LAO Contact

Sonia Schrager Russo

May 29, 2024

The 2024‑25 Budget

Preliminary May Revision Analysis

for CalWORKs

This post provides some initial high-level takeaways and considerations for the Legislature regarding May Revision proposals for the California Work Opportunity and Responsibility to Kids (CalWORKs) program under the Department of Social Services (DSS). We include comments on the overall budget with a focus on new proposals at the time of the administration’s May Revision. For more background on the CalWORKs program and the January Governor’s budget proposals, please refer to our March 2024 analysis of the Governor’s budget proposals for CalWORKs, online here.

Overall CalWORKs Budget And Caseload

May Revision Includes Downward Revisions in Total CalWORKs Funding in Current and Budget Years. Figures 1 and 2 break down CalWORKs funding by source and component. Compared to January, CalWORKs total costs in 2023-24 and 2024-25 are down largely due to the newly proposed reductions (summarized in Figure 4 below) and downward revisions in the administration’s overall caseload estimates. These caseload-related savings associated with CalWORKs grant costs are partially offset by higher-than-expected employment services caseload.

Figure 1

CalWORKs Funding Sources

(Dollars in Millions)

|

2023‑24 |

2024‑25 |

Year‑Over‑Year Change |

||||||

|

May Revision |

Change Relative to January |

May Revision |

Change Relative to January |

2024‑25 Relative to 2023‑24 |

||||

|

Federal TANF block grant funds |

$2,630 |

‑$886 |

$3,282 |

$664 |

$652 |

25% |

||

|

TANF Carry Forwarda |

— |

‑902 |

671 |

671 |

671 |

— |

||

|

General Fund |

1,202 |

902 |

45 |

‑1,252 |

‑1,158 |

‑96 |

||

|

Realignment funds from local indigent health savings |

786 |

— |

684 |

13 |

‑102 |

‑13 |

||

|

Realignment funds dedicated to grant increases |

1,108 |

‑35 |

1,167 |

‑30 |

59 |

5 |

||

|

Other county/realignment funds |

1,216 |

‑3 |

1,218 |

17 |

2 |

— |

||

|

Totals |

$6,942 |

‑$29 |

$6,396 |

‑$587 |

‑$545 |

‑8% |

||

|

aTANF Carry Forward is a non‑add line item for display purposes only. This amount is included in federal TANF block grant funds. |

||||||||

|

TANF = Temporary Assistance for Needy Families. |

||||||||

Figure 2

CalWORKs Budget Summary

All Funds (Dollars in Millions)

|

2023‑24 |

2024‑25 |

Year‑Over‑Year Change |

||||

|

May |

Change Relative |

May |

Change Relative |

2024‑25 Relative |

||

|

Number of CalWORKs Cases |

348,621 |

0.01% |

354,772 |

0.18% |

6,151 |

2% |

|

Cash Grantsa |

$4,186 |

‑$116 |

$4,305 |

‑$109 |

$119 |

3% |

|

Single Allocation |

||||||

|

Employment Services |

$1,159 |

$6 |

945 |

‑$140 |

‑$213 |

‑18% |

|

Cal‑Learn Case Management |

12 |

1 |

12 |

1 |

— |

2 |

|

Eligibility Determination and Administration |

500 |

‑6 |

391 |

‑23 |

‑109 |

‑22 |

|

Subtotals |

($1,670) |

(—) |

($1,349) |

(‑$162) |

(‑$322) |

(‑19%) |

|

Stage 1 Child Care |

$550 |

‑$98 |

$568 |

‑$141 |

$18 |

3% |

|

Other Allocations |

||||||

|

Home Visiting Program |

$108 |

$3 |

$63 |

‑$43 |

‑$45 |

‑42% |

|

Housing Support Programb |

95 |

— |

95 |

— |

— |

— |

|

Expanded Subsidized Employment |

134 |

134 |

— |

— |

‑134 |

‑100 |

|

Family Stabilization |

55 |

55 |

— |

— |

‑55 |

‑100 |

|

Mental Health and Substance Abuse Servicesc |

130 |

— |

4 |

‑127 |

‑127 |

‑97 |

|

Subtotals |

($523) |

($192) |

($162) |

(‑$170) |

(‑$361) |

(‑69%) |

|

Otherd |

$13 |

‑$7 |

$13 |

‑$6 |

— |

4% |

|

Totals |

$6,942 |

‑$29 |

$6,396 |

‑$587 |

‑$545 |

‑8% |

|

aJanuary cash grant estimates did not include the cost of an estimated 0.3 percent grant increase funded by certain realignment revenues, which the May Revision projects beginning in October 2024. bThe 2022‑23 to 2023‑24 decrease in Housing Support Program funding is due to the expiration of one‑time funding. cMental health and substance abuse services includes funding for counties (about $127 million in 2022‑23) and (Indian Health Clinics about $4 million in 2022‑23). dPrimarily includes various state‑level contracts. |

