February 26, 2025

The 2025-26 Budget

MCO Tax and Proposition 35

Summary

In November 2024, California voters approved Proposition 35, which notably changes the spending plan for the state’s managed care organization (MCO) tax. Accordingly, the Governor’s budget includes an initial spending plan to implement the measure, with many key details still forthcoming. This spending plan appears to be reasonable, though the administration does not have a complete implementation plan to assess at the moment.

Pursuant to the measure, legislative appropriation of MCO tax revenues is not required to implement Proposition 35. That said, the Legislature has a role in overseeing how the administration structures and implements the health program augmentations required under the measure. Moreover, the measure could create General Fund cost pressures down the road, particularly if key fiscal uncertainties around the MCO tax materialize in the future. To this end, we recommend the Legislature begin providing early oversight, focusing on a few key issues that we discuss in this post as more details emerge.

Background

In this section, we provide background on (1) the MCO tax; (2) the state’s previous MCO tax spending plan; and (3) Proposition 35, which replaces the state’s previous plan with new rules.

MCO Tax

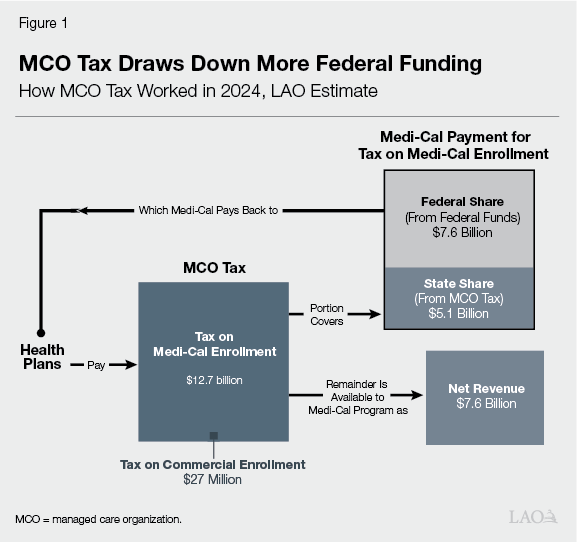

State Charges Specific Tax on Health Plans. For more than a decade, the state has charged a specific tax on health plans (such as Kaiser Permanente and Anthem Blue Cross) called the MCO tax. It has worked differently over time, but in recent years has been based on each plan’s monthly enrollment in the Medi-Cal program (California’s Medicaid program, which covers health care for low-income people) and in the commercial market. Though each sector comprises around half of plans’ taxable enrollment, more than 99 percent of the MCO tax revenue comes from Medi-Cal enrollment. This is because the Medi-Cal tax rate is significantly higher (more than 150 times higher) than the commercial tax rate.

Tax Generates Billions of Dollars in Net Revenue to California… The MCO tax currently generates more than $12 billion in gross revenue annually, but less than $8 billion in net revenue is available to the state to spend. This is because of a state arrangement that covers each health plan’s cost of paying the tax on Medi-Cal enrollment. Under federal Medicaid policy, the MCO tax is part of plans’ cost of enrolling Medi-Cal beneficiaries. Accordingly, Medi-Cal includes funds to cover the cost of the tax in its payments to plans. As Figure 1 shows, Medi-Cal covers the tax-specific payment using a portion of MCO tax funds and—like most other Medi-Cal payments—federal funds.

…Primarily by Drawing Down More Federal Funding. Because of the state’s arrangement, most of the cost of the MCO tax effectively falls on the federal government. Put another way, the tax on Medi-Cal enrollment generates revenue to the state by drawing down more federal funding, rather than imposing costs on health plans. The commercial tax, by contrast, does impose costs on health plans, which in turn likely recover at least some of this cost by increasing premiums on consumers. This impact likely is minimal, however, given the relatively small commercial tax rate ($1.75 per monthly enrollee in 2024).

Net Revenue Historically Supported Medi-Cal Program, Freeing Up General Fund Support. The MCO tax does not directly support the state’s General Fund. Instead, the state deposits funds into special fund accounts, spending the resulting money on the Medi-Cal program. That said, historically the state has used funds to pay for existing service levels in Medi-Cal. Using funds in this way meant that the state needed less money from the General Fund to pay for Medi-Cal services, freeing up General Fund support for other budget priorities.

