LAO Contact

May 23, 2024

The 2024‑25 Budget

Multiyear Budget Outlook

Key Takeaways

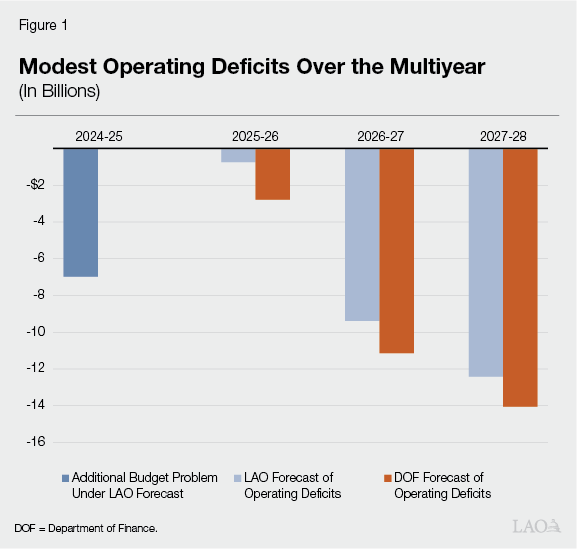

Modest Operating Deficits Persist Through the Multiyear. This post presents our office’s forecast of the condition of the state General Fund budget through 2027‑28 under our revenue estimates and assuming the Governor’s May Revision policies are adopted. Similar to the administration, we project the state faces modest operating deficits (budget problems) over the multiyear period—ranging from a very small deficit in 2025‑26 to larger ones in the out-years.

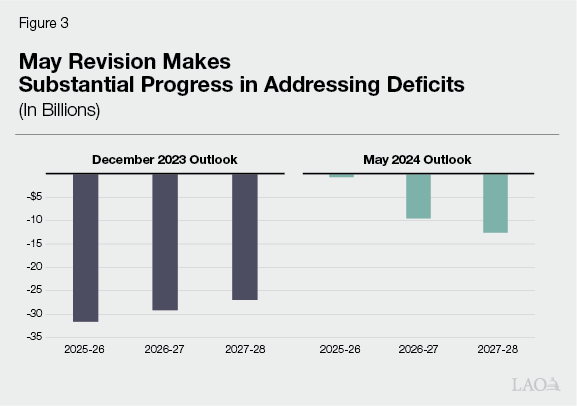

May Revision Makes Substantial Progress Toward Structural Balance. The May Revision puts the state on better fiscal footing and makes substantial progress toward structural balance. By pulling back substantially on one-time and temporary spending, as well as making some ongoing reductions, the Governor’s May Revision shrinks the state’s projected deficits from around $30 billion (our December 2023 estimates) to an average of less than $10 billion (our estimates today). Given this progress, we recommend the Legislature maintain a similar overall structure to the Governor’s approach in the final budget package.

Introduction

This post presents our office’s forecast of the condition of the state General Fund budget through 2027‑28 under our revenue estimates and assuming the Governor’s May Revision policies were adopted. (Our earlier analysis, The 2024‑25 Budget: Initial Comments on the Governor’s May Revision, differed in two ways: (1) it provided our assessment of the budget condition in 2024‑25 only, and (2) it was predicated on the administration’s revenue estimates.) The first section of the post presents our analysis of the budget condition under these assumptions. The second section provides our comments.

Analysis

Budget Year

Budget Problem $7 Billion Higher Under LAO Revenue and Spending Estimates. Under our office’s revenue and spending projections, and assuming the Governor’s May Revision policies are adopted, the budget problem for this year is $7 billion larger. Put another way, the Legislature would need to take $7 billion in additional budget actions to balance the budget. The main source of this difference is our office’s lower revenue estimates. We describe our revenue forecast in greater detail here: The 2024‑25 Budget: May Revenue Outlook. (Alternatively, if the Legislature does not adopt our lower estimates, but our forecast materializes, the Legislature will need to solve the additional budget problem that arises in the next budget cycle.)

Out-Years

Modest Operating Deficits Persist Through the Multiyear. Figure 1 shows our office’s projections of the state’s budget condition compared to the administration’s estimates. As the figure shows, both of our offices project the state will have operating deficits (budget problems) over the multiyear period—ranging from very small deficits in 2025‑26 to larger ones in the out-years. While these estimates assume the state uses a portion of the rainy-day fund in 2025‑26, as planned under the May Revision, there would be more reserves available to cover the additional budget problem in 2025‑26 and 2026‑27. In particular, under our forecast, the entire budget problem in 2025‑26 and $10 billion of the budget problem in 2026‑27 could be solved with reserves.

