Since July 2014, California has exempted certain sales of manufacturing or research and development (R&D) equipment from part of the sales and use tax. According to current estimates, forgone General Fund revenue from this exemption has been much lower than expected—roughly one-quarter of the amount initially projected for 2014-15.

Exemption Began in July 2014. In 2013, the Governor signed two laws creating a new partial sales tax exemption for certain sales of manufacturing or R&D equipment. Since July 2014, purchases that meet statutory and regulatory requirements have been exempt from the state General Fund portion of the sales tax rate—currently about 4.2%. In order to buy equipment at the reduced tax rate, a business must fill out a form certifying that its purchase meets these requirements.

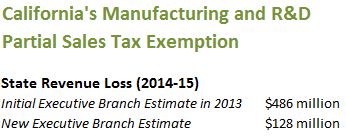

Initial Projection: $486 Million of Forgone Revenue in 2014-15. The State Board of Equalization (BOE) and the Department of Finance (DOF) initially projected that the new exemption would reduce General Fund revenue by $486 million in the 2014-15 fiscal year.

Current Estimate: $128 Million. According to the administration’s current estimates, the exemption reduced General Fund revenue by $128 million in 2014-15—about one-quarter of the amount initially projected.

Small Tax Base or Low Take-Up? Potential explanations for the lower-than-expected numbers fall into two categories: (1) businesses might be spending less money on qualifying purchases than initially projected; and (2) businesses might be making the expected purchases but not completing the necessary steps to receive the exemption.

Qualifying Purchases Might Be Lower Than Projected. The total value of qualifying purchases could be lower than projected for many reasons. Revenue estimates for existing programs often rely heavily on administrative data from those programs. In contrast, revenue estimates for new programs—including new tax expenditures—often must use a combination of administrative and other data sources, such as surveys conducted by the federal government or by industry associations. While useful, these data sources rarely enable precise revenue estimates.

State statutes and regulations limit the exemption to certain types of equipment, types of businesses, uses of the equipment, income tax treatment of the equipment, and spending amounts. Given the highly specific nature of these requirements, it would be unsurprising if actual spending on such purchases were very different from initial estimates.

Businesses Might Not Be Applying the Exemption. To apply the exemption, a business must first become aware of it, and then it must complete the steps necessary to take advantage of it. If businesses are unaware of the exemption or find the process too burdensome, they could be using it at a lower rate than expected. These factors could change rapidly, making the 2014-15 number a potentially misleading indicator of current conditions. For example, awareness might have been low initially, reducing the fiscal year total—but as more businesses become aware of the exemption, its use could become more widespread.

Potential Legislative Responses. Available data have not allowed us to distinguish among the potential explanations described above. To further investigate the possibility of low take-up, the Legislature could invite industry associations or other representatives of the business community to provide information about awareness of the exemption and willingness to use it. Alternatively, if a low amount of qualifying purchases turns out to be the primary explanation, the Legislature still might want to revisit the statutory language that created the exemption. With 2014-15 data in hand, the Legislature can begin to consider whether broadening or narrowing the set of eligible purchases would help achieve desired policy goals.

BOE Voted to Expand Exemption. On August 25, 2015, BOE voted to change state regulations to give businesses more options for qualifying for the exemption. The proposed change would loosen a requirement related to the income tax treatment of the purchased equipment. We note that this requirement is established by statute, so the Legislature may wish to clarify or modify the relevant statutory language.

This post was revised on August 25, 2015, to reflect the outcome of the Board of Equalization meeting.