January 13, 2025

The 2025‑26 Budget

Overview of the Governor’s Budget

Appendix Tables

Executive Summary

Budget Remains Roughly Balanced. In November, we found that the underlying condition of the state’s budget was roughly balanced. This remains true under the Governor’s budget. There are a handful of differences in our estimates, but these changes are small enough on net that they do not substantively change our assessment of the budget condition. Specifically, the administration has higher revenue estimates than our office, but these are mostly offset by their higher spending estimates. We are not describing the budget condition as having a surplus or a deficit at this time. Unique budgetary conditions occurring this year—including atypical legislative action taken last year to both address the deficit and withdraw more in reserves this year—make interpretation of the budget position more complex. (On a technical basis, under the administration’s estimates, we estimate the balance of the Special Fund for Economic Uncertainties would be about $3 billion before the Governor’s proposals.) That said, both our office and the administration anticipate the budget faces deficits in future years.

Governor’s Budget Includes Some Smaller Proposals. The Governor’s budget includes three categories of discretionary proposals. First, some proposals provide short‑term budget savings that create more budget capacity. These total $2.2 billion. Second, the Governor’s budget includes new discretionary proposals that use budget capacity by increasing spending or reducing revenues. These total roughly $700 million. Finally, the Governor sets the balance of the Special Fund for Economic Uncertainties to $4.5 billion—somewhat higher than the level enacted by recent budgets.

Revenue Estimates Reasonable, but Risks Must Be Kept in Focus. The Governor’s budget revenue upgrade, while somewhat higher than ours, is reasonable in light of the recent collection trends. That being said, we continue to be concerned that recent gains are on shaky ground. These gains are not tied to improvements in the state’s broader economy, which has been lackluster, with elevated unemployment, a stagnant job market outside of government and healthcare, and sluggish consumer spending. Instead, the gains appear largely tied to the booming stock market, a situation which can change rapidly and without warning. The administration appears to share some of these concerns, noting recent job losses among high‑wage workers and the risks posed by the inherent volatility of tax receipts tied to stock market gains. We suggest the Legislature take heed of these risks and avoid putting too much stock in the recent revenue rebound until it is accompanied by clear improvements in California’s broader economy.

Governor’s Use of Reserves Remains Reasonable. The Governor’s budget maintains an already planned withdrawal from the state’s rainy day fund, which we think is a reasonable choice. Since 2023‑24, the Legislature has addressed a cumulative total of $82 billion in budget problems, but even including the withdrawal for 2025‑26, has only used about half of the Budget Stabilization Account (BSA). Using some reserves this year is therefore warranted and gives the Legislature capacity to focus on addressing the budget’s out‑year condition.

Maintain Momentum on Solving Budget Deficits. We recommend the Legislature maintain last year’s momentum by developing a plan for addressing the budget problems on the horizon. The underlying budget dynamics today are particularly challenging for three reasons. First, revenues have not caught up with expenditures. Second, under our estimates, expenditure growth exceeds estimated revenue growth. Third, the budget is currently balanced, but only because the Legislature took significant actions last year—nearly all of which involved one‑time uses of funds, like reserve withdrawals, temporary revenue augmentations, and reductions in temporary spending. This means that, going forward, decisions to balance the budget will involve more difficult trade‑offs. We recommend the Legislature use the next few months to review program performance to develop its own approach to addressing the deficits.

Governor’s Interest in Enhancing Reserve Policies Merited. The Governor has signaled interest in changing the state’s reserve policy by: (1) increasing the cap on BSA required deposits from 10 percent of General Fund taxes to 20 percent of General Fund taxes, and (2) excluding the state’s reserve deposits from the state appropriations limit. We agree that rethinking the state’s reserve policies is merited, particularly in light of increasing volatility in state revenues. The two changes proposed by the Governor are reasonable first steps, but additional changes are warranted. For context, if policies like these had been in place over the last decade, the state would have been required to save only a few billion more in reserves. As such, if the Legislature wishes to have substantively more reserves available when responding to downturns or other emergencies, we would recommend also changing the formulas that set aside funds each year to increase how much is saved.

Introduction

On January 10, 2025, Governor Newsom’s administration presented its proposed state budget to the California Legislature. In this report, we provide a brief summary of the Governor’s budget based on our initial review as of January 12. In the coming weeks, we will analyze the plan in more detail and release many additional issue‑specific budget analyses.