Tax Has Been Approved for Limited Periods of Time by Legislature and Federal Government. As with most other state taxes, the Legislature historically has had to approve the MCO tax for it to go into effect. Unlike most other state taxes, however, federal approval also is required. This is because the state uses the tax to draw down federal funds to support the Medi-Cal program. Federal approval is conditioned on meeting specified rules and is for limited periods of time. For this reason, the Legislature historically approved the tax for limited periods of time, renewing the tax every few years and adjusting its structure to remain compliant with federal rules.

Previous State MCO Tax Spending Plan

State Recently Increased Tax. The Legislature most recently renewed the MCO tax in the 2023-24 budget, extending it through the end of 2026. As part of this renewal, the Legislature notably increased the size of the tax—eventually more than tripling it. Nearly all of the revenue growth came from increasing the tax on Medi-Cal enrollment. As a result, the increase reflected substantially more federal funding to the state.

State Used Larger Tax for Two Key Purposes. With a much larger tax in place, the Legislature also changed how it used the MCO tax. The new plan still primarily focused on the Medi-Cal program, but with two key uses, described below.

Supporting Existing Medi-Cal Program (Offsetting General Fund Spending). A portion of MCO tax revenue was to support existing service levels in the Medi-Cal program—the historic use of the MCO tax. This use would continue freeing up General Fund spending for other purposes.

Supporting Augmentations. The remaining portion of MCO tax revenue was to support health program augmentations—a new use of MCO tax funds. Most were increases for Medi-Cal provider rates, such as rates for physician and hospital services. A few augmentations also supported certain health programs outside of Medi-Cal, such as workforce initiatives at the University of California (UC) and the Department of Health Care Access and Information (HCAI).

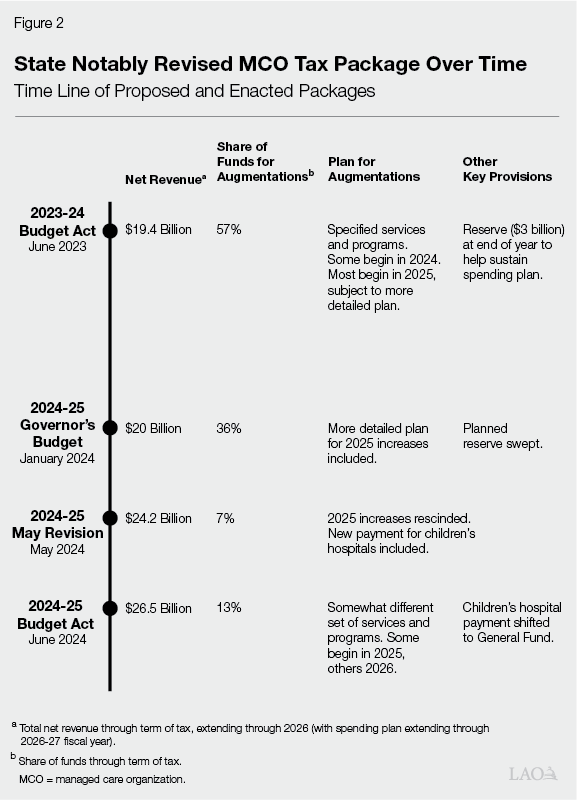

Spending Plan for MCO Tax Evolved Over Time. Though initially enacted as part of the 2023-24 budget, the MCO tax spending plan changed markedly over time. As Figure 2 shows, these changes generally further increased the size of the tax while reducing the share of funds used for augmentations. The specific services and programs receiving augmentations also changed somewhat, with the spending plan at the 2024-25 budget looking different than the initial plan. Many of these changes were budget solutions, using more MCO tax funds to offset General Fund spending in light of the state’s deteriorating budget condition.

Proposition 35 Ended State’s MCO Tax Spending Plan. In fall 2023, proponents drafted and circulated a voter initiative related to the MCO tax. This initiative, which would eventually become Proposition 35, included new rules around how to spend MCO tax funds. As a result, when the Legislature adopted its revised MCO tax spending plan in 2024-25, the trailer bill legislation included trigger language ending the planned augmentations in the event voters approved the measure. Voters subsequently approved Proposition 35 in November 2024, officially ending the state’s previous spending plan.

