LAO Contact

February 15, 2024

The 2024‑25 Budget

California State University

- Introduction

- Overview

- Core Operations

- Enrollment

- One‑Time Budget Solutions

- Debt‑Financed Capital Projects

Summary

Brief Covers the California State University (CSU). This brief analyzes the Governor’s budget proposals relating to CSU’s core operations and enrollment. It also revisits recent one‑time initiatives and capital projects the state has funded at CSU.

Recommend Holding State Funding and Spending Expectations Flat for CSU. The Governor’s main budget proposal for CSU is deferring the $240 million base increase planned for 2024‑25 under his compact. Under the Governor’s proposed approach, the state would delay the base increase until 2025‑26, then double up the ongoing increase and provide a one‑time back payment. In the meantime, CSU would increase spending in 2024‑25 by the originally planned amount, most likely by using its reserves. We recommend rejecting this proposal. The Governor’s approach creates risk for the state, which would be committing to a $734 million General Fund increase for CSU in 2025‑26, despite facing a significant projected budget deficit that year. The approach also creates risk for CSU, which would be increasing spending and likely drawing down its reserves in anticipation of a state funding increase in 2025‑26. If the state is unable to provide these funds, then CSU likely would need to consider significant spending reductions that would be more disruptive than containing spending in the first place. Instead of the deferral, we recommend holding CSU funding and spending expectations flat for 2024‑25, then revisiting once the state budget condition improves.

Recommend Also Holding CSU’s Funded Enrollment Target Flat. In 2023‑24, CSU estimates it is enrolling 368,042 resident full‑time equivalent (FTE) students—an increase of 5,788 students over the previous year. The majority of the increase is attributed to campuses converting self‑supported courses to state‑supported courses in summer 2023, with little enrollment growth occurring in fall 2023. Even with the conversion of these summer courses, CSU remains 19,072 students (4.9 percent) below its funded enrollment target. The Governor’s compact had set forth a 1 percent annual increase in CSU’s funded enrollment target. The Governor’s budget maintains this approach despite CSU currently being below that target. We recommend rejecting this approach. Given that CSU could add many more students within its current funded enrollment target, we recommend instead holding the target flat and not allocating any new enrollment growth funding in 2024‑25. Were the state budget condition to deteriorate further over the coming months, the Legislature could also consider whether to reduce CSU’s funded target to align with its current enrollment level, achieving up to $239 million in estimated ongoing General Fund savings.

Recommend Pulling Back Some Unspent One‑Time Funds From Prior Budgets. From 2021‑22 to 2023‑24, the state appropriated $1.1 billion one‑time General Fund to CSU. Of this amount, we estimate $423 million remains unspent—consisting of $252 million for deferred maintenance, $145 million for certain cash‑funded capital projects, and $26 million for various programs. Given the state’s projected operating deficits, we recommend the Legislature pull back all of these remaining one‑time funds, except the amount for deferred maintenance (as removing those funds would likely increase future costs).

Recommend a Few Changes Related to Debt‑Financed Capital Projects. In 2023‑24, the state appropriated $100 million ongoing General Fund for a total of 21 capital projects that CSU was to debt finance using university bonds. We recommend strengthening oversight of CSU capital projects, reducing last year’s appropriation to align with more recent estimates of debt service costs, and considering whether to pause projects for which bonds have not yet been issued.

Introduction

Brief Focuses on CSU. CSU is one of California’s three public higher education segments. Its 23 campuses provide undergraduate and graduate education. CSU focuses on academic degrees through the master’s level, but it also provides doctoral degrees in certain, primarily applied, fields. This brief is organized around the Governor’s 2024‑25 budget proposals for CSU. The first section provides an overview of the Governor’s CSU budget package. The next two sections focus on core operations and enrollment, respectively. The fourth section discusses recent CSU one‑time initiatives that could be revisited given the state’s projected budget deficits and the final section provides an update on CSU capital projects that the state approved for debt financing last year.

Overview

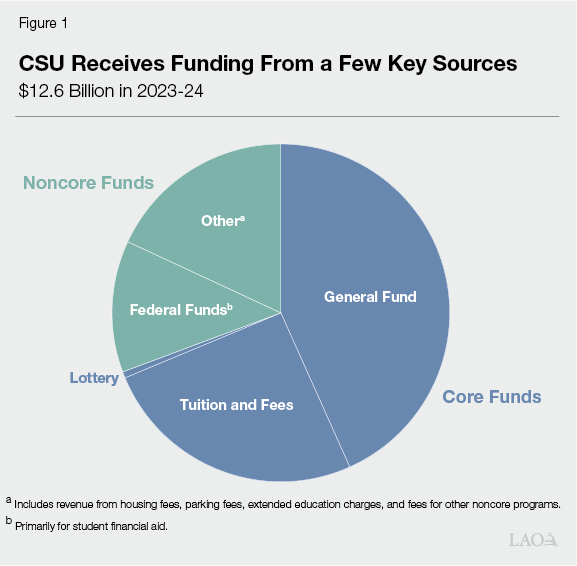

CSU Budget Is $12.6 Billion in 2023‑24. As Figure 1 shows, CSU receives funding from various sources. The state generally focuses its budget decisions around CSU’s “core funds,” or the portion of its budget supporting its academic mission. Core funds at CSU primarily consist of state General Fund and student tuition revenue, with a very small share coming from state lottery revenue. Core funds comprise about 70 percent ($8.7 billion) of CSU’s budget. Between 2022‑23 and 2023‑24, ongoing core funds per student increased 2.6 percent at CSU.

Ongoing Core Funding Increases by $107 Million (1.2 Percent) Under Governor’s Budget. As Figure 2 shows, all of the increase in ongoing core funding for CSU in 2024‑25 comes from student tuition and fee revenue. Specifically, tuition and fee revenue increases by $173 million (5.4 percent), while ongoing General Fund decreases by $65 million (1.2 percent). The increase in tuition and fee revenue is due to both higher tuition charges and enrollment growth. Because expected enrollment growth outpaces funding increases, we estimate ongoing core funding per student decreases 1 percent under the Governor’s budget.

Figure 2

CSU’s Core Fund Increase Comes From Tuition Revenue

(Dollars in Millions, Except Funding Per Student)

|

2022‑23 Actual |

2023‑24 Revised |

2024‑25 Proposed |

Change From 2023‑24 |

|||

|

Amount |

Percent |

|||||

|

Ongoing Core Funds |

||||||

|

General Funda |

$5,041 |

$5,409 |

$5,344 |

‑$65 |

‑1.2% |

|

|

Tuition and feesb |

3,208 |

3,193 |

3,366 |

173 |

5.4 |

|

|

Lottery |

83 |

76 |

76 |

—c |

—c |

|

|

Totals |

$8,332 |

$8,678 |

$8,785 |

$107 |

1.2% |

|

|

FTE studentsd |

383,160 |

388,854 |

397,805 |

8,951 |

2.3% |

|

|

Funding per student |

$21,745 |

$22,317 |

$22,085 |

‑$232 |

‑1.0 |

|

|

aIncludes funding for pensions and retiree health benefits. bIncludes funds used for student financial aid. cLess than $500,000 or 0.5 percent. dReflects total combined resident and nonresident enrollment. The 2024‑25 number incorporates CSU’s planned resident enrollment growth. |

||||||

|

FTE = full‑time equivalent. |

||||||

Governor Proposes to Delay Planned Base Increase for CSU. In May 2022, the administration announced a compact with CSU to provide the university with 5 percent annual unrestricted base increases through 2026‑27. The Governor’s budget, however, proposes a “deferral” of the $240 million base increase planned for 2024‑25. Under the proposed approach, the state would delay the base increase until 2025‑26. In that year, the state would double up the ongoing increase and provide a one‑time back payment. In the meantime, CSU would increase spending in 2024‑25 by the originally planned $240 million using other sources, such as its reserves. Accounting for the increased spending associated with the deferral, CSU’s core funding in 2024‑25 would rise to $9 billion—a $348 million (4 percent) increase over the 2023‑24 level. CSU’s per‑student funding would increase by 1.7 percent.

