LAO Contact

September 7, 2023

MOU Fiscal Analysis: Bargaining Unit 16 (Physicians, Dentists, and Podiatrists)

On the evening of Saturday, September 2, 2023, the administration submitted to our office the tentative agreement between the state and Bargaining Unit 16 (Physicians, Dentists, and Podiatrists). Unit 16 consists of physicians and other medical staff responsible for diagnosis, evaluation, and treatment of patients within state institutions. As of July 2, 2023, Unit 16 members work under the terms and conditions of an expired memorandum of understanding (MOU). Unit 16 is represented by the Union of American Physicians and Dentists. This analysis of the proposed agreement fulfills our statutory requirement under Section 19828.5 of the Government Code. The administration has posted on the California Department of Human Resources’ (CalHR’s) website the agreement, a summary of the agreement, and a summary of the administration’s estimates of the proposed agreement’s fiscal effects. Our State Workforce webpages include background information on the collective bargaining process, a description of these and other bargaining units, and our analyses of agreements proposed in the past.

Background

Federal Receiver

Federal Courts Required State to Improve Health Care in State Prisons and Limit Prison Overcrowding. In February 2006, after finding that the state had failed to provide a constitutional level of medical care to people in prison, a federal court (in the case now referred to as Plata v. Newsom) appointed a Receiver to take control over the direct management of the state’s prison medical care delivery system from the California Department of Corrections and Rehabilitation (CDCR).

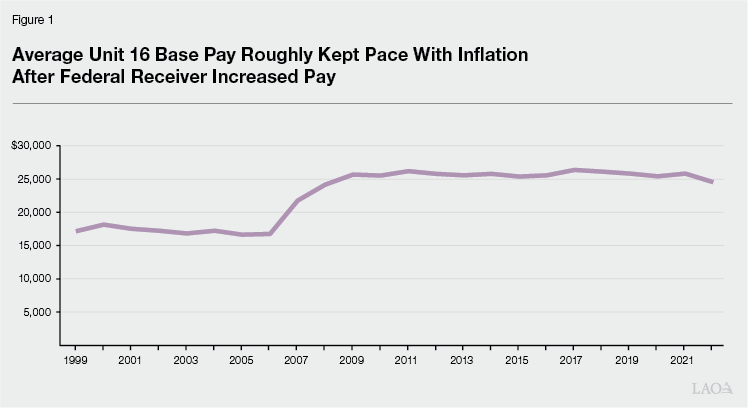

Receiver Significantly Increased Pay of State Medical Professionals. In September 2006, the Receiver substantially raised pay for prison medical staff with pay increases ranging from 5 percent to 64 percent. In the announcement of this action, the Receiver cited “huge vacancies” in prison medical staffing. Specifically, the Receiver indicated that the vacancy rate for physicians stood at 20 percent at the time. In response to the vacancy rate of physicians, the announcement reports that the court allowed the Receiver to increase physician pay to $300,000 from $150,000. Figure 1 shows that, controlling for inflation, the Receiver’s actions significantly increased the average Unit 16 base pay. The figure also shows that Unit 16’s average base pay generally has kept pace with inflation over the past 20 years.

Compensation Study

The most recent Unit 16 compensations study released by CalHR evaluated three occupational groups represented by Unit 16—Dentists (General), Family Medicine Physicians, and Psychiatrists. Together, these three occupational groups account for 80 percent of Unit 16 members.

Study Found All Three Occupational Groups Lead Market. The study compared the state’s total compensation with that provided by other employers to similar employees in the private sector in all cases and the private sector as well as local government in the case of Dentists. The study found that state total compensation for all three of the occupational groups is above market. Specifically, in the case of total compensation, the study found that state Dentists are compensated 46 percent above market, Family Medicine Physicians are compensated 35 percent above market, and Psychiatrists are compensated 13 percent above market.

