February 23, 2024

The 2024‑25 Budget

Transportation Budget Solutions

Summary

Governor Proposes $4.3 Billion in Budget Solutions From Transportation Programs. Using a variety of different approaches, the Governor proposes generating $4.3 billion in General Fund solutions from transportation programs during the budget window (2022‑23 through 2024‑25). These proposals include (1) making $2.8 billion in cash flow adjustments, which revert General Fund that has already been awarded to projects with the intent to restore the funding in a future year when it would be needed to cover expenditures; (2) delaying $1 billion in program expenditures, which reduces costs in 2024‑25 with the intent of restoring the funding in 2025‑26; (3) shifting $796 million in expenditures from the General Fund to the Greenhouse Gas Reduction Fund (GGRF); and (4) making $296 million in program reductions. However, the Governor proposes to restore about $3.3 billion of the postponed and delayed spending in future years, so the net General Fund savings across the multiyear forecast period totals only $1.1 billion.

Recommend Legislature Adopt Most Proposed Solutions. Given the General Fund condition, we recommend the Legislature adopt the proposed cash flow adjustments, certain fund shifts, and reductions. These actions would reduce cost pressures on the General Fund in the near term with minimal impacts to existing programs and infrastructure projects. We note that the proposals do come with some trade‑offs for the Legislature to consider. First, the cash flow adjustments add out‑year cost pressures to the General Fund, which would complicate projected future deficits and necessitate additional General Fund solutions in the coming years. The Legislature has limited flexibility around ultimately providing these funds given the state has already committed them to specific projects. Second, the proposed reductions would result in fewer projects being funded for active transportation and the Port of Oakland. On balance, however, we find the General Fund benefits that the proposals would yield are sufficient to justify their adoption.

Recommend Identifying Additional Options in Case They Are Needed. The Legislature could need additional General Fund solutions if the budget problem worsens and/or if it wishes to reject some of the Governor’s proposals. Some options the Legislature could consider to generate additional General Fund savings from transportation programs include reducing funding for the formula‑based portion of the Transit and Intercity Rail Capital Program (TIRCP), using other transportation special funds to replace some one‑time General Fund, and replacing General Fund for existing competitive TIRCP commitments with the program’s base funding that would otherwise support future projects. Finding additional savings will necessarily result in the trade‑off of supporting fewer transportation activities overall compared to what was originally intended in prior budget agreements, whether that be for transit and rail projects or highway maintenance. While this process will be challenging, taking the time to research and select potential options over the spring will better prepare the Legislature to make decisions in May and June when it will not have much time to gather information and carefully consider program trade‑offs before the budget deadline.

Background

Overview of California’s Transportation System. California’s transportation system consists of streets, highways, railways, airports, seaports, bicycle routes, and pedestrian pathways. All of these various modes provide people and businesses the ability to access destinations and move goods and services throughout the state. Funding for the state’s transportation system comes from numerous local, state, and federal sources. State funding primarily comes from various fuel taxes and vehicle fees that are dedicated to specific transportation purposes. In 2024‑25, total state transportation funding from these sources is estimated to be $14.6 billion. (This does not include revenues from vehicle fees that support the Department of Motor Vehicles and the California Highway Patrol.) Most of this funding is dedicated to maintaining, rehabilitating, and improving state highways and local streets and roads, with a smaller amount supporting transit operations and capital improvements.

Recent Budget Packages Included Significant Augmentations for Transportation. The 2022‑23 budget package planned for significant multiyear General Fund augmentations for transportation programs. In total, these augmentations intended to provide $10.9 billion over a five‑year period. This included $9.5 billion through a Transportation Infrastructure Package and $1.4 billion through a Supply Chain Package. The augmentations represented unprecedented levels of General Fund for these types of programs, many of which historically have been supported with state transportation revenue sources. This anomalous General Fund spending was enabled by the significant tax revenue surpluses the state received—and expected to receive—over the past few years.

