LAO Contact

Jennifer Pacella

September 11, 2024

The 2024-25 California Spending Plan

Higher Education

- Overview

- California Community Colleges

- California State University

- University of California

- Student Financial Aid

- California State Library

This post summarizes the state’s 2024-25 spending package for higher education. It is part of our Spending Plan series. In this post, we provide a short overview of the state’s higher education spending package, then cover spending for the California Community Colleges (CCC), California State University (CSU), University of California (UC), student financial aid, and California State Library. The EdBudget part of our website contains many tables providing more detail about the 2024-25 education budget.

Overview

Budget Increases State Funding for Higher Education in 2024-25. As Figure 1 shows, ongoing General Fund support for higher education is $22.7 billion in 2024-25, reflecting an increase of $1.3 billion (6.1 percent) over the revised 2023-24 level. Ongoing augmentations are concentrated in a few areas, including core campus operations and financial aid programs. The budget also includes a net of $209 million in one-time higher education funding.

Figure 1

Enacted Budget Increases General Fund Support for Higher Education

General Fund (Dollars in Millions)

|

Ongoing |

One Timea |

||||||

|

2022‑23 |

2023‑24 |

2024‑25 |

Change From 2023‑24 |

2024‑25 |

|||

|

Amount |

Percent |

||||||

|

California Community Collegesb |

$8,611 |

$8,495 |

$9,189 |

$695 |

8.2% |

— |

|

|

California State University |

5,041 |

5,409 |

5,583 |

174 |

3.2 |

‑$70c |

|

|

University of California |

4,369 |

4,718 |

4,983 |

265 |

5.6 |

‑120d |

|

|

Student Aid Commission |

2,416 |

2,550 |

2,717 |

167 |

6.6 |

402 |

|

|

Scholarshare Investment Board |

146 |

189 |

189 |

—e |

—e |

— |

|

|

Otherf |

30 |

32 |

29 |

‑3 |

‑10.2 |

— |

|

|

Totals |

$20,614 |

$21,393 |

$22,691 |

$1,298 |

6.1% |

$212 |

|

|

aReflects non‑Proposition 98 General Fund appropriations for one‑time purposes. bExcludes state general obligation debt service payments. In addition to state General Fund, community colleges receive significant funding from local property tax revenues. When these revenues are included, ongoing funding for the colleges increases by $889 million (6.8 percent) between 2023‑24 and 2024‑25. cReflects a $5 million one‑time appropriation for intersegmental partnerships, more than offset by a $75 million base reduction. dReflects a $2.9 million appropriation carried over for the California Institute on Law, Neuroscience, and Education and a one‑time $2.4 million appropriation for the California Nutrition Policy Institute. These appropriations are more than offset by a $125 million base reduction. eLess than $500,000 or 0.05 percent. fConsists of funding for College of the Law, San Francisco and the California Education Learning Laboratory. Excludes programs, including health workforce programs, administered by other agencies. |

|||||||

In Response to Deficit, State Adopts Several Higher Education Budget Solutions. As the state built its 2024-25 budget package, it was facing a projected deficit. In response, the state took various actions to reduce state spending. Within higher education, the main way the state achieved non-Proposition 98 budget solution was by pulling back certain previously provided and planned one-time appropriations. The state also made a few ongoing spending reductions. Figure 2 lists the higher education budget solutions that result in non-Proposition 98 General Fund savings. In the next section, we cover major Proposition 98 actions. While the state enacted a complex set of Proposition 98 actions in response to the state’s projected deficit, those actions did not result in programmatic reductions for the community colleges.

Figure 2

Nearly $2.7 Billion in Higher Education Budget Solutions

General Fund Reductions (In Millions), 2022‑23 Through 2024‑25, Unless Otherwise Noteda

|

Department |

Program |

Amount |

|

One‑Time Reductions |

||

|

California Educational Facilities Authority, California School Finance Authority |

Higher Education Housing Revolving Loan Program |

$1,700b |

|

California Student Aid Commission |

Learning‑Aligned Employment Program |

485 |

|

University of California |

California Institute for Immunology and Immunotherapy |

300 |

|

California State Library |

Local library infrastructure grants |

104c |

|

California State Library |

California Collaborative Connectivity Grant |

34 |

|

Scholarshare Investment Board |

Financial literacy outreach |

10 |

|

University of California |

Equal opportunity practices/professional development |

5 |

|

Subtotal |

($2,638d) |

|

|

Ongoing Reductions |

||

|

University of California |

Graduate medical education |

$11e |

|

Scholarshare Investment Board |

Financial literacy outreach |

5 |

|

California State Library |

Lunch at the Library |

2 |

|

California State Library |

California Library Services Act |

2 |

|

Subtotal |

($20f) |

|

|

Total |

$2,658 |

|

|

aExcludes base funding reductions for UC and CSU that are more than offset by base augmentations. All base changes for these segments are shown in other figures. bReflects $199.7 million in 2023‑24 savings and $300 million in annual savings for the subsequent five years. cConsists of $100 million foregone by rescinding appropriations previously scheduled from 2024‑25 through 2026‑27, along with $4.4 million achieved by reverting unspent funds from a 2022‑23 appropriation. dThough not listed in this figure, the budget package also reduces one‑time, non‑Proposition 98 General Fund for campus mental health partnerships and capacity grants by a total of $150 million (across UC, CSU, and CCC). This initiative was funded through the Department of Health Care Services. eThe budget eliminates the General Fund backfill previously provided in response to declines in Proposition 56 tobacco tax revenues. In 2023‑24, the backfill was $11.2 million. In 2024‑25, the backfill was estimated to grow to nearly $13.5 million. fThough not listed in this figure, the budget package also includes a roughly 10 percent ongoing, unallocated reduction to state operations (including sweeping vacant positions). In 2024‑25, all higher education agencies are subject to these potential reductions, with certain exceptions for the universities. |

