LAO Contact

October 19, 2023

The 2023-24 California Spending Plan

Higher Education

- Overview

- California Community Colleges

- California State University

- University of California

- Student Financial Aid

- Student Housing

- California State Library

This post summarizes the state’s 2023‑24 spending package for higher education. It is part of our Spending Plan series. In this post, we provide a short overview of the state’s higher education spending package, then cover spending for the California Community Colleges (CCC), California State University (CSU), University of California (UC), student financial aid, student housing, and California State Library. The EdBudget part of our website contains many tables providing more detail about the 2023‑24 education budget package.

Overview

Budget Notably Increases State Funding for Higher Education. As Figure 1 shows, ongoing General Fund support for higher education is $21.8 billion in 2023‑24, reflecting an increase of $800 million (3.8 percent) over the revised 2022‑23 level. Ongoing augmentations in 2023‑24 span a few key areas, including core operations, enrollment growth, and student support programs. The budget also includes a total of $535 million for one-time higher education initiatives. Many of these one-time initiatives involve campus-specific projects.

Figure 1

Enacted Budget Increases General Fund Support for Higher Education

General Fund (Dollars in Millions)

|

Ongoing |

One Timea |

||||||

|

2021‑22 Actual |

2022‑23 Revised |

2023‑24 Enacted |

Change From 2022‑23 |

2023‑24 Enacted |

|||

|

Amount |

Percent |

||||||

|

California Community Collegesb |

$9,032 |

$8,873 |

$8,835 |

‑$38 |

‑0.4% |

$14 |

|

|

California State University |

4,606 |

5,050 |

5,417 |

367 |

7.3 |

38 |

|

|

University of California |

4,011 |

4,374 |

4,721 |

347 |

7.9 |

144 |

|

|

Student Aid Commission |

1,974 |

2,499 |

2,588 |

88 |

3.5 |

336 |

|

|

Scholarshare Investment Board |

16 |

163 |

194 |

30 |

18.4 |

0 |

|

|

Otherc |

25 |

27 |

32 |

5 |

18.5 |

3 |

|

|

Totals |

$19,664 |

$20,986 |

$21,786 |

$800 |

3.8% |

$535 |

|

|

aReflects non‑Proposition 98 General Fund appropriations for one‑time purposes. bConsists of Proposition 98 General Fund that counts toward the annual minimum guarantee and non‑Proposition 98 General Fund except for state general obligation debt service payments. The state sometimes uses some Proposition 98 General Fund that counts toward the minimum guarantee for one‑time purposes. In addition to state General Fund, community colleges receive significant funding from local property tax revenues as well as various other state and local sources. When these revenues are included, ongoing funding for the colleges increases by $195 million (1.2 percent) between 2022‑23 and 2023‑24. cConsists of funding for UC College of the Law, San Francisco; the California Education Learning Laboratory, which is administered by the Office of Planning and Research; and the California Medicine Scholars Program, which is administered by the Department of Health Care Access and Information. |

|||||||

In Response to Budget Deficit, State Shifts Capital Projects From Cash to Debt Financing. As the state built its 2023‑24 budget package, it was facing a projected budget deficit. In response, the state took various actions to reduce state spending. Within higher education, the main way the state achieved budget solution was by rescinding a total of $3.2 billion in upfront General Fund cash originally provided for dozens of higher education capital projects. In place of the upfront cash, the state signaled the segments were to issue revenue bonds for the projects. The state budget includes ongoing General Fund augmentations (totaling $240 million) intended to cover the segments’ associated borrowing costs. Figure 2 lists the projects that the state shifted from cash to debt financing. The state shifted all 35 affordable student housing construction projects, as well as nine other university capital projects, to debt financing.

Figure 2

Enacted Budget Shifts $3.2 Billion in Higher Education Capital Projects

From Cash to Debt Financing

(In Millions)

|

Project Costa |

Debt Serviceb |

|

|

Projects Shifted in January |

||

|

CSU Bakersfield Energy Innovation Center |

$83.0 |

$5.5 |

|

CSU San Diego Brawley Center |

80.0 |

5.3 |

|

CSU San Bernardino Palm Desert Center |

79.0 |

5.3 |

|

CSU Fullerton Engineering and Computer Science Hub |

67.5 |

4.5 |

|

CSU University Farms |

75.0 |

5.0 |

|

CSU San Luis Obispo Swanton Pacific Ranch |

20.3 |

1.4 |

|

Subtotals |

($404.8) |

($27.0) |

|

Additional Projects Shifted in May Revision |

||

|

CSU student housing construction projects |

$655.2 |

$52.0 |

|

UC student housing construction projects |

489.0 |

33.5 |

|

UC Berkeley Clean Energy Project |

249.0 |

16.7 |

|

CSU Humboldt polytechnic transition |

201.0 |

16.0 |

|

UC Riverside campus expansion project |

154.5 |

10.3 |

|

UC Merced campus expansion project |

94.5 |

6.3 |

|

CSU University Farms (removed) |

‑75.0 |

— |

|

Subtotals |

($1,768.2) |

($134.8) |

|

Additional Projects Shifted in June |

||

|

CCC student housing construction projects |

$1,010.7 |

$78.5 |

|

Modifications Made in Septemberc |

||

|

Intersegmental student housing projects (UC) |

$236.8 |

$17.2 |

|

Intersegmental student housing projects (CCC) |

‑236.8 |

‑17.0 |

|

Totals |

$3,184.9 |

$240.5 |

|

aReflects state cost of project (excluding nonstate costs). To generate near‑term budget solution, the state rescinds upfront one‑time General Fund for these projects (that is, it rescinds the amounts shown in this column). bThe segments are to issue revenue bonds for the projects. The state provides ongoing General Fund augmentations to cover estimated debt service costs (that is, it provides the amounts shown in this column). cUnder the final budget agreement, UC is to sell revenue bonds for the full cost of three intersegmental student housing projects (Merced, Riverside, and Santa Cruz). Under the June budget agreement, UC and each of the partnering community college districts were to sell revenue bonds separately for each of their respective portions of those projects. |