Unit 16 Members Tend to Be Older and Have Fewer Years of Service Than Average State Employees. While the average state employee (across the entire workforce) is 45 years old, the average member of all three Unit 16 occupations is in their mid-50s. Despite being older than the average state employee, the average Unit 16 member has ten years of service compared with the average state worker having 12 years of service. This difference in part reflects differences among occupational groups. Dentists and Psychiatrists have, on average, worked for the state for a comparable number of years as the statewide average. However, with eight years of service, on average, Family Medicine Physicians have notably less state service than the average state employee.

Retirement Leading Cause of Turnover Among Dentists. Overall, the turnover rate for Dentists (7.8 percent) is comparable to the statewide turnover rate of 7.6 percent. About 85 percent of the turnover among Dentists is due to retirement.

Voluntary Separations Leading Cause of Turnover Among Family Medicine Physicians and Psychiatrists. Both Family Medicine Physicians and Psychiatrists have turnover rates (9.2 percent and 8.7 percent, respectively) that are above the state average. In addition, for both occupations, voluntary separations are the leading cause of turnover—accounting for more than 60 percent of the turnover in both cases. This means that employees in these two occupations are more likely to choose to leave state service without retiring and either seek employment with another employer or exit the state workforce.

Vacant Positions

Unit 16 Vacancy Rate Higher Today Than in 2006. While the receiver characterized a 20 percent vacancy rate as “huge” in 2006, the Unit 16 vacancy rate (as of August 31, 2023) is about 32 percent. This is substantially higher than the statewide average vacancy rate that currently is about 20 percent. The Unit 16 vacancy rate varies by department. CDCR, the California Department of State Hospitals (DSH), and the California Department of Social Services employ the most Unit 16 members and have vacancy rates of 26 percent, 39 percent, and 43 percent, respectively. The vacancy rates also vary by facility. For example, 8 percent of Unit 16 positions are vacant at Chuckawalla Valley State Prison in Blythe but 64 percent at Salinas Valley State Prison (SVSP) in Soledad. The vacancy rate also varies by occupation. As of August 31, 2023, the vacancy rates of the three occupational groups included in the compensation study were 11 percent in the case of Dentists, 23 percent in the case of Family Medicine Physicians, and 46 percent in the case of Psychiatrists.

Major Provisions of Proposed Agreement

Term. The agreement would be in effect from July 1, 2023 to July 1, 2025. This means that the agreement would be in effect for two fiscal years: 2023-24 and 2024-25. This is consistent with our standing recommendation that the Legislature not approve agreements that are longer than two years in duration.

Provisions Related to Pay

General Salary Increase (GSI). The agreement would provide two GSIs over the course of the agreement, described below.

3 Percent in 2023-24. Effective July 1, 2023, all Unit 16 members would receive a 3 percent salary increase.

2.5 Percent in 2024-25. Effective July 1, 2024, all Unit 16 members would receive a 2.5 percent salary increase.

2023-24 and 2024-25 Special Salary Adjustments (SSAs) for Specified Classifications. The agreement would provide a 5 percent SSA to specified classifications twice during the term of the agreement. The first 5 percent SSA would go into effect on July 1, 2023 and the second 5 percent SSA would go into effect on July 1, 2024. The classifications that would receive the SSAs are in occupation groups that were not included in the compensation study: Epidemiologists, Podiatrists, and Physicians and Surgeons (All Other).

2023-24 Top Step Increases for Specified Classifications. Effective July 1, 2023, the top step for specified classifications would be increased by either 3 percent or 5 percent, as described below. Employees who have been at the top step for at least a year would be eligible to receive the pay increase when it goes into effect.

3 Percent. The agreement would provide specified classifications within the Family Medicine Physicians occupation group a 3 percent top step increase.

5 Percent. The agreement would provide specified classifications within the Dentists occupation group a 5 percent top step increase.