||

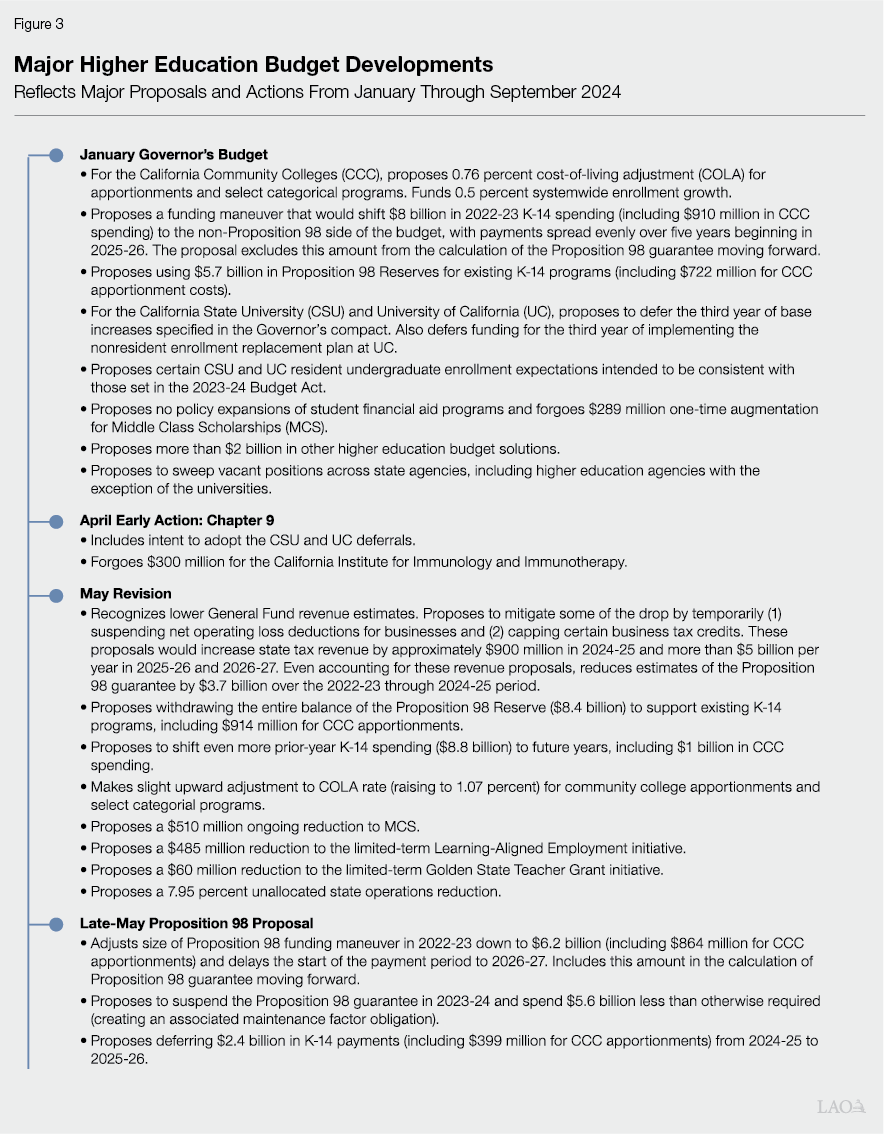

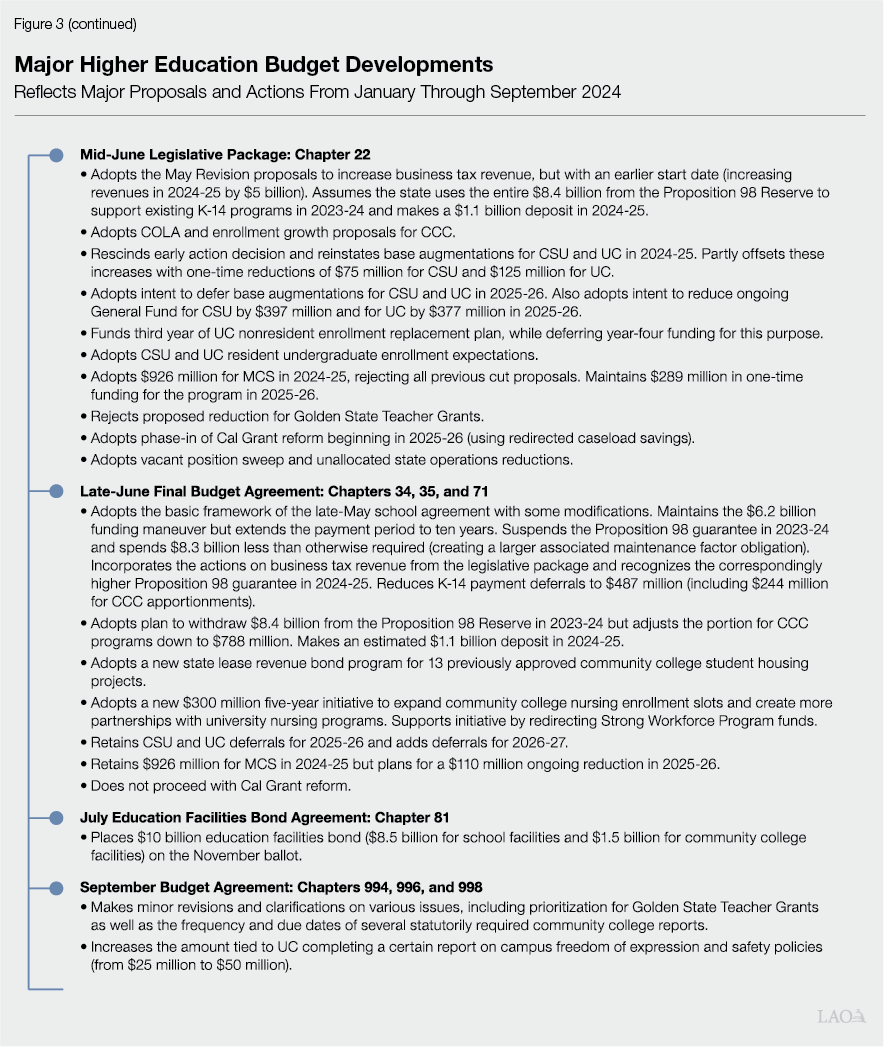

Major Higher Education Decisions Were Made at Key Junctures. Figure 3 highlights major higher education developments that unfolded throughout the state budget process. The Governor launched budget negotiations in January by proposing various higher education spending reductions and deferrals. By May, the estimated deficit was larger, and the May Revision proposed additional higher education spending reductions. In late May, the Governor modified his proposed Proposition 98 budget approach after announcing an agreement with the California Teachers Association. The final budget package includes several (but not all) of the proposed spending reductions, while also including the modified Proposition 98 approach nearly in its entirety. The final budget package rejects CSU and UC deferrals in 2024-25, in exchange for planned deferrals in 2025-26 and 2026-27.

California Community Colleges

Proposition 98 Context for CCC Budget. Proposition 98 funding (a mix of state General Fund and local property tax revenue) is the primary source of support for the community colleges (and K-12 education). Proposition 98 establishes a minimum funding level (called the minimum guarantee), which takes into account factors such as state General Fund revenue and per capita personal income. Largely due to lower-than-expected prior-year state revenues, the Proposition 98 package across the three-year budget window reflects an agreement between the Governor and Legislature to (1) fund colleges and schools above the minimum guarantee in 2022-23, (2) fund below the guarantee in 2023-24 (by statutorily suspending the requirement), and (3) fund at the estimated guarantee for 2024-25. To do so, the budget package relies on a complex set of actions, including a new type of fiscal maneuver, withdrawals from the Proposition 98 Reserve, and several costs shifts, as explained in more detail below.

