDF monies were available to support DOJ legal activities, it would reduce the cost pressure on the General Fund. This is notable as the Governor’s budget proposes various budget solutions to address the estimated budget problem for 2023‑24. However, our estimates suggest the budget problem is likely to be larger in May. Moreover, even under Governor’s budget assumptions, the proposed solutions also are insufficient to keep the state budget balanced in future years, with projected out‑year deficits in the $4 billion to $9 billion range. Reducing the amount of General Fund needed to support such requests on an ongoing basis would provide additional General Fund relief in the budget and future years relative to the Governor’s budget.

Unclear How DOJ Accounts for Offsetting Revenue. Several of the proposed budget requests pertain to implementing legislation that authorizes DOJ to seek civil penalties and/or reasonable attorney fees and costs—some of which is intended to offset DOJ costs. For example, Chapter 320 requires businesses that provide an online service or product likely to be accessed by children comply with certain privacy requirements and authorizes DOJ to seek civil penalties for any violations. Chapter 320 further requires that any penalties, fees, and expenses recovered be deposited into the Consumer Privacy Fund, with the intent that they be used to fully offset costs incurred by DOJ. DOJ, however, is requesting General Fund resources to implement Chapter 320. While General Fund or other funds could be needed to initially pursue such cases, litigation proceeds should be available to reimburse or offset such funds in the future. In discussions with DOJ, it is unclear the extent to which such penalty revenues and attorneys’ fees will be sought, how much might be obtained, and the extent to which they will be used to offset this workload.

Recommendations

As discussed above, the lack of information on how DOJ prioritizes its workload, how it uses its appropriated funds, and the extent to which LDF or offsetting revenues are available to support DOJ workload make it difficult for the Legislature to determine whether existing DOJ funding levels for the Legal Division are appropriate. This, in turn, makes it difficult to determine whether additional resources are truly needed, or if resources could be redirected, to address the workload needs identified in the Governor’s budget proposals, as well as whether state funding is being used consistently with legislative priorities. To address these concerns, we recommend the Legislature require DOJ to report on legal workload annually and provide the requested funding only on a two‑year basis.

Require DOJ to Report on Legal Workload Annually. We recommend the Legislature direct DOJ to report annually beginning January 1, 2025 on its (1) planned legal workload, position count, and allocation of resources for the upcoming fiscal year and (2) actual legal workload, position count, and allocation from the preceding fiscal year and how it compares with its initial plans for that year. Such reporting could include broad descriptions of pending and upcoming workload by legal section, when cases were initiated, the estimated or actual number of hours required for these cases, the number of hours estimated to be available to take on new cases or workload, and the potential remedies sought or achieved (such as the seeking and/or receipt of attorney fees or civil penalties). The information would enable greater legislative oversight to monitor DOJ’s legal workload and ensure the fiscal resources provided to support it are used accountably. This includes helping the Legislature determine whether additional resources are needed for legislative or Attorney General priorities or if existing resources should be reprioritized within the office to accommodate new workload, such as the new workload identified in the Governor’s proposals.

Provide Requested Funding on Two‑Year Basis. Given that the requested resources would support the implementation of recently enacted legislation, as well as workload that could reduce harm to Californians, we recommend the Legislature provide funding to support the identified workload until it receives the above report. As such, we recommend approving the requested funding on a two‑year basis. This would provide DOJ with the necessary resources to implement enacted legislation without delay, to continue its defense of two existing legal cases, and to increase its legal activities in key areas while the recommended report is completed and analyzed. The recommended report could be enhanced by the Legislature also implementing the recommendations from our 2021 report on the LDF to improve legislative oversight of the fund. (We summarize these recommendations in the nearby box.) These LDF recommendations would provide more oversight on the level of litigation proceeds available to support DOJ legal workload.

Summary of Recommendations From LAO 2021 Report on the Litigation Deposit Fund (LDF)

Our January 2021 report—Increasing Oversight of the State Litigation Deposit Fund—offered several recommendations to increase legislative oversight of the LDF and how LDF funds transferred to the Department of Justice (DOJ) special funds are used. Specifically, we recommended:

- Requiring DOJ to transfer all eligible funds from the LDF to the appropriate DOJ special funds rather than continuing to allow DOJ to retain funds in the LDF.

- Requiring LDF allocations occur within a specified amount of time, which would ensure the Legislature receives timely information on the total level of litigation proceeds potentially available for use and prevent the re‑accumulation of funds in the LDF.

- Reconsidering existing state law requiring an automatic transfer from the LDF‑supported Antitrust Account to the state General Fund when monies in the account exceed $3 million, thus providing the Legislature with more choices on how Antitrust Account monies are used.

- Requiring increased LDF reporting, such as information on the costs and litigation proceeds associated with each resolved case and how proceeds may be used.

- Increasing oversight of the use of LDF monies transferred to DOJ special funds, such as by requiring robust annual reports by each DOJ litigation section or unit supported by litigation proceeds.

In combination, the recommended report, as well as implementation of our prior LDF recommendations, would provide the Legislature with the necessary information to (1) conduct meaningful oversight of DOJ’s legal workload, (2) make informed decisions on what level of funding (and the sources of such funding) would be appropriate on an ongoing basis to support legislative and Attorney General priorities, and (3) monitor how provided resources are used and what outcomes are obtained. This includes where ongoing funding is provided for these specific budget requests.