||

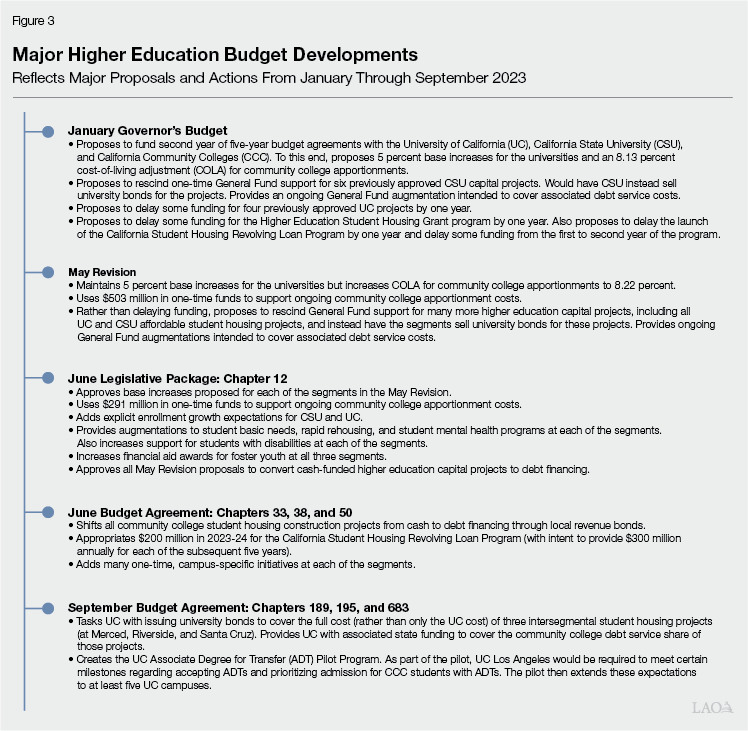

Major Higher Education Budget Decisions Made at Key Junctures. Figure 3 highlights major higher education developments that unfolded throughout the state budget process. The Governor launched budget negotiations in January by proposing to fund the second year of his multiyear budget plans with each of the higher education segments. He also proposed some higher education budget solutions to address the projected deficit. As budget deliberations advanced, the state enacted slightly higher ongoing increases for each of the higher education segments. At the same time, however, the state shifted more higher education capital projects from cash to debt financing, with the amount of higher education budget solutions enacted in June being about eight times greater than the amount proposed in January.

California Community Colleges

Budget Provides $12.5 Billion Proposition 98 Funding for CCC in 2023‑24. Proposition 98 funding (a mix of state General Fund and local property tax revenue) is the primary source of support for the community colleges (and K-12 education). After growing significantly in 2020‑21 and 2021‑22, Proposition 98 funding since then has leveled off. As Figure 4 shows, Proposition 98 support for CCC in 2023‑24 increases by $125 million (1 percent) over the revised 2022‑23 level. The annual growth is entirely due to higher local property tax revenue, which is somewhat offset by falling General Fund revenue.

Figure 4

California Community Colleges Proposition 98 Funding

(Dollars in Millions)

|

2021‑22 |

2022‑23 |

2023‑24 |

Change From 2022‑23 |

||

|

Amount |

Percent |

||||

|

General Fund |

$8,678 |

$8,544 |

$8,453 |

‑$91 |

‑1.1% |

|

Local property tax |

3,515 |

3,787 |

4,003 |

216 |

5.7 |

|

Totals |

$12,193 |

$12,331 |

$12,456 |

$125 |

1.0% |

Funding on a Per-Student Basis Continues to Rise Notably. Even though total Proposition 98 funding has leveled off the past few years, funding on a per-student basis has been rising as a result of budgeted enrollment counts dropping. On a budgeted per-student basis, Proposition 98 funding increases from $10,974 in 2021‑22 to $11,887 in 2023‑24, reflecting a rise of $913 (8.3 percent). Compared to 2019‑20, budgeted per-student funding in 2023‑24 is up even more—$3,500 (42 percent)—reflecting historically high growth over this period.

Package Includes Ongoing Spending Increases and One-Time Reductions. As Figure 5 shows, the budget includes nearly $1 billion in Proposition 98 ongoing spending increases for community college across the 2021‑22 through 2023‑24 period. The budget, however, also contains $500 million in reductions. Nearly all of the reduction is to the CCC facility maintenance and instructional equipment categorical program. This program had received a historically large augmentation as part of the 2022‑23 budget agreement. With the reduction enacted in 2023‑24, this categorical program will receive a total of $347 million in one-time Proposition 98 support (rather than the $841 million enacted in 2022‑23).

