October 16, 2023

The 2023-24 Budget

Overview of the Spending Plan (Final Version)

- Introduction

- The Budget Problem

- Budget Condition

- Evolution of the Budget

- Major Features of the 2023‑24 Spending Plan

- Appendix

Introduction

Each year, our office publishes the California Spending Plan to summarize the annual state budget. This publication provides an overview of the 2023‑24 Budget Act, gives a brief description of how the budget process unfolded, and then highlights major features of the budget approved by the Legislature and signed by the Governor. All figures in this publication reflect actions taken through the end of June 2023, but we have updated the narrative to reflect actions taken later in the legislative session. In addition to this report, we have released a series of issue‑specific, online posts that give more detail on the major actions in the budget package.

The Budget Problem

In this section, we present our estimates of the budget problem the Legislature addressed in the 2023 budget package. After two years of significant surpluses, the state faced a budget problem, or deficit, this year. In the context of budget development, a budget problem occurs when estimated resources are insufficient to cover the costs of currently authorized services. Under the State Constitution, a budget problem must be solved, for example, by increasing revenues or reducing spending.

$27 Billion Budget Problem

Budget Package Addressed a $27 Billion Budget Problem. We estimate the Legislature solved a $26.5 billion budget problem in the 2023‑24 budget package. This budget problem is nearly the same as the one addressed by the Governor in the May Revision. (Although we cited a slightly higher number in our Initial Comments on the Governor’s May Revision report, after further review, the budget problem we estimated at that time should have been slightly lower.) Our estimate of the budget problem is also lower than the figure cited by the administration. The reasons for this difference are generally the same as those we cited at the Governor’s budget and May Revision. Namely, the administration’s calculation of the budget problem included the cost of some policies that had not been adopted by the Legislature. For example, the administration’s estimates included an assumption about the costs of inflation in future years that was not current law. (We explained the differences between our estimates in more detail in our report, The 2023‑24 Budget: Overview of the Governor’s Budget.)

Budget Problem Includes $4.5 Billion in New, Discretionary Proposals. Most of the reason that the state faced a budget problem in 2023‑24 was that state revenues declined relative to expectations from June 2022. (We describe these dynamics in more detail later in this report.) However, about $4.5 billion of the budget problem is the result of new, discretionary spending in the budget package. (We define discretionary spending as new spending or revenue reductions that were not previously authorized under current law or legislative policy.) These discretionary spending amounts are listed in Appendix 3.

How the Spending Plan Addresses the Budget Problem

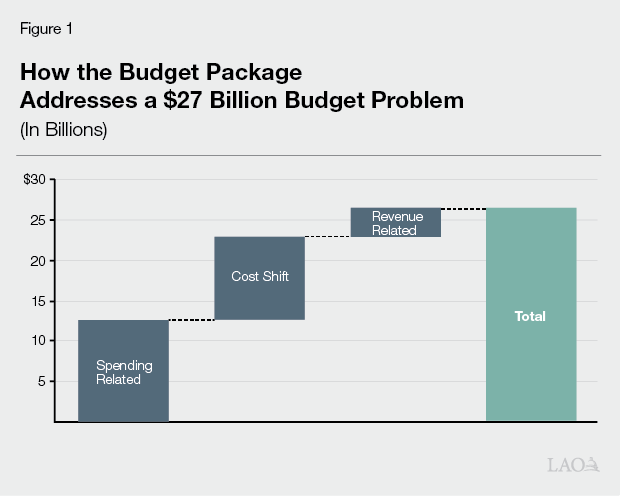

The state has several types of solutions—or options—for addressing a budget problem, but the most important include: reserve withdrawals, spending reductions, revenue increases, and cost shifts (for example, between funds). Figure 1 summarizes the budget solutions that budget package used to address the $27 billion budget problem. They include: $13 billion in spending‑related solutions, $10 billion in cost shifts, and nearly $4 billion in revenue‑related solutions. (As we discuss in more detail later in this report, the spending plan does not use any of the state’s reserves to close the deficit.) The remainder of this section describes each of these components in more detail.

$13 Billion in Spending‑Related Solutions

The budget package includes $13 billion in spending‑related budget solutions. They can be categorized into three types: reductions, delays, and reductions subject to trigger restoration. Nearly all of these solutions would apply to one‑time and temporary spending enacted in recent budgets. Appendix 1 provides a list of the spending solutions in the 2023‑24 budget package. The remainder of this section describes the spending solutions by type.

$5.6 Billion in Reductions. A spending reduction occurs when the Legislature eliminates an appropriation previously approved under current law or policy. The spending plan includes $5.6 billion in reductions. The largest of these is the withdrawal of a discretionary $750 million principal payment on state’s unemployment insurance loan (which otherwise is paid by employers’ payroll taxes). The spending plan also makes a $549 million reduction to the energy arrearage payment program and withdraws nearly $280 million for water recycling projects.

$6.7 Billion in Delays. A spending delay is an expenditure reduction proposed for the budget window (2021‑22 through 2023‑24) with an associated, offsetting cost increase in a future year of the multiyear (2024‑25 through 2026‑27). That is, the spending would be moved to a future year. About half of the spending‑related solutions in the budget package are delays. For example, in 2023‑24, the spending plan delays: $1 billion for zero‑emission school buses and infrastructure, $700 million for the higher education housing revolving loan program, and $550 million for broadband last‑mile project grants.

