Anita Lee

February 19, 2025

The 2025-26 Budget

Department of Justice

Summary

In this brief, we analyze the Governor’s budget proposals for the Department of Justice (DOJ) related to (1) the Bureau of Forensic Services (BFS) and (2) firearm‑related workload.

Recommend Rejecting Requested General Fund Backfill and Requiring BFS Users to Partially Support BFS. We recommend the Legislature reject the Governor’s proposal to provide an ongoing General Fund backfill—$37 million in 2026‑27, declining to $35 million annually beginning in 2028‑29—to the special fund supporting BFS to address declines in fines and fee revenues. Instead, we recommend the Legislature require (1) users of BFS services to partially support BFS beginning in 2026‑27 and (2) DOJ develop a plan for calculating each agency’s share of the BFS services it uses. We find this new funding structure is a better option for maintaining support for BFS as it reflects the importance of such services to state and local agencies, provides greater incentive to prioritize what workload is sent to DOJ, and minimizes the impact on the state General Fund. BFS has sufficient resources in 2025‑26 to maintain service levels while this new funding structure is implemented.

Direct DOJ to Provide a Framework for Determining What Firearm Workload Should Be Funded by Fee Revenues. We raise no concerns with the Governor’s proposal for $19.2 million in 2025‑26 (mainly from the state General Fund)—declining to $6.4 million ongoing beginning in 2027‑28—to support 11 firearm and ammunition budget proposals as they implement legislative proposals or address increased workload. While some of the General Fund costs may statutorily be supported by the state’s firearm and ammunition special funds, the special funds are unlikely to be fiscally able to do so. Additionally, the legal landscape for what level of firearm regulatory fees are allowable is in flux and the General Fund has a limited capacity for ongoing commitments. As such, we recommend the Legislature direct DOJ to provide a potential framework for determining what firearm and ammunition workload should be funded by fee revenues. Such a report could help inform legislative decision‑making on how such workload could be supported in the future—including what fee levels would be appropriate and how costs should be addressed in the absence of sufficient fee revenues.

Overview

Roles and Responsibilities. Under the direction of the Attorney General, DOJ provides legal services to state and local entities; brings lawsuits to enforce public rights; and carries out various law enforcement activities, such as ensuring lawful ownership or possession of firearms and ammunition. DOJ also provides various services to local law enforcement agencies, including providing forensic services to local law enforcement agencies in jurisdictions without their own crime laboratory. Finally, DOJ manages various databases, including the statewide criminal history database.

Spending Proposed for 2025‑26. As shown in Figure 1, the Governor’s budget proposes $1.3 billion to support DOJ operations in 2025‑26—an increase of $5 million (or 0.4 percent) over the revised amount for 2024‑25. A little more than half of the proposed funding supports DOJ’s Division of Legal Services, while the remainder supports the Division of Law Enforcement and the California Justice Information Services Division (CJIS). Of the total amount proposed for DOJ operations in 2025‑26, $496 million (or 38 percent) is from the General Fund. This is a decrease of $12 million (or 2 percent) from the revised 2024‑25 General Fund amount—reflecting the net effect of a variety of technical and workload budget adjustments. The remaining support for DOJ operations comes from a number of special funds and reimbursements, including from departments for the provision of legal services. The proposed budget would provide DOJ with a total of 6,185 positions in 2025‑26, an increase of 107 positions (or 2 percent) from the revised 2024‑25 level.

Figure 1

Department of Justice Budget Summary

(Dollars in Millions)

|

2023‑24 |

2024‑25 |

2025‑26 |

Change From 2024‑25 |

||

|

Amount |

Percent |

||||

|

Legal Services |

$609 |

$693 |

$690 |

‑$3 |

‑0.4% |

|

Law Enforcement |

297 |

347 |

344 |

‑3 |

‑0.9 |

|

California Justice Information Services |

264 |

273 |

284 |

11 |

4.0 |

|

Totals |

$1,170 |

$1,313 |

$1,318 |

$5 |

0.4% |

DNA Identification Fund Backfill

Background

BFS Provides Criminal Laboratory Services. BFS provides criminal laboratory services such as DNA testing, alcohol and controlled substances analysis, and on‑site crime scene investigative support. Ten regional laboratories provide services generally at no charge for local law enforcement and prosecutorial agencies in 46 counties that do not have access to those services. BFS also assists the 12 counties and 8 cities that operate their own laboratories where BFS offers services their laboratories lack. (Local agencies also contract with private or other governmental laboratories for services.) Additionally, BFS provides service to various state, federal, and other entities. Finally, BFS operates the state’s DNA laboratory as well as the state’s criminalistics training institute.

