LAO Contact

March 2, 2023

The 2023-24 Budget

In-Home Supportive Services

Summary. This post describes the Governor’s budget assumptions and proposals related to the In-Home Supportive Services (IHSS) program and offers relevant issues for legislative consideration.

Background

Overview of the IHSS Program. The IHSS program provides personal care and domestic services to low-income individuals to help them remain safely in their own homes and communities. In order to qualify for IHSS, a recipient must be aged, blind, or disabled and in most cases have income below the level necessary to qualify for the Supplemental Security Income/State Supplementary Payment cash assistance program (for example, about $1,135 a month for an aged and/or disabled individual living independently in 2022-23). IHSS recipients generally are eligible to receive up to 283 hours per month of assistance with tasks such as bathing, dressing, housework, and meal preparation. Social workers employed by county welfare departments conduct an in-home assessment of an individual’s needs in order to determine the amount and type of service hours to be provided. In most cases, the recipient is responsible for hiring and supervising a paid IHSS provider—oftentimes a family member or relative. The average number of service hours that will be provided to an estimated 642,289 IHSS recipients is projected to be 116 hours per month in 2023-24.

IHSS Costs Split Between Federal Government, State, and Counties IHSS costs are shared by the federal government, state, and counties. Since IHSS primarily is delivered as a Medi-Cal benefit, the federal share of cost is determined by the Medicaid reimbursement rate, which typically is 50 percent. The state receives an enhanced federal reimbursement rate for many IHSS recipients who receive services as a result of the Patient Protection and Affordable Care Act expansion (90 percent federal reimbursement rate) and the Community First Choice Option waiver (56 percent federal reimbursement rate). Overall, the effective federal reimbursement rate for IHSS is about 54 percent. The remaining nonfederal share of IHSS costs is covered by the state and counties. Historically, counties paid 35 percent of the nonfederal share of IHSS service costs and 30 percent of the nonfederal share of IHSS administrative costs. Beginning in 2012-13, however, the historical county share-of-cost model was replaced with an IHSS county maintenance-of-effort (MOE), meaning county costs would reflect a set amount of nonfederal IHSS costs as opposed to a certain percent of nonfederal IHSS costs. The state is responsible for covering the remaining nonfederal share of costs not covered by the IHSS county MOE.

Budget Overview and Caseload Update

The Governor’s budget proposes a total of $20.5 billion (all funds) for IHSS in 2023-24, which is about $2 billion (10 percent) above estimated expenditures in 2022-23. The budget includes about $7.8 billion from the General Fund for support of the IHSS program in 2023-24. We estimate that this is a net increase of about $1.9 billion (24 percent) above estimated General Fund costs in 2022-23. The main reason for the year-to-year General Fund cost increase is the anticipated end of a temporary increase to federal Medicaid funds (previously largely associated with the public health emergency) that were used to offset General Fund costs in the IHSS program in 2021-22 and 2022-23. This expiration of enhanced federal funds results in roughly $1 billion in IHSS costs shifting back to the General Fund in 2023-24. Additionally, the Governor’s budget assumes continued year-to-year growth in two of the three primary IHSS cost drivers—caseload (4.3 percent) and cost per hour (2.7 percent)—while holding hours per case flat between 2022-23 and 2023-24. We describe in more detail key cost increases and cost shifts in this section.

LAO Bottom Line: Growth in IHSS Caseload and Cost Per Hour Expected to Return to Close to Pre-COVID Rates, but Service Utilization Continues to Remain Below Historical Levels. Caseload growth, cost per hour (essentially driven by IHSS wages), and number of hours per case are key drivers of increasing IHSS costs. Based on our analysis of the proposed 2023-24 budget, we found that hourly wages are expected to continue to grow at a rate generally similar to historical levels. We also found that, after a period of slowed caseload growth, the IHSS paid caseload is expected to begin to increase at rates more similar to pre-pandemic levels. Although the caseload is expected to grow at a faster rate than recent years, recent caseload data indicates that the percentage of authorized cases that are paid in any given month remains below historical averages. Below, we summarize our assessment of the paid caseload, hours per case, and hourly wage assumptions included in the Governor’s budget.

Caseload Growth Expected to Return to Close to Pre-COVID Rates… Prior to the start of COVID-19, the average number of IHSS paid cases had grown at an average rate of about 4 percent annually, reaching 555,000 cases in 2019-20. However, in 2020-21 and 2021-22, the caseload experienced slower growth of 2.1 percent and 3.5 percent respectively. This slowing in the growth of the IHSS caseload coincided with the start of the COVID-19 pandemic (March 2020). The Governor’s 2023-24 budget assumes the caseload will grow at a rate that is closer to pre-COVID-19 levels in 2022-23 (4.9 percent) and 2023-24 (4.3 percent).