$340 Million in Reductions Subject to Trigger Reduction. The Governor’s budget and May Revision proposed making a sizeable amount of spending‑related solutions subject to trigger restoration language. The final budget package, however, ultimately only included this trigger restoration language for $340 million in spending reductions. This included a $235 million reduction for multifamily seismic retrofit matching funds and $50 million reduction to the CalHome program. Under this language, these amounts will be reduced unless, in January 2024, the administration estimates there are sufficient resources available to fund these expenditures. In that case, the programs would be restored halfway through the fiscal year.

Significant Recent One‑Time and Temporary Spending Remains After Spending‑Related Solutions. In 2021‑22 and 2022‑23, in response to historically large surpluses, the Legislature allocated tens of billions of dollars on a temporary basis—that is, to purposes that would end after a few years While the spending plan makes reductions to some of these temporary allocations, most notably in 2023‑24, significant temporary spending is still authorized under current law for 2023‑24 and beyond. Under our estimates, these remaining amounts would total $12.5 billion in 2023‑24, $9.4 billion in 2024‑25, and $4.1 billion in 2025‑26. To the extent budget problems persist—as we anticipate is likely—the Legislature would have to revisit these and other spending augmentations in the future. Appendix 4 provides a list of temporary, discretionary spending (above $50 million) allocated in recent years that is still in place after the reductions in the 2023‑24 budget package.

$10 Billion in Cost Shifts

Under LAO estimates, the budget package includes $10.3 billion in cost shifts. Cost shifts occur when the state moves costs between entities, fund sources, or across fiscal years. For example, shifting spending from the General Fund to special funds or, as has been done in prior budgets, shifting costs from the state to local governments. Major cost shift proposals in the spending plan include: (1) $2.7 billion in loans from special funds (and other state funds) to the General Fund; (2) a shift of $1.6 billion in costs for zero‑emission vehicles and other energy‑related programs from the General Fund to the Greenhouse Gas Reduction Fund (GGRF); and (3) shifts in a variety of capital outlay projects from General Fund cash to bonds, for example, for climate projects, student housing, and clean energy projects. (Bonds associated with the climate projects and clean energy, however, are not yet final. The Legislature currently is considering bills that would put those bonds on the ballot for voter approval. The other bond shifts do not require further legislative action or voter approval.) Appendix 2 provides a list of the cost shifts included in the 2023‑24 budget package.

$3.6 Billion in Revenue‑Related Solutions

The spending plan includes $3.6 billion in revenue‑related solutions, which are also listed in Appendix 2. The main solution in this area is a renewal and increase in a tax on health insurance plans known as the managed care organization (MCO) tax. Under the new policy, the tax would last from April 2023 through December 2026 and primarily be used to maintain and augment support for Medi‑Cal, the state’s Medicaid program. The tax also requires approval from the federal government to be used to draw down federal funding to support Medi‑Cal. (We describe the reauthorized MCO tax in more detail in the “Major Features” section of this report.) The budget package assumes that, in 2023‑24 specifically, the renewed MCO tax provides $3.4 billion to address the budget problem.

Budget Condition

In this section, we describe the overall condition of the General Fund budget under the spending plan. We also describe the condition of the school and community college budget. As is the case in the previous section, all of the figures here use the administration’s budget estimates as of June 2023.

General Fund Budget

Figure 2 summarizes the condition of the General Fund under the revenue and spending assumptions in the June 2023 budget package, as estimated by the administration. The state would end 2023‑24 with $3.8 billion in the Special Fund for Economic Uncertainties (SFEU). (The SFEU is the state’s operating reserve and essentially functions like an end‑of‑year balance.)

Figure 2

General Fund Condition Summary

(In Millions)

|

2021‑22 |

2022‑23 |

2023‑24 |

|

|

Prior‑year fund balance |

$40,057 |

$55,810 |

$26,352 |

|

Revenues and transfers |

232,537 |

205,134 |

208,688 |

|

Expenditures |

216,785 |

234,592 |

225,928 |

|

Ending fund balance |

$55,810 |

$26,352 |

$9,112 |

|

Encumbrances |

$5,272 |

$5,272 |

$5,272 |

|

SFEU balance |

$50,538 |

$21,080 |

$3,840 |

|

Reserves |

|||

|

BSA |

$21,708 |

$22,252 |

$22,252 |

|

SFEU |

50,538 |

21,080 |

3,840 |

|

Safety net |

900 |

900 |

900 |

|

Total Reserves |

$73,146 |

$44,232 |

$26,992 |

|

SFEU = Special Fund for Economic Uncertainties and BSA = Budget Stabilization Account. |

|||

Total General Fund Reserves Reach $27 Billion Under Spending Plan. As mentioned previously, the budget package does not use any reserves to close the $27 billion deficit. As a result, under the administration’s estimates and assumptions, general purpose reserves would total $27 billion by the end of 2023‑24, including $22.3 billion in the Budget Stabilization Account (BSA), the state’s general‑purpose constitutional reserve account. In addition, the state would have $10.8 billion in the School Reserve, available only for school and community college programs. In both cases, the state has reached the constitutional maximum for the accounts, which means deposits are no longer required (but optional deposits can be made).