Budget Roughly Balanced

In November, we found that the underlying condition of the state’s budget was roughly balanced. This remains true under the Governor’s budget. In other words, we are not describing the budget condition as having a surplus or a deficit at this time. These concepts are inherently tools of communication, not accounting, and are ultimately somewhat subjective. Moreover, specific budgetary conditions occurring this year—including legislative action taken last year to withdraw more in reserves this year—make interpretation of the budget position more complex.

Legislative Action in June 2024 Addressed Anticipated Budget Problem Proactively. In June of 2024, the Legislature not only addressed the budget problem for 2024‑25, but also made proactive decisions to address the anticipated budget problem for 2025‑26. This is one of the key reasons that the budget remains balanced now. The June 2024 budget package committed to a total of $28 billion in budget solutions for 2025‑26, which included, $12 billion in spending‑related solutions and nearly $16 billion in all other solutions, including $5.5 billion in temporary revenue increases and a $7 billion withdrawal from the state’s rainy day fund, the Budget Stabilization Account (BSA). The Governor’s budget does not propose any significant policy changes to the already‑adopted budget solutions, but some of the assumed savings are now lower—totaling $23 billion for 2025‑26. Two key areas where these savings have eroded are in the managed care organization (MCO) tax package and reductions to state operations. These are described in the box below. The forthcoming Appendix 1 will also provide a full list of the solutions from the 2024‑25 budget package that generate savings in 2025‑26.

Significant Changes to Solutions From June 2024 Budget Package

Managed Care Organization (MCO) Tax Package. Some of the largest budget solutions in the June budget package involved the MCO tax, a tax on health plans that supports the Medi‑Cal program. Last year’s budget notably increased the size of the MCO tax, generating more revenue for Medi‑Cal. In addition, it used more tax funds to offset General Fund spending on Medi‑Cal, in turn reducing planned spending on provider rate increases. These solutions yielded General Fund savings of $11 billion through 2025‑26. The Governor’s budget reduces this amount by $1.3 billion through 2025‑26. The reason for the reduction is the recent voter approval of Proposition 35 (2024), which requires the state to spend less MCO tax money on offsetting General Fund spending and more money on provider rate increases.

State Operations Reductions. The 2024‑25 budget package assumed that the Department of Finance would reduce state operations expenditures through two unallocated reductions across most state departments. These included (1) a $1.5 billion ($760 million General Fund) reduction through the permanent and ongoing reduction of 10,000 vacant positions and the associated funding and (2) a reduction to General Fund operating expenditures of $2.2 billion in 2024‑25 and $2.8 billion in 2025‑26 and ongoing. In total, the 2024‑25 budget package assumed that state operations costs would be reduced by $3.7 billion ($3 billion General Fund) through these unallocated reductions. The Governor’s budget assumes that the administration achieves significantly lower General Fund savings through these unallocated reductions. Specifically, the Governor’s budget assumes (1) a $620 million ($230 million General Fund) reduction through the permanent elimination of 6,500 vacant positions and associated funding and (2) a $1.5 billion ($820 million General Fund) in 2024‑25 and $2 billion ($1.2 billion General Fund) in 2025‑26 and ongoing reduction to state operations expenditures. In total, the Governor’s budget assumes that state operations costs are reduced by $2.1 billion ($1 billion General Fund) in 2024‑25 and $2.6 billion ($1.4 billion General Fund) in 2025‑26 and ongoing. Essentially, the Governor’s budget assumes that the administration is able to achieve about one‑half of the General Fund state operations savings assumed in the 2024‑25 budget plan.

Budget Position Largely Similar to Our Estimate. Before accounting for discretionary choices, the budget position under the administration’s estimates is similar to what it was under our November estimates. That is, both of our offices have assessed that the budget is roughly balanced. There are a handful of differences in our estimates, but these changes are small enough on net that they do not substantively change our assessment of the budget condition. (On a technical basis, under the administration’s estimates, we estimate the balance of the Special Fund for Economic Uncertainties [SFEU] would be about $3 billion before the Governor’s proposals.) The main differences between our estimates include:

- Revenue Estimates Higher by $9 Billion. Over the budget window—2023‑24 through 2025‑26—the administration’s estimates of revenues (excluding policy proposals) are higher than our November 2024 estimate by $9 billion. Higher estimates for personal income taxes and corporation taxes each account for a bit under half of this difference, with the small remainder attributable to a variety of other revenues. This improves the budget’s bottom line.