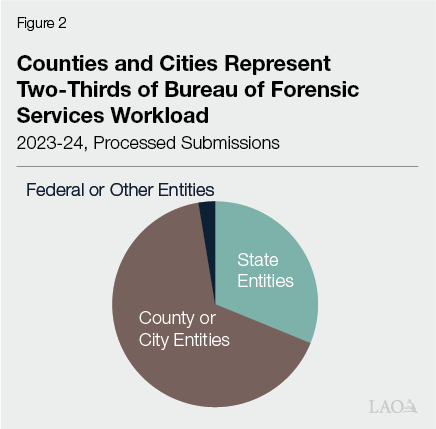

Local Entities Use Most of BFS Services. In 2023‑24, BFS processed 36,422 submissions. As shown in Figure 2, two‑thirds of the processed submissions were for county or city local government entities. About 30 percent of the workload was for state entities, with the California Highway Patrol (CHP) and the California Department of Corrections and Rehabilitation (CDCR) being the two largest users. Additionally, usage of specific types of BFS services varies by entity. For example, state entities proportionately seek a greater share of alcohol or toxicology‑related services. In contrast, counties and cities proportionately seek a greater share of controlled substances, latent print, or criminalistics‑related services.

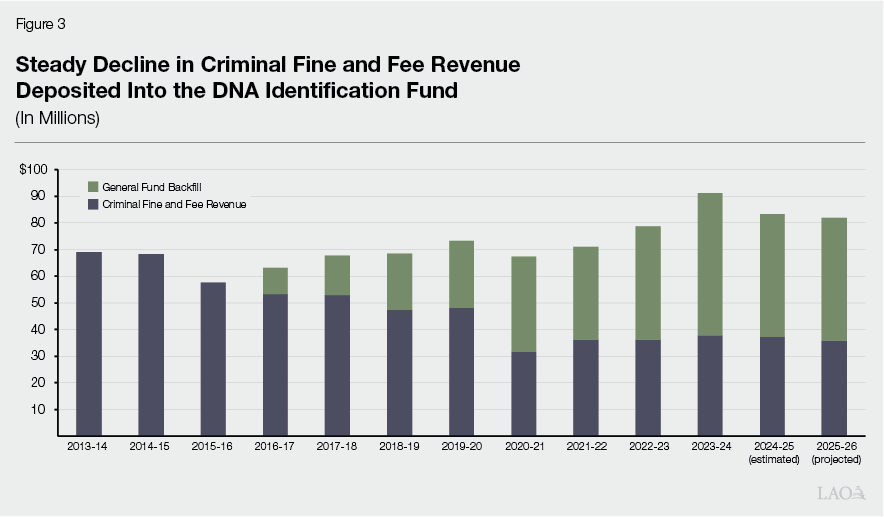

BFS Supported Primarily by DNA Identification Fund, Which Receives General Fund Backfill. BFS receives support from various sources, but primarily from the DNA Identification Fund—a state special fund that receives criminal fine and fee revenue—and the General Fund. As shown in Figure 3, the amount of criminal fine and fee revenue deposited into the DNA Identification Fund has steadily declined from a peak of $69 million in 2013‑14 to $38 million in 2023‑24 (a decline of 45 percent). (This is consistent with the overall trend of decreased criminal fine and fee revenue deposited into the various state and local special funds eligible to receive them. The severity of the decline deposited into a particular fund depends on various factors.) To help address this steady decline and to maintain the level of services provided by BFS, the state has provided General Fund support to backfill the reduction in criminal fine and fee revenue deposited in the DNA Identification Fund since 2016‑17. For example, the 2023‑24 budget package included a three‑year annual $46.1 million General Fund backfill of the DNA Identification Fund. The budget also included budget bill language authorizing the Department of Finance to transfer additional General Fund to the DNA Identification Fund if revenues deposited into fund decline further and are insufficient to support BFS. This transfer can only occur 30 days after written notification is provided to the Legislature.

DOJ Required to Report in 2022 on Potential Funding Options Other Than General Fund. The 2021‑22 budget package required DOJ to provide a report by March 10, 2022 that identified various options—other than the General Fund—to support BFS annually. The budget package specifically directed DOJ to consider an option that would require sharing costs with local agencies that make use of BFS services based on the specific type of forensic services sought, the speed of the service, the size of the agency, and any other factors DOJ chooses to include.

DOJ Report Included Five Potential Funding Options. In response to the above requirement, DOJ provided a report to the Legislature on March 10, 2022. The department identified the following options to support BFS operations: (1) a general tax increase, (2) allowing the surcharge added to criminal history background check fees to also cover BFS costs (and adjusting the surcharge accordingly), (3) increasing the specific fee added when individuals are convicted of criminal offenses which generates the revenue deposited into the DNA Identification Fund, (4) requiring the judicial branch to provide funding to support BFS as it similarly is supported by criminal fine and fee revenue and forensic science is important to courts, and (5) requiring nonlocal government entities (such as CDCR) pay for their share of BFS services. Additionally, DOJ discussed the benefits and drawbacks of various methods for implementing a cost‑sharing model with local agencies. Such methods included establishing: (1) an hourly rate for services provided, (2) a flat fee by type of service provided, (3) a flat fee by county, and (4) a hybrid flat fee‑hourly rate model. After its assessment of the cost‑sharing model and alternative funding options, DOJ maintained that it believes a General Fund backfill is the best approach for supporting BFS annual operations.