Revenues

Figure 3 displays the administration’s revenue projections as incorporated into the June 2023 budget package. As the figure shows, revenues from the state’s three major sources are expected to decline over the three years of the budget window, including by 8 percent between 2021‑22 and 2022‑23 and 2 percent between 2022‑23 and 2023‑24. The bulk of this decline is attributable to the personal income tax (PIT). Declines in the PIT are, in part, attributable to weakness in the technology sector and a decline in investment in California businesses, both of which drag down compensation to higher‑income taxpayers.

Figure 3

General Fund Revenue Estimates

(Dollars in Millions)

|

Revised |

Enacted |

Change From 2022‑23 |

|||

|

2021‑22 |

2022‑23 |

Amount |

Percent |

||

|

Personal income tax |

$137,144 |

$122,769 |

$118,161 |

‑$4,608 |

‑4% |

|

Sales and use tax |

33,026 |

33,072 |

33,366 |

293 |

1 |

|

Corporation tax |

45,128 |

42,091 |

42,081 |

‑11 |

— |

|

Total, Major Revenue Sources |

$215,299 |

$197,932 |

$193,607 |

‑$4,325 |

‑2% |

|

Insurance tax |

$3,495 |

$3,673 |

$3,881 |

$208 |

6% |

|

Other revenues |

4,709 |

4,694 |

8,789 |

4,095 |

87 |

|

Transfer to/from BSA |

‑7,065 |

‑544 |

— |

544 |

‑100 |

|

Other transfers and loans |

16,099 |

‑621 |

2,411 |

3,032 |

‑488 |

|

Totals, Revenues and Transfers |

$232,537 |

$205,134 |

$208,688 |

$3,554 |

2% |

|

Note: Reflects administration estimates of budget actions taken through July 1, 2023. |

|||||

|

BSA = Budget Stabilization Account. |

|||||

Extends Film Tax Credit. The estimates in Figure 3 also include the impact of the state’s revenue‑related policy changes. In particular, the budget package extends the state’s film tax credit program—which awards $330 million per year in tax credits to motion picture productions to offset a portion of their costs—for an additional five years. The credit was set to expire in 2025, but now is in place through 2030. The budget package also makes the film tax credit refundable, meaning production companies can receive a refund for a portion of their tax credits that exceeds their tax liability.

Spending

Figure 4 displays the administration’s June 2023 estimates of total state and federal spending in the 2023‑24 budget package. As the figure shows, the spending plan assumes total state spending of $307.9 billion in 2023‑24. This is essentially flat compared to the 2022‑23 level, but includes an 11 percent increase in special fund spending and a 4 percent decrease in General Fund spending. (The “Major Features” section of this report also describes some of the major discretionary spending choices reflected in the spending plan.) In addition, between 2022‑23 and 2023‑24, federal funds are expected to decline 6 percent as significant pandemic‑related federal assistance to the state continues to decline.

Figure 4

Total State and General Fund Expenditures

(Dollars in Millions)

|

Revised |

Enacted |

Change From 2022‑23 |

|||

|

2021‑22 |

2022‑23 |

Amount |

Percent |

||

|

General Fund |

$216,785 |

$234,592 |

$225,928 |

‑$8,664 |

‑4% |

|

Special funds |

45,257 |

73,700 |

81,960 |

8,261 |

11 |

|

Budget Totals |

$262,042 |

$308,292 |

$307,888 |

‑$403 |

— |

|

Bond funds |

$8,653 |

$6,035 |

$2,916 |

‑$3,119 |

‑52% |

|

Federal funds |

171,542 |

153,230 |

143,882 |

‑9,348 |

‑6 |

|

Note: Reflects administration estimates of budget actions taken through July 1, 2023. |

|||||

School and Community College Budget

Proposition 98 Minimum Guarantee Down Over Budget Window. The State Constitution sets a minimum annual funding requirement for schools and community colleges. The minimum guarantee is met with a combination of General Fund and local property tax revenue. After two years of extraordinary growth in the minimum guarantee, Proposition 98 funding is somewhat down from these peak levels. Compared with the estimates included in the June 2022 budget plan, the administration revises its estimates of the minimum guarantee up $317 million in 2021‑22 and down $3 billion in 2022‑23. For 2023‑24, the administration estimates the minimum guarantee is $108.3 billion—$2 billion below the 2022‑23 level enacted in June 2022. The net decrease over the period is primarily attributable to lower General Fund revenue estimates, somewhat offset by higher local property tax revenue.

Includes Additional Ongoing Spending, Reduces or Delays Previous One‑Time Augmentations. Despite the drop in the guarantee, the budget package provides a total of $4.8 billion to cover an 8.22 percent statutory cost‑of‑living adjustment (COLA) for existing programs. Compared with the June 2022 budget plan, it also includes a net increase of $1.3 billion in constitutionally required deposits into the School Reserve, as well as a few new ongoing and one‑time initiatives. To cover these increases and avoid spending more than the guarantee, the budget package includes $3 billion in reductions or delays to several previously approved one‑time grants.

