LAO Contact

April 15, 2024

Evaluation of a Tax Exemption for Zero-Emission Buses

Introduction

Chapter 684 of 2019 (AB 784, Mullin) created a partial sales tax exemption for zero-emission buses (ZEBs) purchased by transit agencies (hereafter, “ZEB exemption”). That law also required our office to review the effectiveness of the ZEB exemption. Under AB 784, the exemption would have ended on January 1, 2024. Chapter 353 of 2022 (AB 2622, Mullin) pushed back the expiration date to January 1, 2026 and required our office to publish our analysis by May 1, 2024. This post fulfills that statutory requirement. The first section provides background information. The second section describes the basic structure and goals of the ZEB exemption. The third section analyzes the exemption. The fourth section provides a recommendation for Legislative action.

Background

State Budget Condition

State Faces Multiyear Deficits. As described in our December 2023 Fiscal Outlook and our January 2024 Overview of the Governor’s Budget, we project ongoing General Fund operating deficits of roughly $30 billion per year. These deficits likely necessitate ongoing spending reductions, revenue increases, or both.

Transit Agency Finances

Transit Agencies Rely on a Mix of Funding Streams. California has more than 200 transit agencies operating vehicles such as buses, trains, ferries, and paratransit vans. Local governments, such as cities, counties, and local transit authorities, generally own and operate these agencies. In 2019, passenger fares and fees provided 17 percent of funding for these agencies. Forty-six percent came from other local revenues, while the state and federal governments provided 20 percent and 17 percent, respectively.

Some Transit Agencies Are Facing Ridership Declines and Operational Funding Shortfalls. Transit ridership in California declined gradually from 2014 to 2019. Ridership fell by more than 50 percent when the pandemic began in 2020. Due to the pandemic-related disruptions, transit agencies projected significant declines in both fare revenues and other state and local funds dedicated to transit. In response, the federal government provided a nationwide total of nearly $70 billion in operational relief to stabilize transit agencies’ budgets, prevent layoffs, and maintain service levels. California’s transit agencies received $9.8 billion in federal relief funds. While state and local funding sources dedicated to transit generally have recovered to their pre-pandemic levels, ridership and corresponding fare revenues have not.

Innovative Clean Transit (ICT) Regulation

Conventional Buses vs. ZEBs. The ZEB exemption, the ICT regulation, and various other policies make a distinction between conventional buses and ZEBs. Conventional buses burn diesel, compressed natural gas, or other fuels that emit greenhouse gases (GHGs) and other air pollutants. In contrast, ZEBs run on electricity or hydrogen and do not produce tailpipe emissions. The main purposes of policies that promote ZEB adoption are to reduce GHGs and other air pollution.

Requires Transit Agencies to Buy ZEBs. State statutes establish goals for reducing statewide GHG emission and direct the California Air Resources Board (CARB) to take regulatory actions to meet these goals. In December 2018, CARB adopted the ICT regulation. This regulation requires transit agencies to gradually convert their entire bus fleets to ZEBs.

ICT Requirements Ramp Up Over Time. The ICT regulation sets annual requirements for the minimum share of bus purchases that must be ZEBs. From 2023 to 2025, at least 25 percent of the buses purchased by large transit agencies in each calendar year must be ZEBs. From 2026 to 2028, the ICT imposes a similar 25 percent requirement on small transit agencies while raising the requirement for large transit agencies to 50 percent. Finally, the ICT prohibits transit agencies from purchasing conventional buses starting in 2029. The standard useful life of a bus is 12 years, so CARB set these requirements with an eye toward completing the statewide transition to ZEBs by 2040.

CARB Exempts Transit Agencies From ICT Requirements Under Some Conditions. Under the ICT, CARB will exempt a transit agency from the requirements described above under specified conditions outside the agency’s control, including:

The agency declares a financial emergency.

Delayed construction of infrastructure.

Range, gradeability, or weight class requirements that cannot be met with available ZEBs.