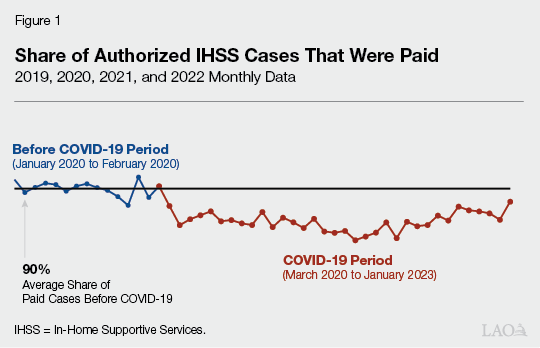

…But Still Lower Share of Authorized Cases Claiming Hours Each Month. Based on our analysis of caseload data, we observe a continued trend of fewer authorized cases claiming service hours in any given month since the start of COVID-19. Figure 1 shows that the average share of authorized cases that are paid every month slightly decreased from 90 percent to 88 percent through July 2022. This translates to roughly 14,000 fewer paid cases every month relative to pre-COVID-19 levels. More recent data, for August 2022 through January 2023, indicate there is a very recent, slight increase in the percentage of authorized cases being paid in 2022-23 (averaging closer to 89 percent, or about 7,000 less paid cases per month). The data also indicate that for those authorized cases that are paid, there was a slight decline in the percentage of authorized hours that were claimed since the start of COVID-19—meaning those cases that were claiming hours were claiming a lower share of their authorized hours than historical trends (declining from about 96 percent before COVID-19 to about 94 percent). (We note that, similar to the recent increase in the share of authorized cases being paid, there has been a recent increase in the share of authorized hours being claimed—with the both December 2022 and January 2023 showing about 97 percent of authorized hours being claimed.) Some of the reasons why authorized cases may not receive paid services include recipients not yet hiring an IHSS provider or being temporarily hospitalized or admitted into a licensed care facility. Additionally, one possible COVID-19-related reason may be that recipients with non-live-in providers or non-live-in providers themselves may be hesitant to interact with individuals outside of their household due to public health concerns. Our office and the department are continuing to work to better understand this decrease in paid cases and will provide an update at the May Revision.

Hours Per Case Projected to Remain Flat. The 2023-24 budget projects the average monthly number of IHSS hours per case to remain flat between 2022-23 and 2023-24. Historically, the administration has estimated slight increases in the average hours per case on a year-over-year basis (most recently expecting year-over-year increases of around 1 percent). In addition to assuming the average hours per case remains flat on a year-over-year basis, we note that the administration has revised their assumed average monthly hours per case downward for 2022-23 since the adoption of the budget (from about 120 hours to 116 hours per case). This lower average hours per case is likely related to the previously noted lower level of IHSS authorized cases being paid and it is something we are continuing to monitor.

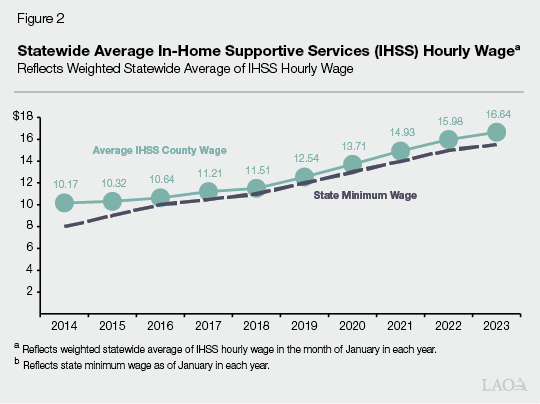

Cost Per Hour Continues to Increase. The Governor’s budget assumes that the cost per hour of IHSS services will increase from $18.62 in 2022-23 to $19.12 in 2023-24. The majority of the cost per hour is associated with IHSS wages (estimated to be an average of $16.64 per hour as of January 2023). As shown in Figure 2, the average IHSS hourly wage has increased by 6 percent annually since 2014. The growth in IHSS hourly wages in part is due to increases to the state minimum wage—from $8 per hour in January 1, 2014 to $15.50 per hour in January 1, 2023. Pursuant to current law, the state minimum wage will increase by inflation annually beginning January 1, 2024. Additionally, counties may establish IHSS hourly wages above the state minimum wage through local wage ordinances or, more commonly, collectively bargained agreements. The state, federal government, and counties share in the cost of IHSS wages.