Figure 5

Total Changes in California Community Colleges Proposition 98 Spending

2021‑22 Through 2023‑24 (In Millions)

|

Ongoing Spending |

|

|

Apportionments (8.22 percent COLA) |

$678 |

|

Apportionment funding protection (stability) |

154 |

|

Select categorical programs (8.22 percent COLA)a |

112 |

|

Enrollment growth (0.5 percent) |

26 |

|

FCMAT new professional development program |

—b |

|

Subtotal |

($971) |

|

One‑Time Initiatives |

|

|

Forestry/fire protection workforce training |

$14c |

|

LGBTQ+ centers |

10d |

|

New entrepreneurship and innovation center at East Los Angeles College |

3 |

|

Online education study |

1 |

|

FCMAT new professional development program |

—b |

|

Subtotal |

($27) |

|

One‑Time Reductions |

|

|

Facility maintenance and instructional equipment |

‑$494e |

|

Student enrollment and retention strategies |

‑5f |

|

Subtotal |

(‑$500) |

|

Total Changes |

$499 |

|

aApplies to the Adult Education Program, apprenticeship programs, basic needs centers, CalWORKs student services, campus child care support, Disabled Students Programs and Services, Extended Opportunity Programs and Services, mandates block grant, mental health services, MESA program, NextUp foster youth program, Puente, rapid rehousing program, Umoja, and veterans resource centers. bConsists of $200,000 in ongoing funds and $75,000 in one‑time funds. cUses reappropriated Proposition 98 funds (previously appropriated funds for other purposes that were not spent). dThe 2023‑24 budget also indicates intent to provide $10 million for this purpose in each of the next two years (2024‑25 and 2025‑26). eReduces funding provided in the 2022‑23 budget agreement for this purpose from a total of $841 million to $347 million. fReduces funding provided in the 2022‑23 budget agreement for this purpose from $150 million to $145 million. |

|

|

COLA = cost‑of‑living adjustment; FCMAT = Fiscal Crisis and Management Assistance Team; LGBTQ+ = lesbian, gay, bisexual, transgender, queer, and plus; and MESA = mathematics, engineering, science achievement. |

|

Budget Prioritizes Funding for Core Operations. The largest of the ongoing spending increases ($678 million) is to fund an 8.22 percent cost-of-living adjustment (COLA) to community college apportionments. The 8.22 percent COLA in 2023‑24 is the third highest COLA on record since the state assumed primary control of K-14 funding in 1978‑79. The budget also provides $154 million for an apportionment funding protection known as “stability.” This protection is intended to provide a cushion to local budgets resulting from enrollment and other declines. The budget also provides $26 million for 0.5 percent systemwide enrollment growth—representing about 4,900 additional full-time equivalent (FTE) students. Provisional budget language continues to allow the Chancellor’s Office to allocate unused enrollment growth funding to backfill shortfalls in apportionment funding (stemming, for example, from enrollment fee revenue or local property tax revenue coming in lower than budgeted). If not needed for an apportionment shortfall, unused enrollment funds revert to the Proposition 98 Reversion Account and become available for other Proposition 98 purposes.

Budget Partly Covers Ongoing Apportionment Costs Using One-Time Funds. Proposition 98 funding in 2023‑24 is insufficient to fully fund all ongoing CCC spending authorized in the budget package. As a result, the budget relies on $290 million in one-time funds to cover the COLA for apportionments in 2023‑24. This creates an ongoing shortfall because COLA costs continue but the one-time funding does not.

An Expanded Number of Categorical Programs Receive a COLA. Historically, when the state provides a COLA to apportionments, it also has provided a COLA to seven CCC categorical programs, including Extended Opportunity Programs and Services and Disabled Students Programs and Services. For 2023‑24, the Legislature placed a high priority on providing a COLA to a broader set of student support programs, including for student mental health services and veterans resource centers. In total, the budget provides $112 million ongoing to provide an 8.22 percent COLA to 15 categorical programs. Of this amount, $95 million is associated with the seven categorical programs that traditionally receive a COLA, whereas $17 million is for the additional eight programs that do not typically receive a COLA.

Colleges Receive New Flexibility in Spending Certain Prior-Year Funds. Trailer legislation allows districts to use funds remaining from three 2022‑23 initiatives (facility maintenance and instructional equipment, student enrollment and retention strategies, and the COVID-19 block grant) for any of those initiative’s statutorily permitted spending purposes. For example, districts can use deferred maintenance funding for enrollment outreach efforts and vice versa. Districts are not required to report the extent to which they use this newly provided flexibility.

Budget Agreement Contains New Nursing Initiative. The higher education trailer legislation appropriates a total of $300 million over five years ($60 million annually from 2024‑25 through 2028‑29) for a new CCC nursing initiative. The language indicates the funds are to expand CCC nursing programs and bachelor of science in nursing partnerships. The language indicates that specific development of the new initiative is subject to future legislation. (Currently, CCC nursing programs are funded primarily through apportionments. Since 2006‑07, the state also has funded a CCC nursing categorical program designed to expand enrollment and provide supplemental student supports such as tutoring. In 2023‑24, this program receives $13 million ongoing Proposition 98 funds.)

Trailer Legislation Contains New Requirements Related to Full-Time Faculty and Faculty Diversity. Consistent with recommendations from a 2023 report by the State Auditor, trailer legislation includes a requirement for the Chancellor’s Office to report annually on community college districts’ progress in increasing the share of instruction provided by full-time faculty. Trailer legislation also requires the Chancellor’s Office to adopt a policy to verify districts are using full-time faculty hiring funds (provided in the 2018‑19 and 2021‑22 budgets) for that purpose. In addition, trailer legislation requires the Chancellor’s Office to verify districts are implementing certain best practices related to promoting faculty diversity.

Budget Authorizes Many CCC Capital Outlay Projects Supported With State Bonds. The 2023‑24 budget includes $232 million in general obligation bond authority to support 14 CCC capital outlay projects. Of these 14 projects, 12 are continuing and 2 are new projects. This EdBudget table lists all of these projects. These projects are supported with remaining bond authority from Proposition 51 (2016) and Proposition 55 (2004).

California State University

CSU Ongoing Core Funding Is $8.6 Billion in 2023‑24. Of this amount, $5.4 billion is state General Fund, $3.1 billion is student tuition and fee revenue, and $65 million is lottery revenue. Ongoing core funding increases $393 million (4.8 percent) from 2022‑23. Nearly all of the annual increase ($367 million) comes from the General Fund, with General Fund support increasing 7.3 percent. Tuition charges remain flat in 2023‑24, but student tuition and fee revenue increases by $26 million (0.8 percent) due to anticipated enrollment growth. In addition to these ongoing changes, the budget includes $38 million in one-time General Fund spending for various initiatives at CSU. Figure 6 shows all the General Fund spending changes for CSU in 2023‑24.