To help address the General Fund shortfall that began materializing last year, the 2023‑24 budget made several modifications to the Transportation Infrastructure and Supply Chain packages. Specifically, the budget shifted costs for certain programs—such as the Active Transportation Program (ATP)—from the General Fund to the State Highway Account (SHA) and delayed funding for certain programs—such as the Port and Freight Infrastructure Program—to future years. Overall, the budget agreement sustained the same overall amounts for the various programs within each package across a multiyear period. The budget also allowed transit agencies facing operational funding shortfalls to use the $4 billion provided and planned for the formula‑based component of TIRCP for operational (rather than just capital) expenditures. Figure 1 displays the multiyear funding totals for each package as revised by the 2023‑24 budget agreement.

Figure 1

Transportation Funding Packages as Revised in 2023‑24 Budget Agreement

General Fund Unless Otherwise Noted (In Millions)

|

Program |

Department |

2021‑22 and 2022‑23a |

2023‑24 |

2024‑25 |

2025‑26 |

2026‑27 |

Totals |

|

Transportation Infrastructure Package |

$4,550 |

$2,600 |

$2,000 |

$350 |

— |

$9,500 |

|

|

Competitive TIRCP |

CalSTA |

$3,650b |

— |

— |

— |

— |

$3,650b |

|

Active Transportation Program |

Caltrans |

750 |

$300c |

— |

— |

— |

1,050c |

|

Highways to Boulevards Pilot Program |

Caltrans |

150 |

— |

— |

— |

— |

150 |

|

Grade separation projects within competitive TIRCP |

CalSTA/Caltransd |

— |

— |

— |

$350 |

— |

350 |

|

Local climate adaptation programs |

Caltrans |

— |

200c |

— |

— |

— |

200c |

|

Formula‑based TIRCP |

CalSTA |

— |

2,000 |

$2,000 |

— |

— |

4,000 |

|

Clean California Local Grant Program |

Caltrans |

— |

100 |

— |

— |

— |

100 |

|

Supply Chain Package |

$670 |

$250 |

$250 |

$210 |

— |

$1,380 |

|

|

Port and Freight Infrastructure Program |

CalSTA |

$600 |

$200c |

$200 |

$200 |

— |

$1,200c |

|

Supply chain workforce campus |

CWDB |

30 |

40 |

40 |

— |

— |

110 |

|

Port operational improvements |

Go‑Biz |

30 |

— |

— |

— |

30 |

|

|

Increased commercial driver’s license capacity |

DMV |

10 |

10 |

10 |

10 |

— |

40 |

|

Other |

$280 |

$410 |

$230 |

$230 |

$230 |

$1,380 |

|

|

Port of Oakland improvements |

CalSTA |

$280 |

— |

— |

— |

— |

$280 |

|

Zero‑Emission Transit Capital Program |

CalSTA |

— |

$410e,f |

$230e |

$230e |

$230e |

1,100e, f |

|

Totals |

$5,500 |

$3,260 |

$2,480 |

$790 |

$230 |

$12,260 |

|

|

aFunding for Transportation Infrastructure Package and Supply Chain Package were provided as part of the 2022‑23 funding agreement, but some funding was scored to 2021‑22. bIncludes $300 million dedicated to adapting certain rail lines to sea‑level rise, as well as $1.8 billion for projects in Southern California and $1.5 billion for projects in Northern California. cIncludes funding from the State Highway Account. dCalSTA is responsible for awarding funds, but a portion of the funding will be included in Caltrans’ budget to reflect awards to projects on the state highway system. eIncludes funding from the Greenhouse Gas Reduction Fund. fIncludes funding from the Public Transportation Account. |

|||||||

|

TIRCP = Transit and Intercity Rail Capital Program; CalSTA = California State Transportation Agency; Caltrans = California Department of Transportation; CWDB = California Workforce Development Board; Go‑Biz = Governor’s Office of Business and Economic Development; and DMV = Department of Motor Vehicles. |

|||||||

Figure 1 also displays $1.4 billion included for certain other significant transportation spending not adopted as part of the two thematic packages. This includes $1.1 billion planned across 2023‑24 through 2026‑27 from various special funds to support the Zero‑Emission Transit Capital Program. This new program was created as part of the 2023‑24 budget package to further support transit agencies across the state. The program provides formula funding for agencies to purchase zero‑emission transit vehicles and related infrastructure and—for those agencies facing operational funding shortfalls—also can be used to cover operational expenses. The figure also includes $280 million from the General Fund provided as part of the 2021‑22 budget package to support infrastructure improvements at and near the Port of Oakland.