Governor’s Budget Includes a Few Other Cost Adjustments for CSU. Aside from the proposed deferral, the Governor’s budget includes only a few General Fund adjustments for CSU. As Figure 3 shows, the only new ongoing General Fund adjustments the Governor’s budget contains for CSU in 2024‑25 are projected changes in retiree health and pension costs. The Governor does not propose any one‑time funding for CSU in 2024‑25.

Figure 3

A Few Costs Are Projected to Change

General Fund Changes, 2024‑25 (In Millions)

|

CSU Ongoing Spending |

|

|

Retiree health benefit cost increase |

$64 |

|

Pension cost decrease |

‑129 |

|

CENIC cost increasea |

— |

|

Total |

‑$65 |

|

aThe 2021‑22 budget agreement included a five‑year plan for covering higher CENIC charges. The annual funding increase in 2024‑25 is $152,000. |

|

|

CENIC = Corporation for Education Network Initiatives in California. |

|

Core Operations

In this section, we first provide background on CSU’s cost pressures and funding. Next, we describe the Governor’s proposal to delay a base funding increase for CSU, followed by CSU’s plans to address the funding delay. Then, we assess the Governor’s proposal and make an associated recommendation.

Cost Pressures

CSU’s Largest Operating Cost Is Employee Compensation. Like other state agencies, CSU spends the majority of its core funds (73 percent in 2022‑23) on employee salaries and benefits. Accordingly, compensation almost always represents CSU’s largest cost pressure each year.

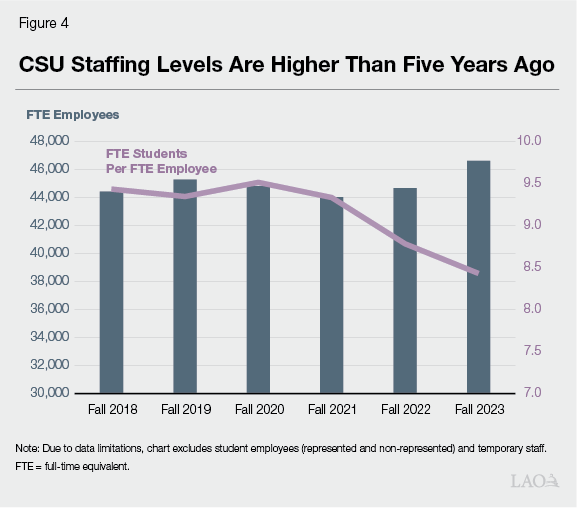

CSU Has About 47,000 FTE Employees. Of these employees, about 45 percent are faculty, about 45 percent are staff, and the remaining 10 percent are managers and executives. CSU’s workforce has grown over the past decade, except for a small decrease during the pandemic (fall 2020 and fall 2021). As Figure 4 shows, staffing levels have since recovered and are now 4.9 percent higher than five years ago. Because student enrollment declined over the same period, the number of FTE students per FTE employee has decreased from 9.4 in fall 2018 to 8.4 in fall 2023.

Most CSU Employees Are Represented by a Labor Union. The largest union is the California Faculty Association (CFA), which accounts for half of CSU’s overall salary base. CFA represents professors, lecturers, counselors, librarians, and coaches. The second largest union, accounting for nearly 25 percent of CSU’s overall salary base, is the California State University Employees Union (CSUEU). CSUEU represents support staff in various roles, including administrative support, technology, operations, and health services. The remaining six unions (representing student services staff, skilled trades workers, and graduate students, among others) together comprise 10 percent of CSU’s overall salary base. Managers and executive staff, who comprise about 15 percent of CSU’s salary base, are not represented by a union.

Most Employee Salary Levels Are Determined Through Collective Bargaining. Whereas the Legislature ratifies collective bargaining agreements for most represented state employees, state law authorizes the CSU Board of Trustees to ratify collective bargaining agreements for CSU’s employees. These collective bargaining agreements determine salary increases for represented employees. The agreements also often indirectly guide salary increases for CSU’s non‑represented employees. Over the past decade, CSU employees have received salary increases in all years except 2020‑21, when the state reduced General Fund support for CSU in response to a projected budget shortfall due to the COVID‑19 pandemic.

CSU Has Negotiated Salary Increases for 2023‑24. As Figure 5 shows, CSU has negotiated agreements with all of its unions to provide a 5 percent general salary increase in 2023‑24. As of this writing, three of these agreements are tentative (pending ratification by the Board of Trustees and union membership) and the remaining have been ratified. As is its typical practice, CSU also is providing a comparable (5 percent) salary increase to its non‑represented employees in 2023‑24.

Figure 5

CSU Has Negotiated 5 Percent Salary Increases Across Groups

General Salary Increases by Employee Group

|

General Salary Increases |

|||

|

2023‑24 |

2024‑25a |

2025‑26a |

|

|

California Faculty Associationb,c |

5% |

5% |

Open |

|

California State University Employees Union |

5 |

5 |

—d |

|

Academic Professionals of Californiab |

5 |

Open |

Open |

|

Teamsters 2010b |

5 |

—d |

—d |

|

United Auto Workers |

5 |

5 |

Open |

|

Statewide University Police Association |

5 |

5 |

5% |

|

Union of American Physicians and Dentists |

5 |

Open |

Open |

|

International Union of Operating Engineers |

5 |

Open |

Open |

|

aIncreases are contingent upon the state providing a specified amount of support to CSU. bTentative agreements pending ratification by the CSU Board of Trustees and union membership. cAgreement also includes 2.65 percent service salary increases for faculty below certain salary levels, along with increases in the minimum salary for certain faculty positions, in 2023‑24 and 2024‑25. dIn lieu of General Salary Increases, CSU and these unions have agreed to implement a salary step structure under which employees receive regular salary increases based on their length of service. |

|||

CSU Also Has Some Contingent Salary Agreements in Place for 2024‑25. As Figure 5 shows, CSU also has agreements extending into 2024‑25 with five unions. Three of these agreements already have been ratified and two are tentative. Several of these agreements provide a 5 percent general salary increase, contingent upon the state providing a specified amount of support to CSU in 2024‑25. For example, the 5 percent increase for employees represented by CFA is contingent upon the state not reducing ongoing base funding to CSU relative to the 2023‑24 Budget Act level, whereas the salary increase for employees represented by CSUEU is contingent upon the state providing a $227 million base augmentation to CSU. As of this writing, 2024‑25 compensation increases have not yet been determined for three smaller unions, as well as non‑represented employees. CSU estimates the cost of every 1 percent increase in its compensation pool for all employee groups in 2024‑25 would be $55 million ongoing.

CSU Is Directly Responsible for Certain Pension Costs. The California Public Employees’ Retirement System (CalPERS) administers pension benefits for CSU and most other state employees. The CalPERS Board sets employer contribution rates for pensions as a percentage of payroll. The state and CSU each pay a portion of the total employer contribution. The state’s contribution is determined by applying the employer contribution rate to CSU’s 2013‑14 payroll level. CSU’s contribution is determined by applying the employer contribution rate to any payroll growth above that level. The state adopted this arrangement in 2013‑14 to provide CSU with a stronger fiscal incentive to contain staffing costs.

Governor Assumes Pension Contribution Rates Decrease in 2024‑25. The Governor’s budget assumes that employer CalPERS contribution rates will decrease in 2024‑25 due to the application of a supplemental pension payment made in 2023‑24. Under the Governor’s proposal, the employer contribution rate for the largest CSU employee group (miscellaneous) would be 26.6 percent of pay—5.4 percentage points lower than the rate in 2023‑24. The employer contribution rate for other CSU employees (peace officers and firefighters) would be 30.5 percent of pay—19.6 percentage points lower than the rate in 2023‑24. These lower rates result in associated budget savings. Specifically, the Governor’s budget reflects a $129 million decrease in the state’s contribution towards CSU’s pension costs. We estimate the lower contribution rates would generate between $63 million and $72 million in savings to CSU associated with payroll beyond the 2013‑14 level. The Governor’s budget assumes that employer contribution rates and costs would return to their higher scheduled levels beginning in 2025‑26. We analyze this proposal in a forthcoming brief.

