In November 2016, California voters approved Proposition 64, which legalized the nonmedical use of cannabis. The state levies two excise taxes on cannabis: a retail excise tax and a cultivation tax.

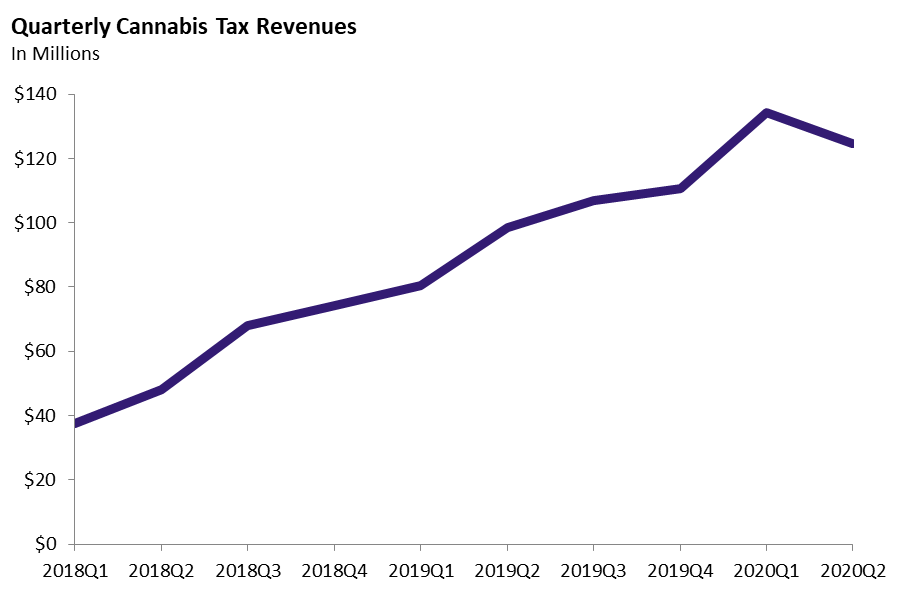

Fourth Quarter of 2019-20: $125 Million. The administration currently estimates that retail excise tax revenue was $102 million and cultivation tax revenue was $23 million in the fourth quarter of 2019-20 (April through June).

Revenue Declined Last Quarter... The $125 million fourth quarter total represented a 7 percent decline from the prior quarter, suggesting that the COVID-19 crisis has weakened legal cannabis sales.

…After Strong Growth in the Prior Quarter. As shown in the figure below, last quarter’s decline followed a quarter of very strong growth. In the third quarter of 2019-20 (January through March), retail excise tax revenue increased by 25 percent and cultivation tax revenue increased by 11 percent.

Why Such Strong Growth in the Prior Quarter? One reason for the strong revenue growth in the third quarter of 2019-20 might be consumer stockpiling in the early days of the COVID-19 crisis. Another reason might be administrative rate adjustments that took effect January 1. Over time, these statutorily required adjustments are supposed to align actual tax rates with the rates established by Proposition 64. In this case, the effective retail excise tax rate increased by 12.5 percent and the effective cultivation tax rates increased by 4.3 to 4.7 percent.

Preliminary 2019-20 Total: $477 Million. The administration’s combined estimates for all four quarters of 2019-20 are $380 million of retail excise tax revenue and $97 million of cultivation tax revenue. Despite a weak final quarter, the current 2019-20 tally is 49 percent higher than 2018-19.