LAO Contact

March 5, 2024

The 2024‑25 Budget

College of the Law, San Francisco

Summary

The Governor’s budget proposes a $2.2 million (11 percent) General Fund base increase for the College of the Law, San Francisco (CLSF) in 2024‑25. After accounting for other revenue increases (primarily from student tuition revenue), CLSF’s total ongoing core funding would increase by $4.5 million (5.6 percent). We recommend the Legislature reject the General Fund base augmentation for CLSF. Providing an ongoing General Fund increase contributes to the state’s projected budget deficits. Moreover, even without a General Fund increase, the school still would have additional revenue from other core fund sources to cover some operating cost increases in 2024‑25.

Introduction

This brief analyzes the Governor’s January budget proposal for CLSF. The brief first provides background on the law school. It then describes the Governor’s budget proposal and the school’s corresponding plans for 2024‑25. The brief concludes by providing an associated recommendation.

Background

CLSF Is a Public Law School. CLSF, formerly Hastings College of the Law, is affiliated with the University of California (UC) but has its own governing board—the Board of Directors. The Board of Directors oversees the school’s finances and makes key decisions, such as setting employee compensation levels. The board also sets the school’s tuition levels and enrollment targets. Of the school’s approximately 1,100 students in 2023‑24, 95 percent are enrolled in the Juris Doctor (JD) program (the most common degree students pursue to enter the legal field). The school also offers three law‑related master’s programs.

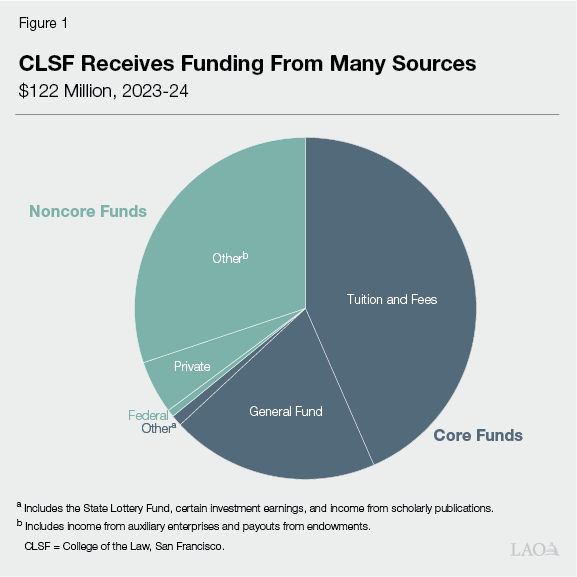

Tuition Revenue Is Law School’s Largest Fund Source. CLSF received a total of $122 million in ongoing funding in 2023‑24. As Figure 1 shows, this funding came from “core” and “noncore” sources. Of the school’s core funding, 68 percent comes from student tuition and fee revenue and 31 percent comes from state General Fund. Remaining core funding comes from various sources, including the State Lottery Fund, certain investment earnings, and income from scholarly publications. Beyond core funding, CLSF receives noncore funding from certain self‑supporting auxiliary programs (including its housing and parking programs). In addition, the school receives noncore funding from private donations as well as external grants and contracts.

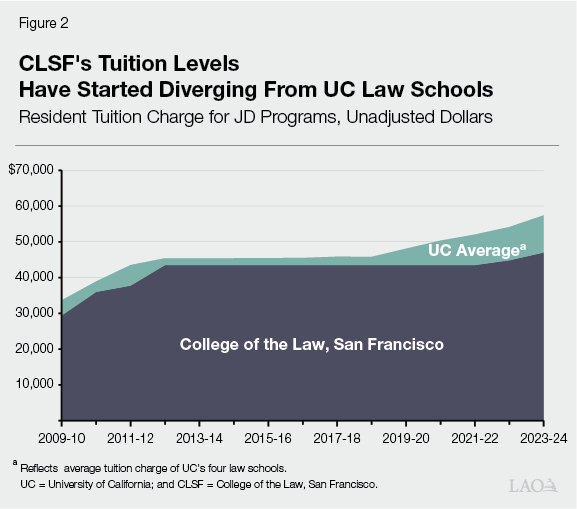

CLSF Recently Increased Its Tuition Charges. As Figure 2 shows, CSLF increased its JD tuition charges during and shortly after the great recession, then held tuition flat from 2012‑13 through 2021‑22. For the past two consecutive years, CLSF has raised JD tuition charges—by 3 percent in 2022‑23 and 5 percent in 2023‑24. Nonresident students pay a supplemental tuition charge. CLSF has also recently increased these charges—by 7 percent in 2022‑23 and 8 percent in 2023‑24. Despite the recent increases, CLSF tuition charges remain lower than the average tuition charges of UC’s four JD programs. While resident CLSF JD tuition was about 5 percent below the resident tuition levels of UC’s JD programs from 2012‑13 through 2018‑19, it was almost 20 percent below in 2023‑24.