CSU Is Also Responsible for Certain Health Benefit Costs. CalPERS also administers CSU’s health benefits. Each year, CalPERS negotiates with health plan providers to establish premiums for the plans offered to CSU’s employees. Pursuant to state law, CSU’s contribution to employee health benefits is based on the average premium of the most popular health plans. When premiums increase, CSU covers the associated cost for its active employees. The state covers the cost for retirees’ health benefits. Health care premiums in 2024 are increasing 11 percent—more than double the average annual rate of increase over the past five years. CSU estimates its associated costs for active employees in 2024‑25 will increase $78 million. In addition, the Governor’s budget includes $64 million to cover the higher cost for CSU’s retirees.

CSU Has Identified Various Other Operating Cost Increases. Beyond employee compensation, CSU has ongoing costs related to various other operating expenses, including facilities, technology, equipment, and supplies. CSU has identified the following associated cost increases in 2024‑25:

- $29 million to cover increased prices due to continued inflation.

- $25 million to debt finance additional capital outlay projects, primarily to address capital renewal needs associated with aging academic facilities and infrastructure.

- $23 million to cover increases in insurance premiums due to several factors, including the increased incidence of liability claims and natural disasters.

- $13 million to cover additional costs of routine maintenance and operations (such as utilities and custodial services) as campuses open new facilities.

Funding

Share of CSU Costs Covered by General Fund Has Increased Over the Past Decade. Since 2013‑14, CSU has primarily relied on state General Fund augmentations to cover increases in its operating costs. From 2013‑14 to 2023‑24, the state provided CSU with General Fund base increases in every year except 2020‑21. During the same period, CSU increased tuition only once (in 2017‑18). As a result, the General Fund has been comprising a growing share of CSU’s core funds. Whereas we estimate the General Fund comprised 50 percent of CSU’s ongoing core funds in 2013‑14, it comprises 62 percent in 2023‑24.

CSU Is Implementing Tuition Increases Beginning in 2024‑25. In 2022‑23, CSU established a work group focused on fiscal sustainability that identified a significant gap between the system’s costs and its revenues. Among the work group’s recommendations was to adopt a tuition policy that provides for gradual and predictable increases. In response, the CSU Board of Trustees adopted a new tuition plan in September 2023. Under the plan, tuition will increase by 6 percent annually for all students beginning in 2024‑25 and extending through 2028‑29. Tuition charges are set at $6,084 for resident undergraduate students in 2024‑25, reflecting a $342 increase from the current year. CSU estimates generating an additional $148 million in revenue from tuition increases in 2024‑25. It plans to use $49 million (33 percent) of this additional revenue to provide larger tuition awards through the State University Grant program. (In addition, the California Student Aid Commission budget includes $35 million in higher associated Cal Grant costs in 2024‑25. Many CSU students with financial need receive full tuition coverage under the Cal Grant program.)

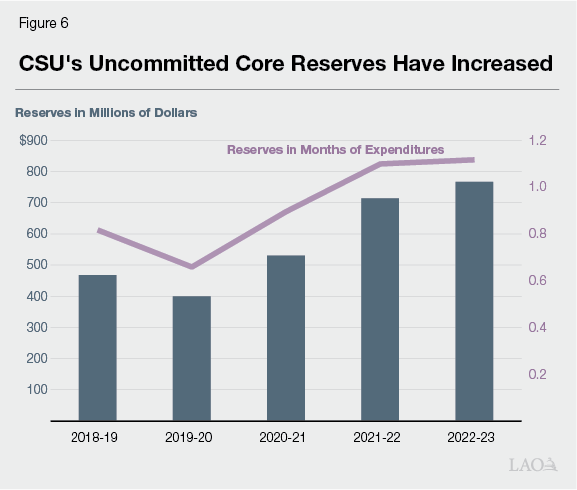

CSU’s Reserves Have Increased but Remain Below Its Target. Like many other universities (as well as public and private entities more generally), CSU maintains reserves. CSU commits part of its reserves for outstanding financial commitments and planned one‑time activities (such as launching a new academic program or designing a new capital project). CSU also leaves some of its reserves purposefully uncommitted to prepare for economic uncertainties, including recessions. CSU’s systemwide reserves policy sets a target to maintain uncommitted reserves worth between three and six months of expenditures. At the end of 2022‑23 (the most recent data available), CSU had $2.5 billion in total core reserves, of which $766 million was uncommitted. As Figure 6 shows, CSU’s uncommitted core reserves have generally increased over the past five years, reaching 1.1 months of expenditures in 2022‑23. Nonetheless, the reserve level remains below the system’s target.

CSU Reports Campuses Are Facing Funding Shortfall in 2023‑24. In 2023‑24, CSU allocated $123 million (slightly more than half) of its General Fund base increase for employee compensation increases. This reflects the amount of the base increase that remained available after covering certain other costs (health care premium increases, insurance premium increases, maintenance and operations of new facilities, and enrollment growth). It falls short, however, of covering CSU’s actual employee compensation costs. CSU estimates that employee compensation increases in 2023‑24 are costing $261 million—$138 million more than the amount covered by the base increase. Campuses are to cover the $138 million shortfall from their existing budgets. CSU is allowing each campus to determine how to address its share of the shortfall. CSU reports most campuses are exploring various actions, including holding positions vacant, reducing course offerings, reorganizing programs and departments, and reducing travel and other nonessential purchases.

Governor’s Proposal

Governor Proposes to Delay Base Increase for CSU Until 2025‑26. Two years ago, the Governor made a compact with CSU to provide annual 5 percent base increases from 2022‑23 through 2026‑27. (The compact is not codified, and the Legislature decides through the annual budget process which, if any, of the components it will enact.) The Governor’s budget does not fund the third year of the base increases. Instead, the Governor proposes to delay the associated $240 million in ongoing funding until 2025‑26. The Governor intends to “double up” funding in 2025‑26, such that CSU would receive an ongoing 10 percent base increase of $494 million that year. (This consists of $240 million to support the higher level of prior‑year ongoing spending, along with $254 million for a new 5 percent base increase.) In addition, the Governor intends to provide CSU with a one‑time back payment of $240 million in 2025‑26 to compensate for the forgone funds in 2024‑25. The Governor describes this proposal as a deferral of the third‑year compact payment. Though CSU could choose how to respond the funding delay, the Governor expects CSU to spend at the higher assumed level in 2024‑25 by using other means, such as drawing down its reserves or borrowing internally from noncore funds. The Governor gives CSU the discretion to choose its corresponding spending priorities.

CSU’s Plan

CSU Would Likely Use Reserves to Address Funding Delay. Although the Governor’s budget delays the $240 million base increase originally planned for 2024‑25, CSU still plans to allocate this amount of funding to campuses. Although CSU has not yet made a final determination as to how it would cover the costs, it indicates the funds would likely come from its reserves. CSU could then replenish its reserves in 2025‑26 if the state provides back payment, as the Governor proposes.

CSU Has Identified Several Priorities for Spending Increases in 2024‑25. CSU’s planned use of reserves, combined with an anticipated increase in tuition revenue, would support $413 million in new spending in 2024‑25. This reflects a 5 percent increase from CSU’s 2023‑24 ongoing core spending level. As Figure 7 shows, CSU has identified several associated spending priorities for 2024‑25. Within this preliminary spending plan, 59 percent of new spending is for employee salaries and benefits, 28 percent is related to expanding enrollment and student support programs, and the remaining 13 percent is for other operating cost increases. CSU intends to adopt its final spending plan in July after the state enacts the budget.