Additional Caseload Differential for Psychiatrists. Effective the first day of the pay period six months following ratification through June 30, 2026, the agreement would provide that psychiatrists at CDCR, Correctional Health Care Services, and DSH would be eligible to receive additional compensation at 135 percent of their base hourly rate if they take on additional caseload.

In-Person Differential for Psychiatrists. The agreement would provide a 15 percent of base pay differential to psychiatrists whose regular duties require them to perform direct, in-person patient care on grounds or at a facility more than one-half of the time.

Various Pay Differentials and Other Payments. The agreement would provide various pay differentials and other payments to Unit 16 members who work under specified working conditions or at specified locations. These pay differentials are numerous and, although they might be significant from an operational stand point, they represent less than 5 percent of the estimated annual cost of the agreement

Other Major Provisions

Reduced Employee Pension Contributions to Align With Standard Under State Law. The Public Employees’ Pension Reform Act established a standard, but not a requirement, that employees and the state each contribute one-half of the normal cost to fund employee pension benefits. The actual rates paid by state employees varies and has been established through the collective bargaining process. As this table from recent California Public Employees’ Retirement System Board meeting materials indicates, Unit 16 members pay among the highest state employee contribution rates. For example, Unit 16 miscellaneous members pay 10 percent of pay to fund the benefit when most other state employees in that pension tier (including Unit 16 managers) pay 8 percent or 8.5 percent of pay. The proposed agreement would reduce Unit 16 members’ employee contribution rates towards their pension benefits by 0.5 percent of pay effective July 1, 2024 and again July 1, 2025. Effective July 1, 2026, similar to what has been adopted for other bargaining units, the employee contribution rate would be reevaluated each year to maintain the standard that employees pay one-half of normal cost. Specifically, if the actuarially determined blended total normal cost increases or decreases by more than 1 percent of pay, the employee contribution will increase or decrease to one-half of the actuarially determined blended total normal cost, rounded to the nearest quarter of 1 percent of pay. For reference, the total blended normal cost for State Miscellaneous is 17.6 percent of pay.

LAO Assessment

Administration’s Fiscal Estimate

Cost Increases Will Increase Costs to Administer State Prisons. As Figure 2 shows, the administration estimates that the agreement would increase annual state costs by $83 million by 2024-25. The administration estimates that extending the provisions of the agreement to employees excluded from collective bargaining (generally, managers and supervisors) would increase annual state costs an additional $12 million. As CDCR is the largest employer of Unit 16 members, this will increase the state’s costs to administer prisons and provide medical care to people in prison.

Figure 2

Administration’s Estimated Fiscal Effects of Proposed Unit 16 Agreement

(In Millions)

|

2023‑24 |

2024‑25 |

2025‑26 |

||||||

|

General Fund |

All Funds |

General Fund |

All Funds |

General Fund |

All Funds |

|||

|

General Salary Increases |

$19.3 |

$20.6 |

$36.1 |

$38.7 |

$36.1 |

$38.7 |

||

|

Pay Differentials |

28.4 |

28.2 |

27.9 |

27.2 |

27.9 |

27.2 |

||

|

Top Step Increases |

8.9 |

9.0 |

8.9 |

9.0 |

8.9 |

9.0 |

||

|

Special Salary Adjustments |

1.7 |

3.8 |

3.5 |

7.7 |

3.5 |

7.7 |

||

|

Additional Caseload Differential for Psychiatrists |

1.0 |

1.0 |

3.0 |

3.0 |

3.0 |

3.0 |

||

|

Other Provisionsa |

‑1.8 |

‑1.9 |

‑2.1 |

‑2.2 |

‑1.9 |

‑2.0 |

||

|

Totals |

$57.4 |

$60.7 |

$77.3 |

$83.3 |

$77.4 |

$83.5 |

||

|

aThe administration assumes that a portion of these costs do not require additional appropriations from the Legislature. |

||||||||

Compensation Study

On the Whole, Study Raises Concerns of Recruitment and Retention for Physicians and Psychiatrist Classifications. Despite the compensation study finding that state total compensation for the Family Medicine Physician and Psychiatrist occupational groups lead the market, the two occupations’ turnover rates and the high Unit 16 vacancy rates suggest that there is cause for concern that the state likely is having significant challenges recruiting and retaining physicians and psychiatrists.