State Often Provides Base General Fund Augmentations. Some years, the primary way CLSF has covered its operating cost increases has been through state General Fund base augmentations. As Figure 3 shows, the size of the CLSF’s base adjustments has varied over the past eight years. CLSF also receives state General Fund adjustments for its lease revenue bond debt service and, in certain years, specific program initiatives. Unlike UC and the California State University (CSU), the state has not funded enrollment growth at CLSF directly, and there is no marginal cost calculation used to determine state funding per student. In the past, the state has provided General Fund base augmentations to the school regardless of whether enrollment increased or decreased.

Figure 3

State Has Provided Law School With Base Augmentations in Most Years

(Dollars in Millions)

|

2016‑17 |

2017‑18 |

2018‑19 |

2019‑20 |

2020‑21a |

2021‑22 |

2022‑23 |

2023‑24 |

|

|

Base General Fund adjustment |

$1.0 |

$1.1 |

$1.1 |

$1.4 |

‑$0.5 |

$2.1 |

$2.0 |

$2.2 |

|

Percent change in General Fundb |

10% |

9% |

9% |

10% |

‑4% |

14% |

12% |

12% |

|

Percent change in ongoing core fundsc |

1.9 |

1.9 |

1.9 |

2.5 |

‑0.9 |

3.5 |

3.0 |

3.0 |

|

aBase General Fund was reduced in response to the pandemic‑related recession. bReflects base General Fund adjustment over the amount of total ongoing General Fund provided the previous year. cReflects base General Fund adjustment over total ongoing core funds provided the previous year. |

||||||||

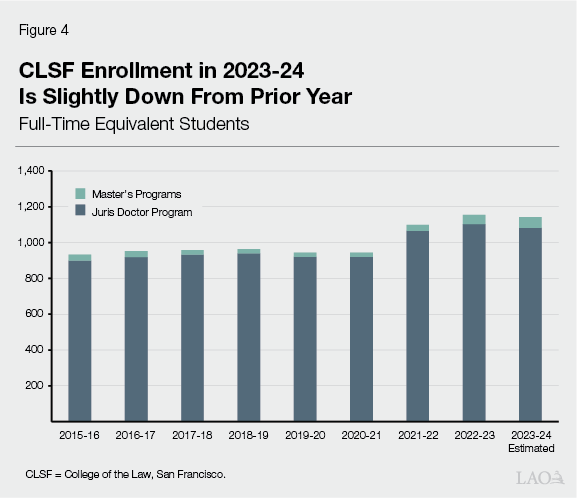

Total Enrollment Is Almost Flat in 2023‑24. As Figure 4 shows, CLSF enrollment remained nearly flat from 2015‑16 through 2020‑21. CLSF then experienced two years of notable growth—with enrollment increasing 16 percent in 2021‑22, followed by 5.1 percent in 2022‑23. During these two years, enrollment grew in the school’s JD program as well as its master’s programs. In 2023‑24, CLSF expects total enrollment to decline by 13 full‑time equivalent (FTE) students (1.1 percent). The majority of the decline is from the JD program, which is expected to decline by 22 FTE students. CLSF did not meet its entering JD class target in 2023‑24. This decline in JD enrollment is expected to be partially offset by enrollment increases in two master’s programs.

Employee Compensation Is School’s Largest Expense. Each year, CLSF faces pressure to cover cost increases associated with the school’s operations. Personnel costs (including salaries and benefits) comprise roughly 50 percent of the school’s total operating costs. Roughly 60 percent of the school’s personnel (including faculty) are not represented whereas 40 percent are represented by labor unions. Specifically, school personnel is represented by the American Federation of State, County and Municipal Employees (AFSCME) and the American Federation of Teachers (AFT). In prior years, CLSF has provided general salary increases and merit increases, as applicable, for its non‑represented personnel. It has provided salary adjustments for its represented employees consistent with their associated collective bargaining agreements. The current AFSCME and AFT bargaining agreements expire June 30, 2024 and October 31, 2024, respectively. New agreements are still under negotiation for 2024‑25. Given its small size and affiliation with UC, CLSF participates in certain UC benefit programs, including the University of California Retirement Plan and UC health and retiree health programs. As discussed in The 2024‑25 Budget: The University of California, the costs of these programs have been increasing over time. In addition to personnel costs, CLSF spends around 30 percent of the tuition revenue it generates from each JD cohort on financial aid.

CLSF Maintains Reserves. Like other higher education segments, CLSF maintains reserves to mitigate risks and manage potential cash flow issues. The Board of Directors adopted a policy to maintain a minimum reserve level equivalent to 5 percent of the school’s total annual operating revenues. As of 2021‑22, CLSF had built up its reserve to 5.5 months of operating expenditures. This level has since declined to 4.2 months of operating expenditures as a result of CLSF using some reserves to offset increased ongoing operating costs in 2023‑24.

Governor’s Proposal

Governor Proposes General Fund Base Augmentation. The Governor’s budget proposes to provide CLSF with an ongoing General Fund base augmentation of $2.2 million (11 percent) to “support operating costs.” The Governor does not propose to defer this base augmentation as he does with the UC and CSU base augmentations. The administration indicates it took a different approach for CLSF because it is a small agency with smaller reserve amounts and less access to borrowing.