State and Federal Funding for ZEB Adoption

In addition to the ZEB exemption, several other state and federal programs offer funding that transit agencies may use to convert their bus fleets to ZEBs. In this section, we briefly highlight some key sources of such funding.

Transit and Intercity Rail Capital Program (TIRCP). TIRCP is one of the main ongoing sources of funding available for ZEB adoption. The program provides competitive funding that supports a variety of capital improvements on transit and rail systems, including the procurement of ZEBs. The program receives ongoing funding from several special funds, with annual appropriations depending in part on the amount of revenue coming into the Greenhouse Gas Reduction Fund. At current revenue levels, ongoing TIRCP funding is around $650 million to $700 million per year. Recent budget agreements provided significant one-time General Fund augmentations for the program. First, the program received an additional $4 billion to provide through its traditional competitive process. The program awarded this funding to local agencies in the spring of 2023. Second, the program received $4 billion—$2 billion in 2023-24 and $1 billion planned for both 2024-25 and 2025-26—to provide on a formula basis to local agencies for capital and/or operational expenses.

Specialized Funding. Two notable state programs provide funding tailored more specifically to ZEBs. The recently established Zero-Emission Transit Capital Program provides formula-based funding to local agencies to buy zero-emission transit vehicles (buses or rail) and/or support operations. The program is supported by several special funds, with $410 million available in 2023-24 and $230 million available annually from 2024-25 through 2026-27. Additional funding is available through the the Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP), which provides incentives to public and private entities to buy zero-emission, heavy-duty trucks and buses. From recent one-time General Fund augmentations, CARB allocated $70 million in both 2021-22 and 2022-23 through HVIP specifically for transit agencies to procure ZEBS. Amounts available for transit agencies through HVIP depend on budget act appropriations and on funding plans developed by CARB.

Federal Grants. The federal government offers funding for ZEB adoption through two competitive grant programs. The Low or No Emission Grant Program is intended specifically to help transit agencies purchase relatively low-emission buses (including ZEBs and some other types of buses). Nationwide, this program offers grants totaling $1.1 billion per year through the 2026 federal fiscal year. Transit agencies also may use funding from the federal government’s broader Bus and Bus Facilities grant program for ZEBs and related infrastructure.

Structure and Goals of Tax Exemption

Basic Structure

Sales Tax Includes General Fund and Other Components. California’s sales tax rate varies across cities and counties, ranging from 7.25 percent to 10.75 percent. The overall rate includes a state General Fund rate of roughly 4 percent, plus various smaller rates that fund local programs.

Partial Exemption. Under AB 784 and AB 2622, ZEBs purchased by transit agencies are exempt from the General Fund portion of the sales tax. They still are subject to the other parts of the sales tax.

Only for Transit Agencies. The ZEB exemption does not apply to zero-emission buses purchased by other entities, such as private businesses or school districts.

Goals

Accelerating Transition to ZEBs. The first major goal of the ZEB exemption is to accelerate transit agencies’ transition from conventional buses to ZEBs. Accordingly, as discussed in the next section, the statute that created the exemption established performance indicators related to bus purchases.

Providing Fiscal Relief to Transit Agencies. As described in the “Background” section, some transit agencies are facing substantial ridership declines and budget shortfalls. Although the Legislature created the ZEB exemption before the COVID-19 pandemic, it did so partly as a way to address financial difficulties resulting from the more gradual, longer-term decline in ridership that began before the pandemic. As we understand it, this was one of the main reasons for limiting the exemption to transit agencies.