Governor’s Proposal

Provides Ongoing General Fund Backfill of DNA Identification Fund. Because the three‑year, $46.1 million annual backfill provided in the 2023‑24 budget will expire at the end of 2025‑26, the Governor’s 2025‑26 budget proposes to provide an ongoing General Fund backfill beginning in 2026‑27. Specifically, the Governor proposes $37 million in 2026‑27, $36 million in 2027‑28, and $35 million annually beginning in 2028‑29. The 2025‑26 budget also maintains the budget bill language allowing DOF to augment the backfill amount. Under this language, the General Fund would be permanently responsible for backfilling the DNA Identification Fund to ensure there is sufficient funding to support BFS.

Assessment

Governor’s Proposal Would Permanently Address Ongoing Decline in DNA Identification Fund Revenues… The Governor’s proposal would fully address the ongoing decline in DNA Identification Fund revenues and provide BFS with a stable level of funding. This is because, under the budget bill language, the General Fund would be permanently responsible for supporting any BFS costs that cannot be supported by the DNA Identification Fund.

…But Requires Trade‑Off With Other Budget Priorities. The Governor’s proposal would commit the state to providing roughly $35 million General Fund annually over the next few years, and potentially even more in the following years. This approach comes with significant trade‑offs for other parts of the state budget. Given the state’s current fiscal position—with a budget that is roughly balanced in 2025‑26 and notable deficits projected in the out‑years—the state does not have capacity for new ongoing commitments. As a result, in future years, this proposed ongoing spending will likely crowd out other areas of spending and require even further budget solutions, such as reduced spending for other existing state programs.

Governor’s Proposal Maintains Key Weaknesses of the Current System. Both the state and local governments have a role in supporting criminal laboratory services because these services are generally needed to investigate and prosecute criminal cases at both the state and local level. However, the current approach to funding and providing these services—which the Governor’s proposal would maintain and extend—has two key weaknesses:

- Many Local Governments Rely on State to Pay for All Forensic Service Costs. City and county law enforcement and prosecutorial agencies are predominantly responsible for collecting and submitting forensic evidence for testing, as well as using the evidence to pursue criminal convictions in court. However, 46 counties and a number of cities rely almost exclusively on the state for these services, which in turn costs the state tens of millions of dollars annually.

- Many Users Lack Incentive to Use BFS Services Cost‑Effectively. BFS’s current funding structure provides the agencies it serves with little incentive to use its services in a cost‑effective manner. For example, since BFS does not charge for its services, local agencies lack incentive to prioritize what forensic evidence is collected and submitted for testing. Their submissions instead are generally only limited by BFS’s overall capacity and service levels, as determined by the amount of funding provided to the bureau in the annual state budget. In contrast, counties and cities that use their own resources to support their labs—or those that decide they want to pay a private laboratory for testing—have a greater incentive to carefully prioritize what evidence should be tested and how quickly it should be done. Similar to local governments, nonlocal government entities that use BFS services (such as CHP and CDCR) lack a financial incentive to prioritize what evidence is submitted for testing.

Alternative Approach Requiring BFS Users to Partially Support BFS Would Address Key Weaknesses. An alternative approach that uses a cost‑sharing model by requiring BFS users to pay a portion of BFS costs would help address the weaknesses we see in the Governor’s approach. First, since these forensic services are essential to their law enforcement and prosecutorial responsibilities, sharing the costs with these agencies—rather than having the state directly bearing all of the costs—is a more appropriate allocation of fiscal responsibility. In addition, requiring agencies to pay for a portion of the BFS services they use would provide them a greater incentive to carefully prioritize what evidence should be tested and how quickly it should be done.

Other Potential Alternative BFS Funding Options Identified by DOJ Raise Concerns. In our review of DOJ’s March 2022 report, we identified various concerns about the viability of the other potential funding options identified. For example, one potential funding option discussed in the report was to increase the specific fee added when individuals are convicted of criminal offenses which generates the revenue deposited into the DNA Identification Fund. Given the state’s complex formula for distributing criminal fine and fee revenue, there is no guarantee that increasing this specific fee will actually increase the amount of revenue deposited in the DNA Identification Fund annually. This is due to the complex formula that dictates the order in which special funds receive criminal fine and fee revenue that is collected. Given the fund’s priority order in this formula, it is not certain that it would receive the expected revenues as funds with a higher‑priority order could receive the bulk of any additional revenue collected. Our concerns with the remaining potential funding options can be found in an earlier publication: The 2023‑24 Budget: Department of Justice Proposals.