Discussion of Budget Proposals for the Housing Strike Force and Antitrust Law Section

In this section, we discuss two specific budget proposals for increased legal resources—specifically, to support increased workload for the Housing Strike Force and the Antitrust Law Section.

Governor’s Proposals

Increased Housing Strike Force Workload. The Housing Strike Force was created by the Attorney General in November 2021 as a partnership of four sections within the Public Rights Division—the Land Use and Conservation Section, the Civil Rights Enforcement Section, the Consumer Protection Section, and the Environment Section. As shown earlier in Figure 9, the Governor’s budget proposes four positions and $1.4 million in 2023‑24 ($973,000 million General Fund and $402,000 LSRF)—decreasing to $1.3 million annually in 2024‑25—for increased housing‑related litigation workload pursued by the Housing Strike Force. Specifically, the resources would be for the Land Use and Conservation Section as well as the Civil Rights Enforcement Section to pursue housing‑related litigation. (The other two sections are not requesting additional resources and are supporting Housing Strike Force workload within their existing budgets.) As mentioned above, the LSRF is a special fund that receives reimbursements from state agencies billed for services. For this request, the state agency that would be billed for DOJ legal services is the Department of Housing and Community Development (HCD)—the state agency tasked with the mission of promoting safe and affordable housing and inclusive and sustainable communities.

Increased Antitrust Law Section Workload. As shown in Figure 9, the Governor’s budget proposes 20 positions and $8 million in 2023‑24 ($4 million Antitrust Account and $4 million UCL Fund)—decreasing to $7.8 million annually in 2024‑25—for increased workload within the Antitrust Law Section. The additional resources would be used to support increased investigations and prosecutions of antitrust violations in technology, gasoline and oil, and agriculture sectors. Under the Governor’s proposal, the section’s staff would increase from 36 positions to 56 positions—a 56 percent increase.

LAO Comments on Proposals

Additional Resources Could Potentially Be Needed. As noted in the previous section, due to the lack of information for the Legislature to monitor how funding provided to support legal workload is used over time, it is difficult to determine whether existing funding is currently being used efficiently and effectively and if additional resources are truly needed. When analyzing these two requests separately, we find that additional resources could potentially be needed for these proposals. For the Housing Strike Force request, the department has been able to identify recent workload, as well as potential forthcoming workload, related to ensuring compliance with recently enacted housing‑related laws. Part of this work would be conducted in partnership with HCD to ensure HCD’s expertise is utilized. This part of the work would be supported by the LSRF portion of the budget request as DOJ would bill HCD for this workload. In addition, DOJ will pursue certain legal activities separate from HCD under the Attorney General’s broad authority. Pursuing action in this manner can sometimes be a cost‑effective method of enforcing state laws. For example, if a local jurisdiction seeks to implement state law in a manner that DOJ interprets to be inappropriate and HCD believes it does not have the authority to pursue legal action, immediate DOJ legal intervention can deter such implementation by other local jurisdictions as well as limit the amount of litigation generated. Such work would be supported by the proposed General Fund resources.

For the proposed increase in resources for the Antitrust Law Section, DOJ was able to identify recent and potential legal workload in particular sectors which could benefit California. For example, California is the home of a significant number of technology firms where antitrust violations can result in harm to consumers. Additionally, to demonstrate the potential impact of dedicating resources to this workload, DOJ temporarily redirected six existing unfunded attorney positions within the Public Rights Division to the Antitrust Law Section in 2021‑22 and supported them using a total of $1.4 million in General Fund, Antitrust Account, and UCL Fund savings. According to DOJ, this redirection allowed DOJ to conduct one new major investigation in the technology industry which is anticipated to conclude in 2022‑23 and result in litigation or a significant settlement. In combination, this suggests that additional, dedicated resources could be needed and benefit the state.

Ongoing Workload and Outcomes for Housing Strike Force Unclear. In recent years, there has been an increase in housing‑related laws which is expected to continue in the near future as it remains a significant area of concern for the Legislature, state and local government entities, and members of the public. This could result in disagreements over how such laws are or should be implemented and enforced, which could then result in litigation workload for DOJ. However, it is unclear whether the ongoing workload would remain high enough to justify the requested resources on an ongoing basis. Additionally, we would note that it is unclear the extent to which such workload may be impacted by HCD’s new Housing Accountability Unit in the future. This new unit was created in 2021‑22 to hold jurisdictions accountable for meeting their housing commitments and complying with state housing laws. As a result, the new unit could result in more reimbursable DOJ workload being pursued in coordination with HCD due to increased violations being referred to DOJ for legal action. As this unit and DOJ’s Housing Strike Force becomes fully operational, it will be important to ensure legal activities are pursued in the most efficient and effective manner. Similarly, it is possible that DOJ’s workload could be impacted by the activities of the Civil Rights Department (formerly the Department of Fair Employment and Housing), which is tasked with protecting Californians from unlawful discrimination in housing and other areas. For example, the department could increase its enforcement actions, which could have the effect of reducing the workload of DOJ. This is because a portion of the requested resources would support DOJ’s Civil Rights Enforcement Section, which could work on issues similar to those handled by the Civil Rights Department. Given this housing workload uncertainty, the Legislature could consider whether annual reporting to monitor DOJ work in this area would be beneficial to conduct ongoing oversight over state legal activities in this area.