Environment and Natural Resources

Last Updated:

October 2020

Last Updated:

October 2020

ENERGY

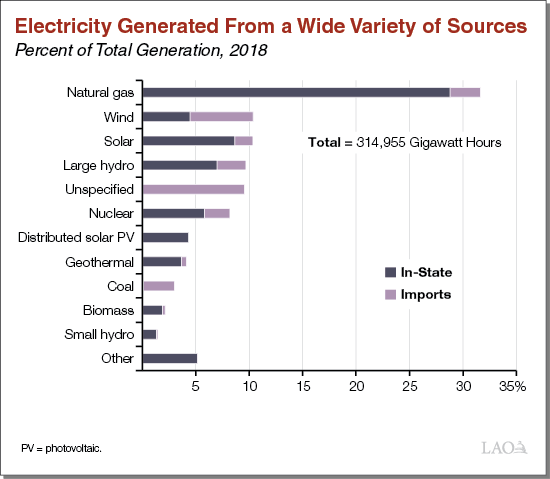

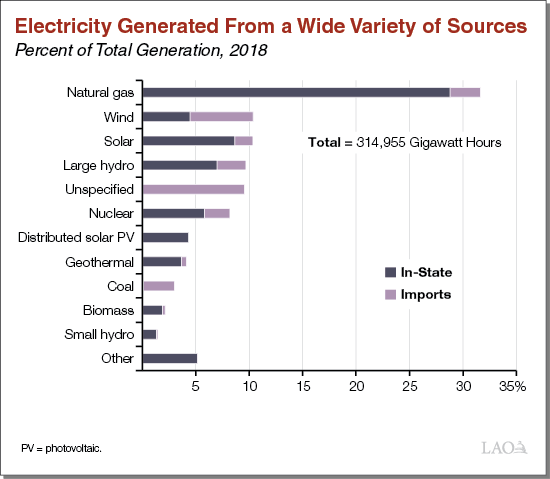

Electricity Generated From a Wide Variety of Sources

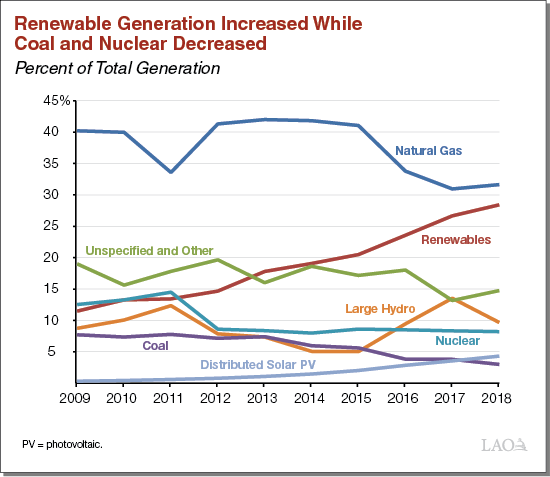

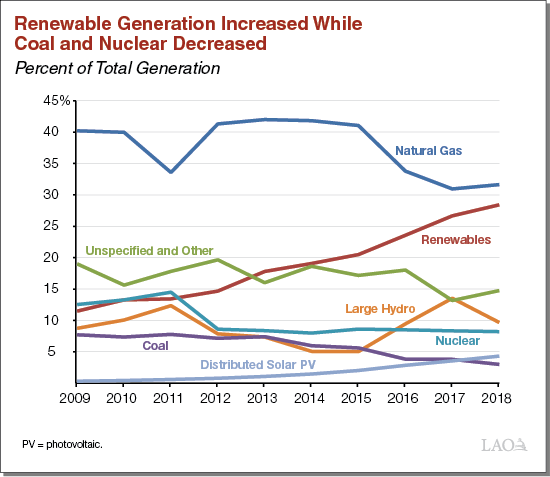

Renewable Generation Increased While Coal and Nuclear Decreased

Last Updated:

October 2020

Last Updated:

October 2020