School’s 2024‑25 Plans

CLSF Is Planning to Increase JD Student Tuition Charges. Resident tuition is scheduled to increase by $2,352 (5 percent), reaching $49,383 in 2024‑25. The nonresident supplemental tuition charge is also scheduled to increase for the third consecutive year. It is set to grow by $554 (8 percent), reaching $7,488 in 2024‑25. Even with these tuition increases, the school’s JD tuition would remain below the tuition level of all of UC’s JD programs.

CLSF Enrollment Is Projected to Remain Nearly Flat in 2024‑25. The school is projecting a second consecutive year of nearly flat total enrollment. CLSF anticipates JD enrollment to decline by 8 FTE students (0.7 percent) in 2024‑25. The school expects this drop to be partially offset by a small anticipated increase in master’s program enrollment (expected to grow by 5 FTE students).

Core Funding Per Student Is Increasing. Beyond the Governor’s proposed $2.2 million General Fund increase, the school expects to generate an additional $2.3 million in tuition revenue as a result of its planned tuition increases. Altogether, the school expects its core funding to increase $4.5 million (5.6 percent). As Figure 5 shows, on a per‑student basis, the school’s core funding increases by approximately $4,100 (5.9 percent).

Figure 5

School’s Core Funding Continues to Increase

(Dollars in Millions, Except Per‑Student Amounts)

|

2022‑23 Actual |

2023‑24 Revised |

2024‑25 Proposed |

Change From 2023‑24 |

||

|

Amount |

Percent |

||||

|

Core Ongoing Funding |

|||||

|

Student tuition and fees |

$51.0 |

$53.2 |

$55.4 |

$2.3 |

4.2% |

|

General Funda |

18.8 |

21.0 |

23.2 |

2.2 |

10.6 |

|

Otherb |

3.3 |

1.3 |

1.3 |

— |

2.9 |

|

Totals |

$73.1 |

$75.4 |

$79.9 |

$4.5 |

5.6% |

|

Full‑time equivalent students |

1,155 |

1,142 |

1,139 |

‑2.8 |

‑0.2% |

|

Funding per student |

$63,280 |

$66,046 |

$70,170 |

$4,124 |

5.9 |

|

aExcludes lease revenue bond debt service and one‑time funds. bIncludes State Lottery Fund, certain investment earnings, and income from scholarly publications. |

|||||

CLSF Is Budgeting for Several Cost Increases. As Figure 6 shows, CLSF is planning for several cost increases in 2024‑25. Its largest planned cost increase is for student financial aid. CLSF also plans to fund a total of nine new positions, including six new tenure‑track faculty and three lecturers. CLSF reports that despite the anticipated decline in enrollment, the college is hiring additional faculty to work towards an American Bar Association goal of having a minimum share of classes taught by full‑time faculty. Beyond these expenses, CLSF intends to increase its overall employee salary pool by 3 percent as well as cover employee benefit cost increases. These costs are partially offset by savings associated with a reduction in certain rental payments and transfers.

Figure 6

School’s Spending Plan Has Several Components

Changes in Core Spending, 2024‑25 (In Thousands)

|

Spending Component |

Amount |

|

Student financial aid |

$2,257 |

|

Faculty hiring |

1,891 |

|

Salary pool increase (3 percent) |

1,032 |

|

Operating expenses and equipment |

302 |

|

Benefit cost increases |

101 |

|

Health Policy and Law master’s program start‑up |

48 |

|

Office renta |

‑586 |

|

Transfersb |

‑1,403 |

|

Total |

$3,642 |

|

aReflects savings from lower rent costs associated with three university facilities. bReflects reduction in funding transferred to certain programs outside of the school. |

|

CLSF Plans to Use Reserves to Cover Some Operating Costs. To cover expected operating costs, CLSF plans to use $4.2 million of its reserves in 2024‑25. This would be the third consecutive year that CLSF went into its reserves to pay for some of the school’s ongoing operating costs. CLSF estimates its reserves will drop to $24 million as of June 30, 2025. Even with the projected decline in reserves, CLSF still would have reserves equating to 3.3 months of operating expenses. CLSF projects that its reserves will begin to increase again in 2027‑28.

Recommendation

Reject Proposed General Fund Base Augmentation. As we discuss in The 2024‑25 Budget: Overview of the Governor’s Budget, the state faces large projected operating deficits over the next few years. Providing CLSF with an ongoing General Fund base augmentation in 2024‑25 contributes to those deficits. We recommend the Legislature reject this proposal and retain state funding for CLSF at its existing level. Without a General Fund augmentation, the school still would have $2.3 million in additional tuition and fee revenue that it could use to cover some components of its spending plan. Given it could not cover all of its spending priorities, the school indicates it likely would consider various cost‑containment measures, including potentially providing smaller salary increases or hiring fewer new faculty. If the state budget situation were to improve in 2025‑26, the state could offer CLSF a base increase at that time that it could afford.