Figure 6

Changes in California State University General Fund Spending

2023‑24 (In Millions)

|

Ongoing Spending |

|

|

Operations |

|

|

Base augmentation (5 percent) |

$227 |

|

Retiree health benefit cost increases |

37 |

|

Student basic needs |

1 |

|

Support for students with disabilities |

1 |

|

Student mental health |

1 |

|

Other |

—a |

|

Facilitiesb |

|

|

Student housing projectsc |

$52 |

|

Five previously approved capital outlay projectsd |

27 |

|

CSU Humboldt polytechnic transitione |

16 |

|

CSU Chico Human Identification Lab |

4 |

|

CSU San Bernardino physician assistant facility |

—f |

|

Subtotal |

($367) |

|

One‑Time Initiatives |

|

|

CSU Dominguez Hills support |

$15 |

|

Science and Technology Policy Fellows programg |

10 |

|

CSU Northridge Basic Needs Suite |

6 |

|

CSU Chico CalFresh Outreach Resource Hub |

3 |

|

CSU San Diego Imperial Valley student housing |

3 |

|

Federal Title IX implementation support |

1 |

|

CSU Dominguez Hills Mervyn Dymally Institute |

1 |

|

Subtotal |

($38) |

|

Total |

$405 |

|

aConsists of a $300,000 augmentation for rapid rehousing and $148,000 for CENIC cost increases. The 2021‑22 budget agreement included intent to fund these CENIC cost increases. bCSU is to debt finance all the facilities listed using university bonds. Amounts shown reflect ongoing General Fund augmentations intended to cover the associated borrowing costs (principal and interest). cIn a conforming action, the budget removes $655 million one‑time General Fund provided or planned for these projects in 2021‑22 through 2023‑24. dIn a conforming action, the budget removes $330 million one‑time General Fund provided for these projects in 2022‑23. eIn a conforming action, the budget removes $201 million one‑time General Fund provided for this project in 2021‑22. fThe budget includes $290,000 ongoing to support borrowing costs for this project. gThe 2022‑23 budget agreement included intent to provide these funds. |

|

|

CENIC = Corporation for Education Network Initiatives in California. |

|

Largest CSU Ongoing Augmentation Is for Core Operations. The 2023‑24 budget provides CSU with a $227 million (5 percent) unrestricted General Fund base augmentation. CSU may use this augmentation to cover employee salary and benefit cost increases, as well as other operating cost increases. Provisional language requires CSU to report to the Legislature on the use of these funds by December 31, 2024. Beyond this base augmentation, the budget provides $37 million ongoing General Fund specifically to cover CSU retiree health benefit cost increases. The budget also provides a combined increase of $2.4 million ongoing General Fund to CSU for its student basic needs, mental health, and rapid rehousing programs, representing a 5 percent augmentation for each program. The budget provides $1 million ongoing General Fund to CSU to provide additional support to students with disabilities.

Budget Sets Enrollment Growth Expectations for CSU Through 2025‑26. Provisional language states an intent for CSU to increase resident undergraduate enrollment by 4,057 FTE students (1.2 percent), bringing its total resident undergraduate enrollment level to 330,080 FTE students in 2023‑24. (With this budgeted growth, CSU would remain below its 2020‑21 peak resident undergraduate enrollment level of 353,262 FTE students.) The provisional language authorizes the administration to reduce funding for CSU if it enrolls fewer students than expected. Funding would be reduced at the 2023‑24 state marginal cost rate of $10,070 for each student below the expected level. Provisional language also sets enrollment expectations for CSU in 2024‑25 and 2025‑26, as Figure 7 shows.

Figure 7

Budget Sets CSU Enrollment Growth Expectations Through 2025‑26

Resident Undergraduate Full‑Time Equivalent (FTE) Students

|

2023‑24a |

2024‑25 |

2025‑26 |

|

|

Growth |

|||

|

Amount |

4,057 |

9,866 |

10,161 |

|

Percent |

1.2% |

3.0% |

3.0% |

|

Total Enrollment Level |

330,080 |

339,946 |

350,107 |

|

aGrowth is relative to the estimated 2022‑23 enrollment level of 326,023 FTE resident undergraduates. CSU’s resident undergraduate enrollment level peaked in 2020‑21 at 353,262 FTE students. |

|||

Budget Shifts Various CSU Capital Projects From Cash to Debt Financing. As a budget solution in response to the state’s projected budget deficit, the budget package removes a total of $1.2 billion one-time General Fund provided or planned for certain CSU capital outlay projects over the 2021‑22 through 2023‑24 period. Instead of receiving upfront cash for these projects, CSU is to debt finance them using university bonds. The budget provides CSU with a total of $95 million ongoing General Fund intended to cover the associated costs. In addition, the budget provides $4.7 million ongoing General Fund to support debt service costs for two new capital projects at the Chico and San Bernardino campuses. Both of these new projects are also to be financed using university bonds.

Administration Also Authorizes CSU to Debt Finance Other Capital Projects. In addition to the capital projects funded in the budget, the administration authorizes CSU to debt finance certain other capital projects and cover the cost using its main General Fund appropriation. The estimated state cost of these projects totals $80 million. Of this amount, $53 million is for various infrastructure improvements across the system. The remaining $27 million is for a pier extension and other improvements at the Maritime campus to accommodate a new federally funded training ship. The annual debt service associated with these projects is estimated to be $5.4 million. CSU submitted final proposals for these projects in November 2022, and the administration provided final approval for them in July 2023. (This EdBudget table provides basic information about these projects.)