Figure 7

CSU Has Several Spending Priorities for 2024‑25

Planned Spending Increases (In Millions)

|

Amount |

|

|

Employee Salaries and Benefits |

|

|

Employee compensation pool increases |

$164 |

|

Health care premium increases |

78 |

|

Subtotal |

($242) |

|

Enrollment and Student Support |

|

|

Student financial aid increases |

$58 |

|

Enrollment growth |

55 |

|

Student basic needs and mental health program expansions |

3 |

|

Subtotal |

($115) |

|

Other Institutional Costs |

|

|

Liability and property insurance premium increases |

$23 |

|

Operations and maintenance of new facilities |

13 |

|

Debt service for new capital outlay projects |

10 |

|

Title IX and DHR program improvements |

8 |

|

State and federal NAGPRA compliance improvements |

2 |

|

Subtotal |

($55) |

|

Total |

$413a |

|

aOf this proposed higher spending, CSU plans to cover $240 million likely from its reserves and $173 million from increases in tuition revenue. |

|

|

DHR = Discrimination, harassment, and retaliation and NAGPRA = Native American Graves Protection and Repatriation Act. |

|

Assessment

Proposed Funding Delay Worsens State’s Projected Out‑Year Budget Deficits. As we discuss in The 2024‑25 Budget: Overview of the Governor’s Budget, the state faces significant operating deficits in the coming years. The Governor’s proposed funding delay for CSU worsens those deficits, as we discuss in The 2024‑25 Budget: Higher Education Overview. Under the proposed approach, the state would need to increase General Fund spending for CSU by $734 million in 2025‑26—consisting of a $494 million ongoing augmentation and an additional $240 million one‑time back payment. Rather than increasing university costs, the state historically has contained these costs when facing multiyear budget deficits.

Proposed Approach Increases Out‑Year Risks for the State. Both our office and the administration project the state faces an operating deficit of more than $30 billion in 2025‑26. Given this projected deficit, increasing spending on CSU in that year would require a like amount of other budget solutions. The Legislature likely will have fewer options for budget solutions next year, with lower reserves and less one‑time spending available to pull back. At that time, the Legislature might face the difficult choice of either cutting other ongoing state programs to make room for the additional CSU spending or, alternatively, forgoing the increase it had committed to providing CSU.

Proposed Approach Also Increases Out‑Year Risks for CSU. Although the Governor’s proposal benefits CSU in 2024‑25 by allowing it to increase spending, it comes with heightened risks for CSU the following year. Under the proposed approach, CSU would be entering 2025‑26 with higher ongoing spending and lower reserves than if the state had forgone the base increase. If the state were then unable to support that higher spending level in 2025‑26, CSU would need to consider significant reductions at that time. Depending upon the severity of the budget situation, CSU might consider actions such as hiring freezes, layoffs, or furloughs—all actions it has taken over the years in response to previous state budget cuts. Such actions would negatively impact both employees and students, as they likely would lead to fewer classes and a reduction in support services. Moreover, they would likely be more disruptive than containing spending increases in the first place.

Without a Base Increase, CSU Still Could Cover Some Cost Increases in 2024‑25. If the state were to forgo rather than delay the base increase planned for 2024‑25, CSU would have less ability to increase spending on various purposes, including employee compensation. It would, however, still have some options for covering a portion of its cost increases. Most notably, CSU’s tuition increases are estimated to generate $99 million in new ongoing revenue in 2024‑25, net of the amount committed for institutional financial aid. CSU also has $766 million in uncommitted reserves that could help cover costs temporarily, though they could not sustain costs on an ongoing basis. These sources could help CSU cover certain cost increases that it cannot avoid in the near term, such as health care premium increases and insurance premium increases, absent a General Fund increase for 2024‑25.

Recommendation

Hold State Funding and Spending Expectations Flat for CSU, Revisit Next Year. We recommend the Legislature reject the Governor’s proposal to delay, then double up, funding for CSU. Such an approach substantially worsens the state’s projected deficit in 2025‑26, and it is risky for the state, CSU, and other state programs that might be cut more deeply in 2025‑26 to make room for the additional CSU spending. Rejecting the Governor’s proposal provides $743 million in budget savings, nearly $500 million of which is ongoing, beginning in 2025‑26. By taking this action this year, the Legislature can mitigate the need for other, potentially more disruptive budget solutions next year. As long as the state is projected to have large, multiyear budget deficits, we caution against raising CSU’s General Fund spending levels or expectations. We recommend the Legislature take a more prudent approach to crafting its budget that aims to contain CSU spending. If the state budget situation were to improve in 2025‑26, the state would then be in the more advantageous position of being able to set a CSU base increase that it can afford at that time.

Enrollment

In this section, we first provide background on CSU enrollment. Next, we cover recent enrollment trends. Then, we describe the Governor’s enrollment expectations, followed by CSU’s enrollment growth plans. Finally, we assess CSU’s enrollment situation and provide two associated options for the Legislature to consider.

Background

Most CSU Students Are California Residents. The vast majority of students at CSU are California residents. About 90 percent of these resident students are undergraduates. Over time, roughly half of CSU’s incoming undergraduates have been freshmen and half have been transfer students. The state has historically viewed CSU as critical to the transfer pipeline, with students able to begin their education at a community college and subsequently earn a bachelor’s degree at CSU. In addition to undergraduates, CSU enrolls postbaccalaureate and graduate students.

State Budget Typically Sets Enrollment Growth Expectations for CSU. In most years, the state sets enrollment growth expectations for CSU in the annual budget act. These growth expectations apply to resident students. In some years, the state sets expectations for total resident enrollment. In other years, its sets expectations only for resident undergraduates, with no expectation for resident graduate students. CSU tracks a running total of these growth expectations, which it commonly refers to as its enrollment target or “funded level.” CSU’s funded enrollment target in 2023‑24 is 387,114 resident FTE students. CSU does not track this target separately for undergraduates and graduate students.

State Typically Funds Enrollment Growth According to Per‑Student Formula. Typically, the state supports resident enrollment growth at CSU by providing a General Fund augmentation based on the number of additional students CSU is to enroll. The per‑student funding rate is derived using a “marginal cost” formula. This formula estimates the cost of the additional faculty, support services, and other resources required to serve each additional student. Those costs are shared between state General Fund and student tuition revenue. In 2023‑24, the total marginal cost per student is $14,749, with a state share of $10,070. The formula calculates one rate that applies to all resident enrollment, whether at the undergraduate or graduate level. Whereas the state subsidizes the cost of educating resident students, nonresident students are charged a higher tuition rate that is intended to cover the full cost of their education.

CSU Also Offers Self‑Supported Courses. Like the other public higher education segments, CSU offers some self‑supported courses (also referred to as extended education or professional and continuing education). Self‑supported courses generally charge student fees intended to cover the full cost of offering them, without any state subsidy. Self‑supported course offerings include an array of academic courses, professional certificate programs, and personal enrichment courses offered throughout the year. In 2022‑23, CSU enrolled 26,334 FTE students in self‑supported courses. These students are not counted toward state enrollment targets.

Many Summer Courses Have Been Self‑Supported. All CSU campuses offer some academic courses during the summer. Historically, many campuses have chosen to offer summer courses as self‑supported, while others have offered them as state‑supported. (Of the self‑supported FTE enrollment in 2022‑23, 52 percent was generated in the summer term.) Each campus sets its own fees for self‑supported summer courses. Based on a review of campus websites, these fees are different from, but not consistently higher or lower than, the tuition charged for comparable state‑supported courses. Students in both types of summer courses have opportunities to receive financial aid, but those opportunities tend to be greater for students in state‑supported courses.

Recent Trends

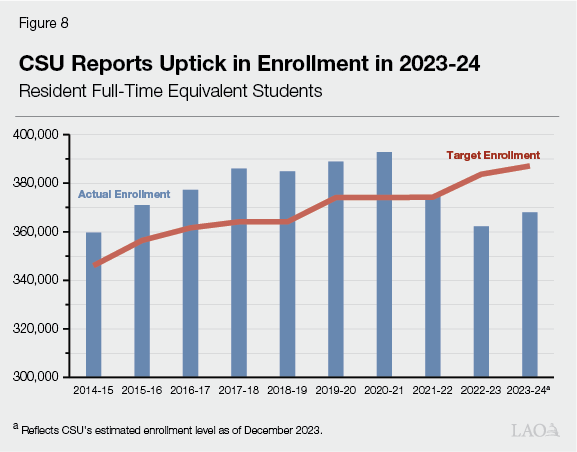

CSU Reports Increase in Resident FTE Students in 2023‑24. As of December 2023, CSU estimates it is enrolling a total of 368,042 resident FTE students in 2023‑24—an increase of 5,788 students (1.6 percent) from the previous year. As Figure 8 shows, the 2023‑24 increase follows two years of significant enrollment declines. Despite the increase in 2023‑24, CSU’s total estimated resident enrollment level remains 19,072 FTE students (4.9 percent) below its funded enrollment target. (In the nearby box, we compare CSU’s estimated 2023‑24 resident undergraduate enrollment with the expectation set in the 2023‑24 Budget Act.)