The State Appropriations Limit (SAL)

The SAL limits how the state can use revenues that exceed a certain limit. In recent years, the SAL has been an important constraint in the budget process and has impacted the Legislature’s budget decisions. This year, the SAL was not salient to the budget process because of declines in revenues, which have meant the state has more room under the limit. Figure 5 provides an overview of the SAL estimates in the budget. As the figure shows, the state is expected to have room across all years in the budget window, including $22 billion in 2021‑22, $11 billion in 2022‑23, and $15 billion in 2023‑24.

Figure 5

SAL Estimates in the 2023‑24 Budget Act

(In Billions)

|

2021‑22 |

2022‑23 |

2023‑24 |

|

|

SAL Revenues and Transfers |

$256 |

$240 |

$243 |

|

Exclusions |

‑152 |

‑115 |

‑117 |

|

Appropriations Subject to the Limit |

$104 |

$124 |

$126 |

|

Limit |

$126 |

$136 |

$141 |

|

Room/Negative Room |

$22 |

$11 |

$15 |

|

Excess Revenues? |

No |

||

|

Note: Reflects administration estimates of budget actions taken through July 1, 2023 |

|||

|

SAL = state appropriations limit. |

|||

Evolution of the Budget

This section provides an overview of the 2023‑24 budget process. Figure 6 contains a list of the budget‑related legislation passed on or before July 1, 2023.

Figure 6

Budget‑Related Legislation Passed on or Before

July 5, 2023

|

Bill Number |

Chapter |

Subject |

|

Budget Bills and Amendments |

||

|

SB 101 |

12 |

2023‑24 Budget Act |

|

AB 100 |

3 |

Amendments to the 2021‑22 Budget Act and 2022‑23 Budget Act |

|

AB 102 |

38 |

Amendments to the 2023‑24 Budget Act |

|

AB 103 |

33 |

Amendments to the 2021‑22 Budget Act and 2022‑23 Budget Act |

|

Early Action Trailer Bills (Passed Before June 1, 2023) |

||

|

AB 110 |

4 |

Early childcare and education |

|

AB 111 |

5 |

Student loan debt |

|

AB 112 |

6 |

Distressed hospital loan program |

|

AB 113 |

7 |

Agricultural labor relations |

|

Other Trailer Bills Passed Before July 1, 2023 |

||

|

AB 116 |

41 |

Early childcare and education |

|

AB 118 |

42 |

Health |

|

AB 119 |

13 |

MCO provider tax |

|

AB 120 |

43 |

Human services |

|

AB 121 |

44 |

Developmental services |

|

AB 127 |

45 |

General government |

|

AB 128 |

46 |

Cannabis |

|

AB 129 |

40 |

Housing |

|

AB 130 |

39 |

Public employment |

|

AB 134 |

47 |

Public safety |

|

SB 114 |

48 |

Education |

|

SB 115 |

49 |

Arts and music education |

|

SB 117 |

50 |

Higher education |

|

SB 122 |

51 |

Public resources |

|

SB 123 |

52 |

Energy |

|

SB 124 |

53 |

Energy |

|

SB 125 |

54 |

Transportation |

|

SB 131 |

55 |

Taxation |

|

SB 132 |

56 |

Film tax credit |

|

SB 133 |

34 |

Courts |

|

Note: This figure includes budget bills and trailer bills identified in Section 39.00 in the 2023‑24 Budget Act that were passed by the Legislature on or before July 5, 2023. Ordered by bill number. |

||

|

MCO = managed care organization. |

||

Governor’s January Budget Proposal

Governor’s Budget Addressed $18 Billion Budget Problem. Governor Newsom presented his proposed state budget to the Legislature on January 10, 2023. We estimate the Governor’s budget addressed an $18 billion budget problem in that proposal. (This is somewhat lower than the $22 billion budget problem the administration has referenced. As described earlier, the difference between our estimates are mainly attributable to differences between what we consider baseline spending.) The Governor’s budget solutions focused mainly on spending, with $13.6 billion in spending reductions, spending delays, and spending reductions subject to trigger restoration. In addition, the Governor also proposed $4.3 billion in cost shifts and $350 million in revenue‑related solutions, which included, most notably, an initial proposal for the state to reauthorize the MCO tax.

Governor Did Not Propose Using State’s Reserves. The Governor did not propose using any reserves. The Legislature can only access required deposits in the BSA or the Proposition 98 Reserve in response to a disaster or if the Governor calls a fiscal emergency. Although a fiscal emergency was most likely available, we understand the Governor did not call one in order to save the state’s reserves in response to continued economic uncertainty and in case they are needed for future deficits. As our office has noted, fiscal conditions could worsen in the coming years. In January, the administration similarly expressed that, if revenues declined further, using reserves would be considered.

Governor’s Spending Reductions Focused on Areas With Large, Recent, Temporary Spending Augmentations. In recent years, the state has focused spending on one‑time and temporary purposes mainly in some key areas, including: natural resources, energy, and climate; housing and homelessness; and transportation. Although to a lesser extent, however, on an ongoing basis, recent surpluses have been dedicated to health, human services, and higher education. In general, the Governor’s budget did not propose large reductions to health and human services programs. Rather, the Governor’s proposed spending‑related solutions were concentrated in areas that received large one‑time and temporary augmentations (for example, natural resources, climate, energy, and transportation).