Provisions Related to Pay

Proposed GSI in 2023-24 Close to Most Recent Inflation Levels. The most recent (July) California Consumer Price Index was 3.1 percent higher compared to the prior year—close to the GSI level proposed in this agreement for 2023-24. Since 2020, however, prices have risen 17 percent, although the average Unit 16 base pay generally has maintained purchasing power due to SSAs and other changes in compensation over time.

Administration Offers No Justification for SSAs or Any Pay Increase. Unlike a GSI, which provides the same pay increase to all classifications represented by a bargaining unit, an SSA provides specified pay increases to specified classifications. While a GSI can be justified by the rate of inflation, an SSA, on the other hand, requires further justification as it singles out one classification over another to receive a pay increase within the same bargaining unit. That being said, it is not clear what methodology, if any, was used to identify which classifications should receive SSAs and at what levels. While there is evidence of possible recruitment and retention issues of physicians and psychiatrists, the administration does not provide a justification for the SSAs, but states they are the result of the bargaining process. Without more information from the administration, the Legislature’s and public’s ability to understand and assess why some state employees should receive higher pay increases than others is limited.

Top Step Increases Could Improve Retention of Physicians. To the extent that the high turnover among physicians and psychiatrists is due to more senior employees not earning competitive compensation, providing top step increase to these classifications could improve retention and reduce the number of voluntary separations. The compensation study indicates that 90 percent of Psychiatrists are at the top step and 74 percent of Physicians are at the top step of their salary ranges. However, it is less clear to what extent this provision would improve recruitment to fill vacancies with new hires. We do not know why the agreement proposed to provide Dentists a larger top step increase when that occupation group appears to have less recruitment and retention challenges and is already compensated well above market.

Legislative Authority

Legislature Is Ultimate Authority of Any Labor Agreement. Under the Ralph C. Dills Act, while the Governor negotiates terms and conditions of employment with bargaining units, the Legislature retains the ultimate authority to approve or reject agreements. The Legislature can reject an agreement either by (1) rejecting a tentative agreement that is submitted to the Legislature for ratification or (2) not appropriating sufficient funds to pay for the terms of an MOU that the Legislature has already ratified.

Administration’s Delivery of Agreement Does Not Allow for Sufficient Time for Legislative or Public Review. The administration submitted this agreement to the Legislature after the budget committees met to discuss other proposed labor agreements submitted near the end of the legislative session. Giving the Legislature such a constrained review period to review a proposal with such significant fiscal and policy implications is inappropriate. The public—including the members of the bargaining unit—also should have a greater opportunity to review the provisions of the agreement and provide input to the Legislature.

Budget Change Proposals of Far Smaller Size Would Require Justification From Administration, Legislative Deliberation, and Public Scrutiny. If ratified and its provisions extended to excluded employees, the agreement will increase state costs nearly $100 million each year. When budget proposals of far lesser value are submitted to the Legislature by the Governor during the budget process, they are subject to public and legislative review for a period of weeks or months, not days.

LAO Recommendations

Require Bargaining Cycle to Consider Legislative Calendar. The parties regularly submit labor agreements to the Legislature with a legislative deadline looming only days away. This is a long-standing problem and is not unique to this administration. This time constraint is unnecessary. The legislative calendar is public and known far in advance. The legislative calendar and deadlines should be built into the administration’s planning such that the Legislature has sufficient time to consider labor agreements. As we have recommended in the past, we recommend that the Legislature adopt a standing policy to reject (1) any agreement that affects the compensation of state employees in the July pay period that is submitted to the Legislature after June 2 and (2) any agreement that is submitted to the Legislature fewer than two weeks before the end of session.