Budget Act Expectations

2023‑24 Budget Act Included Enrollment Growth Expectation for CSU. The 2023‑24 Budget Act stated an intent for the California State University (CSU) to increase resident undergraduate enrollment by 4,057 full‑time equivalent (FTE) students, bringing its resident undergraduate enrollment level to 330,080 FTE students in 2023‑24. This growth expectation is relative to CSU’s actual enrollment level in 2022‑23. It is unrelated to the funded enrollment target that CSU has been tracking for more than a decade. CSU estimates it is enrolling 331,139 resident undergraduate FTE students in 2023‑24, thus somewhat exceeding the expectation set in the budget act. Based on CSU’s data, it generated the bulk of the new enrollment in its summer 2023 term, with little growth in the fall 2023 term.

Growth Is Attributed Mostly to Shifting Some Summer Courses From Self‑Supported to State‑Supported. Of the estimated increase of 5,788 resident FTE students in 2023‑24, 5,459 FTE students are attributed to the summer 2023 term. As Figure 9 shows, state‑supported summer FTE students nearly doubled relative to the previous year. CSU explains the increase was due to campuses shifting certain summer courses from self‑supported to state‑supported. The increase in state‑supported students was largely offset by an accompanying decrease in self‑supported students. CSU indicates the courses shifted to state‑supported were generally academic courses that students took to make progress toward their degree. These include courses taken by continuing students as well as new students participating in summer transition programs. Data is not available on the specific courses that were shifted or the number of FTE students enrolled in those courses.

Figure 9

Total Summer Enrollment Grew Only Modestly in 2023‑24

Summer Resident FTE Studentsa

|

2021‑22 |

2022‑23 |

2023‑24 |

Change From 2022‑23 |

||

|

Amount |

Percent |

||||

|

State‑supported FTE students |

5,547 |

5,836 |

11,295 |

5,459 |

94% |

|

Self‑supported FTE students |

14,608 |

13,050 |

8,345 |

‑4,705 |

‑36 |

|

Totals |

20,155 |

18,886 |

19,640 |

754 |

4% |

|

aReflects annualized full‑time equivalent students across all student levels. |

|||||

|

FTE = full‑time equivalent. |

|||||

Fall Enrollment Is About Flat From Previous Year. In contrast to summer 2023, fall 2023 total resident enrollment changed relatively little from the previous year. Fall resident headcount decreased by 3,645 students (0.8 percent). However, fall resident FTE students increased slightly, by 283 students (0.1 percent), because students are taking more units on average. Specifically, average unit load for resident students across all levels was 12.8 units in fall 2023, up from 12.7 units the previous fall.

Increase in New Freshmen Is Partly Offset by Drop in New Transfer Students. In fall 2023, the number of new resident freshmen enrolling at CSU increased 4.7 percent over the previous year, as Figure 10 shows. This is CSU’s largest incoming freshman cohort to date. The increase in new freshmen, however, was offset by decreases in new transfer and continuing students. New transfer students decreased 0.8 percent, reflecting the continued impact of recent community college enrollment declines on CSU’s transfer pipeline. As a result, the share of new CSU students who are transfer students is down to 43 percent in fall 2023, compared to 47 percent before the pandemic in fall 2019.

Figure 10

Fall Headcount Slightly Decreased in 2023‑24

Resident Fall Headcount

|

2021 |

2022 |

2023 |

Change From 2022 |

||

|

Amount |

Percent |

||||

|

Undergraduate |

|||||

|

New freshmen |

56,444 |

61,272 |

64,125 |

2,853 |

4.7% |

|

New transfer students |

54,649 |

48,006 |

47,613 |

‑393 |

‑0.8 |

|

Continuing students |

293,020 |

277,959 |

273,080 |

‑4,879 |

‑1.8 |

|

Subtotals |

(404,113) |

(387,237) |

(384,818) |

(‑2,419) |

(‑0.6%) |

|

Postbaccalaureate/Graduate |

50,159 |

46,420 |

45,194 |

‑1,226 |

‑2.6% |

|

Totals |

454,272 |

433,657 |

430,012 |

‑3,645 |

‑0.8% |

Continuing Student Enrollment Is Also Down. As Figure 10 also shows, the number of continuing undergraduates in fall 2023 decreased 1.8 percent from the previous year. The decrease is due to multiple factors. CSU enrolled smaller‑than‑usual incoming cohorts the past two years, translating to fewer continuing students now. Moreover, retention rates have generally decreased since the start of the pandemic. The percent of freshmen who return in their second year, for example, decreased from 85 percent for the fall 2019 incoming cohort to 82 percent for the fall 2022 incoming cohort.

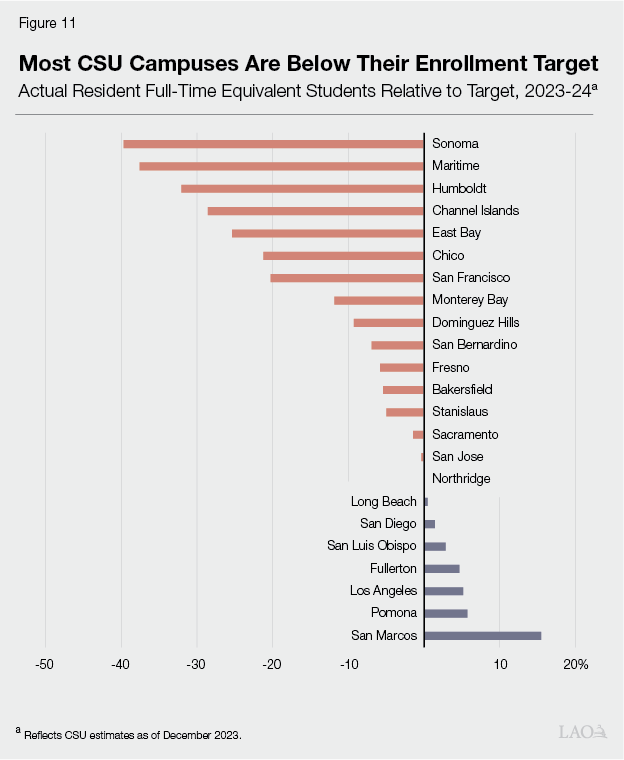

Most Campuses Are Below Their Enrollment Target. CSU allocates its systemwide enrollment target and associated funding by campus. Whether a campus meets its funded enrollment target depends on several key factors, including the number of students who apply, admission rates, yield rates, retention rates, and other aspects of student and campus behavior. As Figure 11 shows, CSU estimates that 15 of 23 campuses are below their target in 2023‑24. Eight of these campuses were more than 10 percent below their target.