Governor’s May Revision

Governor’s May Revision Addressed a Larger Budget Problem. On May 12, 2023, Governor Newsom presented a revised state budget proposal to the Legislature, referred to as the May Revision. Relative to the January projections in the Governor’s budget, we estimated at the time that the budget problem grew by about $10 billion to $28 billion, due largely to lower revenue estimates, which continued to decline relative to Governor’s budget expectations. (Upon further review, the actual budget problem at the May Revision should have been somewhat less than $28 billion.) The Governor proposed addressing much of the additional budget problem with more cost shifts and revenue increases. Major cost shift proposals in the May Revision included, for example, $2 billion in loans from special funds (and other state funds) to the General Fund, and shift of $1.1 billion in costs for zero‑emission vehicles from the General Fund to the GGRF. The increase in revenue‑related proposals were the result of a revision to the proposed MCO tax.

May Revision Proposed Using Safety Net Reserve, but Maintained State’s Constitutional Reserves. The Governor’s May Revision proposed using $450 million from the $900 million balance of the Safety Net Reserve. (The 2018‑19 budget created the Safety Net Reserve to set aside funds for future costs of two programs—California Work Opportunity and Responsibility to Kids and Medi‑Cal—in the event of a recession.) However, the administration did not propose using any funds from the BSA or the School Reserve, nor did the Governor call a fiscal emergency.

Legislature’s Budget

The Legislature passed an initial budget package on June 15, 2023. The Legislature’s budget package adopted LAO estimates of local property tax revenues, which resulted in an increase to the Proposition 98 guarantee by $2.1 billion across 2022‑23 and 2023‑24. The legislative package used this additional funding primarily to help maintain previously approved programs. Otherwise, the Legislature adopted the administration’s revenue projections, which means it also addressed a similarly sized budget problem as the May Revision did. Relative to the May Revision, the Legislature’s budget package also: (1) reallocated projected unspent funds in child care and State Preschool programs to increase provider rates and reduce family fees beginning October 1, 2023; (2) included a slightly different mix of reductions as the Governor from climate change‑related packages (although a similar overall level); (3) restored $1 billion in 2023‑24 in proposed General Fund reductions to transit capital funding and added flexibility to allow local agencies to use this funding for operations; (4) rejected the Governor’s proposals to use General Fund cash to pay for certain capital outlay project costs, instead using lease revenue bond financing to pay for these costs; and (5) accelerated the time line to spend funds for MCO tax‑related augmentations to around four years from eight to ten years.

Final Budget Package

The Legislature passed an amended budget act and associated trailer bills on June 27, 2023 and June 29, 2023. Figure 7 contains a list of the budget‑related legislation passed later in the legislative session. The next section of this report describes the major features of the final budget package.

Figure 7

Budget‑Related Legislation Passed After July 1, 2023

|

Bill Number |

Chapter |

Subject |

|

Budget Bills and Amendments |

||

|

SB 104 |

189 |

Amendments to the 2022‑23 and 2023‑24 Budget Acts |

|

SB 105 |

862 |

Amendments to the 2022‑23 and 2023‑24 Budget Acts |

|

Trailer Bills Passed After July 1, 2023 |

||

|

SB 135 |

190 |

Public safety |

|

SB 137 |

191 |

Health |

|

SB 138 |

192 |

Human services |

|

SB 140 |

193 |

Early childcare and education |

|

SB 141 |

194 |

Education finance |

|

SB 142 |

195 |

Higher education |

|

SB 143 |

196 |

State government |

|

SB 148 |

197 |

State bargaining unit agreements |

|

SB 151 |

211 |

State Bargaining Unit 6 agreement |

|

SB 152 |

198 |

Background checks and fingerprinting |

|

Note: This figure includes budget bills and trailer bills identified in Section 39.00 in the 2023‑24 Budget Act that were passed by the Legislature after July 1, 2023. Ordered by bill number. |

||

Major Features of the 2023‑24 Spending Plan

The major General Fund and federal fund spending actions in the 2023‑24 budget package are briefly described in this section. We plan to discuss these and other actions in more detail in a series of forthcoming publications to be released this fall.

K‑14 Education

Funds Modest Increase in School and Community College Funding. The Proposition 98 minimum guarantee depends upon various formulas that adjust for several factors, including changes in state General Fund revenue. For 2022‑23, the guarantee is down $3 billion (2.7 percent) compared with the estimates made in June 2022 (Figure 8). The decrease in the guarantee is primarily attributable to lower General Fund revenue estimates, somewhat offset by higher local property tax revenue. For 2023‑24, the guarantee increases by $953 million (0.9 percent) relative to the revised 2022‑23 level. For 2023‑24, projected increases in property tax revenue offset declines associated with lower General Fund revenue estimates.