Uses New Type of Fiscal Maneuver. For 2022-23, the state is spending $6.2 billion more than the minimum guarantee ($771 million for colleges and $5.4 billion for schools). For state budgeting purposes, however, the state will not recognize this additional spending in 2022-23. Instead, the state will recognize that spending over a ten-year period, beginning in 2026-27, with one-tenth of the total amount recognized each year. These costs, when recognized, will be attributed to the non-Proposition 98 side of the budget. Conceptually, this maneuver is similar to the state making an internal loan from its cash reserves in order to finance a higher level of funding for colleges and schools. The maneuver does not delay or reduce any payments to community colleges, though it will reduce the funding available for other state programs over the ten-year repayment period.

Withdraws Funding From the Proposition 98 Reserve for 2023-24. Proposition 2 (2014) established a constitutional reserve account within Proposition 98 and set forth rules requiring deposits and withdrawals under certain conditions. One rule requires withdrawals when Proposition 98 funding is below the previous year’s funding level, adjusted for changes in inflation and student attendance. For 2023-24, funding is far below this threshold (primarily due to the suspension of the guarantee), so the state must withdraw the entire balance of $8.4 billion. The budget plan provides $788 million of this amount for community colleges (plus $7.6 billion for schools). These withdrawals will support costs for existing K-14 programs. By suspending the guarantee, the state creates an $8.3 billion Proposition 98 obligation (known as a maintenance factor obligation). A formula determines how this obligation grows over time as well as how much the state must pay toward the obligation in any given year. When these payments occur, they also effectively reduce funding available for non-Proposition 98 programs.