Expiration of Temporary Increase to Federal Medicaid Funding

Budget Assumes IHSS General Fund Costs to Increase in 2023-24 as a Result of Expiration of Temporary Increase in Federal Medicaid Funding… Under the Families First Coronavirus Response Act, the federal government increased the federal match rate for Medicaid services by 6.2 percentage points for the duration of the national public health emergency caused by COVID-19. This increased federal match lowers state costs for Medi-Cal, IHSS, and other programs that rely on federal Medicaid funding. The Governor’s budget assumes this enhanced federal funding is in place from January 1, 2020 through June 30, 2023 and will offset over $1 billion in total IHSS General Fund spending in 2022-23. Because the budget assumes this enhanced federal funding ends in June 2023, the budget also assumes the General Fund will pick up this roughly $1 billion in costs in 2023-24.

…But More Recent Federal Action Provides an Updated Ramp-Down Schedule for Enhanced Federal Funds. In late December 2022, after the development of the Governor’s 2023-24 budget, federal legislation was enacted that set the ramp-down schedule for the enhanced federal funding. Rather than remain at 6.2 percent through the duration of the public health emergency (as assumed by the January budget proposal), the enhanced federal funding will ramp down over the course of calendar year 2023. Beginning in April 2023, the enhanced rate for most services will drop from 6.2 percentage points to 5 percentage points, then to 2.5 percentage points by July 2023, 1.5 percentage points by October 2023, and will be fully eliminated by January 2024.

Ramp Down of Enhanced Federal Funding Will Increase General Fund Costs in 2022-23… As a result, beginning in April 2023, the ramp down of the enhanced federal funding will result in somewhat lower federal funding being available to offset General Fund costs in IHSS in 2022-23 than was assumed by the administration (5 percent rather than 6.2 percent). We estimate the ramp down of the enhanced federal funding will result in increased costs of about $40 million to $50 million in IHSS in 2022-23.

…But Reduce General Fund Costs in 2023-24. The ramp-down schedule for the enhanced federal funding will result in six additional months of enhanced federal funding in 2023-24 than assumed by the administration. Relative to the Governor’s budget, we estimate the additional months of enhanced federal funding will reduce General Fund costs for IHSS costs by over $150 million in 2023-24. The administration will be updating their estimates at the May Revision.

IHSS-Related Home- and Community-Based Services Spending Plan Items

Implementation of IHSS-Related HCBS Spending Plan Items. In addition to the previously mentioned 6.2 percent enhanced federal Medicaid match rate, under the American Rescue Plan (ARP) Act, the federal government increased the federal match rate for IHSS and other Medicaid-funded home- and community-based services (HCBS) by an additional 10 percentage points from April 1, 2021 through March 31, 2022. This increase in federal Medicaid funding offset over $1 billion in baseline IHSS General Fund spending across 2020-21 and 2021-22. As a condition of receiving these funds, the state is required to spend an equal amount of funding on new HCBS enhancements and expansions. Consequently, these savings were transferred to the HCBS ARP Fund and spent on federally approved HCBS enhancements and expansions. California’s various HCBS enhancements and expansions had to be included in the state’s HCBS spending plan that was ultimately approved by the federal government. The state’s HCBS spending plan includes two IHSS-related enhancements: (1) provide a one-time $500 payment to IHSS providers who worked at least two months between March 2020 and March 2021 and (2) create specialized training opportunities and fiscal bonuses for IHSS providers.

We understand that the one-time $500 payments to IHSS providers were sent out to roughly 550,000 providers in the beginning of 2022. Additionally, DSS began implementing the IHSS training opportunities initiative—known as IHSS Career Pathways—in October of 2022. Providers participating in the IHSS Career Pathways program are paid for the time that they participate in the trainings and are eligible for incentive payments if certain trainings are completed. We note that, in order to be eligible for certain incentive payments, IHSS providers must continue to work for IHSS recipients for a certain amount of time after the completion of the training. To be eligible to receive the largest incentive payment (a one-time payment of $2,000), a provider must continue to work for a particular recipient for a minimum of 40 hours a week for six months after completing the training. Although the trainings are relatively new, the administration indicates that as of December 2022:

Over 1,100 providers had taken a training.

The average number of hours of training per provider was 1.95 hours.

The department has received requests for approval of 85 training incentive payments (none have been approved to date).

Key Issues for Legislative Consideration. We understand that the administration is currently in the process of introducing more training opportunities and expects all funds from the HCBS spending plan for the IHSS Career Pathways program (nearly $300 million) to be expended by a December 2023 deadline. Under this assumed December 2023 expenditure deadline, providers would need to complete the training program by the end of June 2022 to be eligible for the largest incentive payment. As such, we are working with the administration to better understand (1) the assumptions they are making to project that all funds will be spent by the December 2023 deadline, (2) how many providers they expect to go through the trainings and receive the incentives in order to expend all of the funds by December 2023, (3) how the administration will wind down the program in a way that ensures providers are aware of the deadlines they must meet in order to be eligible for the various training incentive payments, and (4) whether the administration would propose to extend the IHSS Career Pathways expenditure deadline if not all funds for trainings and incentive payments are spent by December 2023.