Recommendations

Forensic services are important to various agencies in the investigation and prosecution of criminal cases. Accordingly, it is important that BFS receives relatively stable funding to process its workload. This has been challenging in recent years due to the continual decline in revenue in the DNA Identification Fund. The Governor’s budget proposes to stabilize funding by providing an ongoing General Fund backfill to the DNA Identification Fund. In contrast, we recommend an alternative approach that minimizes the impact on the General Fund; increases BFS users’ roles in the provision of forensic services, consistent with these services being essential to their law enforcement and prosecutorial responsibilities; and results in such users having incentive to prioritize the workload that is submitted. Specifically, we recommend the Legislature reject the Governor’s proposed ongoing General Fund backfill beginning in 2026‑27. We also recommend the Legislature require (1) users of BFS services to partially support BFS beginning in 2026‑27 and (2) DOJ to develop a plan for calculating each agency’s share of the BFS services it uses. We discuss each of our recommendations in greater detail below.

Reject Governor’s Proposal. We recommend the Legislature reject the Governor’s proposal to provide an ongoing General Fund backfill to the DNA Identification Fund to support BFS beginning in 2026‑27. As noted above, the $46.1 million backfill provided for 2025‑26 remains unchanged. As such, BFS already has sufficient resources to maintain its service levels in the coming year while a new funding structure (which we describe below) is implemented.

Require Local Users of Forensic Services to Partially Support BFS Beginning in 2026‑27. We recommend the Legislature require local governments to partially support BFS beginning in 2026‑27. Agencies that receive services from BFS would be required to pay for a portion of the services they receive, consistent with this being essential to their law enforcement and prosecutorial responsibilities. Additionally, this would provide them with greater incentive to prioritize what workload they send to DOJ. Delaying this change to 2026‑27 provides time for the implementation of a new funding structure and to allow agencies to adapt to the new funding framework.

Require Nonlocal Users of Forensic Services to Partially Support BFS Beginning in 2026‑27. Similarly, we recommend the Legislature require nonlocal government agencies to partially support BFS by paying for a portion of the services they receive from their operational budgets beginning in 2026‑27. For example, CDCR could be directed to pay for its share of BFS services from its operational budget. This is consistent with these services being important to CDCR’s law enforcement mission. It would also provide CDCR with incentive to consider what evidence, and the amount of evidence, that is submitted. (We note that this would be similar to the DOJ Legal Division billing state agencies for the costs of providing legal advice and service.) Alternatively, the Legislature could designate specific portions of the General Fund it provides to BFS as being exclusively to provide services for each entity—effectively capping the amount of service the entity would receive. Because this amount would be limited, it would similarly provide an incentive for these entities to consider what evidence is submitted and why it is submitted. We note that adopting this recommendation could require some level of increased resources for state agencies that receive BFS services, such as CHP and CDCR. However, this would come at no net General Fund cost as it would correspondingly reduce the General Fund backfill needed to support BFS.

Require DOJ to Develop Plan for Calculating User Share of BFS Support. To support the alternative funding structure identified above, we recommend the Legislature direct DOJ to submit a plan for calculating each agency’s share of the BFS services it uses—including operating and facility costs—and report on this plan no later than October 1, 2025 to allow for its consideration as part of the 2026‑27 budget. We also recommend the Legislature provide DOJ with direction on how much of BFS operation revenues should come from local, state, and other agencies (such as one‑third or one‑half), as well as whether the Legislature plans to directly appropriate a specific General Fund amount to support a certain level of services for state agencies. While the Legislature would determine the amount of revenue DOJ should aim for, we recommend giving DOJ flexibility in calculating each agency’s cost share of BFS services—including operation and facility costs—based on consultation with stakeholders and after considering various factors (including equity concerns). For example, DOJ could require agencies pay more or less based on various factors—such as the specific type of forensic service sought, the speed of the service, or the size of the agency. We acknowledge that developing such a plan may be difficult. However, we believe that the effort is well‑merited as it would result in notable benefits by minimizing impact on the state General Fund and permanently addressing the key weaknesses with the existing system by increasing BFS users’ roles in the provision and use of such services in a cost‑effective manner.

Funding for Firearm‑Related Workload

Background

Bureau of Firearms (BOF) Primarily Responsible for Regulating and Enforcing State’s Firearm and Ammunition Laws. DOJ’s BOF is primarily responsible for the regulation and enforcement of the state’s firearm and ammunition laws. This includes conducting background checks for individuals seeking to purchase firearms and ammunition, licensing firearm and ammunition vendors, conducting vendor compliance investigations, ensuring lawful possession of firearms and ammunition, and administering various other firearm and ammunition programs. BOF engages in various activities related to these responsibilities. For example, BOF has enforcement teams who are primarily responsible for investigating the illegal purchase or possession of firearms and ammunition, as well as seizing them from individuals who are prohibited from owning or possessing them.