Figure 8

Comparing June 2022 and June 2023 Proposition 98 Estimates

(In Millions)

|

2022‑23 |

2023‑24 |

||||||

|

June 2022 Enacted |

June 2023 Revised |

Change |

June 2023 Enacted |

Change From 2022‑23 Revised |

Change From 2022‑23 Enacted |

||

|

Minimum Guarantee |

|||||||

|

General Fund |

$82,312 |

$78,117 |

‑$4,195 |

$77,457 |

‑$660 |

‑$4,855 |

|

|

Local property tax |

28,042 |

29,241 |

1,199 |

30,854 |

1,613 |

2,812 |

|

|

Totals |

$110,354 |

$107,359 |

‑$2,995 |

$108,312 |

$953 |

‑$2,042 |

|

|

Funding by Segment |

|||||||

|

K‑12 schools |

$95,524 |

$93,241 |

‑$2,283 |

$94,953 |

$1,712 |

‑$571 |

|

|

Community colleges |

12,606 |

12,331 |

‑275 |

12,456 |

125 |

‑150 |

|

|

Reserve deposit |

2,224 |

1,787 |

‑437 |

903 |

‑885 |

‑1,322 |

|

Increase in Required Reserve Deposits. In certain circumstances, the Constitution requires the state to deposit some of the available Proposition 98 funding into a statewide reserve account for schools and community colleges. Under the adopted budget plan, the state deposits a total of $7.5 billion into this account across the 2021‑22 through 2023‑24 period—an increase of $1.3 billion compared with the estimates made in June 2022. The higher required deposits are primarily due to revenue estimates from the administration that have capital gains accounting for a larger share of General Fund revenue over the period.

Provides Large COLA to School and Community College Districts. In addition to the required reserve deposits, the budget package has several ongoing and one‑time increases. The largest ongoing augmentation is $4.8 billion to provide an 8.22 percent COLA for K‑12 and community college programs. In K‑12, the budget also includes $300 million ongoing targeted to low‑income schools with relatively high rates of student mobility within the school year, as well as $250 million one time for literacy coaches and reading specialists. For community colleges, the budget also includes $154 million ongoing for an apportionments funding protection known as “stability,” which cushions local college budgets from enrollment and other declines.

Budget Has Notable K‑14 Structural Gap. The 2023‑24 Proposition 98 spending level is not sufficient to fully fund all ongoing spending authorized in the budget package. To cover these costs, the budget package uses $1.9 billion in one‑time, prior‑year funding to fund the primary school and community college funding formulas ($1.6 billion for schools and $290 million for California Community Colleges). Using one‑time funds to cover ongoing costs creates a deficit in the Proposition 98 budget the following year.

Funds School Facilities Grants. The 2022‑23 budget package provided $1.3 billion one‑time non‑Proposition 98 General Fund to cover the state share for new construction and modernization projects under the School Facility Program (SFP). The 2022‑23 budget package also included intent language to provide an additional $2.1 billion in 2023‑24 and $875 million in 2024‑25. The budget provides about $2 billion to the SFP in 2023‑24, which is $100 million less than the previously intended augmentation, and continues to assume an additional $875 million will be provided in 2024‑25. The budget also delays the intended $550 million non‑Proposition 98 General Fund increase to the California Preschool, Transitional Kindergarten and Full‑Day Kindergarten Facilities Grant Program from 2023‑24 to 2024‑25.

Resources and Environment

Reductions to Multiyear Climate Change Budget Packages. To help address the budget problem, the spending plan makes a number of changes to one‑time and temporary funding that was agreed to in previous budgets for climate, resources, and environmental programs. The administration estimates that these multiyear funding reductions and delays have the cumulative effect of lowering General Fund spending by $8.7 billion across the budget window of 2021‑22 through 2023‑24. While it includes less spending than previous budgets initially agreed upon for certain activities—such as related to extreme heat, nature‑based solutions, coastal resilience, and energy—the budget maintains the majority of overall intended funding for each of the original thematic climate‑related packages (maintaining about $25 billion across the three‑year budget window). Moreover, the spending plan backfills some of these General Fund reductions using other sources—primarily the GGRF. For example, while the budget reduces General Fund spending for energy‑related activities by $2 billion, it provides $1.1 billion in GGRF to partially offset associated programmatic impacts.

Flood Management and Response. The spending plan includes $401 million in one‑time funding in 2023‑24 ($374 million from the General Fund and $27 million from bond funds) for flood management and response activities, along with intent to provide an additional $35 million General Fund in 2024‑25. This includes funding for (1) flood management projects in the Central Valley that are part of the State Plan of Flood Control (SPFC); (2) local flood management projects in areas outside the SPFC, including for Delta levees; and (3) support of small agricultural businesses and underserved and small farms affected by storms. The 2023‑24 total also includes $135 million for contingencies related to the 2023 storms—$40 million for the communities of Planada in Merced County and Pajaro in Monterey County, which experienced severe damage and displacement from the storms, and $95 million for other response and recovery activities. Additionally, associated budget legislation streamlines the process for diverting flood flows to both reduce flood risk and recharge groundwater basins.