||||||

Administration Projects Total CalWORKs Costs to Decrease Year Over Year. The May Revision includes CalWORKs funding of $6.9 billion total funds ($1.2 billion General Fund) in the current year and $6.4 billion total funds ($45 million General Fund) in 2024-25. The net decrease of $545 million total funds (8 percent) between 2023-24 and 2024-25 is largely due to the proposed reductions partially offset by increased costs from projected caseload growth.

January to May and Year-Over-Year Swings in General Fund Are Largely Due to Technical Adjustments. CalWORKs is partially funded by the federal Temporary Assistance for Needy Families (TANF) block grant. California receives $3.7 billion in TANF funds annually, over $2 billion of which is spent on CalWORKs (the remainder helps fund aid for some low-income college students and various, small human services programs). To receive its annual TANF grant, the state must spend a maintenance-of-effort (MOE) amount from state and local funds to provide services for families eligible for CalWORKs. This MOE amount is approximately $3 billion annually and can be spent directly on CalWORKs or other programs that meet federal requirements. To ensure California meets the MOE requirement and maximizes the usage of TANF funds each year, the administration makes technical adjustments as needed, shifting costs (within or outside of CalWORKs) from the General Fund to TANF or vice versa. The significant year-over-year and January to May changes in CalWORKs General Fund (shown above in Figure 1) are largely due to these adjustments.

Caseload Estimate Appears Reasonable. The administration estimates an average monthly CalWORKs caseload of about 355,000 households in 2024-25—this represents increases of about 2 percent compared to its most recent estimate for 2023-24 and less than 1 percent compared to its January 2024-25 estimate. Though our independently forecasted caseload estimates often diverged widely from the administration’s in the past, at this time, our two offices’ estimates are similar.

May Revision Increases Grants by 0.3 Percent. The administration estimates a CalWORKs grant increase of 0.3 percent effective October 2024, down from an estimated increase of 0.8 percent at the time of the January budget proposal. This increase is triggered and will be funded by growth in Child Poverty and Family Supplemental Subaccount revenues from realignment funding (with no General Fund impact).With this increase, the state is still not estimated to meet the Legislature’s goal of increasing grants to 50 percent of the federal poverty level (FPL) for a family that is one person larger than the assistance unit (AU) size (to account for CalWORKs households in which the actual family size is larger than the CalWORKs AU). As shown in Figure 3, a grant increase of 0.3 percent would raise grants for all AU sizes in high-cost counties to between 43 percent and 47 percent of the FPL for a family one person larger than the AU size, and to slightly lower levels for families in lower-cost counties.

Figure 3

May Revision Estimates 0.3 Percent Grant Increase

|

Low‑Cost Counties |

|||||

|

Before 0.3 Percent Increase |

After 0.3 Percent Increase |

||||

|

AU Sizea |

Amount |

As Share of FPLb |

Amount |

As Share of FPLb |

|

|

1 |

$693 |

41% |

$695 |

41% |

|

|

2 |

881 |

41 |

884 |

41 |

|

|

3 |

1,112 |

43 |

1,115 |

43 |

|

|

4 |

1,342 |

44 |

1,346 |

44 |

|

|

5 |

1,573 |

45 |

1,578 |

45 |

|

|

High‑Cost Counties |

|||||

|

Before 0.3 Percent Increase |

After 0.3 Percent Increase |

||||

|

AU Sizea |

Amount |

As Share of FPLb |

Amount |

As Share of FPLb |

|

|

1 |

$732 |

43% |

$734 |

43% |

|

|

2 |

927 |

43 |

930 |

43 |

|

|

3 |

1,171 |

45 |

1,175 |

45 |

|

|

4 |

1,412 |

46 |

1,416 |

46 |

|

|

5 |

1,654 |

47 |

1,659 |

47 |

|

|

aAssistance unit size is the number of family members who are eligible for CalWORKs. |

|||||

|

bShare of 2024 federal poverty guideline for a family size that is one person larger than the AU size. |

|||||

|

AU = assistance unit and FPL = federal poverty level. |

|||||

May Revision Proposals

Proposed CalWORKs Reductions Total $738 Million in Budget Year and $467 Million Annually Beginning in 2025-26. Figure 4 summarizes the proposed CalWORKs reductions included in the May Revision (including those initially proposed in January).