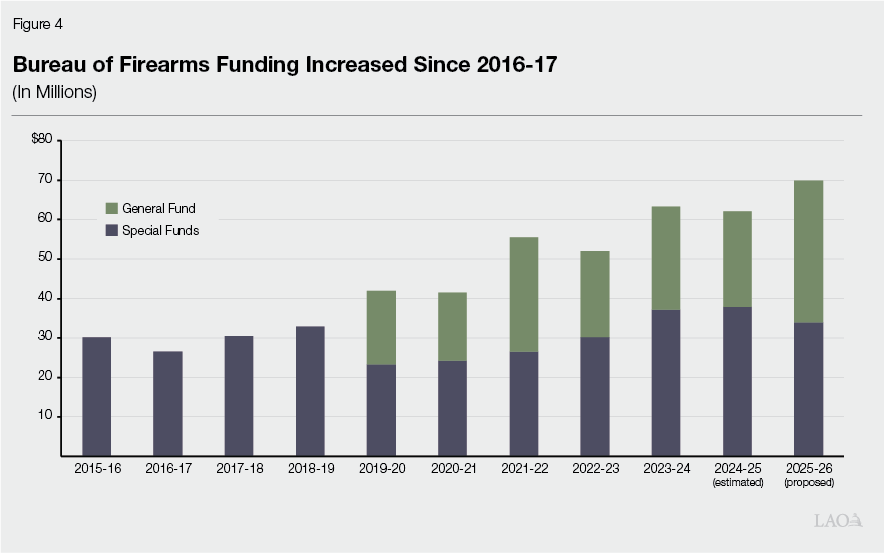

Overall BOF Funding and General Fund Support Increased Over Past Decade. As shown in Figure 4, support for BOF has increased over the past decade from $30.2 million in 2015‑16 to $62.1 million in 2024‑25—an increase of $31.9 million (or 106 percent). During this period, BOF also shifted from being fully supported by various special funds and began receiving General Fund support in 2019‑20. Of the total $62.1 million provided to BOF in 2024‑25, $24.1 million (or 39 percent) was from the General Fund and $37.9 million (or 61 percent) was from various special funds. Most of the General Fund is used to support the Armed and Prohibited Persons System (APPS) enforcement teams, which seize firearms from individuals prohibited from owning or possessing them. This has been the case since 2019‑20 when the budget package shifted full support of these teams over to the General Fund. (We also note that CJIS separately receives millions of dollars annually from several fund sources to maintain and update various databases needed to support BOF’s activities, such as the Automated Firearms System, which tracks firearm serial numbers.)

Five Firearm or Ammunition Related Special Funds Support BOF Workload. Separate from the General Fund, five firearm and ammunition‑related special funds support BOF workload. These five funds include: (1) Dealers’ Record of Sale (DROS) Special Account, (2) Firearms Safety and Enforcement Special Fund, (3) Firearm Safety Account, (4) Ammunition Safety and Enforcement Special Fund, and (5) Ammunition Vendors Special Account. State law authorizes DOJ to charge various fees related to firearms and ammunition that are deposited into these funds to support BOF programs and activities. For example, an individual purchasing a firearm currently pays fees totaling $37.19—a $31.19 fee deposited into the DROS Special Account (the “DROS fee”), a $5 fee into the Firearm Safety and Enforcement Special Fund, and a $1 fee into the Firearm Safety Account. State law also authorizes DOJ to administratively increase some of these fees to account for inflation as long as the fee does not exceed DOJ’s regulatory and enforcement costs. State law authorizes revenues deposited into each of these special funds to be used for various purposes.