State Faces a Multiyear, Multibillion‑Dollar Budget Problem. Due to a deteriorating revenue picture relative to expectations from June 2023, both our office and the administration anticipate that the state faces a significant multiyear budget problem. A budget problem—also called a deficit—occurs when funding for the current or upcoming budget is insufficient to cover the costs of currently authorized services. Estimates of the magnitude of this shortfall differ based on how “baseline” spending is defined—the administration estimates a $38 billion problem whereas in January our office estimated that the Governor’s budget addresses a $58 billion problem—as well as somewhat different revenue projections. Regardless of these distinctions, it is clear that the state faces the task of “solving” a substantial budget problem. More recent fiscal data we summarize in our February publication, The 2024‑25 Budget: Deficit Update, indicate the budget outlook continues to worsen—we now estimate the state has a $73 billion deficit to address with the 2024‑25 budget. The Governor proposes to address the 2024‑25 budget problem through a combination of strategies, including relying on reserves and reducing recent one‑time spending commitments. Given that the transportation policy area was one of the largest categories for recent one‑time investments, the Governor targets these programs for a notable share of spending solutions. Moreover, both our office and the administration estimate that based on current revenue forecasts, the state will face significant operating deficits in subsequent fiscal years. Under the administration’s January projections, even after adopting the Governor’s proposals, the state still would face operating deficits of $37 billion in 2025‑26, $30 billion in 2026‑27, and $28 billion in 2027‑28.

Governor’s Proposals

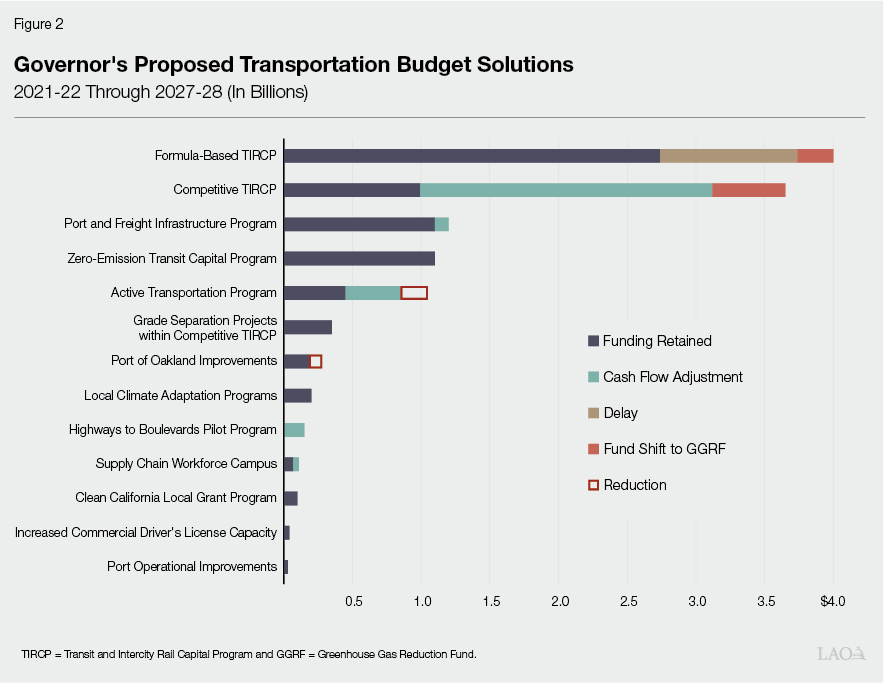

Governor Proposes Several Budget Solutions in Transportation. The Governor proposes various budget solutions that reduce General Fund spending on transportation programs by a total of $4.3 billion across the budget window (2022‑23 through 2024‑25). These solutions all come from recent General Fund augmentations for transportation that were provided through budget agreements over the last three years. However, the Governor proposes to restore about $3.3 billion of the postponed and delayed General Fund spending in future years, so the net savings across the multiyear forecast period totals only $1.1 billion. As shown in Figure 2, the Governor relies on four main strategies to provide General Fund relief. Figure 3 provides more detail on the proposed changes including impacts across fiscal years. The specific changes include:

- $2.8 Billion in Cash Flow Adjustments. The Governor proposes $2.8 billion in General Fund cash flow adjustments. This strategy would revert funding previously provided back to the General Fund (resulting in savings during the budget window), with the intention to reappropriate the funds in future years based on when the administration expects the money will be needed to cover project expenditures. These cash flow adjustments include (1) $2.1 billion for competitive TIRCP, (2) $400 million for ATP, (3) $150 million for the Highways to Boulevards Pilot Program, (4) $100 million for the Port and Freight Infrastructure Program, and (5) $40 million for the supply chain workforce campus. The administering departments have already committed these funds for specific projects through grant awards so grantees are in the process of undertaking planning, permitting, and other pre‑construction activities. Figure 3 displays the administration’s estimates for when the grantees would actually need the cash on hand to support the awarded projects (shown as positive values in the chart reflecting when the state would provide the funds). Under the proposal, all the postponed expenditures associated with cash flow adjustments would continue to be supported by the General Fund when they resume in future years, with the exception of $530 million for competitive TIRCP in 2024‑25. As we discuss below, the Governor proposes to fund that portion with GGRF instead.

- $1 Billion Delay. The Governor proposes to delay $1 billion in General Fund spending for formula‑based TIRCP from 2024‑25 to 2025‑26. Unlike the cash flow adjustments, the delayed funding is not tied to specific projects—because these funds were planned for the budget year, the California State Transportation Agency (CalSTA) has not yet received authority to allocate the funds to local agencies.

- $791 Million in Fund Shifts. The Governor proposes shifting expenditures totaling $791 million from the General Fund to GGRF in 2024‑25. These fund shifts include $261 million planned for formula‑based TIRCP and $530 million for competitive TIRCP. (We note that the latter amount is intended to cover budget‑year costs associated with the proposed cash flow adjustment for competitive TIRCP. As such, the resulting General Fund savings are reflected in the current year as part of the $2.8 billion total cited above.)

- $296 Million in Reductions. The Governor proposes reducing $296 million in total spending across two programs: $200 million from ATP and $96 million from the funding provided for the Port of Oakland (both from the General Fund).

Figure 3

Governor’s Proposed Changes to Transportation Funding

General Fund Unless Otherwise Noted (In Millions )