Transportation

Support for Local Transit Agencies. The budget package includes several measures to support transit and rail improvements and to provide relief to transit agencies that are projecting operational funding shortfalls. This includes $4 billion from the General Fund over a two‑year period (including $2 billion in 2023‑24) for the Transit and Intercity Rail Capital Program and $1.1 billion over a four‑year period (including $410 million in 2023‑24) from the GGRF and the Public Transportation Account for the new Zero‑Emission Transit Capital Program. Both programs will allocate funding to transit agencies on a formula basis to use for capital improvements and/or operational support. The budget package also includes budget trailer legislation that (1) implements several accountability measures for the funding augmentations, such as requiring agencies to submit short‑ and long‑term financial plans; (2) temporarily extends statutory relief measures provided to transit agencies during the pandemic; and (3) requires the California State Transportation Agency to establish a task force to develop and submit policy recommendations to the Legislature on how to grow ridership and improve overall transit services.

Health

Reauthorizes MCO Tax and Makes Related Program Augmentations. The budget package includes trailer bill legislation (Chapter 13 of 2023 [AB 119, Committee on Budget]) to renew a tax on health insurance plans known as the MCO tax. Chapter 13 authorizes the tax from April 2023 through December 2026. Like past versions of the MCO tax, the tax is designed to draw down additional federal Medicaid funding while imposing a relatively small cost to the health insurance industry. This arrangement requires approval from the federal government. If approved by the federal government, the tax is expected to generate revenues of $8.2 billion in 2023‑24 ($32.1 billion through 2026‑27). After factoring in the portion of revenues used to help cover the cost of the tax on health insurance plans, the tax is projected to yield a net fiscal benefit to the state of $4.4 billion in 2023‑24 ($19.4 billion through 2026‑27). Of this amount, $3.4 billion in 2023‑24 ($8.3 billion through 2026‑27) will be used to offset General Fund spending in the Medi‑Cal program. The remaining $1 billion in 2023‑24 ($11.1 billion through 2026‑27) will be deposited in a special fund and used for various health‑related augmentations, most of which will be decided as part of next year’s budget process.

Higher Education

State Increases Base Funding for Universities’ Core Operations. The 2023‑24 budget includes a total of $443 million to provide 5 percent unrestricted General Fund base augmentations to the University of California (UC) and the California State University (CSU). The universities may use their base augmentations to cover any operating cost increases, including increases in employee salary and benefit costs. Provisional language requires the universities to report to the Legislature by December 31, 2024 on how they specifically used these funds. In addition to unrestricted base increases, both UC and CSU receive augmentations for their student basic needs, rapid rehousing, and student mental health programs, as well as their support programs for students with disabilities.

State Sets Resident Undergraduate Enrollment Targets for UC and CSU. The state expects both UC and CSU to enroll more resident undergraduate students in 2023‑24. Specifically, UC is to increase resident undergraduate enrollment by 7,800 full‑time equivalent (FTE) students (4 percent) over its 2021‑22 level. CSU is to increase resident undergraduate enrollment by 4,057 (FTE) students (1.2 percent) over its 2022‑23 level. (With this budgeted growth, CSU would remain below its 2020‑21 peak resident undergraduate enrollment level.) Provisional budget language authorizes the administration to reduce funding for UC or CSU if it enrolls fewer students than expected. Funding would be reduced at the 2023‑24 state marginal cost rates of $11,640 per UC student and $10,070 per CSU student. Provisional language also sets enrollment expectations for the universities for each of the next few years, with UC expected to grow 1.4 percent annually and CSU expected to grow 3 percent annually.

Budget Converts Many Higher Education Capital Projects From Cash to Debt Financing. The 2021‑22 and 2022‑23 budget agreements included significant upfront, non‑Proposition 98 General Fund cash for certain higher education capital projects. In response to the state’s projected budget deficit, the 2023‑24 budget agreement rescinds the vast majority of the 2022‑23 General Fund cash, as well as some of the 2021‑22 cash. The segments instead are to issue revenue bonds. The state provides each of the segments with ongoing General Fund augmentations intended to cover the associated borrowing costs. The state shifted all affordable student housing construction projects (35 projects across the three segments), as well as nine other university capital projects, to debt financing. In total, the state rescinded $3.2 billion in one‑time General Fund appropriations for these projects, replacing it with $240 million in ongoing General Fund augmentations for debt service.

Infrastructure

Legislation Intended to Expedite Infrastructure Projects. The overall budget agreement includes several policy and budget trailer bills aimed at expediting the construction of various types of infrastructure projects. This includes Chapter 60 of 2023 (SB 149, Caballero and Becker), which authorizes some types of infrastructure projects—including certain energy, semiconductor and microelectronic; transportation; and water‑related projects—to receive streamlined judicial review under the California Environmental Quality Act. It also includes Chapter 58 of 2023 (SB 146, Gonzalez), which authorizes the use of two project delivery methods—progressive design‑build and job order contracting—under certain circumstances.

Child Care and Preschool

Sets Aside Funds to Support Collectively Bargained Early Education Agreement and Parity Actions. The budget package includes $2.7 billion in one time funds from various state and federal fund sources to support the following: (1) monthly rate supplement payments to providers based on region and number of enrolled children from January 1, 2024 through June 30, 2025; (2) a one-time provider lump-sum transitional payment; (3) a narrower definition of part-time care; (4) extension of COVID-19 reimbursement flexibility policies from September 30, 2023 to June 30, 2025; (5) maintaining minimum funding levels for health, retirement, and training funds; and (6) administrative funds for MOU-related activities, including dues collections and subsidized provider reporting compliance. These program changes generally were collectively bargained between the state and Child Care Providers United (CCPU) for represented child care and State Preschool providers and, for parity sake, extended to remaining child care and State Preschool providers (with the exception of the health, retirement, and training funds, which is limited to CCPU-represented providers).