Budget Funds Various One-Time CSU Initiatives. The largest one-time CSU General Fund augmentation is $15 million to support the Dominguez Hills campus. The budget also provides one-time General Fund to several campuses for specific initiatives related to student basic needs, student housing, and other support programs. In addition, the budget provides $1 million one-time General Fund to support CSU in implementing federal Title IX policies and strengthening its associated practices.

University of California

UC Ongoing Core Funding Is $10.4 Billion in 2023‑24. Of this amount, $4.7 billion is state General Fund, $5.3 billion is student tuition and fee revenue, and $347 million comes from other core funds. Ongoing core funding increases $592 million (6 percent) from 2022‑23. More than half of the annual increase ($347 million) comes from the General Fund, reflecting growth of 7.9 percent. The remainder ($244 million) comes from student tuition and fee revenue. UC is in the second year of implementing its cohort-based tuition policy, which increases tuition charges for new undergraduates as well as all graduate students. Tuition revenue also increases due to anticipated enrollment growth. In addition to ongoing funding increases, the budget includes $144 million for various one-time initiatives at UC. Figure 8 shows all the General Fund spending changes for UC in 2023‑24.

Figure 8

Changes in University of California General Fund Spending

2023‑24 (In Millions)

|

Ongoing Spending |

|

|

Core Operations |

|

|

Base augmentation (5 percent) |

$211 |

|

Nonresident enrollment reduction/replacementa |

30 |

|

Agriculture and Natural Resources division (5 percent) |

5 |

|

Facilitiesb |

|

|

Student housing projectsc |

$51 |

|

Three previously approved capital projectsd |

33 |

|

UC Riverside School of Medicine building |

7 |

|

Other |

|

|

Graduate medical education |

$5 |

|

UC Riverside School of Medicine operations |

2 |

|

Support for students with disabilities |

2 |

|

Student mental health |

1 |

|

Student basic needs |

1 |

|

Rapid rehousing |

—e |

|

Subtotal |

($347) |

|

One‑Time Initiatives |

|

|

UC Los Angeles Institute for Immunology and Immunotherapyf |

$100 |

|

Cancer research relating to firefighters |

7 |

|

UC Berkeley School of Journalism police records access project |

7 |

|

UC Los Angeles Ralphe J. Bunche Center for African American Studiesg |

5 |

|

UC Davis Equine Performance and Rehabilitation Center |

5 |

|

Cal‑Bridge initiative |

4 |

|

UC San Diego Scripps Institution of Oceanography Coastal Ocean Pollution Pathogen Predictions model |

3 |

|

UC Cooperative Extension fire advisors |

2 |

|

Global Entrepreneurs program |

2 |

|

UC San Diego Scripps Institution of Oceanography California Coastal Mapping Program |

2 |

|

UC Los Angeles Center for Reproductive Health, Law, and Policy |

2 |

|

Nutrition Policy Instituteh |

1 |

|

UC Davis Hypolimnetic Oxygenation Pilot Project to Revitalize Clear Lake |

1 |

|

UC Irvine Inclusive, Diverse, Equitable, and Able Leaders for Water program |

1 |

|

UC Berkeley School of Education/UC Los Angeles Center for the Transformation of Schools REACH Network |

1 |

|

UC Merced Labor Center study of oil and gas industry |

—e |

|

UC Los Angeles Collaborative Neurodiversity and Learning Center for Public Engagement and Education |

—e |

|

Subtotal |

($144) |

|

Total |

$491 |

|

aIn 2023‑24, UC is to reduce its nonresident undergraduate enrollment at three campuses (Berkeley, Los Angeles, and San Diego) by a total of 902 students. It is to backfill these slots with the same number of additional resident undergraduate students. bThe budget authorizes UC to debt finance various capital projects using university bonds. Amounts shown reflect ongoing General Fund augmentations intended to cover the associated borrowing costs (principal and interest). cIn a conforming action, the budget removes a total of $727 million one‑time General Fund for these projects over the 2021‑22 through 2023‑24 period. dIn a conforming action, the budget removes a total of $498 million one‑time General Fund for these projects over the 2022‑23 through 2024‑25 period. eLess than $500,000. fThe 2022‑23 budget plan provided $100 million for this project. The 2023‑24 budget plan also includes intent language to provide an additional $300 million in 2024‑25 for this project. gThe 2022‑23 budget plan provided $5 million one‑time General Fund for this center. The 2023‑24 budget plan states intent to provide an additional $3 million ongoing General Fund for this center beginning in 2024‑25. hThe 2022‑23 budget plan provided $2.4 million for this institute. The 2023‑24 budget plan also includes intent language to provide an additional $2.4 million in 2024‑25 and $1.3 million in 2025‑26 for this institute. |

|

|

REACH = Race Education and Community Healing. |

|

Largest UC Ongoing Augmentation Is for Core Operations. Similar to CSU, the budget provides UC with a base General Fund augmentation as well as augmentations for select student support programs. Specifically, the 2023‑24 budget provides UC with a $216 million (5 percent) unrestricted General Fund base augmentation, of which $5 million is set aside for UC’s Agriculture and Natural Resources division. UC indicates it intends to use its base augmentation for enrollment growth, employee salaries, benefit costs, and other operating cost increases. As with CSU, provisional language requires UC to report to the Legislature on how it used these funds by December 31, 2024. In addition to the base augmentation, the budget provides UC with a combined $2 million ongoing General Fund augmentation (equating to an approximately 5 percent increase) for student basic needs, mental health, and rapid rehousing programs. The budget also provides $1.5 million in new ongoing General Fund to provide additional support to students with disabilities.