|

Program |

Department |

Total Augmentations |

Proposed Changesa |

New Amounts Proposed |

||

|

2023‑24 |

2024‑25 |

2025‑26 Through 2027‑28 |

||||

|

Transportation Infrastructure Package |

$9,500 |

‑$2,875 |

‑$420 |

$3,095 |

$9,300 |

|

|

Formula‑based TIRCP |

CalSTA |

$4,000 |

— |

‑$1,000d |

$1,000 |

$4,000b |

|

Competitive TIRCP |

CalSTA |

3,650 |

‑$2,125 |

530b |

1,595 |

3,650b |

|

Active Transportation Program |

Caltrans |

1,050c |

‑600 |

— |

400 |

850c |

|

Grade separation projects within competitive TIRCP |

CalSTA/Caltrans |

350 |

— |

— |

— |

350 |

|

Local climate adaptation programs |

Caltrans |

200c |

— |

— |

— |

200c |

|

Highways to Boulevards Pilot Program |

Caltrans |

150 |

‑150 |

50 |

100 |

150 |

|

Clean California Local Grant Program |

Caltrans |

100 |

— |

— |

— |

100 |

|

Supply Chain Package |

$1,380 |

— |

‑$140 |

$140 |

$1,380 |

|

|

Port and Freight Infrastructure Program |

CalSTA |

$1,200c |

— |

‑$100 |

$100 |

$1,200c |

|

Supply chain workforce campus |

CWDB |

110 |

— |

‑40 |

40 |

110 |

|

Port operational improvements |

Go‑Biz |

30 |

— |

— |

— |

30 |

|

Increased commercial driver’s license capacity |

DMV |

40 |

— |

— |

— |

40 |

|

Other |

$1,380 |

‑$96 |

— |

— |

$1,284 |

|

|

Zero‑Emission Transit Capital Program |

CalSTA |

$1,100b,e |

— |

— |

— |

$1,100b,e |

|

Port of Oakland improvements |

CalSTA |

280 |

‑$96 |

— |

— |

184 |

|

Totals |

$12,260 |

‑$2,971 |

‑$560 |

$3,235 |

$11,964 |

|

|

aPositive values reflect new proposed spending in that year due to the resumption of cash‑flow adjustments or delays. bIncludes funding from the Greenhouse Gas Reduction Fund (GGRF). cIncludes funding from the State Highway Account. dIncludes a $1 billion delay and a $261 million fund shift from the General Fund to GGRF. eIncludes funding from the Public Transportation Account. |

||||||

|

TIRCP = Transit and Intercity Rail Capital Program; CalSTA = California State Transportation Agency; Caltrans = California Department of Transportation; CWDB = California Workforce Development Board; Go‑Biz = Governor’s Office of Business and Economic Development; and DMV = Department of Motor Vehicles. |

||||||

Assessment

Below, we provide specific comments related to each of the Governor’s proposed transportation budget solutions.

While Multiple Programs Impacted, Most Funding Sustained. The proposed solutions would affect several programs in various ways. Overall, however, the Governor’s proposals would sustain the vast majority of multiyear transportation funding. Specifically, the Governor’s budget would sustain $12 billion, or 98 percent, of the total augmentations intended for transportation programs.

Cash Flow Adjustments Avoid Programmatic Impacts but Create Cost Pressures in Future Years. The proposed $2.8 billion in cash flow adjustments would help alleviate cost pressures in the near term by reducing General Fund commitments in 2023‑24. If the state reappropriates the funding by the time the projects need it for construction, this budget solution should not have any significant programmatic impacts. However, these proposals would create cost pressures for the General Fund in future years when this spending resumes, making addressing projected out‑year deficits more difficult. Moreover, unlike some other spending delays the Governor proposes across the budget (including for formula‑based TIRCP, as discussed below), the Legislature would not have the flexibility to opt not to resume the expenditures in the future—at least not without causing significant fiscal and logistical disruptions for projects and their local sponsors. This is because, as noted, the state has already committed the funds associated with these cash flow adjustments to specific projects. Once grant awards are made, grantees reasonably expect that funding is forthcoming and take steps such as entering into contracts and initiating pre‑construction activities.

Proposed Fund Shift for Competitive TIRCP Is Reasonable. The Governor’s proposal to shift $530 million for this program to GGRF saves General Fund without impacting projects that have already been awarded funding through the program. (This funding would be provided in 2024‑25 as one portion of the proposed cash flow adjustment delays.) As noted above, the state has limited options to avoid providing this funding if it does not want to cause significant disruptions, given it has already entered into project commitments with the awarded grantees. If the state must fund the projects, doing so with a source other than General Fund makes sense in light of the budget condition. Moreover, we find that the proposed fund shift aligns with the goals of GGRF because the projects funded through TIRCP are intended to reduce greenhouse gas emissions.

Delay for Formula‑Based TIRCP Achieves Short‑Term Savings but Creates Out‑Year Cost Pressures. As noted, the Governor proposes to delay $1 billion planned for formula‑based TIRCP from 2024‑25 until 2025‑26. This would generate General Fund solution in the budget year, while also preserving total planned funding for the program across the multiyear period. However, this proposal would create cost pressures in 2025‑26. This is particularly important given that our office and the administration project multiyear operating deficits. Unlike competitive‑based TIRCP, these funds have not yet been committed for specific projects so the obligation to ultimately provide the funds is somewhat less binding.