Proposition 35

Makes MCO Tax Permanent, Subject to Periodic Federal Approval. Under Proposition 35, the MCO tax is now permanent under state law. That is, the tax no longer requires approval from the Legislature to go into effect. The tax must still receive federal approval, however. This means that the Department of Health Care Services (DHCS), which administers the MCO tax and the Medi-Cal program, must periodically submit new versions of the tax for federal approval. Proposition 35 allows DHCS to change the MCO tax structure to get federal approval, within certain limits. Most notably, the measure limits the size of the tax on commercial enrollment, thereby continuing to limit the tax’s effect on the commercial market and consumers.

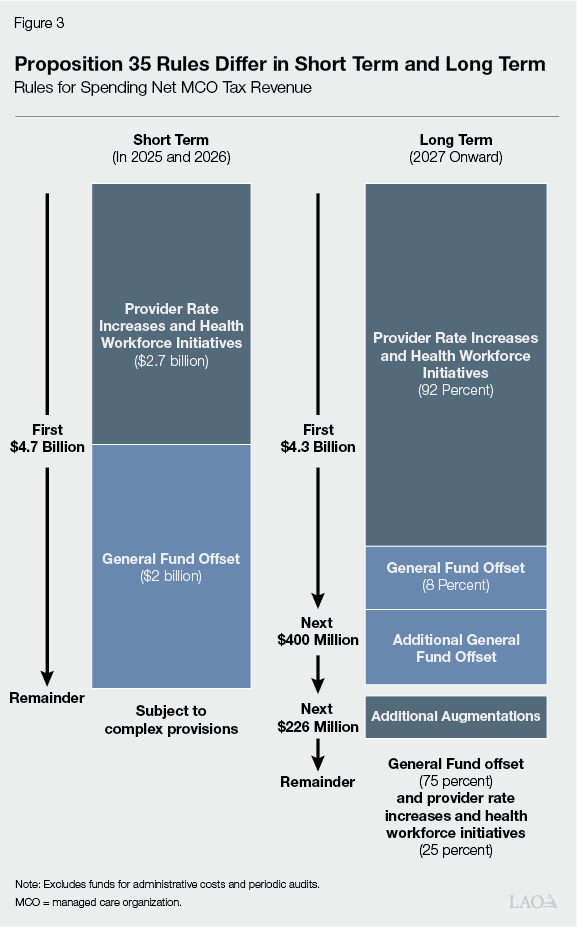

Creates New Rules to Spend Net Revenue, With Differences in Short and Long Term. Proposition 35 also creates new rules around how to spend the MCO tax revenue. Generally, these rules require more MCO tax funding to go for augmentations than in the most recent state spending plan. As Figure 3 shows, the rules differ in the short term (during the term of the existing tax) and in the long term (beginning in 2027, when the tax is renewed), described below.

Short Term (2025 and 2026). In the first two years, the state must spend specified amounts of money on certain augmentations and to offset General Fund spending on Medi-Cal, totaling $4.7 billion. Generally, this requirement follows the initial MCO tax spending plan enacted in the 2023-24 budget, which was still in effect when the proponents drafted the measure in fall 2023. (As we describe later, the Governor’s budget uses most of the funding above $4.7 billion to offset General Fund spending. While the measure did not directly anticipate funds above this amount, we find this proposed use of these funds to be reasonable.)

Long Term (2027 and Onward). Beginning in 2027, the measure creates new rules, depending on how much net revenue the tax raises. For example, for the first $4.3 billion, the state must spend 92 percent of the funds on specified augmentations and 8 percent to offset General Fund spending in Medi-Cal. For funds above $4.3 billion, other rules apply.

Changes Which Services and Programs Receive Augmentations. Proposition 35 does not just change how much MCO tax funding goes for augmentations. It also changes which services and programs receive increases, with somewhat different services affected in the short and long term. As Figure 4 shows, while there is crossover between the state’s previous spending plan and Proposition 35, there also are a number of key differences. For example, Proposition 35 includes more Medi-Cal rate increases for certain kinds of facilities (like hospitals), whereas the state’s previous plan—but not Proposition 35—included increases for certain long-term supports. In the long term, some services and programs only receive increases if net revenue exceeds a certain threshold.