Adopts Three Notable Payment Shifts. The purpose of these payment shifts is to align community college (and school) funding with the levels agreed upon in the budget package for each fiscal year. First, the budget shifts $242 million in CCC payments (and $2.3 billion in school payments) originally counted in 2022-23 to 2023-24. This shift allows the state to cover these costs using funds withdrawn from the Proposition 98 Reserve in 2023-24 instead of providing additional General Fund in 2022-23. Second, the budget shifts $446 million in CCC payments (plus $3.6 billion in school payments) originally counted in 2023-24 to 2024-25. This shift allows the state to reduce spending in 2023-24 to match the lower suspended level of the guarantee that year. Neither of these actions affects cash flow for districts. Third, the budget defers $244 million in CCC payments (and an almost equal amount in school payments) from June 2025 to July 2025, thereby moving the associated costs from 2024-25 to 2025-26. Unlike the other two shifts, this deferral will affect districts’ cash flow, though the impact will be minimal given the payments are delayed less than two weeks.

Budget Provides $13.1 Billion Proposition 98 Funding for CCC in 2024-25. As Figure 4 shows, Proposition 98 support for CCC in 2024-25 increases by $841 million (6.9 percent) over the revised 2023-24 level. The bulk of the increase is for (1) backfilling ongoing programs that were supported with one-time funds in 2023-24 and (2) paying for the costs shifted from 2023-24 to 2024-25. These particular adjustments allow the state to sustain ongoing programs at their existing levels.

Figure 4

California Community Colleges Proposition 98 Spending

(Dollars in Millions)

|

2022‑23 |

2023‑24 |

2024‑25 |

Change From 2023‑24 |

||

|

Amount |

Percent |

||||

|

Proposition 98 |

|||||

|

General Fund |

$8,302b |

$8,173c |

$8,847 |

$674 |

8.2% |

|

Local property tax |

3,884 |

4,094 |

4,260 |

167 |

4.1 |

|

Totalsa |

$12,187 |

$12,267 |

$13,108 |

$841 |

6.9% |

|

aAmounts shown reflect spending. In 2022‑23, spending is above the Proposition 98 minimum guarantee. In 2023‑24, spending is below the minimum guarantee, with the amount shown reflecting the suspension. In 2024‑25, spending is at the minimum guarantee level. bIncludes $771 million in payments disbursed to community colleges in 2022‑23 but attributed to future fiscal years as non‑Proposition 98 costs for state budget and accounting purposes. cIncludes $788 million in withdrawals from the Proposition 98 Reserve. |

|||||

Package Includes a Few CCC Spending Increases. As Figure 5 shows, the budget includes $191 million in new ongoing CCC spending and $39 million for one-time CCC initiatives. The largest of the ongoing spending increases ($100 million) is to fund a 1.07 percent cost-of-living adjustment for community college apportionments. The budget also provides $28 million for 0.5 percent enrollment growth—representing about 5,500 additional full-time equivalent (FTE) students. The largest one-time spending increase is $20 million for the financial aid administration program to assist students with completing the 2024-25 Free Application for Federal Student Aid (FAFSA). (The budget package also provides $60 million for the first year of a new nursing initiative, which, as discussed below, is funded via a carve out of existing Strong Workforce Program funds.)

Figure 5

Increases in California Community Colleges

Proposition 98 Spending

2024‑25 (In Millions)

|

Ongoing Spending |

|

|

COLA for apportionments (1.07 percent) |

$100 |

|

Student Success Completion Grant (caseload adjustment) |

50 |

|

Enrollment growth (0.5 percent) |

28 |

|

COLA for select categorical programs (1.07 percent)a |

13 |

|

Subtotal |

($191) |

|

One‑Time Spending |

|

|

Student financial aid administration |

$20 |

|

eTranscript California expansionb |

12 |

|

Credit for prior learning initativeb |

6 |

|

Apprenticeship instructional hours |

1 |

|

Subtotal |

($39) |

|

Totalc |

$231 |

|

aApplies to the Adult Education Program, apprenticeship programs, CalWORKs student services, campus child care support, Disabled Students Programs and Services, Extended Opportunity Programs and Services, and mandates block grant. bUses reappropriated Proposition 98 funds (previously appropriated funds for other purposes that were not spent). cIn addition to the items shown, the budget package earmarks some existing Strong Workforce Program funds for two purposes. It earmarks $60 million annually for five years for a new nursing initiative and $5 million one time for developing new education pathways for low‑income workers. |

|

|

COLA = cost‑of‑living adjustment. |

|

Budget Agreement Creates New Nursing Initiative. Higher education trailer legislation requires the CCC Chancellor’s Office to develop a competitive grant program aimed at expanding enrollment in registered nursing programs. The Chancellor’s Office must release a request for applications to community colleges by November 2024 and award the first round of grants by July 2025. Grantees have two years to spend their funds. They may use their grants to establish nursing partnerships with universities, expand their own nursing programs, increase clinical placements for nursing students, provide professional development for nursing faculty, and purchase lab equipment, among other allowable uses. Funding for the initiative—$60 million annually for five years—comes from existing redirected Strong Workforce Program resources. (Since 2006-07, the state also has funded a CCC nursing categorical program designed to expand enrollment and provide supplemental student support. In 2024-25, this program receives $13 million ongoing Proposition 98 funds.)