Figure 4

May Revision CalWORKs Reduction Proposals

General Fund

|

May Revision Proposals |

2023‑24 |

2024‑25 |

2025‑26 |

Proposal Type |

LAO Comments |

|

CalWORKs single allocation ongoing augmentation |

$— |

$41 |

$41 |

Ongoing Reduction (From January) |

May Revision maintains the Governor’s January budget proposal for 2024‑25 and ongoing, but eliminates the previously proposed current year reduction. |

|

CalWORKs employment services intensive case management |

— |

47 |

47 |

Ongoing Reduction (From January) |

May Revision maintains the Governor’s January budget proposal. |

|

CalWORKs expanded subsidized employment |

— |

134 |

134 |

Ongoing Reduction (From January) |

May Revision maintains the Governor’s January budget proposal for 2024‑25 and ongoing, but eliminates the previously proposed current year reduction. |

|

CalWORKs family stabilization |

— |

71 |

71 |

Ongoing Reduction (From January) |

May Revision maintains the Governor’s January budget proposal for 2024‑25 and ongoing, but eliminates the previously proposed current year reduction. |

|

CalWORKs single allocation employment services |

— |

272 |

— |

One‑Time Reduction (New in May) |

May Revision proposes one‑time reduction of $272 million in funding for the employment services component of the single allocation. |

|

CalWORKs home visiting program |

— |

47 |

47 |

Ongoing Reduction (New in May) |

May Revision proposes a new ongoing reduction of $47 million for CalWORKs home visiting beginning in 2024‑25 (proposed home visiting funding after the reduction totals about $63 million in 2024‑25). |

|

CalWORKs mental health and substance abuse services |

— |

126 |

126 |

Ongoing Reduction (New in May) |

May Revision proposes a new ongoing elimination of $126 million in CalWORKs mental health and substance abuse services funding beginning in 2024‑25. |

|

Total Proposed Reductions |

$— |

$738 |

$467 |

January Proposals Mostly Maintained. The May Revision maintains the administration’s proposals to eliminate funding for family stabilization, expanded subsidized employment , and the augmentation to the eligibility and administration component of the single allocation beginning in 2024-25 and ongoing. However, unlike in January, the May Revision does not propose current-year reductions to these CalWORKs components (as noted in our previous brief, current-year reductions proposed in January were unlikely to materialize in full).

Introduces Three New Reduction Proposals. The newly proposed reductions include (1) an ongoing reduction of $47 million in CalWORKs home visiting funding beginning in 2024-25 (leaving the home visiting program with about $63 million total funds in 2024-25 and ongoing); (2) a $272 million one-time, budget-year reduction in single allocation employment services funding; and (3) an ongoing elimination of CalWORKs mental health and substance abuse service funding (totaling $126 million annually).