Analysis

Use of the Exemption

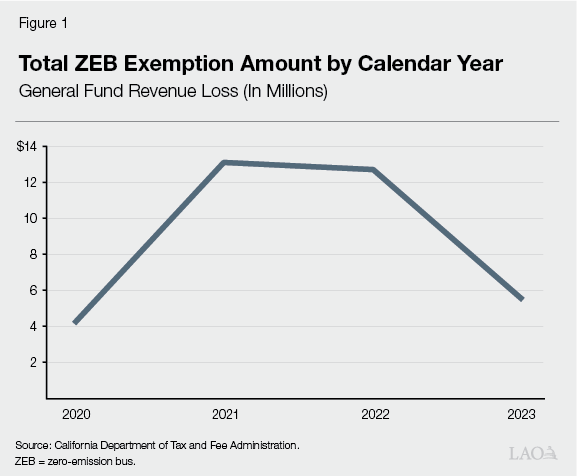

Figure 1 displays the General Fund revenue loss from the ZEB exemption by calendar year. The exemption reduced revenue by roughly $4 million in 2020. The revenue loss climbed to $13 million per year in 2021 and 2022, then dropped to $5 million in 2023.

Trends in ZEB Adoption

Statute Identifies Two Key Bus Purchase Outcomes. Assembly Bill 784 specified two “performance indicators” for the ZEB exemption:

The number of ZEBs purchased by transit agencies.

The number of ZEBs purchased in advance of the ICT time lines.

The ICT’s minimum ZEB purchase requirements began in 2023, while bus fleet data currently are available through 2022. As a result, these two performance indicators are effectively identical.

Performance Indicators Shed Little Light on Effectiveness of Exemption. We describe recent trends in transit agencies’ ZEB acquisition below. While these numbers are useful for tracking the state’s progress towards its ZEB goals, they tell us very little about the effectiveness of any particular policy. As discussed in more detail later in this report, many factors affect ZEB adoption. The ZEB exemption very likely accelerates transit agencies’ ZEB purchases to some extent, but we cannot quantify its contribution to these outcomes with available data.

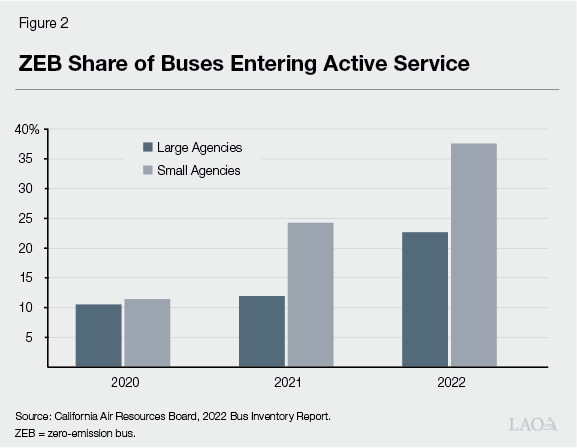

ZEBs Are Growing Share of New Buses. Figure 2 displays the annual share of new buses that are ZEBs. This share has been growing over time. In 2020, 10 percent of buses entering service for large transit agencies were ZEBs; by 2022, that share had grown to 28 percent. In 2020, 11 percent of buses entering service for small transit agencies were ZEBs; by 2022, that share had grown to 38 percent.

As described in the “Background” section, the ICT establishes higher ZEB purchase requirements for large transit agencies than for small transit agencies. As these numbers indicate, however, small agencies seem to be acquiring ZEBs more quickly than large agencies.

ZEB Adoption Varies Across Agencies. As described above, aggregate ZEB purchases in 2022 seemed to compare favorably to the ICT requirements for 2023 through 2025. Notably, however, the ICT applies to individual transit agencies, and ZEB adoption varies substantially across agencies. From 2018 to 2022, five of the state’s 21 large transit agencies did not acquire any ZEBs. Either these agencies must ramp up ZEB purchases substantially, or they must qualify for one of the ICT exemptions described in the “Background” section. Some transit agencies, on the other hand, are on pace to convert their bus fleets entirely to ZEBs far ahead of the ICT deadlines. For example, the Antelope Valley Transit Authority completed its transition to an all-ZEB fleet in 2022.