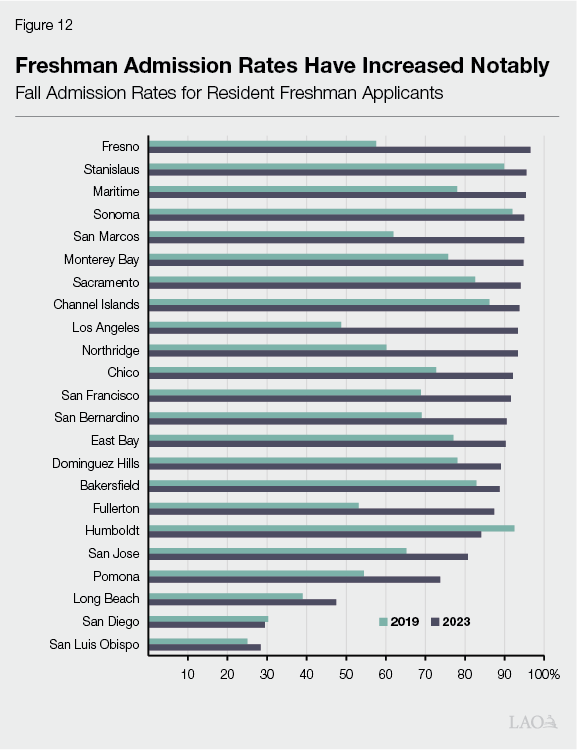

Several Campuses Have Reduced the Use of Impaction. Historically, many CSU campuses have been designated as “impacted,” meaning they have more student demand than enrollment slots. To manage student demand, impacted campuses adopt stricter admissions criteria than the minimum systemwide eligibility requirements. Campuses may apply the stricter admissions criteria to applicants outside their local service area and/or applicants within specific high‑demand programs. Amid recent enrollment declines, CSU reports that several campuses have removed these stricter admissions criteria. Specifically, the Fresno, Northridge, Sacramento, San Bernardino, San Marcos, and Sonoma campuses have discontinued impaction for nonlocal applicants at both freshman and transfer levels. In addition, the Channel Islands, Maritime, Northridge, Sacramento, and San Marcos campuses have discontinued impaction within specific programs, such as engineering, biology, and health science.

Admission Rates Have Increased Significantly Over Past Few Years. As Figure 12 shows, freshman admission rates have increased at nearly all CSU campuses over the past few years. Fourteen campuses had freshman admission rates of 90 percent or higher in fall 2023, compared to only two campuses in fall 2019. Only four campuses continue to have freshman admission rates lower than 75 percent. Transfer admission rates have also increased notably over the past few years. In sum, at most CSU campuses, a higher share of applicants is being admitted, meaning access is widening. The higher admission rates could be due to multiple factors, including the removal of stricter admissions criteria for certain previously impacted campuses and programs, the systemwide removal of standardized testing requirements since fall 2021, and campus efforts to meet enrollment targets amid demographic and fiscal challenges.

Governor’s Proposal

Governor’s Budget Maintains Enrollment Expectations Set in Compact. As part of his compact with CSU, the Governor expects CSU to increase resident undergraduate enrollment by 1 percent annually from 2023‑24 through 2026‑27. (The compact does not include an expectation for CSU to increase graduate enrollment.) This expectation is added to CSU’s funded enrollment target, bringing that target from 383,680 resident FTE students in 2022‑23 to 397,623 resident FTE students in 2026‑27. The Governor expects CSU to cover the cost of this enrollment growth from within its base increase each year. Although the Governor’s budget delays the planned base increase under the compact until 2025‑26, it makes no changes to the associated enrollment expectations. (We discuss the delayed base increase in the “Core Operations” section of this brief.)

CSU’s Plan

CSU Intends to Catch Up to Enrollment Target by 2026‑27. As Figure 13 shows, CSU’s actual enrollment level was significantly below its funded enrollment target at the start of the compact period in 2022‑23. As a result, it would need to grow actual enrollment by more than 1 percent annually (the rate at which the target is increasing) to catch up to the target. Accordingly, CSU plans to grow actual enrollment by 2 percent to 3 percent annually for the next few years. Under this plan, CSU effectively would catch up to its enrollment target by the last year of the compact in 2026‑27.

Figure 13

Under CSU’s Plan, Enrollment Would Reach Target by 2026‑27

Resident Full‑Time Equivalent Students

|

2022‑23 |

2023‑24 |

2024‑25 |

2025‑26 |

2026‑27 |

|

|

Enrollment target under compact |

383,680 |

387,114 |

390,582 |

394,085 |

397,623 |

|

Annual percentage growth |

‑ |

0.9% |

0.9% |

0.9% |

0.9% |

|

CSU’s planned enrollment level |

362,254 |

368,042 |

376,794 |

387,091 |

397,823 |

|

Annual percentage growth |

‑ |

1.6% |

2.4% |

2.7% |

2.8% |

|

CSU’s planned enrollment relative to target |

‑5.6% |

‑4.9% |

‑3.5% |

‑1.8% |

0.1% |

CSU Plans to Allocate New Enrollment Growth Funding to Certain Campuses in 2024‑25. The 1 percent increase in CSU’s enrollment target set forth in the compact equates to 3,468 additional resident undergraduate FTE students in 2024‑25. CSU plans to allocate an associated $38 million in new funding to campuses, corresponding to the state share of the marginal cost of adding those students. (CSU estimates it would also generate $17 million in additional student tuition revenue from this growth.) CSU indicates it would allocate those funds among nine campuses that are planning for growth above their 2023‑24 funded target. Originally, CSU intended to cover the cost from within its base increase. Under the Governor’s budget proposal to delay that increase, CSU instead would likely use its reserves.

CSU Also Plans to Reallocate Existing Enrollment Funding Among Campuses. In addition to providing new enrollment growth funding, CSU plans to reallocate some existing enrollment funding among campuses in 2024‑25. Eight campuses are currently more than 10 percent below their enrollment target. For each of these campuses, CSU plans to reduce its enrollment target and associated funding by 3 percent in 2024‑25 and reallocate those amounts to campuses currently at or above their target. (These reallocated funds would be in addition to any funds the campus receives from the new $38 million for enrollment growth in 2024‑25.) CSU also intends to repeat a similar reallocation process in 2025‑26 and 2026‑27.

Assessment

CSU’s Actual Enrollment Level Is Notably Below Its Funded Enrollment Target. In 2023‑24, CSU’s estimated enrollment level of 368,042 resident FTE students is 19,072 students (4.9 percent) below its enrollment target. This target reflects the number of students for which CSU has previously received ongoing state support, either directly or from within its base funding. Given that CSU is notably below its target, it could add many more students before it needs to allocate new funding for enrollment growth, indicating new funding for enrollment growth is unwarranted at this time. New funding is particularly unwarranted if those funds are to come from CSU’s reserves, as they likely would under the Governor’s budget. It would be more prudent to use those reserves to temporarily cover operating costs that cannot be avoided.

Enrollment Growth in 2023‑24 Is Overstated Due to Shift in Summer Courses. When the Legislature sets enrollment growth expectations for CSU in the state budget, it intends for CSU to add more students. The majority of the increase in FTE students that CSU is reporting in 2023‑24 is unrelated to adding more students and instead stems from shifting summer courses from self‑supported to state‑supported. This approach to enrollment growth does not appear to align with legislative intent. Moreover, given the state’s projected budget deficits, the state likely cannot afford to begin supporting activities that were previously self‑supported. Based on the decline in self‑supported enrollment from the previous summer, we estimate CSU shifted 4,705 resident FTE students from self‑supported to state‑supported in summer 2023. If not for this shift, we estimate CSU would be enrolling only 363,337 resident FTE students in 2023‑24—23,777 students fewer than its funded enrollment target.

Enrollment Growth Is Likely to Be Relatively Low in 2024‑25. While the 2024‑25 admissions cycle remains in its early stages, early indicators suggest CSU could see some growth from its current enrollment level. The growth rate likely would not be large, as potential increases in new freshman could be offset by continued challenges related to new transfer students and continuing students.

- New Freshmen. The number of high school graduates in California is projected to increase by 0.7 percent in 2023‑24, potentially leading to an increase in the incoming freshman class for fall 2024. As of January 2024, CSU is reporting a 5 percent year‑over‑year increase in freshman applicants for fall 2024.

- New Transfer Students. In contrast to freshman applicants, transfer applicants for fall 2024 are about flat year over year. This suggests the transfer pipeline has yet to recover from community college enrollment declines during the pandemic.

- Continuing Students. Since fall 2021, CSU’s incoming cohorts (particularly new transfer students) have been smaller than pre‑pandemic levels. Some of these smaller cohorts will remain at CSU in 2024‑25, likely leading to fewer continuing students. In addition, it remains to be seen whether retention rates begin to recover from the declines seen since the start of the pandemic.