Our Multiyear Estimates of Expenditures Are Somewhat Lower Than the Department of Finance’s Estimates. The main reason that our estimates of the state’s operating deficits are slightly smaller than the administration’s is that our estimate of General Fund spending is lower than the administration’s estimates. Specifically, our estimates of spending (excluding spending on schools and community colleges) are about $5 billion lower in 2025‑26, $4 billion lower in 2026‑27, and $3 billion lower in 2027‑28. These differences are almost entirely driven by our lower spending estimates for Health and Human Services (HHS) programs. Between 2024‑25 and 2027‑27, HHS programs grow at an average annual rate of 5.1 percent under our projections, compared to 8 percent under the administration’s estimates. As we have commented in the past, our office has little insight into the components of, or assumptions underlying, the administration’s projections in HHS. As a result, we cannot identify the precise source of these differences—or the comparative reliability of our respective estimates—with confidence. (Both our office and the administration assume, however, out-year costs associated with the repayments on the Proposition 98 maneuver, which contribute to nearly $2 billion in higher costs each year starting in 2025‑26. For more information on this, see: The 2024‑25 Budget: The Governor’s Proposition 98 Funding Maneuver.)

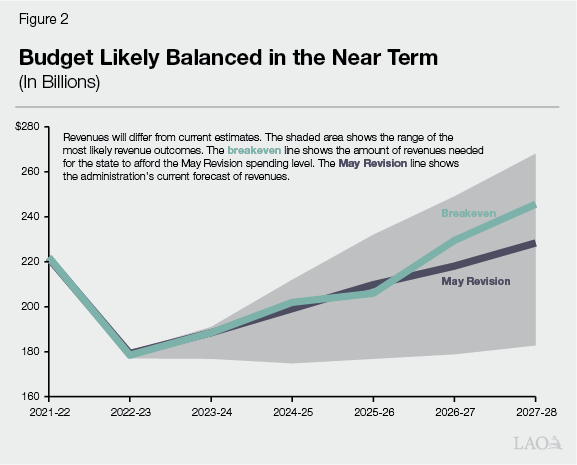

Under May Revision Structure, State Budget Likely Balanced in the Near Term. While both our and the administration’s forecasts suggest the state faces operating deficits, revenues could differ substantially from these estimates. Figure 2 displays the distribution of the most likely revenue outcomes over the multiyear (in gray). The dark line shows the administration’s forecast of revenues in the May Revision. The light green line shows the amount of revenue the state would need to “break even”—that is, the level of revenue the state would need to be able to afford the level of spending proposed in the May Revision. For example, in 2026‑27, revenues would need to be at least $11 billion higher than the May Revision forecast in order for the budget to be balanced. Overall, this figure shows that the state budget is likely balanced over the next couple of years, but a budget problem becomes more likely in later years.

Comments

May Revision Makes Substantial Progress Toward Structural Balance. The May Revision puts the state on better fiscal footing and makes substantial progress toward structural balance. In December of last year, our office projected that the state faced operating deficits in the range of $30 billion per year. This forecast was broadly similar to the administration’s projections under the Governor’s budget released in January. The Governor’s May Revision, however, changes this picture considerably. By pulling back substantially on one-time and temporary spending, as well as making some ongoing reductions, the Governor’s May Revision shrinks these projected deficits from around $30 billion to an average of less than $10 billion. Given this, we recommend the Legislature maintain a similar overall structure to the Governor’s approach in the final budget package.

Fiscal Risks Remain. While the budget is undeniably on better fiscal footing under the May Revision, there are some key fiscal risks to the budget’s out-year condition. Specifically, our forecast assumes the implementation of all of the Governor’s May Revision proposals. Although our forecast includes our best estimates of the Governor’s proposals, due to the nature of forecasting our assessment of the proposals also is subject to some uncertainty. The state’s fiscal condition also faces other uncertainties. This includes, for example, tax proposals that have interactions with measures potentially appearing on the November ballot. These proposals specifically could present downside pressure on the budget picture.