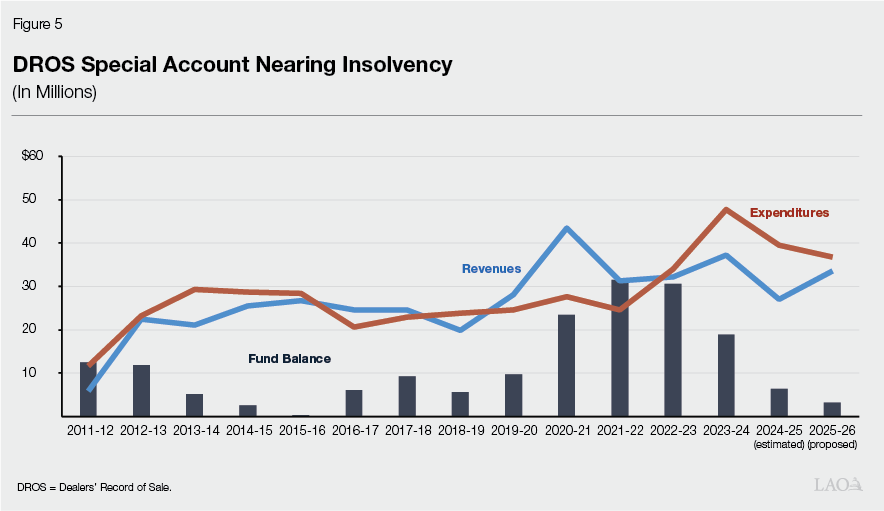

DROS Special Account Is the Primary Special Fund Supporting BOF. The DROS Special Account is the primary special fund supporting BOF activities. This is because it receives the most fee revenue. Additionally, the statutorily permissible uses of the fund are quite broad. Specifically, the DROS Special Account may generally be used to offset DOJ’s reasonable costs of firearm‑related regulatory and enforcement activities pertaining to the sale, purchase, manufacturing, lawful or unlawful possession, loan, or transfer of firearms. As shown in Figure 5, DROS Special Account revenues often fluctuate from year to year, generally reflecting changes in fee levels and the number of firearms sold. DROS Special Account expenditures routinely exceeded revenues prior to 2019‑20—resulting in the decline of the fund balance. To help ensure sufficient revenues would be available to support BOF workload, Chapter 736 of 2019 (AB 1669, Bonta) enabled DOJ to increase the DROS fee charged from $19 to $31.19. For a couple years after this fee increase, revenues generally exceeded expenditures—thereby allowing the fund balance to steadily grow. However, beginning in 2022‑23, expenditures began outpacing revenues, shrinking the fund balance. The Governor’s budget estimates $33.5 million in DROS Special Account revenues in 2025‑26 and expenditures of $36.7 million, resulting in a fund balance of $3.2 million at the end of the year.

Governor’s Proposal

The Governor’s budget proposes $19.2 million in 2025‑26 ($18.6 million General Fund and $640,000 from various special funds)—declining to $6.4 million ongoing ($5.8 million General Fund and $519,000 from the Fingerprint Fees Account) in 2027‑28—to support DOJ firearm workload. As shown in Figure 6, the proposed funding would support 11 budget proposals—including eight related to workload resulting from recently enacted legislation.

Figure 6

Summary of Governor’s Firearm Workload Proposals

|

Workload |

Proposed Resources |

Description |

|

Recently Enacted Legislation |

||

|

Chapter 527 of 2024 (AB 2629, Haney) |

$198,000 General Fund in 2025‑26. |

Prohibits people found mentally incompetent to stand trial in a post release community supervision or parole revocation hearings from possessing or receiving a firearm. DOJ seeks additional resources to update its existing databases to reflect such requirements. |

|

Chapter 529 of 2024 (AB 1252, Wicks) |

5 positions and $1 million General Fund in 2025‑26, declining to $952,000 annually in 2026‑27. |

Establishes the Office of Gun Violence Prevention within DOJ, which advises the Attorney General on gun violence prevention‑related issues. By July 2026, the office is required to issue a public report on achieving sustained gun violence reduction. |

|

Chapter 538 of 2024 (AB 2907, Zbur) |

$165,000 General Fund in 2025‑26. |

Requires the courts and law enforcement take additional actions to ensure that a person subject to a protective order relinquishes any firearm in their possession. These include querying a DOJ database, and providing a copy of the results to prosecutors. DOJ seeks resources to increase the number of results displayed for each query. |

|

Chapter 539 of 2024 (AB 2917, Zbur) |

1 position and $138,000 General Fund in 2025‑26, declining to $125,000 annually in 2026‑27. |

Expands factors a court must consider when determining whether to issue a gun violence restraining order. DOJ seeks additional workload this will generate for its Armed Prohibited Person System. |

|

Chapter 540 of 2024 (AB 3064, Maienschein) |

$489,000 ($398,000 General Fund and $91,000 FSA) in 2025‑26 and $156,000 ($78,000 General Fund and $78,000 FSA) in 2026‑27. |

Authorizes DOJ charge fees, beginning January 2026, to cover certain costs related to approving devices for its firearm safety devices roster and requires DOJ to manage the roster. |

|

Chapter 542 of 2024 (SB 53, Portantino) |

$212,000 ($181,000 General Fund; $16,000 Gambling Control Fund; $15,000 Indian Gaming Special Distribution Fund) in 2025‑26 and $80,000 ($67,000 General Fund; $7,000 Gambling Control Fund; $6,000 Indian Gaming Special Distribution Fund) in 2026‑27. |