Figure 4

Different Services Will Get MCO Tax‑Funded Increases Over Time

What Was in Last Year’s Budget Package, and What Is Now Law Under Proposition 35 (2024)

|

2024‑25 |

Proposition 35 |

||

|

2025 and 2026 |

2027 and Onward |

||

|

Physician and Professional Services |

|||

|

Primary care |

✔ |

✔ |

✔ |

|

Maternity care |

✔ |

✔ |

✔ |

|

Mental health |

✔ |

✔ |

✔a |

|

Specialty care |

✔ |

✔ |

✔ |

|

Emergency care |

✔ |

✔ |

✔ |

|

Dental care |

✔ |

||

|

Facilities |

|||

|

Hospital inpatient services |

✔ |

||

|

Outpatient procedures and services |

✔ |

✔ |

|

|

Designated public hospitals |

✔ |

✔ |

|

|

Emergency rooms |

✔ |

✔ |

|

|

Behavioral health facilities |

✔ |

✔ |

|

|

Clinics and health centers |

✔ |

✔b |

✔ |

|

Medical Transport |

|||

|

Ground emergency |

✔ |

✔ |

✔ |

|

Emergency air |

✔ |

✔ |

|

|

Nonemergency |

✔ |

||

|

Workforce |

|||

|

Medi‑Cal workforce pool |

✔ |

✔ |

✔ |

|

Graduate medical education |

✔ |

✔ |

|

|

Health worker loan repayments |

✔c |

||

|

Long‑Term Supports |

|||

|

Community‑based adult services |

✔ |

||

|

Congregate living health facilities |

✔ |

||

|

Pediatric day health centers |

✔ |

||

|

Other Services and Programs |

|||

|

Reproductive health and family planning |

✔ |

✔ |

✔ |

|

Community health workers |

✔ |

✔c |

|

|

Drug affordability programs |

✔c |

||

|

Private duty nursing |

✔ |

||

|

Continuous Medi‑Cal coverage for children up to five years old |

✔ |

||

|

aNot specifically described in measure, but potentially allowable. bSpecifically for “services and supports for primary care.” cOnly if more than $4.7 billion net revenue is raised. |

|||

|

MCO = managed care organization. |

|||

Creates New Stakeholder Committee to Advise on Augmentations. While Proposition 35 is fairly prescriptive on which kinds of services and programs receive increases, it is much more open-ended on how these increases are to be structured. Accordingly, the measure requires DHCS to convene a new stakeholder committee to advise the department on implementing the augmentations. The committee is advisory only, with DHCS having final decision-making authority. The committee has ten members, representing providers, health plans, and other related stakeholders. Proposition 35 tasks the Governor, the Speaker of the Assembly, and the Senate President pro Tempore with appointing members.

Governor’s Budget

Increases MCO Tax Net Revenue. The Governor’s budget assumes MCO tax net revenue of $27 billion through 2026-27, a $603 million increase over last year’s spending plan. The increase is not the result of higher tax rates, but rather an additional quarter of funding. Last year’s spending plan assumed some of the MCO tax rate increases would begin in April 2024. The federal government, however, later approved these increases to begin in January 2024, three months earlier.

Includes Revised MCO Tax Spending Plan. As Figure 5 shows, the Governor’s budget spends $7 billion on augmentations through 2026-27, an increase of $3.6 billion over last year’s spending plan. Most of the increase ($2.5 billion) is from implementing Proposition 35’s rules in the short term (through 2026). The remainder ($1.2 billion) will be spent in 2027 according to the measure’s long-term rules. (This breakout does not precisely add due to rounding.) The plan is based on the administration’s interpretation of how to implement Proposition 35’s provisions.