Reductions to ATP and Port of Oakland Are Reasonable Given Budget Problem. While the proposed reductions to these two activities would result in fewer projects in future years, they would not impact any current projects. Specifically, for ATP, the proposal would not affect funding that has already been awarded to projects. Instead, the proposed $200 million reduction would be applied to future grant‑award cycles. The proposal would allow the program to maintain $850 million of the original planned multiyear amount and thereby still accomplish a significant number of projects. Similarly, the Port of Oakland would keep $184 million for projects that are underway. While the port has identified projects that could be supported with the remaining $96 million, it has not yet obligated the funding, so it could accommodate the reduction with minimal disruption. As such, we find the proposals to be reasonable ways to address the General Fund problem.

Additional Solutions May Be Needed if Budget Problem Worsens. The Legislature likely will be seeking options for alternative budget solutions if it chooses to reject some of the Governor’s proposals. Moreover, in the event that the budget condition worsens (our current revenue projections suggest this is likely), the Legislature will need to identify additional solutions in order to meet its constitutional requirement to pass a balanced budget. We have identified a few options the Legislature could consider, but none are without trade‑offs.

- Reduce Rather Than Delay $1 Billion for Formula‑Based TIRCP; Reduce Additional $1 Billion. Unlike competitive TIRCP, formula‑based TIRCP is not awarded to specific projects. Instead, the funding is provided on a formula basis to regional agencies. This affords the Legislature more flexibility about potentially changing its funding intentions without disrupting projects to which it has already committed. Specifically, it could reconsider providing the $2 billion in General Fund originally planned for 2024‑25. This could entail reducing rather than delaying the $1 billion the Governor proposes providing in 2025‑26 instead of 2024‑25, and additionally reducing the $1 billion the Governor proposes to retain in the budget year. (As highlighted above and discussed next, the Governor proposes funding $261 million of this retained amount with GGRF.) However, such a reduction would impact the ability of local transit agencies to support operations or locally planned infrastructure improvements.

- Redirect GGRF for Other Activity, Reduce Formula‑Based TIRCP. Given the changed state budget situation, the Legislature will need to consider whether a one‑time augmentation for formula‑based TIRCP still is among its highest priorities. For instance, should a different activity represent a higher priority (such as if a worsening budget picture puts funding for ongoing base programs at risk), the Legislature could opt to shift less than the proposed $261 million GGRF to formula‑based TIRCP—or none at all—reducing overall support for the program instead. The Legislature could then utilize the freed‑up GGRF to support another activity—transportation or otherwise—that might face reductions given the General Fund condition. As mentioned in the previous bullet, however, such a reduction would impact local transit operations and/or capital projects. (We also note that this approach would not yield additional savings if the Legislature opts to reduce all the funding for formula‑based TIRCP in 2024‑25.)

- Shift Funds From Transportation Accounts to Replace General Fund. The Legislature could consider shifting funding for certain programs from the General Fund to state transportation funds such as SHA or the Road Maintenance and Rehabilitation Account (RMRA). The Legislature took a similar action last year, when it shifted $650 million of the one‑time General Fund augmentations for transportation to SHA. This approach could provide additional opportunities for achieving General Fund savings but comes with some limitations and trade‑offs to consider. First, revenues from both accounts are restricted to specific transportation purposes under the California Constitution, so some limitations exist regarding which activities they could be redirected to support. Second, fund shifts would result in less funding available for other activities currently supported by the funds. For instance, any redirections from SHA ultimately would result in less funding available for state highway maintenance and rehabilitation projects. SHA funds the California Department of Transportation’s State Highway Operation and Protection Program, which supports capital projects that rehabilitate and reconstruct the state highway system. In the budget year, the program is estimated to have $5.2 billion for projects through a combination of state and federal funds. The Legislature also would want to consider any potential fund shifts from SHA within the context of the $650 million it shifted last year and the state’s goals for highways. Similar trade‑offs would apply for any potential redirection from RMRA, which also funds state highway maintenance and rehabilitation projects, along with providing funds to cities and counties for local streets and roads and supporting several smaller programs. RMRA is projected to have revenues of $4.9 billion in 2024‑25.