- School and Community College Spending Higher by $5 Billion. Reflecting these higher revenue estimates, the administration’s estimates of constitutionally required General Fund spending on K‑14 education is $4.7 billion higher than our November estimates. This partially offsets the revenue increase described above, deteriorating the budget’s bottom line.

- All Other Spending Lower by $600 Million. Across the rest of the budget, the administration’s estimates of baseline spending (for example, for caseload growth, federal reimbursements, and statutory cost increases) are lower than ours by $600 million. This is a relatively small number on a net basis, but is the result of many, much larger, offsetting differences. For example, the administration’s estimate of baseline costs in Medi‑Cal, the state’s Medicaid program, is higher than our November 2024 estimate by $3.1 billion in 2025‑26. This is largely due to increased pharmacy costs, higher caseload, and a lower General Fund offset from the MCO tax package. These higher costs are more than offset by a range of other areas where the administration’s cost estimates are lower. For example, constitutionally required debt payments are $1.1 billion lower under the administration’s estimates and the administration scores a higher entering fund balance—largely due to over $1 billion in additional revenue accruals—in 2023‑24. On a net basis, these items slightly improve the budget’s bottom line.

Neither our November estimates nor the administration’s estimates included any costs associated with the devastating wildfires in Southern California, as both were developed before those wildfires began. While we anticipate some state costs as well as state policy responses to this disaster, we do not yet have sufficient information about the extent of those costs.

Discretionary Proposals

The Governor’s budget includes three categories of discretionary proposals, which are those that are not already committed to under current law or policy. First, some proposals provide short‑term budget savings that create more budget capacity. These proposals generate a total of $2.2 billion General Fund savings within the budget window. Second, the Governor’s budget includes new discretionary proposals that use budget capacity by increasing spending or reducing revenues. These total roughly $700 million. Finally, the Governor sets the balance of the SFEU to $4.5 billion. We describe the major components of each of these categories below. The forthcoming Appendix 2 and 3 will also provide a complete list of the savings, spending, and tax expenditure proposals.

Savings Proposals

Generates $1.6 Billion School and Community College Settle‑Up Obligation in 2024‑25. The Governor’s budget proposes providing $1.6 billion less in total funding for schools and community colleges than the estimated constitutional minimum funding level for 2024‑25. This provides one‑time General Fund savings in that year, but also creates a “settle‑up” obligation, which will need to be paid in a future year if revenues for 2024‑25 were to remain unchanged. If revenues for 2024‑25 come in below current projections, this obligation would also decline—potentially to zero. We understand that while the administration indicates it will provide this payment in the future—after the final calculation of the minimum funding requirement—it also has not scored this future obligation in its multiyear budget.

Increases Revenue by Around $300 Million. The Governor’s budget proposes to change the rules about how taxable profits are determined for financial institutions. The administration estimates this change would increase revenues on an ongoing basis by around $300 million per year.

Shifts Nearly $300 Million in General Fund Spending to Proposition 4 (2024) Climate Bond. Recent budget packages included significant General Fund appropriations for a variety of climate‑ and environmental‑related activities. The Governor proposes to reduce and revert nine of these prior appropriations totaling $273 million, achieving General Fund savings. These include funds for water recycling, wildfire prevention activities at state parks, and dam safety activities. The proposal would then provide a like amount of funding from Proposition 4, the climate bond approved by voters in November 2024. This would result in maintaining prior funding levels for these activities but would preclude this amount of Proposition 4 funds from supporting expanded service levels or additional projects.

Spending and Tax Expenditure Proposals

New Spending Proposals of Nearly $600 Million. The Governor’s budget includes $570 million in new discretionary General Fund spending in 2025‑26. After 2025‑26, these proposals would add about $300 million in ongoing spending. Some of the largest spending augmentations proposed include: (1) $60 million to provide additional grants under the Cal Competes program; (2) the intent to partially restore an ongoing reduction to the trial courts, which, if enacted, would cost $42 million ongoing; and (3) the Governor’s proposed expansion to College Corps, which would cost $5 million in 2025‑26, but grow to $84 million ongoing.