Expansion of Medicaid to Remaining Undocumented Individuals

Historically, income-eligible undocumented immigrants only qualified for “restricted-scope” Medi-Cal coverage, which covers their emergency- and pregnancy-related service costs. In general, beneficiaries of restricted scope Medi-Cal are not eligible for IHSS. The state has expanded comprehensive, or “full-scope,” Medi-Cal coverage, including IHSS eligibility, to income-eligible undocumented children (effective May 2016), adults aged 19-25 (effective January 1, 2020), older adults aged 50 and over (effective May 2022), and adults aged 26-49 (effective no later than January 1, 2024)—effectively covering all income-eligible undocumented individuals.

The 2022-23 and 2023-24 Budget Includes Funding for the Expansion of Medi-Cal to Undocumented Individuals Aged 50 and Over… The budget includes about $100 million General Fund in 2022-23 and $860 million General Fund in 2023-24 to provide IHSS services to an estimated roughly 3,600 cases in 2022-23 and 29,000 cases in 2023-24 that will become newly eligible for IHSS as a result of the expansion of Medi-Cal to undocumented individuals aged 50 and older. The administration indicates this enrollment will increase further to an estimated 34,000 cases in 2024-25.

…While Costs for the Expansion to those aged 26-49 Assumed to Begin in 2024-25. Although the expansion of IHSS to undocumented individuals aged 26-49 will begin in the 2023-24, the administration does not assume any costs in the IHSS program for this expansion in that year. This is because the administration estimates that those applying for Medi-Cal in 2023-24 will not apply and begin receiving IHSS until 2024-25.

Administration Will Continue to Monitor and Report Back at the May Revision. We understand that the administration will continue to monitor the expansion of Medi-Cal to those aged 50 and over, and its implications for the IHSS caseload. With this information, the administration may be able to better inform its estimate of when the expansion begins to impact the IHSS caseload.

Implementation of Phasing in the Medi-Cal Asset Limit Repeal

Phasing in Medi-Cal Asset Limit Repeal Will Increase IHSS Caseload. Historically, seniors and persons with disabilities had to have assets at or below $2,000 (or $3,000 for couples) to be eligible for Medi-Cal. The 2021-22 budget included legislation to raise the Medi-Cal asset limit from $2,000 to $130,000 for individuals and from $3,000 to $195,000 for couples in July 2022. Moreover, the asset limit will be eliminated altogether no sooner than January 2024. The increase in the asset limit results in more seniors and persons with disabilities becoming eligible for Medi-Cal services, including IHSS. The administration estimates that about 6,000 seniors and persons with disabilities will become eligible for IHSS as a result of this policy change in 2022-23, increasing General Fund costs by $65 million. In 2023-24, when the asset limit is expected to be fully eliminated, the administration estimates nearly 8,000 seniors and persons with disabilities will become eligible—increasing costs by about $88 million in 2023-24.

Implementation of the IHSS Permanent Backup Provider System

Permanent Backup Provider System Established in 2022-23 Budget. The 2021-22 budget included $5 million General Fund to create a permanent IHSS backup provider system on January 1, 2022, contingent on a policy framework being adopted in statute. However, a policy framework for the permanent backup provider system was not adopted within the 2021-22 budget period, resulting in the initial $5 million allocation going unspent. The 2022-23 budget codified a policy framework for the permanent backup provider. Under the permanent backup provider system, a recipient who has an urgent need or whose health and safety will be at risk without a backup provider can receive up to 80 hours (if recipient is non-severely impaired) or 160 hours (if recipient is severely impaired) of backup provider services per state fiscal year. Additionally, backup providers are paid $2 above the local IHSS hourly wage rate. The proposed budget assumes roughly $15 million in General Fund costs to support the Backup Provider System in 2022-23 and 2023-24. This additional funding would support over 35,000 IHSS recipients receiving an average of 119 hours of backup care in a year.

Use of Backup Provider System May Be Lower Than Budgeted in 2022-23. We understand from the administration that the Backup Provider System is available in all counties as of October 2024. Although the system is available for use, utilization for the first three months is lower than expected—likely indicating there will be savings in 2022-23. Specifically, between October 2022 and December 2022, 118 IHSS recipients had utilized the Backup Provider System. We will continue to monitor the caseload and provide updates at the May Revision.