- Use Future Base Funding to Replace General Fund Augmentations for Competitive TIRCP. In addition to the one‑time General Fund augmentations described above, competitive TIRCP receives an annual base amount of funding from GGRF and transportation improvement fee revenues, which is provided through a continuous appropriation. CalSTA currently is in the process of starting its 2024 competitive TIRCP grant cycle, with plans to award about $800 million from these base funds this fall to support new projects over the next five years. Instead of selecting new projects to support with these funds, the Legislature could statutorily direct CalSTA to use them to fulfill the state’s commitments to some of the projects already awarded funds from the one‑time General Fund augmentations to competitive TIRCP. (Because of delays in project implementation and the resulting cash flow adjustments proposed, the state has some flexibility around the timing of when to provide these funds even though projects have already been promised grant awards.) This action essentially would allow the state to sustain funding for local projects to which it has already committed and reduce General Fund expenditures. However, this approach would result in the state supporting fewer overall transit and rail improvement projects over the coming years.

Recommendations

Approve Cash Flow Adjustments. We recommend the Legislature adopt the Governor’s proposed $2.8 billion in cash flow adjustments as they will help address the General Fund condition without programmatic impacts. While postponing providing these funds will create cost pressures in future budget cycles, the state has already committed these amounts for specific projects and, as such, has limited flexibility around making reductions without creating significant disruptions. The proposed approach can help the General Fund condition in the near term but the state will need to prepare to provide the funds in the coming years despite the challenging budget situation.

Approve Fund Shift for Competitive TIRCP. We recommend approving the proposed $530 million fund shift from the General Fund to GGRF for competitive TIRCP. This shift would help the state meet its commitment to funding projects that have already received grant awards while also saving General Fund.

Approve Proposed General Fund Reductions for ATP and Port of Oakland. We recommend the Legislature adopt the proposed General Fund reductions for ATP ($200 million) and the Port of Oakland ($96 million). While these proposals reduce funding for potential projects in the future, they do not impact support for existing projects. In the cases of both activities, a notable amount of funding would be maintained to help accomplish key objectives, albeit at a reduced level. Due to the budget condition, we find these proposals to be reasonable.

Use Spring Budget Process to Identify Additional Potential Budget Solutions in Transportation. We recommend the Legislature take steps now to identify additional options for generating General Fund solutions from transportation programs. Taking such steps will help position the Legislature to respond should the budget problem worsen—which we think is likely—and if the Legislature seeks to modify the Governor’s proposed approach. Some options the Legislature could consider include reducing funding for formula‑based TIRCP (reducing General Fund and/or reducing and redirecting GGRF), using other transportation special funds to replace some one‑time General Fund, and replacing General Fund for existing competitive TIRCP commitments with the program’s base funding that would otherwise support future projects. None of these options are without trade‑offs. Overall, reducing General Fund ultimately will mean supporting fewer transportation activities compared to what was originally intended in prior budget agreements, whether that be for transit and rail projects or highway maintenance. While this process will be challenging, taking the time to consider, research, and select potential options over the spring will better prepare the Legislature to make decisions in May and June when it will not have much time to gather information and carefully consider program trade‑offs before the budget deadline.

Conclusion

Historically, the General Fund has not been a major source of funding for transportation programs. However, the state provided—and planned to provide—an unprecedented amount of General Fund augmentations to support transportation in recent years. Given the change in the state’s overall fiscal condition, reducing this spending correspondingly is both reasonable and necessary. The Governor proposes to reduce General Fund spending for transportation by $4.3 billion during the budget window. However, through a combination of cash flow adjustments, delays, and fund shifts, the actual programmatic reductions are much lower (only $296 million), as are the net multiyear General Fund savings ($1.1 billion). The Legislature faces the difficult task of balancing its goals of augmenting support for the state’s transportation system with its responsibility to address the growing state budget problem.