Funding for Chancellor’s Office Might Be Reduced. The budget includes $27 million non-Proposition 98 General Fund for the Chancellor’s Office in 2024-25 before any reductions are applied. The budget assumes that statewide General Fund state operations expenditures will be reduced by roughly 10 percent (due to a sweep of vacant positions pursuant to Control Section 4.12, together with a 7.95 percent reduction pursuant to Control Section 4.05). The statewide reduction is unallocated and will be determined through a budget exercise led by the Department of Finance (DOF). The budget act requires DOF to report to the Legislature on how the associated savings are being achieved by January 10, 2025. (We describe these actions in more detail in the “State Operations and Employee Compensation” write-up in our Other Provisions post.) Depending on decisions made later this year, the Chancellor’s Office could receive a reduction that is higher or lower than 10 percent.

Budget Authorizes One CCC Capital Outlay Project Supported With State Bonds. The 2024-25 budget includes $29 million in general obligation bond authority (Proposition 51 of 2016) to support a continuing project at College of the Siskiyous. In addition, the Legislature placed Proposition 2 on the November 2024 ballot, which, if approved by voters, would allow the state to sell $1.5 billion in new general obligation bonds for community colleges (plus $8.5 billion for schools). Allowable uses of these community college bond funds would include new buildings, renovations, land purchases, and equipment. If voters approve the proposition, the state would reflect associated debt service costs through subsequent budget actions.

Budget Package Creates Statewide Lease Revenue Bond Program. Higher education trailer legislation creates a new state lease revenue bond program to support 13 of 16 previously approved community college student housing projects. Under the new program, the Board of Governors and the 13 participating colleges will work with the State Public Works Board to finalize any remaining project plans and receive project financing. As part of this process, the specified entities must enter into a project construction delivery agreement. Changes to a project’s scope, cost, or number of affordable beds must be reported to the State Public Works Board, and, in some cases, the Legislature. The budget does not include any initial funding for the lease revenue bond program, given associated debt service costs are not expected to arise for at least one more year. In designing the new state lease revenue bond program, the state concluded that three previously approved community college housing projects (in the Napa, Santa Rosa, and Imperial Valley areas) were not good candidates for the program. The budget package provides $50.6 million in one-time 2023-24 funds to cover the cost of these projects on a cash basis.

California State University

CSU Ongoing Core Funding Is $9 Billion in 2024-25. Of this amount, $5.6 billion is state General Fund, $3.4 billion is student tuition and fee revenue, and $76 million is lottery revenue. Ongoing core funding increases $358 million (4.1 percent) from 2023-24. About half of the increase ($174 million) comes from the General Fund, and about half ($173 million) comes from student tuition and fee revenue. CSU is in the first year of implementing a tuition plan that increases charges for all students by 6 percent annually through 2028-29. Tuition revenue also increases in 2024-25 due to anticipated enrollment growth. The ongoing funding increases are partly offset by a net one-time reduction of $70 million. Figure 6 shows all the General Fund spending changes for CSU in 2024-25.

Figure 6

Changes in California State University

General Fund Spending

2024‑25 (In Millions)

|

Ongoing Spending |

|

|

Base augmentation |

$240 |

|

Retiree health benefit cost increase |

64 |

|

CalVet tuition waiver expansion |

6 |

|

Assembly Fellows (7 new positions)a |

— |

|

CENIC cost increaseb |

— |

|

Pension cost adjustment |

‑135 |

|

Subtotal |

($174) |

|

One‑Time Adjustments |

|

|

Intersegmental partnershipsc |

$5 |

|

Base reduction |

‑75 |

|

Subtotal |

(‑$70) |

|

Total |

$104 |

|

aBudget provides $330,000 for this purpose. bThe 2021‑22 budget agreement included a five‑year plan for covering higher CENIC charges. The annual funding increase in 2024‑25 is $152,000. cFunds support the planning and implementation costs of up to two projects that bring together campuses from the public higher education segments at a single location in a historically underserved area of the state to offer programs that support workforce needs. |

|

|

CENIC = Corporation for Education Network Initiatives in California. |

|

Budget Provides CSU With a Base Augmentation in 2024-25. The 2024-25 budget provides CSU with a $240 million (approximately 5 percent) unrestricted General Fund base augmentation. CSU may use this augmentation to cover employee salary and benefit cost increases as well as other operating cost increases. Provisional language requires CSU to report to the Legislature on the use of these funds by December 31, 2025. Beyond this base augmentation, the budget includes ongoing General Fund adjustments to reflect projected changes in CSU retiree health costs ($64 million increase) and certain CSU pension costs ($135 million decrease). It also includes $5.5 million ongoing General Fund to offset a projected decrease in CSU tuition revenue due to recently enacted legislation that expands eligibility for certain tuition waivers. These ongoing increases are partly offset by a base reduction of $75 million one-time General Fund in 2024-25.

Budget Plan Reduces Base Funding for CSU in 2025-26. The budget also includes a base reduction of $397 million ongoing General Fund for CSU in 2025-26. Both the $75 million reduction in 2024-25 and $397 million reduction in 2025-26 are part of the broader actions to reduce state operations spending. Though agencies generally are subject to state operations reductions of approximately 7.95 percent in 2024-25, the budget assumes the full associated reductions are not applied at CSU until 2025-26. The budget also exempts CSU from the sweep of vacant positions.