Budget Sets Enrollment Growth Expectations for UC Through 2026‑27. Provisional language states intent for UC to increase resident undergraduate enrollment by 7,800 FTE students (over the 2021‑22 level), bringing its total resident undergraduate enrollment level to 203,661 FTE students in 2023‑24. If UC enrolls fewer students than expected in 2023‑24, provisional language allows the administration to reduce funding for UC in proportion to the shortfall. For each FTE student below the target, funding would be reduced at the 2023‑24 state marginal cost rate of $11,640. Provisional language also sets undergraduate enrollment expectations for the subsequent three years, as Figure 9 shows. Provisional language indicates that if UC enrolls more resident undergraduates than the 2023‑24 target, then those additional students are to be counted toward the 2024‑25 target. Consistent with the most recent budget acts, the 2023‑24 Budget Act does not set expectations for graduate enrollment, though UC has committed as part of the Governor’s compact to grow graduate enrollment by a total of 2,500 students from 2022‑23 through 2026‑27.

Figure 9

Budget Sets UC Enrollment Growth Expectations Through 2026‑27

Resident Undergraduate Full‑Time Equivalent (FTE) Students

|

2023‑24a |

2024‑25 |

2025‑26 |

2026‑27 |

|

|

Growth |

||||

|

Amount |

7,800 |

2,927 |

2,947 |

2,968 |

|

Percent |

4.0% |

1.4% |

1.4% |

1.4% |

|

Total Enrollment Level |

203,661 |

206,588 |

209,535 |

212,503 |

|

aGrowth is relative to the estimated 2021‑22 enrollment level of 195,861 FTE resident undergraduates. |

||||

Budget Shifts Various UC Capital Projects From Cash to Debt Financing. As a budget solution, the budget package removes a total of $1.2 billion one-time General Fund provided or planned for certain UC capital outlay projects (including three UC/CCC intersegmental projects) over the 2021‑22 through 2023‑24 period. As with certain CSU projects, these UC projects are to be debt financed using university bonds rather than paid for upfront with cash. The budget provides a total of $84 million ongoing General Fund to cover the estimated debt service costs. In addition, the budget provides $6.5 million ongoing General Fund for debt service costs associated with the UC Riverside School of Medicine building, which UC also is debt financing using university bonds.

Budget Funds Various One-Time UC Initiatives. The largest one-time General Fund augmentation is $100 million to support the UC Los Angeles Institute for Immunology and Immunotherapy. This is the second year of state funding for this institute, adding to the $100 million provided for it in 2022‑23. Provisional language states legislative intent to appropriate an additional $300 million General Fund for this institute in 2024‑25. The budget also includes one-time funding for 16 other initiatives, most of which are focused on special research projects. The largest of these initiatives is $7 million to research carcinogenic exposure among firefighters. Other research projects span various areas, including natural resources, health, and public safety.

Funding for UC Graduate Medical Education to Increase. As part of a major state budget agreement involving a tax on managed care organizations, UC is to receive $75 million annually to expand graduate medical education programs. These funds will come from a new special fund entitled the Medi-Cal Provider Payment Reserve Fund, which will contain a portion of proceeds from the new managed care organization tax. UC is to use the funds to increase the number of primary care and specialty care physicians in the state. Though not specified in the legislation, back-up information from the administration and the legislative budget committees indicate the funds will begin in 2024 and extend through 2029. This funding will supplement the ongoing state funding UC currently receives for graduate medical education. (In 2023‑24, UC is to receive $30 million Proposition 56 funds, together with $10 million General Fund, for graduate medical education.)

UC-Affiliated Law School Also Receives Base Increase and Some One-Time Funding. The 2023‑24 budget provides UC Law, San Francisco (UC Law SF) with a $2.2 million (12 percent) unrestricted General Fund base augmentation to support operational costs. UC Law SF may use these funds for hiring new faculty, providing salary increases, covering higher benefit costs, paying other operating expenses, and furthering other campus priorities. The budget also provides $3 million one-time General Fund for the school’s Urban Alchemy campus safety program, with the funds available for expenditure over the next three years (through 2025‑26). This is the second time the state has provided funding for the Urban Alchemy program. The 2021‑22 Budget Act provided $3 million for the program, with those funds available for expenditure through 2023‑24.

Student Financial Aid

California Student Aid Commission (CSAC) Total Spending Is $3.4 Billion in 2023‑24. Of this amount, $2.9 billion is state General Fund, $400 million is federal Temporary Assistance for Needy Families funding, and the remainder is from other funds and reimbursements. Ongoing General Fund spending increases by $88 million (3.5 percent) from 2022‑23. The majority of the ongoing increase is due to baseline cost adjustments in the Cal Grant and Middle Class Scholarship (MCS) programs. The budget also includes a total of $336 million in one-time General Fund, primarily for the MCS and Golden State Teacher Grant programs. Figure 10 shows all the General Fund spending changes for CSAC in 2023‑24. Below, we describe major CSAC spending changes as well as cover notable changes to financial aid programs administered by other agencies.

Figure 10

Changes in California Student Aid Commission General Fund Spending

2023‑24 (In Millions)

|

Ongoing Spending |

|

|

Cal Grant baseline adjustment |

$43 |

|

Middle Class Scholarship baseline adjustment |

39 |

|

Middle Class Scholarship foster youth award increase |

5 |

|

Program administration and outreacha |

1 |

|

Other |

—b |

|

Subtotal |

($88) |

|

One‑Time Initiatives |

|

|

Middle Class Scholarship one‑time augmentationc |

$227 |

|

Golden State Teacher Grantsd |

98 |

|

Cybersecurity activities |

1 |

|

Carryover funds |

10 |

|

Subtotal |

($336) |

|

Total |

$424 |

|

aConsists of $518,000 for five financial aid workload positions, $469,000 for two cybersecurity positions and related expenses, $120,000 for high school toolkits, $103,000 for Cash for College, and a reduction of $45,000 due to adjustments in employee compensation costs. bReflects baseline adjustment of $42,000 for the Law Enforcement Personnel Dependents financial aid program. cThe 2022‑23 budget agreement included intent to provide these funds. The 2023‑24 budget agreement indicates intent to provide $289 million one time in 2024‑25. dThe 2021‑22 Budget Act appropriated $500 million to be spent annually from 2021‑22 through 2025‑26. Amount shown reflects anticipated spending in year three. |