Figure 5

Governor’s Budget Increases Spending for

Augmentations

MCO Tax Spending Plan (In Billions)

|

2023‑24 |

2024‑25 |

2025‑26 |

2026‑27 |

Totals |

|

|

2024‑25 Budget Act |

|||||

|

Net revenue |

$4.8 |

$7.5 |

$7.6 |

$6.6 |

$26.5 |

|

General Fund offset |

4.5 |

7.1 |

6.6 |

5.0 |

23.2 |

|

Augmentations |

0.3 |

0.4 |

1.0 |

1.6 |

3.3 |

|

2025‑26 Governor’s Budget |

|||||

|

Net revenue |

$4.4 |

$8.8 |

$7.6 |

$6.3 |

$27.1 |

|

General Fund offset |

4.4 |

8.1 |

4.4 |

3.3 |

20.1 |

|

Augmentations |

— |

0.7 |

3.3 |

3.1 |

7.0 |

|

Change |

|||||

|

Net revenue |

‑$0.4 |

$1.3 |

— |

‑$0.3 |

$0.6 |

|

General Fund offset |

‑0.1 |

1.0 |

‑$2.2 |

‑1.8 |

‑3.1 |

|

Augmentations |

‑0.3 |

0.2 |

2.2 |

1.5 |

3.6 |

|

MCO = managed care organization. |

|||||

Continues Funding 2024 Rate Increase… Though the MCO tax spending plan has changed over time, a few augmentations have remained throughout each plan. The most notable one, beginning in January 2024, is an increase in Medi-Cal rates for primary care, maternity care, and certain mental health services. Under the increases, Medi-Cal fee-for-service rates for these services equal 87.5 percent of what the federal Medicare program pays. Trailer bill legislation enacted in the 2023-24 budget also requires health plans to pay at least this level for these services in the Medi-Cal managed care system. The Legislature did not apply Proposition 35 trigger language to the 2024 rate increases. Accordingly, the Governor’s budget assumes these rate increases remain in effect and supported by the MCO tax.

…But Delays Implementation of Other Increases, Subject to Stakeholder Consultation. Pursuant to last year’s trigger language, the Governor’s budget assumes the remaining augmentations under the state’s previous spending plan (those scheduled to begin in 2025 and 2026) are no longer in effect. In their place, the administration’s spending plan supports new augmentations, pursuant to Proposition 35’s rules. That said, the administration has not provided more detail on the structure of these augmentations. This is because DHCS must first convene and consult with the required stakeholder advisory committee. As of the publication of this post, the department had not yet convened the committee.

Backfills Lost Reduction in Funding for General Fund Offset. Under last year’s spending plan, less MCO tax funding would be available in 2025-26 than in 2024-25 to offset General Fund spending, necessitating a General Fund backfill. This is because the augmentations were scheduled to ramp up in 2025 and 2026, requiring a larger share of MCO tax funds. Under Proposition 35, the cost of this backfill is even higher, as even more MCO tax funding must be allocated toward augmentations. Accordingly, the Governor’s budget increases the backfill by $2.2 billion in 2025-26.

Assessment and Recommendations for Legislative Oversight

While Limited in Detail, Administration’s Approach to Proposition 35 Appears Reasonable. At the moment, the administration does not have a complete Proposition 35 implementation plan to assess. The lack of a detailed plan is understandable and expected, given the measure’s recent enactment and its stakeholder consultation requirements. It also appears that the administration is taking the required actions to implement Proposition 35. The measure itself raises complex issues, owing in large part to its being drafted in fall 2023, prior to subsequent changes made to the MCO tax in 2024. Nonetheless, we follow the department’s initial spending plan and raise no concerns with it at this time.

Legislature Has Role in Overseeing Implementation Plan. Though we have no concerns so far with the administration’s plans, we think now is an appropriate time for the Legislature to begin providing oversight over the measure’s implementation. Proposition 35 itself does not require legislative appropriation to implement its provisions. In fact, the measure limits the Legislature’s ability to change the MCO tax’s structure and spending plan moving forward. However, as with any enacted ballot measure, the Legislature can play an important role in ensuring the administration implements the measure as intended by voters. Legislative oversight is particularly warranted given the measure’s interaction with General Fund spending in Medi-Cal. Moreover, Proposition 35 presents an opportunity to notably expand Medi-Cal provider rates and other services, a longstanding area of interest to the Legislature.