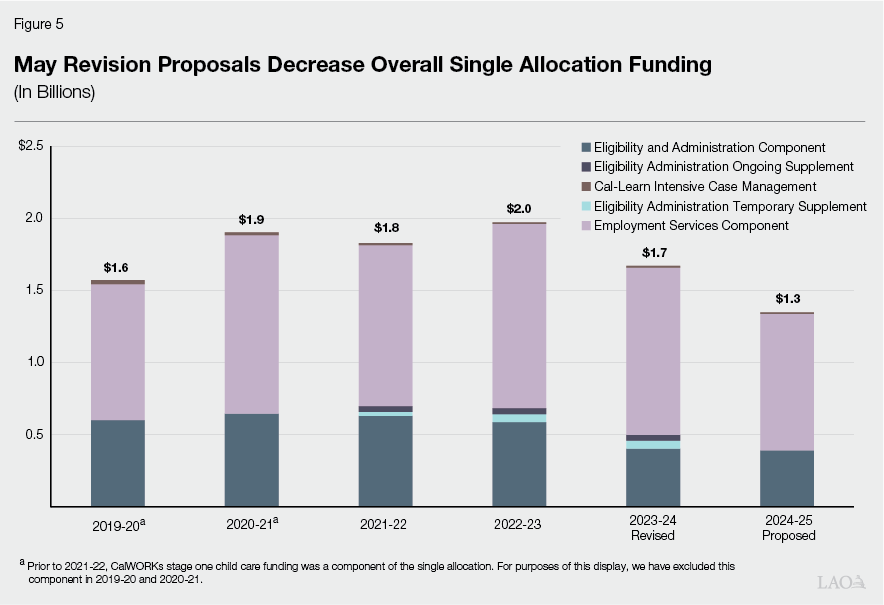

Further Reduces Single Allocation Funding. As mentioned above, the May Revision includes three proposed reductions to the single allocation across its administrative and employment services components. Figure 5 shows how these proposals, alongside caseload-driven funding changes, would reduce single allocation funding in 2024-25 and ongoing. If all proposed reductions to the single allocation were implemented, 2023-24 funding would decrease by 15 percent (relative to 2022-23) and 2024-25 funding would further decrease by 19 percent (relative to revised 2023-24 funding).

Modifies Early Action Single Allocation Reversion. The early action package included a partial reversion of $336.6 million in unspent single allocation funds from the 2022-23 Budget Act. It is our understanding that the May Revision updates this partial reversion to $200 million based on updated expenditure data.

Proposes Full Safety Net Reserve Withdrawal. The May Revision proposes withdrawing the full balance ($900 million) of the Safety Net Reserve, as was proposed in January. The May Revision also proposes withdrawing about $3 billion from the state’s general-purpose reserve—the Budget Stabilization Account—in 2024-25, significantly less than the roughly $12 billion withdrawal proposed in January.

LAO Comments on New Reduction Proposals

As described in Figure 4 above, the administration’s May Revision proposal includes multiple new reductions within CalWORKs. Our comments on these proposals are below. (For more information and our questions related to the proposed reductions included as part of the Governor’s January budget, please refer to our previous analysis.)

Programmatic Reductions Raise Questions About Potential Impacts on Current and Future Recipients. We are working with the administration to learn more about caseload and expenditure trends within the home visiting, mental health, and substance abuse programs to better understand the potential impacts the funding reductions might have on participants, if implemented. Some of the key information provided thus far includes:

CalWORKs Home Visiting Program: As of January 2024, about $33 million (of $86 million total funds) in 2021-22 home visiting funding and about $41 million (of $100 million total funds) in 2022-23 home visiting funding was unspent. DSS indicated roughly 3,400 CalWORKs families, on average, received home visiting services monthly in 2023.

CalWORKs Mental Health and Substance Abuse Services: Funds for mental health and substance abuse services within CalWORKs have also been historically underspent (with about $30 million of $127 million unspent annually in recent years). In 2022-23, over 5,500 CalWORKs recipients, on average, received nonmedical mental health and substance use services monthly through the program. Over 90 percent of these individuals received mental health services.

Administration Proposes Reducing, but Not Eliminating, Home Visiting Funding. The administration used point-in-time estimates to propose a home visiting funding reduction that it thought would more correctly align the budget with actual program costs. However, as of early May 2024, the administration is projecting slightly higher budget year expenditures in home visiting programs—meaning actual reductions in services may need to occur in order to save the proposed amount. We are working with the administration to better understand these home visiting utilization projections.

Proposal Eliminates Mental Health and Substance Abuse Funding. The administration is proposing a complete elimination of funding for CalWORKs mental health and substance abuse services. To do so, the administration assumes savings equivalent to the total budgeted amount for the services. Because counties have historically underspent the mental health and substance abuse services funding allocations, we are working with the administration to better understand expenditures and the feasibility of more closely aligning funding with historical expenditure levels (rather than completely eliminating the services).

Proposal Raises Questions About Potential Impacts on Local Service Delivery. Finally, we are working to learn more about how the proposed reductions might impact local service levels. The administration’s proposals give rise to certain questions, such as: If the proposals are implemented, would service reductions be likely at the county level? If so, in which CalWORKs program components would reduction(s) most likely occur and to what extent? How might these service reductions vary from county to county? Additionally, limited data are currently available on the short- and long-term outcomes of the programs. As such, how might decreases in services impact CalWORKs families’ participation in welfare-to-work activities, sanction rates, well-being, and other outcomes?

Questions About Availability of Alternative Services. The Governor’s proposal to fully eliminate funding for CalWORKs mental health and substance abuse services also raises questions as to whether and how these families might be able to access similar services elsewhere (for example, through Medi-Cal). However, questions remain about the types of services available and how counties might operationalize efforts to connect CalWORKs families with services outside the program.