New Tax Expenditures of $150 Million. The Governor’s budget includes some revenue proposals, which would expand existing tax expenditures and create new ones. This includes increasing the existing film tax credit from $330 million to $750 million per year and excluding some military retirement income from taxation. Taken together, the administration estimates these proposals would reduce revenues by around $150 million in 2025‑26, reaching $300 million by 2028‑29.

Discretionary Reserves

Sets Discretionary Reserve Balance to $4.5 Billion. The SFEU is a general‑purpose reserve commonly used to provide capacity for unanticipated expenditures, including state costs associated with disasters and other emergencies. Technically, it is also the end balance of the state’s General Fund—the money that remains after accounting for all of the state’s expected revenues and spending. The state constitution has a balanced budget requirement, which means the balance of the SFEU must be set above zero for the upcoming fiscal year. Any level above zero is up to the discretion of the Legislature. Recent budgets have set the SFEU between $3.5 billion and $4 billion. The Governor proposes a $4.5 billion SFEU balance for the end of 2025‑26.

Budget Condition

In this section, we describe the overall condition of the General Fund budget after accounting for the Governor’s budget proposals. We also describe the condition of the school and community college budget.

General Fund Condition

Figure 1 shows the General Fund condition based on the Governor’s proposals and using the administration’s estimates and assumptions.

Figure 1

General Fund Condition Summary

(In Millions)

|

2023‑24 |

2024‑25 |

2025‑26 |

|

|

Prior‑year fund balance |

$50,203 |

$35,877 |

$26,299 |

|

Revenues and transfers |

193,269 |

222,473 |

225,095 |

|

Expenditures |

207,595 |

232,051 |

228,892 |

|

Ending Fund Balance |

$35,877 |

$26,299 |

$22,501 |

|

Encumbrances |

18,001 |

18,001 |

18,001 |

|

SFEU balance |

$17,876 |

$8,298 |

$4,500 |

|

Reserves |

|||

|

BSA |

$22,902 |

$18,045 |

$10,945 |

|

SFEU |

17,876 |

8,298 |

4,500 |

|

Safety net |

900 |

— |

— |

|

Total Reserves |

$41,678 |

$26,343 |

$15,445 |

Under Governor’s Budget, Reserves Would Total $15 Billion by End of 2025‑26. Under the Governor’s budget, general purpose reserves would total $15.4 billion by the end of 2025‑26. (In addition, the state would have $1.5 billion in the Proposition 98 Reserve, available only for school and community college programs.) As discussed earlier, this includes a balance in the SFEU of $4.5 billion (somewhat above recently enacted levels), and $11 billion in the state’s main constitutional reserve, the BSA. These balances would be available to mitigate a future budget problem. (As noted earlier, the Governor’s budget maintains a roughly $7 billion withdrawal from the BSA planned as part of last year’s budget. Although the state does not currently have a deficit, this withdrawal would still be allowable under the constitution’s budget emergency rules.)

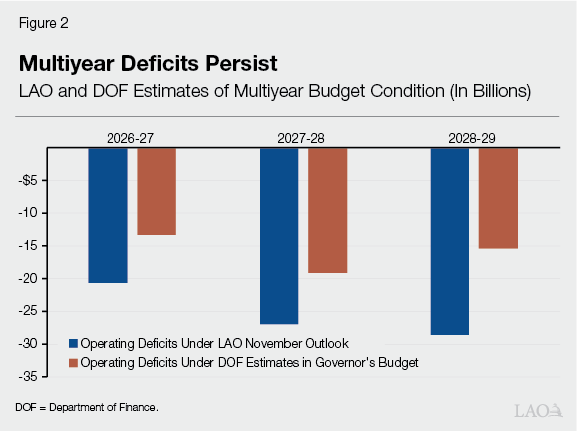

Multiyear Budget Condition. The Governor’s budget includes estimates of multiyear revenues and spending. Under the administration’s projections, the state faces operating deficits of $13 billion in 2026‑27, $19 billion in 2027‑28, and $15 billion in 2028‑29. As shown in Figure 2, these deficits are somewhat smaller than our November 2024 projections of the budget’s position. Although our estimates were based on current law and policy, not the Governor’s budget proposals, the administration does not propose significant spending reductions or revenue increases in future years, so these figures are mostly comparable.