Consider Key Oversight Issues. Given that the administration is still in the early stages of implementation, we recommend the Legislature focus its initial oversight over Proposition 35 on a few key issues. As Figure 6 shows, these issues relate to the measure’s overall implementation of the MCO tax-funded augmentations, as well as fiscal uncertainties around the tax and measure. Below, we describe these issues in greater detail.

Figure 6

Legislature Faces Two Key Sets of Oversight Issues

|

Implementation of Augmentations |

|

|

|

|

Fiscal Uncertainties |

|

|

|

Implementation of Augmentations

When Will the Department Begin Implementing the Augmentations? Before implementing Proposition 35’s augmentations, the department must undertake a number of steps. These steps include: (1) forming the stakeholder advisory committee; (2) consulting with the newly formed committee; (3) structuring the new augmentations; and (4) where necessary, obtaining federal approval (such as by submitting permanent state plan amendments or limited-term waivers). Other state entities, such as UC and/or HCAI, may also play a role in implementing certain augmentations. With so many steps to undertake, it is likely that it will take months, or even longer, to begin implementing Proposition 35. Significant implementation delays could limit the measure’s initial effectiveness on improving access and quality in the Medi-Cal program. To this end, the Legislature likely will want to keep apprised of the administration’s progress, ensuring that implementation is both thoughtful and timely.

How Will the Department Structure the Augmentations? Proposition 35 defers many key questions around the structure of the augmentations to DHCS. The structure of Medi-Cal rates can impact provider incentives, in turn affecting access and quality for beneficiaries. Accordingly, the state over the years has experimented with different ways of structuring rates, including performance-based and value-based payments. During last year’s budget, the administration also initially proposed including equity-based components into provider rate calculations. Structuring Medi-Cal provider payments to achieve certain objectives is made all the more challenging because most services are now delivered in the managed care system. In this system, health plans, rather than the state, are responsible for negotiating rates with providers in their network. The state in recent years has sought to direct additional funding to providers in the managed care system (known as directed payments). As the nearby box explains, however, these payments can raise a number of challenges. The Legislature likely will want to learn more about the department’s plans as they become more concrete.

What Are the Challenges With Directing Provider Payments in the Medi-Cal Managed Care System?

Health Plans Use a Variety of Ways to Pay for Services. In the fee-for-service system (Medi-Cal’s traditional delivery system), adjusting rates, which tend to be uniform across the state, is a relatively simple exercise. In the managed care system, however, rates are far more diverse across the state. For example, some health plans use fee-for-service approaches to pay for services. Others enter into managed care contracts with certain providers, paying monthly rates in exchange for overseeing the care of beneficiaries. Still in other cases, health plans contract with other plans to arrange for the care of enrollees, creating several levels of different payments. As a result of this diversity, state directed payments in the managed care system can be difficult to implement. For example, the plans with managed care arrangements with their providers faced particular difficulty implementing the 2024 managed care organization (MCO) tax-funded rate increases.

Health Plans Likely Pay at Different Levels for Services. Public data on provider rates in the managed care system are not available, as these rates tend to reflect confidential negotiations between health plans and providers. Nonetheless, it is widely understood that the provider rate levels vary considerably by health plan, even for similar services. This variation also can create challenges for state directed payments. For example, some directed payments require plans to increase their provider rates by a uniform dollar amount, regardless of the size of their base payments to providers. Such an approach is likely inefficient and arbitrary, as plans that pay considerably more for services (arguably already providing a more adequate payment) get the same boost in rates as a plan with notably lower payments. More recent directed payments that benchmark rate increases to specific levels (such as to the Medicare program, as in the 2024 MCO tax-funded rate increases) address some of these weaknesses, but can be more difficult for health plans to implement.

Federal Policy Continues to Evolve on Directed Payments. Federal administrators and policymakers have long sought to ensure that additional funds directed to providers in the managed care system are efficient and justified. Accordingly, federal policy and guidance has changed over time. For example, in 2016, federal administrators created rules around directed payments. These rules required states (including California) to change how they pass funds through health plans to providers, tying funds more closely to service delivery and improved health outcomes. In 2024, more federal rules were enacted on directed payments, including new limits for certain kinds of services. The evolving regulatory landscape has required California to restructure some of these payments. In fact, in this year’s budget, the Governor proposes additional staff at the Department of Health Care Services to restructure the state’s several hospital-directed payments, partly in response to evolving federal rulemaking.