|

Budget Funds Cal Grant Cost Adjustments. The enacted budget includes $2.3 billion ongoing for Cal Grants—a $43 million (1.9 percent) increase over the revised 2022‑23 level. This increase aligns Cal Grant spending with CSAC’s most recent cost estimates. We summarize those cost estimates by segment and award type in our Cal Grant Spending EdBudget table. The budget makes no changes to the Cal Grant reform provisions adopted in the 2022‑23 budget agreement. (We describe those provisions in The 2022‑23 California Spending Plan: Higher Education.)

Budget Increases Funding for MCS Program. Under major program changes implemented in 2022‑23, MCS awards for UC and CSU students are now based on total cost of attendance. To determine each recipient’s MCS award amount, CSAC first calculates the recipient’s remaining cost of attendance after accounting for other available gift aid, a student contribution from part-time work earnings, and a parent contribution for dependent students with a household income of more than $100,000. Then, CSAC determines what percentage of each recipient’s remaining costs to cover based on the program funding level. In 2022‑23, CSAC determined that program funding was sufficient to cover 26 percent of each recipient’s remaining costs. Consistent with last year’s budget agreement, the 2023‑24 budget provides an additional $227 million one-time General Fund for the program, bringing the total funding level to $864 million. CSAC estimates this funding level will cover about 35 percent of each recipient’s remaining costs. The budget agreement also includes intent to provide $289 million one-time General Fund in 2024‑25 to cover a similar percentage of each recipient’s costs that year.

State Makes a Few Changes to MCS Program Rules. Trailer legislation changes how emergency basic needs grants and institutional merit scholarships are treated when calculating a student’s MCS award amount. Formerly, receiving these types of aid reduced a student’s MCS award amount. Under the new rules, students may instead apply these types of aid toward their student contribution or any applicable parent contribution before their MCS award amount is affected. The new rules take effect for emergency basic needs grants beginning in 2023‑24 and institutional merit scholarships beginning in 2024‑25. As discussed next, trailer legislation also changes MCS rules for foster youth.

Budget Increases Financial Aid Awards for Foster Youth. Under the new rules, MCS awards for foster youth attending UC and CSU are to cover 100 percent of their remaining costs, rather than a prorated percentage based on the program funding level. The budget act includes $5.2 million ongoing General Fund to support the higher MCS award amounts for foster youth. The budget also funds higher Student Success Completion Grant (SSCG) award amounts for foster youth attending CCC. The SSCG program provides additional nontuition coverage for Cal Grant recipients attending CCC who enroll full time. Trailer legislation increases the maximum SSCG award amount from $1,128 to $5,250 per semester for foster youth enrolled in 12 to 14 units and from $4,000 to $5,250 per semester for foster youth enrolled in 15 or more units. These changes are estimated to cost $14 million (which would be covered within the total SSCG program funding level of $363 million ongoing Proposition 98 General Fund in 2023‑24).

Budget Includes Several Changes to Golden State Teacher Grants. The budget includes $98 million one-time General Fund spending in 2023‑24 for this program, in accordance with the 2021‑22 budget agreement. The program provides scholarships of up to $20,000 to students in teacher preparation programs who commit to working at a priority school for at least four years. (“Priority school” is defined as a school where at least 55 percent of students are low-income, English learners, or foster youth.) The budget also adds $6 million one-time federal Individuals with Disabilities Education Act funding for this program to provide more scholarships for prospective special education teachers. In addition, trailer legislation makes several changes to the program. Most notably, it makes awards of up to $10,000 available to in-state students enrolled in certain online teacher preparation programs based outside California, with spending on these awards capped at 8 percent of total program funding. It also allows recipients to complete their service requirement at either a state- or federally funded preschool or a priority school.

Golden State Education and Training Grants Are Discontinued. As a budget solution, the 2023‑24 budget package reverts $480 million in unspent one-time General Fund provided for this program in 2021‑22. The state originally created the program to provide grants of up to $2,500 to individuals who lost employment due to the pandemic and were seeking additional education and training. Given the end of the California’s pandemic-related state of emergency, the state deemed the program no longer among its highest priorities. The program is to be discontinued as of June 30, 2023.

Budget Funds Launch of Public Interest Attorney Loan Repayment Program. The budget provides CSAC with $451,000 from the Public Interest Attorney Loan Repayment Account for this program. Chapter 881 of 2001 (AB 935, Hertzberg) established the program, which provides up to $11,000 in student loan repayment for selected attorneys who practice in public interest areas of the law. The program is supported by a special fund consisting of money reverted from certain trust accounts used by attorneys. The special fund recently accumulated enough money to launch the program in 2023‑24 and sustain it for at least a few years.

Budget Increases Funding to CSAC for Program Administration and Outreach. The budget provides a total of $1.4 million ongoing and $962,000 one time for the following purposes.

$518,000 ongoing General Fund and five new positions to address workload associated with recent financial aid expansions. (We list new CSAC positions in this EdBudget table.)

$469,000 ongoing General Fund, $962,000 one-time General Fund, and two new positions to improve cybersecurity at CSAC.

$216,000 Public Interest Attorney Loan Repayment Account funds and one new position to administer the Public Interest Attorney Loan Repayment Program.

$120,000 ongoing General Fund to distribute toolkits providing information on financial aid to high schools.