The differences in our estimates are largely attributable to three factors. First, the administration assumes the state continues to suspend deposits into the BSA throughout the multiyear, while we assumed the state would make deposits of around $3 billion to $4 billion each year. Second, the administration’s estimates of revenues are somewhat higher than ours in 2026‑27 and 2027‑28. Third, the administration’s estimate of spending is notably lower than ours in 2028‑29. We do not have detail on the source of this final difference, but it seems to be driven in part by lower spending estimates in health and human services, higher education, and on required debt payments under Proposition 2. That said, in the scope of the budget’s uncertainty for these years, the differences between our estimates and the administration’s estimates are not particularly significant.

School and Community College Budget

Funding for Schools and Community Colleges Up $7.1 Billion Across the Budget Window. Compared with the estimates from June 2024, the administration estimates the constitutional minimum funding level for schools and community colleges is up $7.1 billion. Of this increase, $3.9 billion is attributable to 2024‑25 and $3.2 billion is attributable to 2025‑26. (Spending is unchanged in 2023‑24.) The increase is due almost entirely to higher General Fund revenue estimates. Local property tax estimates, by contrast, are similar to the estimates from June. In addition, approximately $4 billion in one‑time spending expires in 2025‑26, freeing‑up the underlying funding for other school and community college purposes.

Makes Required Reserve Deposits Into Proposition 98 Reserve. The Proposition 98 Reserve is a statewide reserve account for school and community college funding. Under the Governor’s budget, the state would make mandatory deposits of $1.2 billion in 2024‑25 and $376 million in 2025‑26. These deposits would bring the balance in the reserve to $1.5 billion. (The state previously withdrew the entire balance to address shortfalls in 2023‑24.) The mandatory deposit in 2024‑25 replaces a $1.1 billion discretionary deposit included in the June 2024 budget.

Funds Some Ongoing Increases. The Governor’s budget provides approximately $2.5 billion to fund a 2.43 percent statutory cost‑of‑living adjustment for existing school and community college programs. Consistent with previous legislation, the budget sets aside $1.1 billion to complete the expansion of transitional kindergarten in 2025‑26. The budget also provides $746 million to reduce student‑to‑adult ratios in transitional kindergarten classrooms from 12:1 to 10:1. The budget provides a $435 million increase for the Expand Learning Opportunities Program. This augmentation is primarily to increase the number of school districts that must offer enrichment programs (such as after school activities and summer school) to all of their students. The budget also includes $30 million to support 0.5 percent systemwide community college enrollment growth.

Allocates One‑Time Funds for Discretionary Grants, Staffing Enhancements, and Technology Activities. The largest one‑time proposal is to provide $1.8 billion for schools through a new discretionary block grant that could be used to fund new activities or cover costs of existing programs. The budget also includes $500 million to fund literacy and mathematics coaches at high‑poverty schools. This proposal would expand upon a program the state funded in previous budgets. In addition, the Governor proposes a series of initiatives intended to advance teacher training and recruitment efforts at schools and implement a common technology platform across the community college system.

Delays $1.6 Billion Payment in 2024‑25 Pending Revised Revenue Data. As described earlier, under the Governor’s budget, total funding for schools and community colleges in 2024‑25 would be $1.6 billion less than the administration’s estimate of the constitutional minimum funding level that year. The administration indicates it will provide this payment in the future after finalizing the calculation of the minimum requirement. According to the administration, this delay is intended to mitigate some of the downside risk to its revenue estimates. More specifically, if state revenues come in below the levels estimated in the budget, the constitutional funding requirement also would decrease. Under this scenario, the state could reduce or eliminate the $1.6 billion payment more easily than if it had already appropriated that amount for schools and community colleges. (The delay only affects 2024‑25. For 2025‑26, the total funding proposed in the budget equals the estimate of the constitutional minimum level.)

Comments

Revenue Estimates Reasonable, but Risks Must Be Kept in Focus. Our November Fiscal Outlook included an upgrade to the state’s revenue outlook in recognition of positive trends in tax collection in recent months. Since then, this trend has continued with strong end‑of‑year income tax withholding and corporation tax payments. The Governor’s budget revenue upgrade, while somewhat higher than ours, is reasonable in light of these recent collection trends. That being said, we continue to be concerned that recent gains are on shaky ground. These gains are not tied to improvements in the state’s broader economy, which has been lackluster, with elevated unemployment, a stagnant job market outside of government and healthcare, and sluggish consumer spending. Instead, the gains appear largely tied to the booming stock market, a situation which can change rapidly and without warning. The administration appears to share some of these concerns, noting recent job losses among high‑wage workers and the risks posed by the inherent volatility of tax receipts tied to stock market gains. Further complicating this muddied picture is the tax deadline delay in response to the Los Angeles fires, which will make it difficult to read tax collection trends over the next several months. We suggest the Legislature take heed of these risks and avoid putting too much stock in the recent revenue rebound until it is accompanied by clear improvements in California’s broader economy.