Budget Defers Planned Base Augmentations for CSU in Out-Years. Two years ago, the Governor made a compact with CSU to provide annual 5 percent base increases from 2022-23 through 2026-27. Provisional budget language states intent to defer some of these base increases. Specifically, the state plans to delay a $252 million ongoing increase originally intended for 2025-26 until 2026-27. In 2026-27, the state plans to provide the ongoing increase, as well as a one-time back payment to compensate for the forgone funds in the previous year. The state also plans to defer $252 million from 2026-27 until 2027-28, providing both the ongoing increase and associated one-time back payment in 2027-28. This EdBudget table summarizes these base increases, reductions, and deferrals.

Budget Sets Enrollment Growth Expectations for CSU Through 2025-26. Provisional language states an intent for CSU to increase resident undergraduate enrollment by 6,338 FTE students (1.9 percent) in 2024-25. As this EdBudget table shows, this would bring its resident undergraduate enrollment to 339,946 FTE students, consistent with an expectation set in last year’s budget agreement. (With this growth, CSU would remain below its funded enrollment level of 390,598 total resident FTE students in 2024-25. The funded level includes undergraduate and graduate students.) The language authorizes the administration to reduce funding for CSU if it enrolls fewer students than expected. Funding would be reduced at the 2024-25 state marginal cost rate of $10,995 for each student below the expected level. The language also retains an expectation set in last year’s budget agreement for CSU to increase enrollment by an additional 10,161 FTE students (3 percent) in 2025-26, bringing its resident undergraduate enrollment to 350,107 FTE students.

University of California

UC Ongoing Core Funding Is $10.9 Billion in 2024-25. Of this amount, $5 billion is state General Fund and $5.6 billion is student tuition and fee revenue, with the remainder coming from various smaller sources, including lottery revenue. Ongoing core funding increases $478 million (4.6 percent) from 2023-24. Just over half of the increase ($265 million) comes from the General Fund. The remainder ($213 million) comes from student tuition and fee revenue. Tuition revenue increases due to rising tuition charges (consistent with UC’s tuition policy) and anticipated enrollment growth. Figure 7 shows all the General Fund spending changes for UC in 2024-25.

Figure 7

Changes in University of California General Fund Spending

2024‑25 (In Millions)

|

Ongoing Spending |

|

|

Base augmentation |

$228 |

|

Nonresident enrollment reduction/replacementa |

31 |

|

UC Merced medical education building (debt service) |

15 |

|

UC Los Angeles Ralphe J. Bunche Center for African American Studies |

3 |

|

UC graduate medical education (backfill)b |

‑11 |

|

Subtotal |

($265) |

|

One‑Time Adjustments |

|

|

California Institute on Law, Neuroscience, and Educationc |

$3 |

|

Nutrition Policy Instituted |

2 |

|

Base reduction |

‑125 |

|

Subtotal |

(‑$120) |

|

Total Changes |

$145 |

|

aIn 2024‑25, UC is to reduce its nonresident undergraduate enrollment at three campuses (Berkeley, Los Angeles, and San Diego) by a total of 902 students. It is to backfill these slots with the same number of additional resident undergraduate students. bThe budget eliminates the General Fund backfill previously provided in response to declines in Proposition 56 tobacco tax revenues. In 2023‑24, the backfill was $11.2 million. In 2024‑25, the backfill was estimated to grow to nearly $13.5 million. cCarryover to extend the encumbrance period for an appropriation made in Chapter 240 of 2021 (SB 170, Skinner). dRepresents the third year of a four‑year funding plan for the Nutrition Policy Institute. It is the intent of the Legislature that $1.3 million be provided in 2025‑26 for this purpose. |

|

Budget Provides UC With a Base Augmentation in 2024-25. The 2024-25 budget provides UC with a $228 million (approximately 5 percent) unrestricted General Fund base augmentation. UC may use this augmentation to cover employee salary and benefit cost increases as well as other operating cost increases. Provisional language requires UC to report to the Legislature on the use of these funds by December 31, 2025. The budget also provides UC with $31 million General Fund to replace 902 nonresident students at the Berkeley, Los Angeles, and San Diego campuses with resident students. This is the third consecutive year the state has provided funding for this purpose. These ongoing increases are partly offset by a base reduction of $125 million one-time General Fund in 2024-25. Provisional language makes $50 million of UC’s base funding conditional upon it submitting a report by October 1, 2024 on campus freedom of expression and safety policies. (Provisional language makes CSU subject to a similar reporting requirement, without holding back a portion of its base funding.)

Budget Plan Reduces Base Funding for UC in 2025-26. The budget also includes a base reduction of $377 million ongoing General Fund for UC in 2025-26. Both the $125 million one-time reduction in 2024-25 and $377 million ongoing reduction in 2025-26 are part of the broader actions to reduce General Fund state operations spending. Similar to CSU, the budget assumes the full associated reductions are not applied at UC until 2025-26 and it exempts UC from the sweep of vacant positions.

