Heather Gonzalez

March 19, 2025

The 2025-26 Budget

Department of Real Estate

Background

Department of Real Estate (DRE) Both Licenses and Regulates Real Estate Licensees. In California, real estate salespersons and brokers, mortgage lenders, and rental property managers must have a license issued by DRE in order to do business. (Real estate salespersons, also known as real estate agents or Realtors, work with a broker. Brokers are real estate salespersons who are licensed to manage their own businesses.) DRE is within the Business, Consumer Services, and Housing (BCSH) agency. It is responsible for issuing licenses as well as more broadly regulating California’s real estate and mortgage lending professionals. More than 425,000 persons in California were licensed by DRE as of June 30, 2024.

Almost All DRE Funding Comes From the State Real Estate Fund. The revised 2024-25 budget includes $67 million and 384 positions for the operation of DRE, with nearly all of the funding coming from the Real Estate Fund. The main sources of revenue to the Real Estate Fund come from examination, licensing, and other fees. Of these fees, licensing-related fees provide the most revenue—contributing about three-quarters of total DRE funding.

Last Year State Policy Makers Agreed to DRE Fee Increases. In 2022, an independent assessment of DRE’s finances found a structural imbalance between costs and revenue. In response, the Legislature enacted budget trailer legislation—Chapter 41 of 2024 (SB 164, Committee on Budget and Fiscal Review)—as part of the 2024-25 budget package. Senate Bill 164 made two changes to DRE’s fee structure: (1) it increased various fees, and (2) it provided statutory caps under which DRE may make additional adjustments to its fees through the regulatory process without having to seek legislative authorization. Fee increases authorized under SB 164 were implemented by DRE on July 1, 2024.

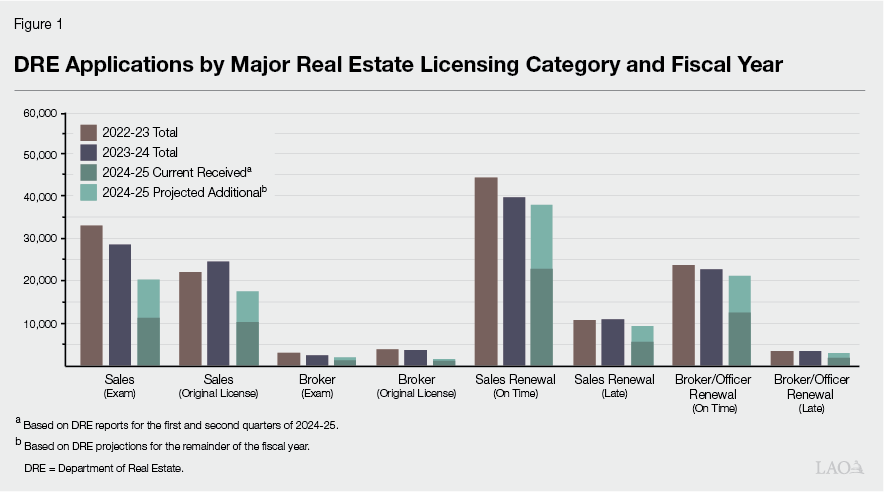

Number of Applications for Real Estate Sales and Broker Examinations and Licenses Is Down. DRE reports that it experienced a significant decrease in the number of people applying for real estate examinations and licenses in the first six months of 2024-25. As shown in Figure 1, DRE expects the annual number of applications received across most major real estate sales and broker licensing categories to decline in 2024-25, with the largest reductions occurring in the categories of first-time or new applications. According to the department, the cause of the decline in applications is due to fluctuations in the housing market.

Governor’s Proposal

January Budget Projected a Negative Fund Balance at End of 2025-26. The Governor’s proposed budget includes $70 million for DRE in 2025-26. This amount reflects an increase of $2.8 million (about 4 percent) from the revised 2024-25 level. The proposed budget would provide DRE with a total of about 387 positions in 2025-26—an increase of 3 positions (less than 1 percent) from the revised 2024-25 level. As proposed, the Real Estate Fund was projected to end 2025-26 with a negative fund balance, as total spending ($74.9 million, which includes expenditures related to statewide administrative costs and BCSH) would exceed total resources ($73.2 million) by about $1.7 million.

Based on Updated Estimates, Fund Would Remain Solvent Through 2025-26. Updated materials provided by the department in March 2025 indicate that DRE is expecting to spend less than originally projected on state operations by about $5 million in 2024-25 and about $3 million in 2025-26. The department expects revenue to remain flat across both years (even with the recent fee increases). As a result of these changes, the Real Estate Fund now appears on track to remain solvent through 2025-26. DRE reports that it expects to have $6.6 million (roughly a month’s worth of funding) in the fund at the end of 2025-26.

Assessment

Despite Recent Fee Increases, Unclear if Structural Imbalance Has Been Fully Addressed. Under the department’s updated estimates, annual spending for the department exceeds projected revenues by about $6.9 million in 2025-26. (The department remains solvent by drawing down reserves.) If expenditures and revenues remain at the levels currently projected for 2025-26, the fund would become insolvent in 2026-27. However, if the department is able to achieve additional savings similar to or beyond those captured in 2024-25, or if revenues improve instead of staying flat, then the condition of the Real Estate Fund could stabilize or improve.

DRE Can Increase Fees Within Its Statutory Cap Without Additional Legislative Action, but May Not Solve the Problem. The department has the authority to increase fees up to the statutory caps without additional legislative authority. However, it is unclear if an additional fee increase would resolve the remaining gap between revenues and expenditures. This is because the underlying drivers of the decline in applications are not fully understood and, therefore, it is difficult to predict how the number of applications will change in the coming years. For example, if an increase in fees contributed to the decline in applications, then an additional fee increase could further reduce applications. In this case, the net effect on revenue would be unclear. If the cause of the drop in the number of applications was due to factors outside of DRE control—such as real estate market or economic conditions resulting in fewer people working in real estate—then the revenue generated by additional increases in fees may not meet expectations either. In other words, the relationship between fee increases and revenues may not be linear, meaning revenue may not increase at the same rate as fees.

Recommendation

Direct DRE to Provide a Plan Describing Specific Actions It Can Take to Address Structural Imbalance. We recommend the Legislature direct DRE to report in spring budget hearings on the number of applications received and related revenues and actions it might take to (1) increase revenue and/or (2) reduce expenditures, if the rate of licensing continues to remain lower than expected. This will allow the Legislature to determine if DRE’s plans are consistent with legislative priorities and/or whether additional or alternative action needs to be taken.