State Faces Some Additional Cost Pressures. The budget faces some cost pressures that are not included in the administration’s estimates. First, the wildfires in the Los Angeles region have brought devastation, and these events create some budgetary uncertainty for the state. The extent of the state costs from these fires will depend on the continually evolving situation, as well as decisions by the Legislature and federal government, including those related to cost sharing for response, clean up, recovery, and other possible assistance. Second, as described earlier, the Governor’s budget generates a settle‑up obligation to schools and community colleges, which is not accounted for in the administration’s multiyear planning estimates. If revenues for 2024‑25 remain at the level currently forecasted—or come in higher—the state would owe $1.6 billion in additional payments to schools. If revenues are lower, this payment would be lower, but the overall condition of the budget would also be worse.

Governor’s Use of Reserves Remains Reasonable. Last year’s budget package planned for a $7 billion withdrawal from the BSA in 2025‑26. The Governor’s budget maintains this withdrawal. We think this is a reasonable choice. Since 2023‑24, the Legislature has addressed a cumulative total of $82 billion in budget problems, but even including the withdrawal for 2025‑26, has only used about half of the BSA. Using some reserves this year is therefore warranted and gives the Legislature capacity to focus on addressing the budget’s out‑year condition. The Governor’s proposal would also leave another $11 billion remaining in the BSA, which would help the Legislature address budget problems that are likely to occur in the future. As such, we recommend the Legislature maintain the Governor’s approach on the use of reserves in its own budget plan.

Maintain Momentum on Solving Budget Deficits. We recommend the Legislature maintain last year’s momentum by developing a plan for addressing the budget problems on the horizon. While out‑year budget problems of this magnitude have been seen before, the underlying budget dynamics today are particularly challenging for three reasons. First, despite recent gains, revenues have not caught up with expenditures, and questions remain about the sustainability of those continued improvements. Second, under our November estimates, outyear expenditure growth exceeds historically average revenue growth. Ultimately, state revenues are unlikely to grow sufficiently to balance the budget. Third, the budget is currently balanced, but only because the Legislature took significant actions last year—nearly all of which involved one‑time uses of funds, like reserve withdrawals, temporary revenue augmentations, and reductions in temporary spending. This means that, going forward, decisions to balance the budget will involve more difficult trade‑offs.

Oversight Provides Information Needed to Make Difficult Choices. Absent above average revenue growth, the Legislature will have to increase revenues or reduce spending to balance the budget in the coming years. Understanding which programs are working well and those ones in need of adjustment is a key starting place for considering these future budget solutions. While some programs have grown considerably in recent years—and understanding the efficacy of those expansions is critical—the Legislature also could examine whether longer‑standing programs still are achieving desired outcomes. The administration has signaled an interest in starting to address the structural deficits, which is warranted. However, the administration indicated they would not begin address the multiyear budget condition until the May Revision. We advise starting this work now. Waiting until May to conduct this oversight would be too late for the Legislature to exercise its priorities effectively in the final budget. As such, we recommend the Legislature use the next few months to review program performance to develop its own approach to addressing the deficits.

Governor’s Interest in Enhancing Reserve Policies Merited. The Governor has signaled interest in changing the state’s reserve policy by: (1) increasing the cap on BSA required deposits from 10 percent of General Fund taxes to 20 percent of General Fund taxes, and (2) excluding the state’s reserve deposits from the state appropriations limit. We agree that rethinking the state’s reserve policies is merited, particularly in light of increasing volatility in state revenues. The two changes proposed by the Governor are reasonable first steps, but additional changes are warranted. For context, if policies like these had been in place over the last decade, the state would have been required to save only a few billion more in reserves. Meanwhile, since 2023‑24, the Legislature has addressed $82 billion in budget problems. As such, if the Legislature wishes to have substantively more reserves available when responding to downturns or other emergencies, we would recommend also changing the formulas that set aside funds each year to increase how much is saved.