Budget Defers Planned Base Augmentations and Nonresident Replacement Funding for UC in Out-Years. As with CSU, the Governor made a compact with UC to provide certain annual funding increases from 2022-23 through 2026-27. Under the compact, UC was to receive annual 5 percent base General Fund increases, along with state funding to offset lost revenue associated with replacing nonresident students with resident students at the Berkeley, Los Angeles, and San Diego campuses. Though the third year of compact funding is included in the 2024-25 Budget Act, provisional budget language states an intent to defer the fourth-year funding increases as well as nearly all of the fifth-year funding increases. Specifically, the state plans to defer a $272 million ongoing General Fund increase originally planned for 2025-26 until 2026-27. In 2026-27, the state plans to provide this ongoing increase, as well as a one-time back payment to compensate for the forgone funds in the previous year. In addition, the state plans to defer another ongoing increase of the same amount from 2026-27 until 2027-28. This EdBudget table summarizes these base increases, reductions, and deferrals.

Budget Sets Enrollment Growth Expectations for UC Through 2026-27. Provisional language states an intent for UC to increase resident undergraduate enrollment by 2,927 FTE students (1.4 percent) in 2024-25. This would bring UC’s total resident undergraduate enrollment to 206,588 FTE students, consistent with an expectation set in last year’s budget agreement. Provisional language authorizes the administration to reduce funding for UC if it enrolls fewer students than expected. Funding would be reduced at the 2024-25 state marginal cost rate of $11,640 for each student below the expected level. The language also retains an expectation set in last year’s budget agreement for UC to further add 2,947 FTE students (1.4 percent) in 2025-26 and 2,968 FTE students (1.4 percent) in 2026-27, bringing its total resident undergraduate enrollment to 212,503 FTE students. These enrollment levels include the additional resident students resulting from replacing nonresident students at the Berkeley, Los Angeles, and San Diego campuses.

Funding for UC Graduate Medical Education (GME) to Decrease. The budget package includes two actions affecting UC GME. One action relates to Proposition 56 (2016). Proposition 56 increased taxes on tobacco products and stipulated that $40 million of the resulting revenue be provided to UC for a GME program aimed at increasing the number of primary care and emergency physicians trained in California. In recent years, Proposition 56 tobacco tax revenues have fallen and the state has used General Fund to sustain the GME program at $40 million. The General Fund backfill for 2024-25 was originally estimated to be $13.5 million. The 2024-25 budget package eliminates this GME backfill. The other action relates to a managed care organization tax agreement made last year. Under that agreement, UC would have received $75 million annually for five years to further expand GME slots in California. The 2024-25 budget package also eliminates this funding.

UC-Affiliated Law School Receives Base Increase. The 2024-25 budget provides College of the Law, San Francisco (CLSF) with a $2.2 million (11 percent) unrestricted General Fund base augmentation to support operational costs (as this EdBudget table shows). Though CLSF is receiving a base augmentation in 2024-25, the budget package contains an ongoing base reduction of $2.1 million in 2025-26 for the school. This reduction is part of the broader action to reduce state operations spending by 7.95 percent. CLSF would have the coming year to plan for the cut.

Student Financial Aid

California Student Aid Commission (CSAC) Total Funding Is $3.5 Billion in 2024-25. Of this amount, $3.1 billion is state General Fund, $400 million is federal Temporary Assistance for Needy Families funding, and a small amount is from other funds and reimbursements. Ongoing General Fund spending increases by $167 million (6.6 percent) from 2023-24. The largest General Fund augmentation is for covering higher projected costs in the Cal Grant program. The budget also includes $399 million one-time General Fund for the Middle Class Scholarship and Golden State Teacher Grant programs. Figure 8 shows all the General Fund spending changes for CSAC in 2024-25. Below, we first describe major CSAC spending changes and then cover notable changes to financial aid programs administered by other agencies.

Figure 8

Changes in California Student Aid Commission

General Fund Spending

2024‑25 (In Millions)

|

Ongoing Spending |

|

|

Cal Grant baseline adjustment |

$106 |

|

Middle Class Scholarship baseline adjustment |

61a |

|

Other |

—b |

|

Subtotal |

($167) |

|

One‑Time Spending |

|

|

Middle Class Scholarship one‑time augmentation |

$289 |

|

Golden State Teacher Grants |

110c |

|

California College of the Arts |

3 |

|

Subtotal |

($402) |

|

Total |

$569 |

|

aThis adjustment brings the program back to its ongoing base funding level of $637 million. bConsists of a $152,000 increase for employee compensation and a $31,000 increase for the Law Enforcement Personnel Dependents program. cThe 2021‑22 Budget Act appropriated $500 million to be spent annually from 2021‑22 through 2025‑26. Amount shown reflects anticipated spending in year four. Because program participation has been higher than originally anticipated, all program funding is expected to be spent by the end of 2024‑25. |

|

Budget Makes Cal Grant Cost Adjustments. The enacted budget includes $2.4 billion for Cal Grants—a $106 million (4.5 percent) increase over the revised 2023-24 level. This increase is the net effect of two changes. First, it reflects a $148 million projected increase in Cal Grant costs under CSAC’s May Revision estimates. We summarize those cost estimates by segment and award type in our Cal Grant Spending EdBudget table. Second, it reflects a $42 million downward adjustment to CSAC’s May Revision estimates. The state postponed the 2024-25 application deadline for most Cal Grant awards from March 2 to May 2 due to implementation issues with the new FAFSA form. This resulted in CSAC receiving key application data after preparing its original spring estimates. These more recent data suggested slower program growth.