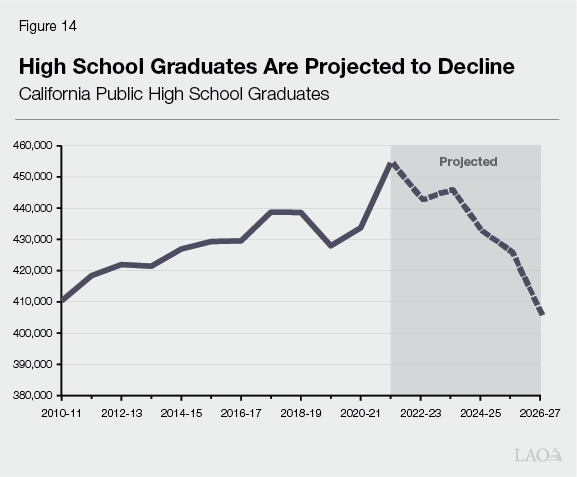

Demographic Trends Are Likely to Limit Growth in Out‑Years. Whereas CSU has seen increases in new freshmen over the past few years, demographic trends could limit this growth moving forward. Based on the most recent projections from the Department of Finance, the number of high school graduates in California has peaked. As Figure 14 shows, the number of high school graduates is projected to decline by 40,097 students (9 percent) from 2023‑24 to 2026‑27. All else equal, this would translate to smaller new freshman cohorts in the out‑years. (We discuss these and other demographic trends in our recent report, Trends in Higher Education: Student Access.)

Most CSU Campuses Are Already Meeting Student Demand. In the past, a key reason the Legislature has funded CSU enrollment growth was to expand access to eligible students who might otherwise not be admitted. This issue is less of a concern today. Over the past few years, admission rates have increased at nearly all CSU campuses, and fewer campuses and programs are impacted. A majority of campuses are currently below their enrollment targets—several by more than 10 percent. Moreover, CSU’s plan to reallocate existing enrollment targets among campuses can help expand capacity at those campuses that continue to have unmet enrollment demand without requiring additional state funds.

Budget Options

As Starting Point, Hold CSU’s Funded Enrollment Target Flat for 2024‑25. Consistent with our recommendation in the previous section to hold state funding for CSU flat, we recommend holding CSU’s enrollment target flat at the current level of 387,114 resident FTE students. CSU is 19,072 FTE students (4.9 percent) below this current target, meaning the system could add that many more students without additional funding. Given the relatively low enrollment growth expected in 2024‑25 and the out‑years, CSU is likely to remain below its current funded target for at least a couple more years. We see no rationale for increasing the target by 1 percent annually as the compact proposes, particularly if CSU would draw down its reserves for this purpose.

If More Budget Solution Is Needed, Consider Aligning CSU Funding With Its Actual Enrollment. One of the first options the state tends to consider when facing budget deficits is aligning funding with actual caseload. This is an approach the state has used across sectors of its budget—from education programs to health and social service programs. Given CSU’s funded enrollment target is substantially higher than its actual enrollment level, the Legislature could achieve notable budget savings using this approach. We estimate it could achieve $239 million in ongoing General Fund savings if it reset CSU’s funded enrollment target at 363,337 FTE students—reflecting its estimated 2023‑24 enrollment level, adjusted to remove the estimated number of students shifted from self‑supported courses. (It could set the enrollment target at a higher level for less corresponding savings.) Depending on the severity of the state budget condition, the Legislature could apply such a reduction retroactively to 2023‑24 or beginning in 2024‑25. This option is unlikely to have a direct impact on student access, as the new target would be based on the number of students CSU currently enrolls. It could, however, impact CSU operations, as it would reduce the amount of funding available for its operating costs. Nonetheless, having this option available could help balance the budget, particularly were the state budget condition to deteriorate further over the coming months.

One‑Time Budget Solutions

In this section, we discuss the Legislature’s options for achieving additional budget savings at CSU by pulling back unspent one‑time funding from prior budgets. Although the Governor does not propose this action for CSU, it could be among the less disruptive options for addressing the 2024‑25 budget deficit and reducing out‑year fiscal pressure to the state.

State Adopted Many One‑Time Initiatives Over Past Three Years. From 2021‑22 through 2023‑24, the state appropriated a total of $1.1 billion one‑time General Fund to CSU for about 50 one‑time initiatives and capital projects. (These amounts exclude capital projects that the state later converted from cash funding to debt financing, as we discuss in the following section.) The state adopted these one‑time appropriations in response to the large operating surpluses it originally was estimating for 2021‑22 and 2022‑23. Designating funds for one‑time purposes when the state has a surplus can be a prudent budget approach, as it avoids building up ongoing programs, particularly when revenues could be spiking and potentially contract in subsequent years. Now that prior surpluses have been replaced with projected multiyear deficits, the state could revisit recent one‑time initiatives to determine how much associated funding remains unspent. The more funds the Legislature pulls back from previous one‑time initiatives now, the less the Legislature might need to turn to ongoing programs for budget solutions moving forward.

CSU Has Some Unspent One‑Time Funding From Prior Budgets. Based on a data request to CSU, our preliminary estimate is that $423 million of the $1.1 billion in one‑time funding for CSU has not yet been spent or encumbered by campuses (as of January 1, 2024). As Figure 15 shows, $252 million of this amount is for deferred maintenance and related projects; $145 million is for various cash‑funded capital projects that remain in planning and design phases; and $26 million is for various academic programs, student support programs, and research initiatives.

Figure 15

Some Recent One‑Time Funding for CSU Initiatives Remains Unspent

General Fund (In Millions)

|

Purpose |

Maximum Available Fundsa |

|

Deferred Maintenance and Related Projectsb |

|

|

2021‑22 appropriation |

$162 |

|

2022‑23 appropriation |

91 |

|

Subtotal |

($252) |

|

Capital Projectsc |

|

|

University farms facilities and equipment |

$46 |

|

CSU Humboldt applied research facilities |

43 |

|

CSU Humboldt science building renovations |

35 |

|

CSU Dominguez Hills Dymally Institute facility |

15 |

|

CSU Dominguez Hills wellness, health, and recreation center |

6 |

|

Subtotal |

($145) |

|

Other Initiatives |

|

|

CSU Monterey Bay Computing Talent Initiative |

$7 |

|

Asian Bilingual Teacher Education Program Consortium |

4 |

|

CSU Bakersfield nursing and health professional programs |

4 |

|

Project Rebound student housing and other services |

3 |

|

Council on Ocean Affairs, Science and Technology |

3 |

|

CSU Dominguez Hills California Black Women’s Think Tank |

3 |

|

CSU San Francisco Asian American Studies |

3 |

|

Subtotal |

($26) |

|

Total |

$423 |

|

aReflects amount not spent or encumbered by campuses as of January 1, 2024. bIncludes deferred maintenance, energy efficiency, and seismic mitigation projects. cIncludes capital projects in design phases only. We exclude any projects that have already entered construction. |

|

Recommend Pulling Back Some of the Available One‑Time Funding. Of the identified unspent one‑time funds, we recommend the Legislature pull back the $145 million for capital projects and $26 million for various programs. Pulling back these funds would achieve near‑term savings. In a few cases, it would also generate out‑year savings, as the funds are for new facilities that would have future operations, maintenance, and capital renewal costs. To maximize potential savings, the Legislature might want to take early action, as doing so would ensure that additional funds are not spent before the end of the fiscal year. At this time, we do not recommend pulling back the $252 million in deferred maintenance funds. Doing so would likely increase future costs, as the foregone projects likely will turn into more expensive facility projects (including emergency repairs) in the long run. Nonetheless, were the state budget condition to deteriorate significantly in the coming months, then the Legislature might need to consider pulling back even these funds.

Debt‑Financed Capital Projects

In this section, we provide an update on various CSU capital projects for which the state provided ongoing General Fund beginning in 2023‑24, raise a couple of implementation concerns, and provide a few associated recommendations.

