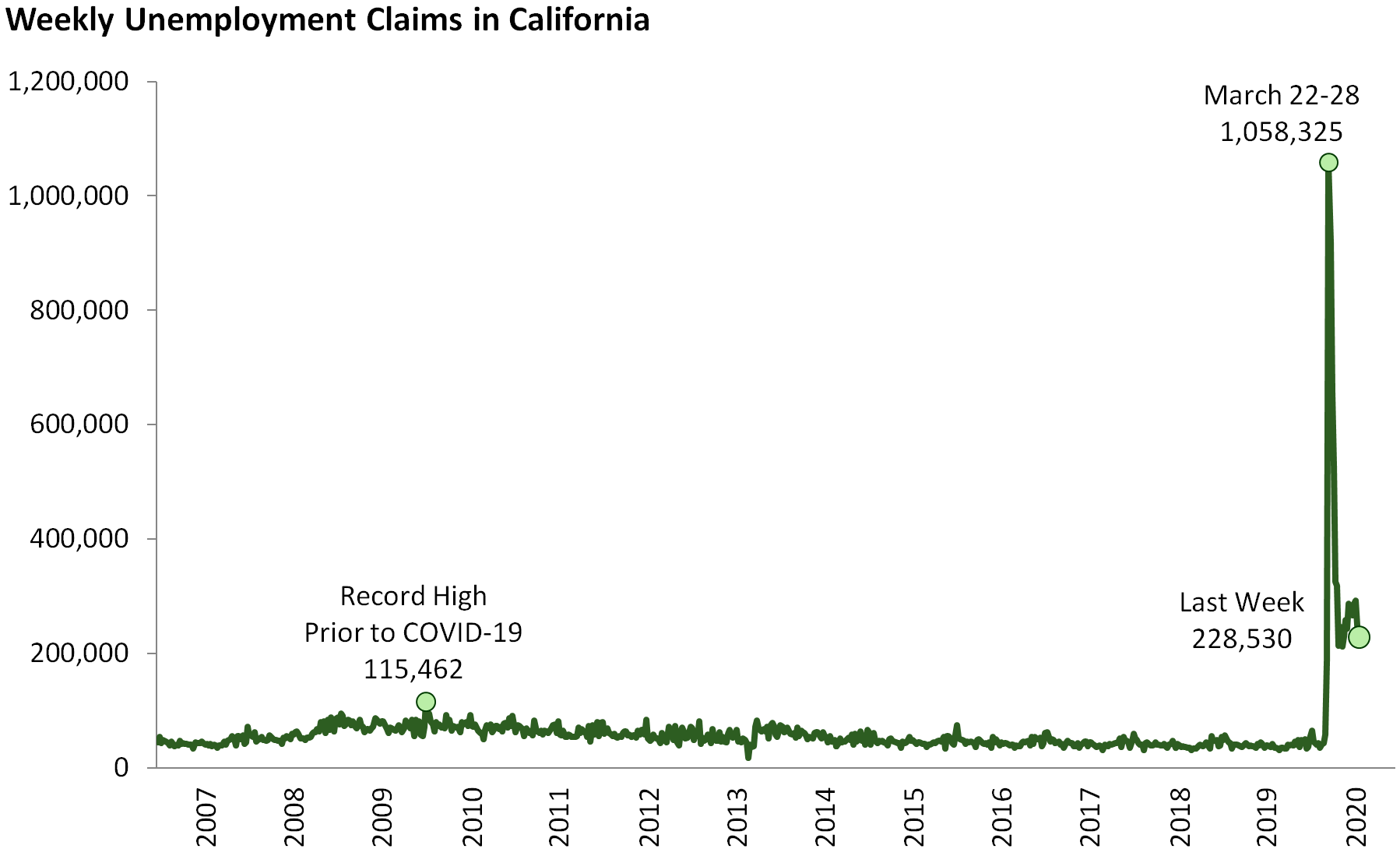

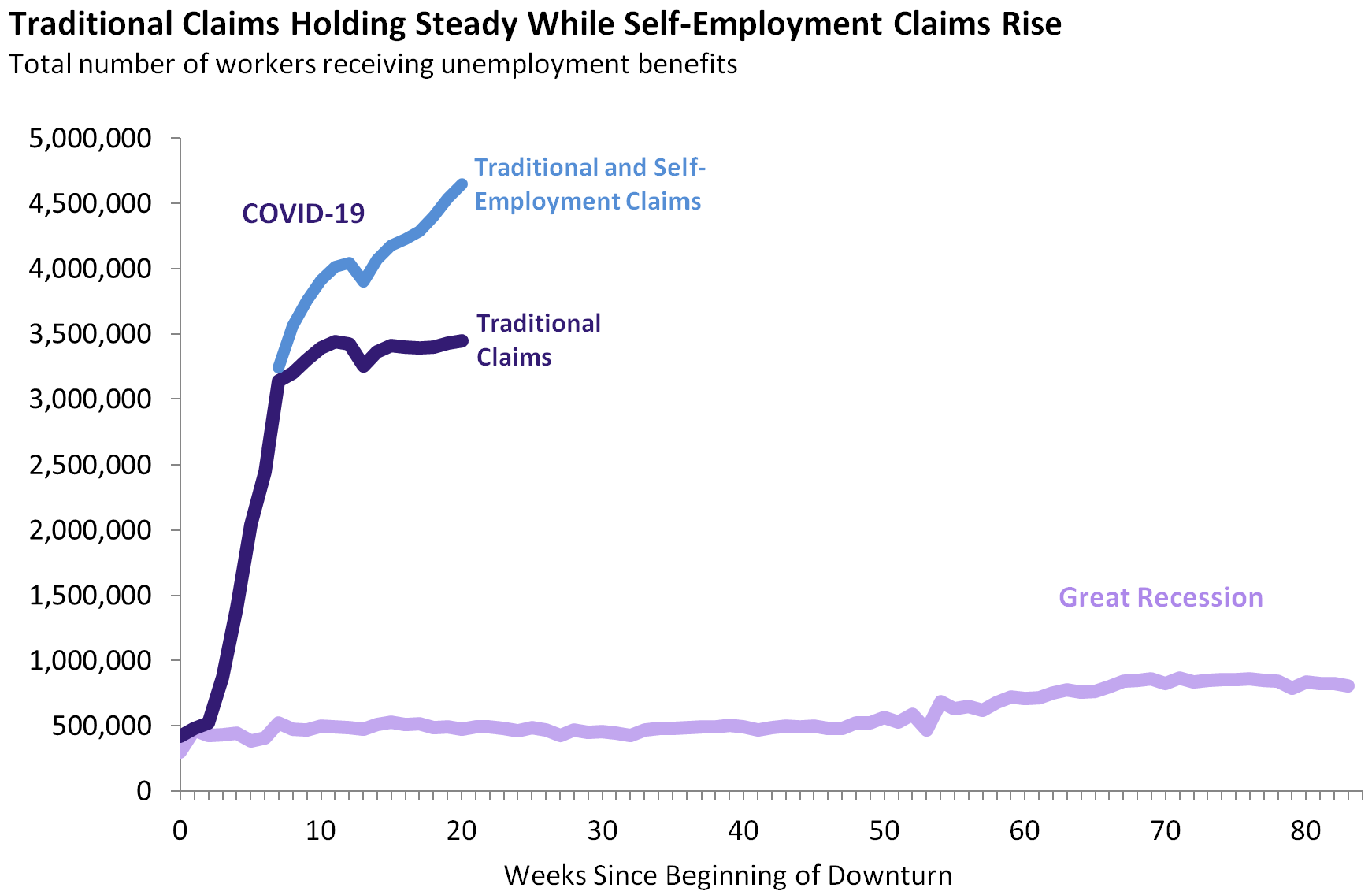

As a result of the COVID-19 pandemic, California has experienced an unprecedented rise in unemployment since the beginning of March. Through March and April, the key measure that captured the impact of the virus on the state’s workers was the number of new unemployment claims being filed each week. Going forward, this number will still be important as a gauge of whether a second wave of business closures and layoffs is emerging. Equally important to track going forward, however, will be the level of continued claims—the total number of people receiving unemployment benefits in a given week. Should continue claims start to decline, it could signal that some businesses are bringing workers back. Should continued claims remain steady or keep rising, however, it could signal that a V-shaped recovery may be less likely.

Number of Processed Claims Declines, Yet Remains Elevated. California processed 228,530 claims for regular unemployment insurance between July 26 and August 1. The number of claims processed in the past two weeks remains high, but has fallen slightly from levels seen during the past two months. During that time, weekly claims held steady around 280,000. Weekly claims since mid-March have remained well above the record high prior to the COVID-19 outbreak of 115,462 in January 2010.

Continued Claims Inch Upward, Hitting New High of 3.4 Million. As of August 1, California had 3.4 million employees receiving traditional unemployment benefits, the highest figure reported since EDD began releasing this information earlier in the year.

Number of Self-Employment Claims Top 1.2 Million This Week. Between July 26 and August 1, California had 1.2 million self-employed workers receiving unemployment benefits under Pandemic Unemployment Assistance—a new program created to expand eligibility for unemployment insurance to self-employed workers. The number of self-employed workers receiving benefits jumped by almost 100,000 from the prior week. While the number of traditional unemployment claims has remained steady over the past month, the number of self-employed workers receiving benefits has increased by about 50 percent. Due to these diverging trends, self-employed workers receiving unemployment benefits now make up more than one-quarter of all workers receiving benefits. (The graph below shows both traditional and self-employment claims. The most accurate comparison is between the Great Recession and COVID-19 traditional claims, as self-employed unemployment benefits were not available during the Great Recession.)