$103,000 ongoing General Fund to support the Cash for College outreach program.

Budget Includes Several Provisions Related to College Savings Accounts. These provisions affect the California Kids Investment and Development Savings (CalKIDS) program administered by the Scholarshare Investment Board (SIB). This program provides college savings account deposits to all newborns, with additional deposits made for low-income first graders. The first change the budget makes is to increase deposits for newborns from $25 to $100. This action is supported by $30 million ongoing General Fund redirected from first-grader deposits, as the cost estimate of that program component has been revised downward. Second, trailer legislation directs SIB to use $8 million in unspent funds provided for CalKIDS in 2019‑20 to establish a statewide marketing campaign for the program. Third, the budget provides $158,000 ongoing General Fund and one new Staff Services Manager to SIB to help administer the CalKIDS program as well as an associated financial literacy program established in 2022‑23. Fourth, trailer legislation directs SIB to partner with the Los Angeles Unified School District and the Riverside County Office of Education in 2023‑24 and 2024‑25 to explore ways to increase participation in the CalKIDS program.

Early Action Legislation Clarifies Tax Treatment of Certain Types of Financial Aid Awards. In a May early action budget decision, the state enacted Chapter 5 of 2023 (AB 111, Committee on Budget) related to how certain forms of financial aid are treated for state personal income tax purposes. Most notably, this legislation specifies that student loans discharged in 2021 through 2025 are to be excluded from taxable income, in conformity with federal tax law. The legislation also clarifies that emergency financial aid grants supported by the federal Higher Education Emergency Relief Fund and unpaid fees discharged by CCC using a state COVID-19 block grant are excluded from taxable income. The amount of foregone revenue associated with the legislation largely depends on actions the federal government takes relating to student loan forgiveness.

Student Housing

Budget Approves New Affordable Student Housing Projects. The budget package approves a second round of affordable student housing construction projects (using all remaining program authority for CSU and UC and all but $81 million in remaining program authority for CCC). Our EdBudget tables show all the student housing construction projects approved for CCC, CSU, and UC. As a budget solution, the state shifts $2.2 billion from non-Proposition 98 General Fund cash to debt financing. Under the new arrangement, UC and CSU are to issue revenue bonds for these projects. UC’s revenue bonds are to include the full cost of three intersegmental projects involving community colleges (in the Merced, Riverside, and Santa Cruz areas). For the remaining community college projects, districts may issue local revenue bonds or wait for a state financing alternative to be developed as part of the 2024‑25 budget process. Beginning in 2023‑24, the state provides each segment with an ongoing non-Proposition 98 General Fund augmentation intended to cover estimated debt service costs on the approved projects. In total, the state provides $164 million ongoing General Fund for these costs ($61.5 million for CCC, $52 million for CSU, and $50.7 million for UC).

Budget Provides First Seed Deposit for Housing Revolving Loan Fund. Trailer legislation enacted last year created the California Student Housing Revolving Loan Program. This program is to provide campuses with no-interest loans for the purpose of constructing affordable housing. The original trailer legislation enacted in 2022 included intent language to provide $900 million for the program in 2023‑24 and an additional $900 million in 2024‑25 (for total program funding of $1.8 billion). Trailer legislation adopted this year changed that funding schedule—appropriating $200 million for the program in 2023‑24, with intent to provide $300 million annually over the subsequent five years (through 2028‑29), for total program funding of $1.7 billion. Of the annual allotments, 75 percent is available for CSU and UC projects and 25 percent is available for CCC projects. If funds are unused from one of these annual allotments, they may subsequently be shifted to another segment.

California State Library

California State Library Funding Is $596 Million in 2023‑24. Of this amount, $574 million is General Fund, $18 million is federal funds, and the remainder comes from various state special funds. Ongoing General Fund support for the California State Library increases by $395,000 (0.8 percent). The budget includes a large amount of one-time General Fund carryover ($506 million) from previous library initiatives, along with a total of $17 million in new one-time spending associated with more than a dozen new library initiatives. This EdBudget table shows all the ongoing and one-time General Fund spending changes for the California State Library in 2023‑24.

Budget Increases Ongoing General Fund Support for Additional Personnel. The largest ongoing General Fund increase is $462,000 for the Witkin State Law Library to support a new Senior Librarian, two Librarians, and a Library Technical Assistant II. The additional staff largely are intended to help address an increase in research workload. The State Library also is receiving $357,000 ongoing General Fund to support three new positions for the California History Room. In addition, the California State Library is receiving $168,000 for a full-time auditor position to establish an audit program. These ongoing cost increases are partially offset by a shift of $664,000 from the General Fund to the Central Services Cost Recovery Fund to ensure that the correct fund source is paying for central services.

Budget Funds More Than a Dozen One-Time Library Initiatives. All but two of these initiatives were added in the legislative package or three-way agreement. These initiatives (totaling $14 million) provide operational support or facility funding for specific local library projects. One initiative, originally included in the Governor’s budget, is $240,000 one time for the California History Room to acquire additional special collection materials to make its offerings more reflective of California’s unique historical diversity. A second initiative, originally included in the 2021‑22 Budget Act, is $2.4 million for the third year of a four-year agreement to help protect cultural artifacts from natural disasters.

Budget Shifts Funding Schedule for Additional Local Library Infrastructure Grants. Of the $506 million in one-time carryover funds, $439 million is from local library infrastructure grants. Partly due to these available carryover funds, together with an additional $50 million provided for infrastructure grants in the 2022‑23 Budget Act, the state delays further funding for this purpose. Specifically, rather than providing $100 million in 2023‑24, the budget package includes intent to provide the $100 million spread over three years beginning in 2024‑25 ($33 million in 2024‑25, $33 million in 2025‑26, and $34 million in 2026‑27).