Update

Last Year, State Converted Some Capital Projects From Cash to Debt Financing. In 2021‑22 and 2022‑22, at the height of its budget surpluses, the state provided one‑time General Fund for many new capital projects. In 2023‑24, facing a moderate budget deficit, the state converted some of those projects from cash funding to debt financing. For CSU specifically, the state reverted $1 billion in one‑time General Fund associated with a total of 16 capital projects. Instead of receiving cash for these projects, CSU was to debt finance them using university bonds. In 2023‑24, the state also approved 5 new projects totaling $209 million in costs that CSU would also debt finance using university bonds. The state appropriated $100 million ongoing General Fund for CSU to support the debt service associated with the 21 projects altogether.

CSU Issued Bonds While Many of These Projects Were Still in Early Phases. In summer 2023, CSU issued a total of $662 million in bonds for the projects approved for debt financing in 2023‑24. These bonds are to cover some or all of the costs associated with 18 of the 21 projects. (CSU intends to issue additional bonds in summer 2024 to cover any remaining costs for these projects as well as the costs of the other three projects.) Whereas CSU typically issues bonds as projects are beginning the construction phase, it chose to instead issue bonds for these projects while many of them were still in earlier stages. CSU indicates it took this approach because some campuses had already begun to spend the cash they had initially received for these projects on planning and design costs, and they were awaiting bond proceeds to cover those costs after the state reverted the cash. As Figure 16 shows, many of these projects remain in planning and design phases as of January 1, 2024. Whereas the state typically has the ability to pause and remove funding for projects that remain in early stages, CSU indicates that doing so for these projects after the bonds have already been issued would have negative consequences for its bond program, possibly including harm to its perceived credit quality.

Figure 16

Many Debt‑Financed Capital Projects at CSU Remain in Early Phases

(In Millions)

|

Project |

Project Costa |

Bond Issuedb |

Current Phasec |

|

Student Housing Projectsd |

|||

|

San Francisco |

$116.3 |

Yes |

C |

|

San Marcos |

91.0 |

Yes |

C |

|

San Jose |

89.1 |

No |

P |

|

Fullerton |

88.9 |

Yes |

P |

|

Long Beach |

53.3 |

Yes |

W |

|

Dominguez Hills |

48.8 |

Yes |

W |

|

Sacramento |

41.3 |

No |

P |

|

Northridge |

37.5 |

Yes |

C |

|

Fresno |

31.1 |

Yes |

P |

|

Humboldt |

27.1 |

Yes |

C |

|

Stanislaus |

18.9 |

No |

P |

|

San Diego/Imperial Valley College |

4.6 |

Yes |

P |

|

Subtotal |

($647.8) |

||

|

Other Projects |

|||

|

Humboldt Housing, Health Care, and Dining Facility |

$101.0 |

Yes |

P |

|

Humboldt Engineering and Technology Commons |

100.0 |

Yes |

W |

|

Bakersfield Energy Innovation Center |

83.0 |

Yes |

P |

|

San Diego Brawley Center |

80.0 |

Yes |

W |

|

San Bernardino Palm Desert Center |

79.0 |

Yes |

W |

|

Fullerton Engineering and Computer Science Hub |

67.5 |

Yes |

P |

|

San Luis Obispo Swanton Pacific Ranch |

20.3 |

Yes |

P |

|

Chico Human Identification Lab |

55.0 |

Yes |

P |

|

San Bernardino physician assistant program facilities |

4.3 |

Yes |

C |

|

Subtotal |

($590.1) |

||

|

Total |

$1,237.9 |

||

|

aReflects state cost of project (excluding nonstate costs). bReflects whether CSU issued bonds for any of the project costs in summer 2023. cReflects project status as of January 1, 2024. dThe state also approved $7.5 million to cover cost overruns across CSU’s student housing projects. |

|||

|

P = preliminary plans; W = working drawings; and C = construction. |

|||

Most of the Bonds Issued for These Projects Were Taxable. CSU may issue bonds that are either tax‑exempt (meaning investors do not owe taxes on the income they receive) or taxable. Tax‑exempt bonds typically have somewhat lower interest rates, but they also have requirements that bond proceeds be spent within a certain time frame. Of the $662 million in bonds that CSU issued for these projects last summer, $462 million was taxable. This was at least in part because some of these projects were still in too early of a stage to spend down the proceeds within the required time frame. CSU’s use of taxable bonds generates higher debt service costs. The state, in turn, is effectively bearing these higher costs.

After State Approval, CSU Changed One Student Housing Projects. In February 2023, CSU submitted a request to the administration and Legislature for a student housing project at the San Jose campus. As originally submitted, and later approved by the state in the 2023‑24 budget package, the project entailed constructing a new housing facility on campus. CSU now indicates that the San Jose campus has entered into an agreement to lease an existing commercial property off campus, with the option to purchase the property in fall 2025. CSU indicates the new project would still provide 517 affordable beds—the same as the original project. Moreover, the cost per bed would be lower and the beds would be available two to three years earlier than under the original project.

Assessment

Legislature Authorized Many CSU Projects Without Applying Its Regular Standard of Review. For most state agencies, the state applies a certain level of scrutiny to capital projects. Traditionally, the state requires a project to have a well‑defined scope, reliable cost estimates, and a detailed schedule before requesting funding. Upon receiving this documentation, the state often advances a project by phase, allowing for regular oversight of a project as it is being developed. The state also typically waits to finance the construction phase of a project until after designs have been developed and cost estimates have been refined. Over the past three years, the Legislature has approved many CSU projects without applying these standards.

Issues Have Emerged in the Absence of Regular Controls. Without regular state standards of review, CSU has had greater discretion than most agencies to proceed with projects, with some issues emerging as a result. Most notably, CSU has financed projects that remain in early planning phases. Borrowing large sums before projects have advanced to the construction phase generally is viewed as poor budget practice, incurring unnecessary interest costs. In addition, CSU has changed at least one project, the San Jose student housing project, midcourse. Although the San Jose project ultimately might be worthwhile, changing the project after it received state approval further weakens legislative oversight.

Recommendations

Recommend Strengthening Oversight of CSU Projects. Were the Legislature to approve later rounds of funding for CSU student housing projects or approve direct state support for other CSU projects, we recommend it apply its regular standard of review and approval to these projects. Specifically, we recommend it (1) identify each project’s scope, cost, and schedule in the budget act; (2) require the timely notification of significant changes to project scope, cost, and schedule, consistent with regular state requirements; and (3) authorize funding to advance projects by phase rather than all at once.

Recommend Aligning Funding With Estimated Debt Service Costs. Whereas the state provided $100 million ongoing General Fund intended to support the debt service associated with the 21 projects, actual debt service costs (even with the higher rates for taxable bonds) are expected to be lower than originally budgeted. The savings will be most substantial in the first two years because not all of the bonds will have been sold. Beginning in the third year, costs might still be slightly lower than the original appropriation depending on interest rates. Based on CSU’s most recent estimates, the debt service costs associated with these projects total $25 million in 2023‑24, $68 million in 2024‑25, and $87 million in 2025‑26 and ongoing. Especially in light of the state’s budget deficit, we recommend the Legislature reduce the $100 million appropriation to align with actual debt service costs. Based on current estimates, this would yield $75 million in savings in 2023‑24, $32 million in 2024‑25, and $13 million annually thereafter.

Legislature Could Consider Pausing Projects for Which Bonds Have Not Been Issued. To date, CSU has not yet issued bonds for three of the projects approved for debt financing last year. These three projects are student housing projects at the San Jose, Sacramento, and Stanislaus campuses. Whereas the Sacramento and Stanislaus projects remain in preliminary plans, the San Jose campus has already entered into an agreement with the intent to purchase an existing property using bond proceeds. Given the state’s projected multiyear budget deficits, the Legislature could consider pausing some or all of these projects and sweeping the associated funding for debt service. We estimate pausing all of the projects would yield $12 million in ongoing General Fund savings (on top of the amounts cited in the previous paragraph).