Adds gun storage requirements and requires DOJ to (1) inform the public of the requirements and (2) comply with the requirements itself. |

|

Chapter 544 of 2024 (SB 899, Skinner) |

$43,000 General Fund in 2025‑26. |

Extends firearm and ammunition relinquishment procedures that currently apply to domestic violence restraining orders to various restraining or court protective orders. Requires DOJ to add ammunition relinquishment language to some of these orders. |

|

Chapter 546 of 2024 (SB 965, Min) |

1 position and $180,000 General Fund in 2025‑26, declining to $161,000 annually in 2026‑27. |

Requires DOJ to annually report on staffing levels for conducting firearm dealer and ammunition vendor inspections, information about each inspection conducted, and specified information about the roster of handguns DOJ maintains. |

|

FITSM |

17 positions and $11.4 million General Fund in 2025‑26. |

Resources to continue development of FITSM, including solution planning, development, procurement, evaluation, and selection for the project which replaces 17 existing firearm and ammunition databases and systems. |

|

Carry Concealed Weapon Program |

26 positions and $3.2 million ($2.7 million General Fund and $519,000 FFA) annually beginning in 2025‑26. |

Permanent funding to address increased carry concealed weapon license workload from the elimination by the federal courts of the requirement to show good cause for such a license. |

|

Firearms Clearance Section Workload |

14 positions and $2.2 million General Fund in 2025‑26, declining to $1.9 million annually in 2026‑27. |

Resources to ensure the timely completion of firearm and ammunition eligibility check workload. |

|

DOJ = Department of Justice; FSA = Firearms Safety Account; FITSM = Firearms IT Systems Modernization Project; and FFA = Fingerprint Fees Account. |

||

Assessment

Proposals Reasonable, but Some Could Statutorily Be Funded by Special Funds… We generally find the requested budget proposals to be reasonable as they support increased workload and the implementation of new legislation. However, a majority of these proposals that are requesting full or partial General Fund support could statutorily be funded by DOJ’s firearm and ammunition special funds—most notably the DROS Special Account as it has the broadest statutorily permissible uses. This is because they generally pertain to DOJ regulatory or enforcement actions to ensure the lawful ownership or possession of firearms.

…While Some Could Not. At least three budget proposals could not statutorily be funded by these special funds and are appropriately seeking General Fund resources. One of these proposals is Chapter 529 of 2024 (AB 1252, Wicks), which would create a new Office of Gun Violence Prevention that focuses on gun violence prevention rather than regulatory or enforcement issues, meaning the activities are generally outside the permissible activities for funding by the five special funds. Another proposal is Chapter 539 of 2024 (AB 2917, Zbur), which seeks additional resources for the APPS System—for which support was previously shifted to the General Fund, as mentioned above. Finally, the third proposal is Chapter 546 of 2024 (SB 965, Min), which seeks additional resources for data reporting. The required reporting generally appears to fall outside of the regulatory or enforcement activities that can be supported by the five special funds.

Special Funds Currently Unlikely to Be Able to Support All Permissible Costs. While a number of the budget proposals could statutorily be supported by the five firearm and ammunition special funds, these special funds are unlikely to fiscally be able to support all of the permissible costs. If all permissible General Fund costs in these requests were shifted from the General Fund to these special funds, more than $15 million would be shifted in 2025‑26—with at least $5 million shifted on an ongoing basis. The DROS Special Account (assuming approval of the Governor’s proposals and no additional changes) faces potential insolvency in 2027‑28, even without shifting the allowable cost of these proposals to the fund. The four other special funds similarly would be unable to support all of these costs. This is because they face structural shortfalls in which expenditures exceed revenues, generally receive less revenue, or can only be used for a relatively narrow number of activities.

State Typically Set Fees to Support Regulatory or Enforcement Activities… The state typically establishes fees to fully support state entity costs to license, regulate, and enforce laws within a particular industry. A key example is the state’s licensing and regulatory activities for various professions—such as lawyers, doctors, and accountants—overseen by the Department of Consumer Affairs (DCA). Nearly the entire $753 million 2024‑25 budget for DCA is supported by fees charged to each profession. Such fees are regularly adjusted or approved by the Legislature as needed to cover increased workload and costs.

…But Recent U.S. Supreme Court Comment on Firearm Regulatory Fees Raises Questions About This Approach. In June 2022, the U.S. Supreme Court issued a decision in the New York State Rifle & Pistol Association v. Bruen case that found laws requiring individuals provide “good cause” to carry a concealed weapon to be unconstitutional. As a result, states that want to regulate an individual’s ability to carry concealed weapons (including California) must have “shall‑issue” regulatory regimes, meaning such states are required to issue carry concealed permits to individuals seeking them if the individuals meet nondiscretionary criteria. The decision included the following footnote: “Because any permitting scheme can be put towards abusive ends, we do not rule out constitutional challenges to shall‑issue regimes where, for example, lengthy wait times in processing license applications or exorbitant fees deny ordinary citizens their right to public carry.” This footnote suggests that there may be a point where firearm regulatory fees become unconstitutionally high.