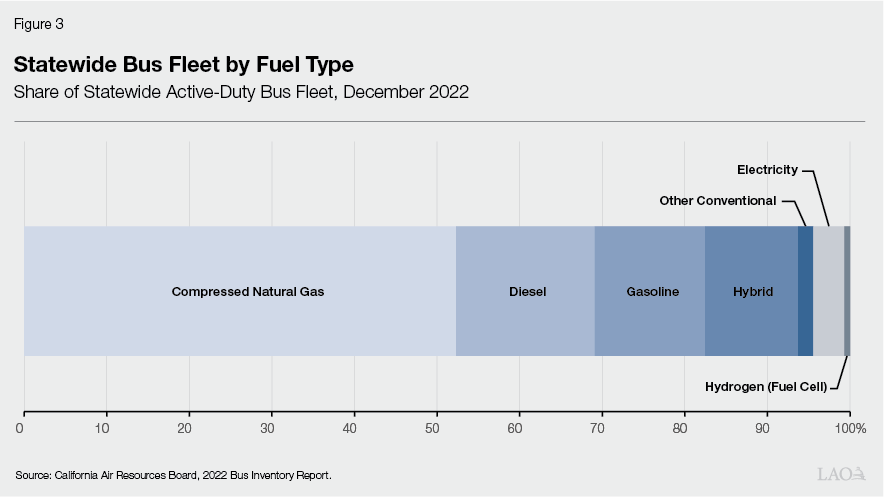

ZEBs Still Make Up Small Share of Statewide Bus Fleet. As described above, a substantial share of the buses entering service over the last few years have been ZEBs. Nevertheless, because buses typically remain in service for at least 12 years, the resulting changes in the composition of the statewide bus fleet have thus far been modest. As shown in Figure 3, the vast majority of buses in active duty at the end of 2022 ran on conventional fuels. Four percent were electric, and 1 percent ran on hydrogen.

Many Factors Affect ZEB Adoption

The ZEB exemption reduces the cost of buying ZEBs, giving transit agencies an incentive to make these purchases earlier than the ICT requires. At the same time, many other factors also influence the pace of ZEB adoption, including:

Transit Agencies’ Policy Goals. Many transit agencies share the state’s goal of reducing GHGs and other air pollution. This intrinsic motivation very likely influences their choices about which types of buses to purchase.

Cost of Other Capital Investments. As transit agencies adopt ZEBs, they incur some other significant up-front costs—for example, constructing and maintaining charging infrastructure.

Ongoing Costs. To operate buses, transit agencies incur ongoing costs for fuel, maintenance, and repairs. These costs generally vary across different types of buses. As transit agencies consider which type of bus to purchase, they must consider how these costs are likely to differ over the useful life of the bus.

State and Federal Funding. As described in the “Background” section, various state and federal programs subsidize transit agencies’ acquisition of ZEBs and installation of related infrastructure. Although most of this funding is not dedicated exclusively to ZEBs, the total amount is much larger than the amount provided by the ZEB exemption.

Exemption Not Targeted to Address Fiscal Problems

Two key aspects of the ZEB exemption make it ill-suited to provide fiscal relief to transit agencies:

All Transit Agencies Eligible for Exemption. The ZEB exemption is available to all transit agencies, including those with relatively small ridership declines or limited fiscal distress. State efforts to address transit agencies’ fiscal problems should instead reflect the varying severity of those problems across agencies.

Rail Ridership Has Dropped More Than Bus Ridership. In 2023, bus ridership was 24 percent lower than in 2019, while rail ridership was 42 percent lower. As a result, the ZEB exemption—and more generally, financial assistance tied to buses—directs relatively little relief to the transit agencies hit hardest by pandemic-era declines in ridership.

State Faces Large Budget Shortfall

As noted earlier, the state’s budget condition likely necessitates ongoing spending reductions, revenue increases, or both. As such, ongoing General Fund commitments—including tax expenditures—should clear a very high bar of need. For example, it could make sense to limit these commitments to proven ways of (1) addressing critical health and safety issues or (2) preventing serious deterioration of core state responsibilities.

Recommendation

Recommend Allowing Exemption to Expire. Due to the state’s budget condition, any ongoing fiscal commitments should clear a very high bar of need. Based on the considerations discussed in this post, we doubt that the ZEB exemption clears this bar. We recommend that the Legislature allow the exemption to expire as scheduled under current law.