Questions About Implementation. Our office is seeking additional information from the administration and counties on how the home visiting program and mental health and substance abuse services are delivered locally. Service delivery and types of services available through these programs vary by county. This variation gives rise to certain questions, such as: If a county no longer has the funding needed to support the existing home visiting caseload, how will it be decided who is disenrolled from the program? When would this disenrollment occur and would it result in an abrupt loss of services? The budget assumes a full year of savings from the elimination of these programs—is that possible to achieve if counties need time to ramp down services for recipients?

While Total Single Allocation Underspent Statewide, Some Counties Likely Would Need to Make Reductions. Counties have consistently underspent total single allocation funds in recent years (see our previous analysis for more information on this recent trend). However, county representatives report that in recent years, funding for the administrative component of the single allocation has been insufficient to cover administrative costs in some counties. Since many administrative activities are statutorily required, some counties regularly use other single allocation funds, especially from the employment services component, to cover necessary administrative costs. Initial reactions from county representatives to the newly proposed one-time reduction to the employment services single allocation component suggest that in some counties, service levels would decrease as a result of the multiple proposed single allocation reductions. We are working with the administration and county representatives to better understand historical single allocation expenditures at the county level.

Methodology for Eligibility and Administration Single Allocation Component Reassessed. DSS, in consultation with counties and the County Welfare Directors Association, also recently reassessed the methodology for the eligibility and administration single allocation component (as is statutorily required every three years beginning in 2024-25). Based on a 56-county survey conducted as part of the reassessment, DSS determined updating the eligibility worker rate to align with current local costs, as reported by counties, would result in a 21.4 percent increase ($160.3 million) in funding for the single allocation’s eligibility administration component. Additionally, according to DSS, updating the funding methodology to account for changes in the number of CalWORKs applications submitted (independent of changes in caseload) would result in an additional 6.7 percent funding increase ($48.8 million). Despite these findings, it is our current understanding that no updates were made to the eligibility administration component’s funding methodology in the May Revision.

Counties May Need to Determine How to Use Limited Funds. DSS has indicated counties could consider using single allocation funds to backfill proposed program-specific reductions if desired locally. However, some counties may have insufficient funds to do so while also covering necessary administrative and employment services costs. We are working with county representatives to learn more about how counties might allocate limited single allocation resources if the proposed reductions are implemented.

Full Safety Net Reserve Withdrawal May Be Inconsistent With Legislative Intent. As mentioned, the May Revision continues the Governor’s January proposal to withdraw the full balance ($900 million) of the Safety Net Reserve in 2024-25. However, the administration proposes significant CalWORKs reductions. The May Revision also projects small year-over-year increases in CalWORKs caseload and caseload-driven costs (including before applying proposed budget solutions). (In contrast, Medi-Cal caseload is projected to decrease year-over-year under the May Revision. Despite this projected decrease, our office projects total costs associated with Medi-Cal caseload to increase year over year and notes that Medi-Cal caseload remains significantly higher than pre-pandemic levels.) Additionally, the administration indicated that if not for the proposed withdrawal from the Safety Net Reserve, additional CalWORKs reductions might have been needed.

However, Given the Budget Situation, Use of Some Reserves Across the Budget Is Likely Warranted. If the Legislature chooses to reject or modify the May Revision proposal to withdraw the full balance of the Safety Net Reserve, equivalent solutions would need to be identified elsewhere in the budget (as would be the case for any proposed solutions the Legislature chooses to oppose).

Other Reserves Could Also Be Used to Support CalWORKs if Needed in the Future. While the Safety Net Reserve was designed to help cover costs of increasing caseload in Medi-Cal and CalWORKs in the event of an economic downturn, it is not the only funding source that could be used for this purpose. Under the administration’s new proposals, the state would end 2024-25 with nearly $23 billion in General Fund reserves. Maintaining these reserves would provide the Legislature more tools in the future to balance the budget and avoid some reductions across the budget, including in CalWORKs if preferred.

Continue to Consider Potential Impacts of January Proposals. Alongside the questions raised above on the newly proposed CalWORKs reductions, our office recommends the Legislature continue weighing the potential trade-offs of the Governor’s January proposals (all of which have been included in the May Revision). For more details on potential considerations, see the “Overarching Issues for Consideration” section in our previous analysis.