Cal Grant Reform Is Not Triggered in 2024-25. The budget does not provide funding to implement a set of program changes known as “Cal Grant reform.” Cal Grant reform would have made several key changes to award types and eligibility rules. Under the 2022-23 budget package, Cal Grant reform would have been triggered in 2024-25 if the state determined in spring 2024 that sufficient General Fund was available to support the action. The trigger condition was not met.

Budget Increases Middle Class Scholarship Funding in 2024-25. Consistent with last year’s budget agreement, the budget provides $289 million one-time General Fund for Middle Class Scholarships. These one-time funds are on top of $637 million in ongoing General Fund, bringing the total program funding level to $926 million in 2024-25 (compared to $803 million in 2023-24). This program provides UC and CSU students with awards that cover a certain percentage of their remaining cost of attendance after accounting for their available resources (consisting of other gift aid, a student contribution, and in some cases a parent contribution). Each year, CSAC determines the percentage of award coverage based on the program funding level. We estimate the 2024-25 funding level is sufficient to cover 39 percent of each recipient’s remaining costs (up from 36 percent coverage in 2023-24). We summarize estimated recipients, spending, and award amounts by segment in our Middle Class Scholarship Program EdBudget table. For 2025-26, the budget assumes a $110 million ongoing General Fund reduction for Middle Class Scholarships and no one-time funds, bringing the program funding level down to $527 million in that year.

Budget Includes Several Changes to Golden State Teacher Grants. The budget reflects $110 million in one-time General Fund spending for this program in 2024-25, accounting for the remainder of the $500 million one-time General Fund appropriation provided in the 2021-22 Budget Act. This program provides scholarships to students in teacher preparation programs who commit to working at a priority school (a school where at least 55 percent of students are low-income, English learners, or foster youth). The budget also adds $1.5 million in one-time federal reimbursements from the California Department of Education (consisting of $1 million in Title II, Part A funds and $500,000 in Individuals with Disabilities Education Act funds) for the program. To stretch the available funds further, trailer legislation makes several changes to the program for 2024-25. Most notably, it lowers the maximum award amount from $20,000 to $10,000 and correspondingly reduces the length of time recipients are required to work at a priority school from four years to two years. It also requires CSAC to prioritize applicants with the lowest income and asset levels when making award offers.

Learning-Aligned Employment Initiative Is Discontinued. The budget reverts $485 million one-time General Fund from this initiative. The state originally created this initiative in 2021-22. The initiative was intended to provide students from underrepresented backgrounds with subsidized work-study opportunities related to their area of study or career interests. Most of the original $500 million appropriation was unspent as of June 2024 and the state reverted the remaining funds to help address its budget deficit.

Financial Literacy Outreach Program Is Discontinued. The budget removes the $5 million ongoing General Fund appropriation provided to the Scholarshare Investment Board (SIB) for financial literacy outreach and reverts a total of $9.5 million in unspent funds provided in previous years for this purpose. The state originally began providing this funding in 2022-23 to support outreach to participants of the California Kids Investment and Development Savings program, a college savings program also administered by SIB. As most of the funds had not yet been spent as of June 2024, the state discontinued the program to help address its budget deficit.

Budget Provides One-Time Funding for CCC Financial Aid Administration. As mentioned in the CCC section, the budget provides $20 million one-time Proposition 98 General Fund to CCC to support community college financial aid offices with increased workload due to FAFSA implementation issues. Financial aid offices may also use these funds to assist students in completing the FAFSA. Provisional language directs CCC to provide a base allocation of $50,000 to each community college, then allocate the remaining funds to colleges based on enrollment and Pell Grant recipients.

California State Library

California State Library Total Funding Is $225 Million in 2024-25. Of this amount, $204 million is General Fund, $18 million is federal funds, and the reminder comes from various state special funds. Ongoing General Fund support for the California State Library decreases by a net of $4.0 million (7.6 percent). This decrease mainly consists of a $2.5 million reduction for the Lunch at the Library program and a $1.8 million reduction for the California Library Services Act. These decreases are partially offset by increases in employee salary and benefit costs as well as increases in broadband costs. The budget also includes $155 million General Fund for one-time library initiatives. Of this amount, $152 million is carried over from appropriations originally made in 2022-23 for local library infrastructure projects; $2.4 million is for disaster preparedness (representing the final year of a four-year funding plan); and $750,000 is new one-time spending to support lesbian, gay, bisexual, transgender, and queer historical archives preservation. This EdBudget table shows all the ongoing and one-time General Fund spending changes for the California State Library in 2024-25. In addition to these General Fund changes, the budget provides $169,000 for a new permanent full-time Tribal and Rural Library Programs Consultant position supported by existing federal Institute of Museum and Library Services funding.

Budget Rescinds Some Unspent Library Funds. In response to the state’s deficit, the budget rescinds unspent, prior-year General Fund provided to the State Library for broadband connectivity grants ($34 million) and local library infrastructure grants ($4.4 million). The budget also foregoes further General Fund support for local library infrastructure grants. The state had planned to provide a total of $100 million in additional General Fund for these grants over the next three years ($33 million in 2024-25, $33 million in 2025-26, and $34 million in 2026-27), but the 2024-25 budget package rescinds this funding. (The May Revision also proposed to rescind $40 million in unspent one-time General Fund for the Dolly Parton Statewide Imagination Library, but the final budget agreement did not include this reduction.)