Concerns With DROS Special Account Insolvency Led to Greater Use of General Fund… As shown in Figure 4, support for BOF followed a fee‑based funding structure through 2018‑19, with all BOF costs supported by special funds. This changed in 2019‑20 when the state decided to shift full support for the APPS Program from the special funds to the General Fund, in part to address the solvency of the firearm special funds. With the passage of Chapter 736 to increase the fee deposited into the DROS Special Account, the Legislature took steps to shift more of the cost of BOF back onto special funds. Despite that action, DOJ firearm‑related costs stemming from increased workload, newly enacted legislation, and the Firearms Information Technology Systems Modernization (FITSM) project continued to push the fund toward insolvency. (FITSM is a technology project currently in progress that would replace 17 existing firearm and ammunition databases and systems.) The looming insolvency of the DROS Special Account has led to DOJ increasingly requesting General Fund resources to support firearm‑related workload that can statutorily be supported by the special funds. In 2025‑26, the Governor’s budget projects that 51 percent of support for BOF will come from the General Fund.

…Leading to Inconsistencies in How Workload Is Funded… The increasing provision of General Fund has led to some inconsistency in what is funded by the General Fund versus the firearm special funds. For example, the 2023‑24 budget package included $19.3 million in 2023‑24 (decreasing to $6 million annually beginning in 2026‑27)—mostly from the DROS Special Account—for the implementation of five pieces of enacted legislation, increased or new baseline workload, and the continuation FITSM. In contrast, the 2024‑25 budget package included $16.2 million in 2024‑25 (decreasing to $11.9 million annually in 2028‑29)—mostly from the General Fund—for the implementation of five pieces of enacted legislation and the continuation of FITSM. Both budget packages included some budget requests to fund similar types of workload but this workload was supported with different fund sources in each budget act. For example, FITSM was funded by the DROS Special Account in 2023‑24 and the General Fund in 2024‑25. The Governor’s budget proposes General Fund support for FITSM in 2025‑26.

…Suggesting State May Want to Examine Its Regulatory Fee Structure, Particularly Given Limited General Fund Capacity for Ongoing Commitments. The inconsistencies in how the state supports current firearm workload and the changing legal landscape suggests the state may want to examine its regulatory fee structure to more consistently determine what regulatory and enforcement activities should be supported by regulatory fees versus the General Fund. This would then help the Legislature determine the appropriate fee levels for existing and future costs. This is especially critical given the multiyear deficits facing the state that leave no capacity for new ongoing commitments, meaning any additional General Fund provided for firearms regulation would likely require reduced spending for other existing state programs. For example, FITSM will require significant resources—potentially in the hundreds of millions of dollars—in the coming years to be completed. To the extent that fees are available to support BOF activities, it would minimize the need for General Fund resources. To the extent fee revenues are not available to support DOJ’s firearm‑related workload, General Fund could be necessary—but would come at the cost of other budget priorities.

Recommendations

We raise no concerns with the Governor’s request to fund 11 firearm and ammunition budget proposals as they implement legislative proposals or address increased workload. However, we have broader concerns with how the state supports firearm‑related workload in the future—specifically what portion of such workload is supported by regulatory fees versus the General Fund. This is particularly important given the multiyear deficits facing the state which mean that any additional General Fund spending would require reductions in other state programs. We discuss our two recommendations to address this broader concern below.

Direct DOJ Provide a Framework for Determining What Workload Should Be Funded by Fee Revenues. We recommend the Legislature direct DOJ to provide the Legislature with a potential framework by January 10, 2026 for determining what firearm and ammunition workload should be funded by special fund fee revenues. In developing this framework, DOJ can evaluate its entire workload, the potential impact of FITSM and other actions that can help improve efficiency, and existing federal and state statute and case law. The framework should provide clear explanations for how the identified workload should be funded, the calculation of appropriate fee levels and how such calculations were reached, recommendations for how frequently the fees should be adjusted and the process by which they should be adjusted, and any recommendations for statutory changes specifying the allowable uses for the special fund revenues. Such a report could help inform legislative decision‑making on how such workload could be supported in the future.

Use Framework to Inform Future Actions. The Legislature could use the DOJ framework to inform its future actions. This could include appropriately aligning firearm and ammunition‑related workload with the appropriate fund source. This would then allow the Legislature to determine what fee levels it is comfortable with—which could be higher or lower than those recommended by DOJ. If the fee levels are lower than current or projected costs, the Legislature would be better equipped to assess (1) how much of this workload needs to be supported from the General Fund at the cost of other budget priorities or (2) whether the cost of the workload needs to be reduced—such as through statutory or other changes—to avoid such budgetary trade‑offs.