When Will Providers Receive Augmentations? Recent experience has shown that, once structured and enacted, rate increases can still take time to make their way to providers. This is particularly true for provider payments directed through the managed care system. This is because, depending on the structure of the payments, health plans must reopen their provider contracts. The MCO tax-funded 2024 rate increases are particularly instructive in this regard. Enacted by the Legislature in June 2023 and scheduled to begin in January 2024, health plans required considerable time and effort to incorporate the new rates into their contracts. As a result, DHCS ultimately gave plans until the end of 2024, requiring retroactive provider payments in 2024. Nonetheless, we understand from stakeholders that some plans had not fully paid out their retroactive rates by the end of last year. Given the much more expansive scope of rate increases under Proposition 35, it is likely similar timing issues will occur, at least initially. To that end, the Legislature likely will want to work with DHCS, managed care plans, and providers to better track the timing of payments.

Fiscal Uncertainties

Will the General Fund Have Capacity to Cover More Costs in 2027? Under Proposition 35, there is a good chance that the state will have to provide even more General Fund support in the long term. This is because Proposition 35’s new rules in 2027 tend to direct larger portions of funds toward augmentations, leaving less money for offsetting General Fund spending in Medi-Cal. For example, were the MCO tax to generate about as much net revenue in 2027 as it does today, we estimate only around one-third of the net revenue (rather than more than half under the Governor’s budget) would be available for the General Fund offset. The pressure to the General Fund could be even greater depending on other factors (described more in the remaining paragraphs). At the same time, as we have noted in other publications, the General Fund is projected to have structural deficits in the future, leaving limited capacity to absorb new costs. As such, it would be prudent for the Legislature to keep in mind these future pressures as it adopts its budget plans this year.

Will Federal Policy Changes Reduce the Size of the MCO Tax? As we have noted in previous publications, future versions of the MCO tax could be much smaller than the current version due to federal policy changes. In a 2023 letter to the state, federal administrators signaled intent to require future MCO taxes to be more proportionate between Medi-Cal and commercial enrollment. This would shift some of the cost of the tax away from the federal government and onto the commercial market and California consumers. Proposition 35, however, limits the size of the tax on commercial enrollment. As a result, the state would have limited ability to impose a large MCO tax under these federal policy changes. Were the MCO tax to be much smaller in the future, there could be upward pressure to the General Fund to backfill the lost revenue. A smaller tax also could result in less funding for augmentations, upending the department’s initial plans. Given these risks, the Legislature likely will want to monitor federal policy developments and better understand how DHCS responds to any required tax reductions.

Will the Augmentations Create Cost Pressure on the General Fund? Generally, Proposition 35 does not require the General Fund to backfill future reductions to MCO tax-funded augmentations. However, experience suggests that the Legislature could face cost pressure to sustain augmentations over time. For example, in recent years, the General Fund has backfilled parts of Proposition 56 (2016)—another ballot measure that funds Medi-Cal provider rate increases (see nearby box for more detail). With so many fiscal uncertainties at play, it will be important for DHCS to structure MCO tax-funded augmentations in ways that preserve fiscal flexibility. To this end, the Legislature likely will want to learn more about DHCS’s plans over time, ensuring that the department is nimble to changes in Proposition 35 rules and the federal policy landscape.

How Has Proposition 56 Impacted General Fund Spending?

Enacted by voters in 2016, Proposition 56 increased taxes on tobacco-related products. The measure requires most of the resulting revenue to go to Medi-Cal. The state generally used this allocation to increase rates for several kinds of providers and services. Over time, Proposition 56 revenues have declined, driven by a long-term reduction in tobacco use. In recent years, the cost of the Medi-Cal rate increases exceeded available funding. Though not required by the measure, the state has elected to backfill these revenue declines with General Fund support to sustain the rate increases. In 2024-25, the state also provided one-time managed care organization tax funds for this purpose. In 2025-26, the Governor’s budget includes a General Fund backfill of $134 million (22 percent of the cost of the rate increases).