Modifies Family Fee Schedule. During the COVID‑19 pandemic, the federal government allowed states to temporarily waive family fees in child care programs. The state waived family fees in both the child care and State Preschool programs, with the fees scheduled to return July 1, 2023. Chapter 4 of 2023 (AB 110, Committee on Budget and Fiscal Review) provided $39 million across state and federal fund sources to waive family fees until September 30, 2023. On October 1, 2023, the family fee schedule must be reinstated in child care programs. Prior to the COVID‑19 pandemic, families making at least 40 percent of the state median income were required to pay a fee (varying from about 1 percent to 10 percent of family income) for child care and full‑day State Preschool services. The budget includes $78 million ($66 million General Fund and $12 million Proposition 98 funds) to reduce family fees in child care and State Preschool to 1 percent of family income for families making at least 75 percent of the state median income, beginning October 1, 2023 (with full‑year costs increasing to $100 million annually). Families making below 75 percent of the state median income would not pay a fee.

Corrections

Reduced Spending Due to Deactivation of Several Correctional Facilities. The budget reflects a reduction of $311 million primarily from the General Fund (growing to $433 million annually beginning in 2027‑28) resulting from the deactivation of two prisons and six individual yards at various prisons due to the ongoing decline in the prison population. (We note that these reductions are in addition to savings resulting directly from having fewer people in prisons overall.) Despite this, prison population projections indicate the state could deactivate additional prisons in the future. To inform such potential future deactivation decisions, the budget package includes budget trailer legislation requiring the California Department of Corrections and Rehabilitation to report on various factors that impact its prison capacity needs, such as the amount of space needed to operate rehabilitation programs. The budget also reflects a $92 million reduction primarily from the General Fund in 2023‑24 (generally growing to $96 million annually beginning in 2025‑26) to reflect the closure of the Division of Juvenile Justice (DJJ) and resulting deactivation of three of its facilities. This closure is the result of legislation included in the 2021‑22 and 2022‑23 budget packages which realigned responsibility for DJJ youth from the state to the counties.

San Quentin Capital Outlay Projects to Support Development of the California Model. On May 5, 2023, Governor Newsom established an advisory council to recommend changes to San Quentin State Prison in order to help develop the California Model, which is broadly focused on promoting a more rehabilitative and health‑focused environment in California prisons. To support this effort, the budget includes $360.6 million in new lease revenue bond authority to demolish an existing building and construct a new educational and vocational center as well as $20 million one‑time from the General Fund for various related capital outlay projects at the prison. In addition, the budget package includes budget trailer legislation to (1) facilitate completion of these projects by 2025, such as by exempting them from historic building preservation requirements and (2) change the name of the prison to the San Quentin Rehabilitation Center.

Housing and Homelessness

Significant, Prior‑Year Funding Augmentations Generally Maintained. Previously enacted budgets authorized significant, albeit primarily one‑time and temporary, funding for housing and homelessness, including authorizing some spending actions for 2023‑24. The 2023‑24 Budget Act largely maintains those spending actions. During the 2023‑24 budget process, the Governor proposed $367.5 million in spending reductions for various primarily homeownership‑related programs. The Legislature largely rejected those spending cuts and instead adopted $67.6 million in General Fund spending reductions for the Department of Housing and Community Development’s (HCD’s) CalHome Program ($50 million) and the Downtown Rebound Program ($17.5 million). The budget also achieves budget‑year savings through the delay of $345 million previously allocated to HCD’s Foreclosure Intervention Housing Preservation Program (this spending will instead be spent over several years through 2026‑27). Finally, the 2023‑24 budget authorizes an increase of $100 million in one‑time General Fund spending for HCD’s Multi‑Family Housing Program and continues the recent practice of providing an additional $500 million for the state Low‑Income Housing Tax Credit Program. (Because these credits would not be claimed until the housing units are complete, the General Fund impact of these tax credits will occur in a few years.) As most of the recently authorized housing and homelessness budget actions have been temporary or one time in nature, most of that funding is set to expire soon.

Budget‑Related Legislation Increases Oversight and Accountability. The 2023‑24 budget included budget‑related legislation aimed to increase oversight and accountability of the state’s housing and homelessness programs. At a high level, this legislation makes the receipt of Homeless Housing, Assistance and Prevention Program funding contingent on the creation of, and adherence to, a regionally coordinated homelessness action plan. It requires each plan to coordinate homelessness funding and services across the region, assign specific roles and responsibilities to each party to the plan, and set forth key actions that each party will take to reduce and prevent homelessness.

Appendix

Note: In the online version of this report, we include a series of Appendix tables that have detailed information on the discretionary choices in the 2023‑24 Budget Act.

Appendix 1: Spending Solutions

Appendix 2: All Other Solutions